AP Macroeconomics Graphs

1/9

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

10 Terms

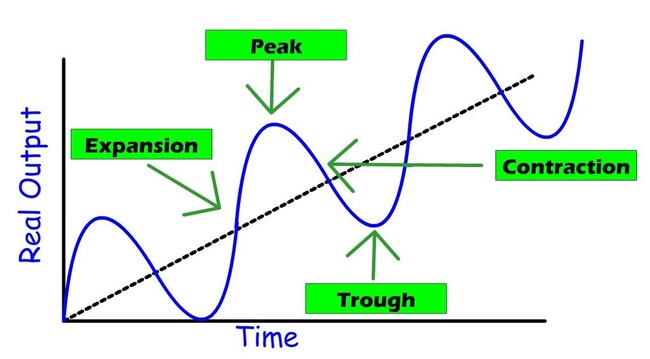

Business Cycle

Natural fluctuations in economic activity over time

Expansion is also called recovery

Peaks coincide with an inflationary gap and may bring high inflation.

Contraction that last more than 6 months are generally referred to as recessions.

Troughs coincide with a recessionary gap and bring high unemployment and possibly deflation.

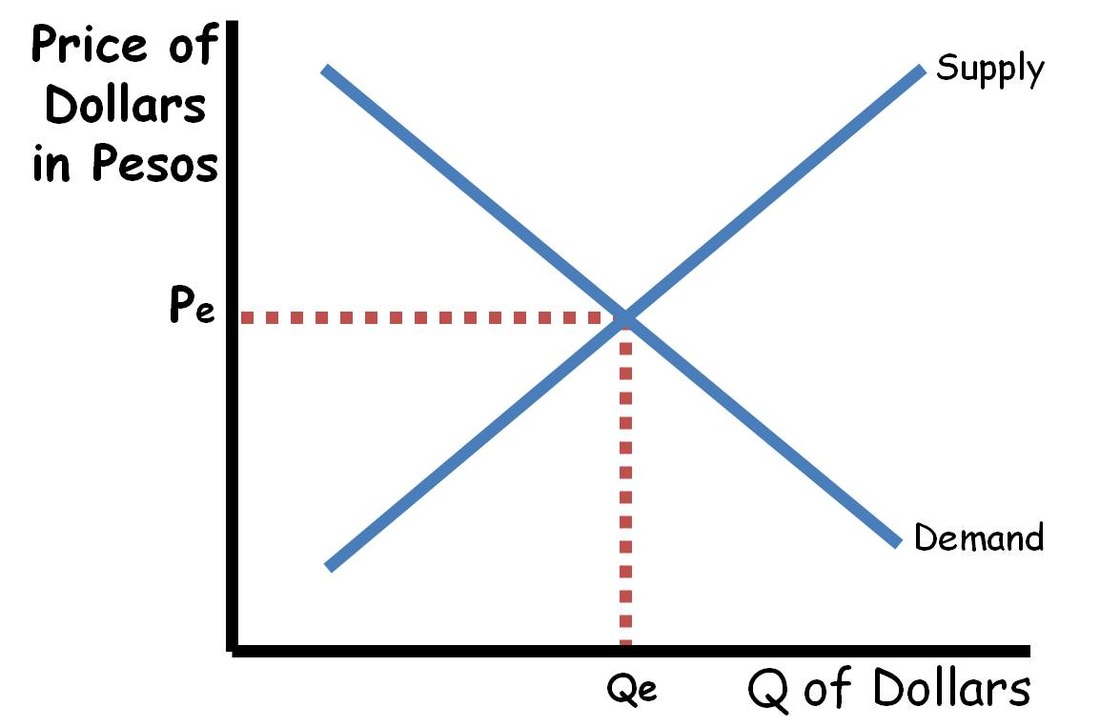

Foreign Exchange Market

A global marketplace for buying and selling currencies, where exchange rates are determined.

demand/supply for currency will shift because of a:

change in the interest rate for this country or other countries

change in the expected future exchange rate

change in anything that would make foreigners want to have more of this country’s currency

increase in demand means simultaneous decrease in the supply of the same currency

vice versa

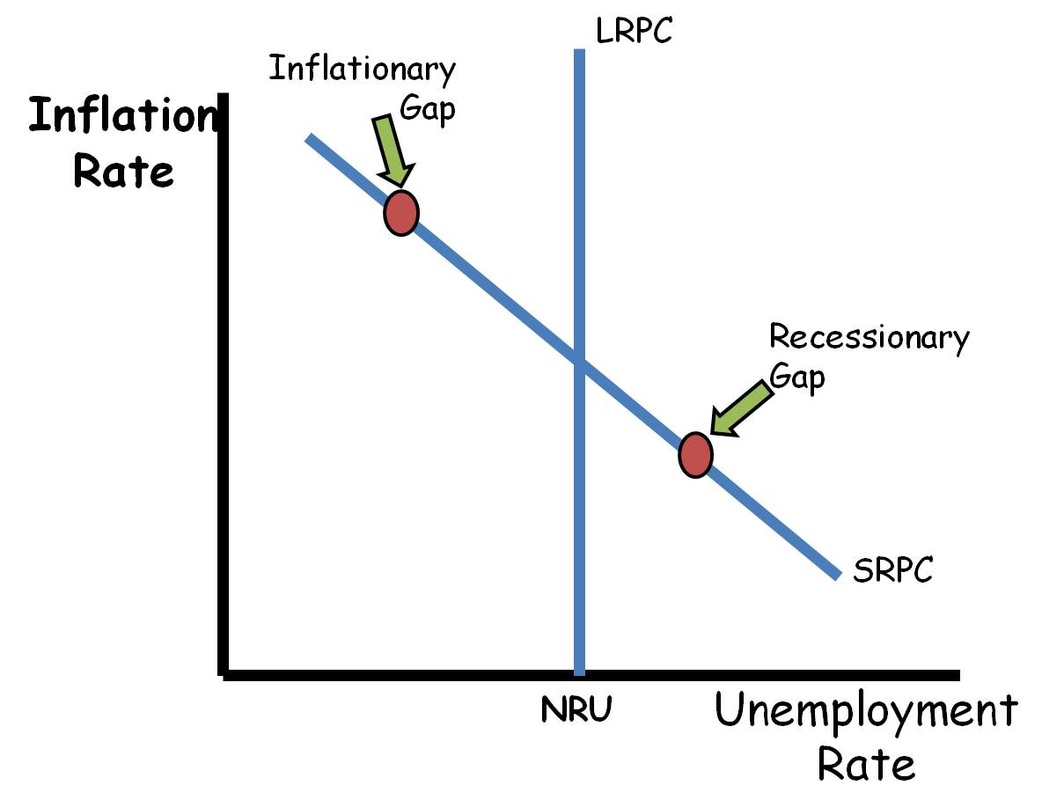

Philips Curve

The SRPC shows the inverse relationship between the inflation rate and the unemployment rate.

The LRPC lies at the Natural Rate of Unemployment (full employment).

The intersection between the SRPC and the LRPC is the expected rate of inflation.

When an economy is in long-run equilibrium the inflation rate will be at the intersection between the LRPC and the SRPC.

Changes in AD will cause movement along the SRPC.

Changes in AS will shift the SRPC left or right.

Changes in inflation expectations will cause SRPC to shift left or right.

The Philips Curve illustrates the trade-off between unemployment and inflation, indicating that lower unemployment can lead to higher inflation in the short run.

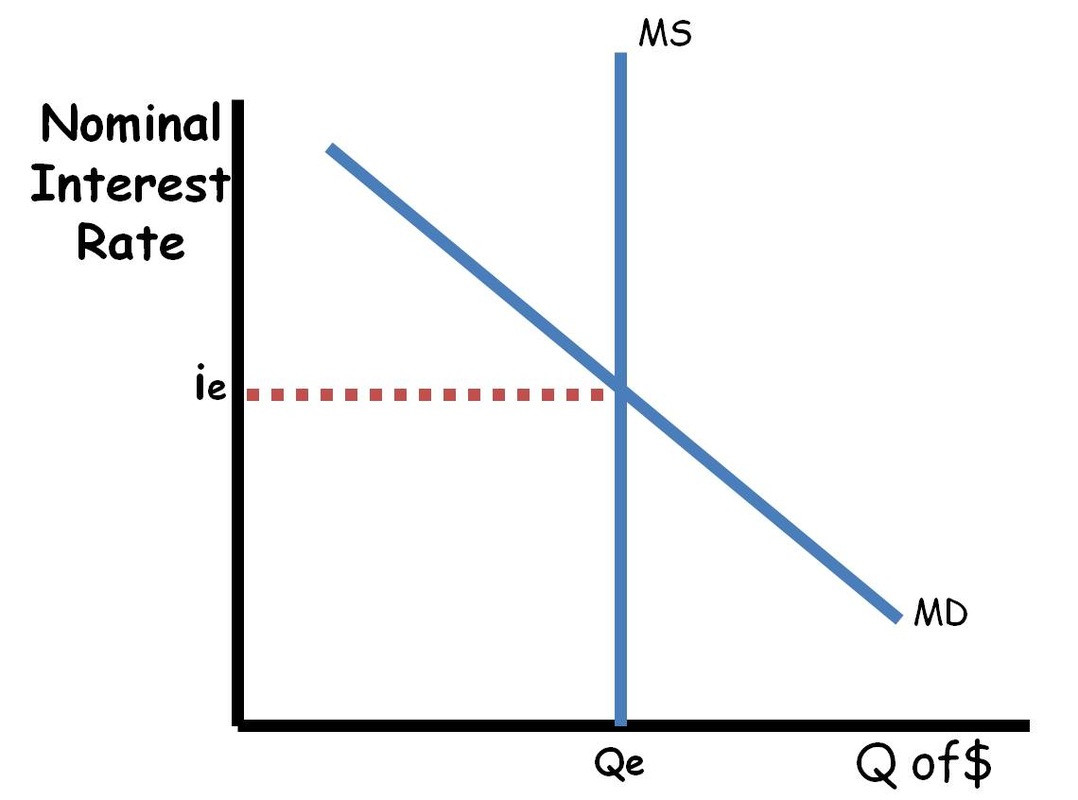

Money Market

MS is the amount of money in the economy as calculated by M1 or M2.

The Federal Reserve (AKA Central Bank) regulates the money supply through open market operations (buying and selling bonds or securities), discount rate, reserve requirement.

Expansionary monetary policy shifts the MS right.

Contractionary monetary policy shifts the MS left.

The MD can move because of a change in the number of transactions in an economy (C+Ig+G+Xn) or a change in the desire to hold cash as an asset.

The money market is where the supply and demand for money determine interest rates and the quantity of money available in the economy.

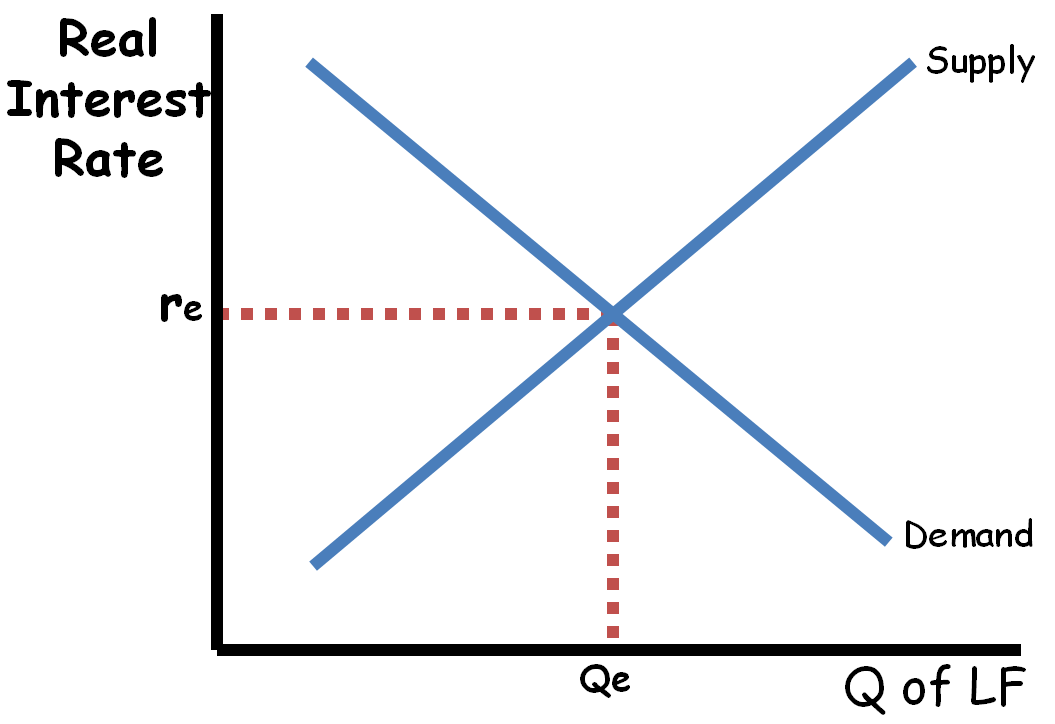

Loanable Funds Market

The supply for loanable funds is determined by how much money is being saved in the economy

The demand for loanable funds is determined by the amount of investment businesses would like to make.

gov increases spending to decrease in supply loanable funds = higher interest rates (crowding out)

gov decreases spending to increase supply of loanable funds - lower interest rates (crowding in)

interest rates effects quantity of investment, meaning interest rate change shifts AD curve

increase in capital accounts = increase in supply of loanable funds

The loanable funds market is where the supply and demand for funds determine interest rates and the level of investment in the economy.

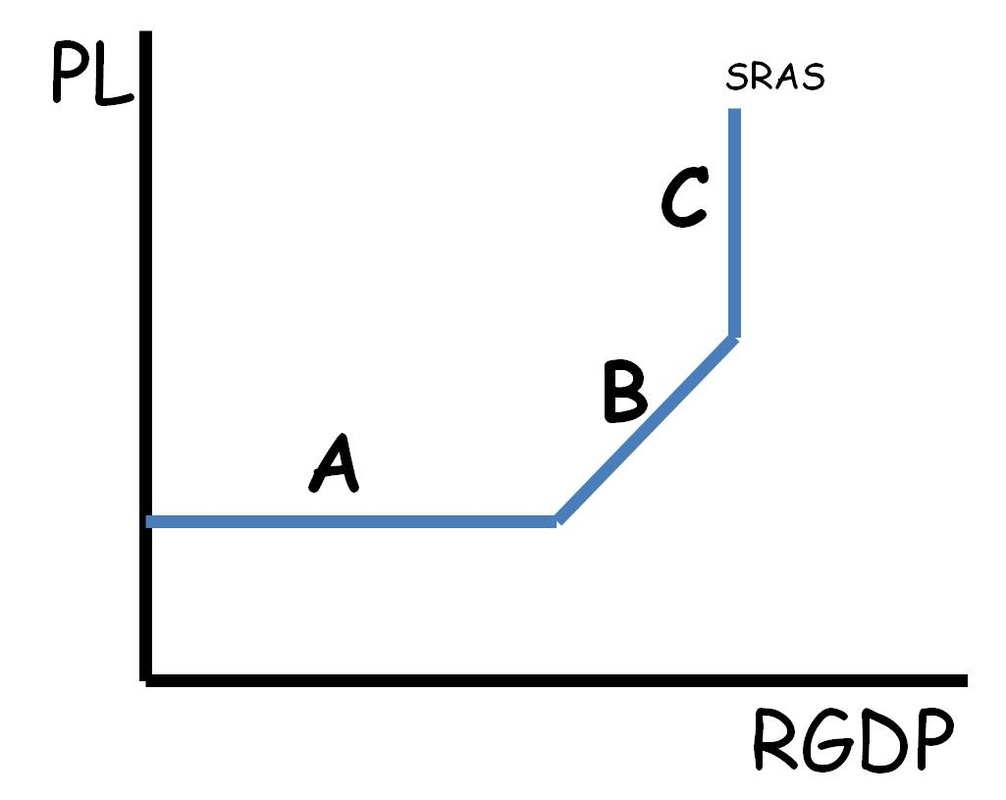

Parts of Short Run Aggregate Supply Curve

The SRAS is the same thing as the AS curve

An economy with an AS curve like A will be able to increase output without increasing the price level.

An economy with an AS curve like B will be able to increase output while increasing the price level.

An economy with an AS curve like C cannot increase output. Only price levels can increase.

**Remember the output and price level will be determined by the intersection between this curve and the AD curve (not shown)

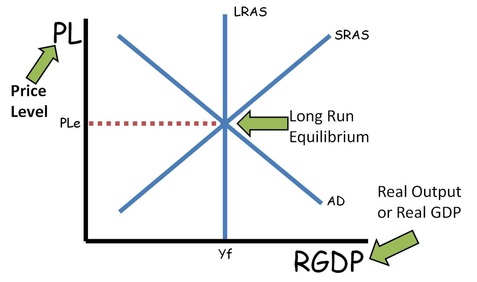

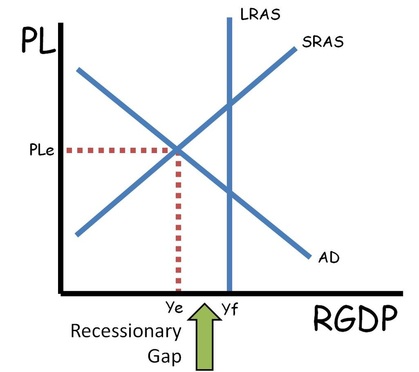

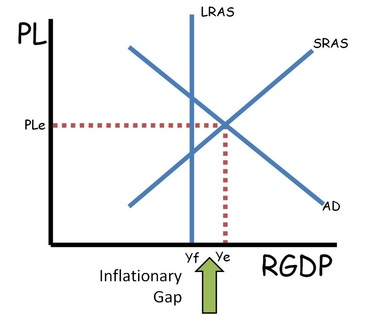

Aggregate Supply and Aggregate Demand

LRAS is equal to the full employment level of output.

In the long run the economy will always return to LRAS.

In the short run the economy can have an inflationary gap (output above LRAS) or a recessionary gap (output below LRAS)

AD is equal to GDP and C+Ig+G+Xn

The government can use fiscal policy to shift AD right or left.

The Fed can use Monetary Policy to shift AD right or left.

AS can shift because of changes in productivity, costs of inputs, or supply shocks.

The LRAS can shift based on anything that would move the production possibilities curve

If the economy is not at long run equilibrium, workers will eventually get lower (Recessionary gap) or higher (Inflationary gap) wages which means a change in input costs causing a shift of the AS towards long-run equilibrium

Aggregate Supply and Aggregate Demand (Recessionary)

Shift LRAS to the left due to decreased output and increased unemployment, leading to lower overall demand in the economy.

Aggregate Supply and Aggregate Demand (Inflationary)

Shift LRAS to the right due to increased output and employment, resulting in higher overall demand in the economy.

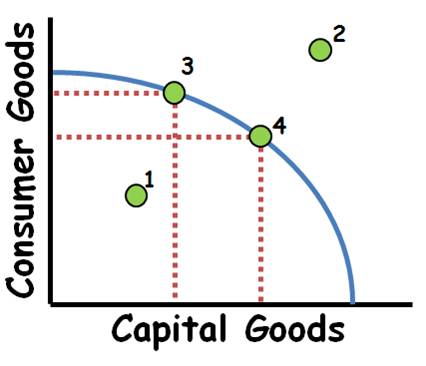

Production Possibilities Curve

Inefficient use of resources, but it is possible to produce at this point.

Scarcity prevents this level of production without new resources. (trade may also make this point possible).

3 to 4 Increasing opportunity costs if PPC is concave. This is due to resources not being equally adaptable both products.

For constant costs the PPC will be a straight line.

Increases in the quality or quantity of resources as well as technological improvements will shift the PPC outward.

Decreases in the quality or quantity of resources will shift the PPC inward