Macro - Topic A

1/39

Earn XP

Description and Tags

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

40 Terms

Which market is IS

Goods market

Which market is LM

Money market

Consumption (C)

the goods and services purchased by consumer

Investment (I)

the purchase of capital goods. It is the sum of non-residential and residential investment.

Government spending (G)

the purchases of goods and services by the federal, state and local governments.

It does not include government transfers (benefits), nor interest payments on the government debt.

Imports (IM)

the purchases of foreign goods and services by consumers, business firms and the domestic government.

Exports (X)

the purchases of domestic goods and services by foreigners.

Output (Y)

GDP

How to measure Y

output, income and expenditure

Disposable income, (YD)

the income that remains once consumers have paid taxes and received transfers from the government

• YD = Y – T

Consumption function

C = C(YD)

OR

C = c0 + c1(YD)

c0

intercept of consumption function

c1

marginal propensity to consume

Savings = 1 – c1

What determines I / Investment function

Investments are endogenous

I = I(Y, i)

Are G & T exogenous

Yes

Fixed unless we choose to change it

Equilibrium condition in goods market

Y = C(Y – T) + I(T, i) + G

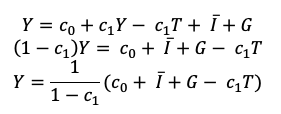

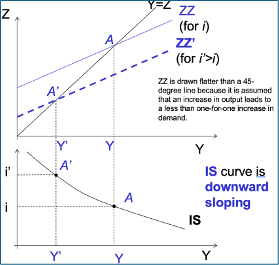

Multiplier formula

1/1-C1

Autonomous spending (intercept in K cross)

c0 + ̅I + G - c1*T

Demand Income graph

Income = production = demand at the 45 degree line

Equilibrium point where 2 lines intersect

Demand for goods = income = production

If nothing else changes, the economy stays at this point

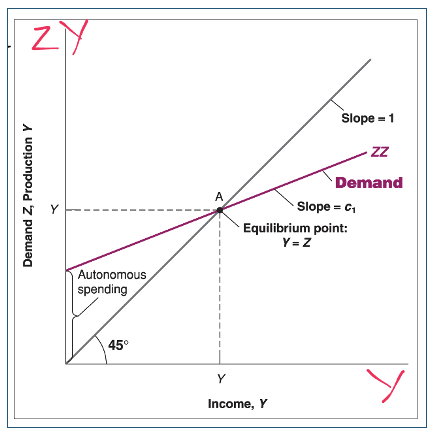

DY graph with fall in Consumer confidence

If there is a fall in consumer confidence (like 2008) the MPC (c1) will fall (slope gets shallower)

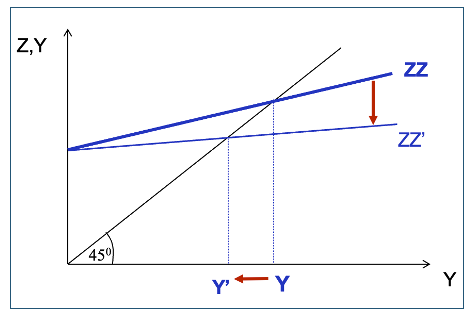

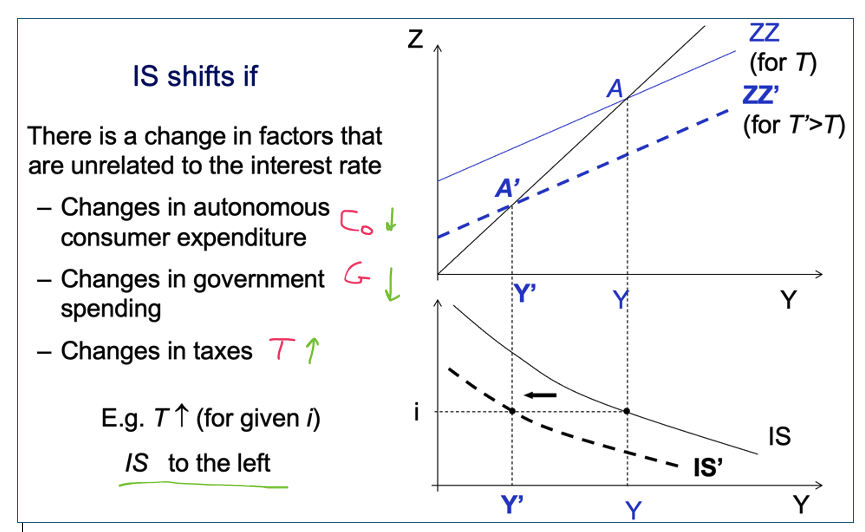

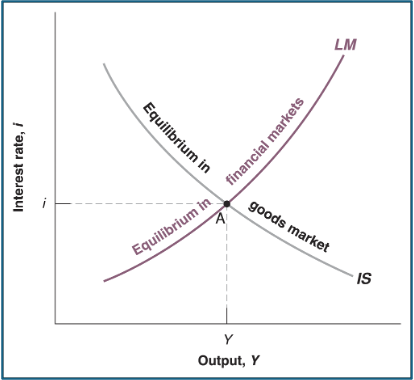

IS Curve

i and Y as axes

If i increases then I decreases

What causes IS to shift

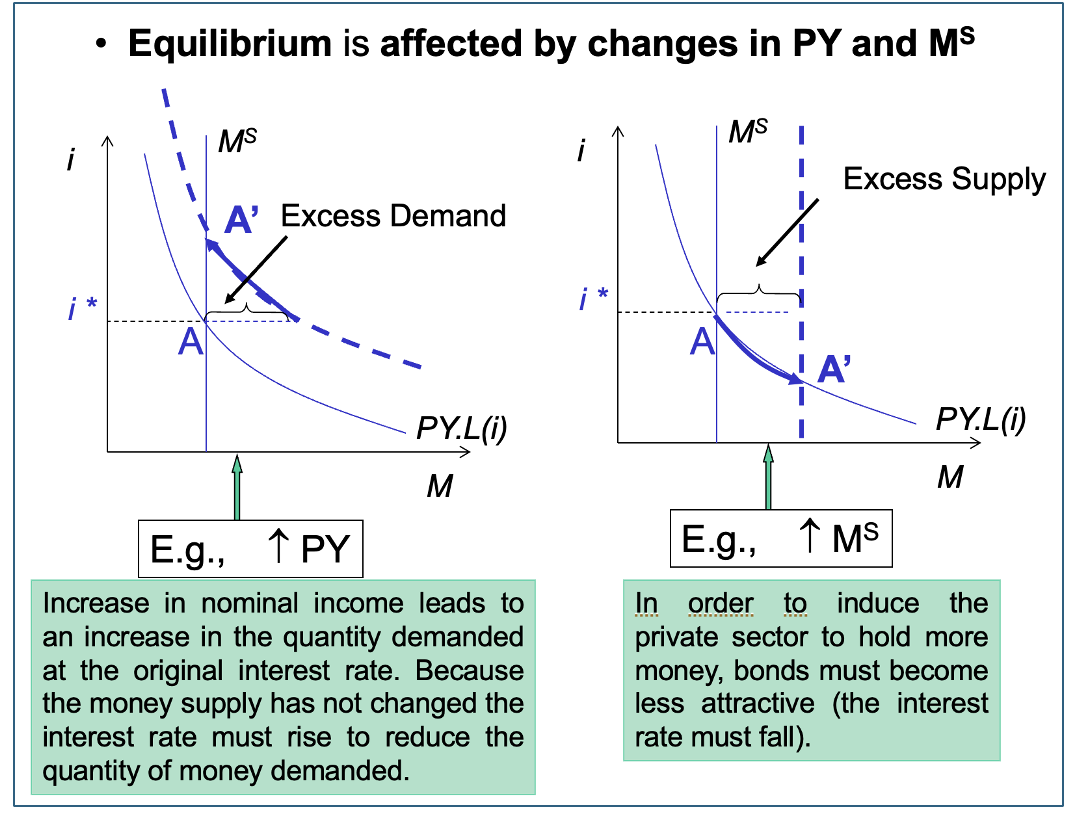

Demand for money

Financial wealth can be held either as cash or as bonds

Bonds pay interest but money can be used for transactions

M^D = L(PY, i)

Your level of transactions - PY

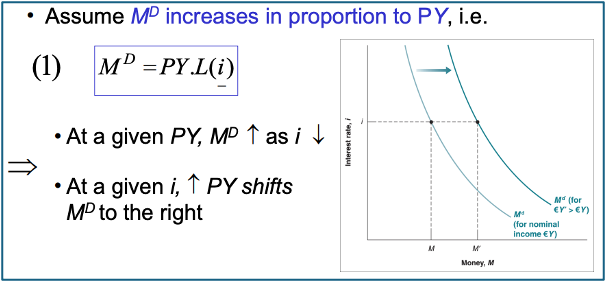

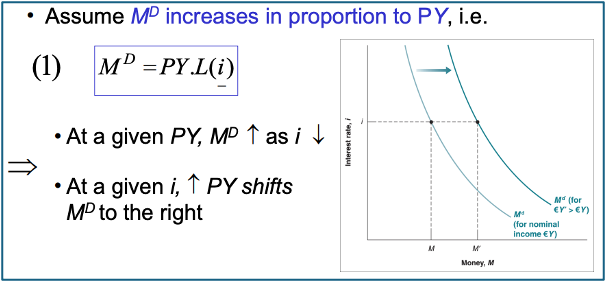

Demand for Money moving proportionally to PY

If we assume M^D increases proportionally to PY then M^D = PY * L(i)

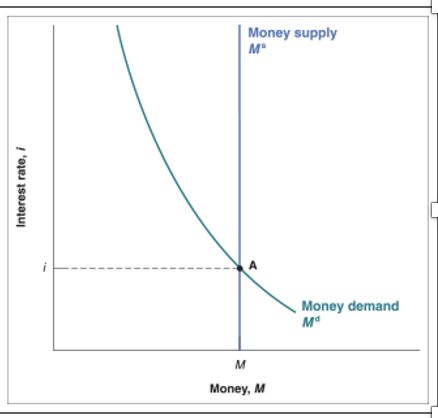

Money Supply

CB control Ss but not i using OMOS (buying and selling bonds)

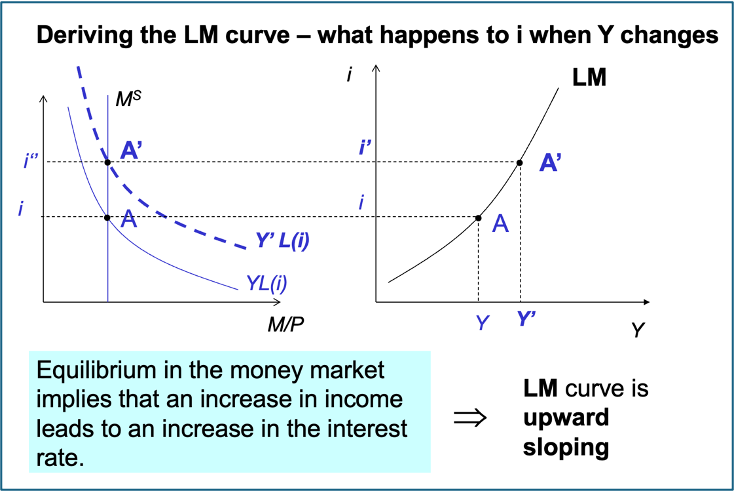

LM function

shows combinations of i & Y where the money market is in equilibrium

What affects Money market equilibrium

PY and MS changes

IS-LM model assumptions

that L supply is perfectly elastic – always spare people (unemployed) in the economy willing to work at whatever the wage rate provides

output supply function is perfectly horizontal - Price level fixed

IS-LM equilibrium

IS & LM must be satisfied simultaneously (IS = LM)

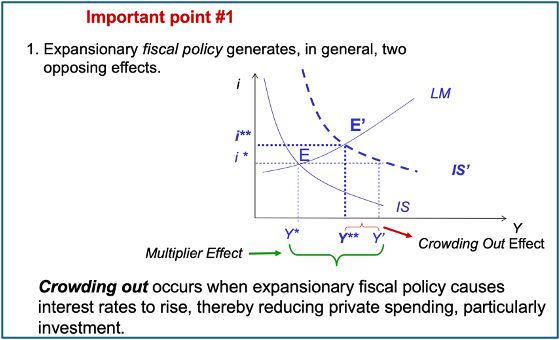

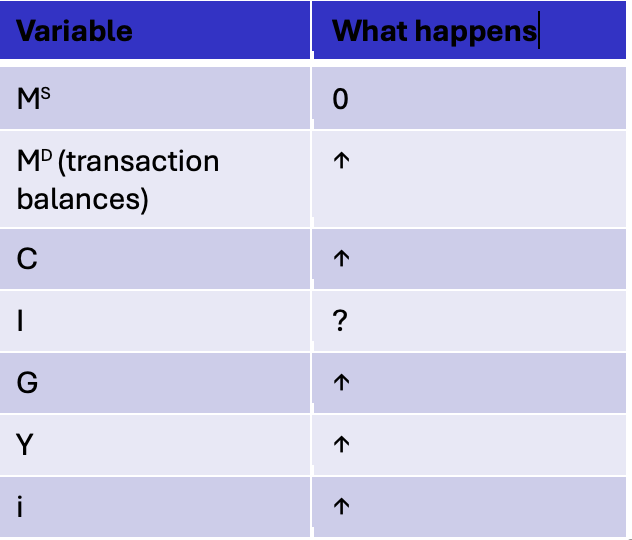

How an increase in G affects IS-LM

In the short run, the effect of fiscal policy on investment is ambiguous due to crowding out

G UP shifts IS out so Y & i increase (opposite reactions in I)

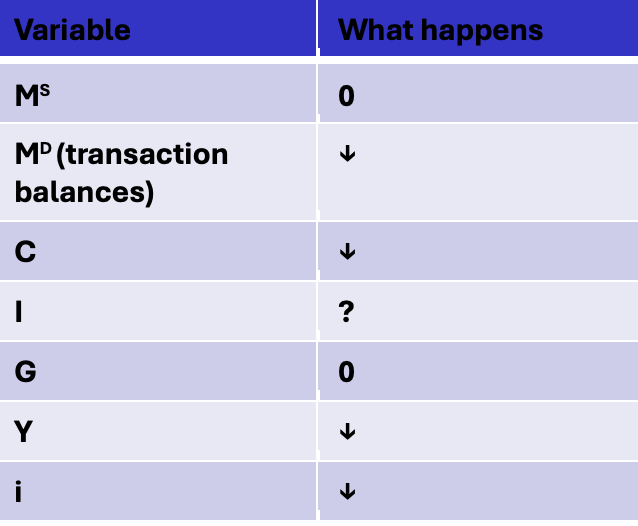

How loss of consumer confidence affects IS-lm

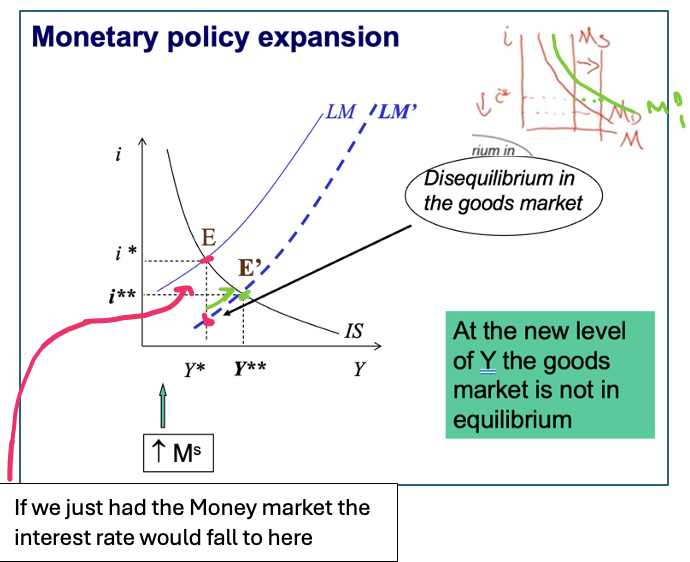

Expansionary MP

Ms increases - shifts out to the right

o This creates an excess supply of money - i falls

o I & C rise → (Y) rises

The excess supply of money is eliminated as i rises until IS = LM

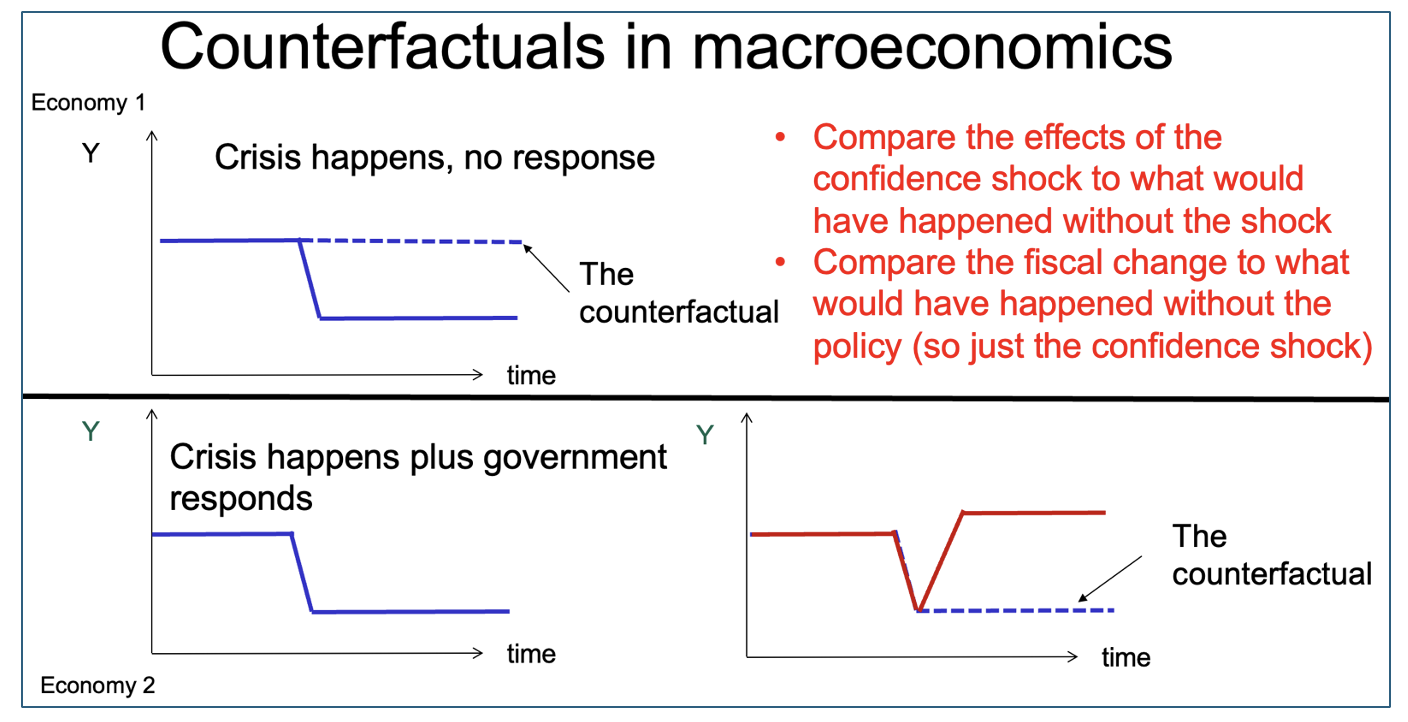

Counterfactuals

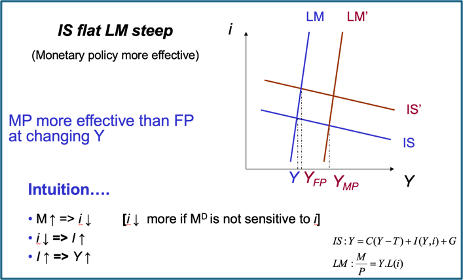

When is MP more effective

Investment really sensitive to changes in i

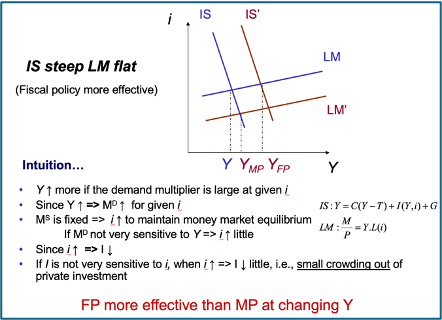

When is FP more effective

Keynsian vs Monetarist

Keynesian view

- MD is unstable and highly elastic

- Investments are not very sensitive to interest rates

Monetary policy not very effective

Fiscal policy very effective

Monetarist view

- MD stable and dependent on P and Y => highly rigid

- Investments are sensitive to interest rates

Monetary policy is very effective

Fiscal policy not very effective

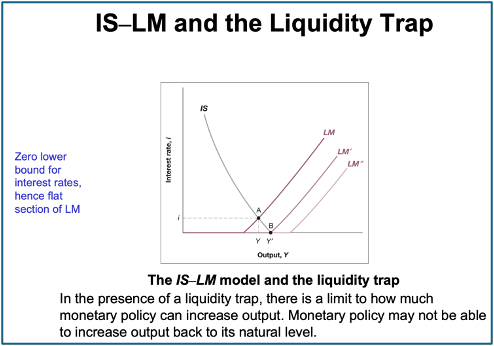

Liquidity trap

• The elasticity of money demand w.r.t. the interest rate is infinite – MP doesn’t have much more room to go

o Given i, any change in MS is absorbed by demand

LM flat

Investment trap

• The elasticity of investment w.r.t. the interest rate is zero

o Investments are unaffected by changes in i

o IS vertical

Limitations of IS-LM model

• Effects of policy depend on slopes of IS & LM

• Assume fixed prices

• Consumption depends ONLY on Current disposable income

• Closed economy assumed