Macro investment and consumption

1/55

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

56 Terms

What is the first of Keynes's three conjectures about consumption?

Disposable income is the main determinant of consumption.

According to Keynes's second conjecture, the Marginal Propensity to Consume (MPC) is between _____ and _____.

0 and 1

What is Keynes's third conjecture regarding the Average Propensity to Consume (APC)?

The APC, or the ratio of consumption to income, decreases as income increases. This suggests that as individuals earn more, they tend to save a greater portion of their additional income rather than spend it.

What is the formula for the Keynesian consumption function?

C = Cˉ+MPC×Y, where Cˉ is autonomous consumption and Y is disposable income.

This formula describes how total consumption (C) is determined by both autonomous consumption (Cˉ), which is the level of consumption when disposable income is zero, and the product of the Marginal Propensity to Consume (MPC) and disposable income (Y).

What is Autonomous consumption, and in relation to the consumption function equations?

The level of consumption that occurs when income is zero, reflecting the basic needs individuals meet regardless of their income level.

In the Keynesian model, what does an increase in income cause the Average Propensity to Consume (APC) to do?

It causes the APC to fall, as shown by the formula APC = Cˉ/Y + MPC

This indicating that with higher income levels the proportion of income spent on consumption decreases.

What is the 'consumption puzzle' that contradicted Keynes's conjectures and what did it suggest?

Simon Kuznets showed that in long-term data, the Average Propensity to Consume (APC) was very stable and did not fall as income grew.

This stability of the APC suggested that individuals did not adjust their consumption patterns as Keynes had predicted, contradicting the expectation of a decreasing APC with rising income.

What is the core assumption of Irving Fisher's model of intertemporal choice? (inter temporal budget constraint)

It assumes the consumer is forward-looking and chooses present and future consumption to maximise lifetime satisfaction and utility given their preferences and resources.

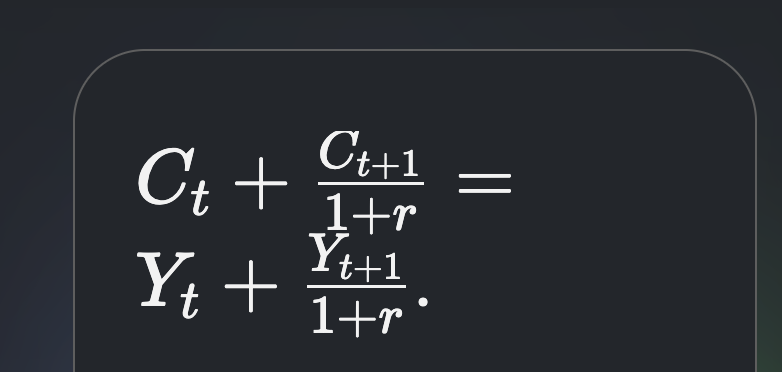

What is the intertemporal budget constraint in Fisher's two-period model?

What is the economic interpretation of the slope, −(1+r), of the intertemporal budget constraint?

It represents the relative price of current consumption in terms of future consumption. The slope indicates how much future consumption must be sacrificed to gain an additional unit of current consumption, reflecting the trade-off between present and future consumption opportunities.

What event causes a parallel shift in the intertemporal budget constraint?

A change in either current income (Yt) or future income (Yt+1).

What event causes the intertemporal budget constraint to rotate around the endowment point?

A change in the real interest rate (r).

What is the endowment point on the inter temporal budget constraint

The endowment point on the intertemporal budget constraint refers to the combination of current and future consumption that a consumer can afford given their current income and future income without any saving or borrowing. It represents the initial allocation of resources before considering any changes in consumption choices.

Where is the optimal consumption choice in the inter temporal budget constraint?

Typically found at the point where the highest indifference curve is tangent to the budget constraint, indicating the best trade-off between current and future consumption.

(occurs where the slope of the indifference curve equals the slope of the budget constraint)

How is the optimal consumption choice in the inter temporal budget constraint represented?

MRSCt,Ct+1 = (1+r) aka marginal rate of sub = market trade off

For a lender, a decrease in the interest rate makes current consumption relatively cheaper, leading to a positive _____ effect.

substitution. The substitution effect occurs when a decrease in interest rates makes current consumption more attractive than future consumption, prompting consumers to alter their spending behavior.

For a lender, a decrease in the interest rate reduces lifetime income, leading to a negative _____ effect on consumption in both periods.

income. The income effect occurs when lower interest rates reduce the total returns on savings, resulting in a decrease in overall lifetime income, thereby affecting consumption patterns.

What is the income and substitution effect?

The income and substitution effects describe how changes in interest rates influence consumer behaviour.

The substitution effect refers to the tendency to prefer current consumption over future consumption when interest rates decline

The income effect refers to the reduction in lifetime income due to lower returns on savings, leading to decreased consumption in both present and future periods.

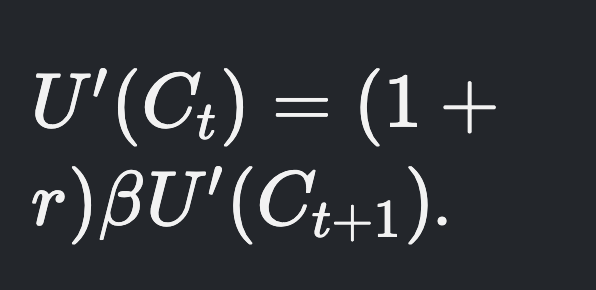

What is the Euler equation, which links current and future marginal utility of consumption?

Explain the Euler equation In simple terms?

Describes how individuals make consumption choices over time based on their current and future marginal utility.

It highlights the relationship between current consumption and expected future consumption, ensuring that individuals optimise their utility by balancing these choices.

What is the main implication of the Euler equation for household behavior?

Households will smooth consumption over time, making them indifferent between receiving income today or in the future. This indicates that households prefer a stable consumption path over time, adjusting their current spending in response to changes in expected future income.

The Euler equation determines the _____ of consumption, not its level.

dynamics

What is the central idea of the Life-Cycle Hypothesis (LCH) developed by Franco Modigliani?

Income varies systematically over a person's life, and saving allows the consumer to smooth consumption, particularly for retirement.

It suggests that individuals plan their consumption and savings behavior based on their expected lifetime income, enabling them to maintain a stable living standard throughout their lives.

What is the central idea of the Permanent Income Hypothesis (PIH) developed by Milton Friedman?

Consumption responds primarily to changes in permanent income (average, expected long-term income), not temporary fluctuations.

According to the PIH, current income (Y) is composed of which two parts?

Permanent income (Y^p) and transitory income (Y^t).

permanent income reflects long-term expectations

transitory income accounts for temporary variations like bonuses or seasonal earnings.

According to the PIH and LCH, how should consumption respond to an anticipated change in income?

There should be no response, as the anticipated change has already been factored into lifetime resources and smoothed out.

This is because consumers have already adjusted their savings behavior in anticipation of future income changes, allowing consumption to remain stable despite fluctuations.

What does empirical literature, such as that reviewed by Jappelli and Pistaferri (2010), suggest about consumption's response to anticipated income changes?

Consumption does respond to anticipated income increases, contrary to the standard models, possibly due to binding borrowing constraints. This suggests that consumers may increase current consumption in response to expected future income changes, influenced by factors like credit availability and confidence.

The Random-Walk Hypothesis, developed by Robert Hall, states that if the PIH and rational expectations hold, then changes in consumption should be _____.

unpredictable and only based on unexpected income changes.

What is the Random Walk hypothesis

The Random Walk hypothesis, developed by Robert Hall, posits that consumers' spending behavior is unpredictable and reflects only unexpected changes in income, adhering to the principles of the Permanent Income Hypothesis (PIH) and rational expectations.

According to the Random-Walk Hypothesis, only _____ changes in income or wealth will alter consumption.

unexpected

What is a binding borrowing constraint?

A situation where a consumer cannot borrow, forcing their current consumption to be less than or equal to their current income (Ct≤Yt).

For a consumer facing a binding borrowing constraint, how does an unexpected increase in current income affect current consumption?3

Consumption increases one-to-one with the increase in income, as the consumer cannot borrow against future income. Consequently, all of the additional income is directed toward current spending without the ability to save or borrow.

What is 'precautionary saving'?

Precautionary saving refers to the practice of setting aside funds as a safeguard against potential future uncertainties or unexpected expenses, ensuring financial security in times of need.

In the neoclassical model of business fixed investment, when is it profitable for a firm to add to its capital stock?

When the marginal product of capital exceeds the cost of capital, indicating that additional investment will generate greater returns than expenses.

The profit-maximizing condition for a production firm is to rent capital until the Marginal Product of Capital (MPK) equals the …?

/real rental price of capital (R/P)

What is the formula for the real cost of capital in the neoclassical investment model?

Pk/P(r+δ), where PKk/P is the relative price of capital, r is the real interest rate, and δ is the depreciation rate.

An increase in the real interest rate _____ the real cost of capital, which in turn reduces business fixed investment.

raises

What is the formula for gross investment in the neoclassical model?

Gross Investment = In [MPK − Pk/P(r+δ)] + δK, where In is net investment.

How does a higher existing stock of capital (K) affect the equilibrium rental price of capital and the MPK?

It reduces both the equilibrium rental price and the MPK, as it represents a movement down the capital demand curve. This is because an increase in the stock of capital leads to diminishing returns in the production process.

How does a reduction in the MPK (due to a higher capital stock) impact the investment demand curve?

A reduction in the MPK shifts the investment demand curve to the left, indicating lower business investment at any given interest rate, as firms expect lower returns on additional capital.

What is the neoclassical model in laymans terms?

The neoclassical model explains how supply and demand interact to determine prices and output in an economy, focusing on how consumers and firms make decisions to allocate resources efficiently. It also emphasizes the role of capital accumulation, technological progress, and individual choices in influencing economic growth and efficiency.

What is the definition of Tobin's q?

q = Market value of installed capital / Replacement cost of installed capital.

It’s a ratio that compares the market value of a firm's assets to the cost of replacing those assets. A q greater than 1 indicates that the market values the assets highly relative to their replacement cost, suggesting favorable investment conditions.

According to Tobin's q theory, if q>1, firms should _____ their capital stock.

increase

In the model of residential investment, the flow of new investment (IH) depends directly on the _____.

relative price of housing (Ph / P)

In the residential investment model, a lower income shifts the demand curve for housing _____, which _____ the relative price of housing and reduces residential

inward; lowers

What are the four main reasons firms hold inventories?

Production smoothing

inventories as a factor of production

stock-out avoidance

work in process.

The motive for holding inventories where firms produce at a steady rate despite fluctuating sales is known as _____.

production smoothing

Why does an increase in the real interest rate reduce inventory investment?

Because the real interest rate is the opportunity cost of holding inventories.

According to exam feedback, a common error when analyzing the Fisher model with binding borrowing constraints is drawing the budget constraint without a ____.

kink

Exam feedback indicates that when explaining the Keynesian model, students often fail to mention the _____ of the change in consumption.

size (i.e., that it is given by the MPC times the change in disposable income)

According to exam feedback, what must be a central part of the discussion when analyzing the impact of interest rates on business investment?

The neoclassical investment function.

Exam feedback highlights that a common mistake in residential investment diagrams is incorrectly labeling the vertical axis as the real interest rate instead of the _____.

relative price of housing (Ph / P)

In Fisher's two-period model, what are the two opposing effects on a lender's current consumption when the interest rate decreases?

A positive substitution effect (current consumption is cheaper) and a negative income effect (lifetime resources are lower).

According to Robert Hall's Random-Walk Hypothesis, consumption changes in response to _____ information.

new (or unanticipated)

What is the marginal propensity to consume (MPC) out of an unanticipated permanent income shock expected to be, according to the PIH?

close to one because consumers save part of the shock for future use.

What is the marginal propensity to consume (MPC) out of an unanticipated transitory income shock expected to be, according to the PIH?

Close to zero. This is because consumers are likely to save most of the transitory income shock for future consumption rather than spending it immediately.