Chapter 5

1/68

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

69 Terms

Temporary, permanent

Regarding length of coverage, what are the two types of life insurance policies

Term

Temporary insurance is also referred to as ______ insurance

Greatest, lowest

Term policies provide for the _____ amount of coverage for the ______ premium

Cash value

Term insurance has no

Death protection

Term insurance provides pure _______

Permanent

_______ life insurance is a general term used to refer to various forms of life insurance policies that build cash value and remain in effect for the entire life of the insured (or until age 100)

Whole life

What’s the most common type of permanent life insurance

Whole life insurance

_______ provides lifetime protection, and includes a savings element (cash value)

Higher

Premiums for whole life policies are usually _____ than term insurance

Level premium

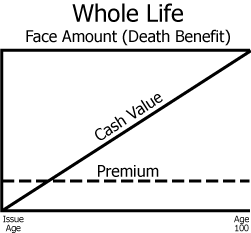

Characteristic of whole life: the premium for whole life policies is based on the issue age; therefore, it remains the same throughout the life of the policy

Death benefit

Characteristic of whole life: ______ is guaranteed and also remains level for life

Cash value

Characteristic of whole life: the ______, created by the accumulation of premium, is scheduled to equal the face amount of the policy when the insured reaches age 100 (the policy maturity date), and is paid out to the policyowner.

Living benefits

Characteristic of whole life: the policyowner can borrow against the cash value while the policy is in effect, or can receive the cash value when the policy is surrendered. The cash value, also called nonforfeiture value, does not usually accumulate until the third policy year and it grows tax deferred

Straight, limited-pay, single premium

What are the three basic forms of whole life insurance

Ordinary

What is straight life insurance also referred to as

Straight life

Type of whole life: the policyowner pays the premium from the time the policy is issued until the insured’s death or age 100. Out of all the whole life policies this has the lowest premium

Limited-pay

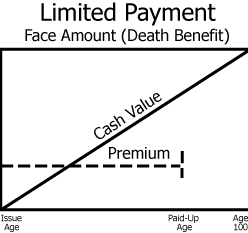

Type of whole life: this policy is defined so that the premiums for coverage will be completely paid-up well before age 100. This type of policy has a shorter premium-paying period so the annual premium is higher. Cash value builds up faster

Ordinary (straight) life

What type of whole life policy is depicted with this graph

Limited payment

What type of whole life policy is depicted with this graph

Single premium

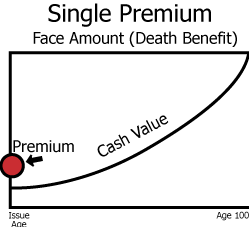

Type of whole life: ____ is designed to provide a level death benefit to the insured’s age 100 for a one-time, lump-sum payment. The policy is completely paid-up after one premium and generates immediate cash

Single premium

What type of whole life policy is depicted with this graph

Endowment

______ policies are another type of whole life insurance that have all the same features as regular whole life policies with a slight variation in the maturity date

Earlier age

What makes whole life different from endowments is that endowments mature at an _______

Higher

The premium for endowments are typically ________

Adjustable life

__________ can assume the form of either term inrance or permanent insurance

Cash value

The ________ of an adjustable life policy only develops when the premiums paid or more than the cost of the policy

Flexible premium adjustable life

Universal life onsurance is also knwon by the generic name of _____

Universal life

In a __________ policy, the policyowner has the flexibility to increase the amount of premium paid into the policy and to later decrease it again

Minimum, target

What are the two types of premiums in universal life

Minimum premium

The _________ is the amount needed to keep the policy in force for the current year, paying it will make the policy parform as an annually renewable term product

Target premium

The _______ if a recommended amount that should be paid on a policy in order to cover the cost of insurance protection and to keep the policy in force throughout its lifetime

Deducted, cash value

If an insured skips a premium payment on a universal life policy, the missing premium may be ______ from the policy’s ______

Insurance, cash

What are the two components of a universal life policy

Renewable term insurance

The insurance compnent of a universal life policy is always annually ________

Level death benefit

What is the option A death benefit offered by a Universal life policy

Increasing death benefit

What is the option B death benefit offered by a Universal life policy

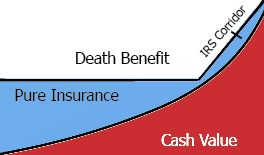

Level death

What Universal life policy death benefit does this image shows

Level death benefit

With _____ the death benefit remains level while the cash value gradually increases, thereby lowering the pure insurance with the insurer in the later years. This allows for greater cash value in the later years

Statuatory definition of life insurance

According to the _______ there must be a specified "corridor” or gap maintained between the cash value and the death benefit in a life insurance policy

Increasing death

What Universal life policy death benefit does this image shows

Increasing death

Under ______ the death benefit includes the annual increase in cash value so that the death benefit gradually increases each year by the amount that the cash value increases

Equal

At any point in time, the total death benefit will always be _____ to the face amount of the policy plus the current amount of cash value

Intermediate premium reduction

An ________ policy is a policy in which the premium is guaranteed for an initial period, and then the insurer can charge up to a maximum premium charge that is specified in the policy

Fixed

_____ life insurance or annuities are contracts that offer guaranteed minimum or fixed benefits that are stated in the contract

Variable

______ life insurance is a level, fixed premium, investment-based product; they’re contracts in which the cash values accumulate based upon a specific portfolio of stocks without guarantees of a performance

Investment risk

In variable contracts, the policyowner bears the _______

Separate account

Assets in a vairable contract must be kept in a ______ rather than the insurance company’s general account because the insurance ompany isn’t the one sustaining the investment risk

Dually regulated

Variable life insurance products are ________ by the State and Federal gov

Securities

The Federal gov has declared that variable contracts are ______

Securities and exchange commission, financial industry regulatory authority

Since the Federal goc declared variable life policies as securities, they are regulated by the _______ and the _______

Variable universal life

_______ is a combo of universal life and variable life, it provides the policyowner with flexible premiums and an adjustable death benefit, the policyowner rather than the insurer decides where the net premiums will be invested, cash values are not guaranteed, and the death benefit isn’t fixed

Both securities, life insurance

For a producer to sell Variable Universal Life, they must be licensed for ______ and ______

Interest-sensitive whole life

_______ is a whole life policy that provides a guaranteed death benefit to age 100, the insurer sets the initial premium based on current assumptions about risk, interest, and expense, it credits the cash value with the current interest rate that is comparable to money market rates, and provides for a minimum guaranteed rate of interest

Current

INterest-sensitive whole life policies allow for _____ interest rates, which allow for either greater cash value accumulation or a shorter premium-paying period

Current assumption life

What is interest-sensitive whole life also referred to as

Equity index whole life

What is indexed whole life also refered to as

Dependent

The main feature of indexed whole life is that the cash value is ______ upon the performance of the equity index, but there is no guaranteed minimum interest rate

Evidence of insurability

An indexed whole life policy’s face amount increases annually to keep pace with inflation without requiring _______

Assumes the inflation risk

Indexed whole life policies are classified depending on whether the policyowner or insurer ______

Increases in the face amount

In regards to an indexed whole life, if the policyowner assumes the inflation risk the policy premium increases with the _______

Remains level

In regards to an indexed whole life, if the insurer assumes the inflation risk the premium _______

Joint life

______ is a single policy that is designed to insure two or more lives

Joint whole life

Joint life is more commonly found as _____

Joint average age

The premium for a joint life policy is based on a ______ that is between the ages of the insured

First death only

In a joint whole life oplicy, the death benefit is paid upon the ______

Buy-sell agreement

A ________ is a business continuation agreement that determines what will be done with the business in the event that an owner dies or becomes disabled

Survivorship life

________ is a policy similar to joint life in that it insurers two oe more lives for a premium that is based on joint age, except it pays on the last death instead of the first

Lower

Premiums for survivorship policies are typicaly _____ that joint life

Liabiliity of the estate tax

Survivorship policies are often used to offset the ________ upon the death of the last insured