AP Macro Unit 4

5.0(2)

5.0(2)

Card Sorting

1/69

Earn XP

Description and Tags

Study Analytics

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No study sessions yet.

70 Terms

1

New cards

Financial Sector

→ network of institutions that link borrowers and lenders

→ includes banks, mutual funds, pension funds, and other financial intermediaries

→ includes banks, mutual funds, pension funds, and other financial intermediaries

2

New cards

Assets

anything tangible or intangible that has value

3

New cards

Interest Rate

the amount a lender charges borrowers for borrowing money--the "price" of a loan

4

New cards

Interest-bearing Assets

assets that earn interest over time

5

New cards

Market Risk

when you lose money from fluctuations in market prices

6

New cards

Default Risk

when companies/individuals are unable to fulfill their payment/debt obligations

7

New cards

Inflation Risk

when the value shrinks from inflation

8

New cards

Liquidity

the ease with which an asset can be converted to a medium of exchange (in general, the higher the liquidity = the lower the rate of return)

→ cash and demand deposits are the two most liquid forms of money

→ cash and demand deposits are the two most liquid forms of money

9

New cards

Demand deposit

deposits by customers that can be withdrawn at anytime (EX. checking accounts)

10

New cards

Risks of Buying Assets

( 1 ) Market Risk

( 2 ) Default Risk

( 3 ) Inflation Risk

( 2 ) Default Risk

( 3 ) Inflation Risk

11

New cards

Bonds

(securities) loans or IOUs that represent debt that the government, businesses, or individuals must repay to the lender

12

New cards

Stocks

(equities) represent ownership of a corporation and the stockholder is often entitled to a portion of the profit paid out as dividends

13

New cards

Bond Prices and Interest Rates

→ a bond is issued at a specific interest rate that doesn't change throughout the life of the bond

→ bond price and interest rates are inversely related

→ bond price and interest rates are inversely related

14

New cards

Real Interest Rates

the percentage increase in purchasing power that a borrower pays (adjusted for inflation)

Real = nominal interest rate -- expected inflation

Real = nominal interest rate -- expected inflation

15

New cards

Nominal Interest Rate

the percentage increase in money that the borrower pays (not adjusted for inflation)

Nominal = real interest rate + expected inflation

Nominal = real interest rate + expected inflation

16

New cards

The Time Value of Money

you can determine the future value of any amount of money ($X) if you know the interest rate (ir) and the number of years (N)

Equation to calculate future value:

$X in N Years = $X(1 + ir)^N

(ir is expressed as a decimal)

Equation to calculate future value:

$X in N Years = $X(1 + ir)^N

(ir is expressed as a decimal)

17

New cards

Present Value of Money

the current worth of some future amount of money

Equation to calculate present value:

($X) / (1 + ir)^N

Equation to calculate present value:

($X) / (1 + ir)^N

18

New cards

The Barter System

goods and services are traded directly; there is no money exchanged

Problems with the Barter System

( 1 ) before trade could occur, each trader had to have something the other wanted--this is called the "Double Coincidence of Wants"

( 2 ) some goods cannot be split

Problems with the Barter System

( 1 ) before trade could occur, each trader had to have something the other wanted--this is called the "Double Coincidence of Wants"

( 2 ) some goods cannot be split

19

New cards

Money

anything that is generally accepted as payment for goods and services

→ NOT the same as wealth or income (wealth is the total collection of assets, income is a flow of earnings per unit of time)

→ NOT the same as wealth or income (wealth is the total collection of assets, income is a flow of earnings per unit of time)

20

New cards

Commodity Money

something that performs the function of money and has intrinsic value

EX.) gold, silver, cigarettes, etc.

EX.) gold, silver, cigarettes, etc.

21

New cards

Fiat Money

something that serves as money but has no other value or uses

EX.) paper money, coins, digital currency

EX.) paper money, coins, digital currency

22

New cards

3 Functions of Money

( 1 ) A Medium of Exchange

( 2 ) A Unit of Account (Measure of Value)

( 3 ) A Store of Value

( 2 ) A Unit of Account (Measure of Value)

( 3 ) A Store of Value

23

New cards

A Medium of Exchange

money can easily be used to buy goods and services with no complications of barter system

24

New cards

A Unit of Account (Measure of Value)

money measures the value of all goods and services: money acts as a measurement of value

25

New cards

A Store of Value

money allows you to store purchasing power for the future

26

New cards

What backs the money supply?

there is no gold standard, money's value comes from our collective belief that it is valuable

27

New cards

What makes money effective?

( 1 ) Generally Accepted → buyers and sellers have confidence it is legal tender

( 2 ) Scarce → money must not be easily transported and divided

( 3 ) Portable and Dividable → money must be easily transported and divided

( 2 ) Scarce → money must not be easily transported and divided

( 3 ) Portable and Dividable → money must be easily transported and divided

28

New cards

Purchasing Power

the purchasing power of money is the amount of goods and services a unit of money can buy

→ inflation decreases purchasing power, hyperinflation decreases acceptability

→ inflation decreases purchasing power, hyperinflation decreases acceptability

29

New cards

M1 (Highest Liquidity)

( 1 ) Currency in circulation

( 2 ) Checkable bank deposit (checking accounts)

( 3 ) Savings Accounts

( 2 ) Checkable bank deposit (checking accounts)

( 3 ) Savings Accounts

30

New cards

M2 (Near-Moneys)

( 1 ) Everything in M1

( 2 ) Time deposits (CDS = certificate of deposits)

( 3 ) Money market funds

( 2 ) Time deposits (CDS = certificate of deposits)

( 3 ) Money market funds

31

New cards

Fractional Reserve Banking

when banks hold a portion of deposits to cover potential withdrawals and then loans the rest of the money out

32

New cards

The Money Multiplier

1 / Reserve Requirement

33

New cards

Bank Balance Sheets

a record of a bank's assets, liabilities, and net worth

(demand deposits in a bank are liability for the bank, asset to the depositor)

(demand deposits in a bank are liability for the bank, asset to the depositor)

34

New cards

Required Reserves

the percent that banks must hold by law

35

New cards

Excess Reserves

the amount that the bank can loan out

36

New cards

The Demand for Money

( 1 ) Transaction Demand for Money → people hold money for everyday transactions

( 2 ) Asset Demand for Money → people hold money since it is less risky than other assets

( 2 ) Asset Demand for Money → people hold money since it is less risky than other assets

37

New cards

What is the opportunity cost of holding money in your pocket or checking account?

the interest rate you could be earning from other financial assets like stocks, bonds, and real estate

38

New cards

Interest Rate and the Quantity of Money Demanded

there is an inverse relationship

→ when interest rates increase, quantity demanded falls because individuals would prefer to have interest-earning assets instead

→ when interest rates decrease, quantity demanded increases, there is no incentive to convert cash into interest earning assets

→ when interest rates increase, quantity demanded falls because individuals would prefer to have interest-earning assets instead

→ when interest rates decrease, quantity demanded increases, there is no incentive to convert cash into interest earning assets

39

New cards

Money Demand Shifters

( 1 ) Change in price level

( 2 ) Change in income

( 3 ) Change in technology

( 2 ) Change in income

( 3 ) Change in technology

40

New cards

Money Supply

the U.S. Money Supply is set by the central bank and is independent from the interest rate

41

New cards

The Federal Reserve

the Fed is a nonpartisan government office that adjusts the money supply to influence the economy → this is called Monetary Policy

42

New cards

Increasing the Money Supply

if the money supply increases, a temporary surplus of money will occur; the surplus will cause the interest rate to fall

increase money supply → decrease interest rate → increase investment → increase AD

increase money supply → decrease interest rate → increase investment → increase AD

43

New cards

Decreasing the Money Supply

if the money supply decreases, a temporary shortage of money will occur; the shortage will cause the interest rate to rise

decrease money supply → increase interest rate → decrease investment → decrease AD

decrease money supply → increase interest rate → decrease investment → decrease AD

44

New cards

Money Supply Shifters

the Fed adjusts MS by changing:

( 1 ) The Reserve Requirement (ratios)

( 2 ) The Discount Rate

( 3 ) Open Market Operations

( 1 ) The Reserve Requirement (ratios)

( 2 ) The Discount Rate

( 3 ) Open Market Operations

45

New cards

Discount Rate

the interest rate that the Fed charges commercial banks

46

New cards

Open Market Operations

when the Fed buys or sells government bonds (securities)

→ this is the most important + widely used monetary policy

→ this is the most important + widely used monetary policy

47

New cards

Federal Funds Rate

the interest rate that banks charge on another for one-day loans of reserves

48

New cards

Actions the Fed could take to decrease the MS

increase discount rate, increase reserve ratios, sell bonds

49

New cards

Actions the Fed could take to increase the MS

decrease discount rate, decrease reserve ratios, buy bonds

50

New cards

Modern Changes to Banking

( 1 ) Interest on Reserves (IOR)

→ the interest rate that the Federal Reserve pays commercial banks to hold reserves

→ IOR and the discount rate are examples of administered rates

( 2 ) Administered Rates

→ interest rates set by the Fed rather than determined in a market

→ reserves at the Fed have no risk, therefore, banks have no incentive to lend money at an interest rate that is lower than what they can get from the Fed

→ the interest rate that the Federal Reserve pays commercial banks to hold reserves

→ IOR and the discount rate are examples of administered rates

( 2 ) Administered Rates

→ interest rates set by the Fed rather than determined in a market

→ reserves at the Fed have no risk, therefore, banks have no incentive to lend money at an interest rate that is lower than what they can get from the Fed

51

New cards

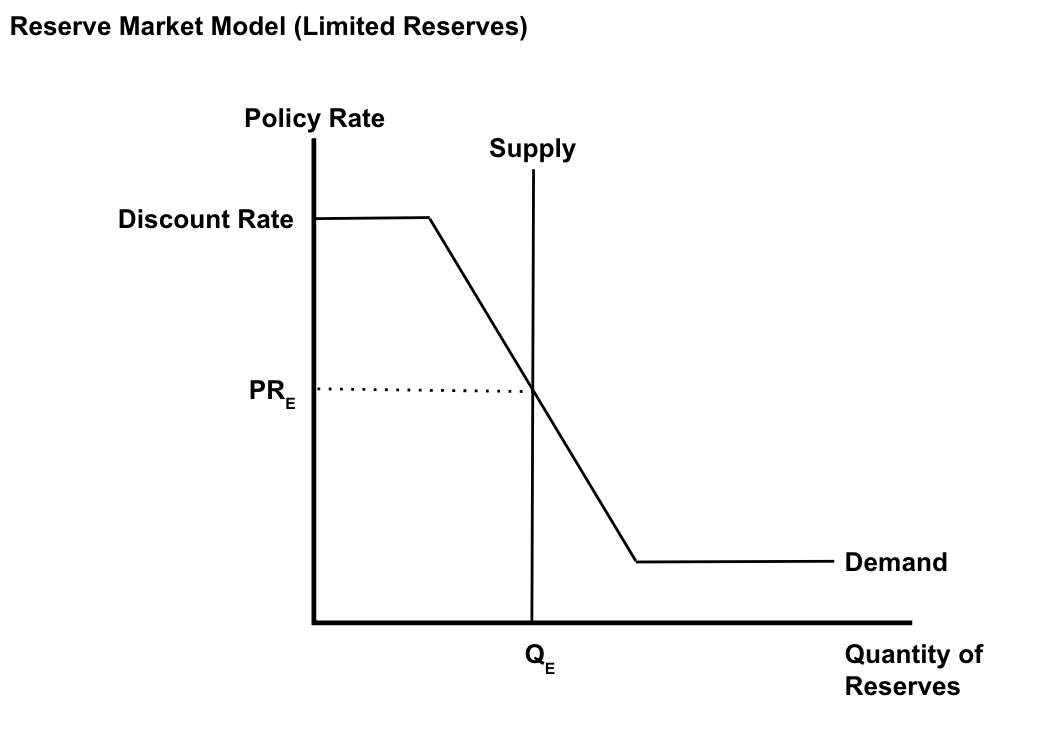

Limited Reserves

when there are limited reserves:

→ banks deposit fewer reserves with the central bank

→ small changes in the money supply can affect interest rates

→ the central bank conducts monetary policy by changing the reserve requirement or the discount rate or by using open market operations

→ banks deposit fewer reserves with the central bank

→ small changes in the money supply can affect interest rates

→ the central bank conducts monetary policy by changing the reserve requirement or the discount rate or by using open market operations

52

New cards

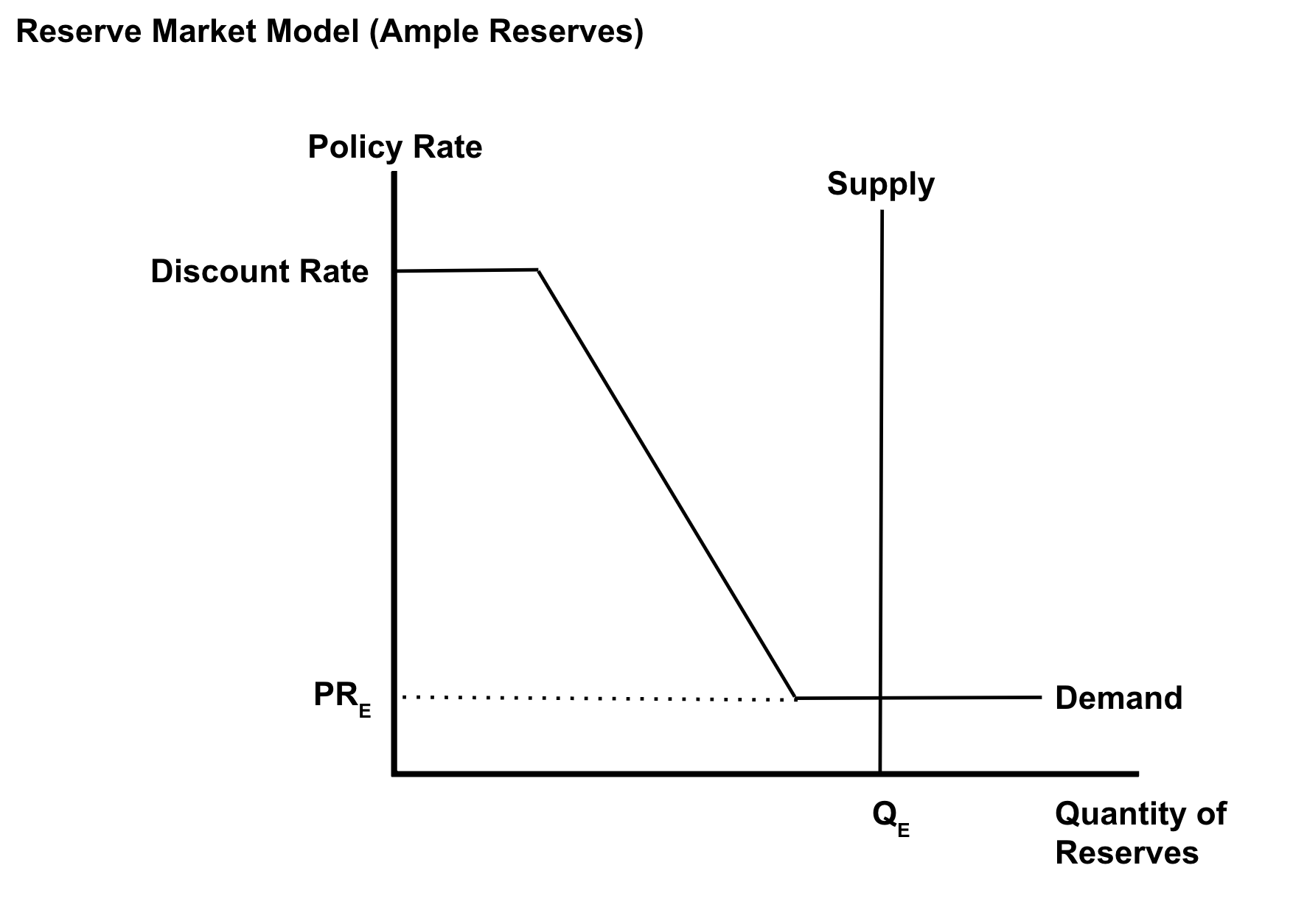

Ample Reserves

when there are ample reserves:

→ banks deposit a lot of reserves with the central bank

→ changing the money supply has little to no effect on interest rates

→ the central bank conducts monetary policy by changing its administered rates (IOR or discount rate)

→ banks deposit a lot of reserves with the central bank

→ changing the money supply has little to no effect on interest rates

→ the central bank conducts monetary policy by changing its administered rates (IOR or discount rate)

53

New cards

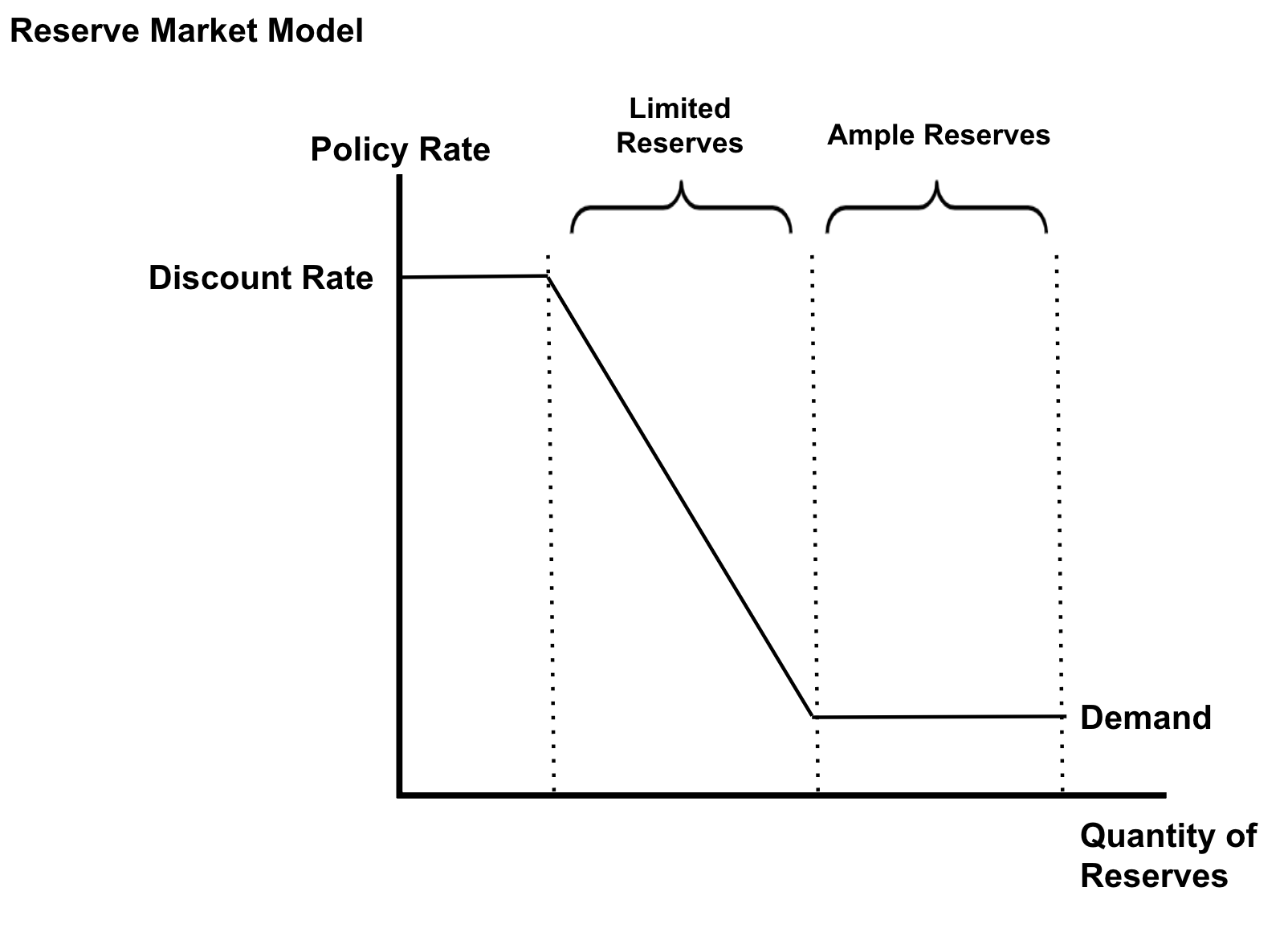

Reserve Market Model

→ inverse relationship between the Federal Funds Rate and the quantity of reserves demanded

→ when the Policy Rate is high, banks want to hold less reserves

→ when the Policy Rate is low, banks want to hold more reserves

→ when the Policy Rate is high, banks want to hold less reserves

→ when the Policy Rate is low, banks want to hold more reserves

54

New cards

Reserve Market Model (Limited Reserves)

55

New cards

Monetary Policy Used (Limited Reserves)

( 1 ) Reserve Ratios

( 2 ) Discount Rate

( 3 ) Open Market Operations

( 2 ) Discount Rate

( 3 ) Open Market Operations

56

New cards

Monetary Policy Used (Ample Reserves)

(Administered Rates)

( 1 ) Interest On Reserves

( 2 ) Discount Rate

( 1 ) Interest On Reserves

( 2 ) Discount Rate

57

New cards

Reserve Market Model (Ample Reserves)

58

New cards

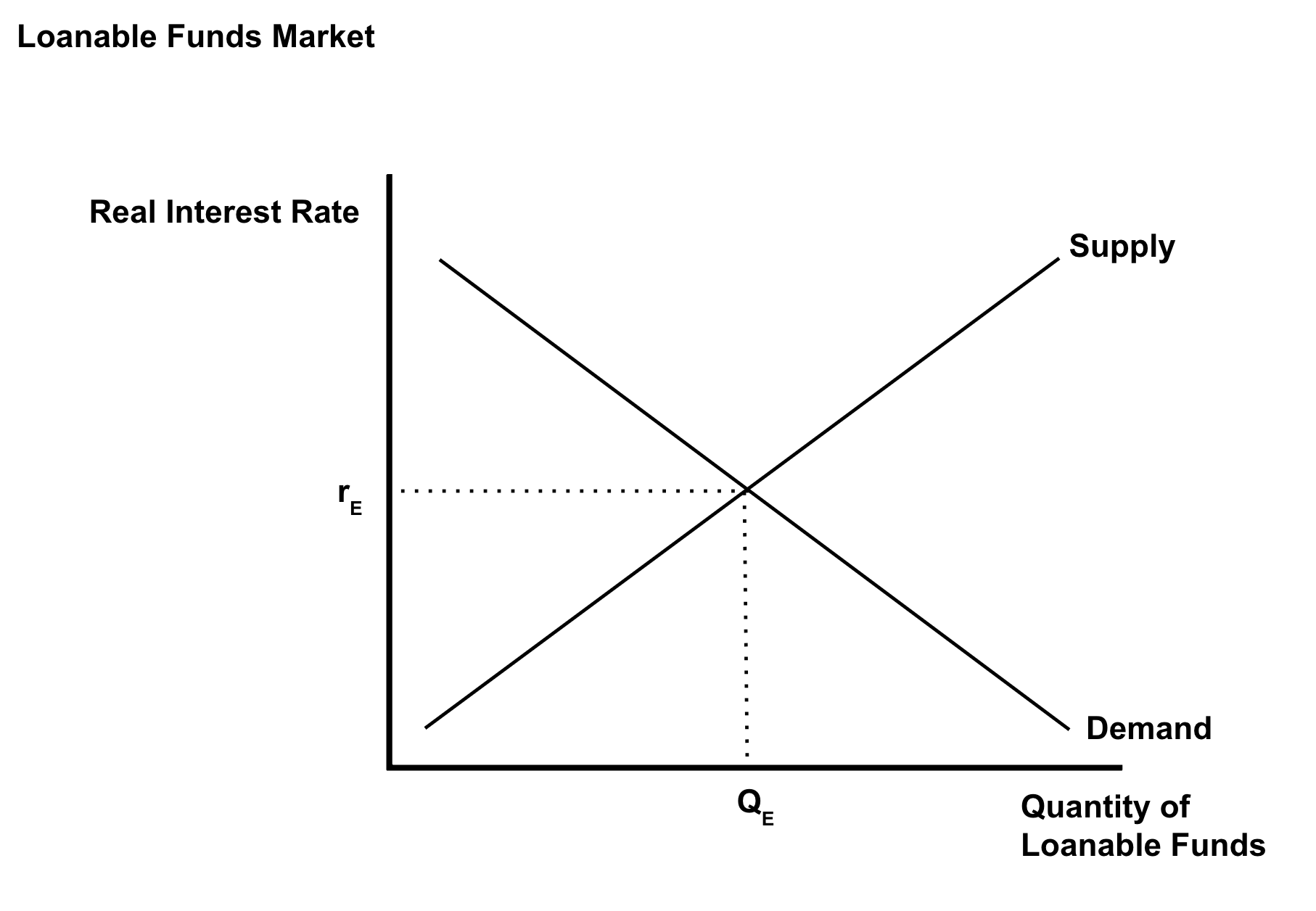

Loanable Funds Market

shows the supply and demand of loans and shows the equilibrium interest rates

→ demand has an inverse relationship between real interest rate and quantity loans demanded

→ supply has a direct relationship between real interest rate and quantity loans supplied

→ at the equilibrium real interest rate, the amount that borrowers want to borrow equals the amount lenders want to lend

→ demand has an inverse relationship between real interest rate and quantity loans demanded

→ supply has a direct relationship between real interest rate and quantity loans supplied

→ at the equilibrium real interest rate, the amount that borrowers want to borrow equals the amount lenders want to lend

59

New cards

Private Saving

the amount that households save instead of consume

60

New cards

Public Saving

the amount that the government saves instead of spends

61

New cards

National Savings

public saving + private saving

62

New cards

Capital Inflow

the amount of money entering the country

63

New cards

Capital Outflow

the amount of money leaving the country

64

New cards

Net Capital Inflow

capital inflow -- capital outflow

65

New cards

Private Investment

borrowing by businesses and consumers

66

New cards

Government Borrowing

deficit spending when government spending is greater than tax revenue

67

New cards

Loanable Funds Market Demand Shifters

( 1 ) Changes in borrowing by consumers

( 2 ) Changes in borrowing by businesses

( 3 ) Changes in borrowing by the government (ex. deficit spending)

( 2 ) Changes in borrowing by businesses

( 3 ) Changes in borrowing by the government (ex. deficit spending)

68

New cards

Loanable Funds Market Supply Shifters

( 1 ) Changes in private savings behavior

( 2 ) Changes in public savings behavior

( 3 ) Changes in foreign investment (ex. more inflow of foreign financial capital)

( 2 ) Changes in public savings behavior

( 3 ) Changes in foreign investment (ex. more inflow of foreign financial capital)

69

New cards

Loanable Funds Market Supply & Demand

→ demand for loans comes from borrowers/investors

→ supply for loans comes from lenders/savers

→ supply for loans comes from lenders/savers

70

New cards

Monetary Base

includes money in circulation and bank reserves