Chapter 11: Price Discrimination

1/20

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No study sessions yet.

21 Terms

Which of the following is NOT a good example of price discrimination?

Target places all of its leftover Easter candy on 50% clearance.

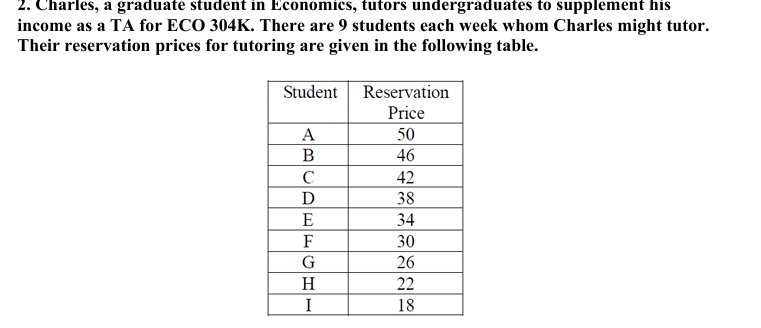

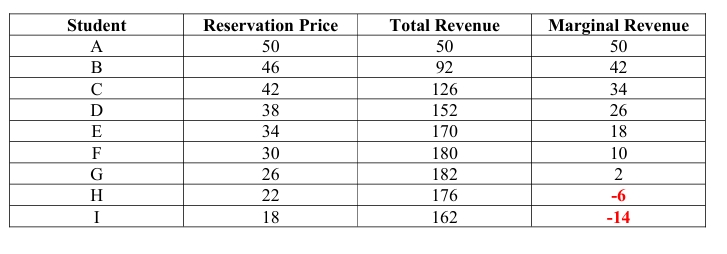

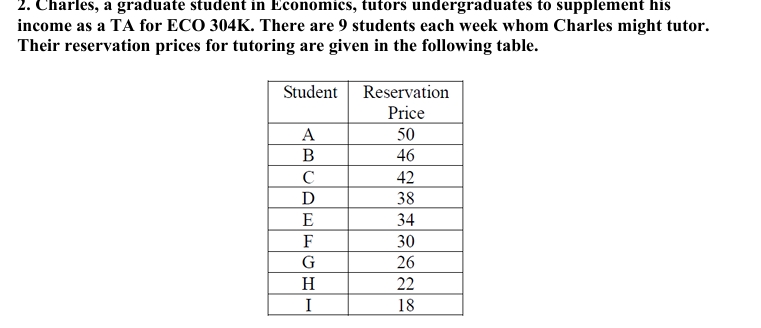

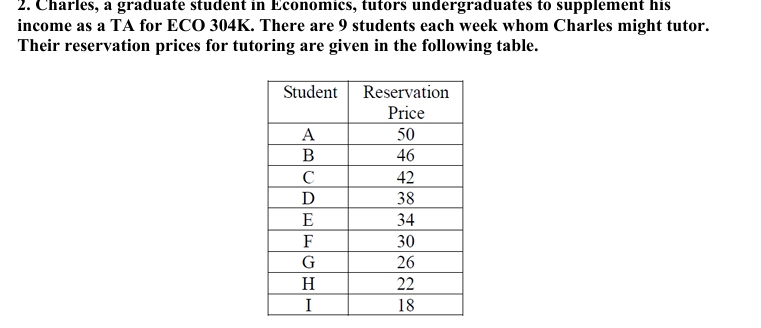

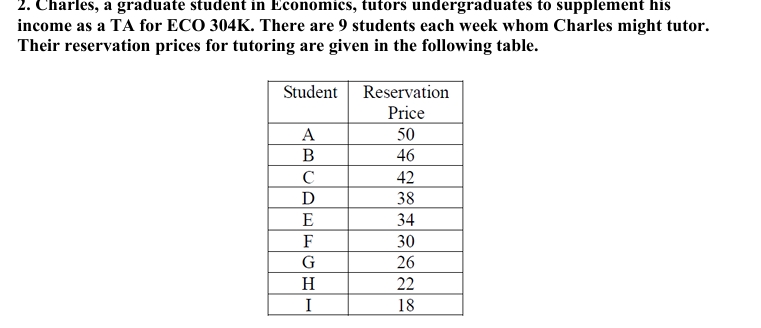

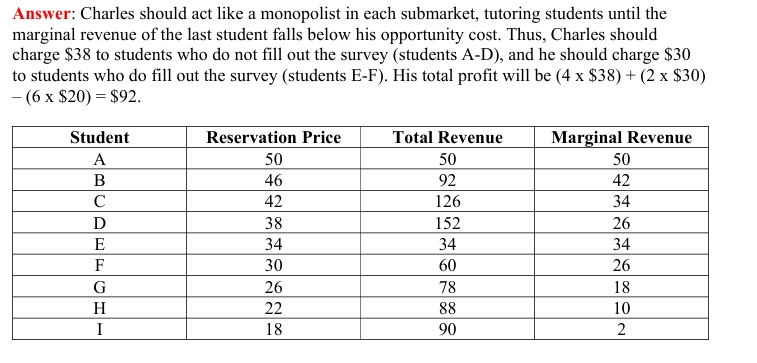

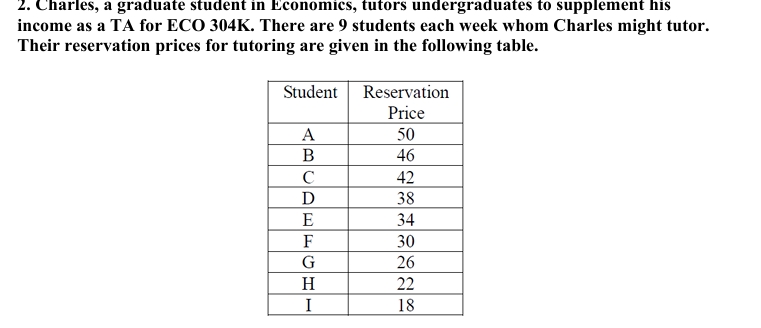

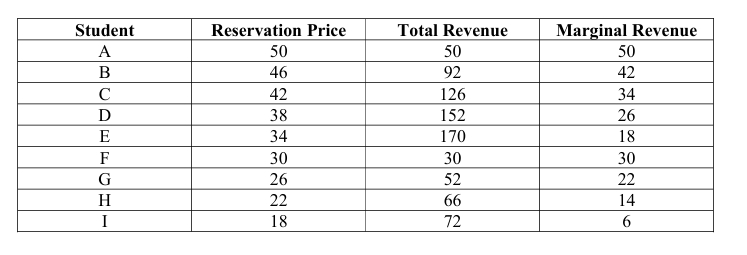

Charles, a graduate student in Economics, tutors undergraduates to supplement his income as a TA for ECO 304K. There are 9 students each week whom Charles might tutor. Their reservation prices for tutoring are given in the following table.

A) If the opportunity cost of Charles’ time is $20 per hour and if he must charge the same price to each student, how many students should he tutor each week? What price should he charge? What will be his economic profit?

He should tutor 4 students (students A-D). The marginal revenue of tutoring student D is $26, which is greater than Charles’ opportunity cost, but the marginal revenue of tutoring student E is only $18, which is less than Charles’ opportunity cost. Charles should stop at student D. He should charge $38, which is student D’s reservation price. At this price, his economic profit will be (4 x $38) – (4 x $20) = $72.

B) What is the socially efficient number of students for Charles to tutor? What would his economic profit be if he were to charge the same price to each student and tutor the socially optimal number of students?

He should tutor 8 students (students A-H) since they are willing to pay more than Charles’ reservation cost of $20. To do so, Charles would have to charge no more than $22. At this price, his economic profit would be (8 x $22) – (8 x $20) = $16.

C) Suppose Charles can tell exactly how much each student is willing to pay for tutoring (in other words, he knows their reservation price). How many students should he tutor, and what will be his economic profit?

Answer: He should again tutor students A-H, since they are willing to pay more than his reservation price. To maximize his profits, he should charge each their reservation price so his economic profit will be $50 + $46 + $42 + $38 + $34 + $30 + $26 + $22 – (8 x $20) = $128.

D) Now suppose that Charles decides to offer a rebate coupon to students who go online and fill out a customer satisfaction survey. Suppose only students with reservation prices of $34 or less will ever bother to fill out the survey to get the rebate. In this case, how much should Charles charge for students who don’t fill out the survey and how much should he charge students who do fill out the survey? What will his economic profits be?

Answer: Charles should act like a monopolist in each submarket, tutoring students until the marginal revenue of the last student falls below his opportunity cost. Thus, Charles should charge $38 to students who do not fill out the survey (students A-D), and he should charge $30 to students who do fill out the survey (students E-F). His total profit will be (4 x $38) + (2 x $30)= (6 x $20) =92

E) How would your answer to part d change if instead only students with a reservation price of $30 or below are willing to fill out the survey?

Answer: Charles should still charge $38 to students who do not fill out the online survey (students A-D), and he should charge $26 to students who do fill out the survey (students F-G). His total profit will be (4 x $38) + (2 x $26) – (6 x $20) = $84

In order to be able to effectively price discriminate a firm must:

have a downward-sloping demand curve, be able to prevent resale, and identify at least two groups of customers with different elasticities of demand.

Which is the best example of a firm that price discriminates?

Regal Cinemas

Where is price discrimination at work?

Going to China Buffet for lunch, instead of dinner

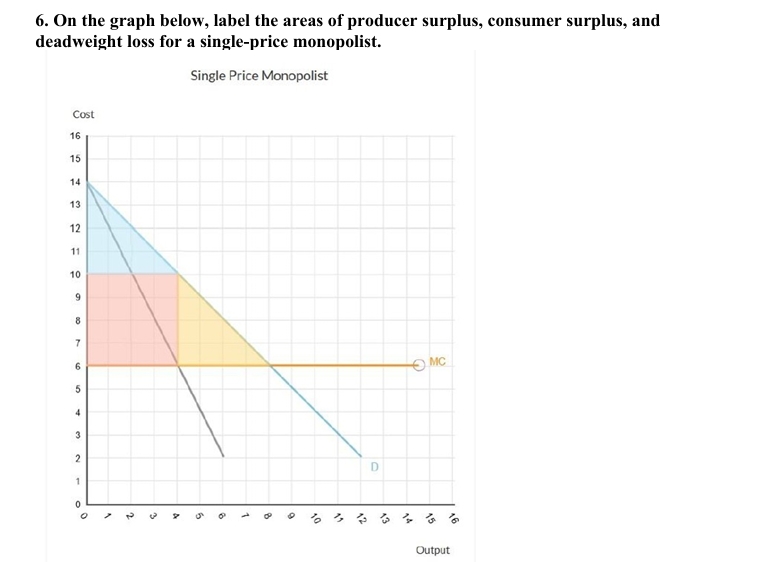

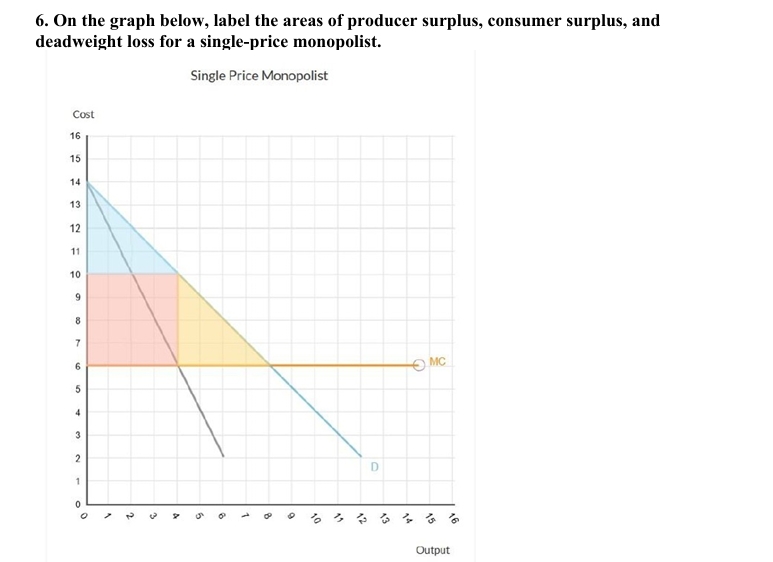

A non–price-discriminating monopolist (or a "single-price" monopolist) produces the quantity where marginal cost equals marginal revenue. Here, that quantity is 4. When this monopolist produces 4 units, the most it can charge is determined by the demand curve: $10. The area below $10 but above the MC curve, from 0 units until 4 units, is the producer surplus (highlighted in RED). The triangle above $10 below the demand curve is the consumer surplus (highlighted in BLUE). The area under the demand curve to the right of 4 units is the deadweight loss (highlighted in YELLOW). This area would be part of the surplus if this were a perfectly competitive industry. A single-price monopoly has some consumer surplus (above the market price, but below the demand curve), some producer surplus (above the supply curve and below the market price) and some deadweight loss (the area between the demand and supply curves to the right of the quantity produced)

Suppose the single-price monopolist above figures out how to perfectly price-discriminate. What area represents the producer surplus that the monopolist can now get by perfectly price-discriminating?

By charging the exact amount each consumer is willing to pay, the monopolist produces 8 units. As a result, there is no longer any consumer surplus or deadweight loss. Those areas are converted into producer surplus.

Determine whether each of the following examples is best characterized by price discrimination, perfect price discrimination, or no price discrimination.

A) The public bus line offers unlimited rides on the weekends for all of its customers.

Even though the same offer is made to all customers, this is still an example of price discrimination. Those who use the bus to get to work during the week have a more inelastic demand and pay more for the bus on average. Casual travelers who just ride on the weekends would pay an average price of zero

Determine whether each of the following examples is best characterized by price discrimination, perfect price discrimination, or no price discrimination.

B) Senior citizen tickets for basketball games are $5

This is a simple example of price discrimination. Senior citizen tickets are cheaper to entice those patrons, who have more elastic demand, to attend the game. Tickets for those with more inelastic demand are set at a higher price.

Determine whether each of the following examples is best characterized by price discrimination, perfect price discrimination, or no price discrimination.

C) A restaurant offers a 20% discount for customers who order dinner between 4pm and 6pm.

This is an example of price discrimination. The restaurant offers a discount for those who are price sensitive and are willing to eat at nonpeak hours.

Determine whether each of the following examples is best characterized by price discrimination, perfect price discrimination, or no price discrimination.

D) A bookstore has a half-price sale on last year’s editions

This is an example of price discrimination. The store discriminates on the basis of people who are willing to pay higher prices for current models versus people who are more price sensitive and would prefer to pay less, even if doing so means buying an older version.

Determine whether each of the following examples is best characterized by price discrimination, perfect price discrimination, or no price discrimination.

E) A well-respected golf instructor charges each customer a fee just under the customer’s maximum willingness to pay for lessons.

This is a good example of perfect price discrimination. The golf instructor knows the customer’s willingness to pay and charges a price just below it. The golf instructor charges a different price to each individual.

Describe the difference between 1st, 2nd and 3rd degree price discrimination and provide an example of each.

Answer: 1st degree price discrimination occurs when the seller attempts to charge you your exact willingness to pay. Example: You negotiate with a car dealer over the purchase price.

Answer: 2nd degree price discrimination occurs when you receive a discount for making a bulk purchase. Example: You buy one item and get the second item half off.

Answer: 3rd degree price discrimination occurs when distinct groups of customers pay different prices based on differences in their price elasticity of demand. Example: Admission prices to movies.

Which of these is an example of second-degree price discrimination?

A pizza shop offers a buy two, get one free discount when you buy three large pizzas.

When an airline price discriminates, this leads to:

more customers flying.

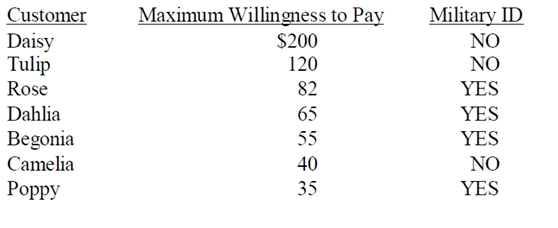

Consider the table below, which shows seven potential customers, each interested in bungee jumping. How much additional profit will the firm make if it price discriminates by charging two prices? The MC is $0

$130

For price discrimination to be effective:

the firm must identify at least two groups of customers with different elasticities of demand.