Food service costs

1/55

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

56 Terms

sole proprietorship

owner has total decision making authority

least costly

avoid double taxation of owner and business

unlimited personal liability

partnership

increases sources of knowledge

easiest to initiate

avoids double taxation of owner and business

unlimited liability

C corporation

limited liability of ownership

easier to attract capital

ease in transferring ownership

costly and time consuming to create

doublet taxation

S corporation

limited liability of owners

avoids double taxation

ease in transferring ownership

high tax rate than c corp

limited to 75 stockholders or less

limited liability company

limited liability of owners

can have multiple owners

avoids double taxation of owner and business

costly and time consuming to create

aspects of accounting

auditing

cost accounting

financial accounting

managerial accounting

cost accounting

determination and control of cost

financial accounting

reporting of transactions for an organization and the periodic prep of various reports

managerial accounting

uses historical and estimated financial data to assist management in daily operations

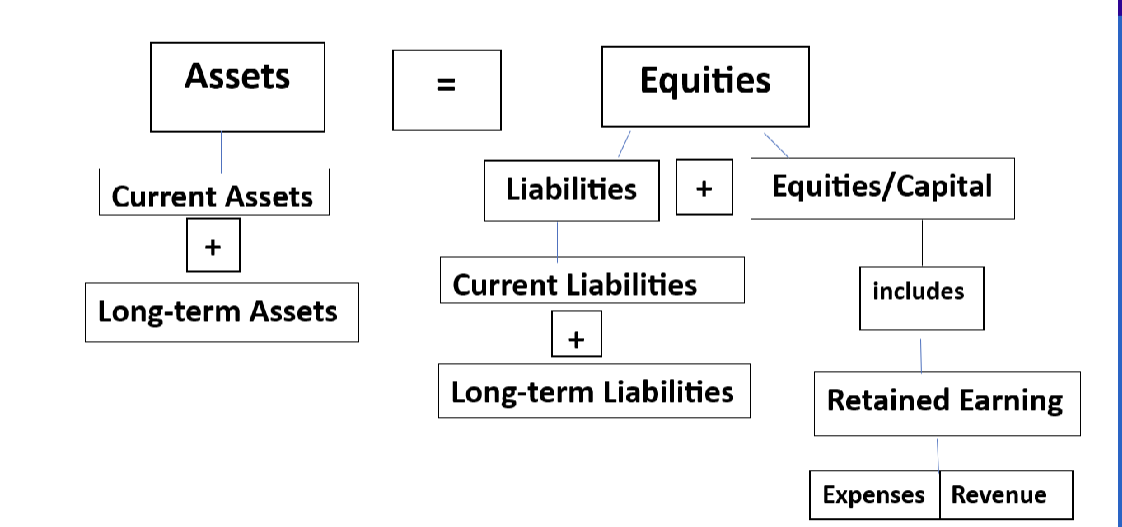

basics of accounting

assets, equities, liability, capital

assets

things that have value

equities

ownership or claims against the assets

liabilities

claims against the company

debts

capital

interest of the owners in the company

food service assets

cats, money, inventory, accounts receivable, equipment, stocks and bonds

balance sheet

statement which shows the financial condition of a business at a given point in time

income statement

statement which shows the results of operating a business over a period of time

also called profit and loss statement

operating statements

often used interchangeably with profit and loss statements

frequently completed on a monthly basis and will have more specifics to better analyze how your business is doing

financial statements

balance sheets

income statement - revenue and expenses

major expenses

labor, food, operating expenses

accounting methods

recording transactions

cash

accrual - record transitions when revenue is earned not necessarily received and when expenses are incurred regardless of when cash goes out

importance of cash handling

separation of duties

who has access to cash

security background checks on employees

reconciliation

unaccounted audits

cash drawers

surveillance cameras

major expenses

labor - salaries

food - cost of goods sold

operating expenses

2 times of recording transactions

cash - record transactions at the time the cash actually goes in or out of the business

accrual - used most frequently record transactions when revenue is earned not necessarily received and when expenses are incurred regardless of when cash goes out

assets = equities

fixed costs

do not vary with volume or service rendered, even if volume increases or decreases, these costs do not vary

considered non-controllable

may vary but not because of volume

variable costs

costs vary directly and proportionately with the volume of business

controllable

semi variable costs

vary in the same direction but less than proportionately with changes in volume

usually controllable

Full cost

direct + indirect costs

direct costs

items of cost which are specifically traceable to an item, food, labor

indirect costs

elements of cost that are associated with an item but are not directly traceable to an item, utilities, supervisor’s salary

sunk costs

already incurred and cannot be recouped by a new decision or alternative

differential cost

amount of increase or decrease in cost when you compare alternative choices

straight line depreciation

original cost - less salvage value

double declining balance

if 20%

$10,000 × 20%

$2000 depreciation year 1

$1600 depreciation year 2

$1200 depreciation year 3

sum of the years digits

add #’s 1-n (estimate life)

food cost %

cost of food/food sales

labor cost %

cost of labor/food sales

primal foodservice costs

food cost

labor cost

food cost

most readily controlled items and is subject to the greatest fluctuations

consider:

menu planning

type of service

purchasing method

receiving control

purchases method

purchases for period of time/food sales

frequently look at total purchases/# meals served

inventory method

[beginning inventory (1st day of month) + food purchases (for that month] - [closing inventory (last day of month)] / cost of food

pre-cost an item

purchase price, amount purchases, cooking process (shrinkage + EP)

EP cost/# portions

selling price methods

factor mark up method

prime cost method

actual cost method

demand oriented pricing

competitive pricing

factor-pricing/conventional method

based on raw food cost and a mark up factor

prime cost method

food % + labor cost % = prime cost %

mark up factor = 100%/prime cost %

actual cost method

menu price = food costs + labor cost + variable costs + fixed cost + profit

demand-oriented pricing

whatever the market will bear

often time based pricing (lunch, early bird specials)

competitive pricing

compare to the competition

not a calculation

dynamic pricing

not necessarily planned but when low inventory, very high demand

odd cents pricing

ends in odd number

number other than zero

just below zero

pricing by the ounce

$ per ounce

two tier food service

offering upscale items at a different price

table d’hote

fixed priced menus

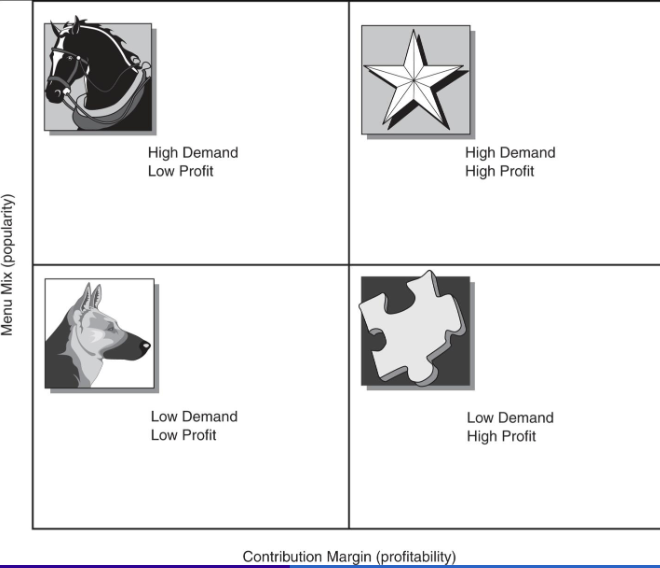

menu engineering

computerized menu analysis

focus on looking at which menu items make money

CM contribution margin

MM menu mix

popularity and profitability