ACC 121 Exam 1 Chapters 1-3

1/29

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

30 Terms

Gullett Corporation had $26,000 of raw materials on hand on November 1. During the month, the Corporation purchased an additional $75,000 of raw materials. The journal entry to record the purchase of raw materials would include a:

debit to Raw Materials of $101,000

credit to Raw Materials of $75,000

debit to Raw Materials of $75,000

credit to Raw Materials of $101,000

Answer: debit to Raw Materials of $75,000

Debit Raw Materials 75k

Credit AP 75k

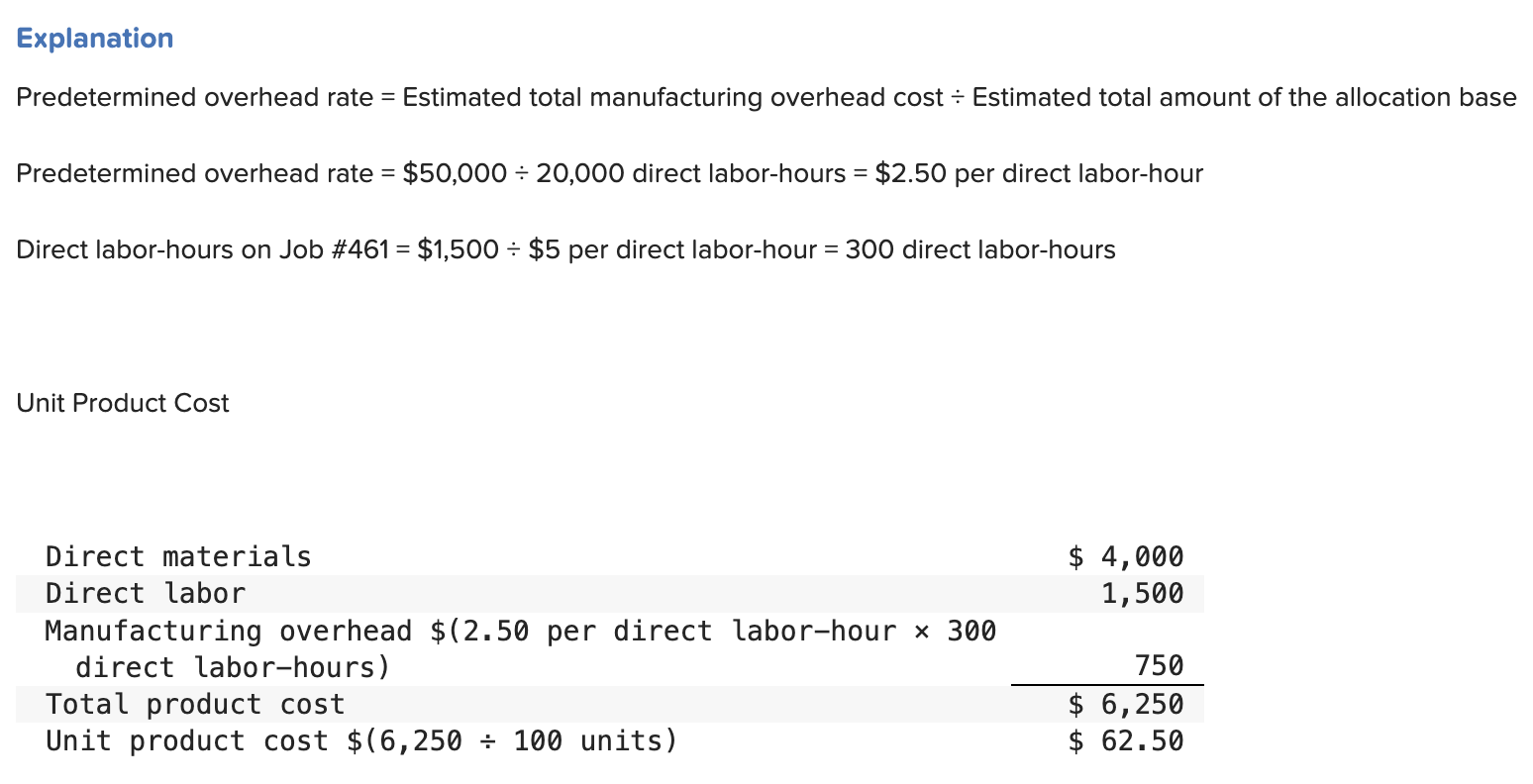

Parker Corporation has a job-order costing system and uses a predetermined overhead rate based on direct labor-hours to apply manufacturing overhead to jobs. At the beginning of the year, manufacturing overhead and direct labor-hours for the year were estimated at $50,000 and 20,000 hours, respectively. In June, Job #461 was completed. Materials costs on the job totaled $4,000 and labor costs totaled $1,500 at $5 per hour. At the end of the year it was determined that the company worked 24,000 direct labor-hours for the year and incurred $54,000 in actual manufacturing overhead costs.

If Job #461 contained 100 units, the unit product cost on the completed job cost sheet would be:

$61.75

$62.50

$63.10

$55.00

Answer: $62.50

Gallon Corporation had $24,000 of raw materials on hand on April 1. During the month, the Corporation purchased an additional $52,000 of raw materials. During April, $62,000 of raw materials were requisitioned from the storeroom for use in production. These raw materials included both direct and indirect materials. The indirect materials totaled $2,000. The debits to the Work in Process account as a consequence of the raw materials transactions in April total:

$60,000

$62,000

$0

$52,000

Answer $60,000

Debit Work in Process 60k

Debit Manufacturing Overhead 2k

Credit Raw Materials 62k

During June, Buttrey Corporation incurred $67,000 of direct labor costs and $7,000 of indirect labor costs. The journal entry to record the accrual of these wages would include a:

debit to Work in Process of $67,000.

credit to Work in Process of $74,000.

debit to Work in Process of $74,000.

credit to Work in Process of $67,000.

Answer: debit to Work in Process of $67,000.

Debit Work in Process 67k

Debit Manufacturing Overhead 7k

Credit Salaries and Wages Payable 74k

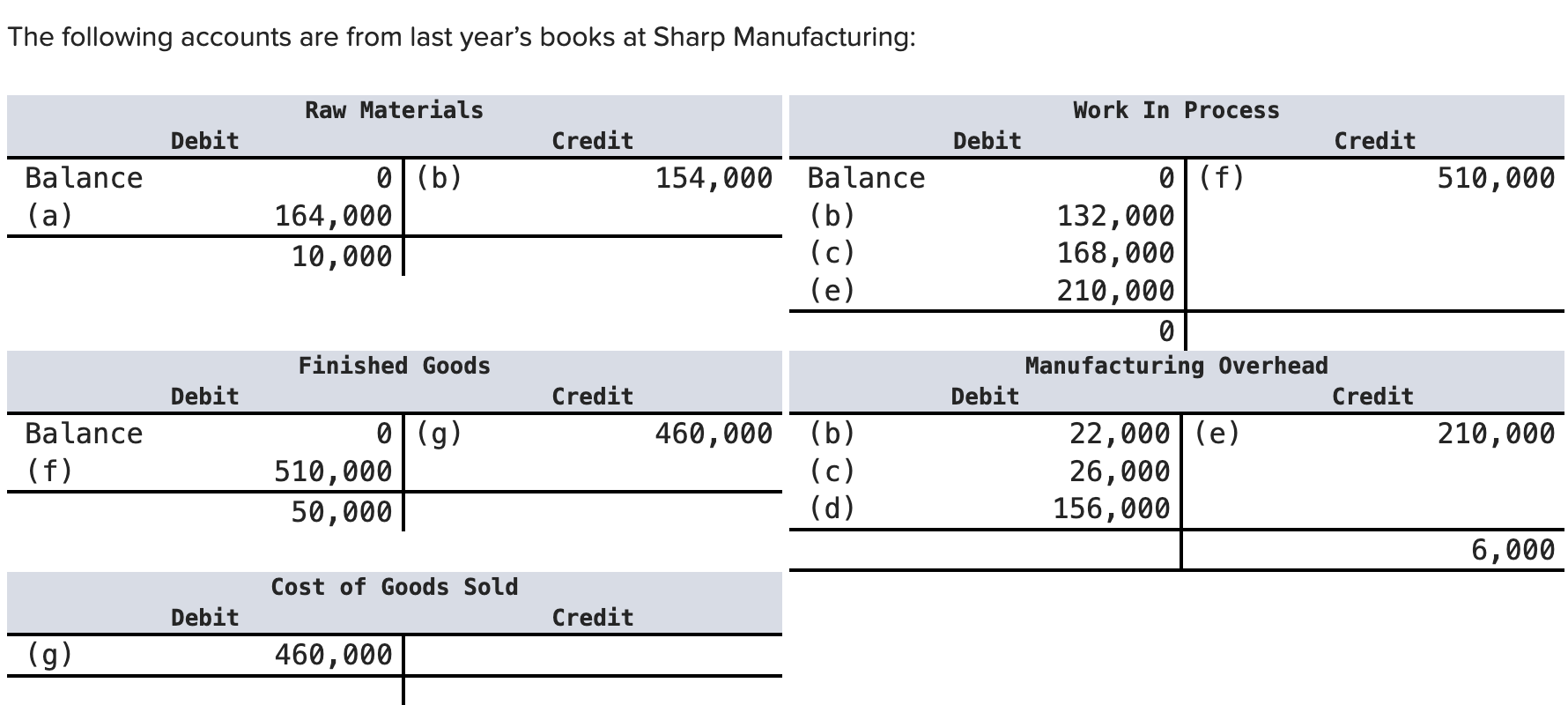

Sharp uses job-order costing and applies manufacturing overhead to jobs based on direct labor costs. What is the manufacturing overhead overapplied or underapplied for the year?

Answer: $6,000 overapplied

The manufacturing overhead is overapplied by $6,000 because the manufacturing overhead applied of $210,000 exceeds the manufacturing overhead incurred by $6,000.

Hardigree Corporation uses a job-order costing system.

Beginning balance in Work in Process | $ 36,000 |

|---|---|

(1) Raw materials purchased on account | $207,000 |

(2) Direct materials requisitioned for use in production | $161,000 |

(3) Indirect materials requisitioned for use in production | $ 42,000 |

(4) Direct labor wages incurred | $ 87,000 |

(5) Indirect labor wages incurred | $101,000 |

(6) Depreciation recorded on factory equipment | $ 42,000 |

(7) Additional manufacturing overhead costs incurred | $ 57,000 |

(8) Manufacturing overhead costs applied to jobs | $219,000 |

(9) Cost of jobs completed and transferred from Work in Process to Finished Goods | $403,000 |

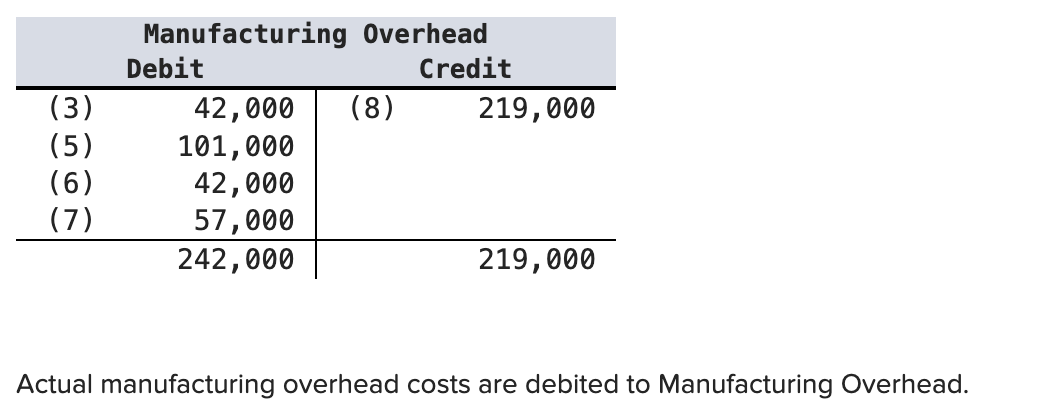

The total amount of manufacturing overhead actually incurred was:

$200,000

$284,000

$219,000

$242,000

Answer: $242,000

Able Corporation uses a job-order costing system. In reviewing its records at the end of the year, the company has discovered that $2,000 of raw materials has been drawn from the storeroom and used in the production of Job 110, but that no entry has been made in the accounting records for the use of these materials. Job 110 has been completed but it is unsold at year end. This error will cause:

Work in Process to be understated by $2,000 at year end.

Cost of Goods Manufactured to be overstated by $2,000 for the year.

Finished Goods to be understated by $2,000 at the end of the year.

Cost of Goods Sold to be overstated by $2,000 for the year.

Answer: Finished Goods to be understated by $2,000 at the end of the year.

Job 110 has been completed, but has not been sold. Therefore, the error will reduce Raw Materials and increase Finished Goods by $2,000.

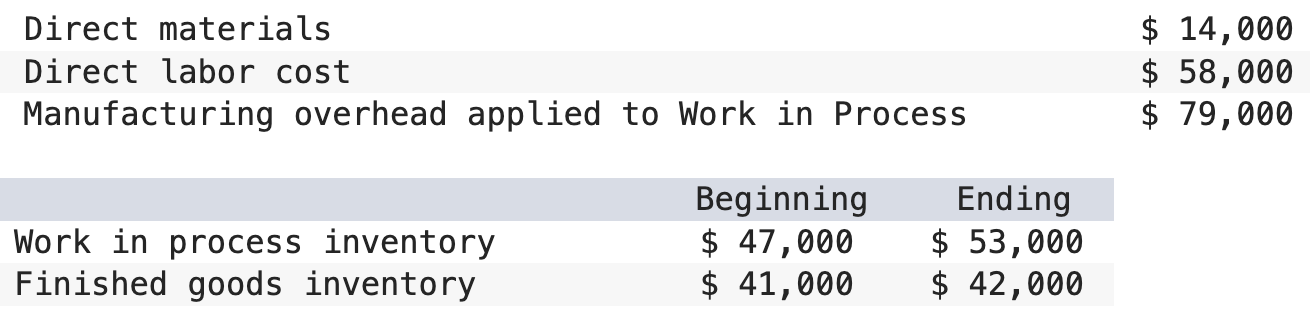

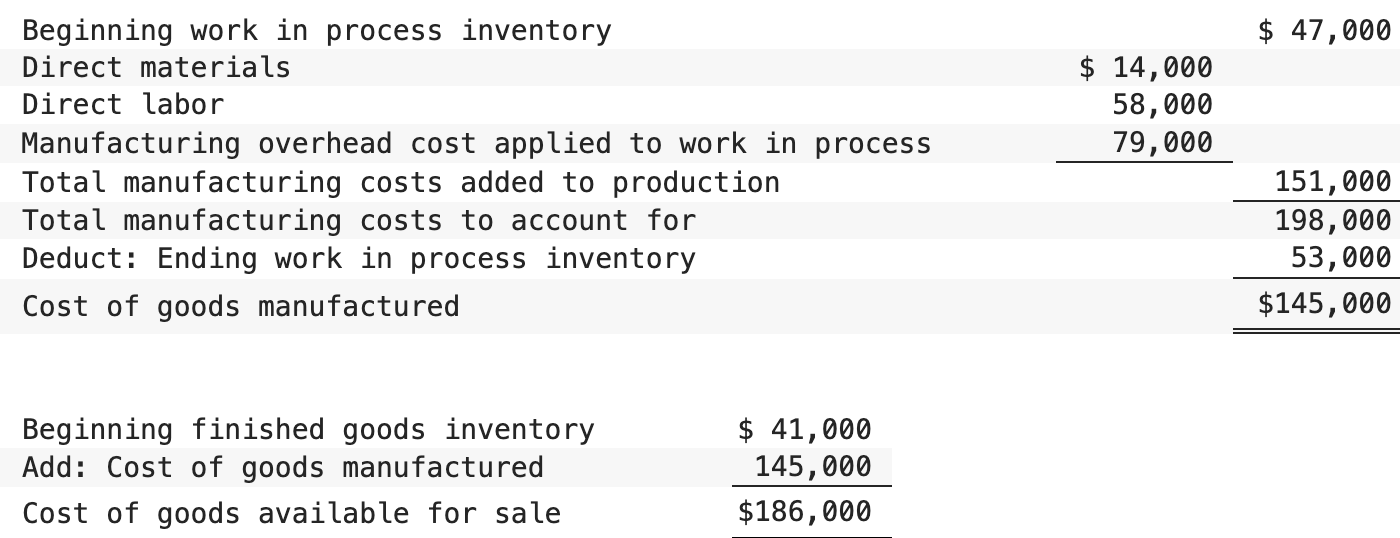

How much is the cost of goods available for sale on the Schedule of Cost of Goods Sold?

$186,000

$145,000

$144,000

$138,000

Answer: $186,000

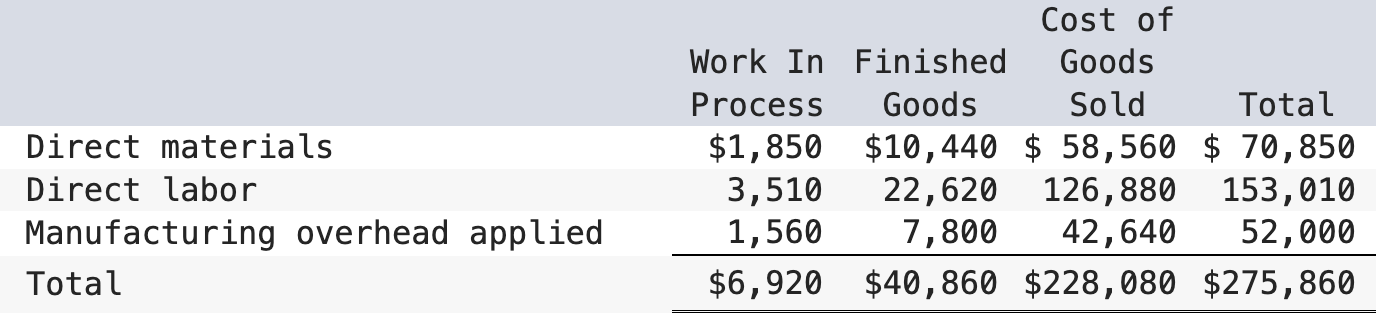

Reith Incorporated has provided the following data for the month of November. There were no beginning inventories; consequently, the direct materials, direct labor, and manufacturing overhead applied listed below are all for the current month.

Manufacturing overhead for the month was overapplied by $4,000.

The company allocates any underapplied or overapplied manufacturing overhead among work in process, finished goods, and cost of goods sold at the end of the month on the basis of the overhead applied during the month in those accounts.

The cost of goods sold for November after allocation of any underapplied or overapplied manufacturing overhead for the month is closest to:

$224,800

$231,360

$224,080

$232,080

Answer: $224,800

Allocating overapplied manufacturing overhead reduces the balances in the inventory and cost of goods sold accounts.

Cost of goods sold for November after allocation of overapplied manufacturing overhead = $228,080 − [($42,640/$52,000) × $4,000] = $228,080 − (82% × $4,000) = $224,800

Niebla Corporation has provided data concerning the Corporation's Manufacturing Overhead account for the month of July. Prior to the closing of the overapplied or underapplied balance to Cost of Goods Sold, the total of the debits to the Manufacturing Overhead account was $72,000 and the total of the credits to the account was $77,000. Which of the following statements is true?

Manufacturing overhead applied to Work in Process for the month was $72,000.

Actual manufacturing overhead for the month was $72,000.

Manufacturing overhead for the month was underapplied by $5,000.

Manufacturing overhead transferred from Finished Goods to Cost of Goods Sold during the month was $77,000.

Answer: Actual manufacturing overhead for the month was $72,000.

The debits to the Manufacturing Overhead account consist of the actual manufacturing overhead for the month.

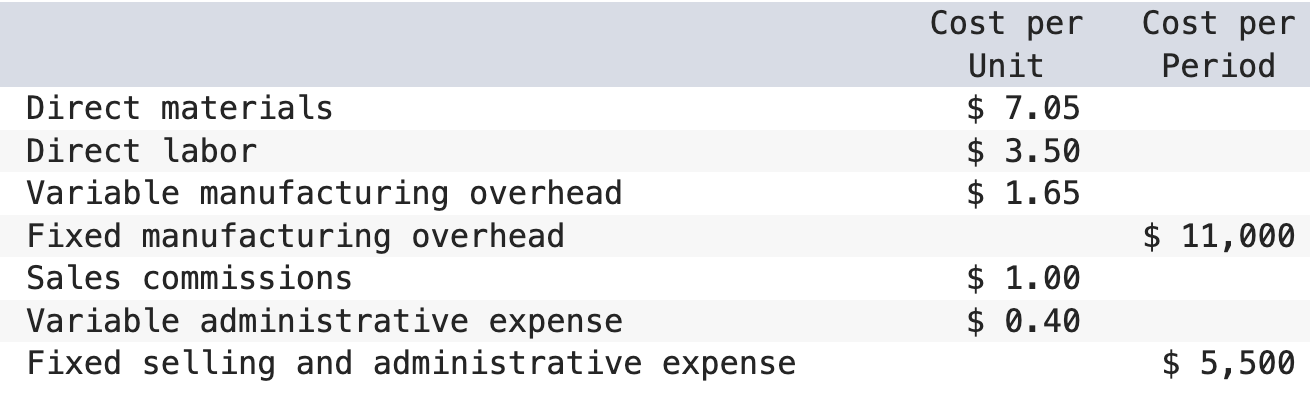

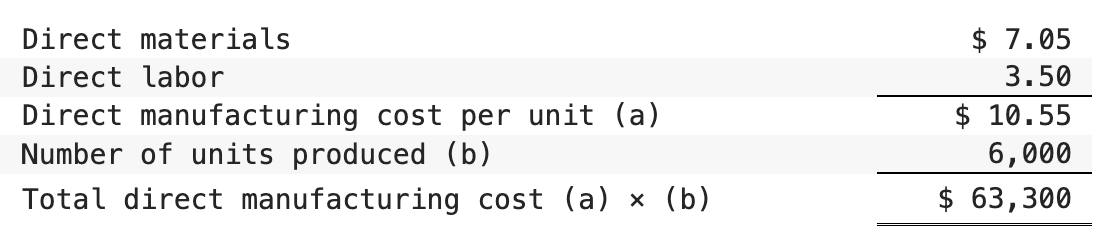

If 6,000 units are produced, the total amount of direct manufacturing cost incurred is closest to:

$73,200

$69,300

$86,400

$63,300

Answer: $63,300

Which of the following would most likely NOT be included as manufacturing overhead in a furniture factory?

The cost of the glue in a chair.

The amount paid to the individual who stains a chair.

The workman’s compensation insurance of the supervisor who oversees production.

The factory utilities of the department in which production takes place.

Answer: The amount paid to the individual who stains a chair.

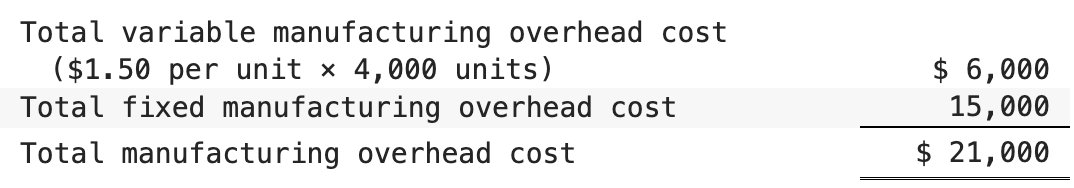

If 4,000 units are produced, the total amount of manufacturing overhead cost is closest to:

$21,000

$14,000

$28,000

$17,500

Answer: $21,000

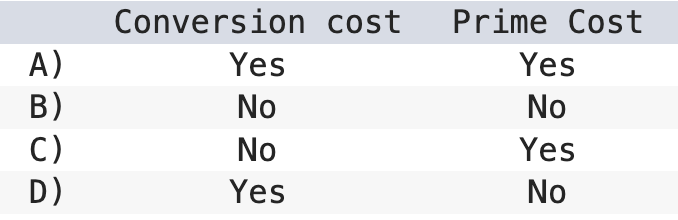

Direct labor cost is classified as:

Choice A

Choice B

Choice C

Choice D

Answer: Choice A

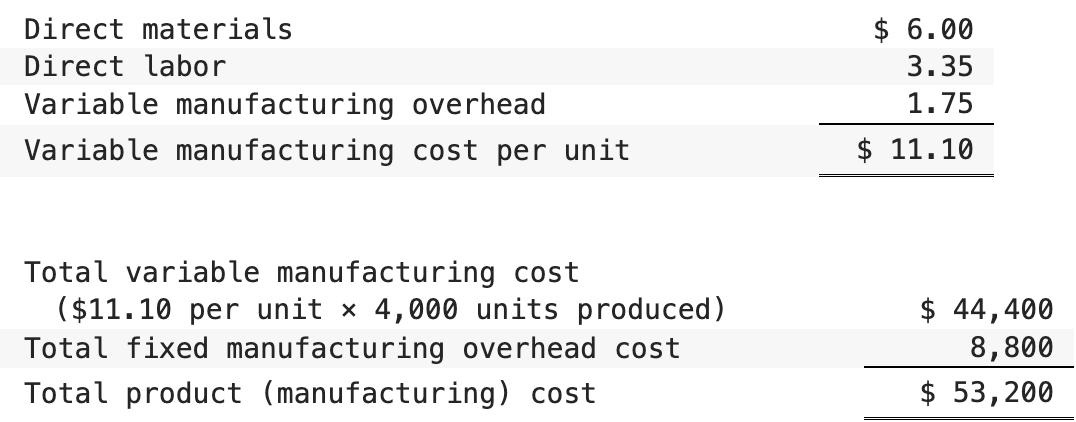

For financial reporting purposes, the total amount of product costs incurred to make 4,000 units is closest to:

$57,200

$8,800

$44,400

$53,200

Answer: $53,200

Factory overhead is typically a(n):

mixed cost.

fixed cost.

variable cost.

irrelevant cost.

Answer: Mixed Cost

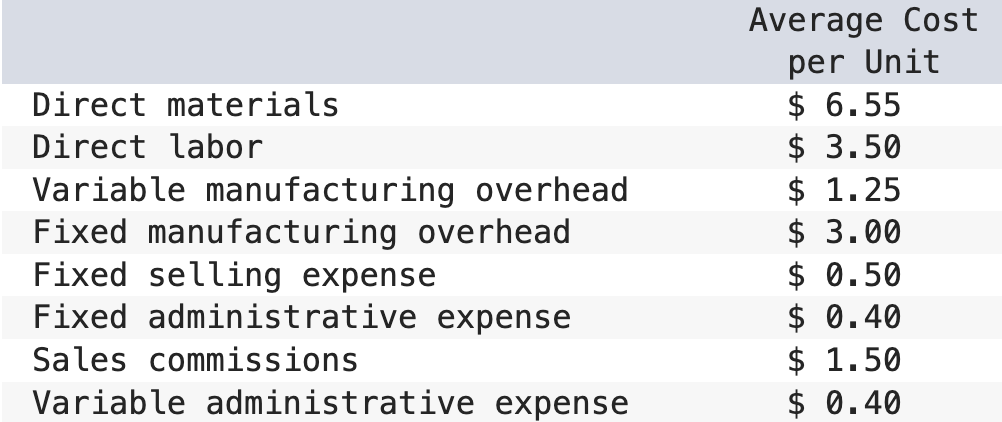

Mullennex Corporation's relevant range of activity is 2,000 units to 6,000 units. When it produces and sells 4,000 units, its average costs per unit are as follows:

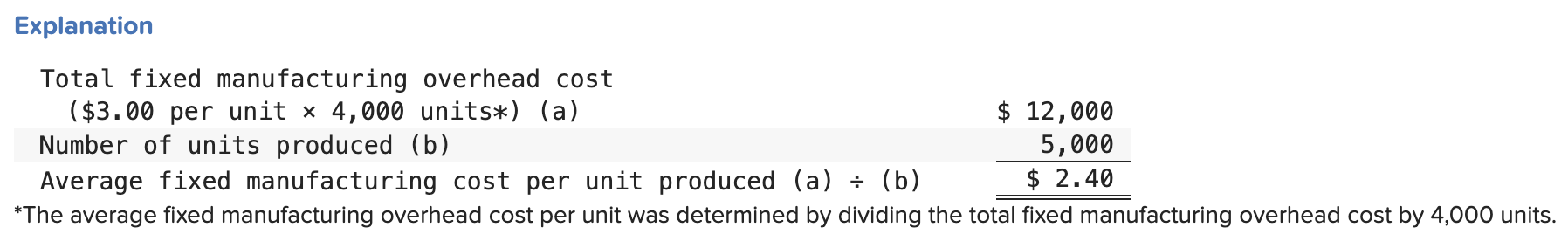

If 5,000 units are produced, the average fixed manufacturing cost per unit produced is closest to:

Answer: $2.40

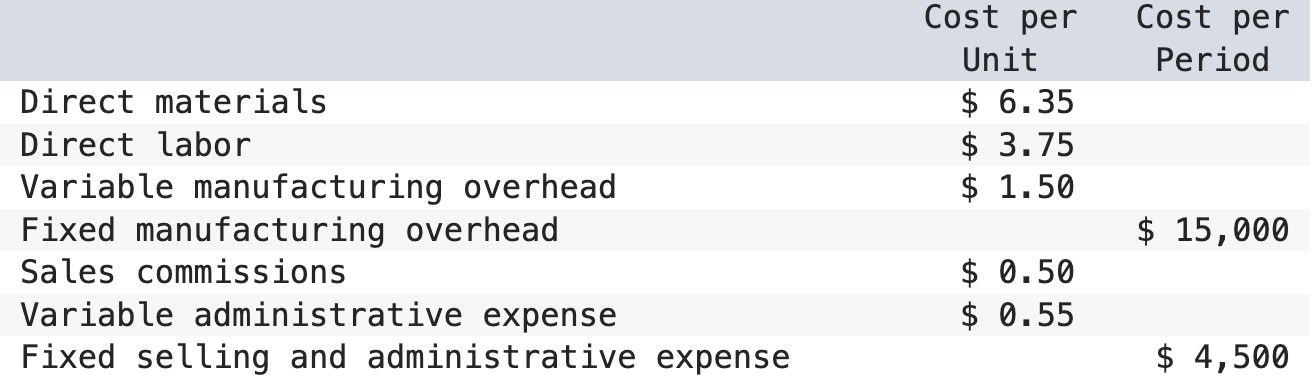

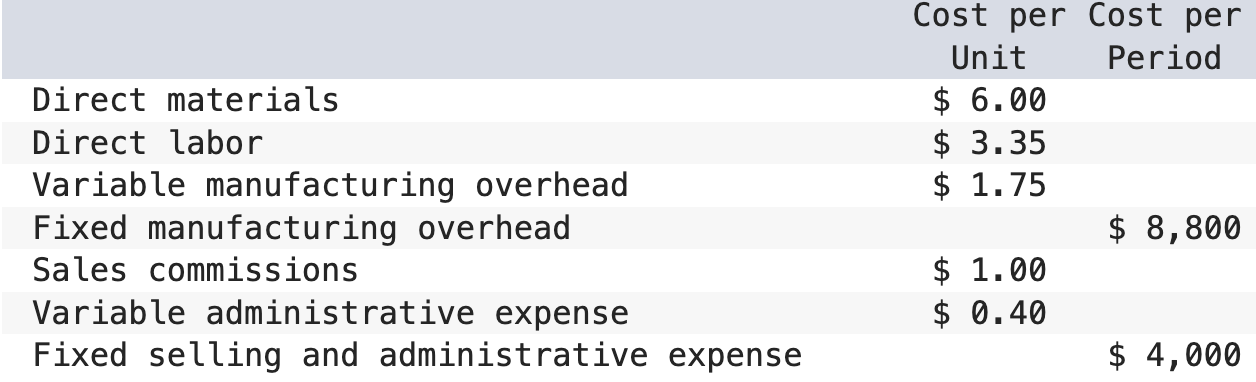

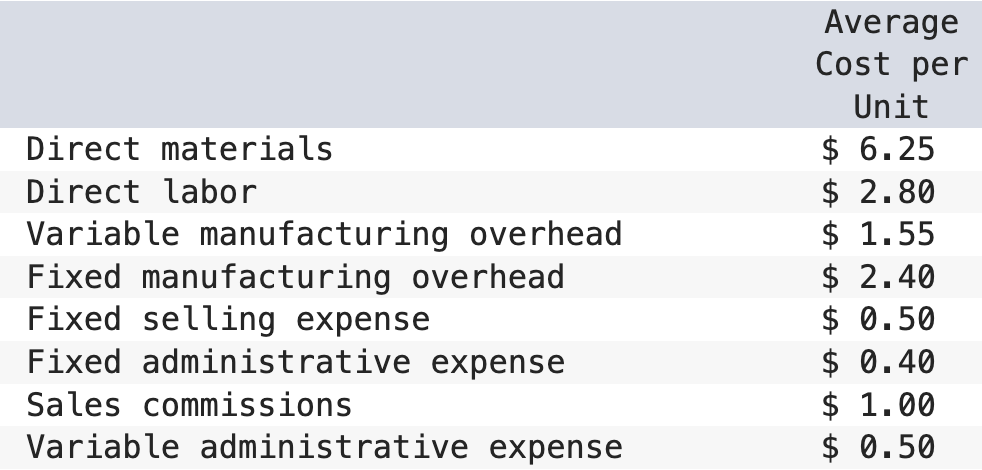

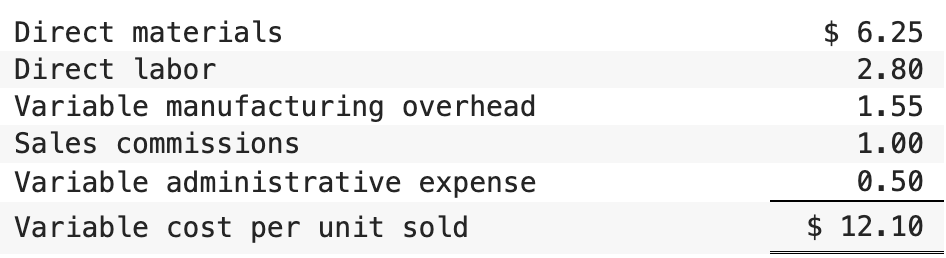

Adens Corporation's relevant range of activity is 2,000 units to 6,000 units. When it produces and sells 4,000 units, its average costs per unit are as follows:

If 5,000 units are sold, the variable cost per unit sold is closest to:

Answer: $12.10

Dominik Corporation purchased a machine 5 years ago for $527,000 when it launched product M08Y. Unfortunately, this machine has broken down and cannot be repaired. The machine could be replaced by a new model 310 machine costing $545,000 or by a new model 240 machine costing $450,000. Management has decided to buy the model 240 machine. It has less capacity than the model 310 machine, but its capacity is sufficient to continue making product M08Y. Management also considered, but rejected, the alternative of dropping product M08Y and not replacing the old machine. If that were done, the $450,000 invested in the new machine could instead have been invested in a project that would have returned a total of $532,000.

In making the decision to invest in the model 240 machine, the opportunity cost was:

$545,000

$450,000

$532,000

$527,000

Answer: $532,000

Opportunity cost = Return from alternative investment = $532,000

Contribution margin is:

Sales less cost of goods sold.

Sales less variable production, variable selling, and variable administrative expenses.

Sales less variable production expense.

Sales less all variable and fixed expenses.

Answer: Sales less variable production, variable selling, and variable administrative expenses.

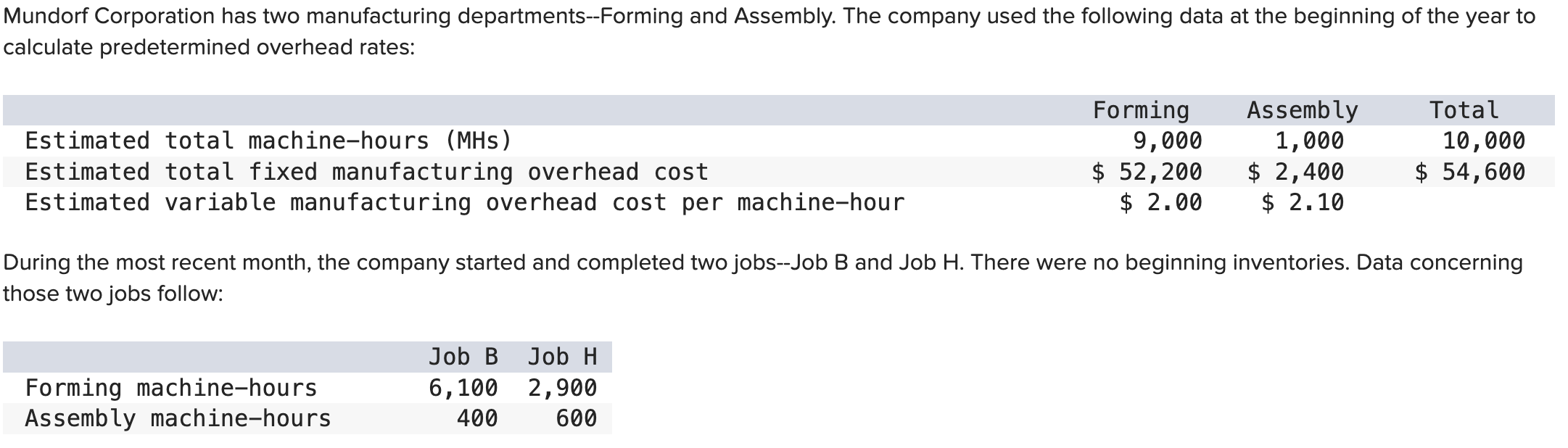

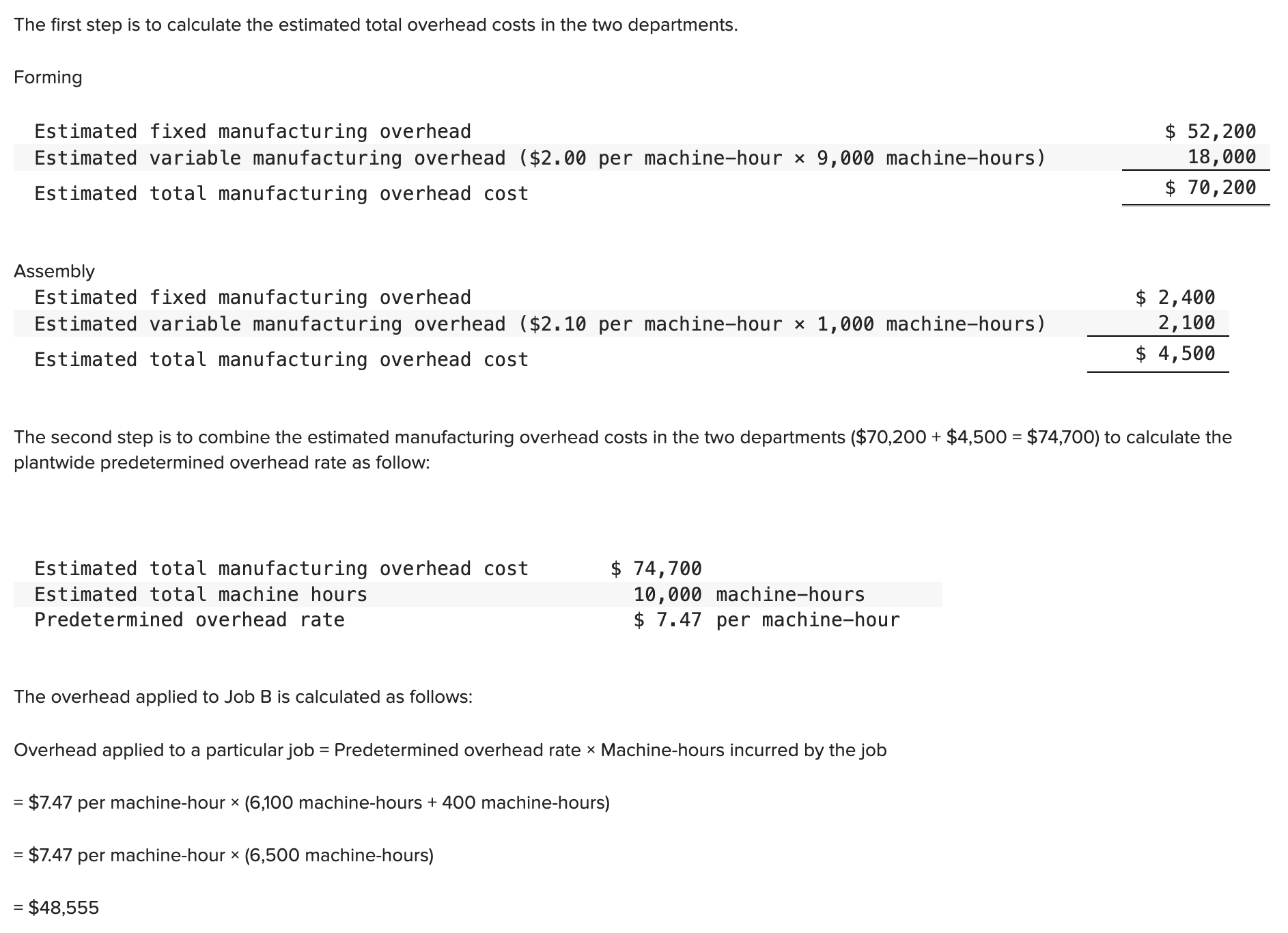

Assume that the company uses a plantwide predetermined manufacturing overhead rate based on machine-hours. The amount of manufacturing overhead applied to Job B is closest to:

$48,555

$35,490

$2,988

$45,567

Answer: $48,555

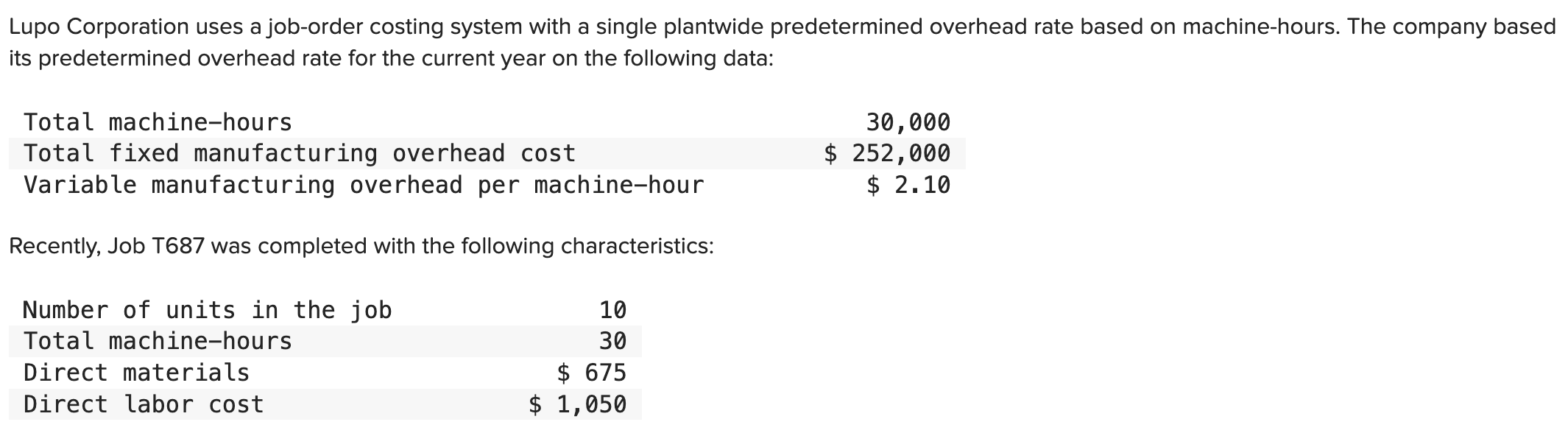

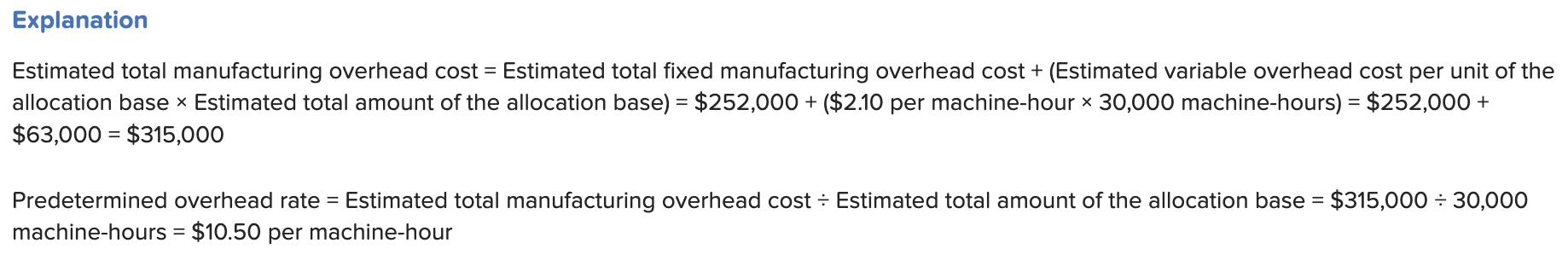

The predetermined overhead rate is closest to:

$12.60 per machine-hour

$10.50 per machine-hour

$8.40 per machine-hour

$2.10 per machine-hour

Answer: $10.50 per machine-hour

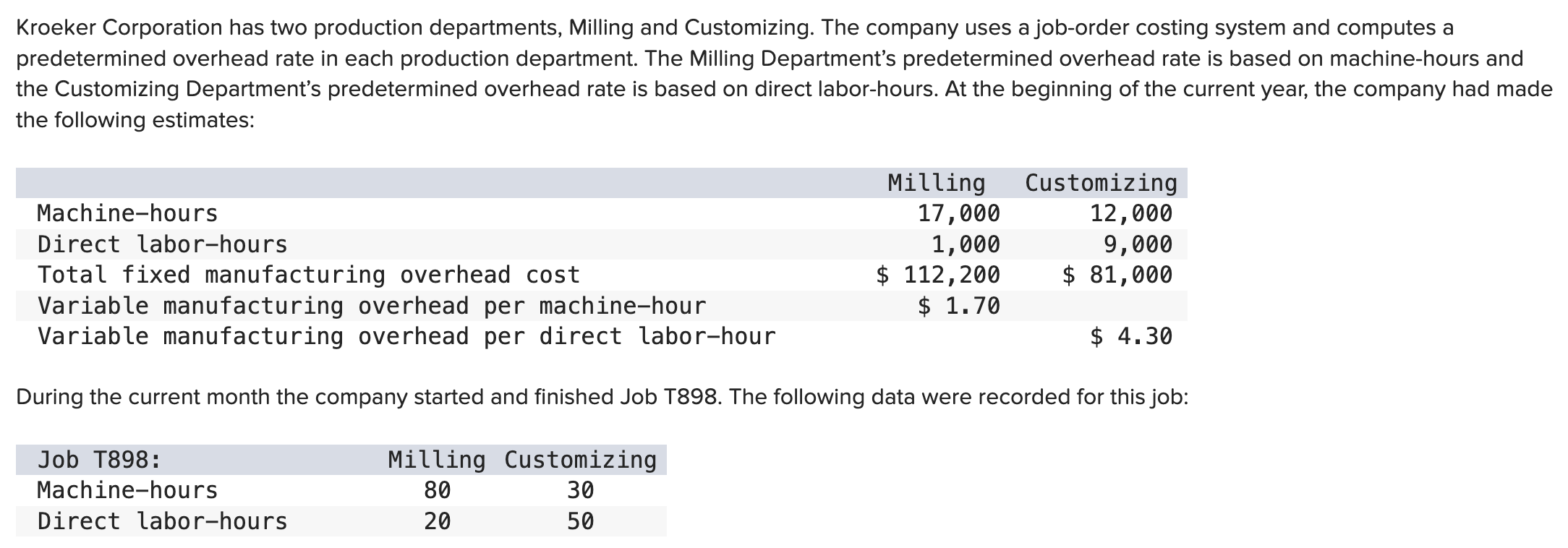

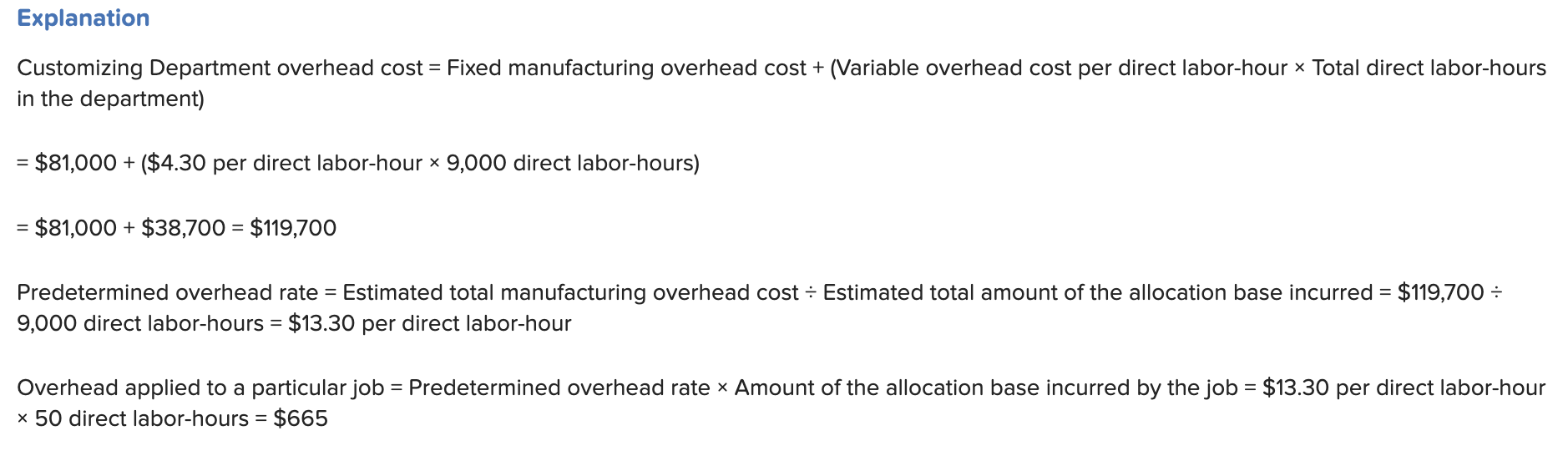

The amount of overhead applied in the Customizing Department to Job T898 is closest to: (Round your intermediate calculations to 2 decimal places.)

$450.00

$119,700.00

$665.00

$215.00

Answer: $665.000

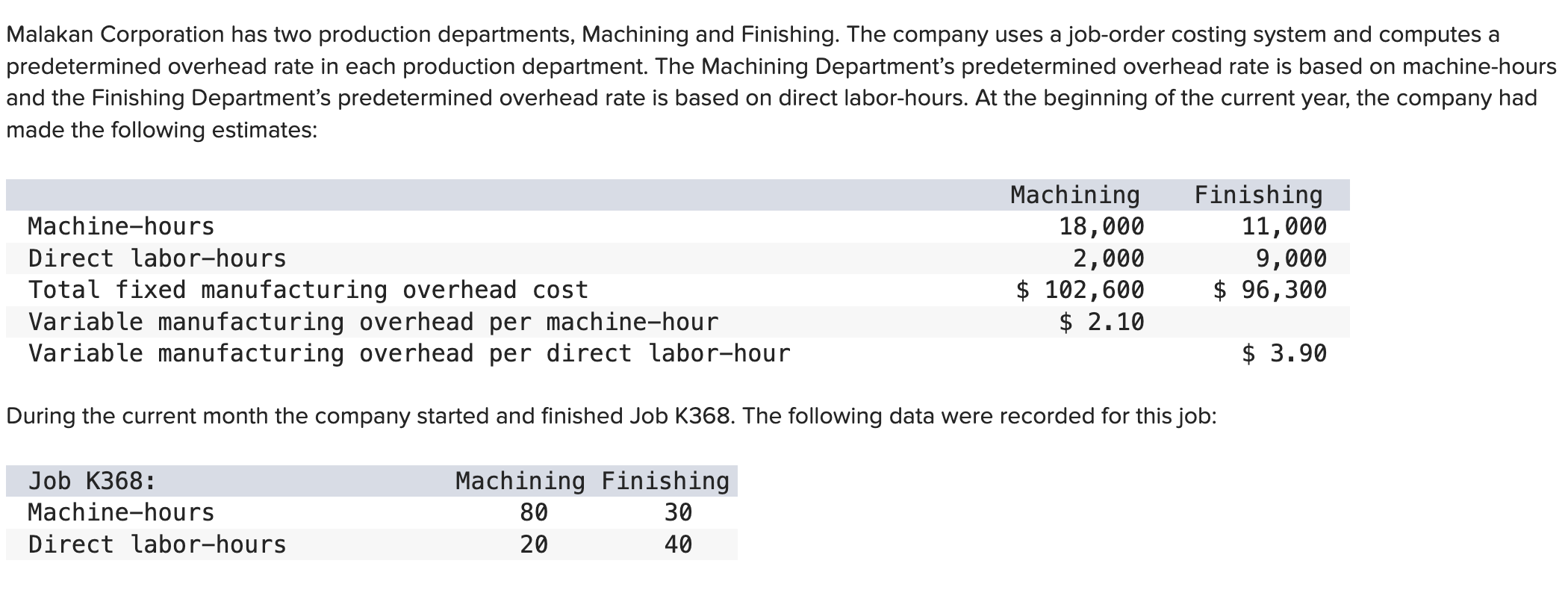

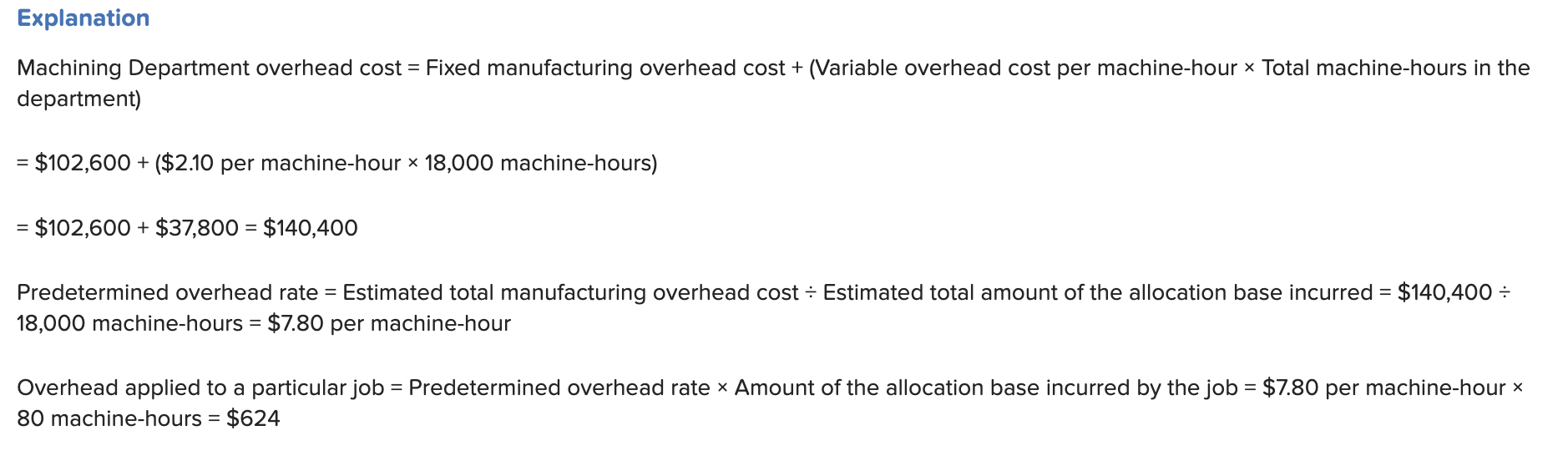

The amount of overhead applied in the Machining Department to Job K368 is closest to: (Round your intermediate calculations to 2 decimal places.)

$856.00

$168.00

$624.00

$140,400.00

Answer: $624.00

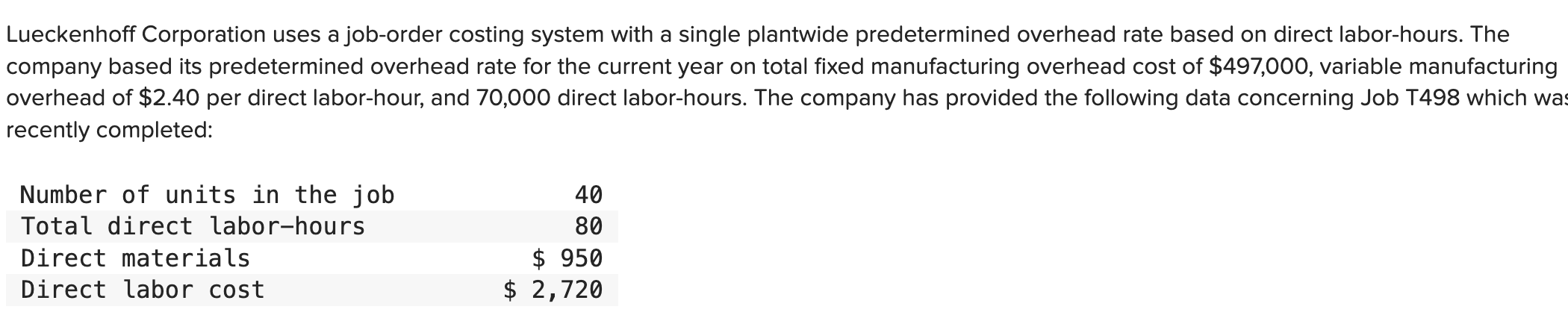

The unit product cost for Job T498 is closest to: (Round your intermediate calculations to 2 decimal places.)

$55.38

$42.75

$91.75

$110.75

Answer: $110.75

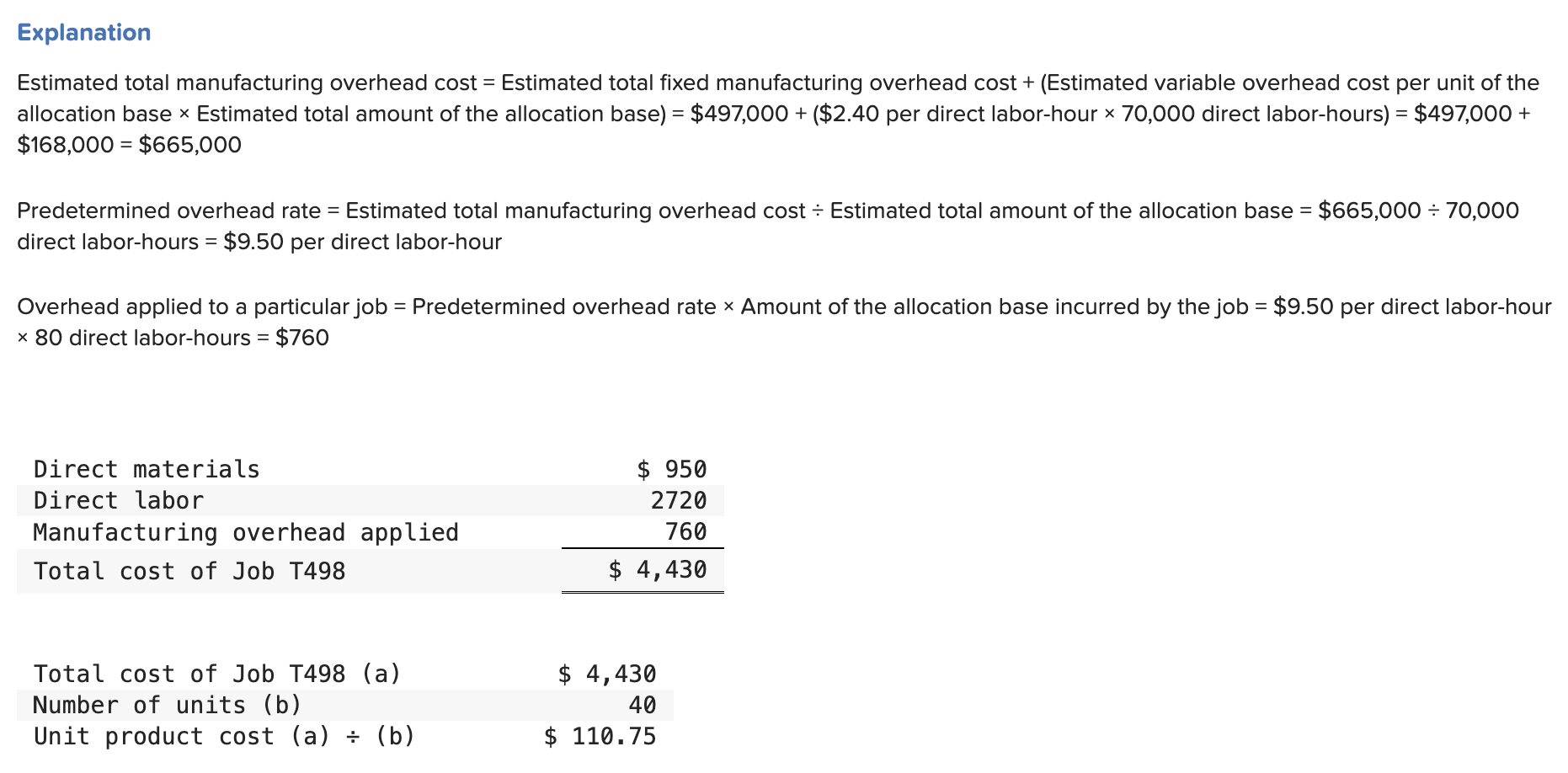

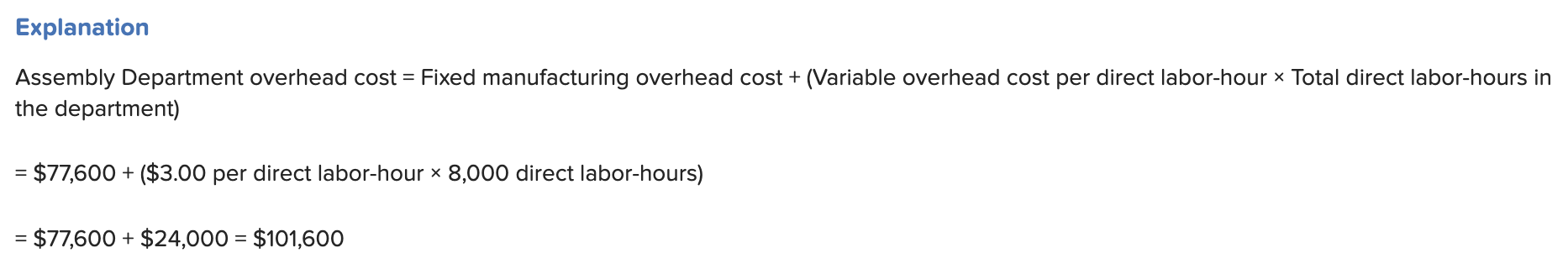

The estimated total manufacturing overhead for the Assembly Department is closest to:

$77,600

$101,600

$56,674

$24,000

Answer: $101,600

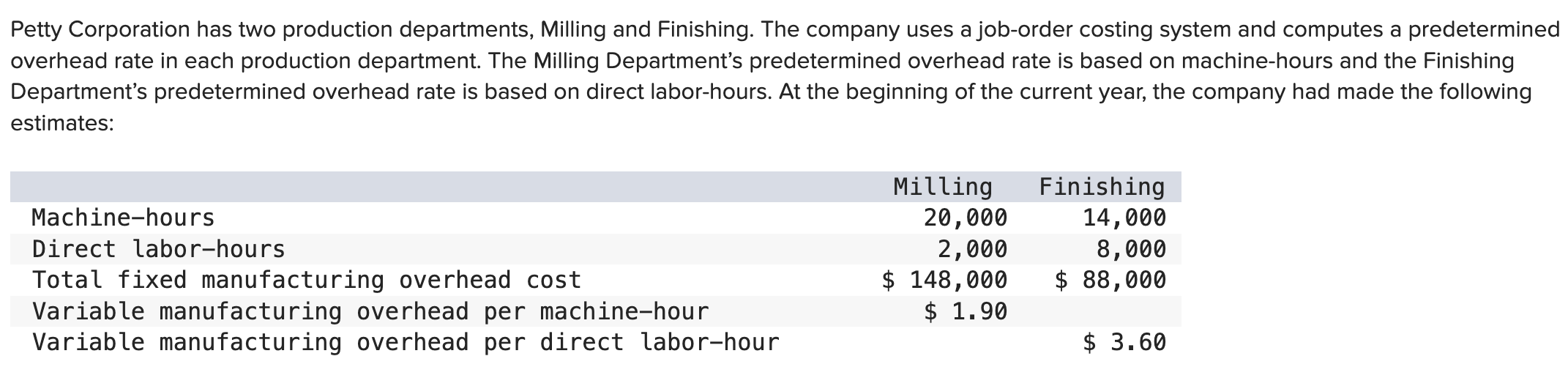

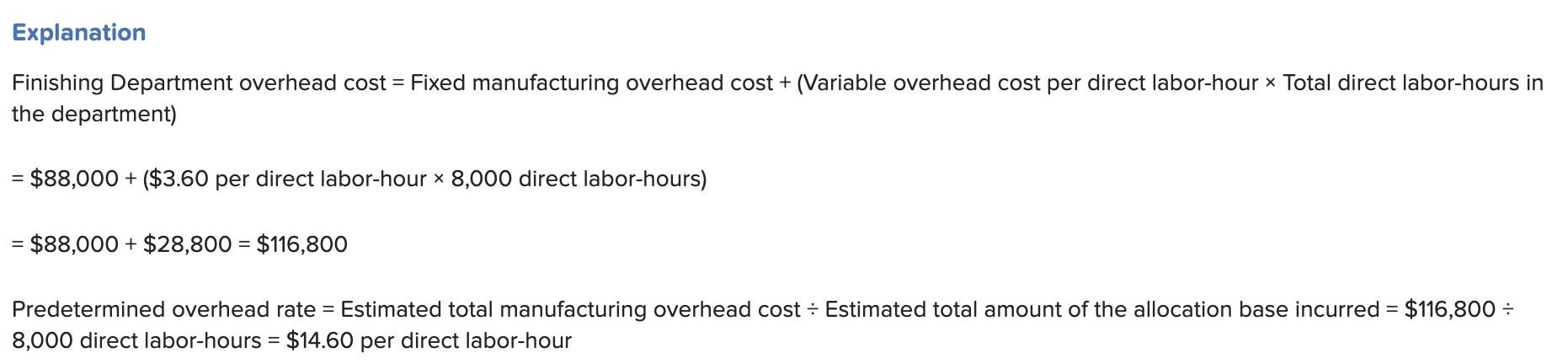

The predetermined overhead rate for the Finishing Department is closest to:

$5.84 per direct labor-hour

$3.60 per direct labor-hour

$11.00 per direct labor-hour

$14.60 per direct labor-hour

Answer: $14.60 per direct labor-hour

Which of the following would usually be found on a job cost sheet under a normal cost system?

Choice A

Choice B

Choice C

Choice D

Answer: Choice B

Which of the following statements is not correct concerning multiple overhead rate systems?

A multiple overhead rate system is more complex than a system based on a single plantwide overhead rate.

A multiple overhead rate system is usually more accurate than a system based on a single plantwide overhead rate.

A company may choose to create a separate overhead rate for each of its production departments.

In departments that are relatively labor-intensive, their overhead costs should be applied to jobs based on machine-hours rather than on direct labor-hours.

Answer: In departments that are relatively labor-intensive, their overhead costs should be applied to jobs based on machine-hours rather than on direct labor-hours.

Assigning manufacturing overhead to a specific job is complicated by all of the below except:

Manufacturing overhead is an indirect cost that is either impossible or difficult to trace to a particular job.

Manufacturing overhead is incurred only to support some jobs.

Manufacturing overhead consists of both variable and fixed costs.

The average cost of actual fixed manufacturing overhead expenses will vary depending on how many units are produced in a period.

Answer: Manufacturing overhead is incurred only to support some jobs.