Chapters 8-12 Ratios and Meanings

1/23

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

24 Terms

Liquidity

Having sufficient cash (or other assets convertible to cash in a relatively short time) to pay currently maturing debts

Lack of liquidity can result in financial difficulties or even bankruptcy

Liquidity Management

Management can influence the ratios that measure liquidity to some extent

Ex:

Delay the shipment and billing of certain inventory parts to receive them in early January rather than late December, reducing inventory and accounts payable at year-end

Make additional purchases in late December, increasing inventory and accounts payable at year-end

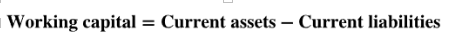

Working Capital

The difference between current assets and current liabilities

After paying our current obligations, how much in current assets will we have to work with?

A large positive working capital is an indicator of liquidity (whether a company will be able to pay its current obligations on time)

Not the best measure of liquidity when comparing one company with another, because it doesn’t control for the relative size of each company

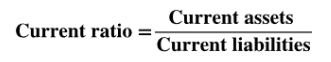

Current Ratio

Current assets divided by current liabilities; measures the availability of current assets to pay current liabilities

A ratio greater than 1: indicates there are more current assets then current liabilities

The higher the current ratio, the greater the company's liquidity and less risk

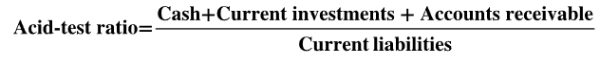

Acid-Test Ratio (Quick Ratio)

Cash, current investment, and accounts receivable divided by current liabilities; measures the availability of liquid current assets to pay current liabilities

Because the numerator contains only a portion of the current assets used in the current ratio, the acid-test ratio will usually be smaller than the current ratio

Provides a better indication of a company's liquidity than the current ratio

A more conservative measure of a company's ability to pay current liabilities

Its more conservative because it eliminates current assets such as inventories and prepaid expenses that are less readily convertible into cash, the acid-test ratio often provides a better indication of a company's liquidity than does the current ratio

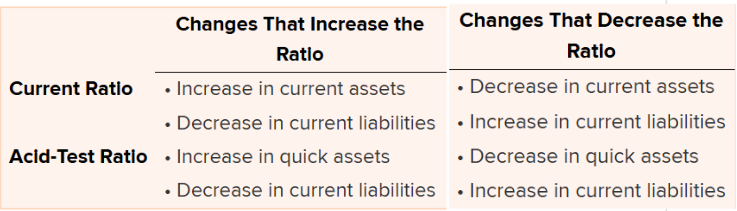

Changes that affect the current and acid-test ratios

Be able to find a second or third monthly interest payment.

first calculate the first month's interest using the original principal, then subtract that interest from your total payment (or the principal for interest-only loans) to get the new principal for the second month, and then recalculate interest on that new, slightly lower principal for the second month

solvency

a company’s ability to pay its current and long-term liabilities

long term

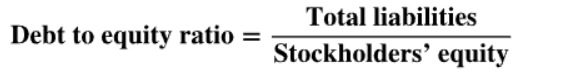

debt-to-equity-ratio

Total liabilities divided by stockholders' equity; measures a company's risk

The higher the ratio the higher the risk of bankruptcy

Best measures financial leverage

Indicates the risk of bankruptcy

Other things being equal, the higher the debt to equity ratio, the higher the risk of bankruptcy

More debt increases the risk of bankruptcy, but it also increases the potential returns investors can enjoy

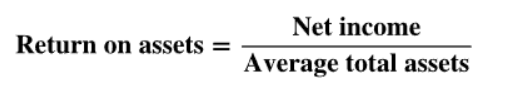

Return on Assets

Net income/average total assets

Measures the amount of net income generated for each dollar invested in assets

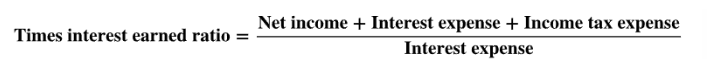

times interest earned ratio

Ratio that compares interest expense with income available to pay those charges

Provides indication to creditors of how many "times" greater earnings are the interest expense

The higher a company's earnings relative to its interest expense, the more likely it will be able to make current and future interest payments

• The times interest earned ratio measures a company’s ability to meet interest payments as they become due.

• A higher ratio indicates a greater ability of a company to meet its interest obligation.

Compares interest payments with a company's income available to pay those charges

Classified as a solvency ratio rather than a liquidity ratio

A company wants a higher net income before interest expense and income tax expense in relation to the amount it needs for interest expense alone

Liquidity Ratios

Liquidity ratios focus on the company's ability to pay current liabilities

short term

Receivables turnover ratio

average collection period

inventory turnover ratio

average days in inventory

current ratio

acid test ratio

Solvency Ratios

solvency ratios include long-term liabilities

Debt to equity ratio

Times interest earned ratio

Receivables Turnover Ratio

Measures how many times receivables are collected during the year

A high turnover ratio is positive

Average Turnover Ratio

Measures the days it takes to convert receivables into cash

The short the period the better

Inventory Turnover Ratio

Measures how many times average inventory is sold during the year

A high ratio indicates that inventory is selling quickly

An extremely high ratio might show lost sales due to inventory shortages

Average Days in Inventory

Measures the average number of days it takes to sell its entire inventory during the year

Companies try to minimize the number of days they hold inventory

Profitability Ratios

Profitability ratios measure the earnings or operating effectiveness of a company over a period of time, such as a year

Investors view profitability as the number one measure of company success

Gross Profit

Return on Assets

Profit Margin

Asset Turnover

Return on Equity

Earnings per share

Price-earnings ratio

Gross Profit Ratio

Indicates the portion of each dollar of sales above its cost of goods sold

Gross profit ratios vary by industry

Return on Assets

Measures the income the company earns on each dollar invested in assets

A higher percentage would indicate a higher amount earned compared to the assets that it owns

Profit Margin

Measures the income earned on each dollar of sales

A higher profit margin indicates a higher amount actually earned (after expenses are accounted for) compared to its total revenues

Asset Turnover

Measures sales volume in relation to the investment in assets

A company wants higher revenues compared to each dollar invested in assets

Return on Equity

Measures the income earned for each dollar in stockholders' equity

A higher amount earned compared to the investment made by the owners of the company is desirable

Price-Earnings Ratio

Compares a company's share price with its earnings per share

A higher PE ratio shows that investors have a higher expectation of earnings growth