ib econ- 4.2: types of trade protection

1/26

Earn XP

Description and Tags

credits https://www.econinja.net/global-economy/4-2-types-of-trade-protection

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

27 Terms

what is a tariff?

a specific tax on imported goods and services

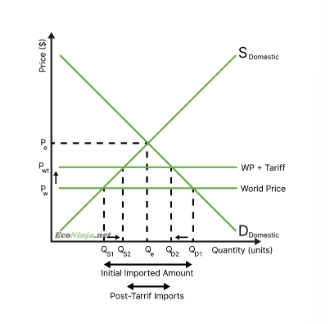

draw the diagram for a tariff

how do tariffs work?

when the world price is much lower than the domestic equilibrium, domestic producers lose out as they have to compete with international firms. to support domestic firms, the government might put a tariff in place - raising the cost of foreign products by taxing them. this makes foreign goods more expensive than before, meaning that more people consume domestic products.

what are the impacts of tariffs on imports, price, quantity supplied by domestic firms, quantity demanded, and on government revenue?

imports decrease

price increases

quantity supplied by domestic firms increases

quantity demanded by consumers decreases

the government earns extra tax revenue

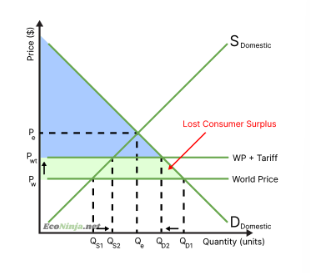

what is the effect of tariffs on consumers?

surplus lost as prices increase

in the long run, foreign companies may choose to stop selling as the price is too high, which decreases competition, decreasing consumer choice

the effects depend on the price elasticity of the product

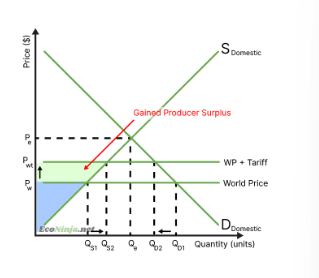

what is the effect of tariffs on producers?

surplus is gained by domestic producers as prices increase

foreign companies lose out as their goods are marked up and look less attractive

in the long run, other governments may retaliate, which negatively affects domestic producers

these effects depend on the price elasticity of the product

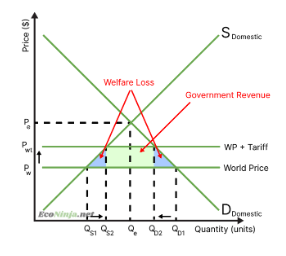

what is the effect of tariffs on the market?

the gained surplus for producers is smaller than the lost surplus for consumers

hence, tariffs make markets less efficient, as they reduce the social/community surplus.

what are the effects of tariffs on the government?

they receive increase tax revenue

they will be protecting domestic producers, strengthening a national industry

however, it will have to spend money administrating and regulating the tariff

other countries might say it is unfair and complain

the world trade organisation may step in and fine the country

what is a quota?

a quantitative limit on imports of a good or service into a country

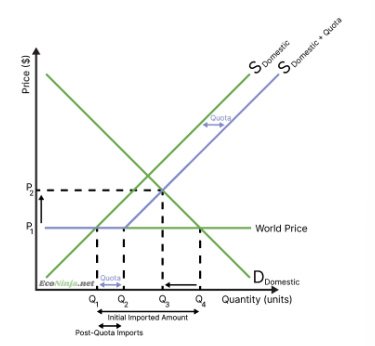

draw the diagram for a quota and explain how they work

before the quota domestic producers were willing and able to supply Q1, but consumers were demanding Q4, so imports were Q1→Q4, and the price was P1

after the quota, imports are restricted to a certain amount (Q1→Q2), and domestic producers have to produce the rest of the demand, so they can ask for equilibrium prices.

this equilibrium meets at (q3, p2)

domestic producers now produce q3, and consumers also demand this

foreign producers are only allowed to export q1→q2

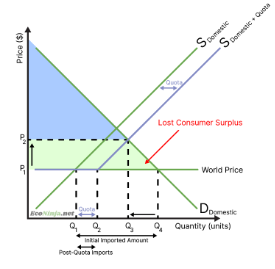

what is the effect of a quota on consumers?

surplus is lost as prices increase

since the amount of imports decrease, there is less choice for consumers

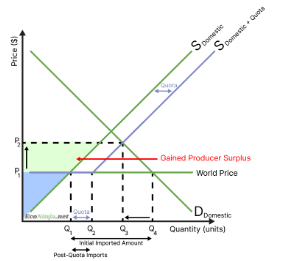

what is the effect of a quota on producers?

surplus is gained for domestic producers as prices and quantity demanded increases

in the long run, other governments may retaliate, negatively affecting domestic producers

foreign producers will be able to sell less products, but at a higher price, hence, the change in revenue will depend on the ped of the product

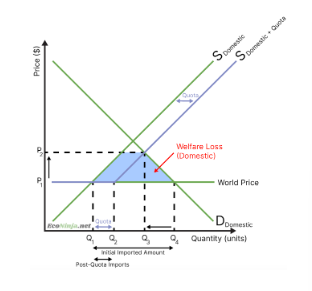

what is the effect of a quota on the market?

gained producer surplus is smaller than lost consumer surplus

hence, quotas make markets less efficient, as they reduce the social surplus

what is the effect of a quota on the government?

no visible effect in revenue

in many cases, govs. sell import licences in markets with quotas, earning itself some revenue

the gov. also has to spend extra money as it has to administrate this quota (prevent smuggling etc.)

what is a subsidy?

a form of financial assistance to producers by lowering their costs of production and encouraging higher output

what are the two types of subsidy and what is the difference between them?

production subsidies: general subsidies meant to lower the cost of production of goods for domestic producers (reducing imports)

export subsidies: targeted subsidies meant to protect certain exporting domestic producers

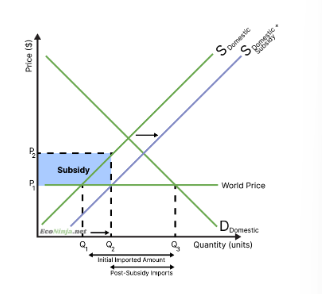

draw the diagram for a production subsidy

Before subsidy:

Domestic producers produce at Q1, because price is at P1

Consumers consume at Q3, because price is at P1

Hence, the rest is imported (Q1 <-> Q3)

After subsidy:

Domestic producers get a subsidy of P1 <-> P2, so they produce as if the price is P2, so at Q2

Domestic consumers still get the price of P1, so they still consume at Q3

Hence, the new imported amount is Q2 <-> Q3

what is the effect of a subsidy on consumers?

no change for consumers, other than the fact that they now buy more domestic product. if domestically produced goods are worse quality then consumers will be worse off, but international trade diagrams assume homogeneous products

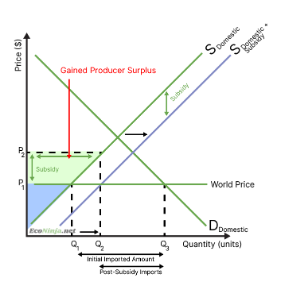

what is the effect of a subsidy on producers?

domestic producer surplus increases

foreign producers lose out as they now export less

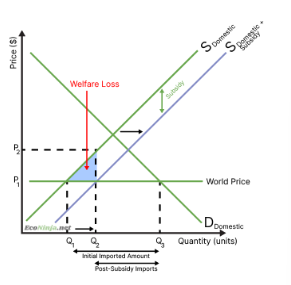

what is the effect of a subsidy on the market, and on the government?

because producer gain is larger than consumer loss, the market experiences a positive surplus change

however, the government has to dish out a subsidy, which is taxpayer money it could have spent on other things (opportunity cost)

a welfare loss is still created, as some of the subsidy does not translate to surplus for producers. this is because, due to the subsidy, producers are not incentivised to produce as efficiently as before

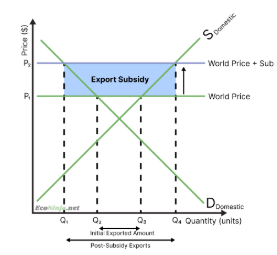

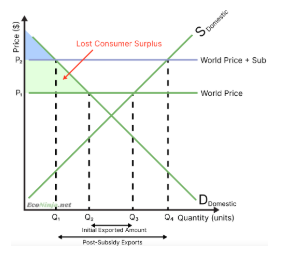

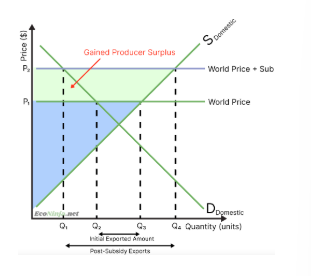

draw the diagram for an export subsidy and explain how it works

Before export subsidy:

Domestic producers produce at Q3, because price is at P1

Consumers consume at Q2, because price is at P1

Hence, the rest is exported (Q2 <-> Q3)

After export subsidy:

Domestic producers get a subsidy of P1 <-> P2, so they produce as if the price is P2, so at Q4

Since producers get a higher price exporting, they are only willing to sell domestically if they get the same price P2

This means domestic consumers now have to pay P2 instead of P1, reducing their demand from Q2 to Q1

Hence, the new exported amount is Q1 <-> Q4

what is the effect of export subsidies on consumers?

because firms can now earn more money by exporting, they are only willing to sell domestically if they can sell at the same price as abroad, meaning that consumers have to pay more money and decreasing their surplus

what is the effect of export subsidies on producers?

firms get to sell more of their products while also earning more per product, in the form of payments from the government

this means domestic producers significantly increase their surplus

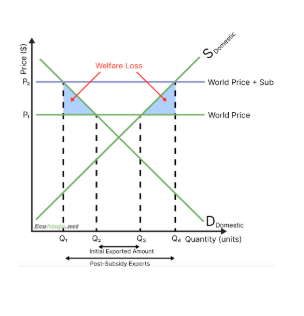

what is the effect of export subsidies on markets and governments?

because the producer gain is larger than the consumer loss, the market experiences a positive surplus change

however, the government has to dish out a subsidy, which is taxpayer money they could’ve spent on other things (opportunity cost)

a welfare loss is still created, as some of the subsidy does not translate to surplus for producers, as producers are not incentivised to produce as efficiently as before

what are administrative barriers?

rules, regulations and standards applied to imports of goods and services from foreign firms in an effort to reduce the imports

what are the impacts of administrative barriers on domestic producers, consumers, foreign firms and market efficiency?

favours domestic producers as it complicates and raises costs of imports

negatively affects consumers as they will have less choice and experience higher prices

may upset other countries who retaliate with their own barriers

hampers market efficiency, but protects domestic industry

what are some examples of administrative barriers?

stricter or more frequent inspection of an imported good or service, making the process more tedious

implementing a complex application process for foreign firms who want to start selling abroad, disincentivising them from doing so

an outright ban on imports of a certain good or service