ADM 1300 Chapter 15: Financial Decisions and Risk Management

1/100

Earn XP

Description and Tags

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

101 Terms

role of financial manager

plan and control the acquisition and distribution of the company's financial assets

finance

business function involving decisions about a firm's long term investments and obtaining the funds to pay for those investments

four responsibilities of finance

determine long-term investments, obtain funds to pay for investments, conduct everyday financial activities, manage risks that are taken

objective of financial officer

increase firm's value and shareholder wwealth

cash-flow management

managing the pattern in which cash flows into the firm in the form of revenues and out in the form of debt payments

financial control

process of checking actual performance against plans to ensure that the desired financial status is achieved

financial planning

description of how a business will reach some financial position it seeks for the future; includes projections for sources and uses of funds

short-term expenditures

incurred during everyday business activities

accounts payable

unpaid bills owed to suppliers plus wages and taxes due within a year

accounts receivable

funds due from customers who have bought on credit

credit policies

rules governing a firm's extension of credit to customers

inventory

material and goods currently held by the company that will be sold within the year

raw-materials inventory

basic supplies used in production process

work-in-process inventory

goods partway through the production process

finished-goods inventory

items that are ready for sale

capital expenditures

long-term expenditures that are not normally sold for cash

trade credit

granting of credit by a selling firm to a buying firm

open-book credit

informal agreement of trade credit

promissory notes

legally binding agreement stating when and how much money will be paid to the seller

trade draft

attached to shipments and must be signed by buyer to receive merchandise

secured short-term loans

loans in which the borrower is required to put up collateral

inventory as collateral

lender lends the borrower some portion of the stated value of inventory

pledging accounts receivable

lender can seize accounts receivable if loan isn't paid on time

factoring accounts receivable

purchaser tries to collect on the receivables and profits to the extent that the money it eventually collects exceeds the amount it paid for the receivable

unsecured short-term loan

borrower does not have to put up collateral

lines of credit

standing agreement between a bank and a firm that there is a maximum amount the bank will make available to the borrower for a short-term unsecured loan

revolving credit agreements

guaranteed line of credit for which the firm pays the bank interest on fund borrowed and a premium

commercial paper

firm sells unsecured notes for less than face value and repurchases them at face value within 270 days

debt financing

raising money to meet long-term expenditures by borrowing from outside the company

long-term loans

typically comes from a chartered bank

bonds

promise by the issuing company to pay the holder a certain amount of money on a specified date, with stated interest payments in the interim

bond indenture

details terms of the bond

default

if a firm fails to make a bond payment

registered bonds

registers the names of holders with the company and mailing out the cheques to bondholders

bearer bonds

bondholders clip coupons from certificates and sends them to the issuer to receive payment

secured bonds

bonds issued by borrowers who pledge assets as collateral in the event of nonpayment

debentures

unsecured bonds

callable bonds

issuers can call it in and pay it off before the maturity date at a price stipulated in the indenture

serial bonds

firm retires portions of the bond issue in a series of different preset dates

convertible bonds

can be converted into the common stock of the issuing company

equity financing

raising money to meet long-term expenditures by issuing common stock or by retaining earnings

issuing common stock

selling shares of common stock to obtain funds needed to buy land, building and equipment

par value

arbitrary value of a stock set by the issuing company's board of directors and stated on stock certificates

book value

value of a common stock expressed as total shareholders' equity divided by the number of shares

market value

current price of one share of a stock int he secondary securities market; true value of a stock

investor relations

publicizing the positive aspects of a company's financial condition to financial institutions

market capitalization

dollar value of stocks listed on a stock exchange; number of company's outstanding shares times the market value of each share

retaining the firm's earnings

using profits not paid out in dividends

hybrid financing

payments on preferred stock are fixed amounts but it will never mature

capital structure

relative mix of a firm's debt and equity financing

risk-return relationship

shows the amount of risk and the likely rate of return on various financial instruments

diversification

buying several kinds of investments rather than just one kind

asset allocation

proportion of funds invested in each of the investment alternatives

current dividend yield

rate of return from dividends paid to shareholders; calculated by dividing yearly dollar amount of dividend income by the investments current market value

price appreciation

increase in the dollar value of an investment

capital gain

profit gained from increased market value of a stock

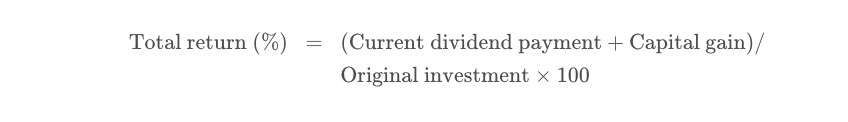

total return

a calculation that includes the annual dividend as well as any increase or decrease in the original purchase price of the investment

compound growth

with each additional time period, interest returns accumulate and earn more interest

rule of 72

divide annual interest rate into 72; shows how long it will take money to double

primary securities market

handles buying and selling of new shares (IPO)

private placements

new securities being sold to one buyer of a small group of buyers

secondary securities market

market for existing stocks and bonds

investment banking

new stocks have to be approved by a provincial securities commission before being issued

investment bankers

financial specialists in issuing new securities

stock exchanges

voluntary organizations of individuals formed to provide an institutional setting where members can buy and sell stock for themselves and their clients in accordance with the exchange's rules

stockbroker

individual licensed to buy and sell securities for customers in the secondary market

discount brokers

offers well informed individual investors a fast and low cost way to participate in the market

over the counter market

organization of securities dealers formed to trade stock outside of the formal institutional setting of the organized stock exchanges

stock quotations

daily market transactions of individual stocks

bond quotations

daily market transactions of bonds

market indexes

provides a summary of price trends in a specific industry

bull markets

period of rising stock prices

bear markets

period of falling stock prices

market order

broker should buy or sell a certain security at the prevailing market price at the time

limit order

authorizes the purchase of a stock only if its price is less than or equal to a given limit

stop order

broker will sell a stock if its price falls to a certain level

round lot

requests 100 shares of some multiple therof

odd lot

fractions of a round lot

call option

the right to buy a particular stock at a certain price; right lasts up to a certain date

put option

the right to sell a particular stock at a specified price; right lasts until a particular date

margin

percentage of the total sales price that a buyer must put up to place an order for stock or a futures contract

day traders

those who buy and sell stock in the same day; seeking quick profits on large volumes of stock

short sales

selling borrowed shares of stock in the expectation that prices will fall; replacement shares are then bought for less

mutual funds

any company that pools the resources of many investors and uses those funds to purchase various types of financial securities

no-load funds

investors are not charged a sales commission when they buy into or sell out of the mutual fund

load funds

carry a charge between 2% and 8% of invested funds

exchange-traded funds

bundle of stocks that is in an index that tracks the overall movement of the market

hedge funds

private pools of money that try to give investors a positive return regardless of stock market performance

principal protected notes

guarantee that investor will have original investment back at a certain time; not necessarily additional returns

futures contracts

agreement to purchase specified amounts of a commodity at a given price on a set future date

blue sky laws

laws regulating how corporations must back up securities to help prevent fraud

venture capital

outside equity funding provided in return for part ownership of the firm

planning for cash-flow requirements

success hinges on anticipating times when cash will be short and when excess cash is expected

risk management

conserving a firm's financial power by minimizing the financial effect of accidental losses

speculative risks

event that offers the chance for either a gain or loss

pure risk

event offers only the chance of loss or no loss

risk avoidance

stopping participation or refusing to participate in ventures that carry any risk

risk control

techniques to prevent, minimize or reduce losses in the consequences of losses

risk retention

covering of a firm's unavoidable losses with its own funds