Formulas and Calculations

1/127

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

128 Terms

Chapter 1

What is the formula for calculating taxable trading profit?

You are given:

Accounting profit = £100,000

Income exempt from tax = £5,000

Disallowable expenses = £3,000

Accounting depreciation = £4,000

Capital allowances (tax depreciation) = £6,000

Taxable Trading Profit =

Accounting Profit

– Income exempt or taxed elsewhere

Disallowable expenses

Accounting depreciation

– Tax depreciation (capital allowances)

Example:

Accounting profit = £100,000

Exempt income = £5,000

Disallowable expenses = £3,000

Accounting depreciation = £4,000

Capital allowances = £6,000

Taxable trading profit = 100,000 – 5,000 + 3,000 + 4,000 – 6,000 = £96,000

What is the formula for calculating capital gains (chargeable gain)?

What is the formula for calculating a chargeable capital gain?

You are given:

Sale proceeds = £150,000

Selling costs = £5,000

Original cost = £90,000

Purchase costs = £2,000

Enhancement costs = £10,000

Indexation allowance = £3,000

Chargeable Gain =

Proceeds

– Selling costs

– Original cost

– Purchase costs

– Enhancement costs

– Indexation allowance

Example:

Sale proceeds = £150,000

Selling costs = £5,000

Original cost = £90,000

Purchase costs = £2,000

Enhancement = £10,000

Indexation = £3,000

Chargeable gain = 150,000 – 5,000 – 90,000 – 2,000 – 10,000 – 3,000 = £40,000

What is the formula for calculating VAT when the price is exclusive of VAT?

You are given:

Net price = £100

VAT rate = 20%

VAT = Net Price × VAT Rate

Gross Price = Net Price × (1 + VAT Rate)

Example (20% VAT):

Net price = £100

VAT = 100 × 20% = £20

Gross price = 100 + 20 = £120

What is the formula for calculating VAT when the price is inclusive of VAT?

What is the formula for calculating VAT when the price is inclusive of VAT?

You are given:

Gross price = £120

VAT rate = 20%

VAT = (Gross Price × VAT Rate) ÷ (100 + VAT Rate)

Example (20% VAT):

Gross price = £120

VAT = (120 × 20) ÷ 120 = £20

Net price = 120 – 20 = £100

What is the formula for calculating VAT payable or reclaimable?

You are given:

Output VAT = £1,000

Input VAT = £600

VAT Payable = Output VAT – Input VAT

If Output VAT > Input VAT → you owe HMRC

If Input VAT > Output VAT → you reclaim from HMRC

Example 1 (Payable):

Output VAT = £1,000

Input VAT = £600

VAT payable = 1,000 – 600 = £400

Example 2 (Reclaim):

Output VAT = £800

Input VAT = £1,000

Reclaim = 1,000 – 800 = £200

What is the formula for calculating taxable income for employees?

You are given:

Salary = £40,000

Bonus = £2,000

Commission = £1,500

Benefits = £1,000

Subscriptions = £300

Pension contributions = £2,500

Charity donations = £200

Personal allowance = £12,570

Taxable Income =

Salary

Bonus, Commission, Benefits

– Subscriptions (approved)

– Pension contributions

– Charity donations

– Personal allowance

Example:

Salary = £40,000

Bonus = £2,000

Commission = £1,500

Benefits = £1,000

Subscriptions = £300

Pension = £2,500

Donations = £200

Personal allowance = £12,570

Taxable income = 40,000 + 2,000 + 1,500 + 1,000 – 300 – 2,500 – 200 – 12,570 = £28,930

How do the VAT Payments on Account (PoA) work for large businesses?

You are given:

Expected VAT per quarter = £60,000

Interim payment in month 2 = £30,000

Interim payment in month 3 = £30,000

Actual VAT due = £62,000

Make:

2 interim monthly payments (months 2 & 3)

1 balancing payment when submitting the VAT return

Based on previous VAT return averages

Applies if annual VAT liability > £2.3 million

Example:

Expected VAT per quarter = £60,000

Feb interim = £30,000

Mar interim = £30,000

Actual VAT = £62,000

Balancing payment = 62,000 – 60,000 = £2,000

Chapter 2

How do you calculate a balancing allowance for tax purposes?

Given: TWDV = £2,000, Sale proceeds = £1,000

Balancing Allowance = Tax Written Down Value (TWDV) – Sale Proceeds

Example:

Asset cost = £10,000

Capital allowances claimed = £8,000

TWDV = £2,000

Sale proceeds = £1,000

Balancing Allowance = £2,000 – £1,000 = £1,000

How do you calculate a balancing charge for tax purposes?

Given: TWDV = £1,000, Sale proceeds = £2,000

Balancing Charge = Sale Proceeds – Tax Written Down Value (TWDV)

Example:

Asset cost = £10,000

Capital allowances claimed = £9,000

TWDV = £1,000

Sale proceeds = £2,000

Balancing Charge = £2,000 – £1,000 = £1,000

What is the formula to adjust accounting profit to taxable profit?

Given:

Accounting profit = £100,000

Disallowable expenses = £5,000

Depreciation = £8,000

Accounting loss on disposal = £2,000

Accounting profit on disposal = £3,000

Capital allowances = £10,000

Balancing allowance = £1,000

Balancing charge = £2,000**

Taxable Profit =

Accounting Profit

Disallowable Expenses

Depreciation

Accounting Loss on Disposal

– Accounting Profit on Disposal

– Capital Allowances

– Balancing AllowanceBalancing Charge

🧾 Example: Taxable Profit Calculation 📘 Accounting Info:

Accounting profit: £100,000

Disallowable expenses: £5,000 (e.g. client entertainment)

Depreciation: £8,000

Accounting loss on disposal of asset: £2,000

Accounting profit on disposal of another asset: £3,000

Capital allowances claimed: £10,000

Balancing allowance: £1,000

Balancing charge: £2,000

📊 Step-by-step using the formula:

Taxable Profit =

= £100,000

£5,000 (disallowable expenses)

£8,000 (add back depreciation)

£2,000 (add back accounting loss on disposal)

– £3,000 (remove accounting profit on disposal)

– £10,000 (capital allowances)

– £1,000 (balancing allowance)£2,000 (balancing charge)

✅ Final Taxable Profit:

= £103,000

How do you calculate a capital gain for tax purposes?

Given:

Sale proceeds = £50,000

Selling costs = £2,000

Purchase cost = £30,000

Purchase costs = £2,000

Enhancement = £3,000

Indexation = £1,000**

Capital Gain = Net Sale Proceeds – (Original Cost + Costs of Purchase + Enhancement Costs + Indexation Allowance)

Example:

Sale proceeds = £50,000

Selling costs = £2,000 → Net proceeds = £48,000

Purchase cost = £30,000

Purchase costs = £2,000

Enhancement = £3,000

Indexation = £1,000

Capital Gain = £48,000 – (30,000 + 2,000 + 3,000 + 1,000) = £12,000

How is indexation allowance calculated?

Given: Original cost = £10,000, Indexation factor = 0.25

Indexation Allowance = Original Cost × Indexation Factor

Example:

Original cost = £10,000

Indexation factor = 0.25

Indexation allowance = £10,000 × 0.25 = £2,500

How do you calculate taxable capital gain when rollover relief is used and the replacement asset is later sold?

Given:

Deferred gain from old asset = £20,000

New asset bought for = £100,000

Sold 20 years later for = £120,000**

Final Taxable Gain = Sale Price – (Original Cost of Replacement – Deferred Gain)

Example:

Deferred gain from old asset = £20,000

New asset bought for £100,000

Tax base = £100,000 – £20,000 = £80,000

New asset sold for £120,000

Gain = £120,000 – £80,000 = £40,000 (includes deferred + new gain)

Chapter 3

What is the formula for calculating underlying tax on a dividend received from a foreign subsidiary?

Also explain what it represents.

Given:

Tax on profits = £250

Profit after tax = £750

Gross dividend = £750

Underlying Tax Formula

Underlying Tax = (Tax on Profits / Profit After Tax) × Gross Dividend

Example:

Profit before tax = £1,000

Tax on profits = £250

Profit after tax = £750

Gross dividend = £750

Underlying Tax = (250 / 750) × 750 = £250

So, £250 of the dividend represents underlying tax already paid by the foreign subsidiary.

How is withholding tax applied to cross-border payments such as dividends or interest?

Given:

Gross payment (e.g. royalty) = £1,000

Withholding tax rate = 10%

Example:

UK company pays £1,000 dividend to an Indian company

UK imposes 10% withholding tax

Tax withheld = £100

Net payment = £900 (that’s what the Indian company receives)

What’s the adjustment required for transfer pricing of goods and services when the transaction is not at arm’s length?

Given:

Actual transfer price = £5/unit

Arm’s length price = £10/unit

Quantity = 10,000

UK tax rate = 20%

Adjustment: Increase taxable profit to what it would’ve been at market rate.

Example:

Actual transfer price: £5/unit × 10,000 = £50,000

Arm’s length price: £10/unit × 10,000 = £100,000

Difference = £50,000 → Add to taxable profits

If tax rate = 20% → Additional tax = £10,000

How is thin capitalisation adjusted when a loan to a related company is not at arm’s length?

Given:

Interest paid = £1,500,000

Arm’s length interest = £300,000

UK tax rate = 20%

Adjustment: Disallow excessive interest not on commercial terms.

Example:

Loan: £10m at 15% interest = £1.5m interest

Arm’s length: £5m at 6% = £300k interest

Excess = £1.2m → Disallowed

If tax rate = 20% → Additional tax = £240,000

What are the 3 methods of double taxation relief and how do they affect tax?

How is tax calculated under the Tax Credit method of Double Tax Relief?

Given:

Foreign tax paid = £80

UK tax on same income = £100

How is tax calculated under the Deduction method of Double Tax Relief?

Given:

Foreign income = £1,000

Foreign tax = £200

UK tax rate = 20%

Exemption

Income excluded from local tax.

Example: Dividend from foreign PE is ignored → no local tax.

Tax Credit

Foreign tax is credited against local tax.

Example:

Foreign tax = £80, UK tax = £100

Credit = £80 → Pay £20 more in UK

Deduction

Foreign tax deducted from income before tax is calculated.

Example:

Foreign income = £1,000, tax = £200

UK tax on £800 @ 20% = £160

Total tax = £360

Chapter 7

What is the formula for calculating the historical cost of an asset and how is it used in financial reporting?

Asset purchased for £50,000 with £1,000 installation cost.

Formula:

Historical Cost = Purchase Price + Transaction Costs

Example:

Machine purchased for £50,000 + £1,000 installation = £51,000 (this value is recorded on the balance sheet).

How do you calculate the historical cost of a liability?

Loan received is £100,000 with £2,000 in transaction fees.

Formula:

Historical Cost of Liability = Amount Received – Transaction Costs

Example:

Loan received: £100,000; fees: £2,000

Historical cost = £100,000 – £2,000 = £98,000

What is the formula for calculating fair value of an asset or liability?

Investment property could be sold today for £120,000.

Formula:

Fair Value = Price in an orderly transaction between market participants at the measurement date

Example:

If market value of an investment property is £120,000 on 31 Dec 20X1, then

Fair value = £120,000

How is value in use calculated, and what does it represent?

Example: Asset generates £6,000/year for 5 years; discount rate = 10%

Formula:

Value in Use = Present Value of Future Net Cash Flows

Example:

Future cash flows expected: £6,000/year for 5 years

Discount rate = 10%

Present value ≈ £6,000 × 3.79 = £22,740

✅ Formula

Value in Use = Present Value of Future Net Cash Flows

= Annual Cash Flow × Present Value Interest Factor (PVIF)

🔢 Step-by-Step Example

Scenario:

An asset is expected to generate £6,000 per year for 5 years

Discount rate = 10%

Step 1: Identify the cash flows

Annual cash flow = £6,000

Period = 5 years

Step 2: Choose the appropriate discount rate

Discount rate = 10%

Step 3: Get the Present Value Interest Factor (PVIF)

Use the PVIF for an ordinary annuity from standard PV tables (or a calculator):

For 10% over 5 years:

PVIF = 3.7908

This means that £1 received annually over 5 years at 10% is worth £3.7908 today.

Step 4: Multiply Value in Use=£6,000×3.7908=£22,744.80\text{Value in Use} = £6,000 × 3.7908 = £22,744.80Value in Use=£6,000×3.7908=£22,744.80

(Rounded earlier to £22,740 for simplicity)

✅ Final Answer:

Value in Use ≈ £22,744.80

What is the formula for calculating fulfilment value of a liability?

Example: £10,000 paid per year for 2 years; discount rate = 8%

Formula:

Fulfilment Value = Present Value of Expected Outflows to Settle the Liability

Example:

Expected payments: £10,000 per year for 2 years

Discount rate = 8%

PV ≈ £10,000 × (0.9259 + 0.8573) ≈ £17,833

✅ Formula

Fulfilment Value = Present Value of Expected Outflows to Settle the Liability

= Cash Outflow × Present Value Interest Factor (PVIF) for each period

🔢 Step-by-Step Example

Scenario:

Expected payments = £10,000/year for 2 years

Discount rate = 8%

Step 1: Identify the cash flows and time period

Cash outflow = £10,000 per year

Time = 2 years

Discount rate = 8%

Step 2: Find the PVIF for each year

From standard present value tables (or a calculator), we get:

Year 1 PVIF @ 8% = 0.9259

Year 2 PVIF @ 8% = 0.8573

Step 3: Multiply each year's payment by its PVIF Year 1 PV=£10,000×0.9259=£9,259Year 2 PV=£10,000×0.8573=£8,573\text{Year 1 PV} = £10,000 × 0.9259 = £9,259 \text{Year 2 PV} = £10,000 × 0.8573 = £8,573Year 1 PV=£10,000×0.9259=£9,259Year 2 PV=£10,000×0.8573=£8,573

Step 4: Add the present values together Fulfilment Value=£9,259+£8,573=£17,832\text{Fulfilment Value} = £9,259 + £8,573 = £17,832 Fulfilment Value=£9,259+£8,573=£17,832

(Rounded in the previous message to £17,833)

✅ Final Answer:

Fulfilment Value ≈ £17,832

What is the formula for current cost of an asset and how is it used?

Example: Replacement cost today is £55,000; delivery cost is £500.

Formula:

Current Cost = Cost to replace the asset at measurement date + related transaction costs

Example:

Replacing a machine today costs £55,000 + £500 delivery

Current Cost = £55,500

What is the formula for calculating profit using Physical Capital Maintenance (PCM)?

Example: Opening capital = £2,000, asset price increased by 7.5%, closing capital = £2,200

Formula:

Profit = Closing Capital – Adjusted Opening Capital

Adjusted Opening Capital = Opening Capital × (1 + Specific Price Change %)

Example:

Opening capital = £2,000

Specific price increase = 7.5% → 2,000 × 1.075 = £2,150

Closing capital = £2,200

Profit = £2,200 – £2,150 = £50

How do you calculate profit under Financial Capital Maintenance (FCM) using inflation?

Example: Opening capital = £2,000, inflation = 5%, closing capital = £2,200

Adjusted Opening Capital = Opening Capital × (1 + General Inflation Rate)

Profit = Closing Capital – Adjusted Opening Capital

Example:

Opening capital = £2,000

Inflation = 5% → 2,000 × 1.05 = £2,100

Closing capital = £2,200

Profit = £2,200 – £2,100 = £100

Chapter 8

What is the accounting equation used in the SOFP?

Given assets of £250,000 and liabilities of £90,000, calculate equity.

Formula:

Assets = Equity + Liabilities

Example:

If assets = £250,000 and liabilities = £90,000,

Equity = £250,000 − £90,000 = £160,000

How is total equity calculated in the SOFP?

Formula:

Total Equity = Share Capital + Share Premium + Revaluation Surplus + Retained Earnings

Example:

Share Capital = £50,000

Share Premium = £20,000

Revaluation Surplus = £15,000

Retained Earnings = £100,000

Total Equity = £185,000

How is total comprehensive income calculated?

Given profit = £40,000 and revaluation gain = £10,000.

Formula:

Total Comprehensive Income = Profit or Loss + Other Comprehensive Income (OCI)

Example:

Profit for the year = £40,000

OCI (revaluation gain) = £10,000

Total Comprehensive Income = £50,000

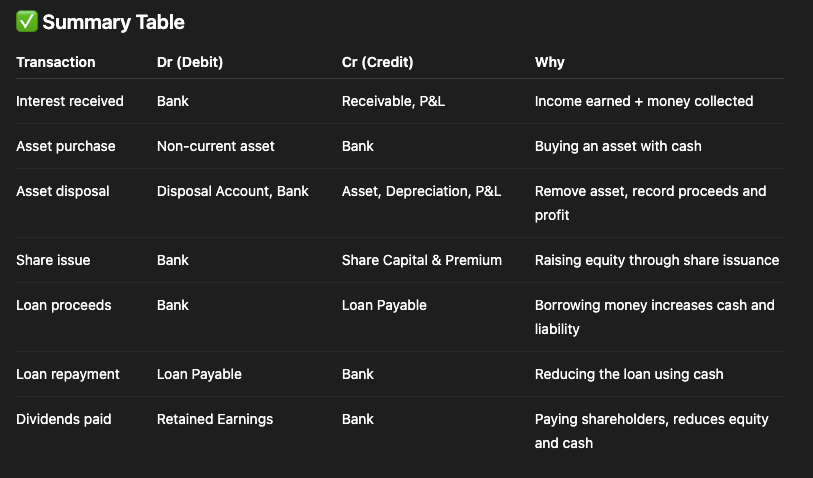

What is the journal entry for issuing shares above nominal value?

1,000 shares issued at £3 each, nominal value £1.

Formula/Entry:

Dr Cash/Bank

Cr Share Capital (nominal value)

Cr Share Premium (excess over nominal)

Example:

Issued 1,000 shares at £3, nominal value £1:

Dr Bank £3,000

Cr Share Capital £1,000

Cr Share Premium £2,000

What is the journal entry for paying an ordinary dividend in cash of £5000?

Formula/Entry:

Dr Retained Earnings

Cr Cash/Bank

Example:

Dividend paid = £5,000

Dr Retained Earnings £5,000

Cr Bank £5,000

What is the journal entry if a dividend is declared but not yet paid (£3000)

Formula/Entry:

Dr Retained Earnings

Cr Dividend Payable

Example:

Dividend declared = £3,000

Dr Retained Earnings £3,000

Cr Dividend Payable £3,000

What is the journal entry for preference dividends when treated as equity and paid immediately (£2000)

Formula/Entry:

Dr Retained Earnings

Cr Cash/Bank

Example:

Preference dividend = £2,000

Dr Retained Earnings £2,000

Cr Cash £2,000

What is the journal entry for preference dividends when treated as a liability and unpaid at year-end (£1500)

Formula/Entry:

Dr Finance Cost

Cr Accruals

Example:

Preference dividend = £1,500

Dr Finance Cost £1,500

Cr Accruals £1,500

How do you split lease liabilities in the SOFP?

Formula:

Total Lease Liability = Current Portion + Non-current Portion

Example:

Lease liability = £100,000

Due next year = £20,000 (current)

Due after = £80,000 (non-current)

What is the formula for closing retained earnings?

Opening = £80,000

Profit = £25,000

Dividends = £5,000

Formula:

Closing Retained Earnings = Opening Retained Earnings + Profit − Dividends

Example:

Opening = £80,000

Profit = £25,000

Dividends = £5,000

Closing Retained Earnings = £100,000

Chapter 9

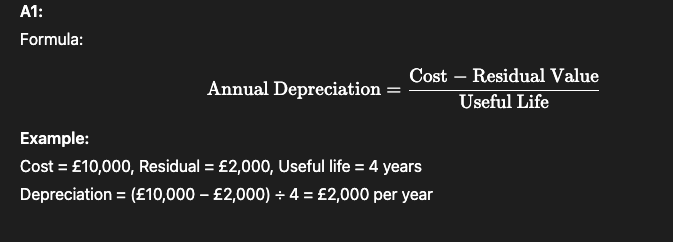

What is the formula for Depreciation using the straight-line method?

Data: Cost = £10,000, Residual value = £2,000, Useful life = 4 years

When do you use it?

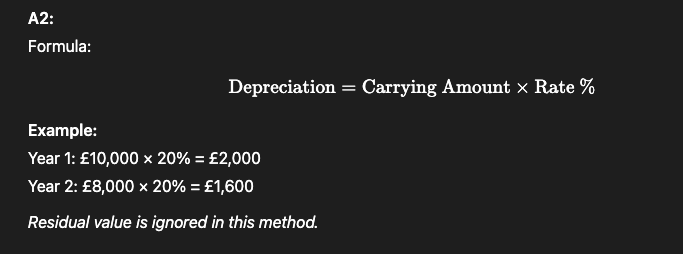

How do you calculate depreciation using the reducing balance method?

Data: Initial carrying amount = £10,000, Depreciation rate = 20%

When is residual value ignored?

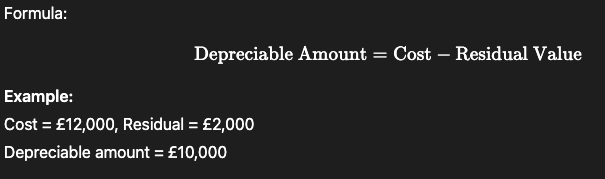

How do you calculate the depreciable amount of an asset?

Data: Cost = £12,000, Residual value = £2,000

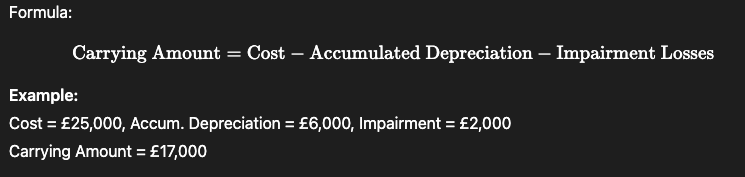

How do you calculate Carrying Amount of an asset?

Data: Cost = £25,000, Accumulated depreciation = £6,000, Impairment = £2,000

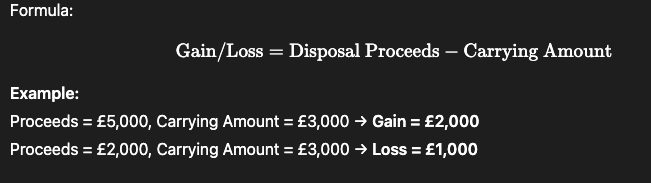

How do you calculate Gain or Loss on Disposal?

Data: Disposal proceeds = £5,000, Carrying amount = £3,000

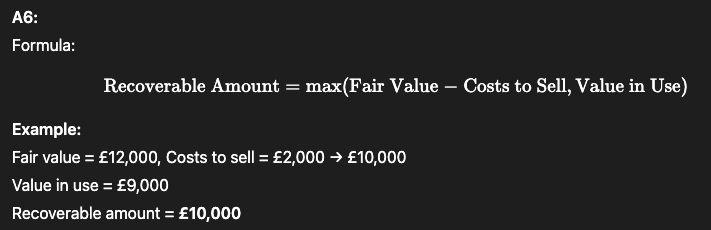

How do you calculate Recoverable Amount of an asset?

Data: Fair value = £12,000, Costs to sell = £2,000, Value in use = £9,000

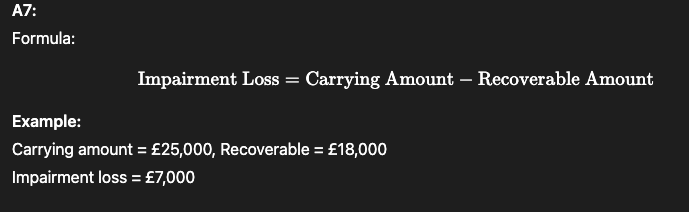

How do you calculate an impairment loss?

Data: Carrying amount = £25,000, Recoverable amount = £18,000

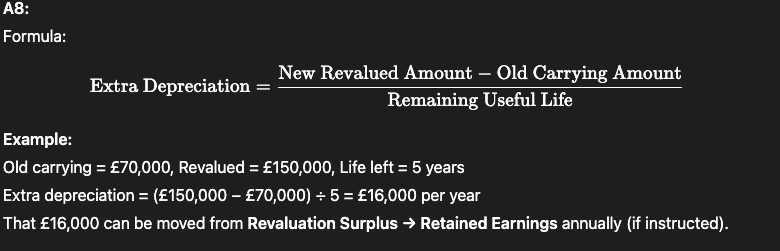

How do you calculate the increase in depreciation after an upward revaluation?

Old carrying amount = £70,000, Revalued amount = £150,000, Remaining life = 5 years

What can be transferred to retained earnings annually?

Extra depreciation = revalued amount-old carrying amount/remaining useful life

🔹 Step 1: Understand the revaluation What’s happening?

The asset was previously worth £70,000, and now it’s been revalued to £150,000.

This is a £80,000 increase in value, but it’s unrealised (you haven’t sold the asset), so it goes into a special equity account called:

Revaluation Surplus

No gain is recognised in profit.

🔹 Step 2: Realise that the asset now has a higher value — so depreciation increases

Because you're now saying the asset is worth more, you need to depreciate more each year.

You are spreading the new, higher value across the remaining life of the asset.

🔹 Step 3: Apply the formula for extra depreciation

We calculate how much additional depreciation results only because of the revaluation:

Extra Depreciation=150,000−70,0005=£16,000 per year\text{Extra Depreciation} = \frac{150,000 − 70,000}{5} = £16,000 \text{ per year}Extra Depreciation=5150,000−70,000=£16,000 per year

So depreciation increases by £16,000 per year.

🔹 Step 4: Why is this not charged to the Profit or Loss (P&L)?

If we charged this extra depreciation to profit, we’d be reducing current year profit —

→ but we never increased profit when the asset went up in value.

That would be unfair.

That £80,000 gain was locked away in Revaluation Surplus, not P&L.

So we don’t reduce profit — instead, we release £16,000/year from Revaluation Surplus into Retained Earnings.

🔹 Step 5: Record the transfer

Journal Entry (annually, if instructed):

nginxCopyEdit

Dr Revaluation Surplus £16,000 Cr Retained Earnings £16,000

This shows: “I’m using up part of the revalued gain now that the asset is being depreciated.”

It's a movement within equity, not an income or expense.

🔹 Step 6: What’s the impact?

Asset’s value is still decreasing through depreciation (like normal)

Revaluation Surplus decreases a little each year

Retained Earnings increases a little each year

Profit stays accurate and isn’t impacted by revaluation effects

✅ Summary of Logic:

Action | Why It Happens |

|---|---|

Revalue asset to £150k | Asset is now worth more — show this on the SOFP |

Depreciation increases | Higher value = higher usage cost over time |

Extra depreciation NOT in P&L | Because revaluation gain wasn’t in P&L either |

Release £16k/year to retained earnings | Recognise that some of the gain is now "earned" |

When an asset is revalued upwards, it creates a revaluation surplus (equity). Over time, this increases depreciation. To prevent that higher depreciation from reducing annual profits (since the gain was never in profit), we subtract the extra depreciation from the revaluation surplus instead. Each year, we move that amount into retained earnings. This reflects that we’ve now “used up” part of the gain, without affecting current profit.

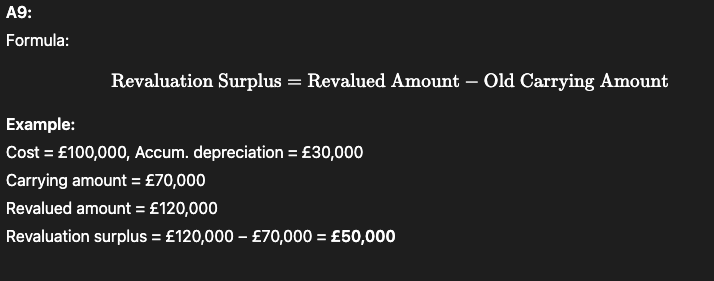

When an asset is revalued upwards, how is the revaluation surplus calculated?

Data: Revalued amount = £120,000, Carrying amount = £70,000

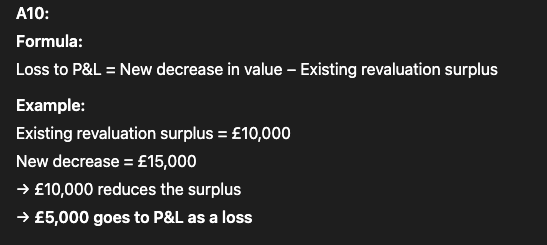

In a downward revaluation (after upward one), how much goes to P&L?

Data: Revaluation surplus = £10,000, New revaluation loss = £15,000

✅ Step-by-Step Logic:

The asset has dropped in value again by £15,000.

You are allowed to offset this against the existing revaluation surplus.

The surplus can only absorb £10,000 of the drop.

The remaining £5,000 is treated as a loss in the P&L.

What is the rule for releasing a revaluation surplus on disposal?

A11:

You transfer the entire revaluation surplus related to that asset to Retained Earnings:

Example Entry:

Dr Revaluation Surplus

Cr Retained Earnings

This appears in SOCIE, not in profit or loss.

Chapter 10

What is the formula for revaluation increase (surplus) when an asset under the revaluation model increases in value before being classified as held for sale?

Data:

Carrying amount = $10,000

Fair value = $12,000

Formula:

Revaluation Increase = Fair Value − Carrying Amount

Worked Example:

Fair Value = $12,000

Carrying Amount = $10,000

Revaluation Increase = $12,000 − $10,000 = $2,000

Dr PPE $2,000

Cr Revaluation Surplus $2,000

What is the formula to determine the carrying amount after revaluation, before classifying an asset as held for sale?

Data:

Original carrying amount = $10,000

Revaluation surplus = $2,000

A:

Formula:

Revised Carrying Amount = Original Carrying Amount + Revaluation Surplus

Worked Example:

Original Carrying Amount = $10,000

Revaluation Surplus = $2,000

Revised Carrying Amount = $10,000 + $2,000 = $12,000

🧠 Is the revised carrying amount equal to fair value?

✅ Yes — but only if you’re using the revaluation model under IAS 16.

Here’s how it works:

📘 Under the Revaluation Model (IAS 16):

When an asset is revalued:

🔹 Revised carrying amount = Fair Value at the date of revaluation

So in your example:

The asset had a carrying amount of $10,000

You revalue it to fair value of $12,000

The new carrying amount becomes $12,000

🧾 This is reflected by:

nginxCopyEdit

Dr PPE $2,000 Cr Revaluation Surplus $2,000

❗Important Caveat:

This applies only if you're using the revaluation model.

If you were using the cost model, you wouldn't update the carrying amount to fair value — you'd just stick with original cost minus depreciation.

🔁 Then What?

Once the asset is reclassified as "held for sale" (IFRS 5), you:

Stop depreciating

Measure at lower of:

Carrying amount (which, after revaluation, is fair value)

FVLCTS (Fair value less costs to sell)

So yes — right before classification as held for sale, revised carrying amount = fair value if you're using the revaluation model.

Would you like a quick visual cheat sheet or flowchart for this?

How do you calculate the fair value less costs to sell (FVLCTS) when classifying an asset as held for sale?

Data:

Fair value = $12,000

Costs to sell = $3,000

How are non-current assets held for sale measured?

A:

Formula:

FVLCTS = Fair Value − Costs to Sell

Worked Example:

Fair Value = $12,000

Costs to Sell = $3,000

FVLCTS = $12,000 − $3,000 = $9,000

🔵 Topic: Classification of an Asset as "Held for Sale" (IFRS 5)

When you classify a non-current asset as “held for sale,” this affects two key things:

1. 📏 Measurement 2. 📋 Classification

Let’s walk through each.

✅ 1. MEASUREMENT

When an asset becomes “held for sale,” you stop accounting for it under its usual standard (like IAS 16 for PPE), and instead follow IFRS 5.

🧠 Key Rule:

✔ You must measure the asset at the lower of:

Its carrying amount (book value on the balance sheet)

Its fair value less costs of disposal (i.e. what you’d actually get after selling it)

This is shown visually in the diagram.

Example:

Carrying amount = $12,000

Fair value = $11,000

Costs to sell = $1,500

Fair value less costs = $9,500

Since $9,500 < $12,000, you write the asset down to $9,500

→ The difference is an impairment, which goes to the income statement (SPL)

❌ No Depreciation Anymore

Once the asset is “held for sale” → depreciation stops.

Until that point, you continue depreciating as normal under IAS 16 (for PPE).

✅ 2. PRESENTATION & CLASSIFICATION

Once the asset is “held for sale,” it moves to a new category in your financial statements:

🔷 It is shown as a separate line under current assets

(even though it was a non-current asset before, like PPE or investment property)

This helps users of the accounts clearly see which assets are intended for disposal.

💡 Summary Cheat Sheet:

Concept | What Happens |

|---|---|

Measurement | Value at lower of carrying amount or FVLCTS |

Depreciation | Stops once classified as held for sale |

Impairment | If FVLCTS < carrying amount, record impairment in SPL |

Presentation | Move from non-current to current asset category |

What is the impairment loss formula when revalued assets are written down to fair value less costs to sell under IFRS 5?

Data:

Carrying amount after revaluation = $12,000

FVLCTS = $9,000

Formula:

Impairment Loss = Carrying Amount after Revaluation − FVLCTS

Worked Example:

Carrying Amount after Revaluation = $12,000

FVLCTS = $9,000

Impairment Loss = $12,000 − $9,000 = $3,000

Dr Profit or Loss $3,000

What are the journal entries to transfer a revalued asset to "Held for Sale" at fair value less costs to sell, including impairment?

Original carrying amount = $12,000

Revalued up to fair value = $12,000

Costs to sell = $3,000

Entries (based on the example):

Dr Held for Sale Asset $9,000

Dr Profit or Loss (Impairment) $3,000

Cr PPE $12,000

🔹 1. Dr Held for Sale Asset $9,000

Type: Asset (current asset)

DEAD: A = Asset → DEBIT to increase

📌 You're bringing in a new asset (the reclassified asset held for sale), so you debit it to increase it.

🔹 2. Dr Profit or Loss (Impairment) $3,000

Type: Expense (impairment loss)

DEAD: E = Expense → DEBIT to increase

📌 This is a loss on the asset, so it’s treated as an expense — you debit to reflect the increase in expense (which lowers net income).

🔸 3. Cr PPE $12,000

Type: Asset (non-current)

DEAD: A = Asset → CREDIT to decrease

📌 You’re removing the PPE from the balance sheet, so you credit to reduce the PPE asset.

What happens to the revaluation surplus when the asset is disposed of?

Action:

The Revaluation Surplus is transferred to Retained Earnings upon disposal of the asset.

How are non-current assets held for sale measured?

Formula:

Value at lower of:

Carrying Amount

Fair Value less Costs of Disposal (i.e. selling costs)

If FVLCTS < Carrying Amount → Impairment is charged to profit or loss

Chapter 11

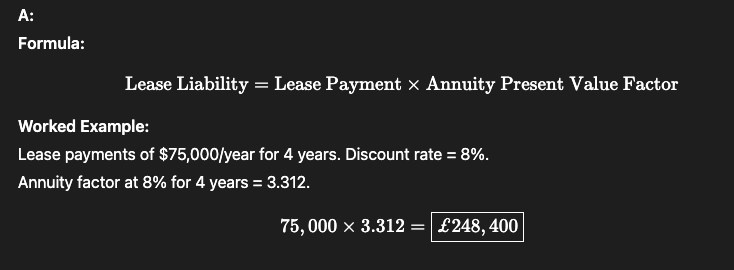

How do you calculate the lease liability at the start of a lease? What payments are included?

Lease payments: $75,000 per year

Term: 4 years (1st payment already made, so 4 payments remain)

Discount rate: 8%

Payments made in arrears (end of each year)

Present Value (Lease Liability) – Summary Workings

Scenario:

Lease payments: $75,000 per year

Term: 4 years (1st payment already made, so 4 payments remain)

Discount rate: 8%

Payments made in arrears (end of each year)

Step 1: Use the present value of annuity formula

PV = Payment × [(1 − (1 + r)^−n) / r]

Step 2: Plug in values

= 75,000 × [(1 − (1.08)^−4) / 0.08]

= 75,000 × [0.265 / 0.08]

= 75,000 × 3.312

Step 3: Calculate

Lease liability = $248,400

This is the present value of the future lease payments and represents the initial lease liability under IFRS 16.

![<p><strong>Present Value (Lease Liability) – Summary Workings</strong></p><p>Scenario:</p><ul><li><p>Lease payments: $75,000 per year</p></li><li><p>Term: 4 years (1st payment already made, so 4 payments remain)</p></li><li><p>Discount rate: 8%</p></li><li><p>Payments made in arrears (end of each year)</p></li></ul><p>Step 1: Use the present value of annuity formula<br>PV = Payment × [(1 − (1 + r)^−n) / r]</p><p>Step 2: Plug in values<br>= 75,000 × [(1 − (1.08)^−4) / 0.08]<br>= 75,000 × [0.265 / 0.08]<br>= 75,000 × 3.312</p><p>Step 3: Calculate<br>Lease liability = $248,400</p><p>This is the present value of the future lease payments and represents the initial lease liability under IFRS 16.</p>](https://knowt-user-attachments.s3.amazonaws.com/ae068145-be66-49c0-acb2-c2d1f3782f83.png)

How do you calculate the lease liability using a discount factor or annuity table?

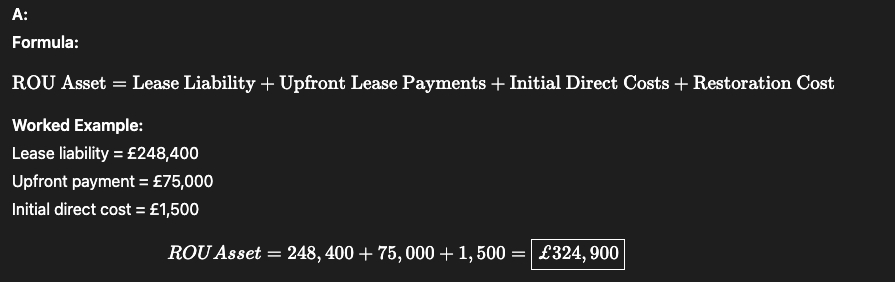

How do you calculate the right-of-use (ROU) asset at lease commencement?

Data: Lease liability = $248,400; initial lease payment = $75,000 (paid in advance); initial direct cost = $1,500

How do you calculate initial recognition?

What is subsequent measurement and how is it calculated for both the lease liability and ROU? use same data as before.

What are the rules for depreciation?

Answer:

At lease commencement, the lessee must recognise:

Lease Liability – measured at the present value of unpaid future lease payments, discounted using the implicit rate (or incremental borrowing rate if unknown).

Right-of-Use (ROU) Asset – measured at:

Lease liability

Lease payments made at or before commencement

Initial direct costs

Estimated dismantling/restoration costs (if applicable)

Subsequent measurement

A. Lease Liability

After initial recognition, the lease liability is:

Increased by interest (unwinding of the discount)

Decreased by lease payments made

Key Formulas:

Interest = Opening Lease Liability × Discount Rate

Principal Repayment = Lease Payment − Interest

Closing Lease Liability = Opening Liability − Principal

Journal Entries:

To record interest:

Dr Finance Cost (P&L)

Cr Lease Liability (SFP)To record lease payment:

Dr Lease Liability

Cr Cash

B. Right-of-Use (ROU) Asset

Measured using the cost model:

ROU Asset = Initial ROU Cost − Accumulated Depreciation − Impairment (if any)

Depreciation Rules:

If ownership transfers at lease end → depreciate over asset's useful life

If ownership does not transfer → depreciate over the shorter of:

Lease term

Asset’s useful life

Depreciation Formula:

Annual Depreciation = ROU Asset ÷ Depreciation Period

Journal Entry:

Dr Depreciation Expense

Cr Accumulated Depreciation

Lease Liability Tables For Payments in Arrears (end of year):

Year | Opening Balance | Interest | Payment | Principal | Closing Balance |

|---|---|---|---|---|---|

1 | X | X | X | X | X |

2 | X | X | X | X | X |

For Payments in Advance (start of year):

Year | Opening Balance | Payment | Subtotal | Interest | Closing Balance |

|---|---|---|---|---|---|

1 | X | (X) | X | X | X |

2 | X | (X) | X | X | X |

📝 Note: For advance payments, year 1’s payment is already made, so it’s excluded from future liability.

Example:

📘 Example Summary (Same as Before)

Lease term: 5 years

Lease payments: $75,000 per year

First payment made on Day 1 (i.e. 1 Dec 20X5) → this is a payment in advance

Discount rate: 8%

PV of remaining 4 payments = $248,400 (→ initial lease liability)

Initial direct cost: $1,500

ROU Asset = 248,400 + 75,000 (first payment) + 1,500 = $324,900

Now let’s work through what happens at the end of Year 1 (31 Dec 20X6).

🔁 Step 1: Lease Liability (Subsequent Measurement)

We use the payments in advance format from the table in your image.

📘 What happens during Year 1:

The first $75,000 payment was made at the start (1 Dec 20X5)

That payment is not part of future payments, so not included in liability at this point

We apply interest on the opening balance of $248,400

🔹 Lease Liability Table (Payments in Advance)

Year | Opening Balance | Payment | Subtotal | Interest (8%) | Closing Balance |

|---|---|---|---|---|---|

1 | $248,400 | (0) | $248,400 | $19,872 | $268,272 |

➡ We haven’t made another payment yet this year (payment is due 1 Dec 20X6), so the liability increases due to interest.

🧾 Journal Entries – Lease Liability (Year 1)

Interest charge:

javaCopyEdit

Dr Finance cost (P&L) 19,872 Cr Lease liability (SFP) 19,872

Payment on 1 Dec 20X6 (Year 2's first day):

nginxCopyEdit

Dr Lease liability 75,000 Cr Cash 75,000

🟩 Step 2: Right-of-Use (ROU) Asset – Depreciation

We use the cost model (initial cost – depreciation – impairment).

📘 Depreciation period?

Ownership does not transfer at lease end

So: Depreciate over shorter of lease term or useful life = 5 years

🔹 Annual Depreciation: 324,900÷5 = 64,980 per year

🧾 Journal Entry – ROU Asset (Depreciation for Year 1)

nginxCopyEdit

Dr Depreciation expense 64,980 Cr Accumulated depreciation 64,980

✅ End of Year 1 Snapshot

Component | Value | Notes |

|---|---|---|

Lease liability | $268,272 | After adding interest |

ROU asset | $324,900 – $64,980 = $259,920 | After 1 year of depreciation |

Profit or loss | $64,980 depreciation + $19,872 interest = $84,852 expense |

✅ End of Year 2 Snapshot (Continuing Sadio’s Example) Recap:

Lease term: 5 years

Annual lease payment: $75,000

Discount rate: 8%

First payment made in advance (1 Dec 20X5)

Lease liability at end of Year 1: $268,272

Second payment made on 1 Dec 20X6 (start of Year 2)

Lease Liability – Year 2:

Opening balance: $268,272

Less: Payment on 1 Dec 20X6: ($75,000)

Subtotal: $193,272

Add: Interest at 8%: $15,462

Closing balance: $208,734

ROU Asset – Year 2:

Opening value (after Year 1): $259,920

Less: Depreciation for Year 2: ($64,980)

Closing value: $194,940

Profit or Loss – Year 2:

Depreciation: $64,980

Interest: $15,462

Total expense in P&L: $80,442

📋 End of Year 2 Summary Table:

Component | Value | Notes |

|---|---|---|

Lease liability | $208,734 | After interest and payment |

ROU asset | $194,940 | After 2 years of depreciation |

Profit or loss | $80,442 | Includes depreciation and interest |

✅ Example: Lease Payments in Arrears (Simple Case)

Let’s walk through a 3-year lease paid in arrears (i.e. at the end of each year).

Scenario:

Lease term: 3 years

Lease payment: $10,000 per year

Discount rate: 5%

Payments made at end of each year

No upfront payments or fees

Initial Recognition:

Calculate the present value of lease payments:

PV = 10,000 / 1.05^1 + 10,000 / 1.05^2 + 10,000 / 1.05^3

= 9,524 + 9,070 + 8,638 = $27,232

Initial lease liability = $27,232

ROU asset = $27,232

Depreciation = $9,077.33 per year

Lease Liability Tables:

Year 1:

Opening: $27,232

Interest: $1,362

Payment: $10,000

Principal: $8,638

Closing: $18,594

Year 2:

Opening: $18,594

Interest: $930

Payment: $10,000

Principal: $9,070

Closing: $9,524

Year 3:

Opening: $9,524

Interest: $476

Payment: $10,000

Principal: $9,524

Closing: $0

Summary:

Lease liability reduces to zero over 3 years

Interest is expensed each year

Lease payments made at the end of each year

Depreciation = $9,077.33 per year

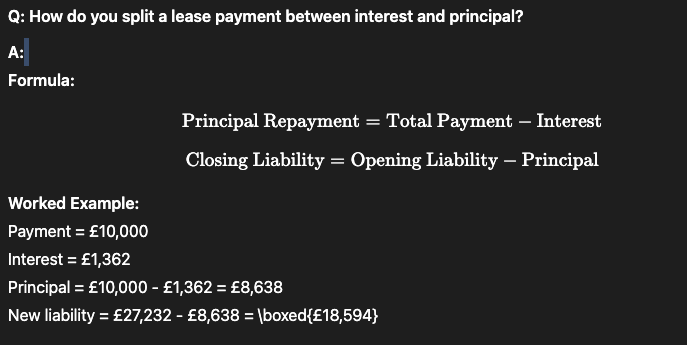

✅ What Does the Principal Column Show?

The principal column shows the portion of the lease payment that reduces the lease liability.

Every lease payment is split into:

Component | What it does |

|---|---|

Interest | Expense recognised in P&L (finance cost) |

Principal | Reduces the lease liability (the debt owed) |

Formula:

Principal = Lease Payment − Interest

Example (Year 1 from above):

Lease payment = $10,000

Interest = $1,362

Principal = $10,000 − $1,362 = $8,638

So:

$1,362 → recorded in P&L

$8,638 → reduces lease liability on balance sheet

Final Takeaway:

The principal portion is how much of the lease payment you're actually “paying off” — like repaying a loan. Interest is just the cost of borrowing.

🧠 Summary

Subsequent measurement includes:

Interest charge each year → increases lease liability

Lease payments → reduce liability

Depreciation on ROU asset

Balance sheet split:

Lease liability = current + non-current

ROU asset = cost – accumulated depreciation

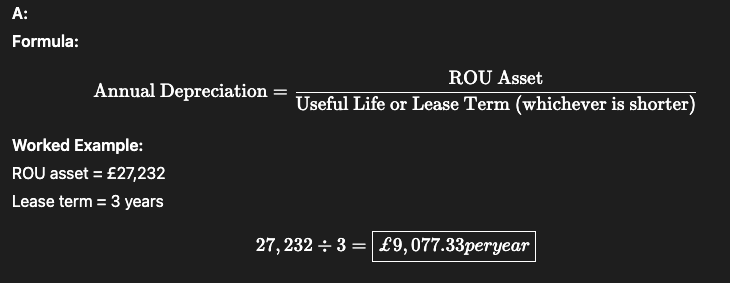

How do you calculate the annual depreciation on the ROU asset?

Data: ROU asset = $27,232; Lease term = 3 years; ownership does not transfer

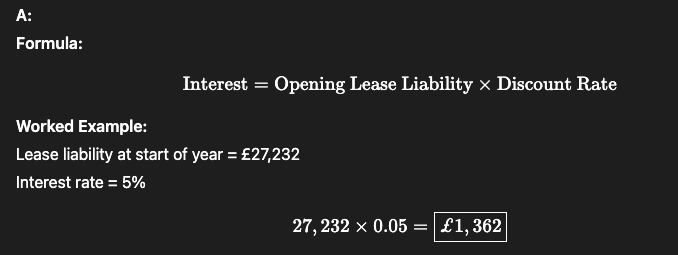

How do you calculate the interest charge on the lease liability each year?

Lease liability at start of year: £27,232

Interest rate 5%

How do you split a lease payment between interest and principal?

How do you calculate the lease expense for a low-value or short-term lease under the simplified approach?

Formula:

Lease Expense per Year = Total Lease Payments ÷ Lease Term in Years

Worked Example:

Total lease payments = $5,000 (including deposit and rent)

Lease term = 4 years

Lease Expense = $5,000 ÷ 4 = $1,250 per year

How do you calculate the prepayment shown on the balance sheet under the simplified approach?

A:

Formula:

Prepayment (Current Asset) = Cash Paid − Expense Charged to P&L

Worked Example:

Cash paid in Year 1 = $2,000

Lease expense for Year 1 = $1,250

Prepayment = $2,000 − $1,250 = $750

✅ What is a Prepayment on the Balance Sheet?

A prepayment is a payment made in advance for goods or services that will be received in future periods. Until those services are "used up," the payment is treated as an asset, not an expense.

🧾 In IFRS 16 Context:

If a lease payment is made before the related lease period starts, the amount is recorded as a prepayment (a current asset), not as an expense.

📘 Example:

Total lease cost: $5,000 over 4 years

Annual lease expense = $1,250 (5,000 ÷ 4)

Cash paid in Year 1: $2,000 (deposit + first year payment)

In Year 1:

P&L expense = $1,250

Excess paid = $2,000 − $1,250 = $750

Balance Sheet:

Show $750 as a prepayment (current asset)

📦 Why It's an Asset:

You’ve paid for a benefit you haven’t yet received — so until it’s “used,” it sits on the balance sheet as a future economic benefit.

✅ Summary:

When Paid | What Happens |

|---|---|

Before the period | Record as prepayment (asset) |

During the period | Allocate as expense in P&L |

How do you calculate the total lease expense for the year under the accruals concept (low-value lease)?

A:

Formula:

Lease Expense = Total Rentals Payable ÷ Total Lease Period

Worked Example:

Total rentals = $5,000

Lease period = 4 years

Lease Expense = $5,000 ÷ 4 = $1,250 per year

Chapter 12

What is the formula for calculating the value of inventory using the FIFO method? Include when it's used.

During the first four days of June, Tyrone made the following inventory transactions:

Day 1: Purchase 200 units @ $15

Day 2: Purchase 100 units @ $18

Day 3: Sale of 250 units (ignore selling price)

Day 4: Purchase 150 units @ $20

There was no opening inventory.

A1:

FIFO (First In, First Out) assumes the oldest inventory is sold first.

Formula:

Closing inventory = Total purchases – Sales

Then value the remaining (newest) units using most recent purchase prices.

Example:

Purchases: 200 units @ $15, 100 units @ $18, 150 units @ $20

Sales: 250 units

Closing inventory = 200 + 100 + 150 – 250 = 200 units

Use most recent purchases:150 × $20 = $3,000

50 × $18 = $900

Total = $3,900

How do you calculate the value of closing inventory using the periodic AVCO method? Use the following scenario:

During the first four days of June, Tyrone made the following inventory transactions:

Day 1: Purchase 200 units @ $15

Day 2: Purchase 100 units @ $18

Day 3: Sale of 250 units (ignore selling price)

Day 4: Purchase 150 units @ $20

There was no opening inventory.

Required:

Using the periodic AVCO method, calculate the value of closing inventory at the end of Day 4.

A2:

AVCO (Average Cost) assumes all inventory is valued at a weighted average cost.

Step 1: Add up all purchases

200 × $15 = $3,000

100 × $18 = $1,800

150 × $20 = $3,000

Total cost = $7,800

Total units = 200 + 100 + 150 = 450 units

Step 2: Calculate Weighted Average Cost per unit

$7,800 ÷ 450 = $17.33

Step 3: Calculate Closing Inventory

250 units were sold → 450 – 250 = 200 units remain

200 × $17.33 = $3,467

How do you calculate Net Realisable Value (NRV) for inventory?

How is inventory valued? At the lower of…

A3:

NRV = Estimated Selling Price – Costs to Complete – Costs to Sell

Example:

Selling price = $18,000

Cost to complete = $4,200 (only $2,100 borne by entity)

NRV = $18,000 – $2,100 = $15,900

📘 IAS 2 — Inventory Valuation Rule

Inventory must be valued at the lower of:

Cost, and

Net Realisable Value (NRV)

✅ Cost = What it took to bring the item to its current state/location

Purchase price

Conversion costs (e.g. labour, overheads)

Freight and handling (if applicable)

✅ NRV = The amount you expect to sell it for

NRV = Selling Price – Costs to Complete – Costs to Sell

🧠 Why “Lower of”?

This is a conservative accounting principle:

If inventory is worth less than what it cost, we must record the loss immediately

We don’t overstate assets or profits

📦 So, how do you determine “Cost”?

When it’s hard to track the actual cost of each item (e.g. identical units bought at different prices), IAS 2 allows reasonable approximations:

🔁 Reasonable Cost Approximations (Approved by IAS 2): 1⃣ FIFO (First-In, First-Out)

Assumes the oldest inventory is sold first

Closing inventory = newest purchases

Appropriate when stock rotates (e.g. perishables like food)

2⃣ AVCO (Average Cost Method)

All inventory units are assigned the same weighted average cost

Appropriate when items are indistinguishable (e.g. oil, grains)

🔗 How It All Fits Together:

Choose a method (FIFO or AVCO) to estimate the cost of inventory

Compare that cost to NRV

Value inventory at the lower of the two

✅ Example:

FIFO Cost of closing inventory = $3,900

AVCO Cost of closing inventory = $3,467

NRV = $3,500

Final inventory valuation =

Under FIFO: $3,500 (lower than $3,900)

Under AVCO: $3,467 (lower than NRV, so use $3,467)

How do you value inventory under IAS 2 when NRV is lower than cost?

A4:

Inventory is valued at the lower of cost and NRV.

Example:

Inventory cost = $16,800

NRV = $15,900

→ Value = $15,900

What is a replacement cost?

Under IAS 2, if the replacement cost of materials falls after purchase, how should inventory be valued?

Include how this interacts with the ‘lower of cost and NRV’ rule. How about for the reverse?

Replacement cost is the amount it would currently cost to repurchase the same materials.

Under IAS 2, replacement cost is not used directly to value inventory. Instead, inventory is valued at the lower of original cost and Net Realisable Value (NRV).

A drop in replacement cost may suggest NRV has fallen, but you only reduce the inventory value if NRV < cost.

Example:

Original cost = $12,000

Replacement cost = $10,000

If NRV is still above $12,000 → value remains at $12,000.

Under IAS 2, inventory should be valued at the lower of original cost and NRV (Net Realisable Value) — not replacement cost.

A fall in replacement cost does not affect inventory valuation unless it indicates that NRV has fallen below original cost.

Example:

Original cost = $12,000

Replacement cost = $10,000 (lower, but irrelevant unless NRV is also low)

If the inventory is still for a profitable order → NRV > $12,000

✅ Therefore, value at $12,000Reversed

Under IAS 2, if NRV falls below the original cost, inventory must be valued at NRV. This applies even if the materials were originally bought at a higher cost.

Example:

Original cost = $12,000

NRV = $10,000 (due to fall in selling price or damage)

✅ Since NRV < cost, value the inventory at $10,000

This ensures the inventory is not overstated on the balance sheet and reflects expected future economic benefit.

How is inventory valued under the AVCO method using rolling updates (perpetual method)? Use the following data to calculate closing inventory value:

Day 1: Purchase 200 units @ $15

Day 2: Purchase 100 units @ $18

Day 3: Sale of 250 units

Day 4: Purchase 150 units @ $20

There was no opening inventory.

Under the perpetual AVCO method, you recalculate the average cost after each purchase. This new average is used to value any subsequent sales.

🧮 Step-by-step calculation:

Day 1:

Purchase 200 @ $15 = $3,000

→ Avg. cost = $15

Day 2:

Purchase 100 @ $18 = $1,800

New average cost = ($3,000 + $1,800) ÷ (200 + 100)

→ $4,800 ÷ 300 = $16 per unit

Day 3:

Sell 250 units @ $16

→ COGS = 250 × $16 = $4,000

→ Inventory left = 50 units × $16 = $800

Day 4:

Purchase 150 @ $20 = $3,000

New average cost = ($800 + $3,000) ÷ (50 + 150)

→ $3,800 ÷ 200 = $19 per unit

Chapter 13

How do you calculate cash received from customers using the direct method?

Data:

Sales = 444, Opening receivables = 42, Closing receivables = 48

Formula:

Cash received = Sales revenue + Opening receivables – Closing receivables

Calculation:

Cash received = 444 + 42 – 48 = 438

Explanation:

This formula adjusts sales revenue to reflect the actual cash collected.

If receivables increase, it means some customers haven’t paid yet (less cash in).

If receivables decrease, it means more was collected than earned in the period.

How do you calculate cash paid to suppliers using the direct method?

Data:

Cost of materials used = 222

Opening inventory = 24, Closing inventory = 42

Opening payables = 18, Closing payables = 30

Step 1 – Calculate Purchases:

Purchases = Materials used + Closing inventory – Opening inventory

= 222 + 42 – 24 = 240

Step 2 – Cash paid to suppliers:

= Purchases + Opening payables – Closing payables

= 240 + 18 – 30 = 228

Explanation:

Purchases show what was bought, but payables adjust for timing of cash payments.

If payables increase, you paid less (cash out goes down).

If payables decrease, you paid more (cash out goes up).

What is the formula for cash generated from operations (Indirect Method)?

What is the formula for cash generated from investing activities?

What is the formula for cash generated from financing activities?

Operations

Profit before tax

Depreciation

Loss on disposal

– Profit on disposalFinance costs

– Investment/rental income

± Changes in inventories, receivables, and payables

Example:

Profit before tax = 114

Depreciation = 84

– Profit on disposal = (60)Finance costs = 18

– Increase in inventories = (18)

– Increase in receivables = (6)Increase in payables = 12

Cash from operations = 144

Investments

Purchase of PPE (-)

Purchase of Investments (-)

Proceeds from sale of PPE (+)

Proceeds from sale of investments (+)

Interest received (+)

Dividends received (+)

Financing

Proceeds from issue of ordinary shares (+)

Proceeds from issue of preference shares (+)

Proceeds from long-term borrowings (+)

Dividends paid (-)

Redemption of long term borrowings (-)

How do you calculate interest paid using a T-account?

Finance cost = 18, Opening = 4, Closing = 6

Formula:

Interest paid = Finance cost (P&L) + Opening payable – Closing payable

Example:

Finance cost = 18, Opening = 4, Closing = 6

Interest paid = 18 + 4 – 6 = 16

How do you calculate interest/dividends received (Investing Activities)?

Interest income = 8, Opening = 2, Closing = 1

Formula:

Cash received = P&L amount + Opening receivable – Closing receivable

Example:

Interest income = 8, Opening = 2, Closing = 1

Cash received = 8 + 2 – 1 = 9

P&L income = 8,000, Opening receivable = 2,000, Closing receivable = 1,000

Entries:

Dr Bank 9,000 → cash actually received

Cr Interest Receivable 1,000 → reduced the receivable (asset down)

Cr P&L (Interest income) 8,000 → recognise the full income earned

Why:

You earned £8k, but only £9k came in because you also collected £1k that was owed from before.

How do you calculate cash paid for non-current assets?

Opening = 100, Disposal = 10, Depreciation = 20, Closing = 140

Formula:

Use carrying amount T-account:

Cash paid (additions) = Balancing figure

Example:

Opening = 100, Disposal = 10, Depreciation = 20, Closing = 140

Right side = 10 + 20 + 140 = 170

Left side = 100 + Additions

Additions = 170 – 100 = 70

Balancing figure from asset T-account.

Entries:

Dr Non-Current Asset 70,000 → asset increased

Cr Bank 70,000 → cash paid out

Why:

You're spending money to buy an asset — cash goes down, assets go up.

How do you calculate cash received on disposal of non-current assets? What are the step by step journal entries?

Cost = 40, Acc. dep = 30, Profit = 5

Carrying amount = 10

Formula:

Cash received = Carrying amount ± Profit/Loss on disposal

Where: Carrying amount = Cost – Acc. depreciation

Example:

Cost = 40, Acc. dep = 30, Profit = 5

Carrying amount = 10

Cash received = 10 + 5 = 15

Cost = 40,000, Accumulated depreciation = 30,000, Profit = 5,000

Step-by-step entries:

Remove original asset:

Dr Disposal Account 40,000

Cr Non-Current Asset 40,000

Remove depreciation:

Dr Accumulated Depreciation 30,000

Cr Disposal Account 30,000

Record cash received:

Dr Bank 15,000

Cr Disposal Account 15,000

Record profit on sale:

Dr Disposal Account 5,000

Cr P&L (Gain) 5,000

What is the formula to calculate proceeds from new share issues?

A:

Formula:

Proceeds = (Closing share capital + premium) – (Opening share capital + premium)

Example:

Closing = 140, Opening = 100

Proceeds = 140 – 100 = 40

Share capital + premium increased by 40,000.

Entries:

Dr Bank 40,000 → cash received

Cr Share Capital and Premium 40,000 → equity increased

Why:

You issued new shares and received cash — equity and bank both increase.

What is the formula to calculate loan proceeds?

Closing = 90, Repayment = 10, Opening = 50

A:

Formula:

Proceeds = Closing loan + Repayment – Opening loan

Example:

Closing = 90, Repayment = 10, Opening = 50

Proceeds = 90 + 10 – 50 = 50

Opening loan = 50k, closing loan = 90k, repayment = 10k → proceeds = 50k

Entries:

Dr Bank 50,000 → cash received

Cr Loan Payable 50,000 → liability increased

Why:

You're borrowing money — cash increases, but so does what you owe.

What is the formula to calculate loan repayments?

Opening = 60, Proceeds = 40, Closing = 70

Formula:

Repayment = Opening loan + Proceeds – Closing loan

Example:

Opening = 60, Proceeds = 40, Closing = 70

Repayment = 60 + 40 – 70 = 30

Opening loan = 60k, Proceeds = 40k, Closing = 70k → repayment = 30k

Entries:

Dr Loan Payable 30,000 → reduce liability

Cr Bank 30,000 → cash out

Why:

You paid off part of a loan — cash decreases, and your liability decreases.

What is the formula to calculate dividends paid using retained earnings?

Opening = 120, Profit = 72, Closing = 170

Formula:

Dividends paid = Opening retained earnings + Profit – Closing retained earnings

Example:

Opening = 120, Profit = 72, Closing = 170

Dividends = 120 + 72 – 170 = 22

Opening RE = 120k, Profit = 72k, Closing = 170k → dividend = 22k

Entries:

Dr Retained Earnings 22,000 → reduce equity

Cr Bank 22,000 → cash paid out

Why:

Paying dividends reduces both retained profits and cash.

What is the formula to calculate interest earned on a deposit or savings account over a specific time period? Include any useful assumptions.

Deposit = £10,000

Interest rate = 5% per annum

Period = 90 days

Day count = 365

Formula:

Interest = (Amount deposited × Annual interest rate × Number of days interest earned) / Annual day count

Assumptions:

UK interest typically uses 365 days/year

US dollar interest in money markets uses 360 days/year

Example:

Deposit = £10,000

Interest rate = 5% per annum

Period = 90 days

Day count = 365

Interest = (10,000 × 0.05 × 90) / 365 = £123.29

How do you calculate the return from a Treasury Bill bought at a discount?

Face value = £10,000

Purchase price = £9,900

Formula:

Return = Face value – Purchase price

Example:

Face value = £10,000

Purchase price = £9,900

Return = £10,000 – £9,900 = £100

How do you calculate the interest yield (return as a percentage) on a Treasury Bill or similar discount instrument?

Example:

Face value = £10,000

Purchase price = £9,900

Days to maturity = 91

Formula:

Yield (%) = [(Face value – Purchase price) / Purchase price] × (365 / Number of days to maturity) × 100

Example:

Face value = £10,000

Purchase price = £9,900

Days to maturity = 91

Yield = [(10,000 – 9,900) / 9,900] × (365 / 91) × 100

Yield ≈ 0.0101 × 4.0109 × 100 ≈ 4.05%

How do you calculate interest income from a Certificate of Deposit (CD) if held to maturity?

Example:

Principal = £50,000

Interest rate = 4%

Term = 180 days

Day count = 365

Formula:

Interest = Principal × Annual interest rate × (Term in days / Annual day count)

Example:

Principal = £50,000

Interest rate = 4%

Term = 180 days

Day count = 365

Interest = £50,000 × 0.04 × (180 / 365) = £986.30

How do you calculate the return from selling a negotiable CD or bill of exchange in the secondary market?

Example:

Purchase price = £99,500

Selling price = £100,200

Formula:

Return = Selling price – Purchase price

Example:

Purchase price = £99,500

Selling price = £100,200

Return = £100,200 – £99,500 = £700

How is the effective yield on a bill of exchange or commercial paper calculated when sold at a discount?

Example:

Face value = £100,000

Discounted price = £98,500

Maturity = 90 days

A:

Formula:

Yield (%) = [(Face value – Discounted price) / Discounted price] × (360 / Days to maturity) × 100

Example:

Face value = £100,000

Discounted price = £98,500

Maturity = 90 days

Yield = [(100,000 – 98,500) / 98,500] × (360 / 90) × 100

= 0.0152 × 4 × 100 ≈ 6.08%

Chapter 15

What is the formula for the Working Capital Cycle (manufacturing business)? Include all components.

Working Capital Cycle =

Raw Materials Holding Period

Work-in-Progress (WIP) Holding Period

Finished Goods Holding Period

Receivables Collection Period

− Payables Payment Period

Example:

Raw Materials = 40 days

WIP = 15 days

Finished Goods = 30 days

Receivables = 35 days

Payables = 25 days

Working Capital Cycle = 40 + 15 + 30 + 35 − 25 = 95 days

What is the simplified Working Capital Cycle formula for a retail or wholesale business?

Working Capital Cycle =

Inventory Holding Period

Receivables Collection Period

− Payables Payment Period

Example:

Inventory = 50 days

Receivables = 20 days

Payables = 30 days

Cycle = 50 + 20 − 30 = 40 days

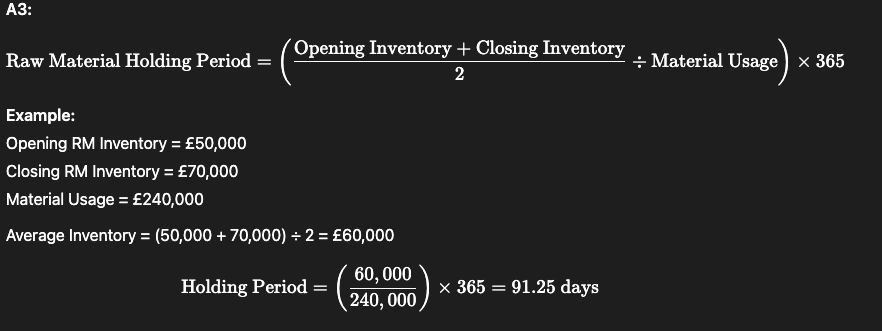

What is the formula for Raw Material Inventory Holding Period?

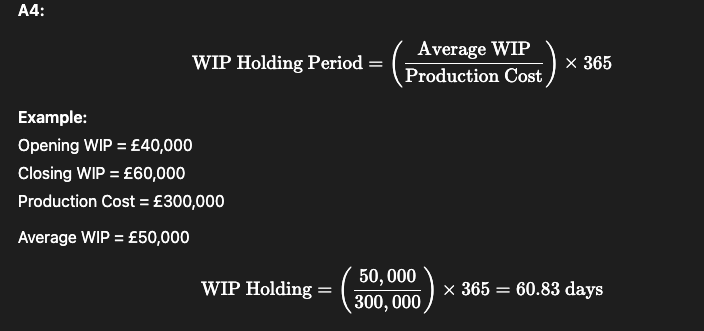

What is the formula for WIP Holding Period?

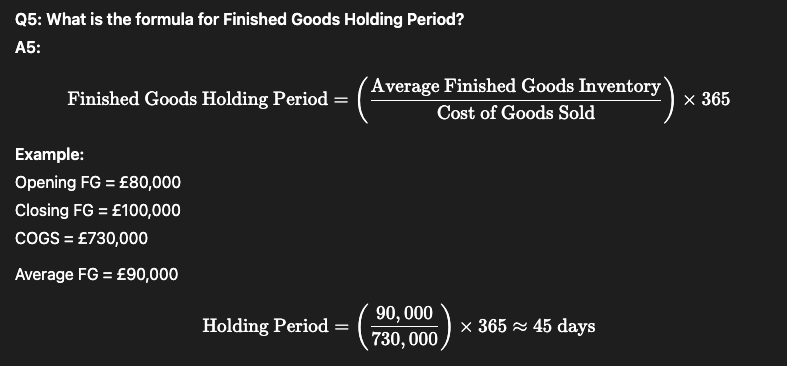

What is the formula for Finished Goods Holding Period?

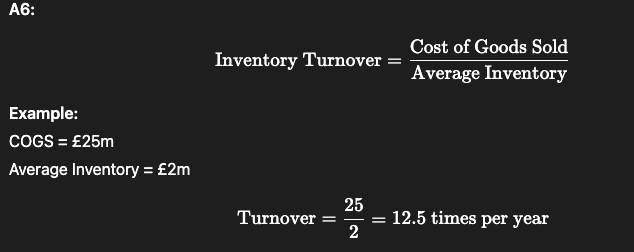

What is the formula for Inventory Turnover (number of times)?

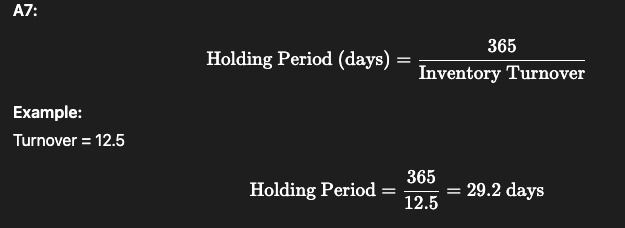

How do you convert an Inventory Turnover Ratio into a Holding Period?

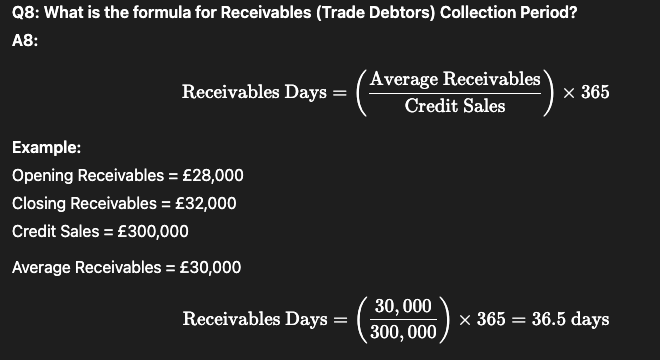

What is the formula for Receivables (Trade Debtors) Collection Period?

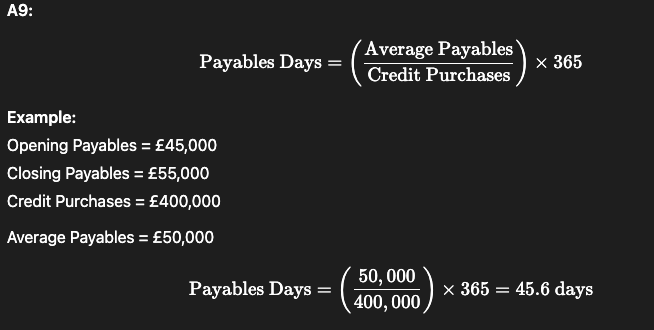

What is the formula for Payables (Trade Creditors) Payment Period?

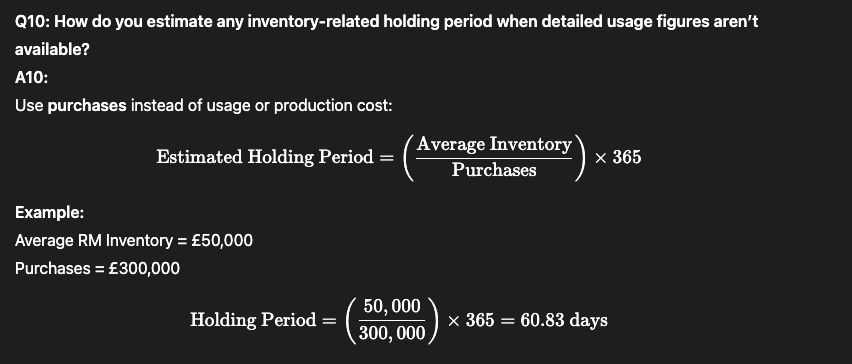

How do you estimate any inventory-related holding period when detailed usage figures aren’t available?

Chapter 16

How do you calculate the receivable balance using receivable days?

A:

Formula:

Receivable balance = (Sales × Receivable days) ÷ 365

Example:

Sales = £5,000,000

Receivable days = 60

Receivable balance = (5,000,000 × 60) ÷ 365 = £821,918

How do you calculate the annual finance cost of receivables using an overdraft rate?

A:

Formula:

Finance cost = Receivable balance × Overdraft interest rate

Example:

Receivable balance = £821,918

Interest rate = 10%

Finance cost = 821,918 × 10% = £82,192