MICRO T8 - Distribution of Income

1/24

Earn XP

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

25 Terms

What is the difference between income and wealth?

Income is a flow of money going to factors of production

Wealth is the current value of a stock of assets owned by someone or society as a whole

What are some factors influencing inequality?

Skills bias arising from technological change – super-high pay for some people

Rising share of capital income – concentrated among the rich (Piketty)

Tax systems have become less progressive + Welfare cuts

Rise in scale of in-work poverty, reduced employee bargaining power

Hollowing out of employment in manufacturing, increasing economic inactivity

What are the consequences of high relative poverty (inequality) for economic growth?

Causes a self-perpetuating poverty cycle as there is limited access to health care and education, Volatile incomes, high debts and low savings

Misallocation of scarce resources as capital investment in society is skewed towards the preferences of the rich. Low collateral which limits growth of entrepreneurship

Social and political unrest/tensions because of increased pressure on state welfare systems, rise of the informal economy and high interest rate loans (doorstep lenders)

How can inequality drive economic growth?

Encourages competition and effort among workforce

Incentivizes risk: taking behaviour by entrepreneurs + incentives to invest in education – both good for innovative / competitiveness

Helps to build up market demand for certain consumer goods that require a minimum purchasing power in poor economies (cars)

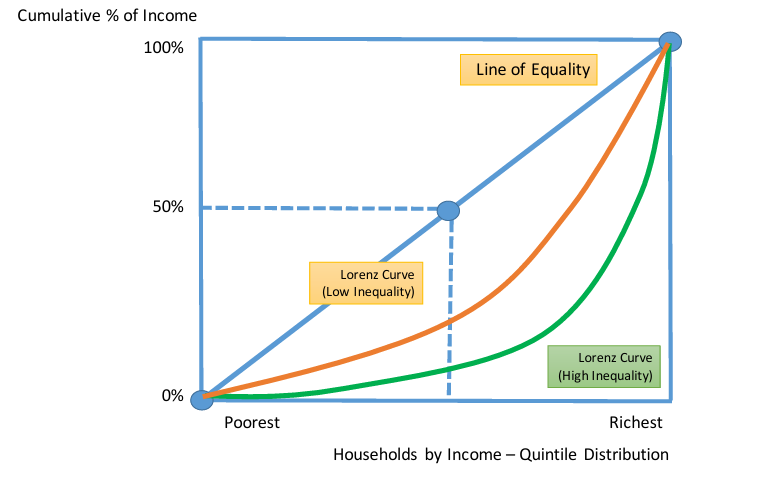

What is the Lorenz Curve?

Gives a visual interpretation of income or wealth inequality

The diagonal line shows a situation of perfect equality of income i.e. 50% of population has 50% of income

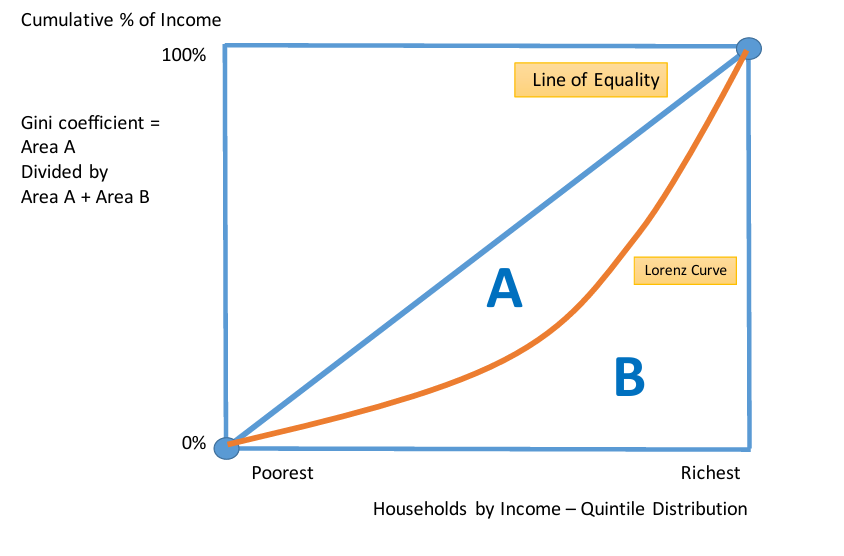

How can the Lorenz Curve measure the Gini coefficient?

Between 0 and 1

The higher the number, the greater the degree of income inequality. At 0 everyone has the same income

At 1 a single individual receives all the income

Absolute Poverty

When a household does not have sufficient income to sustain even a basic acceptable standard of living or meet basic needs

Absolute poverty thresholds will vary between developed and developing countries

The extreme poverty measure now used by the World Bank is the percentage of the population living on less than $1.90 a day (PPP)

Relative Poverty

A level of household income that is considerably lower than the median level of income within a country

The official UK relative poverty line is household disposable income (adjusted for household size) of less than 60% of median income

Official Poverty Line

An income level that is considered minimally sufficient to sustain a family in terms of food, housing, clothing, medical needs, and so on.

What are the main causes of absolute or extreme poverty?

Population growing faster than GDP in low income countries

Severe savings gap - families unable to save and living on less than $1.90 per day

Absence of basic public services

Effects of endemic corruption in government and business

High levels of debt and high interest rates

Damaging effects of civil wars and natural disasters

Low employment rates, vulnerable jobs and poverty wages

Absence of basic property rights

What are welfare state transfers?

Universal child benefits / unemployment benefit

Public or state pensions

Conditional welfare transfers e.g. Conditional on attending unemployment programmes

Targeted welfare payments- linked to income

What are some examples of state provided services to help inequality?

Education - reduces inequality of market incomes

Health care – state provided health services

Social housing - Provided by local authorities

Employment training

What are some examples of redistributive welfare transfers that reduce inequality?

Higher child benefit and the triple lock on state pensions

Expanded supported for disadvantaged students in paying tuition fees

Public goods free at the point of consumption

Minimum income scheme + capital endowments for young people

What are some examples of progressive income, consumption and wealth taxes that reduce inequality?

Higher taxes on property

Increased income tax allowances and higher marginal rate on incomes above £100,000

Progressive consumption tax

What are some examples of strengthening wage floors and employment rights in the labour market that reduce inequality?

National Living Wage, rising minimum wage

Improved employment rights, affordable child care, tackling monopsony employers

What are some examples of tackling structural barriers to employment that reduce inequality?

Early years education and more nutritional school meals to improve brain development

Improved access to new technologies in disadvantaged communities

Better vocational education, coding, STEM subjects

Targeted measures to address long term unemployment

What are some underlying causes of inequality?

Skills bias arising from technological change – super-high pay for some people

Rising share of capital income – concentrated among the rich (Piketty)

Tax systems have become less progressive + Welfare cuts

Executive pay and bonuses rising faster than for ordinary employees

Rise in scale of in-work poverty, reduced employee bargaining power

Increasing deep regional economic inequalities

Hollowing out of employment in manufacturing, increasing economic inactivity

Evaluate the following policy to lower inequality, providing a real world example.

Higher minimum wage

2024 NLW increased 10% from 2023

Boosts work incentives and take-home pay

HOWEVER, Might cost some jobs and lead to higher prices

Evaluate the following policy to lower inequality, providing a real world example.

Free provision of services

Free NHS treatment, state education

Access to merit goods not based on ability to pay

HOWEVER, Universal access not as effective as targeted provision

Evaluate the following policy to lower inequality, providing a real world example.

Higher rates of income tax

45% top rate of income tax may be raised to 50% again

Progressive taxes on the rich lower inequality and raise revenue

HOWEVER, High taxes on the rich may reduce their incentive to earn and be productive, potentially lowering overall tax revenue (Laffer Curve effect)

Lowering regressive taxes could significantly reduce government revenue, leading to potential austerity measures.

Evaluate the following policy to lower inequality, providing a real world example.

Investment in training

Subsidies for workplace training / internships

Helps to raise productivity, jobs and real wages

HOWEVER, Effective in the long run but risk of the free rider problem

Evaluate the following policy to lower inequality, providing a real world example.

Subsidies for childcare

2014 - max Govt contribution of £2,000 a year for each child

Improve incentives for mothers to look for and take work

HOWEVER, Effective, but quality of childcare needs improving

Horizontal Equity

The identical treatment of identical individuals or groups in society in identical situations.

Vertical Equity

The different treatment of individuals or groups which are dissimilar in characteristics.

What are some evaluative points for redistribution of income?

Incentives: Many policies risk distorting incentives, potentially leading to inefficiency.

Government Finances: The ability of governments to afford these policies is a critical consideration.

Equity vs. Efficiency: Balancing fairness with economic efficiency is challenging.

Normative Judgments: Government intervention based on fairness may not always lead to the best economic outcomes.

Extent of Inequality: Assessing whether inequality is severe enough to warrant intervention.