health services management econ

1/112

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

113 Terms

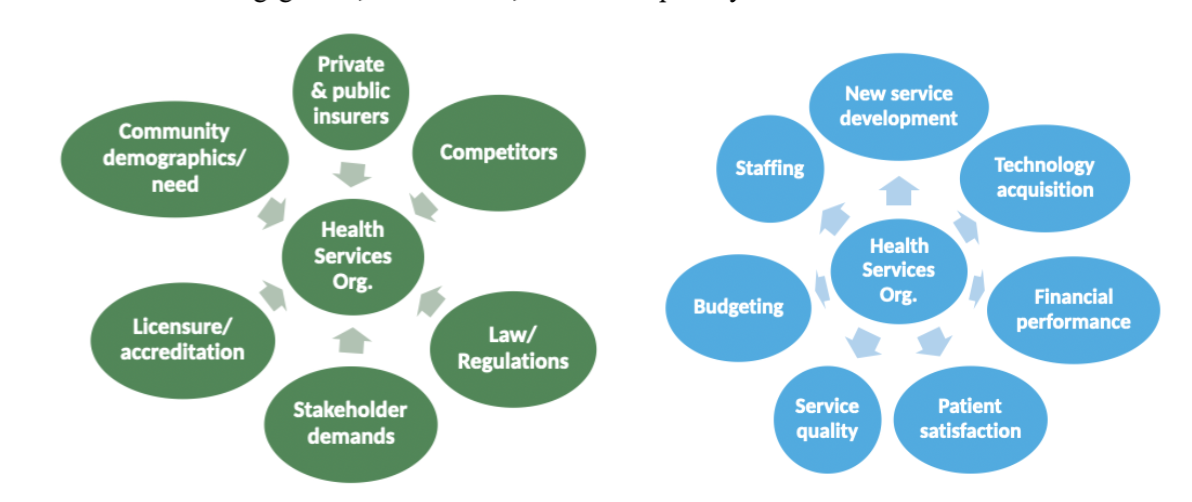

healthcare organization

An entity designed for a specific purpose:

To create products provide services, using people and resources to improve health; and

To maintain relationships with customers, suppliers, competitors, and regulators

direct care

Provide healthcare services to individual people firsthand

Traditionally paid by insurance

non direct care

Provide products and services that support healthcare services

May be paid by insurance or out-of pocket

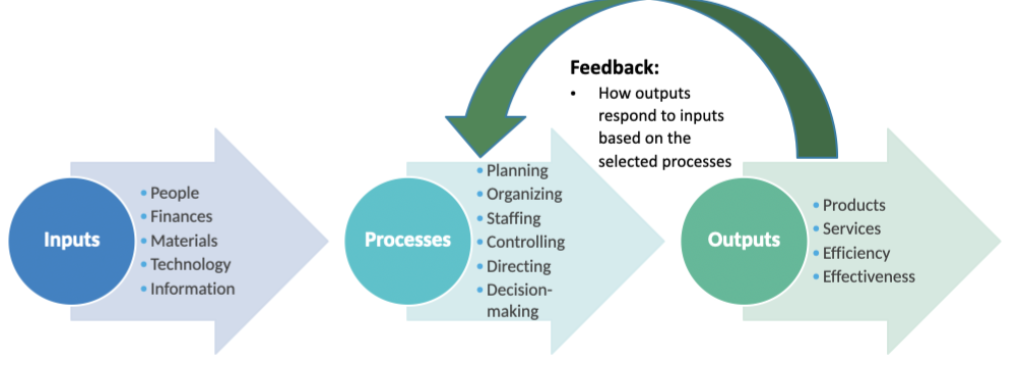

healthcare management

Accomplishing organizational goals by controlling and regulating activities and behaviors within established relationships to coincide with previously established plans

planning

set priorities and performance targets

organizing

designate reporting relationships and responsibilities

staffing

recruit, develop, and retain workforce

controlling

monitor performance and take corrective action

directing

lead, motivate, and communicate with staff

decision making

weigh pros and cons of alternative actions

systems theory

Measures workplace effectiveness based on interaction between organization and its environment

Open vs closed system

To what extent is the organization interacting with its environment?

We have to pay attention to the people and how they are relating to one another in the organization, while also focusing on outside processes

patient centered management

Systems approach, interdisciplinary

Addressing root causes of disease, social determinants of health, patient engagement, collaboration, cultural competency

leadership - board of directors

Establish mission

Set vision

Motivate stakeholders

Be effective spokesperson

Determine future strategy

Transform organization

Network

management - staff

Staff personnel

Assure patient centered practices

Control resources

Supervise services provided

Oversee adherence to regulations

counsel/develop employees

Manage operations

organizational culture

Shared beliefs, attitudes, and behavior that prescribe the way things are dine

The character, personality, and experience of organizational life

Guiding principles defined and shaped by the organization’s values, mission, vision, and managers

mission statement

Fundamental purpose

What the organization does, for whom, and why

Broad and enduring

vision statement

Desired future state

What organization plans to accomplish over a period of time (ex 3 to five years)

values

Principles in which organization believes

Shape purpose, goals, and daily behavior

Serve as a foundation for activities

healthcare organization governance

Responsibility for organization’s strategic oversight

governing body

Group of people who collectively assume responsibility for organization’s governance

Board of trustees - nonprofits

Board of directors - for profits

sources of authority

State law

Organization’s bylaws

Articles of incorporation

board member duty of care

Act with good faith and competence - ordinarily prudent person in similar circumstances

Make informed reasonable decisions

board member duty of loyalty

Act in organization’s best interest

Avoid conflicts of interest/do not use information for personal gain

board member duty of obedience

Act consistent with organiations goals and missions

Follow the law and organization rules

governing board responsibilities

Strategic planning, including mission vision and value

Oversight of quality performance and measurement

Financial oversight

Ceo selection, performance, evaluation, and succession planning

Risk and identification and oversight

Communication and accountability

Governance

ex officio board members

Employees are not usually governing board members

The CEO may be an ex officio board member

Does not vote

Serves on the board as a result of their employment in that job

for profit organizations

Public investor owned or private equity

Goal compensate investors

How is profit used?Distribute profit to shareholders

Do they pay income tax?

yes

Must they offer charity care?

May offer to be a good citizen but no tax advantage for doing so

nonprofit organizations

Public charity or Private foundation

Benefit the public - promotion of health for a community’s benefit

How is profit used?

Reinvest profit back into organization

Do they pay income tax?

Exempt from income tax

Must they offer charity care?

Must provide some charity care in exchange for tax exempt status

revenue

what the organization earns from providing services

money available to fund operations

expenses

what it costs the organization to provide servies

profit (or loss)

total revenues minus total expenses

profit margin

profit divided by total revenue

990 summary

Number of employees

Number of volunteers

990 mission and programs

Brief description of mission

Accomplishments for 3 largest program service areas

990 governance, management, and disclosure

Number of voting members on governing body

Conflict of interest policies

990 compensation

Names of current board members (typically not paid(

Names of “key employees”

990 statement of revenue

Program service revenue

Government grants

Fundraising

What the organization earns from providing services

990 statement of functional expenses

Salaries and wages

Employee benefits

Fees (legal, accounting, fundraising expenses, etc)

Advertising

Office expenses

What it costs the organization to provide services

990 reconciliation of net assets

Total revenue less expenses

Organization’s profit or loss

primary health services

Family medicine

Internal medicine

Pediatrics

OBGYN

Diagnostic lab/radiology

Emergency medicine

Pharmaceutical

preventative health services

Pre and perinatal

Health screenings

Well child visits

Pediatric eye, ear, dental screenings

Immunizations

Family planning

Preventative dental

enabling services

Referrals to specialists

Case management

Help with accessing public benefits

Outreach and education

Transportation

Interpretation and translation

optional servies

Mental health and SUDs

Recuperative care

Environmental health

Agricultural workers

what is missing from the FPL?

What is missing?

Taxes

Regional price differences

Payments from antipoverty programs (EITC, housing subsidies, SNAP)

Assumes 2 parent households, 1 parent working and 1 staying home full time

Food accounts for smaller share of household expenses today, having been overtaken by costs of housing, childcare, transportation, and health care

MIT’s living wage calculator

determines the amount that a full time worker must earn to cover their family’s basic needs

Varies by family size and county

Accounts lowest option to meet minimum but adequate needs for food, child care, health care, housing, transportation, civic engagement, internet/mobile, and other necessities, as well as income and payroll taxes

Does not account for eating out, leisure time, vacations, savings, or retirement/long term investments

price

consumers have less purchasing power due to price increase

time

travel time and waiting time - opportunity costs, lost wages

income

purchasing power, incentive to stay healthy and maintain ability to work

care quality

- patient perception of higher quality increases demand

health status

increased demand when health status decreases

education

increased health literacy, earning capacity, likelihood of insurance

age

age related health declines—inccreased demand, increased service intensity

tastes and preferences

- other factors that influence an individual’s willingness to purchase

complementary goods

demand for complements also decreases, things that are used together ex. syringes and vaccines

substitute goods

demand for substitutes increases (assuming buyer has information about substitutes and their prices)

ex. physical therapy vs surgery

socioeconomic factors

40% Education, employment, income, family and social support, community safety

physical environment

10% Air and water quality, housing and transit

health behaviors

30% Tobacco use, diet and exercise, alcohol and drug use, sexual activity,

clinical care

20% Access to care and quality

health inputs

Health care, diet, exercise, environment, income, and time

Leads to health capital stock over time

Leads to health outputs each year

Healthy days, physically and mentally, activity limitations

commercial determinants of health

behaviors of private entities in the healthcare industry that influence health based on what is or is not provided to whom, when, where, how, and at what cost

Manufacturers (pharmaceutical and medical device firms)

Providers (hospitals, clinicians, trade associations)

Payers (insurance)

Other firms (consulting firm)

health industry as an essential service

which can also cause considerable harm, contributing to high spending with poor outcomes

Political practices (lobbying)

Preference shaping (consumption of individual medical services > promotion of public health and equity)

Legal and extralegal environment (corporate ownership and market consolidation)

Product generation and promotion (marketing, provider induced demand)

income

preventative care, healthy food, insurance, education/health literacy, living environment, working conditions

health

number of hours worked/amount earned, more health expenses/less disposable income, leave of absence/inability to do work

absolute income hypothesis

increased income leads to increased consumption of health goods and services leads to lower mortality/morbidity

Assumes relationship between income level and health is constant (linear) and income is the only factor determining purchasing decisions

law of diminishing marginal utility

As you continue to consume a given product, you will eventually get less additional utility (satisfaction) from each unit you consume

Income has a diminishing effect on health: substantial improvement in health initially as income increases

Health improvements get smaller as income increases

Whitehall study

Tracked health outcomes of 18000 british male civil servants for 10 years, beginning in 1967

Those with lowest ranking jobs were 3x as likely to die younger than those with highest ranking hobs

Lower ranking hobs were associated with obesity, smoking, low physical activity levels, higher prevalence of underlying disease, and high blood pressure

Whitehall II study tracked over 10000 people from 1985-2013 and found consistent results showing a stable relationship between occupational rank and health

headstart program

receive federal funds to provide preschool services to children ages 3-5

“Promote the school readiness of young children from loaw income families by enhancing their cognitive, social, and emotional development)

Children are eligible if

Family income below FPL

Recieves temporary assistance or supplemental security income benefits

Family is homeless

Child is in foster care

Federal law provides that children who are eligible for special education services should be prioritized for head start services

healthcare spending and financing

US healthcare spending was nearly 4.9 trillion in 2023

Spending

Hospital care - 31%

Physician and clinical spending - 20%

Prescription drugs - 10%

Nursing homes - 4%

Dental services - 4%

Home health care - 3%

Other spending - 28% - professional servives, medical equipment, other nondureable medical products, government administreation, gov public health activities etc

Financing

Out of pocket - 10%

Private health insurance 30%

Medicare 21%

Medicaid 18%

Other funding 21%

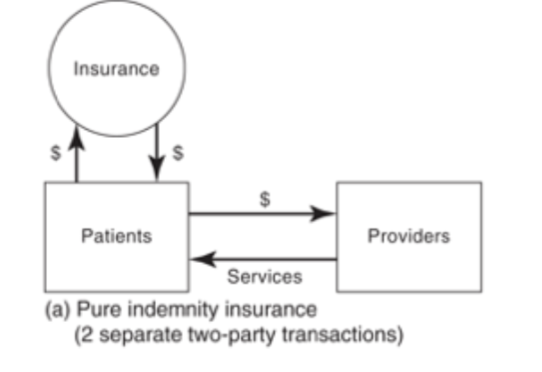

the healthcare services market

is not a perfectly competitive market because there is not equal information, nor is there equal market powers, also there is a third party (insurance)

how does a healthcare market differ from perfect competition

Perfect competition

Buyer pays seller for good/service

Buyer and seller are price takers

Price is the only term that matters

Buyer decides what to purchase

Price is the same for all buyers

Healthcare market

Multiple pirates involved in payment

Seller or payer may influence price

Trust, quality, licensure/regulation

incomplete/asymmetric information

Price discrimination (different prices for different buyers)

insurers role in the healthcare market

Pool and price risk

Manage service utilization

Reimburse providers for care

why by health insurance

Protection from large bills if one becomes seriously or chronically ill

Costs beyond capacity of individual savings or contributions from family/friends

Some predictability for out of pocket cost of routine medical care

Probability and expected value of healthcare costs averaged over a large group of people is predictable

health insurance

method of pooling financial risk so that one person’s loss is shared across so many people

benefits of risk pooling

Patients:

limited financial risk/peace of mind

Ability to obtain medical care could not otherwise afford

Insurers

Profits when premiums collected exceed provider reimbursement and administrative costs

Profits from interest earned on premium funds before paid out

Providers

Increased demand for healthcare services

Regular payments

actuarially fair price

Estimated annual cost of healthcare for the covered population +

loading factor

administrative costs and profits

how premiums are set

actuarially fair price + loading factor

medial loss ratio

the percent of premium income that insurers pay out for medical claims (vs administrative costs and profit)

why are insurance premiums rising

Higher service costs

Higher use of specialty prescriptions

Provider consolidation

Higher utilization

Workforce shortages

which types of insurance are subsidized by the federal government?

medicare: part A funded by payroll taxes paid by employers and employees

Parts b and d funded by income taxes and enrollee premiums

Medicaid: funded by federal and state taxes. Nominal out-of-pocket costs enrollees

Individual market - provides tax credits and subsidies - premiums paid by individuals. Federal subsidies based on income

Some help for employer-sponsored but clients are likely not aware. Employer payment is not taxable to employees

price sensitivity/elasticity

Demand for healthcare goods and services is generally price inelastic (price changes do not affect the quantity demanded)

However, there is some variation in by service type:

Price sensitive (demand increases as price decreases)

Mental health coverage

Prescription drugs

Not price sensitive (price changes do not change demand)

Hospital admissions

Six in 10 covered workers have an annual deductible of $1,000 or more

moral hazard in the healthcare market

Insurance generally increases consumption of healthcare services by making people less aware of, and less sensitive to, price

Excess service use results in higher premiums and higher healthcare prices

Insurers use cost sharing and/or utilization management to control “excess” service use

rand health insurance experiment

Increased premiums

Decreased enrollment and coverage renewals

Largest effects on those with the lowest income

Many become uninsured and faced increased barrier to care and financial burdens

Increased cost sharing

Even small levels decreased use of needle services

Increased use of more expensive services (ER)

Negative effects on health outcomes

Increased financial burdens for families

Money?

State savings are limited

Offset by disenrollment, increased cost in other areas, and administrative expenses

ACA no cost sharing requriements

Vaccines

Newborn screenings

FDA approved contraceptives

Statins to prevent cardiovascular disease

Colorectal cancer screening

PREP drugs to prevent HIV

Type 2 diabetes screening

conventional insurance

Providers are independent of health plan

No utilization management

no preferred provider network, fee for service, patient pays for a portion of provider charge

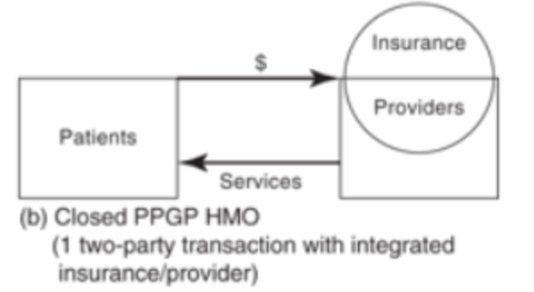

Closed pre paid panel group practice HMOs

Providers are integrated within health plan

Strict utilization management

Restrictive, quality of care decreases because of how strict they were—with plans that refused other care needed

open HMO, PPO, POS

Network providers contracted with health plan

Some utilization management

HMO

health maintenance organization - must see network providers —patient pays set monthly charge rgardless of service use (capacitation)

PPO

preferred provider organization, low cost sharing for in network services, no gatekeeper for specialist or hospital services

POS

point of service plan - lower cost sharing for in network services, need referral for specialist or hospital services

HDHP/SO

high deductible ehealth plan with savings option - deductible of at least $1000 single/$2000 family coverage, offered with health reimbursement or health savings account

HDHP/SOs allow for lower premiums

Incentivizes patients to “shop around”

how managed care can reduce costs

Total premiums = (price x quantity) + overhead

Reduce price -

Decrease provider payment

Increase patient cost sharing

Reduce quantity

Referrals

Prior authorization

Limit on number of days/visits

Reject claim as not medically necessary

Substitute cheaper inputs

RX formularies

Replace doctors with md-level practitioners

Require physical therapy v surgery

Reorganize

Integrate providers with health plan (closed panel HMO)

what is the price of healthcare services

it depends on coverage, deductibles paid, cost sharing, and co insurance

Prices paid by private insurance are higher than those paid by public programs

charges

the “list price” for a healthcare service (amount charged by provider without any discounts)

Does not reflect what (most) patients pay

Typically set abnormally high (in relation to cost of providing the service)

prices

total amount that provider expects to receive from insurer/patient as payment for a healthcare service

Accounts for discounts negotiated by insurers (provider agrees to lower price in exchange for higher patient volume)

advantages and disadvantages of fee for service

Fee schedule is prospective

Payment is retrospective

Provider receives set amount for each service provided to patient

Payment is based on volume, not quality

Incentive to provide more services and more intense services

Waste and unnecessary care

simplified capitation

Payment is prospective

Provider receives fixed monthly amount to provide a defined set of services to each patient

Provider is paid regardless of whether patients use services

Incentive to provide fewer services and/or keep patients healthy

Patients may go without care they actually need

value based care

Legal and regulatory changes

Standards and capabilities for data collection, sharing, and analysis

New models to improve care coordination across settings

New models that incentivize high quality, cost-efficient care

Provider performance measures based on clinical best practices

pay for performance

Provider receives set amount for each service provided to patient, plus incentives for reporting data or achieving certain quality measures

Financial incentives may be bonuses or penalties

Incentives are not based on achieving cost targets