G202 Exam 1 Content

1/43

Earn XP

Description and Tags

Topics 1-4 from Spotlight Slides

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

44 Terms

Both Pe and Qe are _______ of government action

independent

Rule 1 for Social Efficiency: Produce and sell product that has consumer value ______ production costs

greater than or equal to

Rule 2 for Social Efficiency: Avoid producing and selling product that has consumer value _______ production costs

less than

Net benefit given up by society when

below Qe

Net cost incurred by society when

above Qe

Taxes on sellers cause an _______ shift of the supply curve by _______ production costs

inward; increasing

What determines how much of the tax and subsidy can be passed to the consumer

elasticity

Taxes will increase efficiency in an ________ market

overproducing

For taxes: ________ price to buyers → ________ consumer surplus

increased; decreased

For taxes: _____ seller price→_____ producer surplus

decreased; decreased

Subsidies given to sellers cause an _______ shift of the supply curve by _______ production costs

outward; decreasing

Because the buyer’s price _________ from a subsidy, ______ will be consumed, so the market ________.

decreased; more; expands

Subsidies are efficient in what kind of market

underproducing

For a subsidy: ______ prices to buyers → consumer surplus ________

decreased; increases

For a subsidy: ______seller price → producer surplus ______

increased; increased

productive regulations imposed on sellers cause an _______ shift of the supply curve by forcing the seller to ______

inward; incur compliance costs

For a productive regulation: because the buyer’s price _______, ______ will be consumed, so the market _______

increased; less; shrinks

Taxes and Productive Regulations act the same, so what is the only difference between the two?

Who keeps the revenue. For PR - the rev is kept somewhere in the supply chain

Lobbying (Rent Seeking)

devoting resources to influence public policy formation in order to bring more income/support to your group

Special interest effect

small group of people, with the incentive to take political action, receive benefits at the expense of a large unorganized group of people

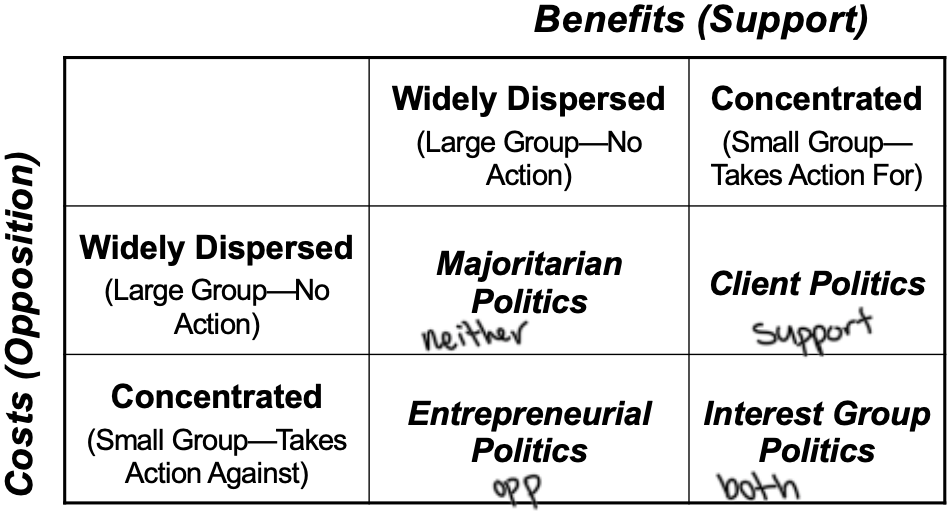

Majoritarian Politics

Widely dispersed costs and benefits

Ex: Social Security

Lobbying does not occur

Client Politics

concentrated benefits and widely dispersed costs

Ex: USDA Foreign Advertising Funds (MAP)

Lobbying will likely be successdul

Interest Group Politics

Concentrated benefits and costs

Ex: Legalizing Marijuana (NORML [pro] vs CALM [anti]) and UBER!

Lobbying success depends on relative strength of either side

Entrepreneurial politics

Concentrated costs and widely dispersed benefits

ex: nuclear waste dumps

Successful lobbying will be costly: You have to convince a large group to give up their benefits

Logrolling

politicians trading support on regional projects that they each care about

risky

Pork Barrel Legislation

politicians bundling different regional politics together into a package to vote on collectively

less risk

Consumption Rule (QD) for imports: Domestic consumers should consume as long as value DUS is ____________ production cost (PW)

greater than or equal to

Production Rule (QS) for imports: Domestic producers should produce as long as their production costs (SUS) are _________ the world’s cost (PW)

less than or equal to

Foreign Gains Formula:

(quota price - original price - licensing fee)*quota = foreign gains

Tariff

Tax on imports

Quota

Physical limitation on imports

True or False: Quota Price is impacted by the licensing fee

FALSE. Licensing fee only change foreign gains and gov revenue

The _____ that imports are restricted, the _______ that under consumption and over production will become.

more; bigger

When is a tariff more inefficient than a quota

If the tariff has more restrictions and the quota has no foreign gains

Communal Property

No single owner, everyone has access while it lasts

Over-utilization occurs (tragedy of the commons)

Government Property

property decisions made by a small group of elected political representatives (lots of power in hands of few)

Private Property gives owners incentive to:

create ______ value with property and benefit others

maintain property and conserve _____ for the future

innovate ____ and create new technologies

engage in _____ voluntary exchange

all more

Private property rights incentivizes

benefitting others w property

conservation for the future

innovation

voluntary exchange

Patent

Right to exclude all other from using, producing, or selling an invention (everyone benefits from patents)

Trademark

a work, name, symbol, or device that is used in trade with goods to indicate their source

Copyright

Right to exclude all others from reproducing, distributing, or performing a work

The sharing economy

an economic system in which assets or services are shared between private individuals, either for free or for a fee, typically by means of internet

may increase crime rates bc the notion of IP ownership is unclear

Equation for Becker’s Crime Model

Expected Utility = (probability of success)*(current income + gain)+(probability of failure)*(current income-fine)

Expected Utility MUST be greater than current utility to commit the crime