ACC 201 - Unit 4 Revenues, Receivables, and Cash

1/26

Earn XP

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

27 Terms

What is the revenue recognition principle?

Revenue recognized when they are earned: obligations satisfied

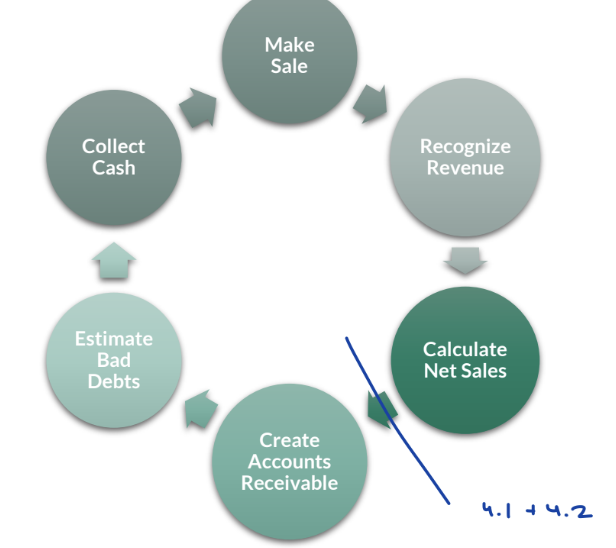

What is the process of the Sales Cycle?

Shipping terms: What is FOB shipping point?

Free on Board Shipping Point; recognize revenue at once shipped to buyer. Buyer pays freight cost

Shipping terms: What is FOB destination?

Free on Board destination: recognize revenue once buyer receives. Seller pays freight cost

What account is variable pricing for Credit Card Discounts? What’s its normal balance?

Contra revenue (XR), debit (-R)

What account do all variable pricing circumstances (Credit Card/Cash discounts, sales allowance/returns) credit?

Accounts Receivable (-A)

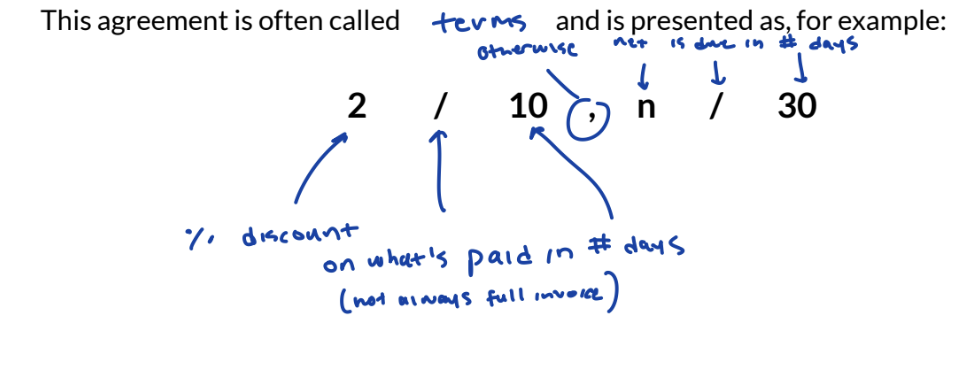

How are cash discount agreement terms formatted?

How do you make a journal entry for Cash discounts?

Debit cash (order-discount), Debit Cash Discount (+XR), Credit A/R

What accounts do you credit and debit for Sales Returns and Allowances?

Debit Sales Returns (+XR), Credit A/R (-A)

What is the difference between gross and net sales?

Gross: sum of all revenue booked; Net: all revenue booked minus expenses and adjustments

How do you calculate Net Sales Revenue?

Gross Sales Revenue - (Less: all discounts and returns) = Net Sales Revenue

Are Trade and Volume Discounts Contra Revenue (XR) accounts? Are they included in Net Sales?

No because customers do not see this; these discounted numbers included in Gross Revenue

T/F: We collect cash when we recognize a Sales Revenue.

False; we only recognize A/R and adjust based on discounts and if they are paid after the sale

How do companies account for Uncollectible Accounts/Bad Debts after a sale?

Create an Allowance for Doubtful Accounts AFDA (XA), money set aside to account for A/R that won’t be collected

What is the normal balance for AFDA?

Contra Assets are credited

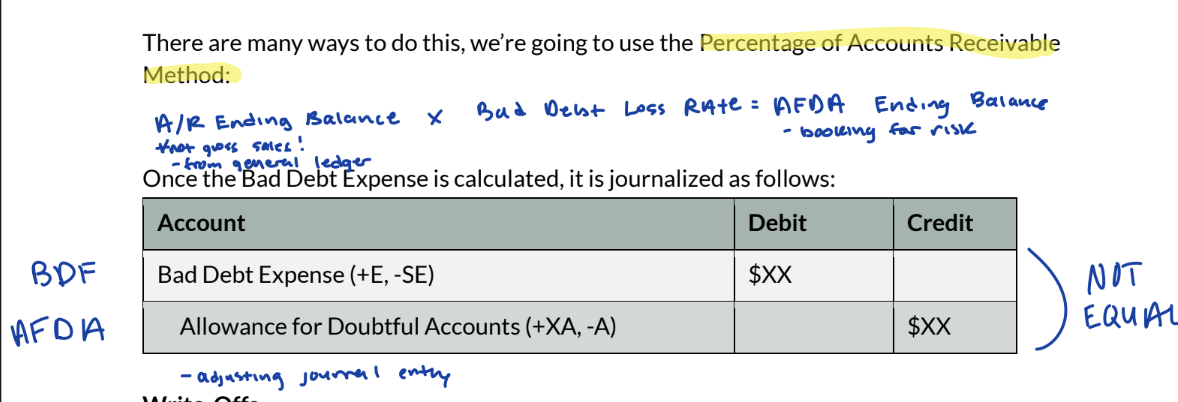

How does management estimate AFDA to account Bad Debts?

Percentage of Accounts Receivable Method

A/R EB * BDER = AFDA EB

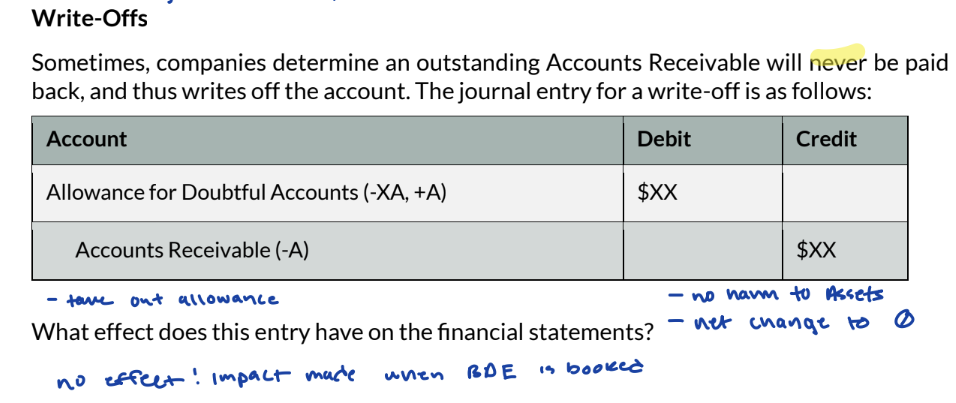

How are accounts that won’t be paid written off? Do write-offs have an effect on Financial Statements?

Debit AFDA (-XA), Credit (A/R), no effect because company made allowance (AFDA)

How do you calculate Net Realizable Value of A/R (Net A/R)?

Net A/R = A/R EB - AFDA EB

What are the steps to calculate and report net A/R?

Record Monthly Transactions

Book BDE

Calculate/Report Net A/R

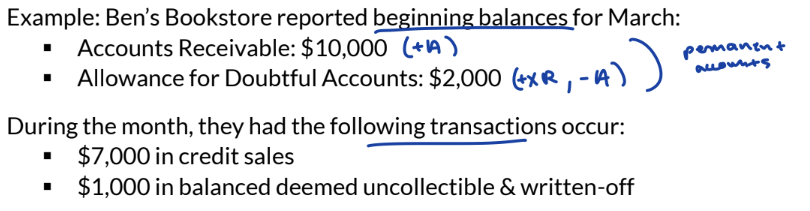

Course Pack p.83: Practice Problem for 4.3 Tips

Utilize A/R T-Account (gross A/R) and AFDA T-Account (amount for BD credited to get EB of AFDA)

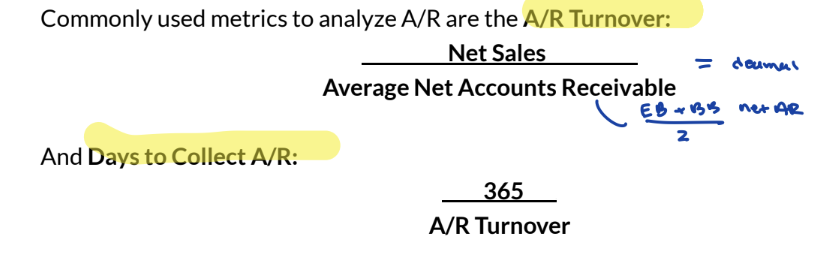

How do you calculate A/R Turnover? How do you calculate Days to Collect A/R?

Average Net A/R = (Net A/R: EB + BB)/2

What do the metrics A/R Turnover and Days to Collect A/R help analyze? How do you use these metrics?

How quickly companies collect credit sales

if terms re being met: are days to collect more/less than term days?

What current asset is the most liquid?

Cash

What are cash equivalents?

Checking/Savings Accounts

Checks

Investments

Certifications of Deposit

Treasury Bills

How do companies safeguard cash to avoid theft/fraud?

Internal controls: auditors check valid activity

What are examples of internal controls?

Separation of Duties

Daily Deposits

Check Signatures

Mandatory Vacations

Bank Reconciliation

What are some consequences of not safeguarding cash?

Legal Issue: Prison…. EX: Dane Cook + half-brother Darryl McCauley