A* content theme 2

1/18

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

19 Terms

2.1 economic performance - 3 concepts

hysteresis

underemployment

labour force participation rate

2.2 AD - 5 concepts

negative wealth effect

permanent income hypothesis

paradox of thrift

marshall-lerner condition

j curve effect

neg. wealth effect

prices falling = ppl feel poorer = less consumption

permanent income hypothesis - by Milton Friedman

higher income doesn’t necessarily mean more consumption, as people don’t spend more from short term increases

if anything they might save it (short term = high MPS, low MPC), which might weaken the multiplier

should look more at long term expectations to see an increase in consumption

paradox of thrift

everyone saves during a recession = no spending = WORSE

marshall-lerner condition

pound depreciation will only improve (X-M) if the PEDs of exports and imports is more than 1 (elastic)

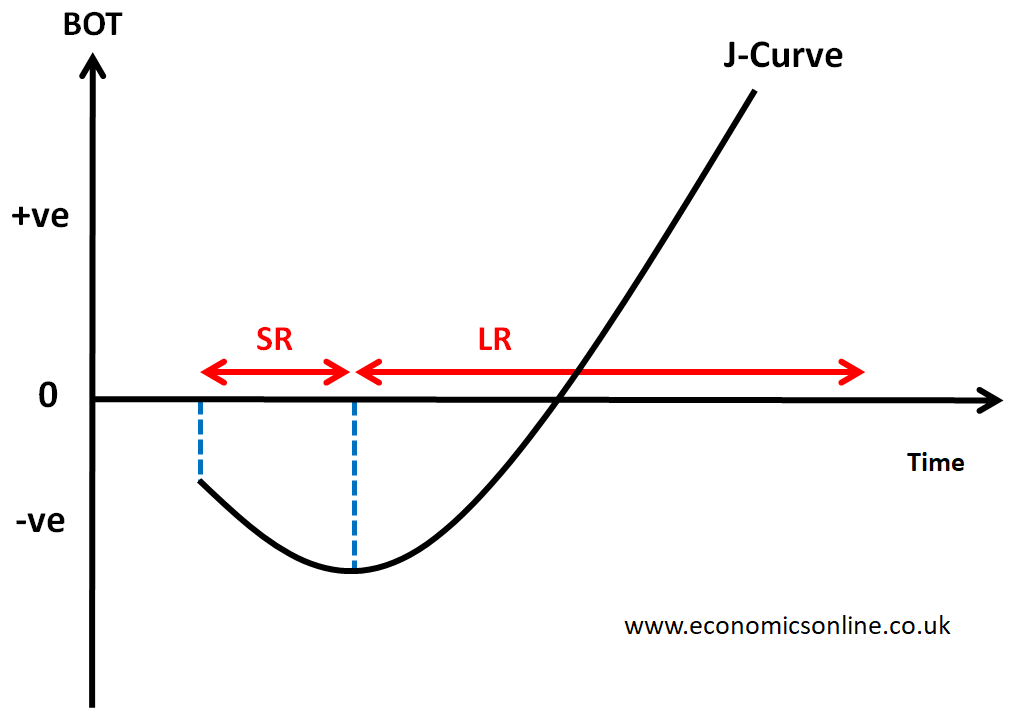

j curve

deprecation —> net trade gets WORSE before it gets better:

import/export contracts fixed in the short run

demand/supply inelastic in the short run

2.3 AS - 1 concept

exogenous shocks

exogenous shocks

conflict, natural disaster, pandemic etc

can be POSITIVE: technological breakthroughs

2.4 national income - 1 concept

accelerator effect

accelerator effect

rising demand = rising investment (at a faster rate)

magnifies economic cycles —> investment = volatile

2.5 economic growth - 1 concept

productivity trap

productivity (output per worker) trap

low productivity = low profits = low wages = low consumption = slow growth = low investment = cycle repeats

2.6.2 demand side - 5 concepts

liquidity trap

financial crowding out

cyclical vs structural deficit

discretionary vs automatic fiscal policy

laffer curve

liquidity trap

interest rates already low —> cutting them won’t work

cyclical v structural deficit

cyclical = result of the trade/business cycle

structural = permanent, result of fundamental imbalance in gov

discretionary vs automatic fiscal policy

automatic = automatic stabilisers

discretionary = deliberate moves from the gov

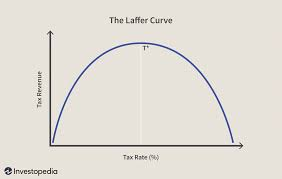

laffer curve

past a certain point, increasing tax might actually decrease revenue (no incentive to work)

general things to remember

opportunity cost of doing stuff

time lags involved in doing stuff

theory vs reality!!!