Chapter 8: Corporate Formation, Reorganization, and Liquidation

1/30

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No study sessions yet.

31 Terms

The Taxation of Property Dispositions

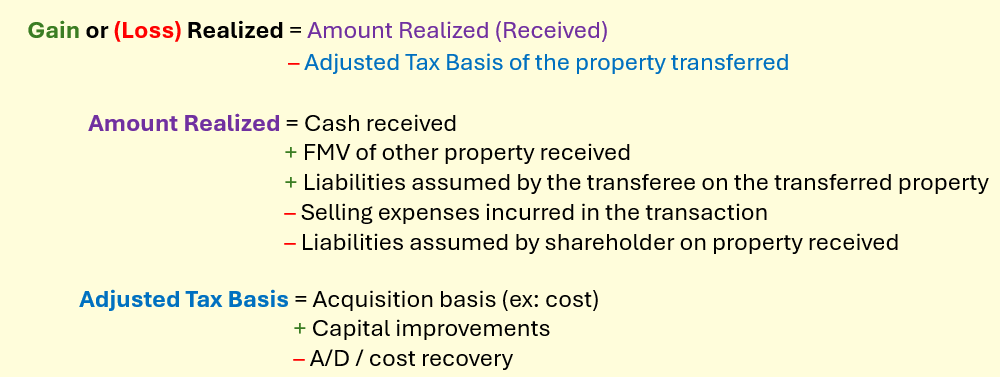

Realization is the gain or loss that results from an exchange of property rights in a transaction

The amount realized is the value of everything received by the seller in a transaction (cash, FMV of other property, and relief of liabilities) less selling costs

Adjusted tax basis is an asset’s carrying value for tax purposes at a given point in time, measured as the initial basis (for example, cost) plus capital improvements less depreciation or amortization

The entire amount of gain or deductible loss realized is recognized unless otherwise excluded or deferred by other provisions of the law

Gain or loss that is excluded from gross income will never be recognized

Gain or deductible loss that is deferred is merely postponed to a future period

Tax-Deferred Transfers of Property to a Corporation

In §351, Congress provides for the deferral of gain or loss on qualifying transfers of property to a corporation in exchange for stock in order to remove tax consequences as an impediment to conducting business in the corporate form

Congress justifies tax deferral because shareholders maintain an interest in the property transferred through a different form of ownership (i.e., from direct ownership to indirect ownership through stock)

In other words, the shareholders making the transfer have not substantively disposed of their ownership of the property

Transactions Subject to §351 Tax Deferral

For shareholders to receive tax deferral in a transfer of property to a corporation, the transferors must meet all three requirements in §351 as follows:

One or more shareholders must transfer property to a corporation

Shareholders who transfer property to the corporation (the transferors) must receive stock of the transferee corporation in exchange for the property they transfer

Immediately after the transfer, the transferors, together, must control the corporation to which they transferred the property

Deferral is mandatory when requirements are met

Applies to both C and S corps

Section 351 applies only to those persons who transfer property to the corporation in exchange for stock (i.e., shareholders)

A person is defined for tax purposes to include individuals, corporations, partnerships, and fiduciaries (estates and trusts)

Requirement 1: Section 351 Applies Only to Transferors of Property to the Corporation

Property includes money, tangible assets, and intangible assets

Services are excluded from the definition of property

Thus, a person who receives stock in return for services generally has compensation equal to the FMV of the stock received

Requirement 2: The Property Transferred to the Corporation Must Be Exchanged for Stock of the Corporation

Only the portion of the property exchanged for stock will qualify for tax deferral

Nonqualifying property (other than stock in the transferee corporation) received by shareholders is referred to as boot

The receipt of boot will cause the shareholder (transferor) to recognize gain, but not loss, realized on the exchange

The type of stock a shareholder can receive in a §351 exchange is quite flexible and includes voting or nonvoting and common or preferred stock

However, stock for purposes of §351 does not include stock warrants, rights, or options

Property transferred in exchange for debt of the corporation is not eligible

Requirement 3: The Transferor(s) of Property to the Corporation Must Control the Corporation Immediately after the Transfer

Control is defined as ownership by group of transferors of ≥ 80% of the corporation’s voting stock AND each class of nonvoting stock

The control test is based on the collective (aggregate) ownership of the shareholders transferring property to the corporation immediately after the transfer

This group of shareholders (i.e., the transferors) is composed only of those shareholders who have transferred property in exchange for stock

The group does not include shareholders who only exchange services for stock

Generally, when a shareholder transfers both services and property to the corporation in exchange for stock, that shareholder is considered to be a transferor of property for purposes of the control test

However, if the primary purpose for the shareholder’s transfer of property to the corporation is to qualify the exchange of another person under §351, that shareholder would be considered to be a transferor of property only if the stock received for property is not of “relatively small value” (> 10% of the value of the stock received for the services provided) compared to the value of the stock received for services

In other words, property exchanged must have a value of at least 10% of stock already owned to be included in control test

Tax Consequences When a Shareholder Receives No Boot

If the requirements of Section 351 are met and no boot is received in the exchange, any gain on the transaction is deferred

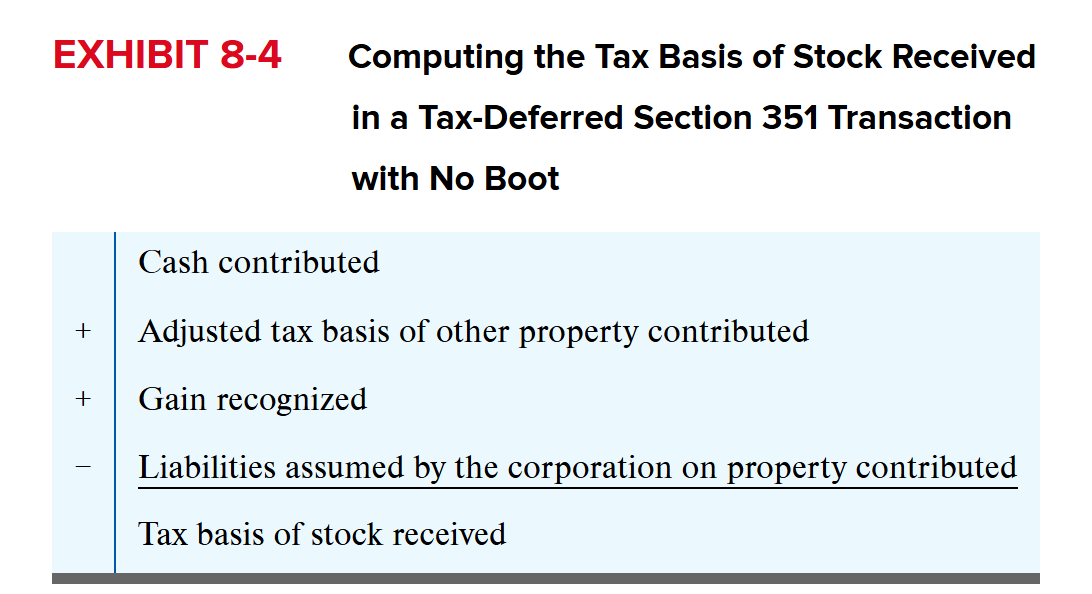

When no boot is involved, the tax basis of stock received in a tax-deferred §351 exchange equals the adjusted tax basis of the property transferred less any liabilities assumed by the corporation

Shareholder receives a “substituted basis” as the adjusted basis of the property contributed is used to compute the tax basis of the property received

Corporation takes the adjusted basis of the property received

Any liabilities assumed by corporation will reduce the basis of the property

Tax Consequences When a Shareholder Receives Boot

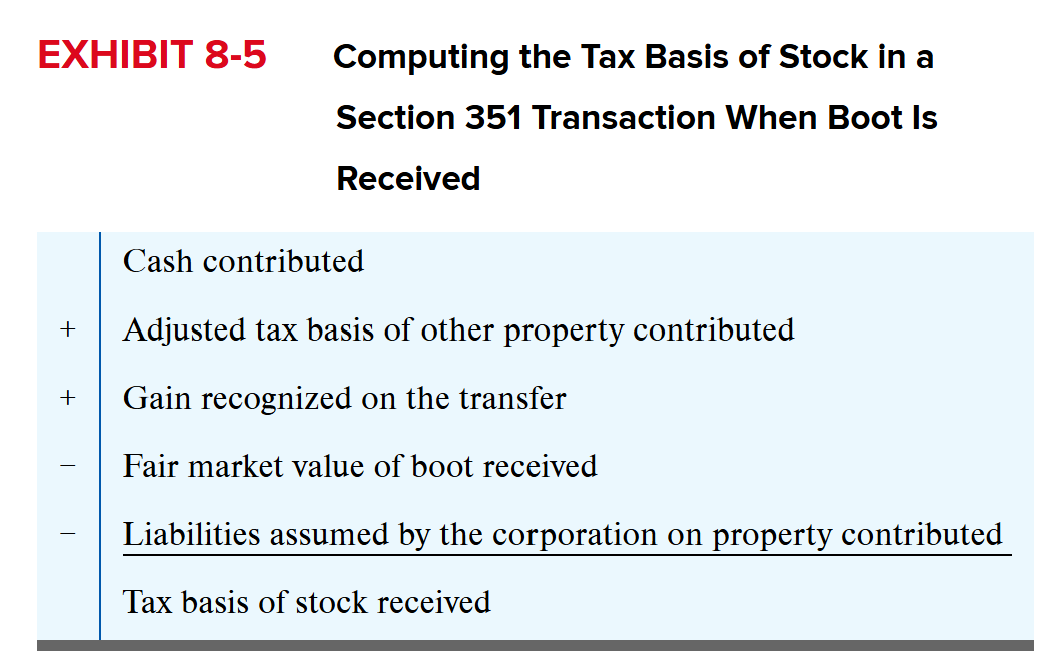

Receipt of boot triggers gain recognition

No loss is recognized

Recognized Gain = lesser of (1) FMV of the boot or (2) the realized gain on property transferred

Boot is allocated based on the FMV of the properties transferred

Character of gain recognized depends on nature of asset transferred

Ordinary asset (such as inventory) – ordinary gain

Capital asset – capital gain

The shareholder’s stock basis is increased by any gain recognized and reduced by the fair market value of any boot received

Assumption of Shareholder Liabilities by the Corporation

When business assets are exchanged for stock in a §351 transaction, the corporation frequently assumes the outstanding liabilities of the business, such as accounts payable or mortgages

The corporation’s assumption of a shareholder’s liability is not treated as boot received by the shareholder

Instead, they reduce the basis of the stock received by the transferor (shareholder) in the transaction

Exception: liabilities are only treated as boot when the purpose of the assumption is to avoid taxes (ex: there is no business purpose for the assumption)

Transferors are required to recognize gain to the extent that the liabilities assumed exceed the aggregate tax basis of the property transferred in a §351 transaction

Tax-Avoidance Transactions

If any of the liabilities assumed by the corporation are contributed with the purpose of avoiding the federal income tax or if there is no corporate business purpose for the assumption, all liabilities assumed are treated as boot to the shareholder

Motive is often present when the liabilities are created immediately before a §351 transaction

Motive can also be present when shareholders have the corporation assume their personal liabilities (ex: a home mortgage or car payments)

Liabilities in Excess of Basis

Even when liabilities are not treated as boot, under §357(c) the taxpayer is required to recognize gain to the extent the liabilities assumed by the corporation exceed the aggregate adjusted tax basis of the properties transferred by the shareholder

The character of §357(c) gain recognized should be based on the character of the transferred assets, but this rule is inadequate if the transfer includes two or more assets of differing character

The regulations indicate that the character of the gain in this situation should be determined by allocating the gain according to the relative fair market value of the transferred assets

Tax Consequences to the Transferee Corporation

The corporation receiving property in exchange for its stock does not recognize gain or loss realized on the transfer

In transactions that do not qualify for §351, the corporation will have a FMV tax basis in the property

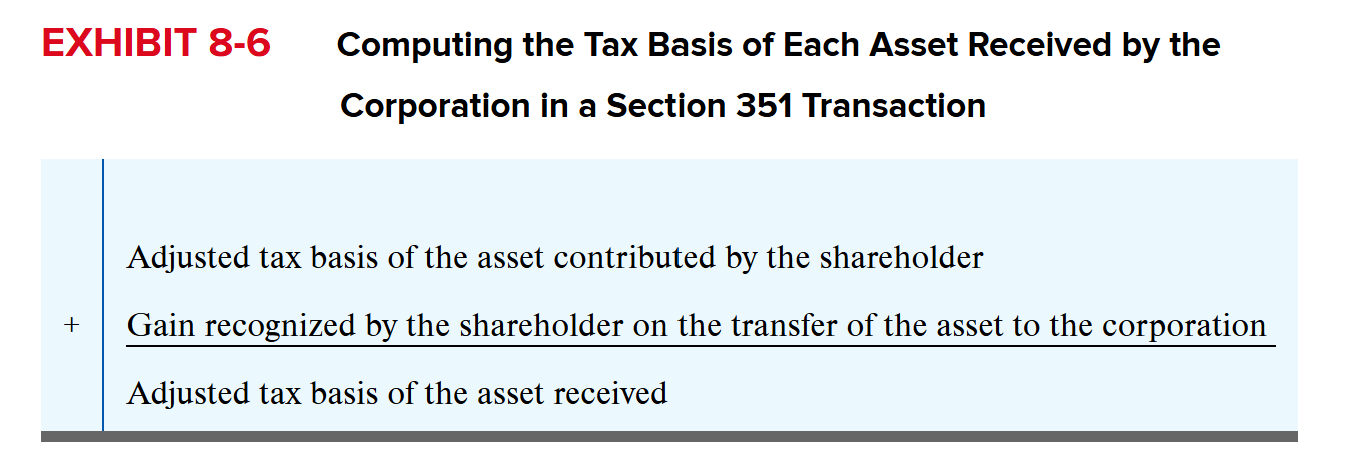

In a §351 transaction, the corporation will have an adjusted tax basis in the property that equals the property’s adjusted tax basis in the transferor’s hands

The transferred property is said to have a carryover basis (the corporation “carries over” the shareholder’s basis and holding period in the transferred property)

To the extent the shareholder’s adjusted tax basis carries over to the corporation and the property is §1231 property or a capital asset, the shareholder’s holding period also carries over (it tacks to the property)

If the shareholder recognizes gain as a result of the property transfer, either because the shareholder received boot or the liabilities assumed by the corporation in the exchange exceeded the adjusted tax basis of the property contributed by the shareholder, the corporation increases its tax basis in each asset by the gain recognized on that asset

The law limits the ability of a shareholder to transfer a built-in loss (fair market value less than adjusted basis) to a corporation in a §351 transaction

Without this limitation, a shareholder could create a duplicate loss, one loss for the shareholder and a second loss for the corporation

If the aggregate adjusted tax basis (after adding the increase in basis for any gain recognized by the shareholder) of property transferred to a corporation by a shareholder in a §351 transfer exceeds the aggregate fair market value of the assets, the aggregate adjusted tax basis of the assets in the hands of the transferee corporation is limited to the aggregate fair market value

When the tax basis is limited, the reduction in tax basis is allocated among the assets transferred in proportion to their respective built-in losses immediately before the transfer

As an alternative, the transferor and transferee can elect to have the transferor reduce their stock basis to fair market value (the duplicate loss is eliminated at either the corporate or shareholder level)

Other Issues Related to Incorporating an Ongoing Business

Depreciable Assets Transferred to a Corporation

Contributions to Capital

Section 1244 Stock

Depreciable Assets Transferred to a Corporation

To the extent a property’s adjusted tax basis carries over from the shareholder, the corporation in effect steps into the shoes of the shareholder and continues to depreciate the carryover basis portion of the property’s adjusted tax basis using the shareholder’s depreciation schedule. Any additional tax basis (from recognition of gain due to boot received) is treated as a separate asset and is subject to a separate depreciation election (i.e., this one physical asset is treated as two separate tax assets for depreciation purposes).

Practitioners often advise against transferring appreciated property (especially real estate) into a closely held corporation. By doing so the shareholder creates two assets with the same built-in gain as the original property (the stock received in the hands of the shareholder and the building owned by the corporation). The federal government can now collect taxes twice on the same gain, once when the corporation sells the property received and a second time when the shareholder sells the stock. You will notice that Congress is not concerned by a duplication of gain result, only a duplication of loss result. By retaining the property outside the corporation, the shareholder can lease the property to the corporation, thereby reducing the corporation’s taxable income through rent deductions. Note, however, that there may be valid state tax reasons to own the property inside a corporation, such as lower property taxes.

Contributions to Capital

A contribution to capital is a transfer of property by shareholder but no stock or other property is received in return

Corporation is not taxed on the receipt of the property if the property is contributed by a shareholder

Corporation takes a carryover tax basis in property contributed by a shareholder

Corporation takes a tax basis of zero in property contributed by a non-shareholder

The corporation recognizes the value of the contributed property as income and takes a FMV basis in the property

Shareholder making a capital contribution increases the tax basis in existing stock by the tax basis of the property contributed

Section 1244 Stock

Stock is generally a capital asset in the hands of the shareholders, and gains or losses from sale or exchange are capital in nature

Section 1244 allows a shareholder to treat a loss on the sale or exchange of stock that qualifies as §1244 stock as an ordinary loss

Shareholder can deduct up to $50,000; $100,000 (MFJ) per year of ordinary loss on sale of the stock (excess is capital loss)

Requirements

Applies only to individual shareholders who are the original recipients of the stock

Must have been a small business corporation when the stock was issued (< $1,000,000 capitalization)

For the 5 taxable years preceding the year in which the stock is sold, the corporation must have derived > 50% of its aggregate gross receipts from an active trade or business

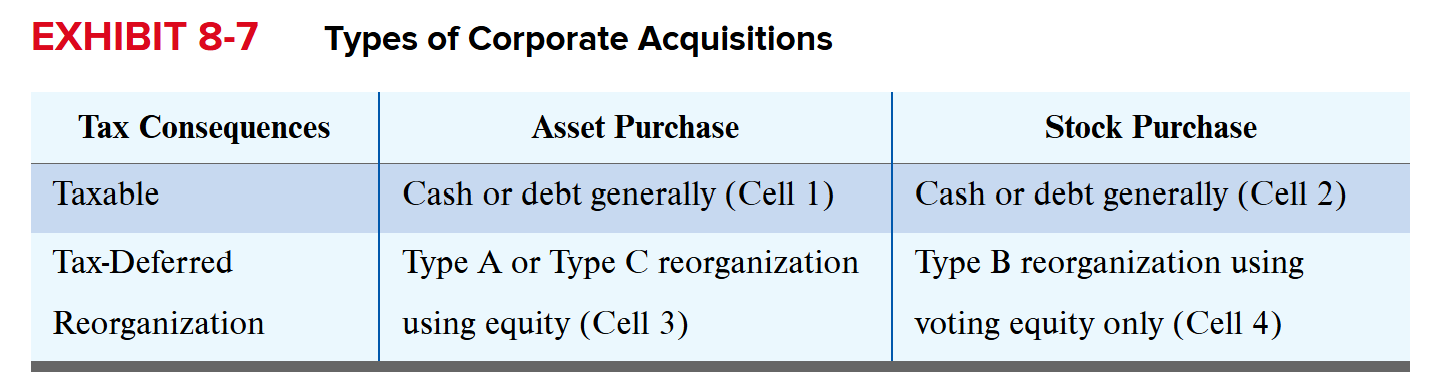

Taxable and Tax-Deferred Corporate Acquisitions

When negotiating an acquisition, management of the acquiring corporation must decide whether to acquire assets or stock and what to use as consideration

Acquiring company can acquire a target through a stock or asset acquisition

Acquisition can be structured as taxable or tax-deferred depending upon structure and consideration

The acquisition can only occur after the buyer and seller negotiate and agree on price, consideration, and form of the transaction

The Acquisition Tax Model

The form of a corporate acquisition (asset or stock purchase) and the consideration (equity, debt, cash) jointly determine the tax status of the transaction

Acquirers will consider both nontax factors (the ease of transferring stock, the existence of contingent liabilities, etc.) and tax benefits (carryover of tax attributes or step up in tax basis) when choosing between different transaction forms

Likewise, tax and nontax factors will influence the preferences of the shareholders of the target corporation

For example, cash provides liquidity, but it also causes the transaction to be taxable to the seller

Receiving equity in the acquiring corporation can allow shareholders to defer paying tax on gains realized on the exchange, but the sellers must accept the risk that the acquiring corporation’s stock could decline in value after the deal

— Buyer can purchase either stock or assets in a transaction that is either taxable or tax-deferred to the seller

A taxable asset acquisition allows the acquiring corporation to step up the tax basis of the assets acquired to fair value

In stock acquisitions and tax-deferred asset acquisitions, the tax basis of the assets remains at the carryover value (generally, cost less accumulated depreciation)

Buyer Preference

Taxable asset acquisition

Acquire assets at FMV —> increases future depreciation or amortization tax deductions for acquirer

Seller Preference

Tax-deferred transactions

Any tax on the appreciation will be deferred

If deferral of the gain is not possible, then the seller would prefer to sell the stock in a taxable transaction because any gain on the stock will be taxed as capital gains

The seller would likely be reluctant to sell the assets of the corporation in a taxable asset transaction (cell 1) because the seller would be required to pay both the corporate tax on appreciation of the assets and the individual capital gains tax on the appreciation of the stock

Taxable Acquisitions

Cash purchases of stock are common for public firms due to nontax advantages

The acquiring corporation does not “acquire” the target corporation’s shareholders in the transaction

A stock acquisition for cash results in the acquired company retaining its tax and legal identity, albeit as a subsidiary of the acquiring company

The acquiring company can liquidate the acquired company into itself or merge it into an existing subsidiary to remove the subsidiary

Tax-Deferred Acquisitions (Reorganization)

Called reorganizations, tax-deferred acquisitions are often complex transactions

Reorganization is a tax-deferred transaction (acquisition, disposition, recapitalization, or change of name or place of incorporation) that meets one of the seven statutory definitions found in §368(a)(1)

For tax purposes, reorganizations include:

Acquisitions and dispositions of corporate assets (including subsidiaries’ stock)

Corporation’s restructuring of its capital structure, place of incorporation, or company name

Reorganizations are subject to judicial doctrines developed over time by the courts

Judicial Doctrines that Underlie All Tax-Deferred Reorganizations

Continuity of Interest (COI)

Tax deferral in a reorganization is based on the presumption that the shareholders of the acquired (target) corporation retain a continuing ownership (equity) interest in the target corporation’s assets or historic business through their ownership of stock in the acquiring corporation

There is no bright-line test to establish whether (COI) has been met, although the regulations provide an example that says COI has been satisfied when the shareholders of the target corporation, in the aggregate, receive equity ≥ 40% of the total value of the consideration received

Continuity of Business Enterprise (COBE)

Continuity of business enterprise (COBE) is a judicial (now regulatory) requirement that the acquiring corporation must continue the target corporation’s historic business or continue to use a significant portion of the target corporation’s historic business assets

Whether the historic business assets retained are “significant” is a facts-and-circumstances test, which adds to the administrative and judicial rulings that are part and parcel of the reorganization landscape

Example The regulations suggest that in an acquisition of a corporation with three equal business lines, an acquirer will meet COBE if one line of business is continued without interruption.

COBE does not apply to the historic business or assets of the acquiring corporation; the acquiring corporation can sell off its assets after the reorganization without violating the COBE requirement

Business Purpose Test

Acquiring corporation must be able to show a significant non–tax avoidance purpose for engaging in the transaction

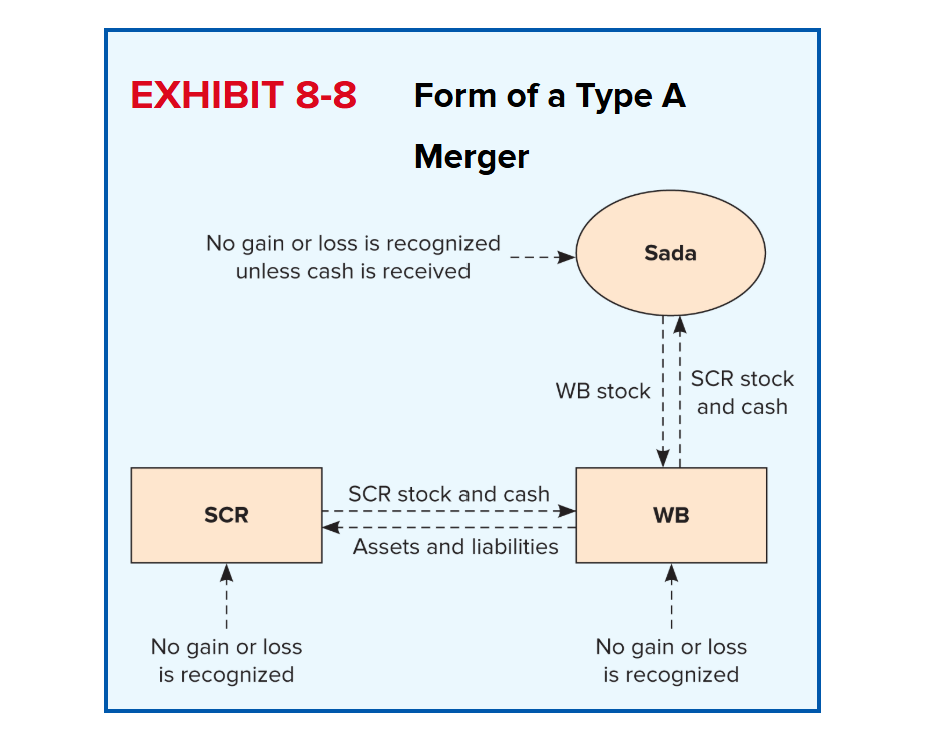

Type A Asset Acquisitions

In a Type A asset acquisition, one corporation acquires the assets and liabilities of another corporation in return for stock or a combination of stock and cash

Type A reorganizations are statutory mergers or consolidations

Merger: the acquisition by one (acquiring) corporation of the assets and liabilities of another (target) corporation

No new entity is created in the transaction

Consolidation: the combining of the assets and liabilities of two or more corporations into a new entity

Acquisition is tax-deferred if the transaction satisfies the continuity of interest, continuity of business, and business purpose requirements

Must meet state law requirements to be a merger or consolidation

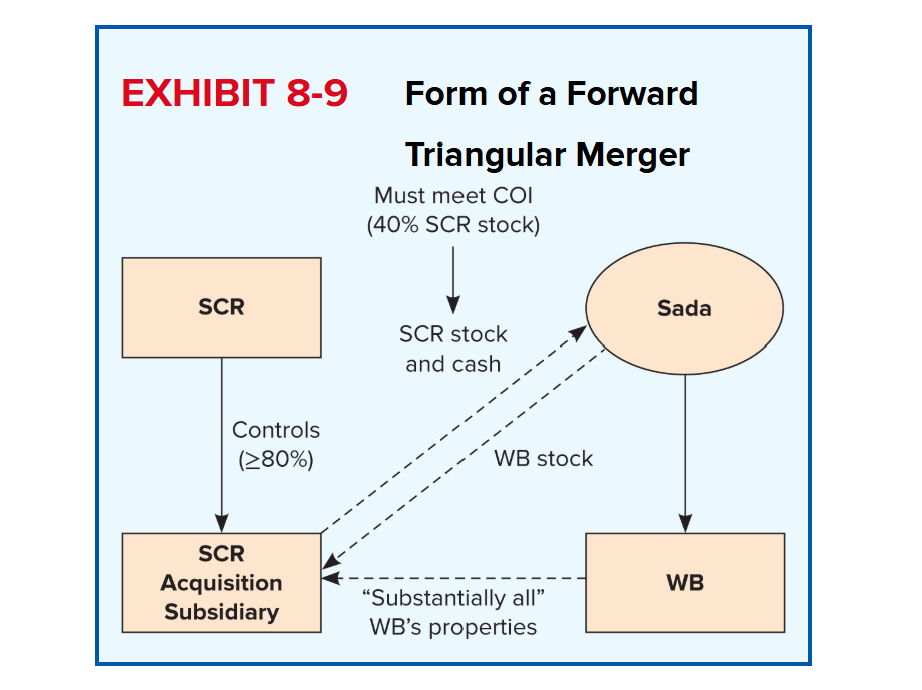

Forward Triangular Type A Merger

In a forward triangular merger, the acquiring corporation creates a subsidiary corporation that holds stock of the acquiring corporation

The target corporation then merges into this subsidiary with its shareholders receiving stock of the acquiring corporation in exchange for the stock of the target corporation

Acquiring subsidiary uses stock of its parent corporation to acquire the target corporation’s stock, after which the target corporation merges into the acquiring corporation

Three requirements for reorganization status:

Acquiring subsidiary must use solely the stock of its parent corporation

Acquiring subsidiary must acquire ≥ 80% of the stock of the acquiring corporation

Acquiring subsidiary must acquire “substantially all” of the target corporation’s properties in the exchange (90% of the FMV of the target corporation’s net properties and 70% of the FMV of the target corporation’s gross properties

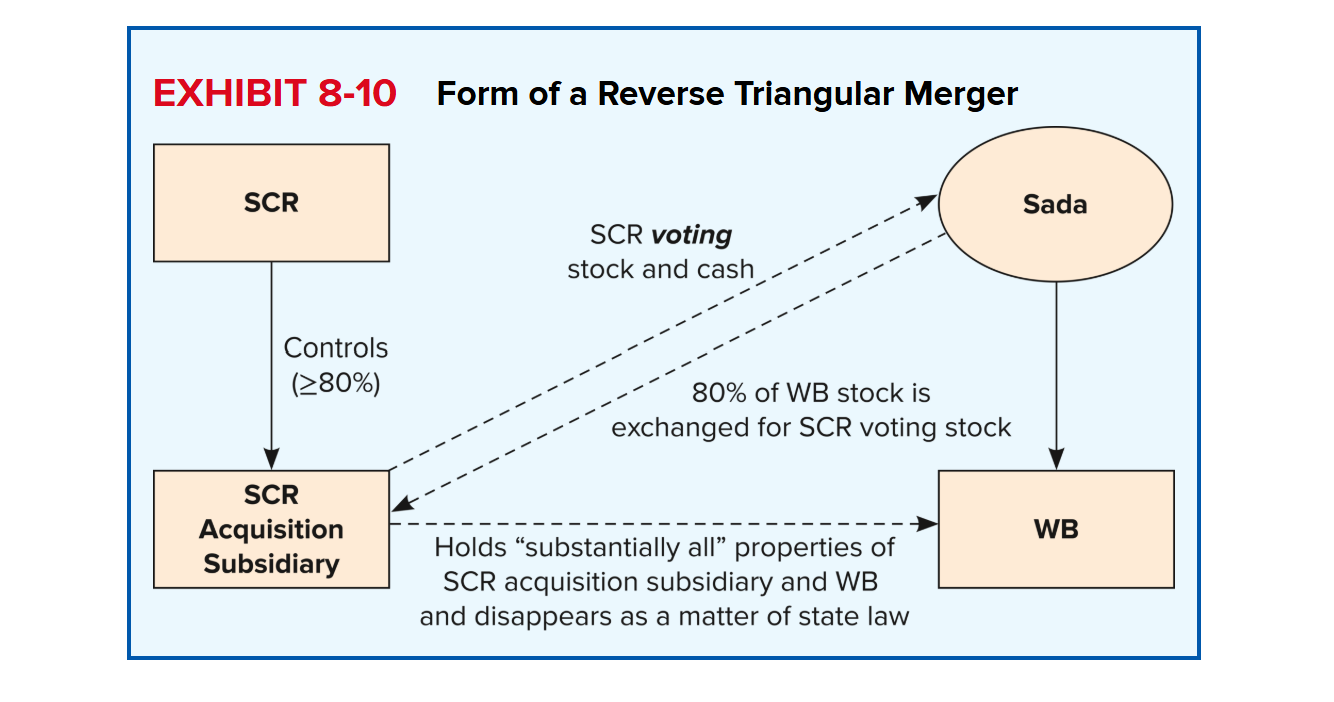

Reverse Triangular Type A Merger

In a reverse triangular merger, the acquiring corporation still creates a subsidiary corporation that holds stock of the acquiring corporation

However, it is the acquisition subsidiary that merges into the target corporation, and the acquisition subsidiary disappears as a matter of state law

Subsidiary uses Parent stock to acquire the target corporation’s stock then merges into the target corporation

Three requirements for reorganization status

Surviving corporation must hold “substantially all” of the properties of both the surviving and the merged corporations

Target shareholders must transfer in exchange an amount of stock in the target that constitutes control of the target (≥ 80% of the target’s stock)

Target shareholders must receive parent corporation’s voting stock in return for target’s stock that constitutes control of the target corporation

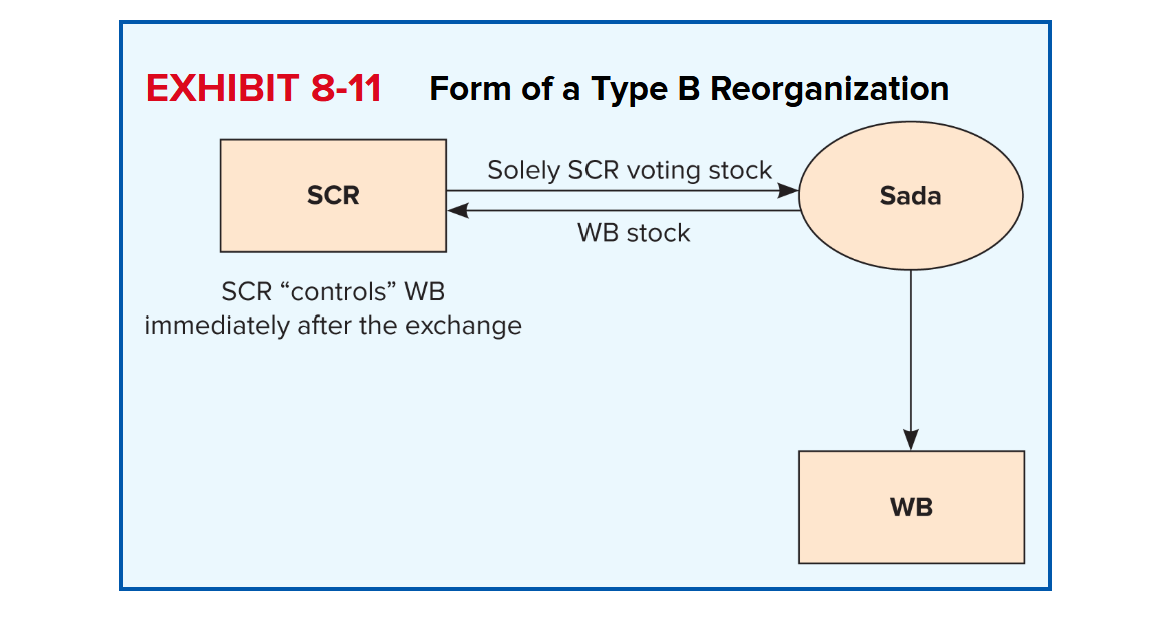

Type B Stock-for-Stock Reorganizations

Type B reorganizations (stock-for-stock acquisitions) are an exchange of solely voting stock by the acquiring corporation in exchange for stock of the target corporation, after which the acquiring corporation controls (owns 80 percent or more of) the target corporation

Requirements:

Acquiring corporation must exchange solely voting stock for stock of the target corporation

Acquiring corporation must control (own ≥ 80%) the target corporation after the transaction

For tax-deferred purpose, the target shareholders must receive solely voting stock of the acquiring corporation

Acquiring corporation takes a carryover tax basis in the target corporation stock received in the exchange

Very rare among publicly traded corporations

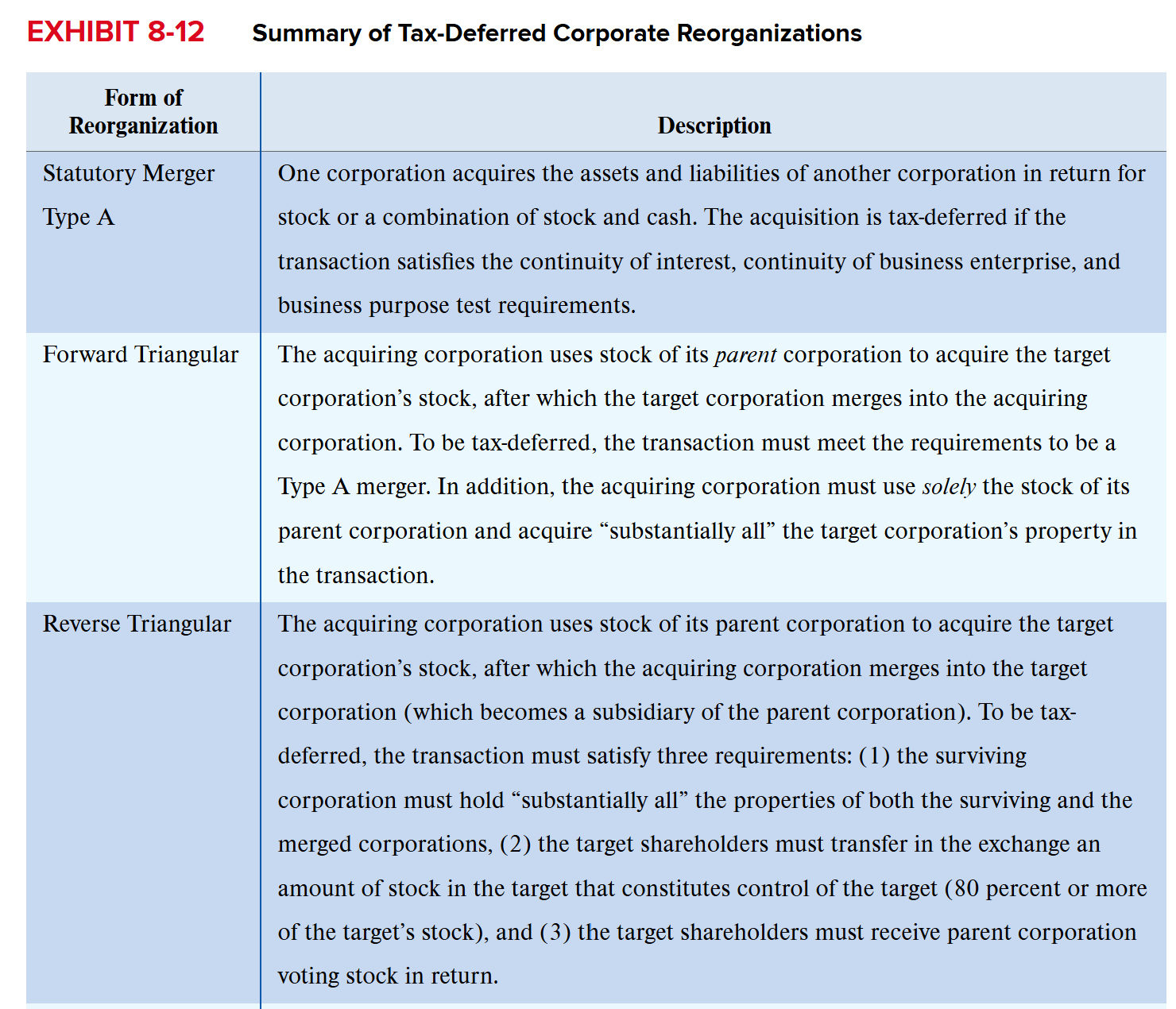

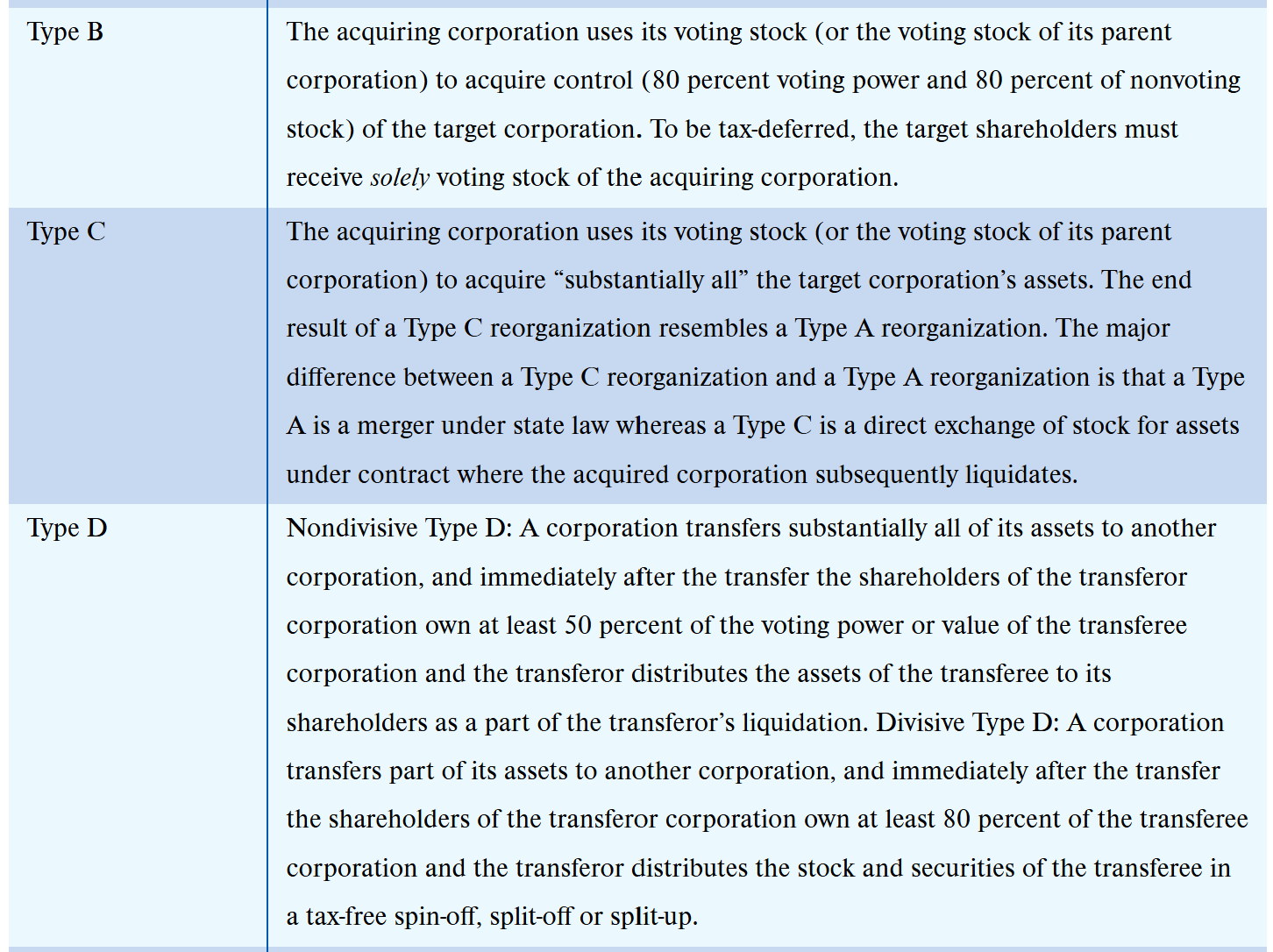

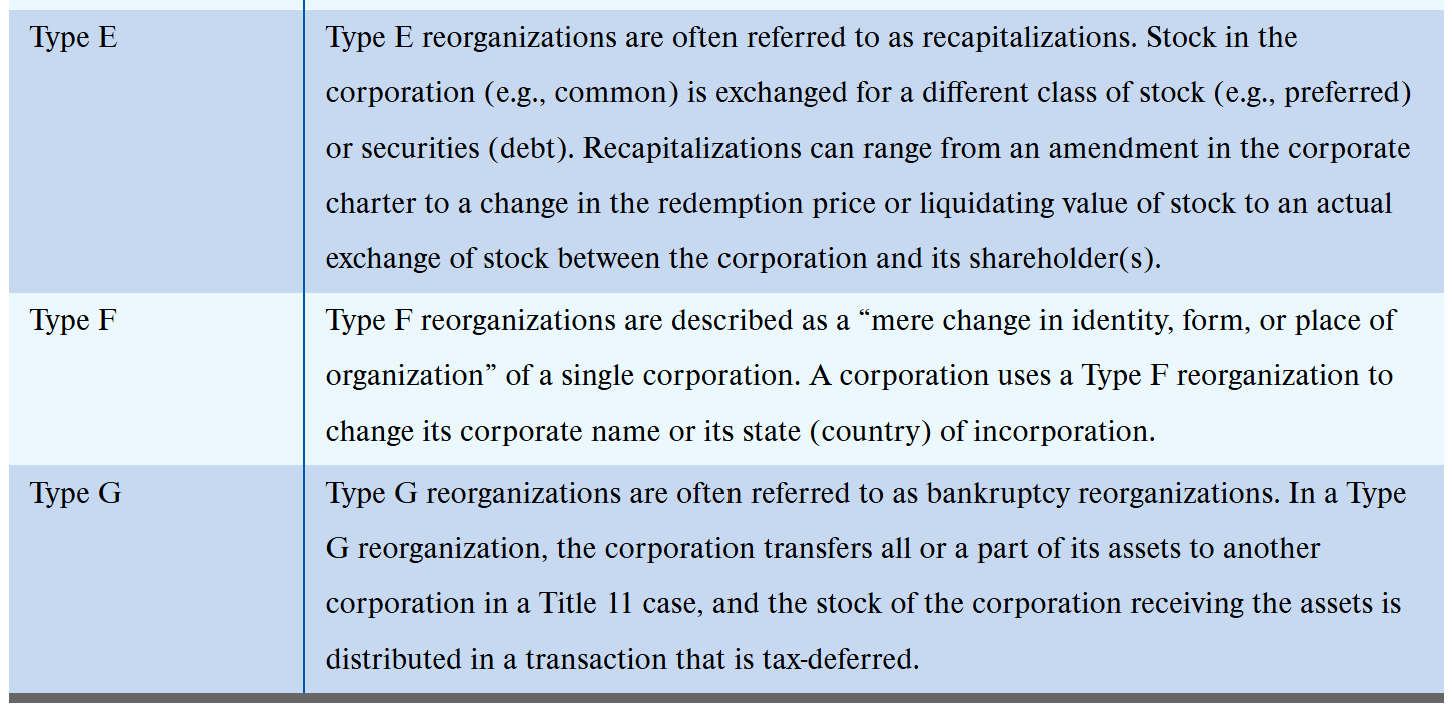

Summary of Tax-Deferred Corporate Reorganizations

Complete Liquidation of a Corporation

A complete liquidation occurs when a corporation redeems all its stock from all its shareholders in exchange for all its net assets, after which the corporation ceases to do business

Files Form 966 (“Corporate Dissolution or Liquidation”) to inform the IRS of its intention to liquidate its tax existence

The form should be filed within 30 days after the board of directors resolve to liquidate the corporation

Tax Consequences to the Shareholders in a Complete Liquidation

Depends on

Shareholder’s identity

Ownership percentage in the corporation

Noncorporate shareholders receiving liquidating distributions have a taxable transaction

Shareholders treat the property received as “full payment in exchange for the stock” transferred

A noncorporate shareholder computes capital gain or loss by subtracting the stock’s tax basis from the money and FMV of property received in return

Shareholder’s tax basis in the property received equals the property’s FMV

Debt assumed by the shareholder reduces the (net) FMV of property received

FMV of the property cannot be less than the debt assumed by the shareholder (IRC §336 (b))

Exception: corporate shareholders owning ≥ 80% of the stock of the liquidating corporation do not recognize gain or loss on the receipt of liquidating distributions

This nonrecognition treatment is mandatory

The tax basis in the property transferred carries over to the recipient, which allows a group of corporations under common control to reorganize their organizational structure without tax consequences (gains)

Tax Consequences to the Liquidating Corporation in a Complete Liquidation

As a general rule, a liquidating corporation recognizes all gains and certain losses on taxable distributions of property to shareholders

However, certain losses on liquidating distributions to related parties and losses on built-in loss properties are not deductible by the liquidating corporation

Liquidating Distributions of Loss Property

Liquidating corporation does not recognize loss if the property is distributed to a related party and either:

Distribution is non-pro rata (to the related person), OR

The asset distributed is disqualified property

A distribution of loss property is non–pro rata unless the related person only receives in the distribution an interest in the loss property equal to the related party’s ownership interest

A related person is defined as a shareholder who owns > 50% of the value of the stock in the liquidating corporation

Disqualified property is property acquired within 5 years of the date of distribution in a tax-deferred §351 transaction or as a nontaxable contribution to capital

A second loss disallowance rule potentially applies to property with built-in losses (value less than adjusted basis) that were acquired by the corporation in a §351 transaction or as a contribution to capital

Loss on the complete liquidation of such property is not recognized if the property distributed was acquired in a §351 transaction or as a contribution to capital, and a principal purpose of the contribution was to recognize a loss by the liquidating corporation

This rule prevents a built-in loss existing at the time of the distribution from being recognized by treating the basis of the property distributed as being its FMV at the time it was contributed to the corporation

This provision is designed as an anti-stuffing provision to prevent shareholders from contributing property with built-in losses to a corporation shortly before a liquidation to offset gain property distributed in the liquidation

Nontaxable Liquidating Distributions: Liquidating Distributions by a Controlled Subsidiary

The liquidating corporation does not recognize gain or loss on distributions of property to an 80% corporate shareholder (parent)

If the parent corporation receives tax deferral in the liquidation, the liquidating corporation cannot recognize any loss, even on distributions to shareholders who receive taxable distributions

Liquidation-related expenses, including the cost of preparing and effectuating a plan of complete liquidation, are deductible by the liquidating corporation on its final Form 1120

Deferred or capitalized expenditures such as organizational expenditures also are deductible on the final tax return