Principles of Accounting

1/20

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

21 Terms

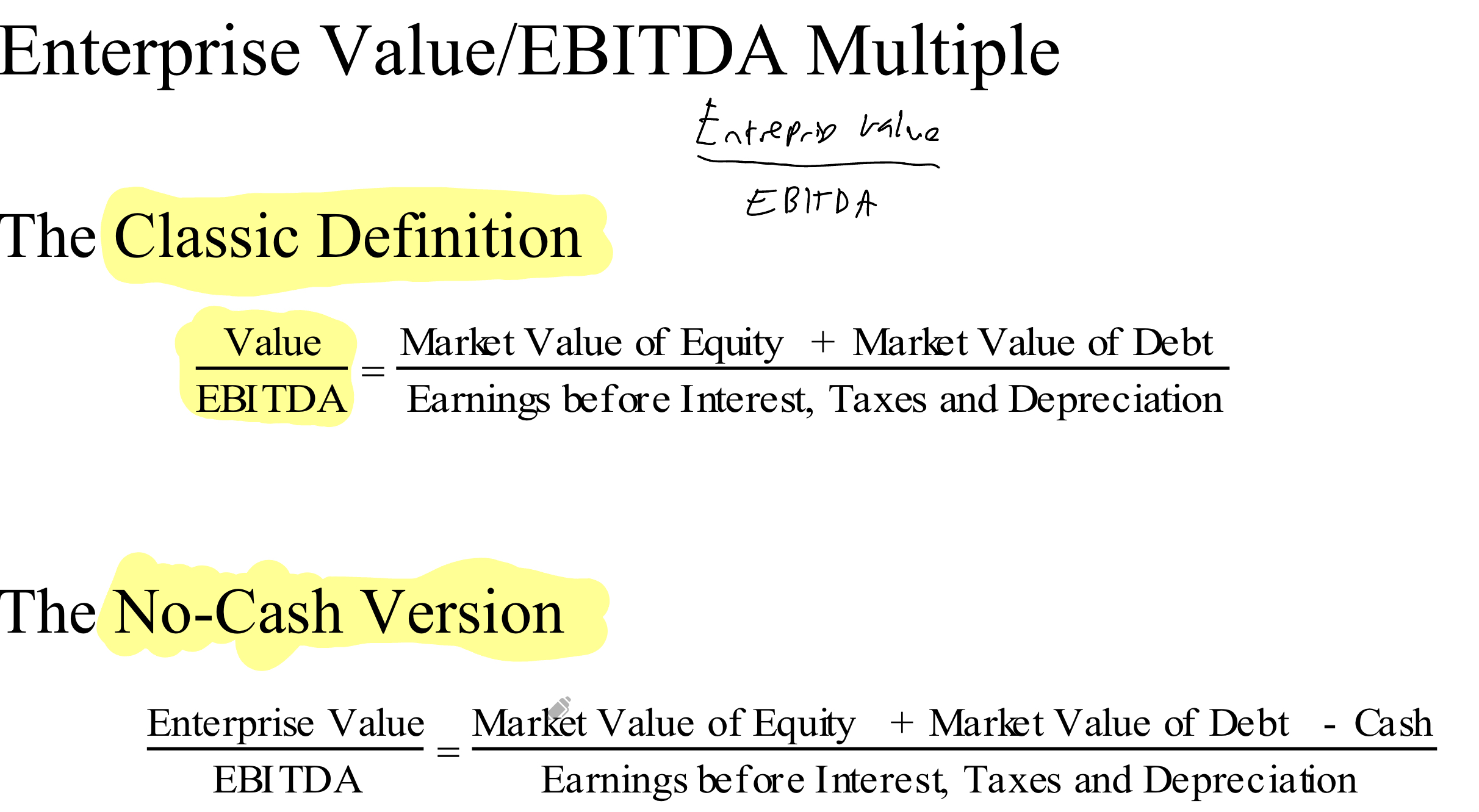

Enterprise value/EBIDTA, both cash and cashless

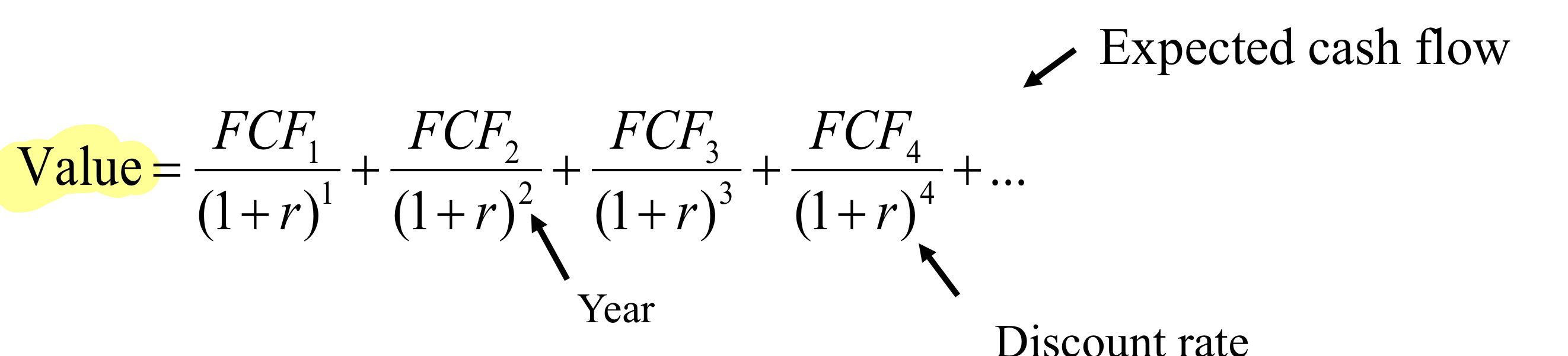

Present Value of Future Cashflow

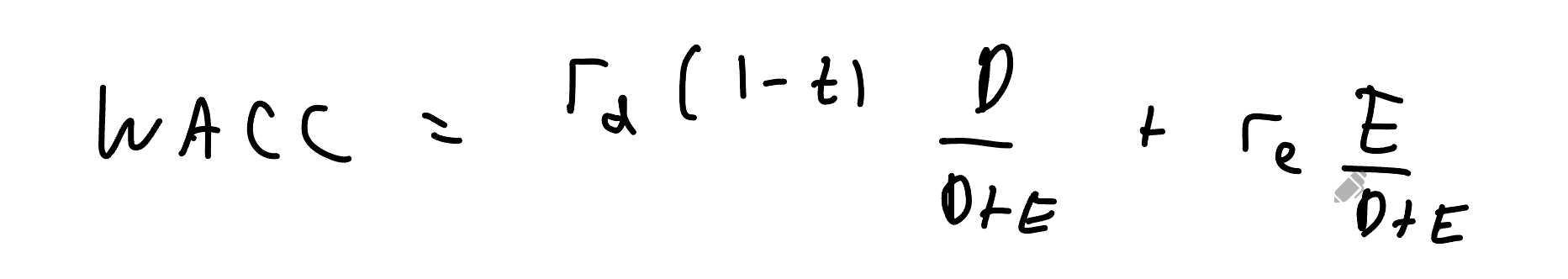

WACC

FCF

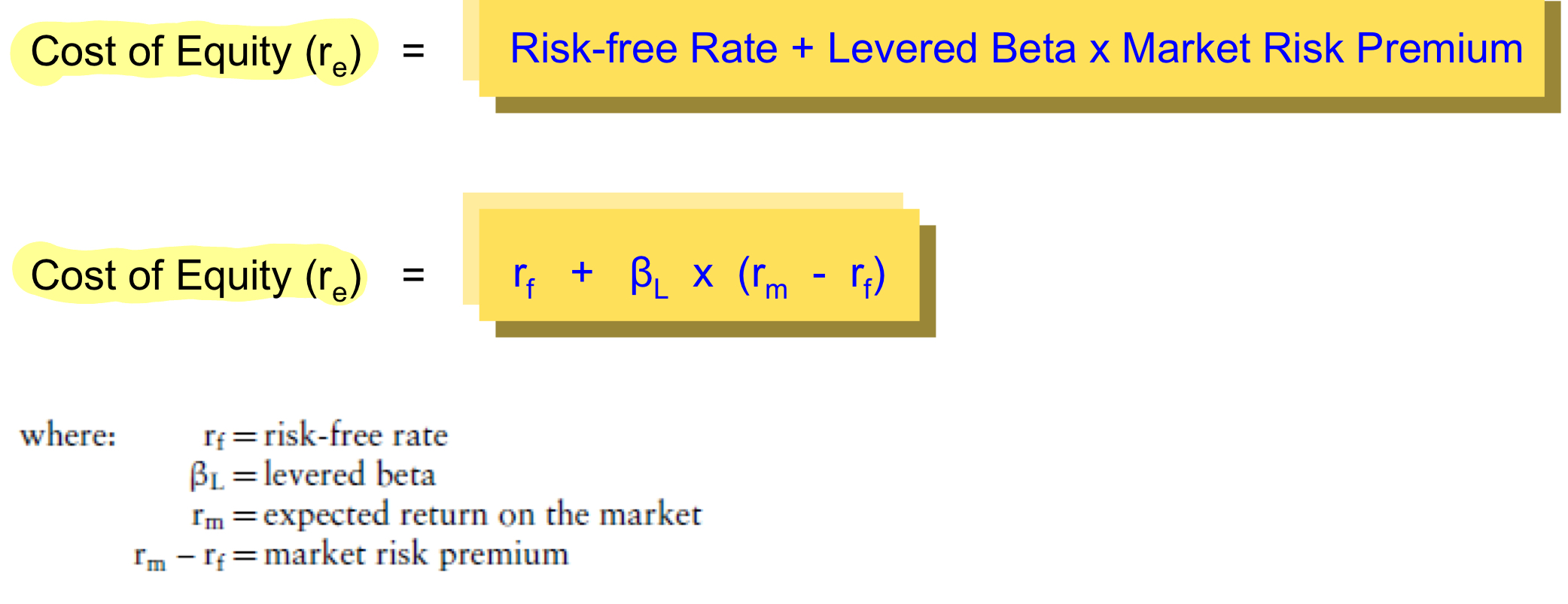

Cost of Equity

What is size premium

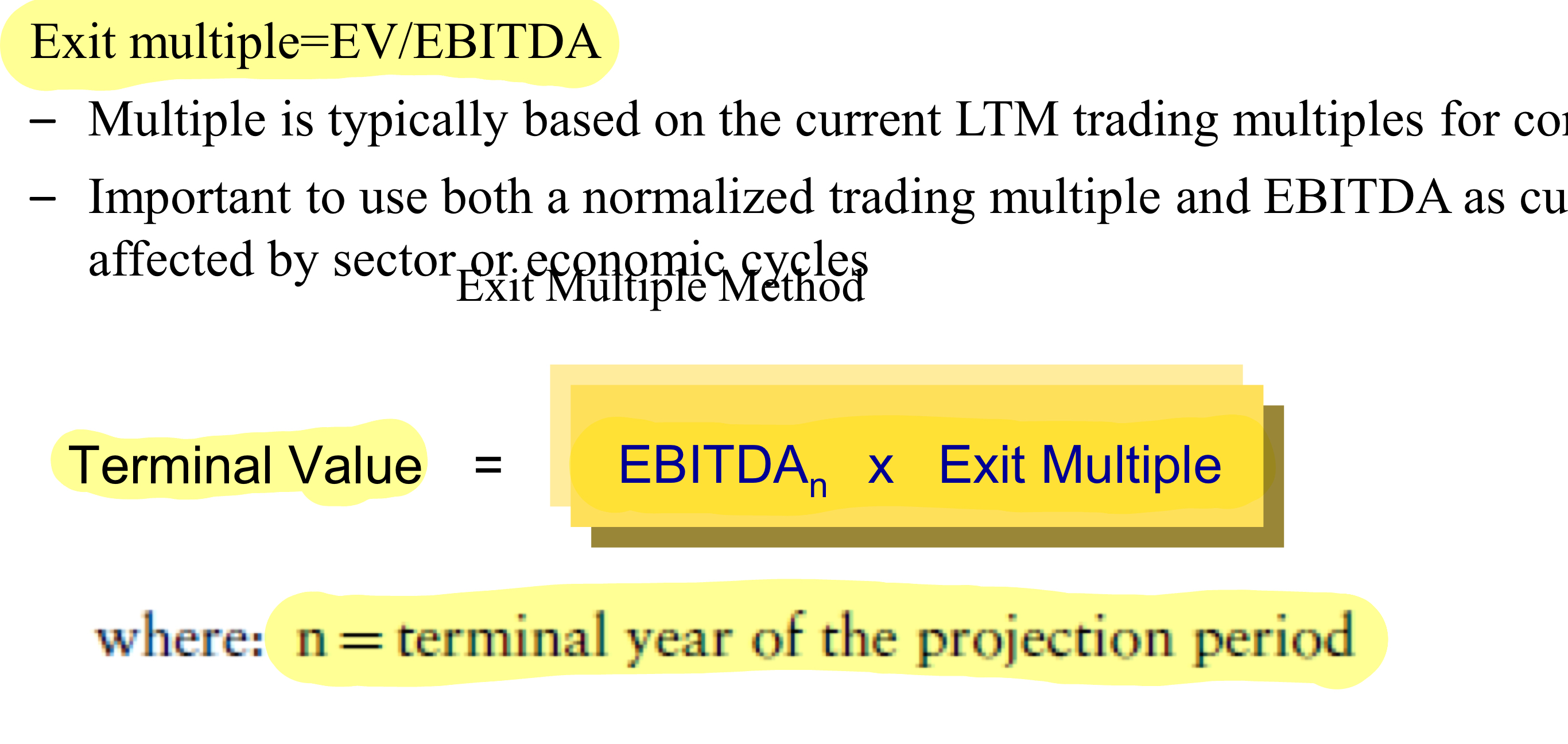

Exit Multiple and Terminal Value, Exit multiple method

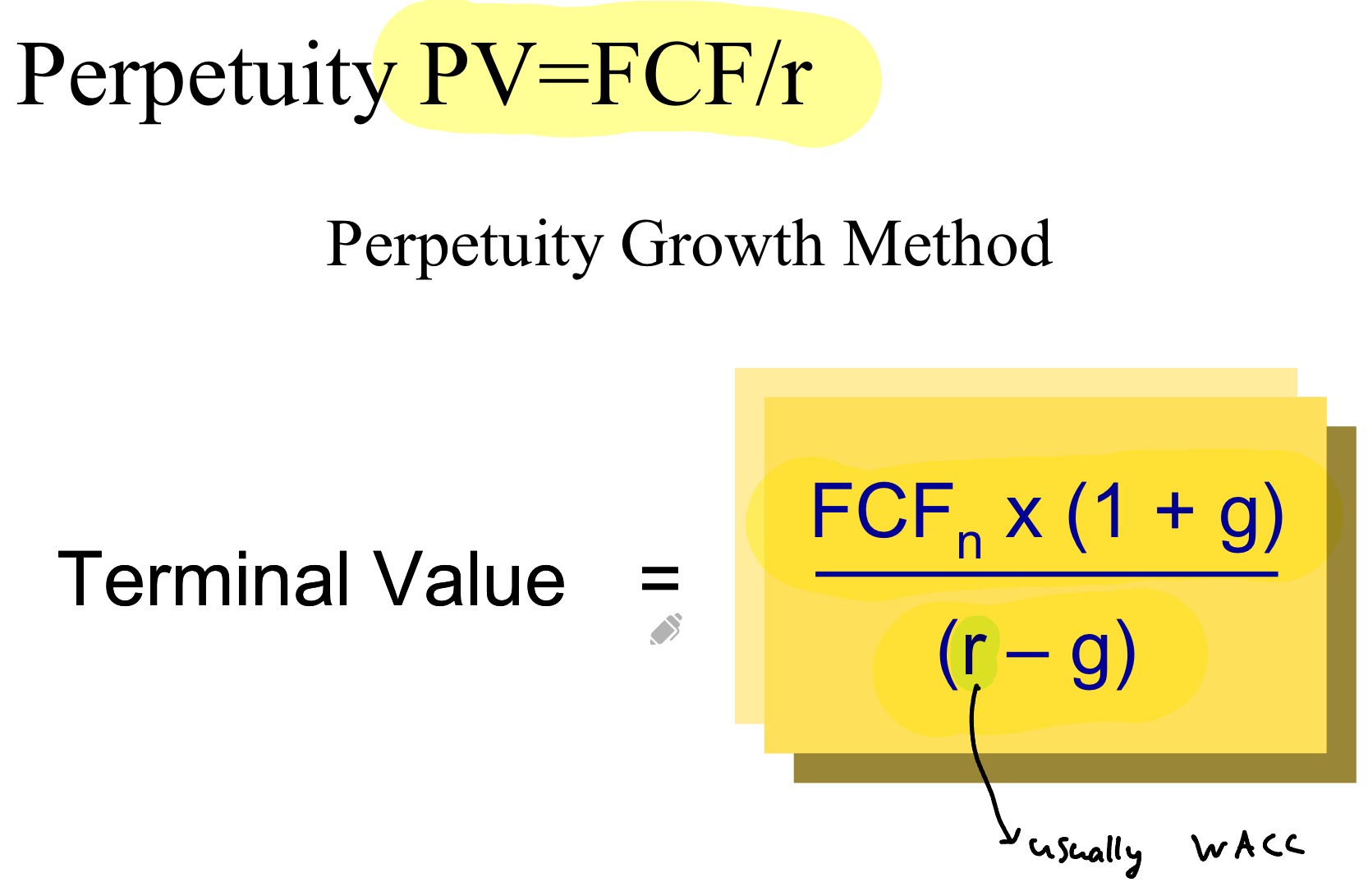

Perpetuity and Terminal Value, perpetuity growth method

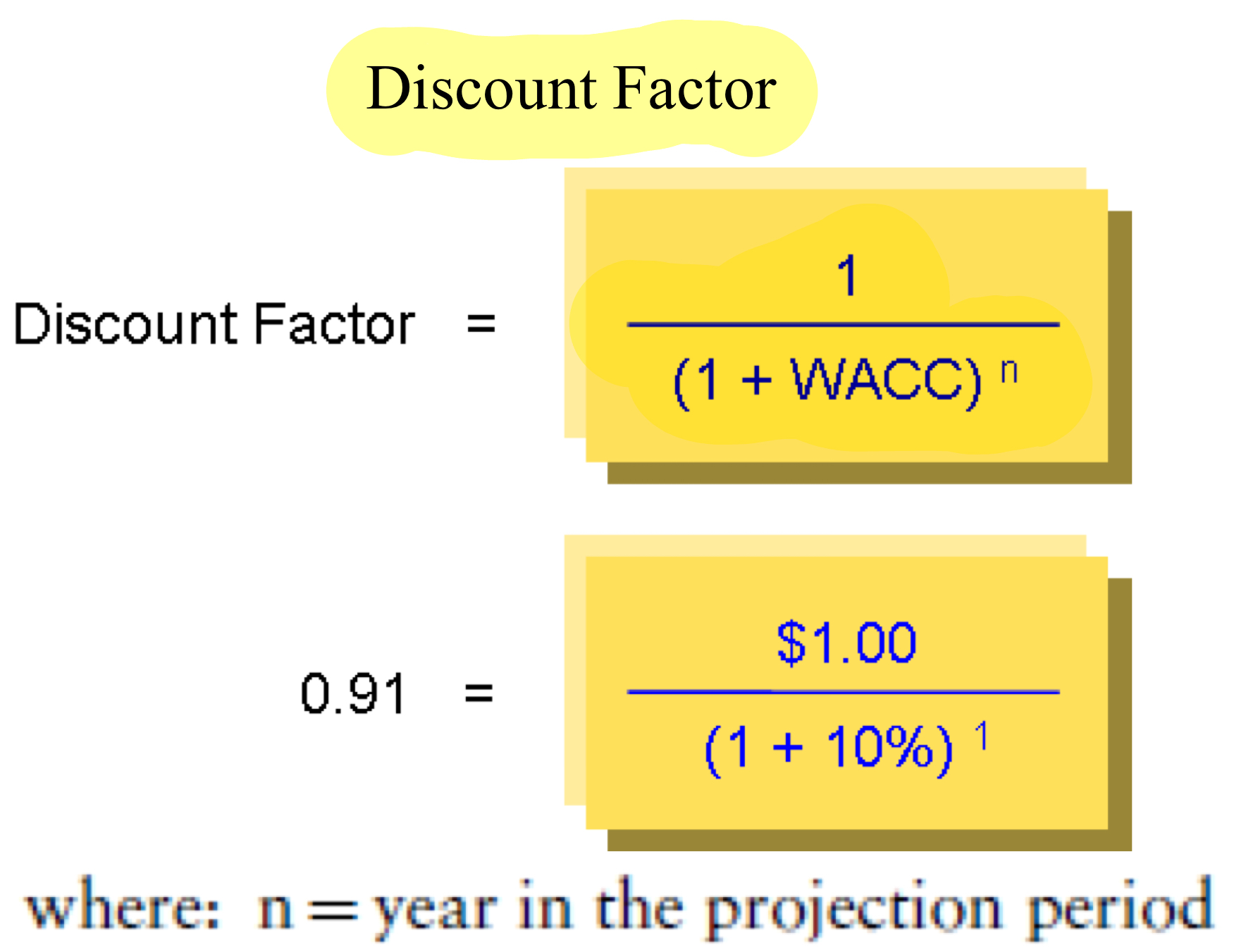

Discount Factor

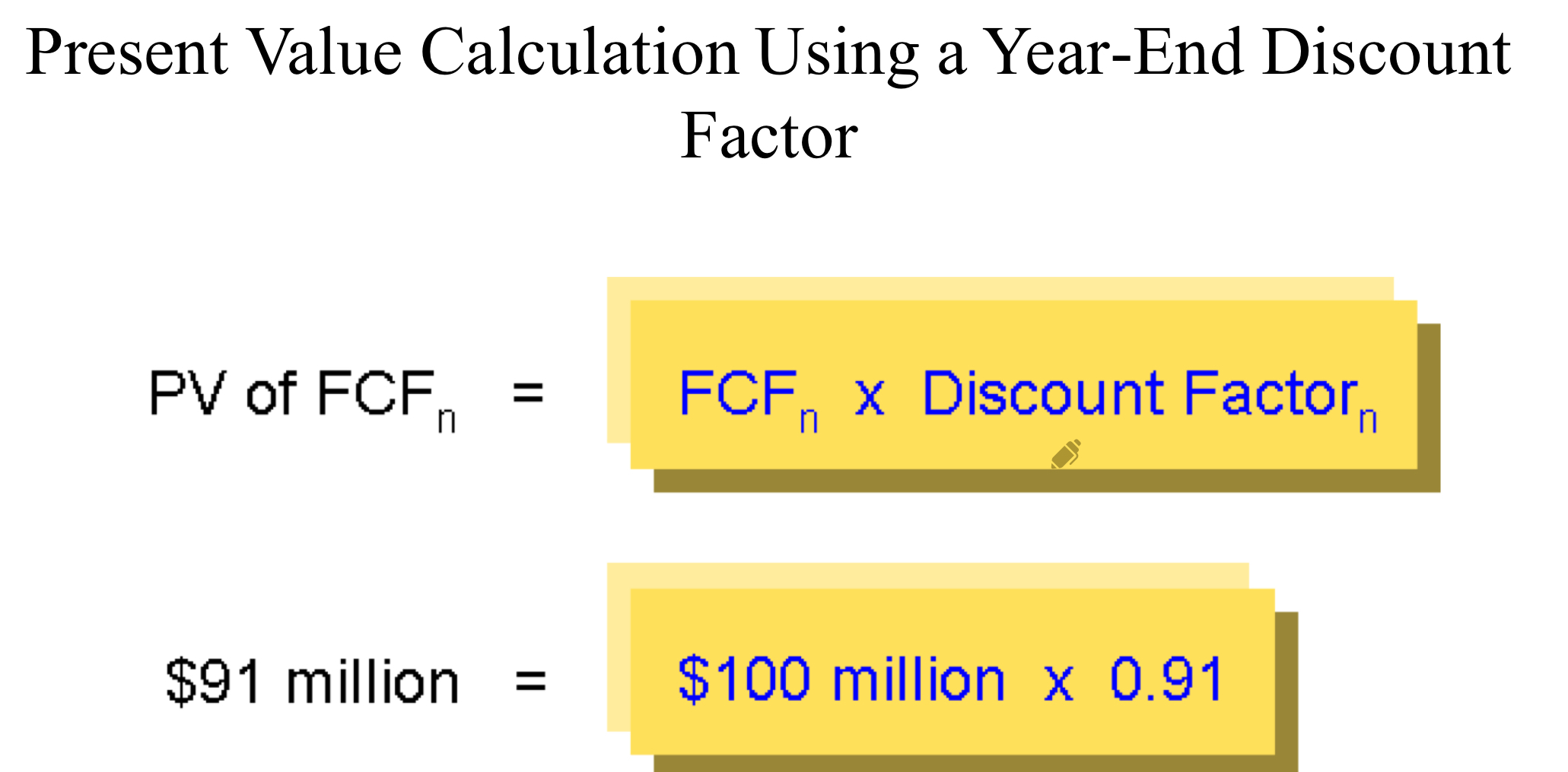

Present Value using Year-end discount factor

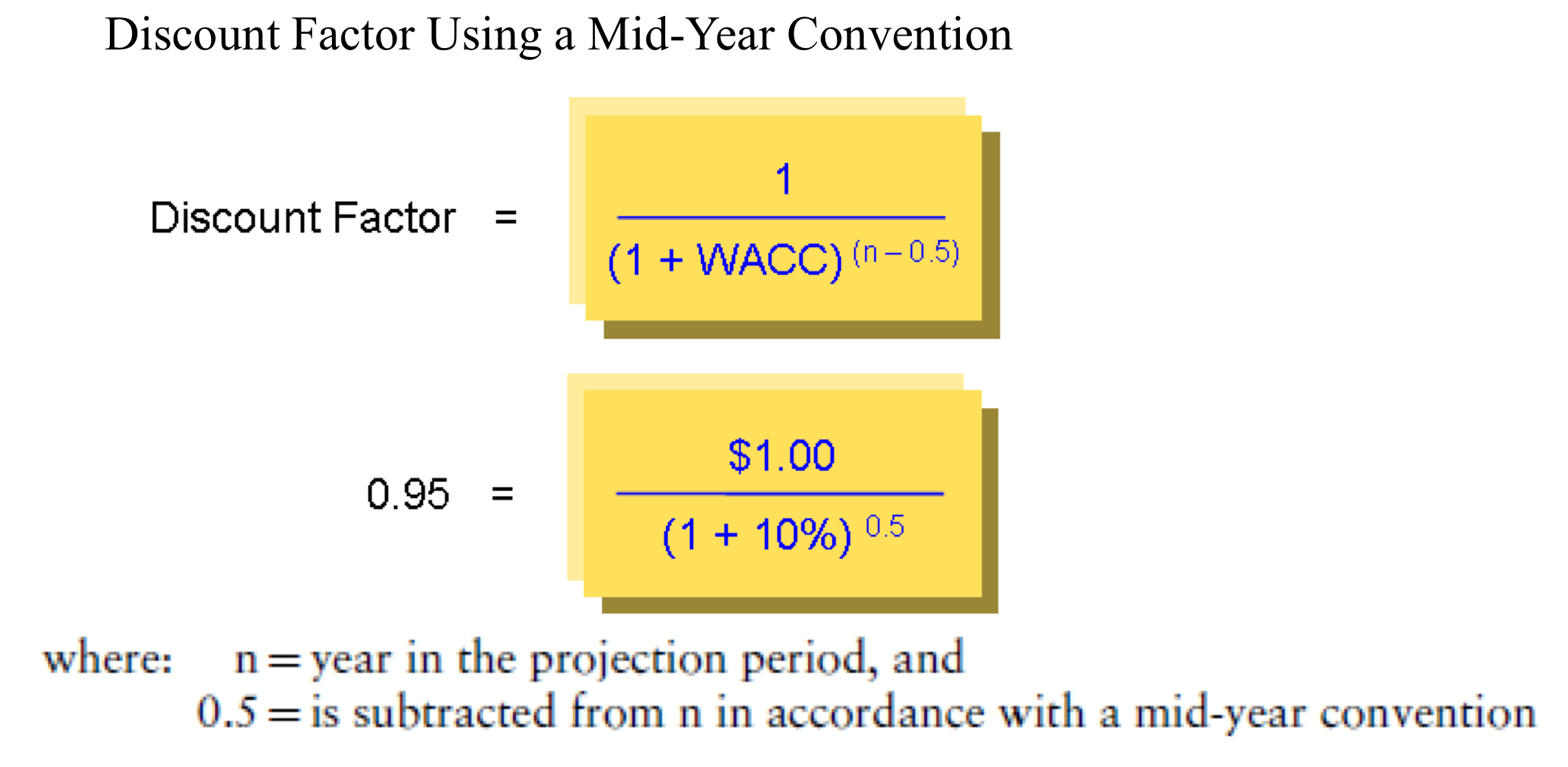

Discount Factor using Mid-Year Convention

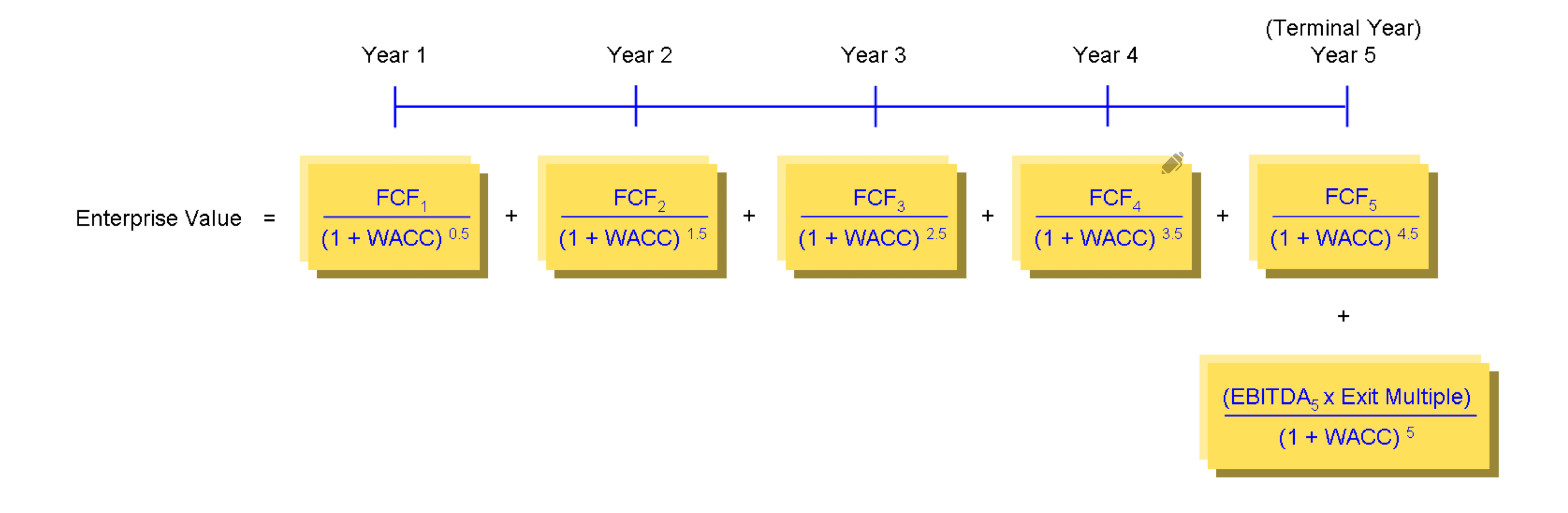

Entreprise value using mid-year discounting

Why is entreprise value calculated using mid-year convention

Because it is calculated throughout the year so use mid-year convention

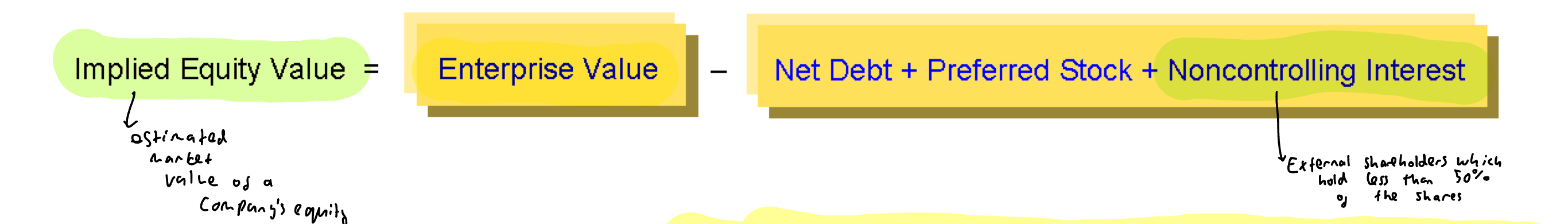

Implied Equity Value

Implied Share Price

Difference between implied equity value and market cap

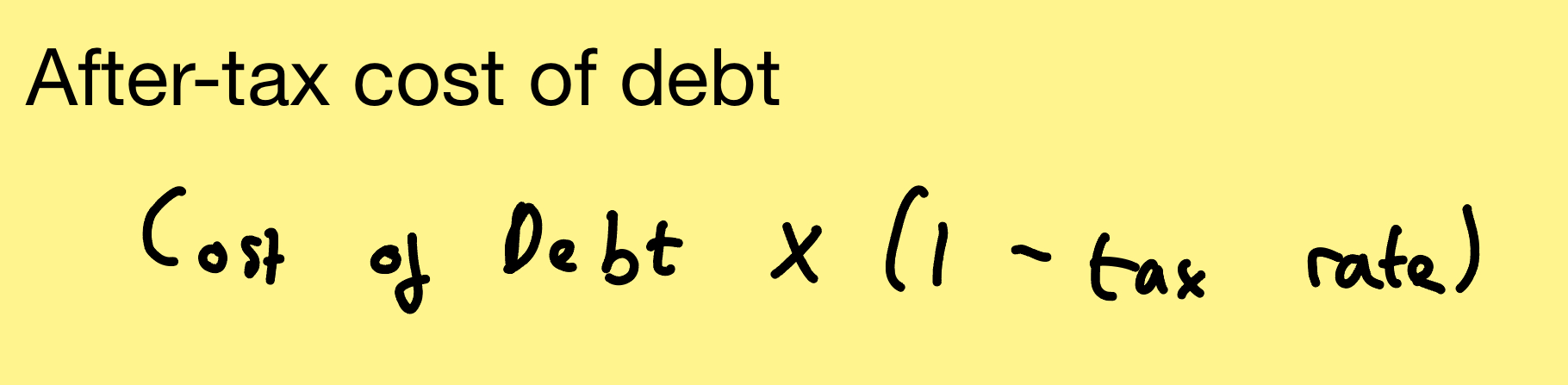

After tax cost of debt

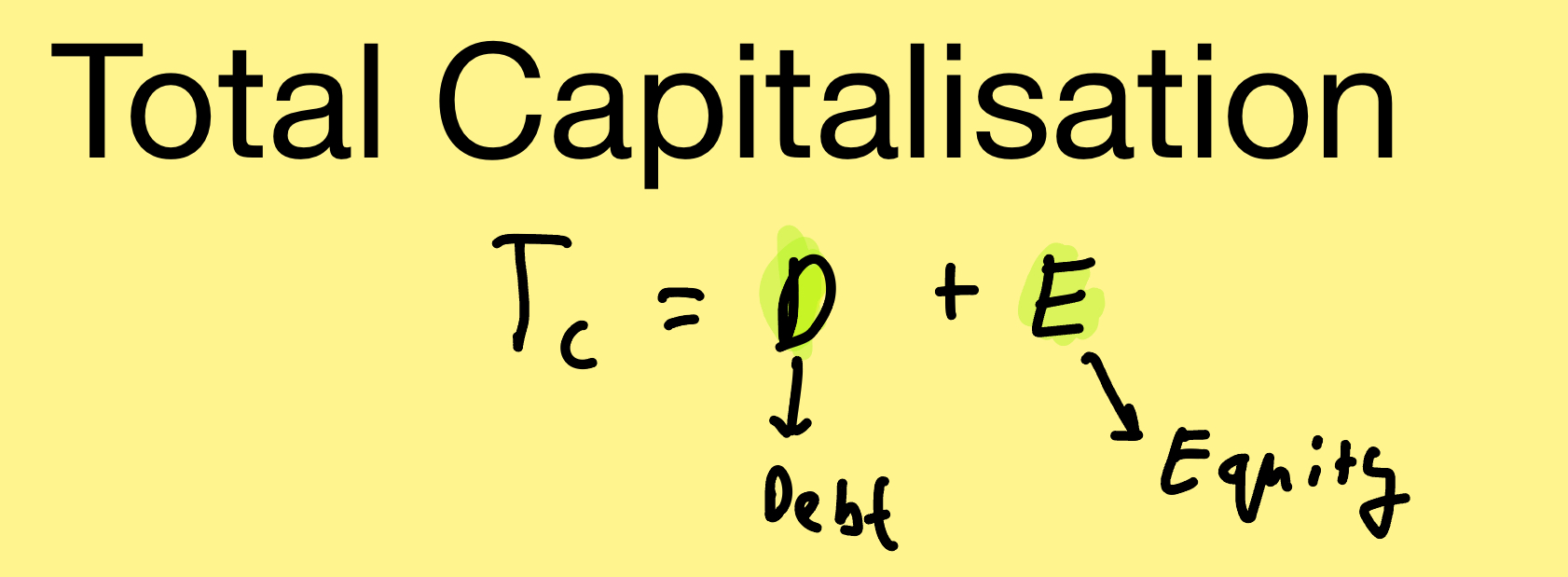

Total Capitalisation

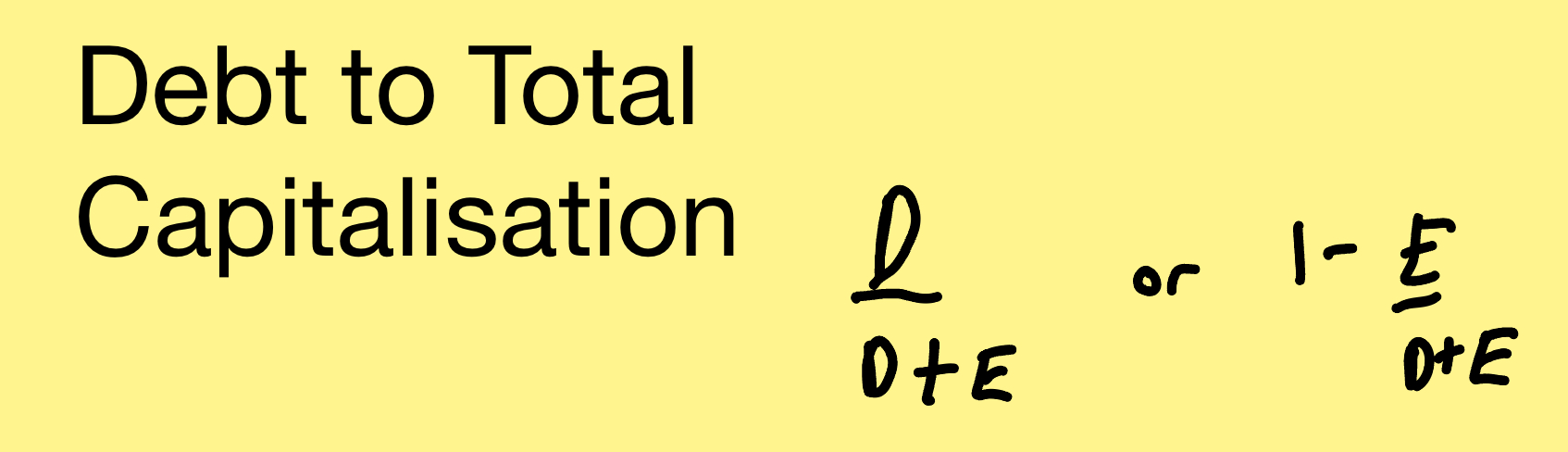

Debt to Total capitalisation

Equity to total capitalisation

Cost of Equity