AP Macroeconomics Module 22-24 Quiz

1/23

Earn XP

Description and Tags

Weathers AP Macroeconomics 2025-2026

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

24 Terms

What are the three types of financial assets?

Loans

Bonds

Stocks

What is a loan?

A lending agreement between lenders and borrowers

What is a bond?

An IOU issued by a borrower

What is a stock?

A share in the ownership of a company

What are the five types of financial intermediaries?

Mutual funds

Financial service websites

Life insurance companies

Pension funds

Banks

What is a mutual fund?

Diversified stock portfolios that reduce risk

What are financial service websites?

Websites that track the daily performance of many mutual funds.

What are life insurance companies?

Pay beneficiaries when policyholders die

What are the functions of pension funds?

Gather money from many individuals to invest collectively.

What do banks do?

Use depositors’ money to provide loans to borrowers in exchange for paying them back interest.

What are the 3 tasks of the financial system?

Reducing transaction costs

Reducing risk

Providing liquidity

What does reducing transaction cost mean?

Reducing the expenses of negotiating & executing deals

What does reducing risk mean?

Reducing the uncertainty about future outcomes

What does providing liquidity mean?

Making it easy to convert an item into cash

What are the 3 roles of money?

Medium of exchange

Storing value

Providing a unit of account

What does medium of exchange mean?

Money can be used to buy other goods & services

What does storing value mean?

Money holds its purchasing power over time

What does unit of account mean?

Money sets the prices for purchasing goods & services

What are the 3 types of money?

Commodity money

Commodity-backed money

Fiat money

What is commodity money?

Items that have monetary value even if they’re not being used as money (diamond wedding rings)

What is commodity-backed money?

Money that can be exchanged for a specific amount of a valuable commodity, like gold or silver.

What is fiat money?

Money that has value because the government says it does.

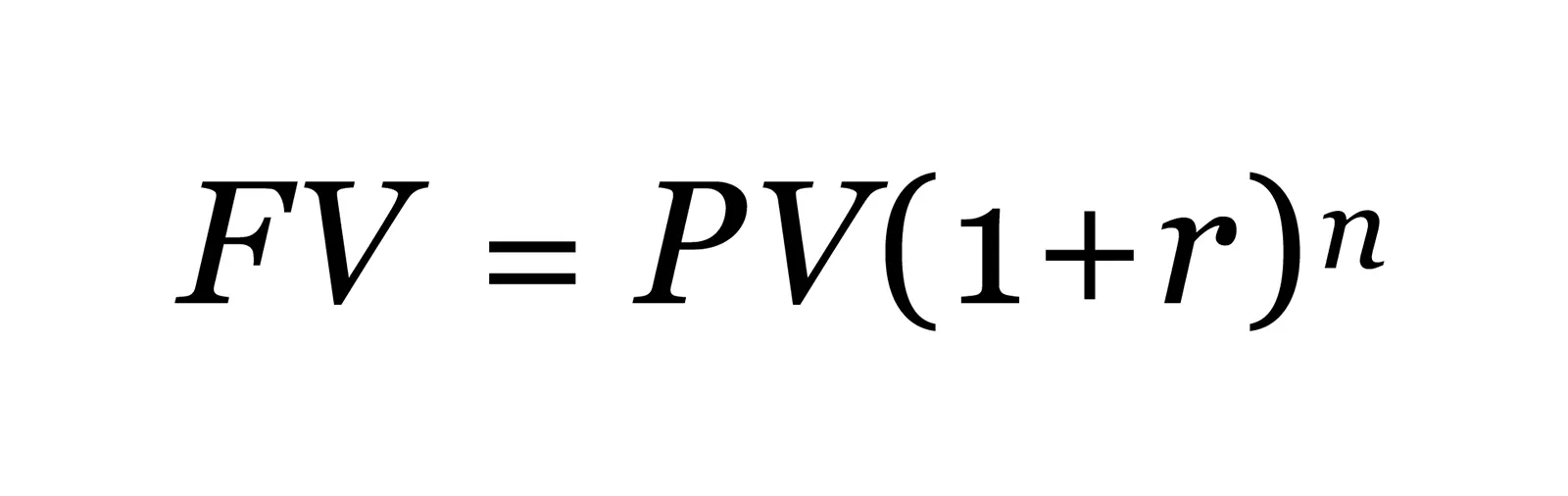

How to calculate future value

FV=PV(1+r)n

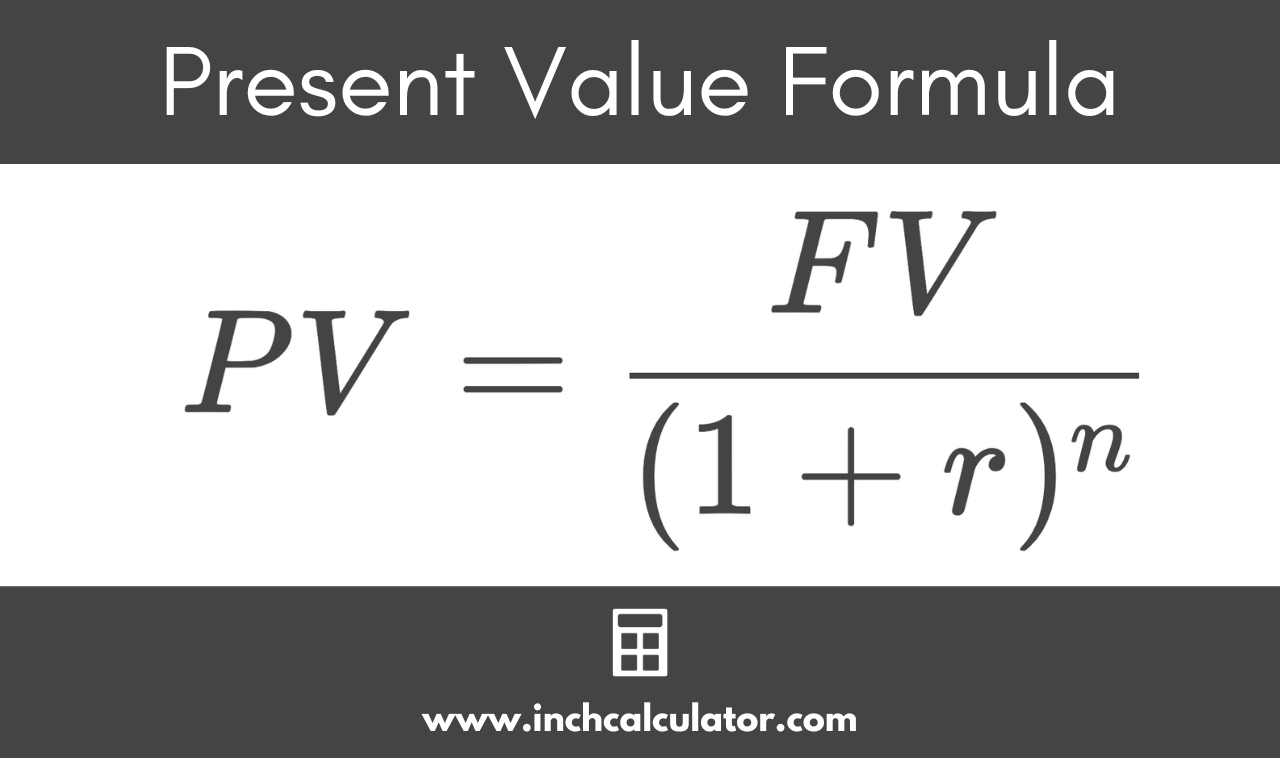

How to calculate present value

PV=FV/(1+r)n