AP Macroeconomics

1/124

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

125 Terms

Gross Domestic Product (GDP)

the total value of all final goods and services produced in a year within that country

2 ways to calculate GDP

the income approach and the expenditure approach.

National Income (NI)

sum of the income earned by the factors of production owned by a country’s citizens

Personal income (PI)

the money income received by households before personal income taxes are subtracted

Disposable income (DI)

personal income minus personal income taxes

Expenditure approach

adds up spending by households, firms, the government, and the rest of the world using the following formula:

GDP = C(consumption by households) + I(investment) + G(gov purchases) + (X-M) exports - imports

Income Approach def + formula

slightly modifies national income to arrive at GDP

GDP = NI + Depreciation - Subsidies + Net income of foreigners

Depreciation

decline in the value of capital over time due to wear or obsolescence

Difference between national income and GDP

National income is the total income earned by a nation's residents, while GDP measures the total economic output within a country. An american making a film in france would add to US’s national income and France’s GDP.

Net domestic product

GDP minus depreciation. indicates how much output is left over for consumption and additions to the capital stock after replacing the capital used up in the production process

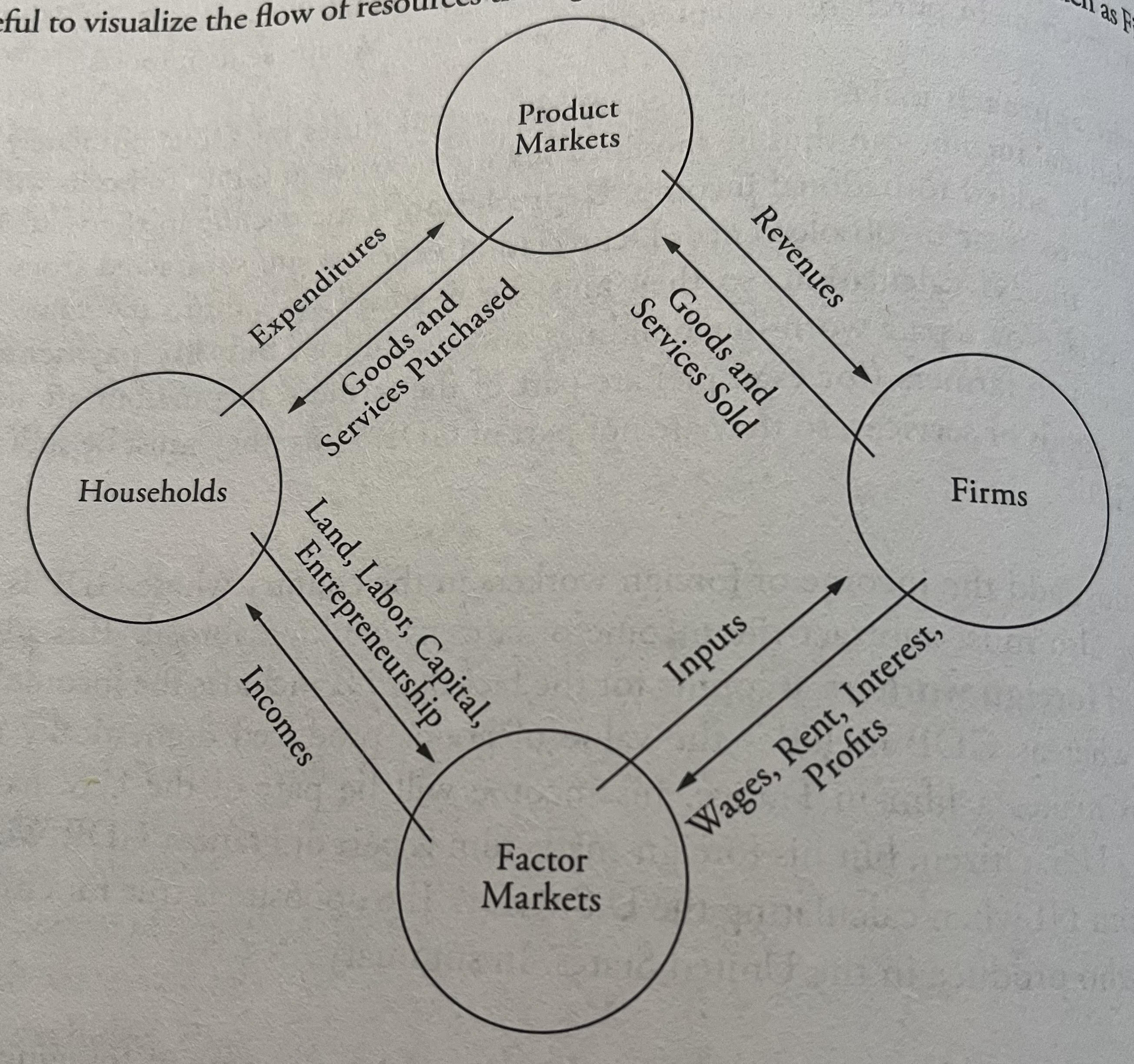

Circular flow model

Aggregate income = aggregate expenditure = GDP

Labor force

includes employed and unemployed adults

unemployed

a labor force participant willing and able to work and has made an effort to seek work in the past four weeks.

labor force participation rate

#of people in the labor force/working-age population

Discouraged workers

those willing and able to work but have stopped looking for work due to being discouraged and frustrated. do not count as part of the labor force

dishonest workers

claim to be unemployed to receive benefits, are able to work or are working for cash in an unreported job.

full employment (potential output)

level of unemployment that corresponds with the natural rate of unemployment (about 5% in the US)

Okun’s Law

for every 1% increase in the unemployment rate above the natural rate, output falls by 2-3%.

Frictional unemployment

temporary unemployment bc they’re moving to a new location/occupation in which they will be more productive

Structural unemployment

unemployment that occurs when workers' skills are unmarketable and no longer neededdue to changes in the economy or technological advancements.

Cyclical unemployment

unemployment that results from economic downturns or recessions, when aggregate demand decreases.

Seasonal unemployment

unemployment because of the season/time of year

Inflation

sustained increase in the overall price level

Deflation

sustained decrease in the overall price level

Nominal salary

actual number of dollars a person earns

Real salary

purchasing power of the money one earns

Money illusion

When one’s nominal salary increases but their real salary (purchasing power) hasn’t increased→ leads to excessive spending

Consumer Price Index (CPI)

government’s gauge of inflation. used to adjust tax brackets and social security payments

CPI formula + inflation formula

CPI = (Cost of base year market basket at current prices / cost of base year market basket at base year prices) * 100

Inflation between years Y and Z = (Year Z’s CPI / Year Y’s CPI-1) * 100

Bureau of Labor Statistics

calculates CPI by using the average change over time in the prices paid by consumers for a basket of goods and services.

Real GDP formula

Real GDP = (Nominal GDP / CPI for the same year as the nominal figure) * 100

Producer Price Index (PPI)

measures changes in the prices of wholesale goods such as lumber and steel

GDP Deflator

alternative general price index that reflects the importance of products in current market baskets, rather than in base year market baskets, which become less relevant over time

GDP Deflator formula

Cost of current year market basket at current prices / cost of current year market basket at base year prices * 100

the GDP deflator tends to register a lower inflation rate than CPI because

GDP deflator reflects both price changes and substitutions away from goods that have become relatively expensive

Business cycles

fluctuations in aggregate output and employment

Output gap

difference between potential output and actual output (where the actual gdp curve and potential gdp intersect the output gap is 0)

Say’s law

states that production (supply) creates its own demand, suggesting that supply will generate an equal level of demand in the economy.

John Maynard Keynes economic theory

a flat AS curve in the depression range and argued that wages cannot adjust to match changes in price levels. Further, he argues that deviations from full employment output might persist until the government steps in with monetary or fiscal policy.

which 3 effects cause the inverse relationship between price and GDP

real wealth effect, foreign trade effect, interest rate effect

foreign trade effect

when the price level in one country increases, the prices of imports from other countries become relatively less expensive. leads to more imported goods and fewer exports → decreases real GDP

interest rate effect

wen price level increases, purchasing power of money decreases. increases the demand for money in the form of loans, decreases the supply of loanable funds. This leads to higher interest rates, which decreases investment and consumption, ultimately reducing real GDP.

real wealth effect

price level increases, the value of assets such as cash and checking account balances falls. real value of assets declines, so people buy less leading to real GDP reduction

aggregate supply curve (SRAS)

In the short run, it slopes upward, illustrating a positive relationship between the price level and the quantity of goods and services supplied. has a horizontal depression “keynesian” stage, a positively sloped intermediate range, and a vertical physical limit “classical stage”

LRAS curve

vertical and stands at the level of output that corresponds with full employment

Cost-push or supply side inflation

when inflation results from an increase in resource costs that shifts the AS curve to the left

Stagflation

rising prices + falling output (increasing inflation and increasing unemployment)

Demand pull inflation

result of the AD curve shifting out to the right relative to the AS curve (like inflation or increase to the money supply)

creeping inflation

remains steady at a low rate for a long period of time

galloping inflation

exceeds 10 percent per year and grows month after month unsteadily

hyperinflation

very rapid prince increases in excess of 50 percent per year

recessionary gap

amount by which equilibrium real GDP would have to increase to reach LAS

inflationary gap

amount by which equilibrium real GDP would have to decrease to reach LAS

spending mulitplier/ expenditure multiplier

number by which the initial amount of new spending should be multiplied to find the total resulting increase in real GDP

marginal propensity to consume (MPC)

amount by which consumption increases for each additional dollar of real income

MPC formula

change in consumption/ change in real income

Marginal propensity to save (MPS)

fraction of each additional dollar of income that is saved

MPS formula

change in saving / change in real income; MPS = 1-MPC

spending multiplier/expenditure multiplier formula/government spending multiplier formula

Multiplier = 1/MPS

Tax multiplier def + formula

total change in real GDP resulting from each $1 change in taxes

Tax multiplier = -MPC/MPS

fiscal policy

excercised by the gov when trying to counter fluctuations in aggregate expenditure with changes in purchases, transfer payments, or taxes

Money + its 3 functions

anything that is commonly accepted as a means of payment for goods and services. medium of exchange, store of value, unit of account

medium of exchange

avoids a double coincidence of wants and the need to barter. money acting as a common medium of exchange simplifies transactions

store of value

key characteristic distinguishing money from currency. allows for a non perishable item that will hold value of past production into the future

unit of account

standard unit price listings and comparisons that provides a consistent measure of value, allowing individuals to compare the value of different goods and services.

Currency

any item that is used as money that does not act as a store of value or carry intrinsic value (like paper cash would have no value past being scratch paper if the US ceased to exist)

Commodity money

raw material with intrinsic value (silver coin) that is used in exchange for other goods in an economy

Fiat money

currency without intrinsic value (paper cash). also known as currency

central banks

manage macroeconomic indicators and influence economies via the policy rate.

U.S. central bank and policy rate name

Federal Reserve Bank and federal funds rate

Fed “dual mandate” two goals

maximize the employment rate and maintain price stability

Money supply

amt of money available on the market

liquidity

the ease of converting assets into cash without affecting their market price. how easily that money can be accessed

M1

sum of coin and paper money (currency) + checking deposits + traveler’s checks

M2

M1 +saving deposits, small-time deposits, money market mutual funds

limited reserves

economies with this system use a fractional reserve banking system in which only a fraction of total deposits is held on reserve and the rest is lent out

reserve ratio (formula)

bank reserves / total deposits

money creation

generation of assets caused by an initial deposit to a bank being held partially in reserve and partially redistributed as a loan over and over again

Money multiplier def + formula

total amount of deposits resulting from an initial deposit that is ultimately held as reserves

Money multiplier = 1 / required reserve ratio

discount rate

interest rate banks pay to borrow money from the Fed

Open market operations

Fed’s purchase and sale of government securities

ample reserves

economies with this system rely on administered interest rates, the discount rate and interest on reserves, to influence the economy

financial assets

subcategory of economic assets. these are entities over which institutional units or individuals assert ownership rights.

Monetary policy

the use of money and credit controls to influence interest rates, inflation, exchange rates, unemployment, and real GDP

expansionary monetary policy effects

Money supply (Ms) goes up, interest rates(r) decrease, investment (i) goes up, aggregate demand (AD) goes up, output (Y) goes up

contractionary monetary policy effects

Money supply (Ms) goes down, interest rates (r) goes up, investment (i) goes down, aggregate demand (AD) goes down, output (y) goes down

Monetary inflation

when prices increase due to an oversupply of currency

Phillips curve

illustrates the inverse relationship between inflation and unemployment

Rational expectations theory

suggests that people learn to anticipate government policies designed to influence the economy. Anticipating an AD shift to the right and the subsequent increase in the price level, people will demand higher prices and wages and shift AS back to the left. argues gov intervention is not necessary or useful for economic stability

Budget deficit

difference between fed gov spending and tax collections in one year

national debt

accumulation of past deficits → the total amount that the fed gov owes at a given time

Ricardian Equivalence Theory

states that deficit financing is no different from tax financing bc if the former is chosen, people will simultaneously increase their savings by the amount they would have been taxed in preperation for the inevitable repayment of the debt at a later time

balance of payments

statement of all international flows of money over a given period

trade deficit exists when

imports exceed exports, opposite being a surplus

merchanidse trade balance equation

merchandise exports - merchandise imports

current-account balance equation

trade balance + services balance + transfers (unilateral)

Financial account balance equation

foreign purchases of home assets - home purchases of foreign assets

merchandise trade deficits or surpluses must be offset elsewhere in

the current-account or financial account balances

arbitrage

practice of buying low and selling high

fixed exchange rate

when set by the central bank changes in demand affect only the quantity of dollars purchased; supply curve is horizontal bc changes in demand dont affect value of currency but affect quantity of it