CH 12 Inflation and the Quantity Theory of Money

1/91

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

92 Terms

Inflation

An increase in the average level of prices.

Inflation Rate

The percentage change in a price index from one year to the next.

Inflation Rate Formula

Inflation rate % = ((P2 - P1) / P1) × 100, where P2 is the index value in year 2, and P1 is the index value in year 1.

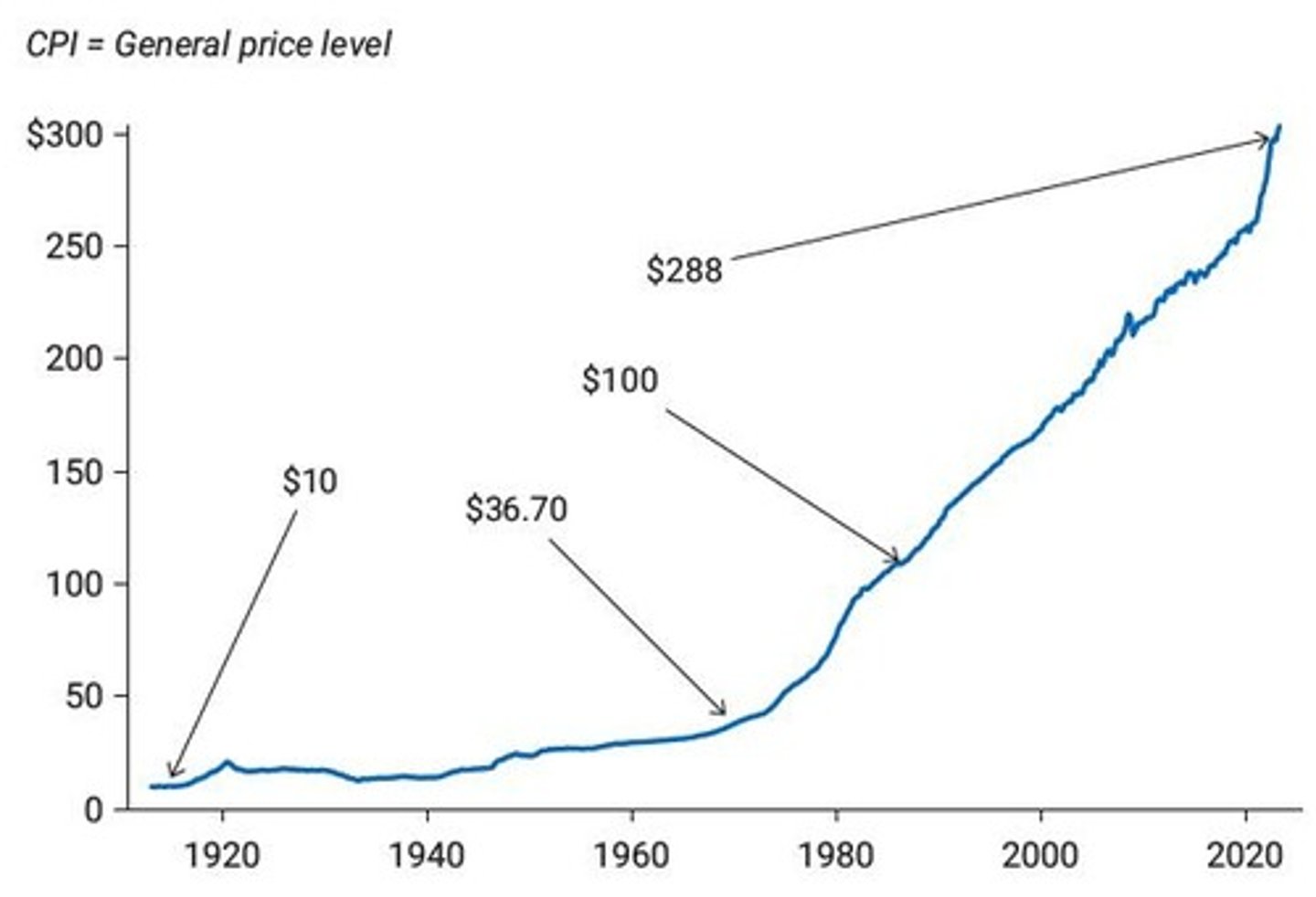

Consumer Price Index (CPI)

Measures the average price for a basket of goods and services bought by a typical American consumer; covers 80,000 goods and services and is weighted so major items count more.

GDP Deflator

The ratio of nominal to real GDP multiplied by 100; covers finished goods and services.

Producer Price Indexes (PPI)

Measure the average price received by producers; includes intermediate and finished goods and services.

Relevance of CPI

For Americans, CPI is the measure of inflation that corresponds most directly to their daily economic activity.

Real Price

A price that has been corrected for inflation. Real prices are used to compare the prices of goods over time.

Real Price Calculation

The CPI is used to calculate real prices, for example, the real price of gasoline in 2006 was slightly lower than in 1982.

Hyperinflation

Occurs when price increases are so out of control that the concept of inflation is meaningless.

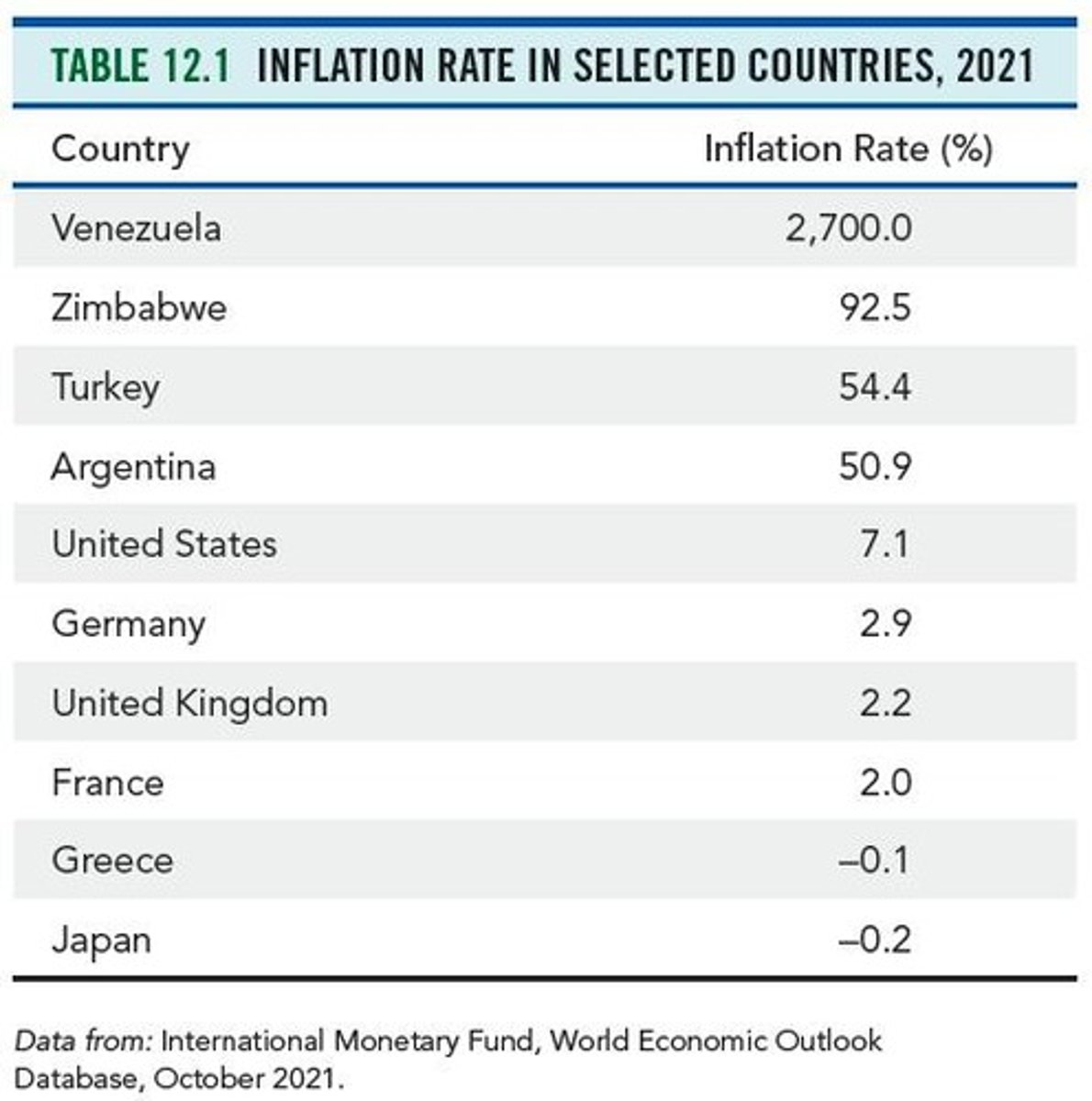

Highest Inflation Rate

In 2021, Venezuela had the highest inflation rate in the world at 2,700%.

Cumulative Inflation Rate

Hungary's postwar hyperinflation after World War II, 1945-1946, had a cumulative inflation rate of 1.3 × 10^24%.

Inflation Example

If the price index is 200 in year 1 and 210 in year 2, the rate of inflation is 5%.

Inflation Measurement

Inflation is measured by changes in a price index.

Bureau of Labor Statistics (BLS)

The agency that computes the Consumer Price Index (CPI).

Inflation Effect

The effect of inflation on a large basket of goods.

Deflation

A decrease in the average level of prices.

Price Index

A measure that examines the weighted average of prices of a basket of consumer goods and services.

Nominal GDP

The market value of goods and services produced in a country in a given period without adjusting for inflation.

Real GDP

The market value of goods and services produced in a country in a given period, adjusted for inflation.

Inflation and Economic Activity

Inflation affects purchasing power and can influence economic decisions.

Cumulative inflation rate

1.3 × 10^24% after World War II, 1945-1946.

Maximum inflation rate

4.19 × 10^16% on a monthly rate basis.

Real price

A price that has been corrected for inflation.

Quantity Theory of Money

Sets out the general relationship between money, velocity, real output, and prices.

Money supply (M)

The total amount of money available in an economy at a specific time.

Price level (P)

The average of current prices across the entire spectrum of goods and services produced in the economy.

Velocity of money (v)

The average number of times a dollar is spent on finished goods and services in a year.

Real GDP (YR)

The total value of all goods and services produced in an economy, adjusted for inflation.

Nominal GDP

The total value of all goods and services produced in an economy without adjusting for inflation.

Stable velocity of money

The velocity of money is determined by factors that change only slowly.

Inflation

Caused by an increase in the supply of money.

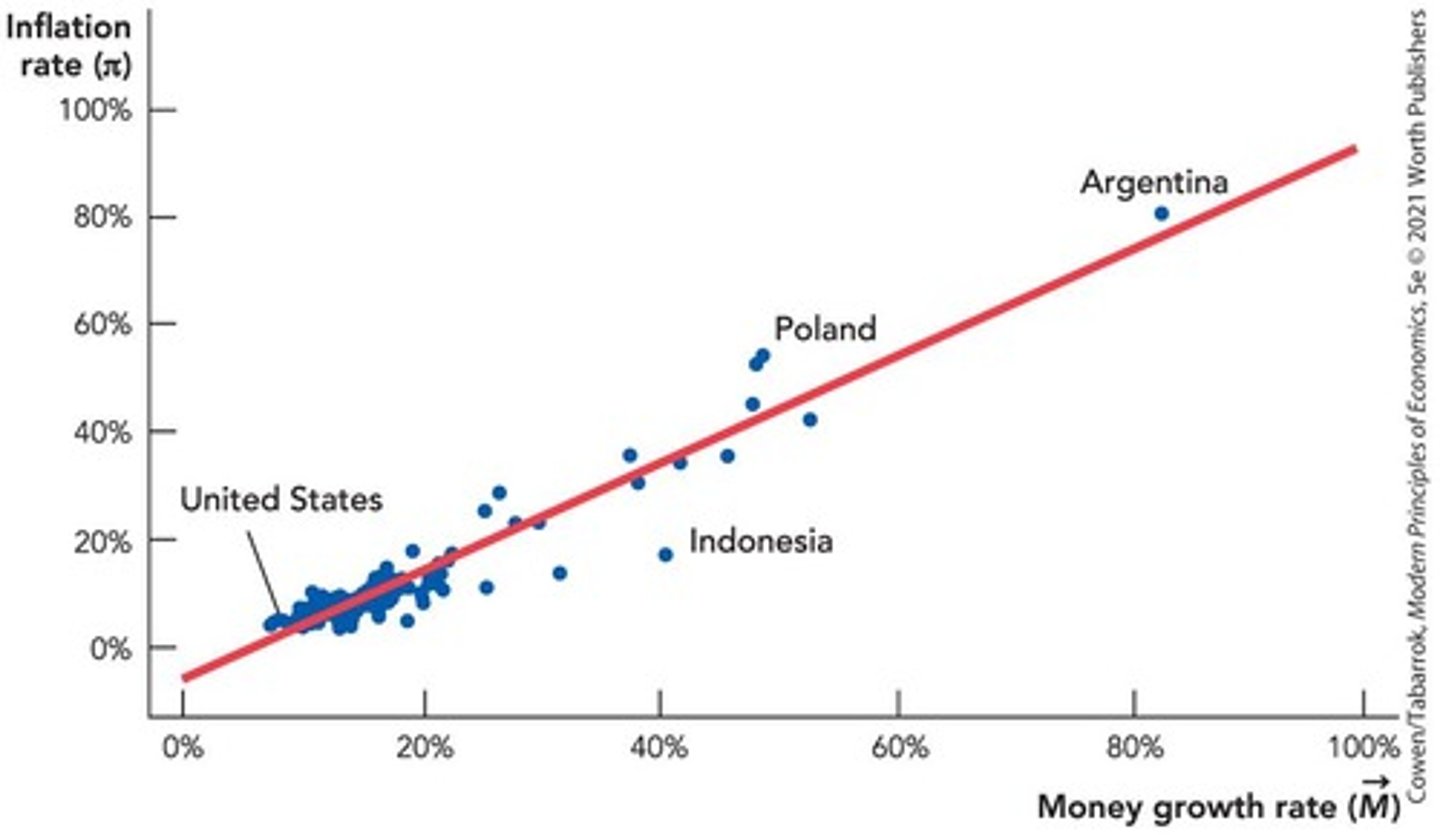

Growth rate of money supply

Approximately equal to the inflation rate.

10% increase in money growth rate

Leads to a 10% increase in the inflation rate.

Critical role of money supply

Determines the inflation rate.

Factors of production

Capital, labor, and technology that fix Real GDP.

Currency turnover rate

Another term for the velocity of money.

Milton Friedman

Economist who stated, 'Inflation is always and everywhere a monetary phenomenon.'

Linear relationship of money supply and inflation

Nations with rapidly growing money supplies had high inflation rates.

Average relationship of money growth and inflation

Almost perfectly linear as indicated by the red line.

Assumption of stability

Both real GDP (YR) and velocity (v) are stable compared to the money supply (M).

Dollar spent on final goods

The number of times a dollar is spent on final goods and services in a year.

Deflation

A decrease in the average level of prices (a negative inflation rate).

Disinflation

A reduction in the inflation rate.

Money Illusion

When people mistake changes in nominal prices for changes in real prices.

Real Rate of Return

The nominal rate of return minus the inflation rate.

Nominal Rate of Return

The rate of return that does not account for inflation.

Fisher Effect

The tendency of nominal interest rates to rise with expected inflation rates.

Real Interest Rate Formula

rReal = i − π where: rReal = Real interest rate, i = Nominal rate of interest, π = Rate of inflation.

Nominal Interest Rate Formula

i = Eπ + rEquilibrium where: rEquilibrium = Equilibrium real rate of return, i = Nominal rate of interest, Eπ = Expected rate of inflation.

Costs of Inflation

Four problems associated with inflation: 1. There is price confusion and money illusion. 2. Inflation redistributes wealth. 3. Inflation interacts with other taxes. 4. Inflation is painful to stop.

Price Confusion

Inflation makes price signals more difficult to interpret.

Redistribution of Wealth

Inflation is a type of tax that transfers real resources from citizens to the government.

Unexpected Increase in Money Supply

An unexpected increase in the money supply can boost the economy in the short run.

Long Run Money Neutrality

In the long run, money is neutral.

Inflation and Lenders

Inflation reduces the real return that lenders receive on loans, transferring wealth from lenders to borrowers.

Inflation and Borrowers

When inflation and interest rates fall unexpectedly, wealth is redistributed from borrowers (who are paying higher rates) to lenders.

Price Signals

It is not always clear whether prices are rising because of increased demand or because of an increase in the money supply.

Resource Allocation

Resources are wasted in activities that appear profitable but are not, and resources flow more slowly to profitable uses.

Self-Check Question

A decrease in the average level of prices is called: a. deflation. b. disinflation. c. money illusion.

Self-Check Answer

A decrease in the average level of prices is called deflation.

Fisher Effect

The tendency of the nominal interest rate to increase with expected inflation.

Unexpected Inflation

Inflation that is not anticipated by borrowers and lenders.

Unexpected Disinflation

A decrease in the inflation rate that is not anticipated.

Expected Inflation = Actual Inflation

When the expected inflation rate matches the actual inflation rate.

Real Rate Equal to Equilibrium Rate

When the real interest rate is balanced with the equilibrium interest rate.

Real Rate Less Than Equilibrium Rate

When the real interest rate is below the equilibrium interest rate.

Real Rate Greater Than Equilibrium Rate

When the real interest rate is above the equilibrium interest rate.

No Redistribution of Wealth

A situation where inflation does not affect the distribution of wealth among individuals.

Harms Lenders, Benefits Borrowers

A condition where unexpected inflation negatively impacts lenders while benefiting borrowers.

Benefits Lenders, Harms Borrowers

A condition where unexpected deflation negatively impacts borrowers while benefiting lenders.

Monetizing the Debt

When the government pays off its debts by printing money.

Government Incentive to Increase Money Supply

A government with massive debts has an incentive to increase the money supply, since it benefits from unexpected inflation.

Lenders Expect Inflation

If lenders expect inflation, they will increase nominal rates.

Buyers of Bonds as Voters

Buyers of bonds are often also voters, who would be upset if real returns were shrunk.

Negative Real Rate of Return

When nominal interest rates are not allowed to rise and the inflation rate is high, leading to a negative real rate of return.

Supply of Savings Falls

When people take their money out of the banking system, leading to a decrease in the supply of savings.

Financial Intermediation Becomes Less Efficient

A situation where negative real interest rates reduce financial intermediation and economic growth.

Inflation Volatility and Long-term Loans

When inflation is volatile and unpredictable, long-term loans become riskier.

Tax Systems and Nominal Terms

Most tax systems define incomes, profits, and capital gains in nominal terms.

Inflation Produces Tax Burdens

Inflation will produce some tax burdens and liabilities that do not make economic sense.

Capital Gains Taxes Due to Inflation

If asset prices rise due to inflation, people pay capital gains taxes when they should not.

Inflation Pushes People into Higher Tax Brackets

Inflation can push people into higher tax brackets.

Corporations Pay Taxes on Phantom Profits

Corporations pay taxes on profits that do not reflect real economic gains due to inflation.

Government Reduces Inflation

The government can reduce inflation by reducing the growth in the money supply.

Lower Inflation Misinterpreted as Demand Reduction

When inflation is expected, lower inflation may be misinterpreted as a reduction in demand.

Workers Unemployment Due to Real Wage Increase

Workers may become unemployed as the unexpected increase in their real wage makes them unaffordable.

Inflation as a Monetary Phenomenon

Sustained inflation is always and everywhere a monetary phenomenon.

Money Neutral in the Long Run

Although money is neutral in the long run, changes in the money supply can influence real GDP in the short run.

Inflation Makes Price Signals Difficult

Inflation makes price signals more difficult to interpret.

Arbitrary Redistributions of Wealth

Arbitrary redistributions of wealth make lending and borrowing riskier and thus break down financial intermediation.

Mild Rate of Inflation

Anything above a mild rate of inflation is generally bad for an economy.