Tariff

1/22

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

23 Terms

Tariff is a tax on ______a good or service into a country

Specific tariff

Ad valorem tariff

Compound tariff

importing

Specific tariff is _______ as ________ amount per unit of import, such as dollars per tin of steel bars, or dollars per eight-cyclinder two-door sports car.

stipulated; a money

Ad valorem tariff is a ________ of the ____________ of the imported good when it reaches the importing country

percentage; estimated market value

Compound tariff is a _______ of specific and ad valorem tariffs

combination

Khi đánh thuế → Giá trị nhập khẩu của hàng hóa_____

tăng

A tariff almost always _____ world well-being

lowers

A tariff usually ____ the well being of each nation, including the nation ___________

lowers; imposing the tariff

A tariff absolutely helps those groups tied closely to ____________, even when the tariff is bad for the nation as a whole

the production of import substitutes

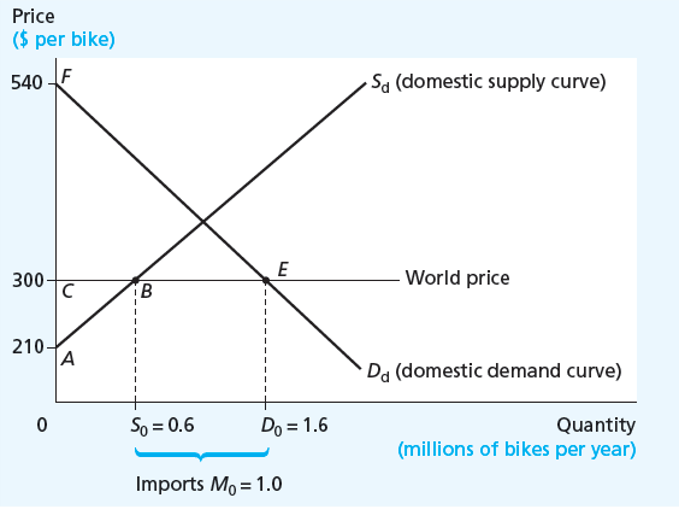

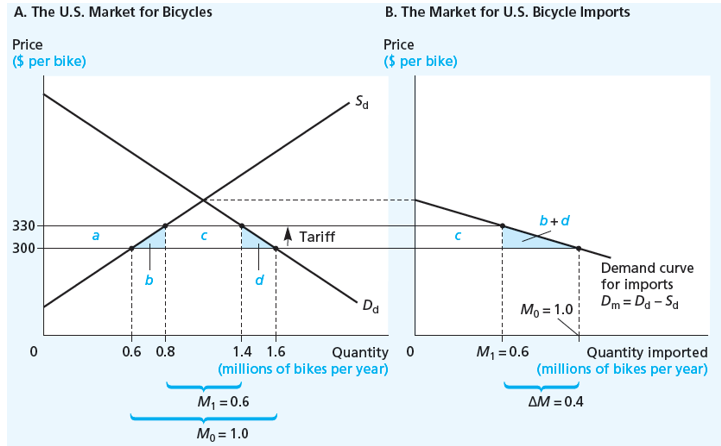

The effect of tariff on domestic producers

Domestic producer surplus is area ____

Domestic consumer surplus is area ____

CBA

FEC

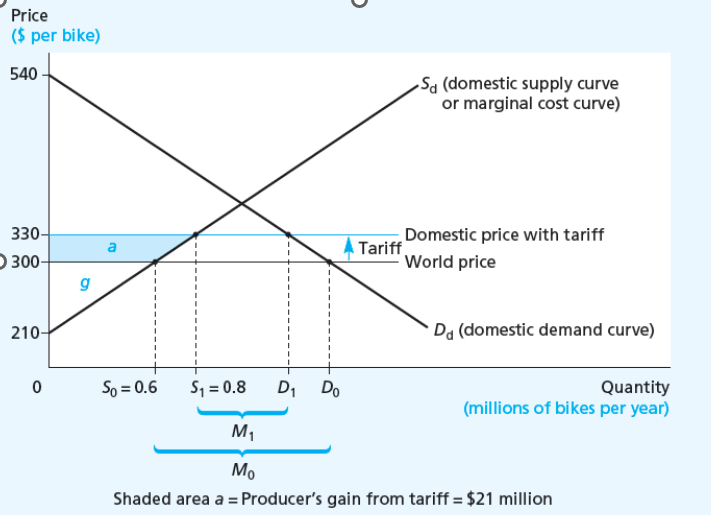

The effect of tariff on domestic producers

Producer được lợi

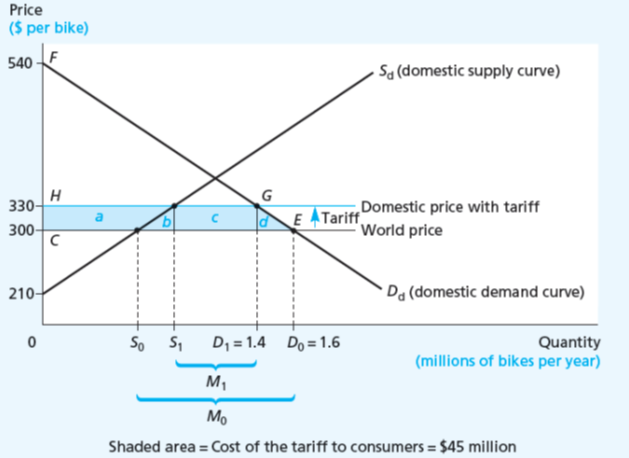

The effect of a tariff on domestic consumers

M1 * (330-300) =_______ →________

= quantity of imported * price of tariff

Diện tích hình c ; is the gov revenue from tariff

As long as the tariff is ________ to ______ all imports, it also brings ______ to the country’s government

This_____ could be used to pay for _________, matched by ________ in some other _____, or serve as ________

not so high as; prohibit; revenue

revenue; estra government spending; an equal cut; tax; extra income.

The Net National Loss form a Tariff

One-dollar, one-vote metric: Every dollar of gain or loss is just as important as every other dollar of gain or loss, regardless of who the gainers or losers are

= producers surplus - consumers surplus.

Sự cảm nhận về giá của mỗi người (Consumers và producers) khác nhau → sự mất đi và tăng thêm đối với mỗi quốc gia còn phụ thuộc vào nhiều yếu tố và chính sách của quốc gia đó.

The Net National Loss form a Tariff

Consumption effect of the tariff shows the loss to the consumers in the importing nation based on the reduction in their total consumption (area d in the diagram)

Thiệt hại mất đi vĩnh viễn ko lấy lại được của người tiêu dùng

The Net National Loss form a Tariff

Production effect of the tariff is the amount by which the cost of drawing domestic resources away from other uses exceeds the savings from not paying foreigners to buy extra units (area b in the diagram)

Thiệt hại mất đi vĩnh viễn ko lấy lại được của người sản xuất

Small Importing Country: Net National Loss from a Tariff

Thặng dư → mất đi b, c, d nhưng cuối cùng c vẫn thuộc revenue của gov → coi như không mất → Net los = b + d

Net gain = c - (b+d) → c càng lớn, b+d càng nhỏ càng tốt

Sau khi đánh thuế thì lượng sản xuất ko tăng lên, trong khi nếu ko đánh thuế thì có thể sản xuất ở lượng 0,8

→ 0.8 - 0.6 = 0.2 là dead loss

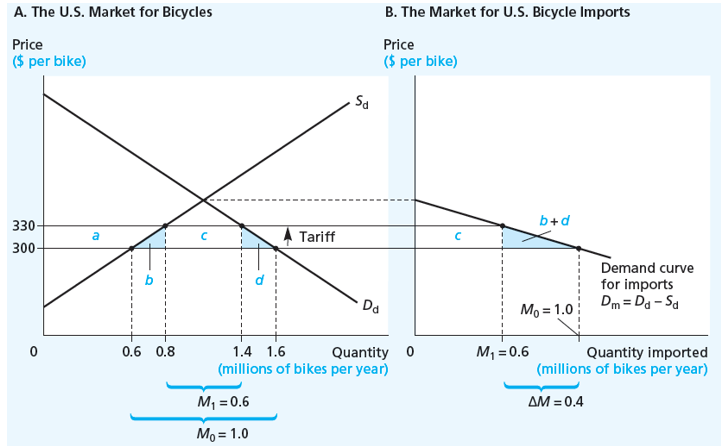

P0 = Giá trị trường

P0 - T = Giá sản xuất

Giá sản xuất + Tax = Giá trị trường

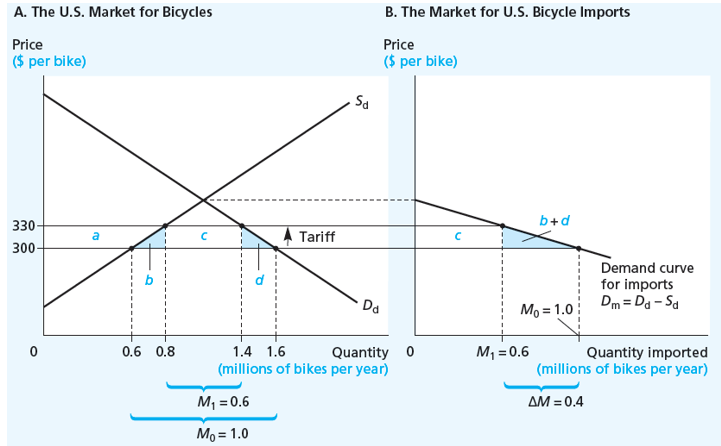

Large Country and the Terms of Trade

Monopsony power: a nation has ____________ for one of its imports that changes in the country’s import buying can _______________

a large enough share of the world market; noticeably affect the world price of the product

Large Country and the Terms of Trade

If the country’s _________, its terms of trade deteriorate (giảm). If its ___________, its terms of trade improve

demand for imports increases; import demand decreases

Nhu cầu mua / nhập khẩu tăng → có sức mạnh thương lượng → ToT giảm

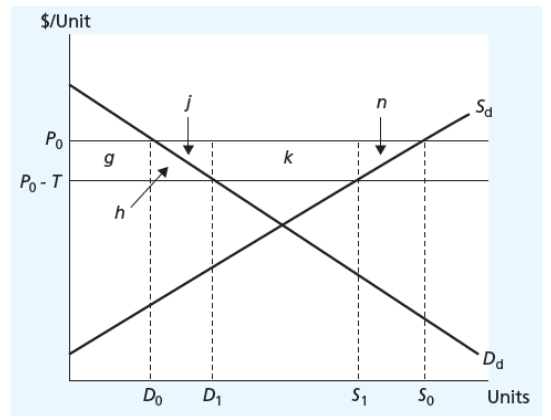

The Terms-of-Trade Effect of a Tariff Imposed by a Large Country

The large country will _______ because the _______ the _________, so foreign firms export less and produce less

import less; tariff inreases; domestic price

The Terms-of-Trade Effect of a Tariff Imposed by a Large Country

By _________ on foreign production, the ____________ of foreign production is lower

removing demand pressure; marginal cost at the smaller level

The Terms-of-Trade Effect of a Tariff Imposed by a Large Country

With ___________ and ________, foreign firms will compete and ___________

lower marginal cost; weak demand; lower their export price

A Large Country Imposes a Small Tariff

Giá thuế = 6 (cố định)

Vì sức mạnh thương lượng tăng → market price = 303 → giảm động lực sản xuất → sản xuất (vì exporter phải trả 1 phần thuế là 3 - dưới)

Người tiêu dùng chịu 3 đồng - trên