E100 Topic 3 - Labour Markets

1/43

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

44 Terms

Akerlof Market EQ with perfect info

Two separate markets, where each worker type’s wage is equal to their revenue product. This is an efficient outcome as the wage is above the reservation wage and less than or equal to the workers’ revenue products.

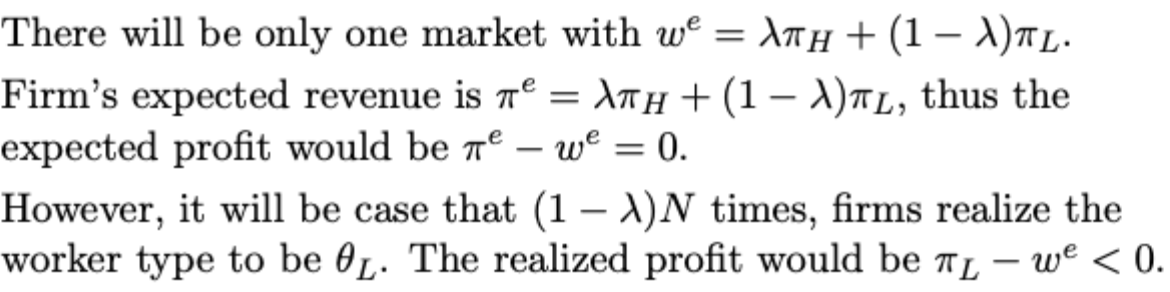

Akerlof Market EQ with imperfect and symmetric info (neither side knows worker types)

Firms set wages to the expected revenue product of a worker, based on the known proportions of H type to L type workers. Inefficient because there will be low type workers who are paid more than their revenue product.

Akerlof Market EQ 1 with imperfect and asymmetric info (workers know their types but firms don’t) - wage offer between reservations of H and L

Wage offer is between the H type’s reservation wage and L type’s reservation wage - expected profit be the revenue product of type L - the wage, so the wage must be set to the revenue product of type L. Inefficient because only type L workers are hired even though the revenue product of type H is higher than their reservation wage

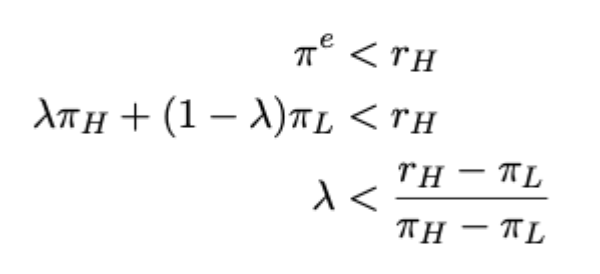

Akerlof Market EQ 2 with imperfect and asymmetric info - wage offer above the reservation of H

Wage offer is above type H’s reservation wage. The expected profit is the expected revenue (from symmetric EQ) - the wage. Therefore, the reservation wage of H is below the expected revenue, the wage will be the revenue product of H, and L and H workers are employed. If the reservation wage of H is above expected revenue, the firm will have no demand.

This is an ex ante efficient pooling EQ where all employees are hired, but if the reservation of H is above the expected revenue, only the first EQ exists (market failure)

Market failure conditions for Akerlof market with asymmetric and imperfect info

Market fails when:

Gamma is too low

The productivity difference between the two types is too small

Not much additional gain of pooling in higher workers

The reservation of type H is too high compared to the value of type L

Need to provide too much incentive to keep type H workers in the pool.

Adverse selection in labour in the Akerlof market

Low productivity workers know their type and thus crowd out type H workers from the market.

With continuous ability the key insight is the same - for a wage = expected revenue, only workers below a productivity threshold will supply their labour, so average productivity is lower than the wage → offering w = expected rev is not profitable. Lowering w will crowd out medium productivity workers, and thus push the average further down (unravelling)

Key insight of the Akerlof market

Asymmetric info in the market leads to a competitive but inefficient EQ → the first welfare theorem (competitive EQs are Pareto optimal) fails

Setup of the Spence worker signalling model

Two types of worker productivity (high and low), who can obtain an observable level of education (assume that it does not influence productivity - pure signalling). Firms only observe the level of education, and assume that the reservation wage of both types is 0 (no outside options).

The cost of education is an increasing and marginally increasing function.

High type workers have a lower total and marginal education cost.

Features of a weak perfect Bayesian equilibrium

Sequential rationality: player strategy should be optimal given their beliefs at each decision node

Consistency of beliefs: When a player updates their beliefs upon observing actions, they do so via Bayes’ rule when possible

The signalling game is an example - the receiver updates beliefs on the sender’s type based on the observed signal.

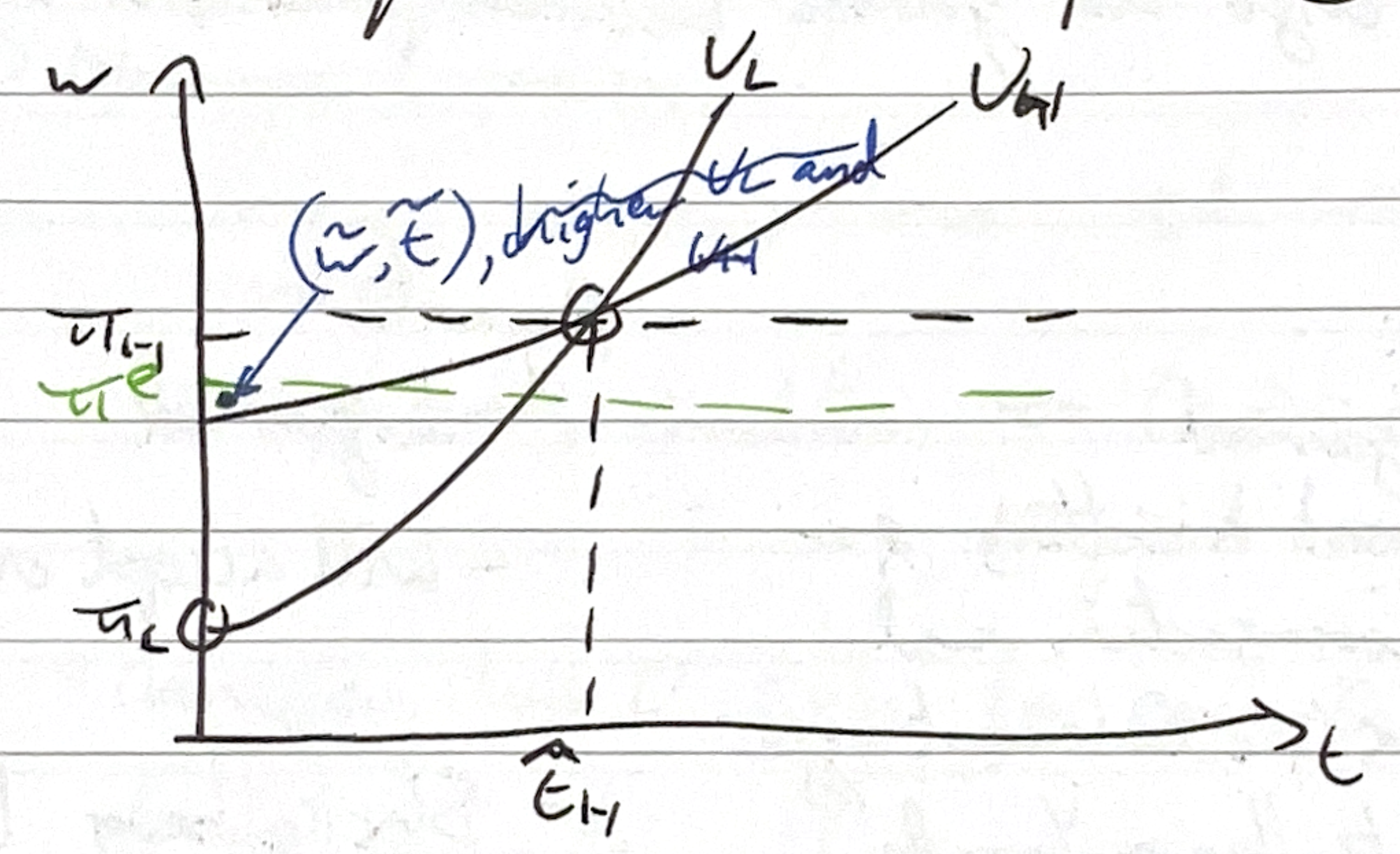

What are the characteristics of the most efficient separating EQ in the Spence signalling game

In separating EQ, firms perceive everyone with education level H to be type H, and everyone with education level L to be type L.

Therefore, the equilibrium level of education that satisfies the incentive compatibility constraint (no one of either type can prefer the other type’s payoff, given education cost) must be the education level that makes type L indifferent between educating to level H and not educating at all.

How can the separating EQ in the signalling game be affected by weird initial beliefs in the weak perfect Bayesian equilibrium

Firms could believe initially that a certain education level (not 0) denotes type L, which may be above the EQ level H education level. In this case, type H have to educate at a higher level than this to signal their type.

The limit of this is the education level that makes type H workers indifferent between getting a type H wage at that education level and getting a type L wage and not educating at all.

Features of the pooling EQ in the signalling game

Same level of education for all workers, so no updating beliefs for firms → wage is just the expected productivity. For all other levels of education, you take the worst belief, so the wage is just the type L productivity.

Any education level between 0 and the maximum that both can afford can be a pooling EQ. Above that upper limit, type L workers will deviate.

Welfare considerations of the separating EQ

Signalling device may lower overall welfare

If firms believe all the ‘off the path’ (counterfactual) education levels come from type L, this pushes up the required education for H, reducing welfare. The EQ also rules out choosing e=0 for H workers.

As the proportion of type H workers in the economy grows, it’s more likely that type H are made worse off by the signalling mechanism

As it tends to 1, nearly every worker has to get a costly education just to avoid being seen as type L. The more people have to get costly education, the less efficient the market.

Welfare considerations in the Pooling EQ

All pooling EQ can be Pareto ranked - same payoff for different levels of cost.

Pooling EQ with 0 education for either side dominates all other options. Pareto dominated pooling EQ are sustained by the workers’ fear that deviation leads to firms seeing them as type L.

All pooling EQ are still (weakly) Pareto dominated by the no-signalling Akerlof outcome.

Separating vs pooling EQ welfare comparison

Firms: equally well off in either EQ

Type H: ambiguous - depends on the relative size of the pooling vs separating wage vs education level.

Type L: strictly better off in the pooling EQ. They receive a wage equal to expected productivity rather than the type L wage. (And if education costs of pooling EQ are too great, it breaks into separating EQ).

Potential market interventions to improve welfare

Ban the signalling activity (gives Akerlof EQ which weakly Pareto dominates all signalling EQ)

Cross-subsidisation: mandate two distinct education levels with corresponding wages (i.e. mandate a wage slightly above productivity of type L workers and a 0 education level for them, then a lower education level than the separating EQ for type H workers, with wages slightly below their productivity.) Design these wages such that the mandated education and wage support separation between two types, and firms earn zero profit on average through cross-subsidisation. Both types better off (effects given below):

High type workers: benefit from reduced education cost (this has to be reduced by more than the wage)

Low-type workers: benefit from receiving wages above productivity

Firm: still earns 0 profit in aggregate.

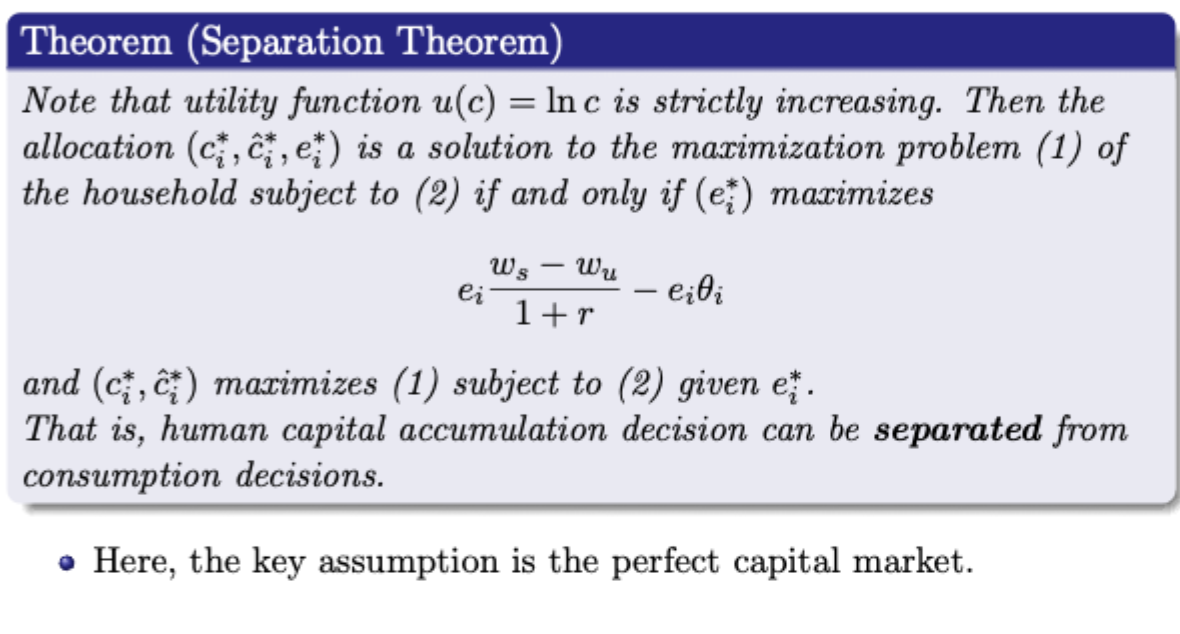

Two period model of education and human capital: key finding

Same empirical implication as signalling theory:

More years of education are positively associated with higher productivity

Higher returns to education promote educational attainment

Two period model of education and human capital: setup

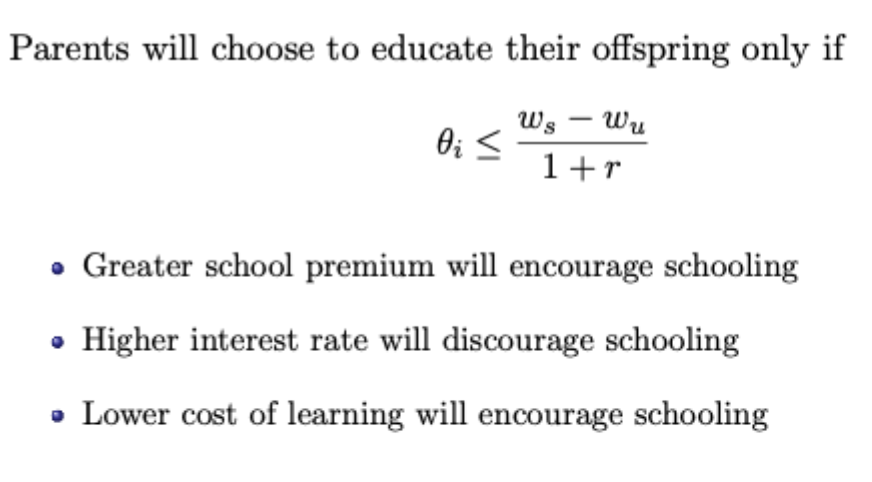

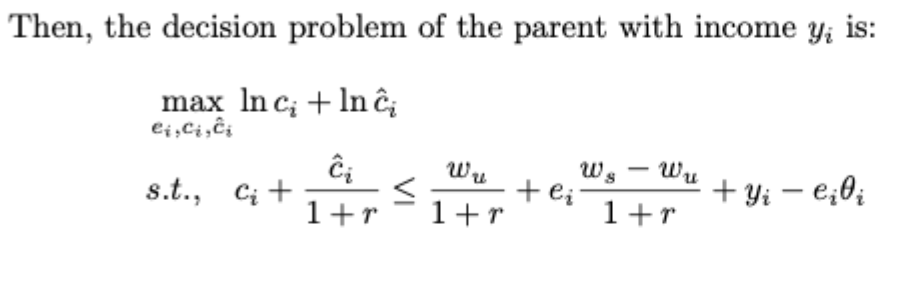

Income is exogenous, ws and wu are the wages of skilled and unskilled workers. Whether you are skilled or unskilled depends on the decision to get an education, signalled by the binary variable e, and education costs the amount theta.

Solving the two period model of human capital

Note that e is a binary variable, so choosing e to maximise this expression is just equivalent to saying whether the expression is greater when e is 0 or 1. This will of course depend on other parameters.

Why are there no pooling EQ in the screening game?

Firms can deviate from a pooling EQ by setting a higher wage with a higher task requirement. Since the marginal cost of satisfying the task requirement is lower for type H, this can be designed in such a way that type H strictly prefer this offer whereas type L don’t. Since firms move first they can strategically design contracts to ensure separation.

Why is there no cross subsidisation in any separating EQ in the screening game?

L wages lower than L productivity is impossible, since any deviation between that moved L wages closer to L productivity would generate higher profits

H wages lower than H productivity is impossible, since a deviation in H wages closer to H productivity, while changing the task requirement to ensure no L type workers would deviate would generate higher profits.

Therefore setting wages of H and L equal to their productivities is the only case where the firm makes zero profit.

EQ task requirement on type H in the screening game

Type L accept their productivity as a wage, with a task requirement of 0. Type H accept their productivity as a wage, and the task requirement is set such that type L workers are indifferent between the offers between type H and type L (remember type H are better off due to lower costs of the task requirement)

Why might a separating EQ not exist in the screening game?

There may be a deviation that attracts all workers if expected productivity is sufficiently high that the new wage is below it, and with a low enough time requirement, there can be a deviation that is on a higher indifference curve for both types. Pictured.

Welfare effects of the screening game

(Compared to Akerlof market)

Firms: Equally well off (0 profit)

Type L: Worse off (they get more when the wage is set to the expected productivity)

Type H: Better off

If the EQ exists it is a constrained Pareto optimal outcome. Any social planner who cannot observe worker types cannot achieve a Pareto improvement.

Description of the parties in a principal-agent framework

Principal: uninformed → proposes a setting for the transaction and makes a take it or leave it offer → Stackelberg leader

Agent: informed → accepts the offer or not → Stackelberg follower

Definition for moral hazard model

Hidden action - agent (manager) takes actions / decision that impact that transaction and at least one of the parties’ utility, in this case they decide on a certain effort level.

The principal cannot perfectly observe all of these actions, only observing a noisy signal about these actions.

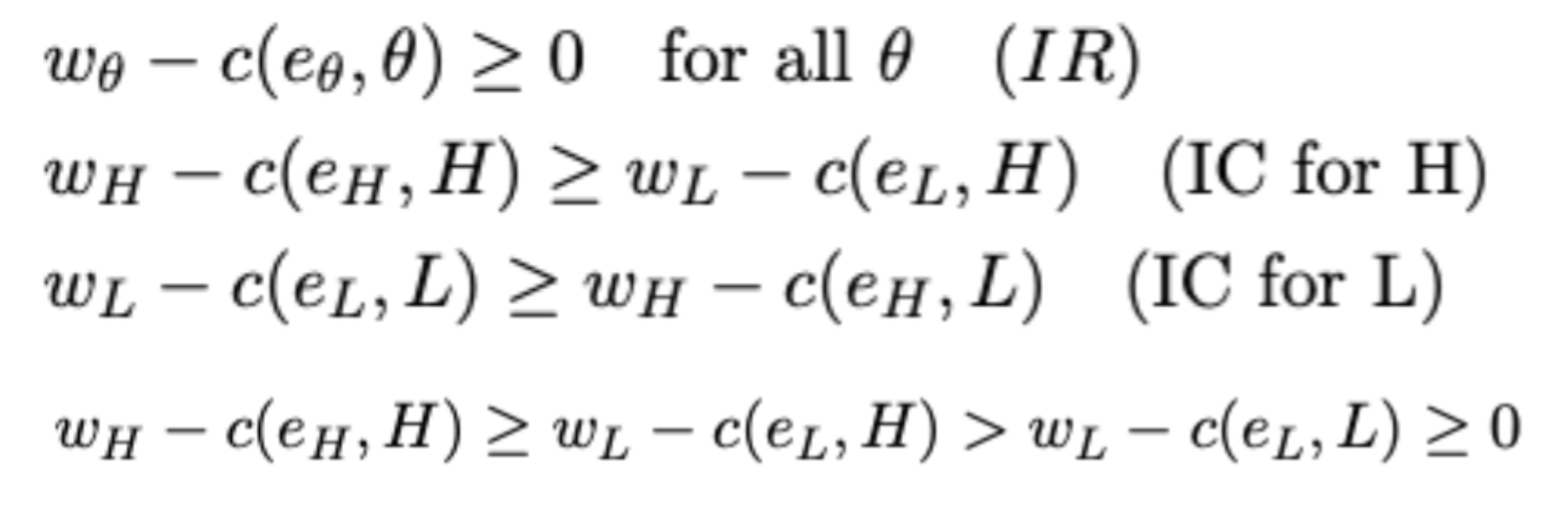

Definition for adverse selection model (also known as screening model - but will call adverse selection here to avoid confusion)

Hidden knowledge: the agent (manager hired for project) has private information on their disutility of effort. The principal (shareholders) does not know this and only has its prior beliefs on the parameter’s value (Bayesian setting).

First and second order stochastic dominance

First order: If a probability distribution A is less than another probability distribution B across all values of x (which implies a higher density of probabilities around the higher values), agents will strictly prefer A. Hence A first order stochastically dominates B

Second order: If the definite integral of A between -infinity and x is less than that of B for all x, this implies that even with the same expected value, B has a higher density of lower values than A (so higher risk). Therefore, a risk averse consumer (concave utility function) will prefer A, and hence A second order stochastically dominates B.

What is the basic full information EQ in the adverse selection model

Marginal benefit of increasing effort = marginal cost of increasing effort, wage extracts all surplus from the manager and for each given disutility of effort the manager has zero utility: IR constraint binds.

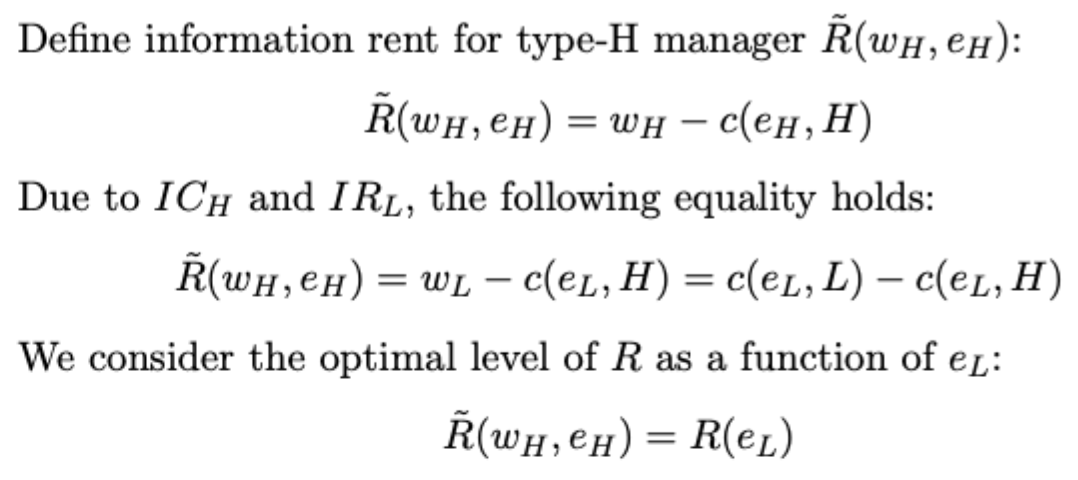

What is informational rent

The positive surplus acquired by a type H manager in the adverse selection game. It is gained by definition, and derived by combining the IR constraints and the incentive compatibility constraints as pictured.

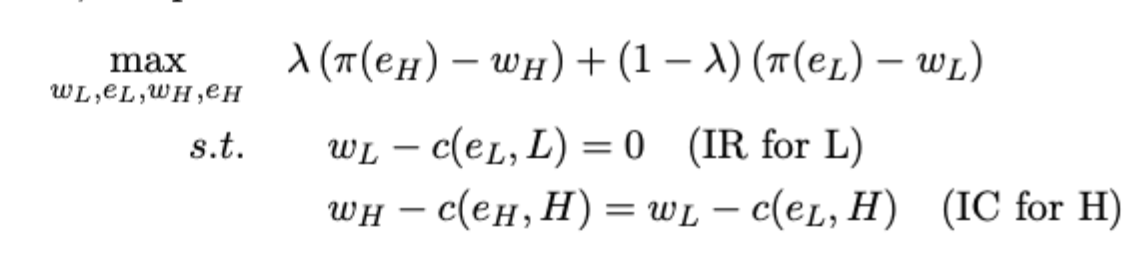

Full owner’s optimisation problem in the adverse selection game

Check notes for proof of why IC constraint for L doesn’t bind but ICC for H does, and see previous cards for why the IR for H doesn’t bind but the IR for L does.

Characterise information rent in the optimisation problem of the adverse selection game

Key takeaway: information rent for type H is an increasing function of the effort level for type L

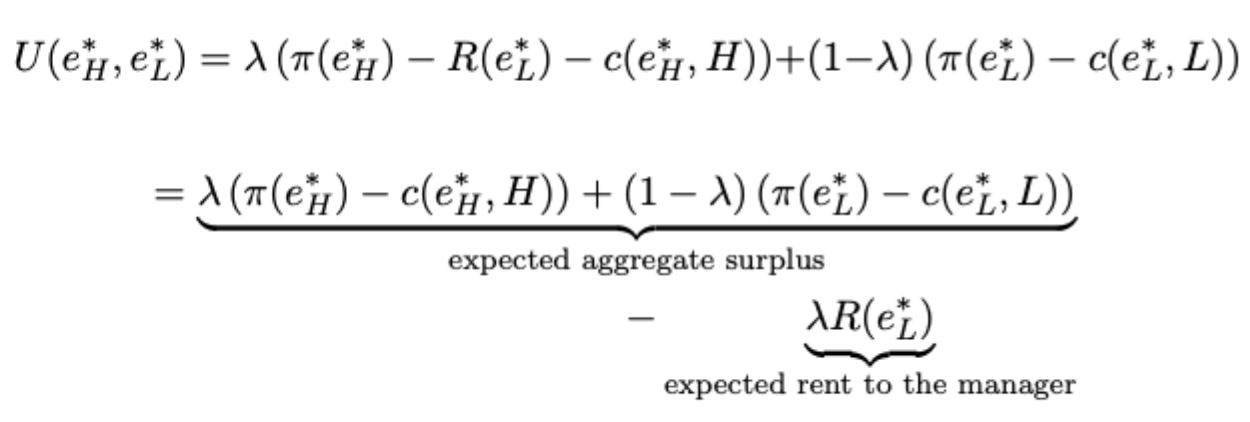

For given solutions to the owner’s maximisation problem, what is the indirect utility of the owner (adverse selection)

For the exam, you just need to state that it is the difference between expected aggregate surplus and expected rent tot he manager. Increasing effort level (of L) will increase the owner’s efficiency and surplus, at the cost of also increasing the size of the expected rent. (remember gamma is the probability of a manager being type H (implying lower disutility of effort(?))

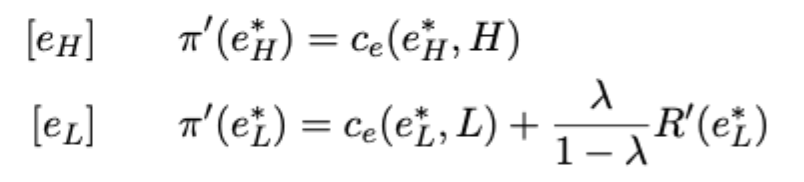

Optimality conditions for the adverse selection game

Key result: no distortion at the top - result for H is the same as for the full info case. But there is inefficiency at the bottom since the marginal benefit must now be equal to the marginal cost of effort for type L + a weighted marginal rent level that depends on L’s effort. Hence the effort level of type L is lower than the full info case.

What policies could a firm adopt instead of playing the adverse selection (screening) game?

Non discriminatory policies: set offers in such a way that the optimal effort for both parties will be the same, and thus give both the same wage.

Not optimal since the best non-discriminatory contract you can get is the same as the L type wage and effort level from the full info game

Exclusion policy: set offers in such a way that the optimal effort for type L is 0, and hence 0 wage, and then have same offer for type H as in full info game.

Possible, but not optimal since while it extracts all surplus from H, and information rent vanishes, you lose more from not getting any surplus from type L.

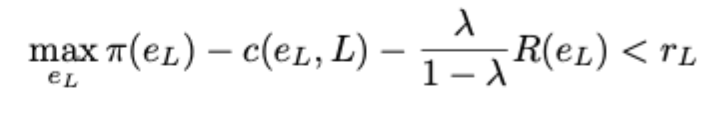

Effect of non-zero reservation wage on adverse selection game

Exclusion policy may be the optimal policy if the pictured condition holds, i.e. there is no policy that will generate enough profit from type L to make their participation optimal for the owner.

Assuming full info policy does not exclude type L, this would imply that asymmetric info leads to an extreme form of inefficiency at the bottom (i.e. no hiring of type L workers)

Effect of ex-ante contracting on the adverse selection game (manager is privately informed of her type after signing the contract, so the participation decision is made without knowledge of her true type)

Modify the optimisation problem to include an expected IR constraint as shown.

With full info, the IR condition binds, and the optimality condition guarantees that the manager’s marginal utilities across types are equal and fully insured.

With asymmetric information, you have similar results to the standard asym info game, except in this case we look at expected payoffs. Manager is inefficiently insured, receiving utility greater than 0 in state H and equal to 0 in state L.

The owner’s expected payoff is therefore strictly lower than the expected payoff when types are observed, whereas the manager’s is the same.

Key takeaway: due to the presence of asymmetric information, the contract necessarily distorts the effort choice of the manager.

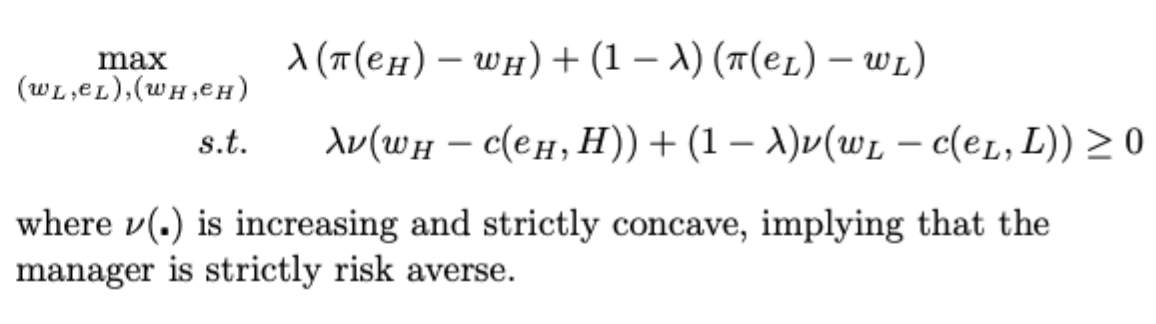

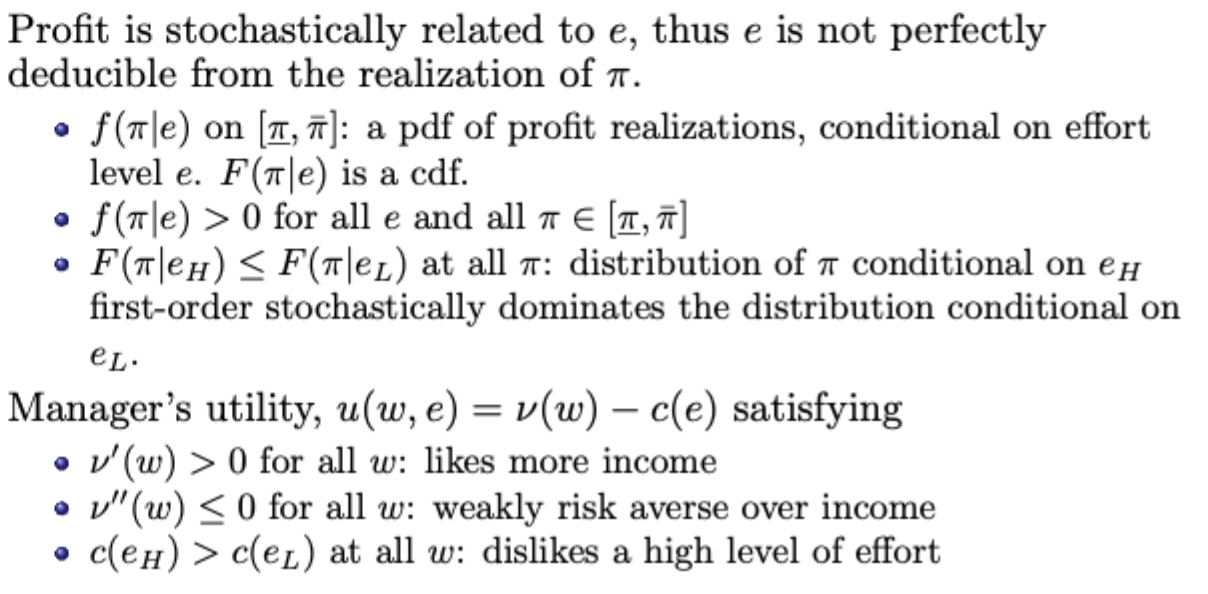

Key set up for the moral hazard game

The distribution of profits conditional on high effort is strictly preferred to that conditional on low effort

Full information moral hazard model: problem and key result

IR constraint binds at the optimum (utility of the wage = cost of the manager’s effort). Strictly averse manager is fully insured.

Owner’s solution will compare the incremental increase in expected profit from getting the higher effort level over the low one, compared with the monetary cost of the incremental disutility it causes the manager

Principal proposes a forcing contract: take an observed action e*, then you will be paid a fixed rate equal to the monetary cost of your disutility of effort.

Gives an efficient effort choice, and a contract that fully insures a risk averse manager against income risk

Asymmetric info moral hazard game: risk neutral manager (v(w) = w)

The optimal contract generates the same effort choice and expected utilities for the manager and the owner as when effort is observable (see slides for proof if you have time)

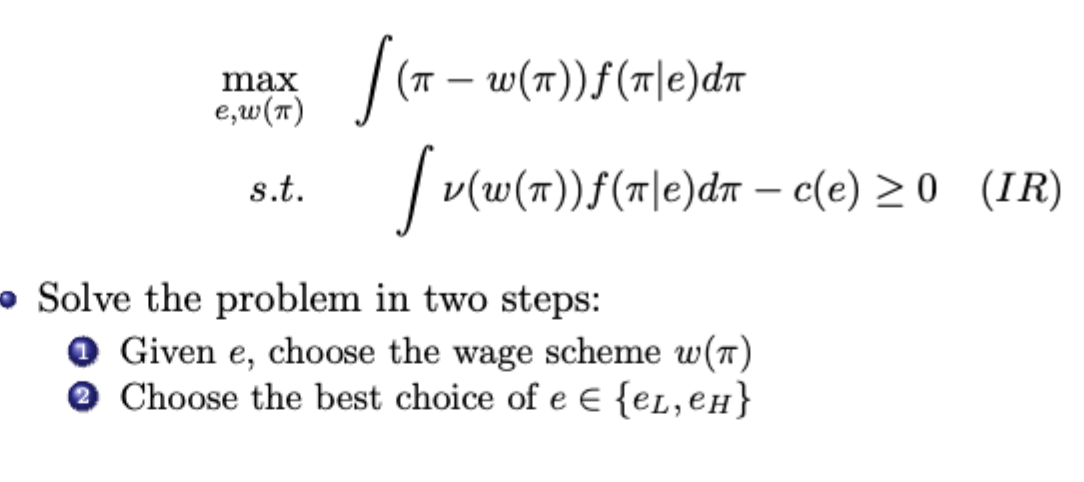

Asymmetric info moral hazard game: risk averse manager

Key result: effort level induced by the owner depends on the incremental changes in expected profits and incremental cost.

The cost of implementing the low effort level does not change compared to the full info case, but the cost of implementing the higher effort level increases from the full info case. Therefore, there will be some cases where implementing high effort was optimal under full info, but not in asymmetric info.

Economic discrimination as a tool with asymmetric information

Taste-based: discrimination based on preference / aversion or prejudice to some groups even when they are equally productive to others.

Statistical: Firms have limited information about the skills and turnover propensity of applications, in particular with young workers. They hence have an incentive to use easily observable characteristics such as race or gender to statistically discriminate among workers if these characteristics are correlated with performance.