Joint Cost Allocation

1/15

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

16 Terms

Why do companies allocate costs?

To measure income and assets.

To justify costs for reimbursement or price regulation.

To inform economic decisions.

To influence managerial behavior (more on this later).

Cause and Effect

Using this criterion, managers identify the variables that cause resources to be consumed. For example, managers may use number of sales orders as the variable when allocating the costs of order taking to products and customers. Cost allocations based on the cause-and-effect criterion are likely to be the most credible to operating personnel.

What Cost allocation method is this?

Benefits Received

Using this criterion, managers identify the beneficiaries of the outputs of the cost object. The costs of the cost object are allocated among the beneficiaries in proportion to the benefits each receives. Consider a corporatewide advertising program that promotes the general image of the corporation rather than any individual product. The costs of this program may be allocated on the basis of division revenues; the higher the revenues, the higher the division's allocated cost of the advertising program. The rationale behind this allocation is that divisions with higher revenues apparently benefited from the advertising mare than divisions with lower revenues and, therefore, ought to be allocated more of the advertising costs.

What Cost allocation method is this?

Fairness or Equity

This criterion is often cited in government contracts when cost allocations are the basis for establishing a price satisfactory to the government and its suppliers. Cost allocation here is

viewed as a "reasonable" or "fair" means of establishing a selling price in the minds of the contracting parties. For most allocation decisions, fairness is a matter of judgment rather than an operational criterion.

What Cost allocation method is this?

Ability to Bear

This criterion advocates allocating costs in proportion to the cost object's ability to bear

costs allocated to it. An example is the allocation of corporate administration costs on the basis of division operating income. The presumption is that the more-profitable divisions have a greater ability to absorb corporate administration costs.

What Cost allocation method is this?

Joint products

Two or more products produced simultaneously by the same process. Becomes separate and identifiable at the split-off point.

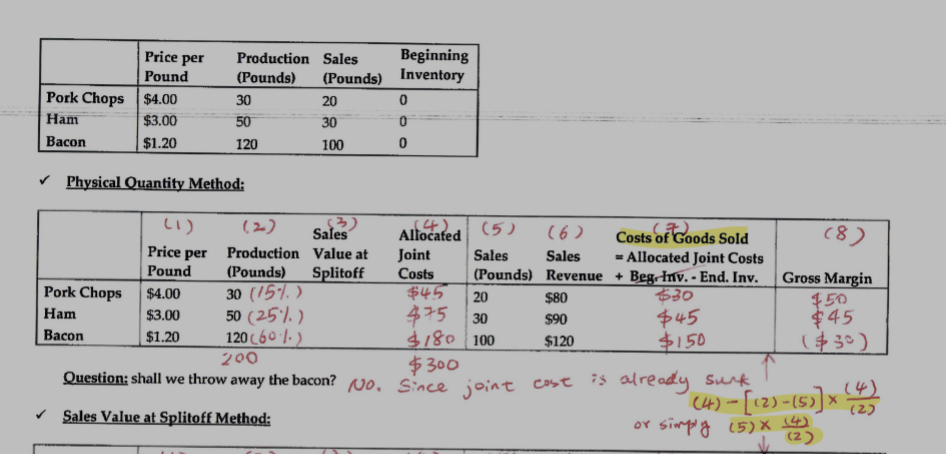

Physical Quantity Method

A cost allocation method that uses physical measures such as weight, volume, or quantity of output to divide joint costs among multiple products produced together.

You take the Production, find its percentage through the total, and add the percentage to get the allocated joint costs. To find cost of goods sold, you take AJC, subtract them by (Production-Pounds of sale), and then you multiply it by AJC/Production. Then, to get gross margin, you take the sales revenue and subtract it from the cost of goods sold.

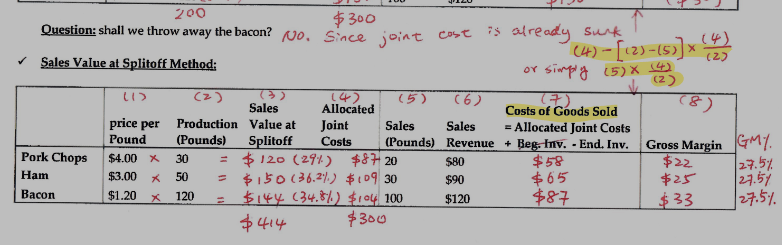

Sales Value at Splitoff Method

This method allocates joint costs based on the relative sales value of each product at the split-off point. It emphasizes the economic value of products to determine cost distribution. To calculate sales value at splitoff, you take the price per pound and multiply it by the production amount. Then with those totals, you calculate the percentage each value takes up by dividing each number by the sum of all of them. Giving you allocated joint costs. To calculate Cost of Goods Sold, you take Sales, and multiply it by AJC divided by Production. Finally, to get gross margin, you take the sales revenue and subtract the cost of goods sold from it.

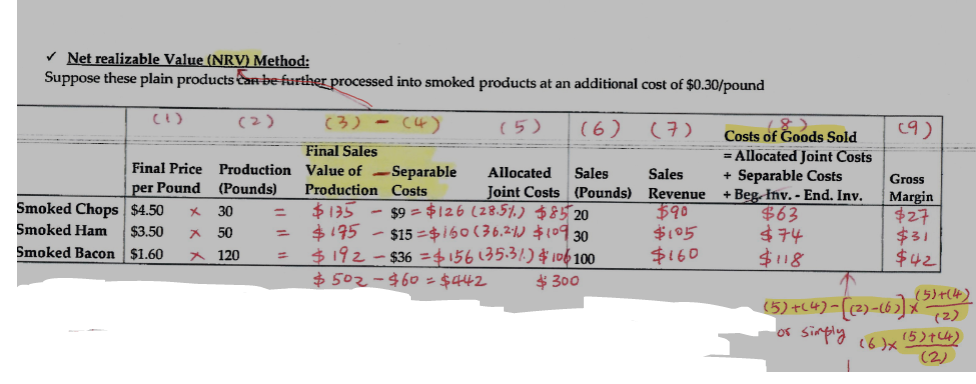

Net realizable Value (NRV) Method:

A method for allocating joint costs based on the estimated net realizable value of each product after the split-off point. This value is calculated by taking the final sales value of the product and subtracting any additional costs required to make the product saleable.

To calculate this method, you take the FINAL price per pound and multiply it by the pounds of production. This gives you Final Sales Value of Production. Then you subtract them by separable costs. Then you add them up and divide each individual number by the total to get the percentage. Then you multiply each individual number by its respective percentage to get the allocated joint costs. To calculate sales revenue, you take the final price and multiply it by the price per pound. Then, to calculate cost of goods sold, you take the pounds sold multiplied by AJC+Separable costs/pounds of production.

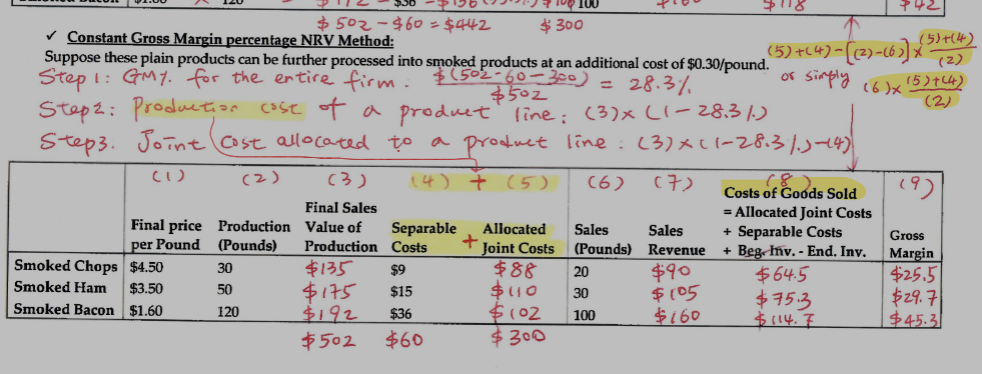

Constant Gross Margin percentage NRV Method:

A joint cost allocation method that ensures each product retains a consistent gross margin percentage based on its net realizable value. This method adjusts the allocated costs to maintain a predetermined gross margin across all products derived from joint production.

To calculate this method, you find the GM for the entire firm, (Total final sales value of production-Separable Costs-Total Allocated joint costs from the NRV method.) And then you divide all those numbers by the total Final sales value of production. Then you take the production cost of a product line: Final sales value of production*(1-GM%), then you take that number and subtract it by the separable costs to get allocated joint costs. Finally, you take sales revenue and multiply it by (1-GM%) to get Cost of goods sold. Then you subtract sales revenue by cost of goods sold to get the gross margin.

Are joint costs relevant regarding what to do with a product from the split-off point forward?

No, they are irrelevant, as the joint costs become sunk costs at that point.

If Incrememtal revenue - Incremental costs > 0

Process further

If Incrememtal revenue - Incremental costs < 0

Don’t process further.

If from further processing-from further processing > 0

Process further.

If from further processing-from further processing < 0

Don't process further.

What is the most useful method of Joint Cost Allocation?

Sales Value at Split-off