Macroeconomics week 2

1/42

Earn XP

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

43 Terms

Wealth

A stock variable (measured one time). It is everything you own (real estate, machinery, capital goods) - the debt you owe + debt owed to you

Bond

A security that promises to pay fixed amount of money at specific intervals

e.g you loan money to the government in return for a agreed rate of interest decided by the bond-coupon

Usually over a long period of time (10-30 years)

if you loan 1000€ for 10 years with a 5% interest, you get paid 50€ every year.

Considered as a low risk investment

Income

The amount of money one receives over some period of time

Depreciation

Reduction in the values of a stock or wealth over time

Net income

Gross income- depreciation

Earnings

Income from labor

Savings

Income that is not consumed

Investment

Expenditure on newly produced capital goods that is going to be used to make new goods and services.

Interest rate

The price of bringing some buying power forward in time

What decides the amount of consumption an individual will bring forward?

Consumption smoothing

Impatience

Consumption smoothing

Consumption smoothing is the strategy of maintaining a stable level of spending over time by saving during periods of high income to cover expenses during periods of low income.

Diminishing marginal returns to consumption

The value of an additional unit declines, the more consumption the individual has

Pure impatience

myopia; (short-sightedness): People experience the present satisfaction more strongly than the same satisfaction later

Prudence; People know that they may not be around in the future, and so they want to consume now

What is the consumer’s optimal point of consumption?

Where their discount rate (MRS) is tangent with the rate of interest (MRT)

Reservation indifference curve

All of the points at which the individual would be just as well off as at the reservation position (endowment)

Endowment

The facts about an individual may affect their income, such as the physical wealth a person has, either land, housing, or a portfolio of shares (stocks). It also includes other relevant qualities such as schooling, gender, etc.

For a borrower, their endowment refers to the resources they already have available to them before engaging in borrowing. This could include cash reserves, assets, or any other form of wealth that they can utilize to fulfill their borrowing needs.

For a saver, their endowment represents the resources they allocate towards saving or investing. This could include income, assets, or any other form of wealth that they set aside for future use.

Balance sheet

Summarises what the household or firm owns, and what it owes to others

Asset

Anything of value that is owed; liabilities + net worth

Liabilities

Anything of value that is owed

Net worth

Assets- liabilites

Stock

A part of the assets of a firm that may be traded. It gives the holder a right to receive a proportion of a firm’s profit and to benefit when the firm’s assets become more valuable

Central bank

A central bank is a financial institution that manages a country's currency, money supply, and interest rates to stabilize the economy and control inflation.

The CB acts as the banker for the commercial banks, who have accounts at the central bank that hold legal tender

Legal tender

Currency that must be accepted for payment of debts and obligations within a specific jurisdiction.

Base money

Base money refers to the total amount of physical currency in circulation and the reserves held by the central bank. It is also known as high-powered money.

Bank Money

The money that commercial banks create by making loans

a liability to the bank

banks earn profit by charging interest on bank money

≠ legal tender

Broad money

base money + bank money

Default risk

Default risk is the likelihood that a borrower will not be able to repay a loan or meet their debt obligations, leading to financial loss for the lender.

e.g. mortgage loan, your house is at risk if you don’t pay the loan bank

Liquidity risk

Liquidity risk refers to the possibility of not being able to buy or sell an asset quickly without affecting its price.

Systematic risk

A risk that affects all assets in the market, so that it is not possible for investors to reduce their exposure to the risk by holding a combination of different asset

aka. undiversifiable risk

Idiosyncratic risk

A risk that only affects a small number of assets at one time. Traders can almost eliminate their exposure to such risks by holding a diverse portfolio of assets affected by different risks

aka diversifiable risk

Maturity transformation

Maturity transformation is a banking strategy where short-term deposits are used to fund long-term loans, profiting from the interest rate spread.

Since short-term deposits can be taken out at any time, this creates liquidity risk

Liquidity transformation

Liquidity transformation is the process where financial institutions convert short-term liabilities into long-term assets, balancing liquidity needs.

Market capitalization rate

The rate of return that is just high enough to induce investors to hold shares in a particular company. This will be high if the company is subject to a high level of systematic risk.

Fundamental value of share

The share price based on anticipated future earnings and the level of risk.

Bank-run

A situation where all depositors demand their money at once; may result in bank failure

Policy interest rate

The interest rate on base money, set by the central bank to influence monetary conditions, inflation, and economic growth in a country.

Affects the level of spending in the economy, because households and firms borrow to spend

Bank lending rate

The average interest rate charges by commercial banks to firms and households

Official rate

Official rate is the exchange rate set by the government or central bank, used for official transactions and to control the value of the national currency.

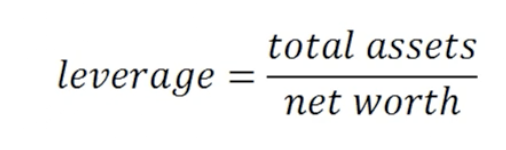

Leverage

Refers to the ability to use borrowed funds or financial instruments to amplify the potential returns of an investment or business activity

In order to increase profit, one would like to decrease net worth and increase total assets

From a risk POV, higher leverage makes it more likely that you will be insolvent (unable to pay debts owed)

Principal-agent problem

A conflict of interest between principal and agent, about some hidden action or attribute of the agent that cannot be enforced or guaranteed in a binding contract.

What can be done in order to resolve the conflict of interest between the principal (lender) and the agent (borrower)?

Equity: the lender may require the borrower to put some of her wealth into the project

Collateral: the borrower has to set aside property that will be transferred to the lender if the loan is not repaid

Credit rationing

When those with less wealth are credit-constrained or credit excluded

credit constrained, borrow on unfavorable terms compared with those with more wealth

Credit excluded, poor people are refused a loan

Explain the mechanism behind how lowering the official rate by the Central Bank stimulates consumption and investment

Change in base money: The central bank typically implements monetary policy by adjusting the base money supply, which includes physical currency and commercial bank reserves

Change in Credit Provision by Commercial Banks: owering the central bank's interest rate makes it cheaper for commercial banks to borrow money from the central bank. As a result, commercial banks are encouraged to lend more money to businesses and consumers at lower interest rates.

Change in Bank Money: When commercial banks lend money to businesses and consumers, they create bank money. This is money in the form of deposits that can be used for transactions.

Change in Broad Money: Broad money refers to the total money supply within an economy, including both base money and bank money. As commercial banks increase their lending in response to lower interest rates, the broad money supply expands. This increase in the availability of money encourages spending and investment throughout the economy.

Changes in Feasible Frontiers of Saving, Borrowing, and Investing: Lowering interest rates alters the feasible frontiers of saving, borrowing, and investing for individuals and businesses. When interest rates are lower, the cost of borrowing decreases, making it more attractive for businesses to invest in new projects and for consumers to purchase big-ticket items through loans.