COA Ch 17 Auditor's Reports

1/22

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

23 Terms

Audit Report

Providing an independent and expert opinion on the fairness of financial statements through an audit is the most frequent attestation service.

When performing an audit, the auditors gather evidence to obtain reasonable assurance that the statements are in conformity with G A A P.

Conditions Requiring a Modification of the Auditor’s Report

Conditions, although not departures from G A A P, about which the readers of the financial statements should be informed.

Material departure from G A A P in the client’s financial statements.

Material scope limitation (and auditor unable to obtain sufficient appropriate audit evidence).

Reports Coverage of Audit Reports

Reports on the financial statements ordinarily include an opinion that is on both the:

Financial statements themselves:

Balance sheet.

Income statement.

Statement of cash flows.

Statement of retained earnings (equity).

Financial statement disclosures:

The notes to the financial statements are considered an integral part of the financial statements.

(notes are required to disclose information that required by GAAP that cannot be conveyed on the face of the financial statements) Notes supplement the financial statements—they do not correct financial statement presentation)

Auditors Unmodified Report - nonpublic clients

Title that includes the word independent.

Ordinarily addressed to the company itself, the shareholders, the audit committee, and/or the board of directors.

Sections: Opinion, Basis for Opinion, Key Audit Matters (when in terms of engagement), Management Responsibilities, and Auditor Responsibilities.

Signed with name of C P A firm not individual partner unless the firm is structured as a sole practitioner.

Dated no earlier than the date on which the auditors obtained sufficient appropriate audit evidence to support their opinion.

Auditors Unqualified Report - Public Company

Includes the words “Registered” and “Independent” in the title.

Must be addressed to shareholders and board of directors (additional parties are allowable).

Indicates audit performed following standards of the P C A O B.

In Basis for Opinion section, provides auditor and management responsibilities.

If appropriate, includes a paragraph indicating that the auditors have also issued a report on the client’s internal control over financial reporting, or is a combined report on both the financial statements and internal control.

Includes a Critical Audit Matters section.

Includes statement on year audit firm began serving the client.

Signed with name of C P A firm not individual partner.

Includes the City of the office with responsibility for the audit.

Dated no earlier than the date on which the auditors obtained sufficient appropriate audit evidence to support their opinion.

Critical Audit Matters

Any matters arising from the audit that were communicated or required to be communicated to the audit committee and that (1) relate to accounts or disclosures that are material to the financial statements, and (2) involved especially challenging, subjective, or complex auditor judgment

Example –Valuation of nonmarketable securities

In determining whether a matter involved “especially challenging subjective, or complex auditor judgment” the auditor should consider factors such as the:

Assessment of the risks of material misstatement, including significant risks.

Degree of auditor judgment related to financial statement areas that involved the application of significant judgment or estimation by management, including estimates with significant measurement uncertainty.

Nature and timing of significant unusual transactions and the extent of audit effort and judgment related to them.

Nature and extent of audit effort required to address the matter, including the extent of specialized skill or knowledge needed or the nature of needed consultations outside the engagement team.

Nature of audit evidence obtained regarding the matter.

For matters that meet the definition of a CAM, the auditor must include the following in the audit report:

Identification of the matter.

Description of the principal considerations that led the auditor to determine that the matter is a CAM.

Description of how the CAM was addressed in the audit.

Reference to the relevant financial statement accounts and disclosures that relate to the CAM.

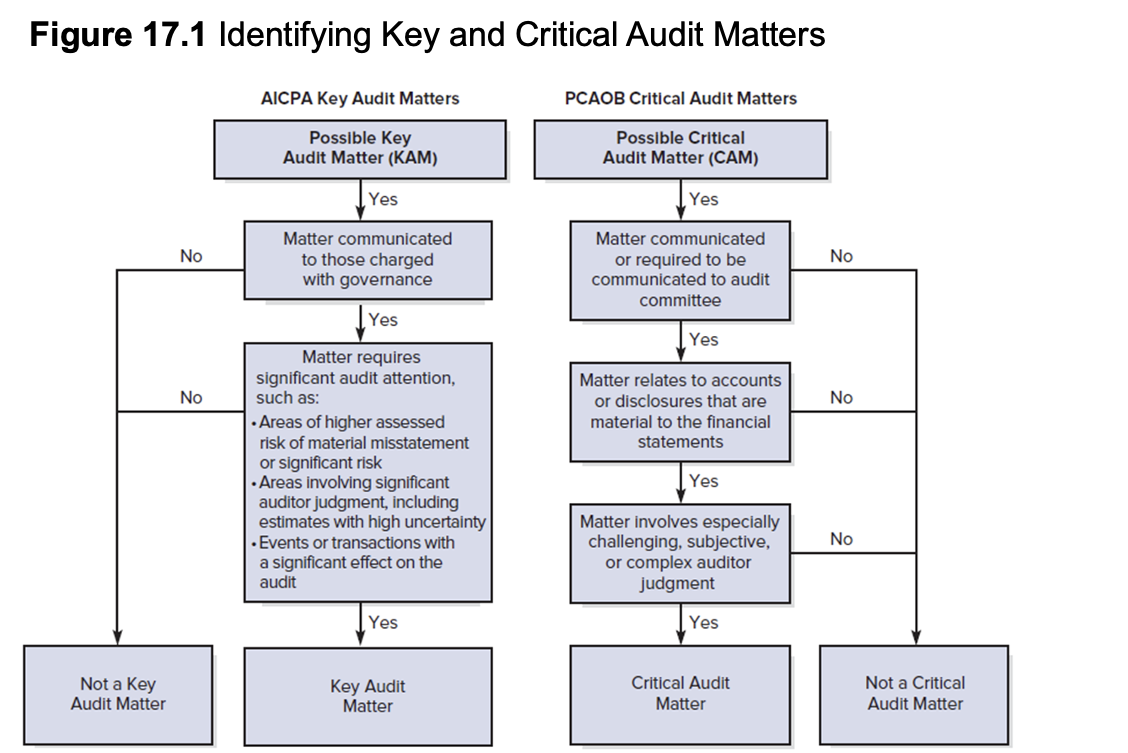

Identifying Key and Critical Audit Matters

Types of Reports with Unmodified Opinions

Unmodified (Unqualified) opinion. This report may be issued only when the auditors have obtained sufficient appropriate audit evidence to conclude the financial statements are not misstated and there is no need to alter the report for situations 2, 3, or 4 below. The standard reports on previous slides were unmodified (unqualified) opinions

Unmodified opinion—with additional financial statement related information. To emphasize a matter appropriately presented in the financial statements (for example, a change in accounting principles).

Unmodified opinion—with additional audit-related information included. To emphasize a matter other than those presented or disclosed in the financial statements (for example, reporting on comparative statements when thee is a predecessor auditor involved).

Unmodified opinion on group financial statements. When two or more C P A firms are involved in an audit and the group auditor (the firm that performs majority of the work) does not wish to take responsibility for the work of the component auditors.

Unmodified Opinions with Additional Financial Statement Related Matter

Substantial doubt about the company’s going-concern status.

Generally accepted accounting principles not consistently applied.

Reissued financial statements correcting a misstatement.

Other circumstances that the auditors believe should be emphasized.

Going Concern

Generally accepted accounting principles assume that a company is a going concern.

Assets and liabilities are valued on the assumption that the company will continue to operate for a reasonable period of time.

Requirements:

Management must evaluate whether there is substantial doubt about the company’s ability to continue in existence for a reasonable period of time (a year from the date of issuance of the financial statement).

Auditor not required to perform procedures specifically designed to test going-concern assumption but must evaluate the assumption.

Conditions indicative of going concern problem.

Negative cash flows from operations.

Defaults on loan agreements.

Adverse financial ratios.

Work stoppages.

Legal proceedings.

Loss of a key franchise, customer, or supplier.

An uninsured catastrophe.

Dividend arrearages.

If conditions indicate there could be substantial doubt about the company’s ability to continue as a going concern:

Auditors DOCUMENT in working papers the conditions and events and Managements plans

Auditors DOCUMENT their auditing procedures to evaluate manangement’s plans, and conclusions about whether substantial doubt exists

THIS IS USUALLY DONE BY A CHECKLIST

Going concern disclosures in financial statements are required to be INCLUDED in the notes to financial statements

Regardless of whether the auditors decide to add an emphasis-of-matter paragraph to a report with an unmodified opinion or to issue a disclaimer of opinion, the auditors should consider the adequacy of financial statement disclosures that relate to the firm's going-concern status.

Financial statement disclosures include (this is not all inclusive):

Pertinent conditions and events giving rise to the substantial doubt and their possible effects.

Management's evaluation of the significance of the conditions and effect and management's plans for dealing with them.

Auditors evaluate the conditions and management’s plans to determine if they believe there is substantial doubt as to whether the company can continue as a going concern

Consistency in Application of Accounting Principles

Auditors are required to indicate in the report when a company has changed accounting principles resulting in a material effect on the financial statements being reported on.

This requirement pertains to changes in accounting principles but not changes in accounting estimates.

In accepting the change, the auditors should evaluate whether:

The newly adopted principle is generally accepted.

The method of accounting for the effect of the change is in conformity with generally accepted accounting principles.

The disclosures related to the change are adequate.

Management has justified that the new accounting principle is preferable.

A lack of consistent application of accounting principles results in an emphasis-of-matter section

Auditor Discretioanry

A risk or uncertainty.

Significant related party transactions described in a note to the financial statements.

The company is a component of a larger business enterprise.

Unusually important significant events. (e.g significant litigation)

Accounting matters affecting comparability (other than changes in accounting principles) of financial statements with those of the preceding year.

In either a nonpublic or public company report the section is added at a point following the Basis for Opinion section.

Group Financial Statements

Group engagement team should obtain understanding of

Whether component auditors are competent and understand and will comply with ethical requirements.

Extent of group engagement team involvement with component auditors.

Whether group engagement team will be able to obtain necessary information on the consolidation process.

Whether component auditors operate in a regulatory environment that actively oversees auditors.

Communicate with component auditors:

Inform component auditors how their work will be used.

Communicate ethical requirements.

Provide list of related parties.

Communicate significant risks of misstatement.

Group auditor alternatives:

Make no reference to the component auditors.

Make reference to the component auditors.(share responsibility)

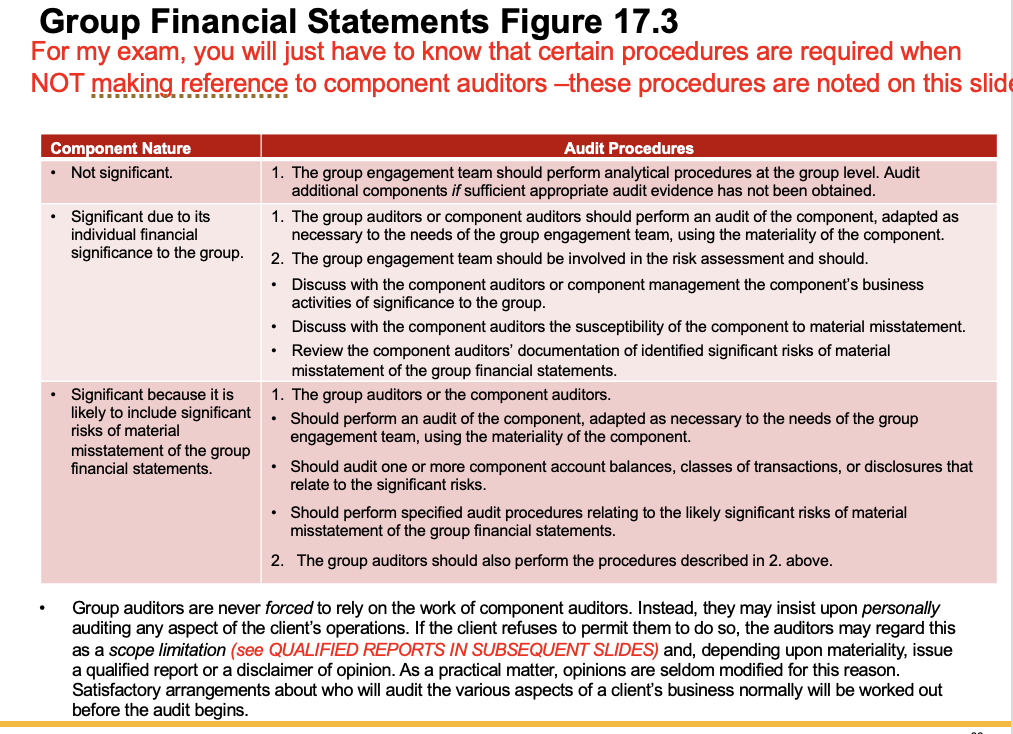

Group Financial Statements Figure 17.3

Qualified Opinion

A qualified opinion states that the financial statements are presented fairly in conformity with generally accepted accounting principles “except for” the effects of some matter.

Departure from G A A P:

Immaterial – unmodified.

Material – qualified.

Material and pervasive—Adverse.

Misstatements become pervasive when any one of the following applies:

Not confined to specific accounts.

If confined, they represent a substantial proportion of the financial statements.

In relation to disclosures, they are fundamental to users’ understanding of the financial statements.

Adverse Opinion

An adverse opinion states that the financial statements are not presented fairly in conformity with generally accepted accounting principles.

Financial statements do not present fairly the financial position, results of operations, and cash flows of client in conformity with G A A P.

Material and pervasive departures from G A A P.

Auditor believes departure causes financial statements taken as a whole to be misleading.

Disclaimer of Opinion

A disclaimer of opinion states that due to a significant scope limitation, the auditors were unable to form an opinion or did not form an opinion on the financial statements.

Auditor has no opinion.

Issued whenever the auditor is unable to form an opinion as to fairness of financial statements.

Circumstances resulting in a disclaimer are those in which the possible misstatements are material and pervasive.

Multiple uncertainties may also lead to a disclaimer.

Not an alternative to adverse opinion.

Scope Limitations

Scope limitations:

Imposed by circumstances.

Important accounting records destroyed.

Due to nature of audit.

Engaged too late in year to observe client’s beginning inventory.

Imposed by client.(this may affect auditor’s assessment of fraud risk)

Client refused to allow auditors to send confirmations to customers.

Often results in a disclaimer as opposed to a qualification.

NOTE: When scope limitation is encountered, auditors attempt to obtain sufficient appropriate audit evidence by performing alternative procedures— If the evidence is obtained—no qualification is necessary

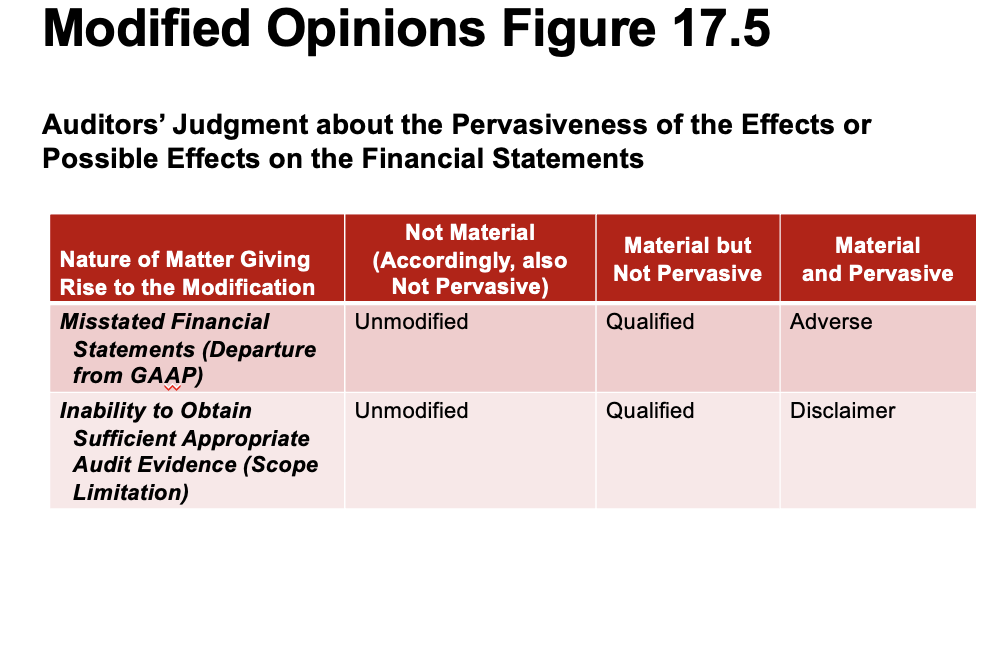

Modified Opinions Figure 17.5

Two or More Report Modifications

Qualified for two or more reasons.

Example: Qualified because of both a scope limitation and separate departure from G A A P.

Wording of report would include appropriate qualifying language and explanatory paragraphs for both types of qualifications.

Auditor should consider cumulative effects – disclaimer of opinion may be appropriate.

Different Opinions on Different Standards

It is acceptable to express an unqualified opinion on one statement while expressing a qualified or adverse on the others.

Example: Auditors retained after client has taken its beginning inventory. A disclaimer may be issued on the income statement (the auditor doesn't know if income is reasonably stated), but an unqualified opinion may be issued on the year-end balance sheet.

Reporting on Comparative Financial Statements

Report should cover current year as well as prior period audited by their firm.

Can express different opinions on different years.

Auditor should update report for all prior periods presented for comparison.

If prior period audited by another (predecessor) C P A firm.

Current year opinion only covers years the C P A firm audited.

For financial statements audited by predecessor auditor either:

Predecessor auditor reissues report with original date (SEC Filings), or

Current auditor refers to report of other auditor.

Reports to SEC

Forms filed with S E C which include audited financial statements.

Forms S-1 through S-11 (registration statements).

Forms S B-1 and S B-2 (registration for small businesses).

Form 8-K (current report).

Form 10-Q (quarterly report).

Form 10-K (annual report).

Auditors should be well versed on requirements of each form.