2.6 macroeconomic objectives and policies

1/66

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

67 Terms

economic growth

Pursuing sustainable, long-run growth (around 2–2.5% for the UK)

prioritizing growth may harm the environment or increase inequality.

low unemployment

Close to full employment; UK target roughly 3–5% to account for frictional/structural unemployment

inflation

– UK target is 2% (measured via CPI).

current account

Sustainable balance of payments on the current account

Greater equality

Reducing inequality through redistributive policies; measured with tools like the Gini coefficient or Lorenz curve

what is monetary policy

Deliberate action by the government designed to influence the supply of money in the economy

The Bank of England (BoE) controls monetary policy in the UK

what does quantitative easing achieve

Stimulate the economy, particularly during a recession

Possible multiplier effects

Likely to be used when base rate changes can’t achieve objectives on its own

intrerest rates

Managed by the Bank of England’s Monetary Policy Committee (MPC).

Raising rates tampers AD; cutting rates stimulates consumption, investment, weakens the pound, and supports net trade

explain how a rise in englands base rate may lead to a fall in inflation

BoE raises base rate

This increases the cost of retail banks’ borrowing from the BoE

Retail banks raise their own interest rates

Higher interest rates encourage saving and discourage spending and investment (C + I)

Less spending reduces the amount of aggregate demand in an economy

This reduces inflation (the rate at which average prices increase)

bank of england base rate limitations

Time lags

It takes months for interest rate changes to affect spending, investment, and inflation.

Liquidity trap

When interest rates are near zero, further cuts have little to no effect.

Only tackles demand-side issues

It can’t solve cost-push inflation (e.g. rising energy prices or supply chain shocks).

define the term “price level”

the avergae price of goods and services in an economy indicating inflation or deflation

define the term “interest rate”

is the percentage charged on borrowed money or earned on savings reflecting the cost of credit or the return on investment over a specific time period

Explain how the use of Quantitative easing leads to greater real output and higher inflation

BoE creates money

BoE buys govt bonds from banks

Banks more inclined to lend to firms and individuals

Lowers interest rates

Greater lending boosts C + I and so AD

Extra spending/AD creates a stimulus to help an economy recover from recession

limitations of quantitative easing

Trade-offs of macroeconomic objectives

Potential long-term inflationary pressure due to increased amount of money in the economy

Information problem – how much QE?

‘Zombie’ banks & businesses – propped up by cheap credit

direct VS indirect taxes

Direct: Income tax, corporation tax, etc.

Indirect: VAT, excise duties—affect producers and consumers differently

Limitations: Time lags, imperfect information, , uncertain multiplier effects, high-interest environments dampen effectiveness, long-term debt concerns

explain the distinction between a government budget deficit and surplus

-if total government spending exceeds total revenue from taxation there is a budget deficit

-if total government spending is less than total revenue from taxation there is a budget surplus

supply side policies

policies aimed at increasing the productive potential of an economy and moving the supply curve to the right

investing in education, infrastructure, and technology, and reducing business costs through deregulation and tax cuts

rightward shift of LRAS:

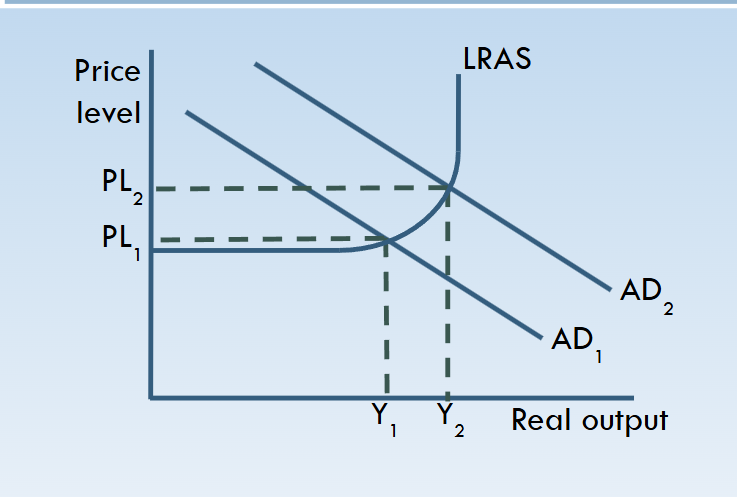

economic growth & inflationary presssures

Rapid increases in aggregate demand (particularly from consumer spending) are likely to lead to rising inflation

i.e. when growth in consumer demand is high, the supply constraints lead to rising prices

Rising AD causes spare capacity to fall which creates greater scarcity in the economy

macroeconomic trade offs

Not all economic objectives are likely to be achievable simultaneously

When success in one objective compromises the ability to meet another objective, it is described as a trade-off

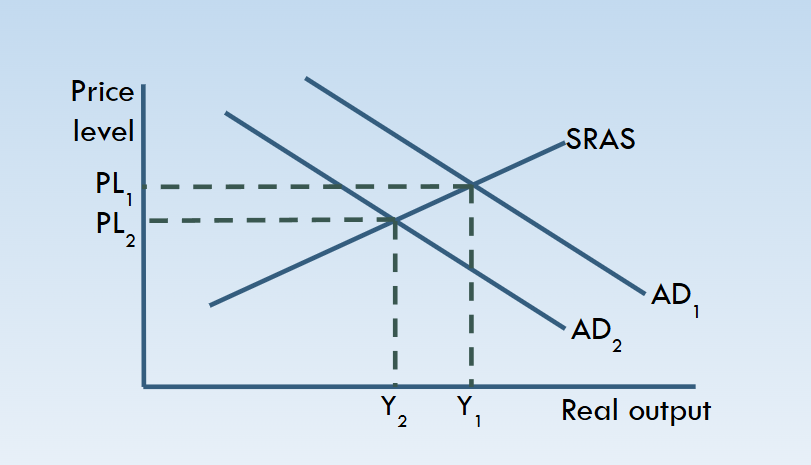

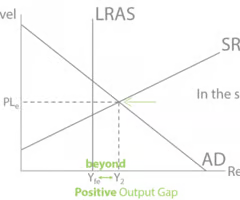

economic growth & infaltion diagram

evaluation for economic growth & inflation

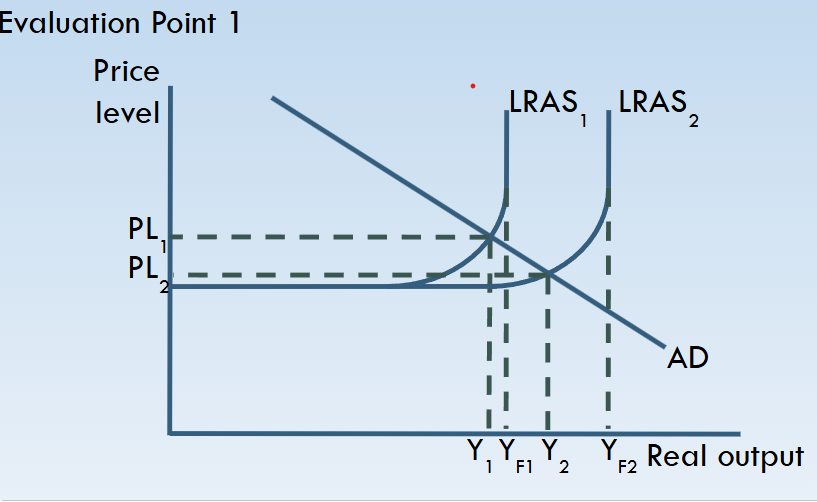

Supply-side improvements will increase LRAS leading to an improvement in both

Anything improving technology, skills, productivity will lower costs of production while also increasing real output

(This is a really good point of evaluation, but can’t be used if the question is about demand-side policies)

diagram for evaluation of economic growth & inflation

evaluation 2 for economic growth & inflation

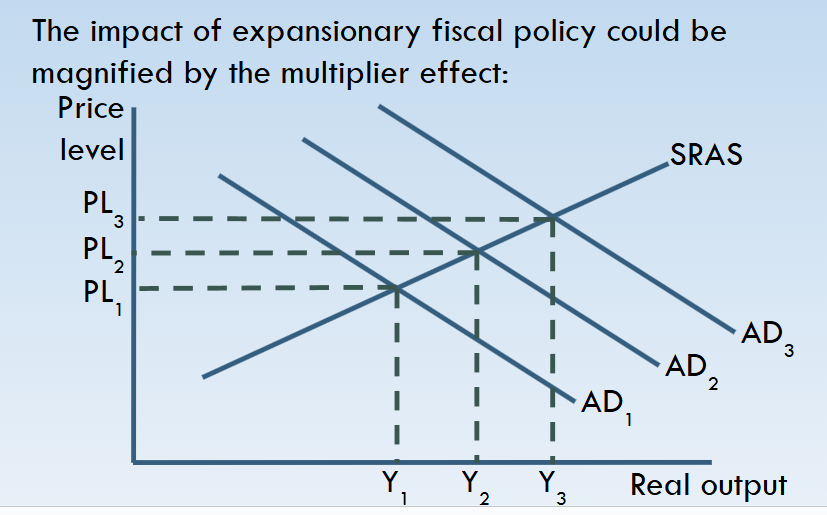

Increases in AD when there is significant amount of spare capacity can lead to higher real output (Y1 to Y2) without creating significant increases in the price level

The spare capacity means that output can increase without creating significant competition for factors of production and goods and services

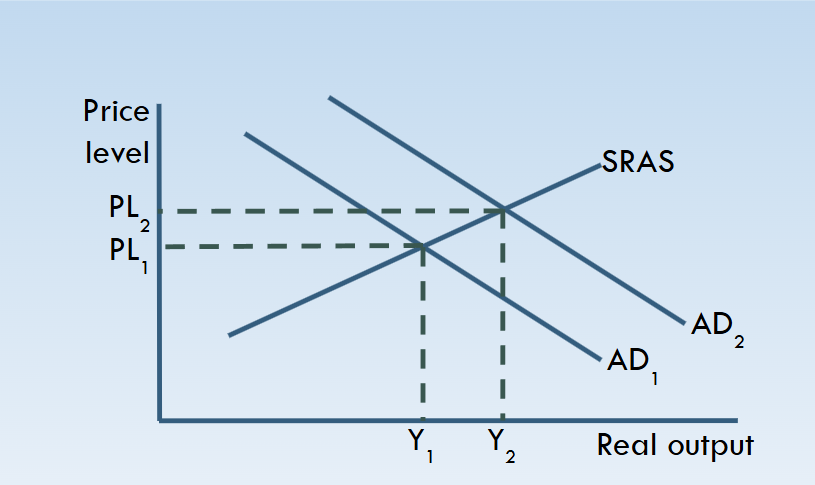

falling unemployment & inflation

Falling unemployment tends to lead to higher inflation

As unemployment falls a shortage of labour means workers’ bargaining position is stronger

🡪 allows workers to claim higher wages

🡪 leads to higher business costs

🡪 leads to higher prices

The phillips curve

Low unemployment = high employment -> more people earning incomes -> consumption increases -> AD increases -> raises price level from PL to PL1 (inflation)

economic growth & current account

If economic growth is based on consumer spending it is likely to worsen the current account

Rising spending (C) causes a rise in AD (actual growth)

A portion of the extra spending will be on imported goods

evaluation of economic growth & current account

It depends on the cause of the economic growth

If economic growth is ‘export-led’ then these objectives could be achieved simultaneously

Rise in both AD and the current account as a result of a rise in the value of exports (X-M)

economic growth VS fiscal deficit reduction

Attempts to reduce the fiscal deficit involve cutting spending and/or raising taxes

Both have a withdrawal effect of the circular flow of income

The result is likely to be a fall in aggregate demand, reducing GDP

The budget deficit is reduced, but as a result economic growth suffers

evaluation of economic growth and fiscal reduction

Evaluation

When GDP increases, extra spending increases tax revenues (e.g. VAT)

More people in employment means that fewer people need to be given unemployment benefits (automatic stabilisers)

So, as a result of economic growth the budget deficit improves

explain the tools involved in fiscal policy

Government spending (G) and taxation (T). Can be expansionary or contractionary.

Direct taxes: Income tax, corporation tax; Indirect taxes: VAT, excise duties.

Budget positions: deficit or surplus.

fiscal policy evaluation

time lags - when the government makes spending and taxation decisions there is a time lag before the effects are seen

trade off - if the government tries to influence AD it cannot achieve all macroeconomic objectives - AD leads to a fall in unemployment but a rise in inflation

interventionist policies

Aim to correct market failures by active government involvement in improving economic performance.

Examples:

Education and training investment

Infrastructure spending

Subsidising R&D

Regional development grants

➡ Goal: Raise productivity and long-term growth by improving resources and capacity.

market based policies

Market-based supply-side policies aim to increase the efficiency and productivity of the economy by reducing government intervention and allowing free-market forces to operate more effectively.

They shift the Long-Run Aggregate Supply (LRAS) curve to the right by making markets more competitive, flexible, and efficient, thus boosting the economy’s productive potential.

incentive market based policies

Encourage work, investment, and entrepreneurship

✅ Lower income tax:

→ Increases the post-tax return to work

→ Encourages labour participation (especially among secondary earners)

→ Incentivises effort and productivity🧠 A* Tip: Refer to the Laffer Curve — lowering tax rates might increase tax revenue if disincentives at high tax rates are severe.

✅ Lower corporation tax:

→ Increases retained profits

→ Encourages investment in capital, R&DExample: UK cut corporation tax from 28% (2010) to 19% (2017) to boost business growth.

✅ Reduced welfare benefits:

→ Reduces the replacement ratio (benefits vs wages)

→ Makes employment more attractiveEvaluation: Can worsen inequality and poverty — depends on availability of jobs and upskilling.

labour market reforms

Deregulation of labour laws:

→ Easier hiring/firing = more flexible employment

→ Encourages firms to take on workersEvaluation: May reduce job security and wages → worsens working conditions.

✅ Reduction in trade union power:

→ Prevents excessive wage demands

→ Allows wages to reflect productivityA* Application: UK saw this post-1980s with Thatcher’s trade union reforms.

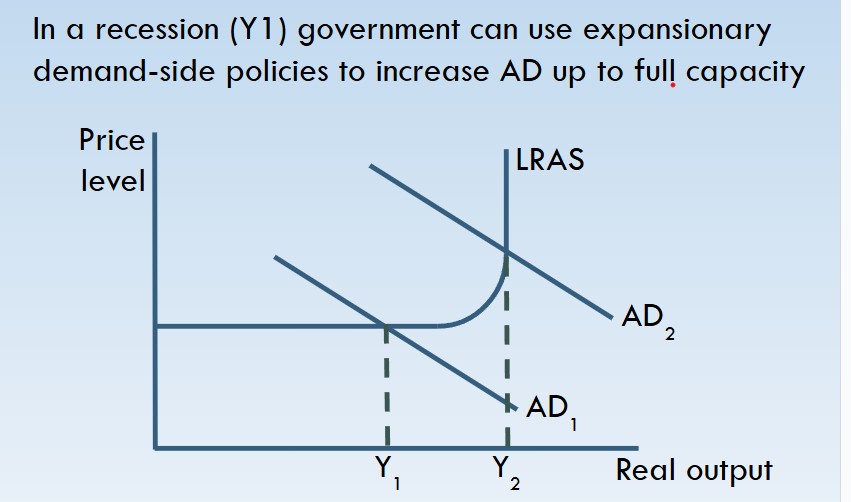

demand side policies

policies designed to influence the level of AD

Monterary policy - conducted by the bank of england

fiscal policy - conducted by the treasury

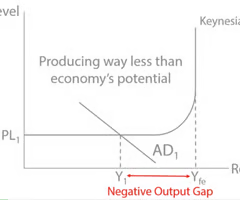

Diagram - impact of a successful demand side policy in moving an economy from recession to full capacity

interventionist

Human Capital: Investment in education, training, healthcare

Infrastructure: Transport, digital networks, public capital

Goal: Address market failures and enhance productive capacity → shift LRAS right

Evaluation: Long-term payoff vs high costs, implementation time, potential inefficiency

the purpose of fiscal policy

To influence the level of economic activity

Spending and taxation levels can have an impact on the aggregate demand of the economy

E.g. greater spending by the government leads to a rise in AD and so a greater level of economic activity

automatic VS discretionary spending

Automatic

Some spending and taxation changes happen automatically as an economy moves through the economic cycle

Discretionary

Sometimes government makes active decisions to change the level of spending - known as discretionary changes

automatic stabilisers

In a recession:

more people out of work automatically leads to more government spending on unemployment benefits

Less consumer spending automatically results in less VAT & income tax being collected, reducing the amount of withdrawals from the economy

These create a net injection into the economy

discretionary spending in a recession

In a recession:

Government might actively spend money or reduce taxes to create an injection into the economy

Examples:

Spending in 2008/09 in response to recession

Covid response in 2020/21

exspansionary fiscal policy

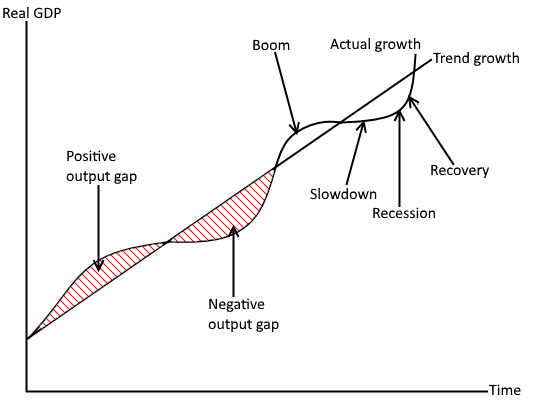

fiscal policy influencing economic activity

Fiscal policy can be used as part of ‘demand management’

When AD grows too much, adjustments in fiscal policy can prevent the boom becoming too much of a ‘bubble’

When AD falls, greater spending or lower taxes can help to prevent a deep recession

Sensible use of fiscal policy might help ‘smooth’ the economic cycle

contractionary fiscal policy

contractionary fiscal policy

Contractionary fiscal policy

Spending and taxation by government with the aim of decreasing the level of AD

Less spending

Higher taxes

Decrease in a budget deficit/increase in a budget surplus

expansionary fiscal policy multiplier effect

what is national debt

he total amount of money that a country's government has borrowed, by various means.

disadvantages of a progressive tax

- brain drain (they move to countries with lower tax rates, laffer curve)

- reduced work incentives for those earning high incomes. These are the people that the UK needs as they are productive and skilled

impact of decreasing interest rates on investment

low interest rates incentivise borrowing and investment because it actually lowers the risk of investment to firms. If the cost of borrowing is less, firms now need to make a lower rate of return of their investment to cover the cost of the loan and make a profit

increase in the base rate of interest on the pound

Higher interest rates can attract foreign capital ("hot money"), increasing demand for sterling and causing the exchange rate to appreciate. This can make UK exports more expensive for foreign buyers and imports cheaper, potentially worsening the UK's trade balance.

base rate

The interest rate set by the Bank of England which influences all other interest rates in the economy.

trade cycle diagram

negative output gap

The level of actual real output in the economy is lower than the trend output level

positive output gap

The level of actual real output in the economy is greater than the trend output level

advantages of increasing benefits

Advantage - Workers have more disposable income --> increase consumption --> increased aggregate demand

Disadvantage - little incentive to work --> more unemployment --> decrease GDP , also known as the 'benefits trap'

education and positive consumption externality

Investment in education and training can also be viewed as addressing a positive consumption externality.

The private benefits to individuals (e.g., higher wages, better employment prospects) are less than the social benefits to the economy (e.g., increased productivity, lower unemployment, higher tax revenues).

As a result, the free market underprovides education, meaning government intervention — such as subsidies or direct investment — can increase consumption to the socially optimal level.

In the long run, this helps reduce structural unemployment and increases potential output (LRAS).

deflationary spiral

The spiral begins with deflation which is where there is a sustained fall in the general price level. Consumers notice the falling prices and decide to delay their purchases and wait for prices to fall further. This causes a reduction in AD as consumption is a component of AD. The fall in AD lowers the price level again and so consumers further delay their purchases. And the cycle repeats.

unemployment on the economy

lost output- real GDP will fall

- reduced tax revenue for the government

- increased burden on the taxpayers to fund benefits and training measures

- increased burden on the healthcare system

- increased crime

what impacts wages

- relative bargaining power of trade unions (to the employer)

- derived demand from economic growth

- changes in productivity of labour (has education improved?)

- government policy: public sector pay and minimum wage

why do we want 2% inflation

Stability firms can predict future costs and prices to help with financial

forecasting

• Encourages investment

• Helps protect the real value of savings

• Keeps goods and services internationally competitive increasing /

maintaining level of exports

• High inflation tends to be unsustainable

what is occupational immobility of labour

When workers can't move between different jobs because they lack the skills needed

how can the government solve occupational immobility of labour

1) education

2) training

3) apprenticeships

4) provide information about job openings

why may expansionary fiscal policy not reduce unemployment

However, an increase in government spending may lead to the crowding-out effect.

If the government borrows heavily to finance its fiscal stimulus, interest rates may rise, reducing private sector investment and consumption.

As a result, the increase in AD could be partially offset by a fall in private demand, limiting the reduction in unemployment.

This effect is likely to be stronger if the economy is already close to full capacity or if financial markets lose confidence in government borrowing.

what is expansionary fiscal policy

Expansionary fiscal policy involves increasing government spending and/or cutting taxes to boost overall demand in the economy.

Government spending increases (on infrastructure, public services, subsidies) → directly raises AD.

Tax cuts increase households’ disposable income → higher consumption → higher AD.

The increase in AD leads to:

Higher output (GDP)

More employment (reducing cyclical/demand-deficient unemployment)

Potential short-run inflation if the economy is near full capacity

base rate

The base rate of interest is the Bank of England’s official interest rate, which influences the cost of borrowing and the return on saving.

Effect of increase:

An increase in the base rate makes borrowing more expensive and saving more attractive, reducing aggregate demand.

impact of investment of a higher rate of interest

Firms face higher borrowing costs → investment (I) falls → AD shifts left → lower output.

Long-term, productive capacity may also be impacted if firms delay expansion.

Problem:

Could reduce long-term economic growth and competitiveness.