Chapter 4 - Loans and Amortization Tables

1/9

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No study sessions yet.

10 Terms

Ammortization Tables:

A) What is the loan balance at the beginning of the year?

B) How do you calculate the interest payment?

C) What is the principal repayment?

D) How do you calculate the total payment?

E) How do you calculate the loan principal balance at the end of the year?

A) The value that you borrowed and still have to pay.

B) Interest rate * loan balance at the beginning of the year

C) The amount of the principle that you are paying back at that time

D) interest payment + principal repayment

E) Loan balance at the beginning of the year - principal repayment

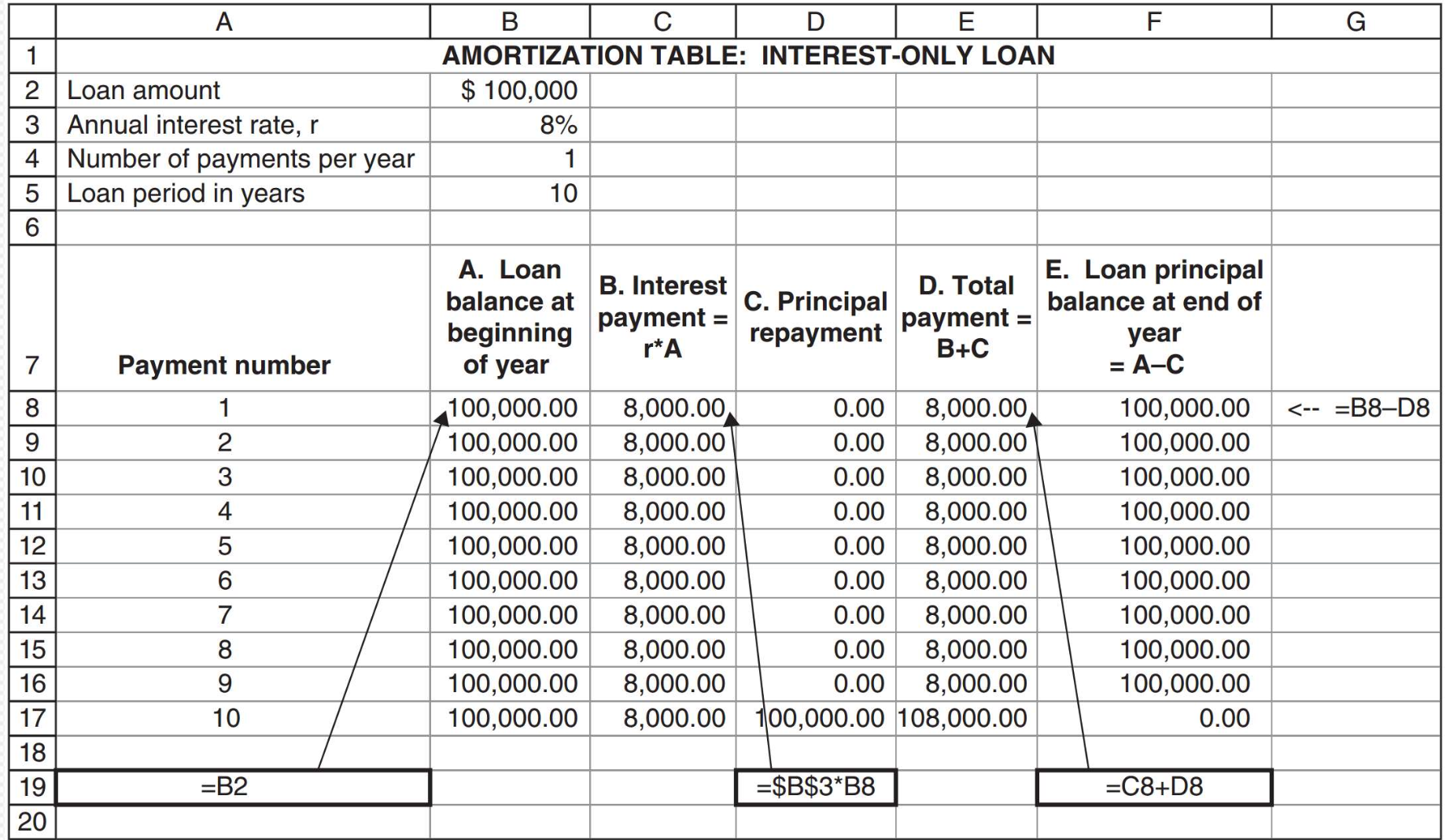

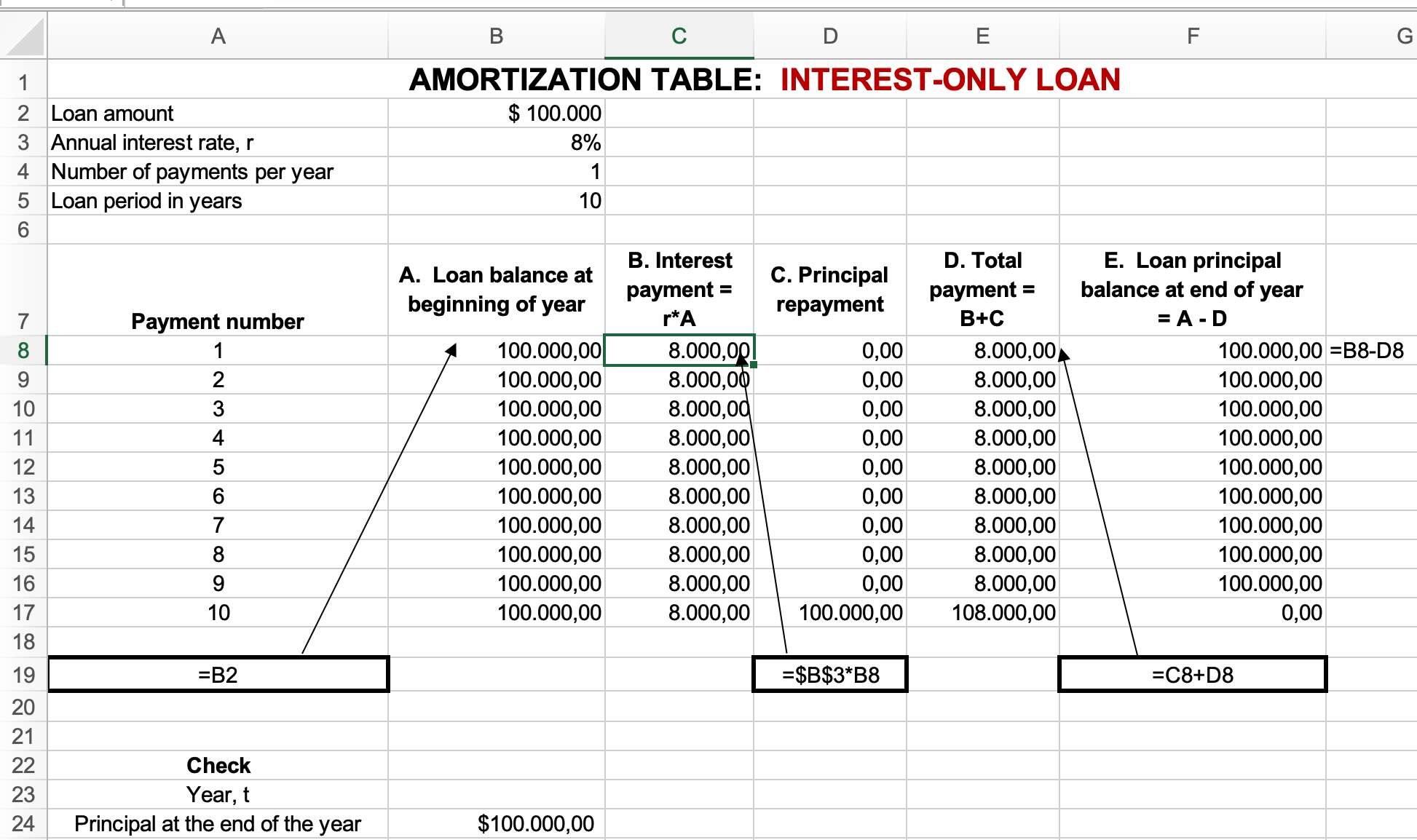

Interest-Only Loan:

A) What is the remaining balance of a loan (loan principal balance) after n payments?

B) How about the value of the principal repayment?

C) How about loan balance at the beginning of the year?

D) What does the last payment include?

A) It is going to be equal to the loan amount and it is going to remain that way until the last payment. On the last payment it becomes 0.

With interest-only loan you pay only the interest and at the last payment you pay the principal.

B) It is going to be 0 for the most part, and at the last payment it will be the full amount of the loan.

C) It will always be the loan amount

D) The last payment includes the loan amount + the final interest.

Equal Amortization Term Loan:

A) What do the payments consist of?

B) What happen to the colomn loan balance at the beginning of the year?

C) What happens to the interest payment column?

D) How about the value of the principal repayment?

E) How about loan balance at the end of the year?

F) What happens to the total payment?

A) In an Equal Amortization Term Loan, each payment consists of two parts: interest and principal.

B) The loan balance at the begging of the year colomn decreases over time as repayment of the principal happens.

C) It descreases over time, as the loan balance value decreases so does the interest since it representative of a percentage of the remaining loan balance.

D) It always stays the same

E) It decreases over time and becomes 0 at the last payment. The loan is fully paid off by the end of the term.

F) it decreases over time

Term Loan (Equal Payment Term Loan aka Mortgage):

A) What do the payments consist of?

B) What happen to the colomn loan balance at the beginning of the year?

C) What happens to the interest payment column?

D) How about the value of the principal repayment?

A) Interest + Principal. However, the portion of the payment allocated to interest and principal changes with each payment.

B) The loan balance at the begging of the year colomn decreases over time as repayment of the principal happens.

C) It descreases over time, as the loan balance value decreases so does the interest since it representative of a percentage of the remaining loan balance.

D) It increases over time.

Initially, a larger portion of the payment goes towards interest, while the remainder pays down the principal. Over time, as the principal decreases, more of the payment goes towards paying the principal and less towards interest.

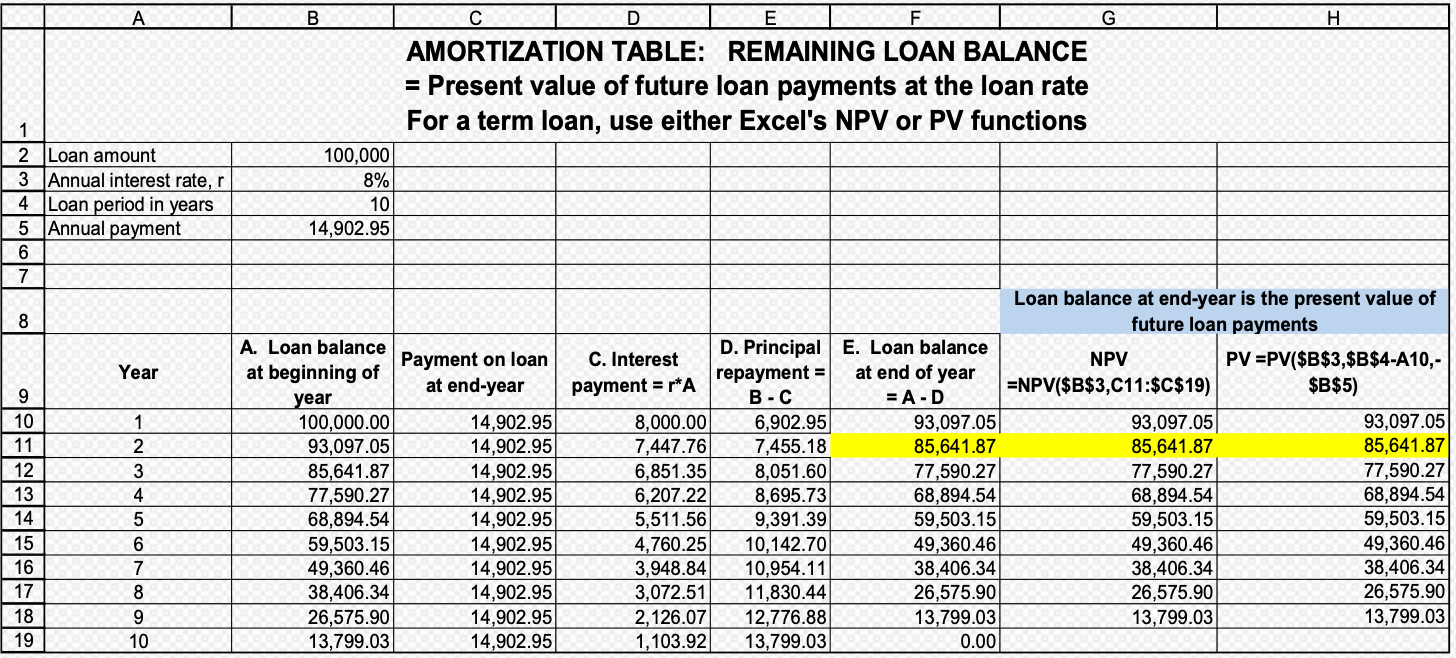

Term Loan (Equal Payment Term Loan aka Mortgage):

E) How about loan balance at the end of the year?

F)What is the remaining balance of a term loan after n payments? (How do you calculate the loan balance at the end of the year)

G) What happens to the total payment?

H) How do we find out what is the value of the annuity payment that can pay off the loan?

E) It decreases over time and becomes 0 at the last payment. The loan is fully paid off by the end of the term.

F) Method 1:

Loan balance at beginning of year - Principal repayment |

Method 2:

Determine the present value of the future loan payments using the NPV formula.

Method 2:

Determine the present value of the future loan payments using the PV formula.

G) In a Term Loan with Equal Payments, each payment is the same amount from the beginning till the end.

H) By using the PMT function on excel:

=PMT(Annual Interest rate;Loan period in years;-Loan amount)

Rate is the interest rate on the loan, NPER is the number of repayment periods, and PV is the loan principal.

Note: if the loan principal is written as a positive number, Excel presents the payment as a negative number; to avoid this, we write PV as a negative number.

Morgage (Discussion 1):

A) What is another way to calculate the loan balance at the beginning of the year?

A) The loan balance is simply the present value of all the future loan payments. So you can also calculate it by using the NPV formula or the PV formula

Morgage using IPMT AND PPMT:

A) What is IPMT and how does the formula work?

B)What is PPMT and how does the formula work?

A) IPMT is a formula to calculate the interest part of a payment. (Interest Payment)

IPMT (rate; per; nper; pv; [fv]; [type])

Rate - Interest Rate

Per - Period for which you want to calculate interest

Nper - Total number of payment periods

PV - Initial loan amount

FV - Future value of the loan (usually 0 in loans)

Type - Whether payment is done at the beginning or end of the period

B) PPMT is a formula to calculate the principal part of a payment.(Principal Repayment) The formula is the same as the one for IPMT.

PPMT (rate; per; nper; pv; [fv]; [type])

![<p><strong>A) </strong><mark data-color="purple">IPMT is a formula to calculate the interest part of a payment. (Interest Payment)</mark></p><p><mark data-color="purple">IPMT (rate; per; nper; pv; [fv]; [type])</mark></p><p>Rate - Interest Rate</p><p>Per - Period for which you want to calculate interest</p><p>Nper - Total number of payment periods</p><p>PV - Initial loan amount</p><p>FV - Future value of the loan (usually 0 in loans) </p><p>Type - Whether payment is done at the beginning or end of the period </p><p><strong>B) </strong><mark data-color="purple">PPMT is a formula to calculate the principal part of a payment.(Principal Repayment) The formula is the same as the one for IPMT. </mark></p><p><mark data-color="purple">PPMT (rate; per; nper; pv; [fv]; [type])</mark></p>](https://knowt-user-attachments.s3.amazonaws.com/a61851f7-343b-46fd-86e6-5b53ce7858ab.png)

Shorter method for mortgages:

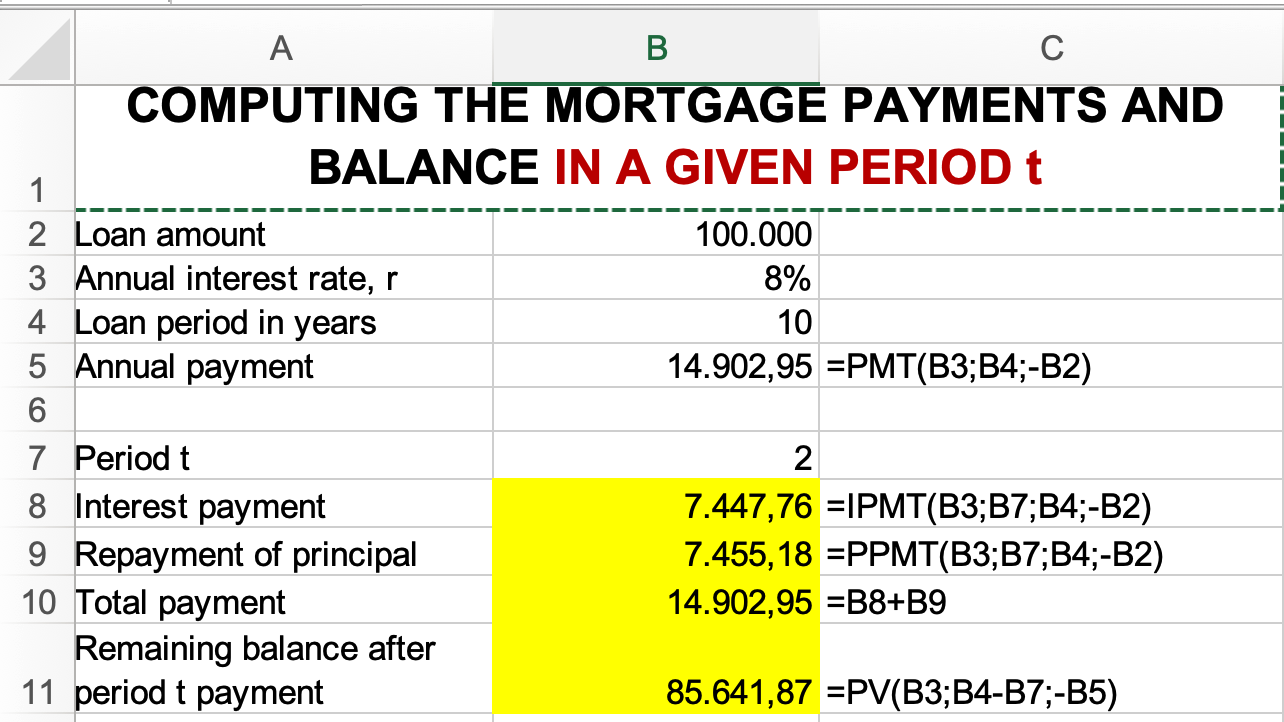

COMPUTING THE MORTGAGE PAYMENTS AND BALANCE IN A GIVEN PERIOD t |

A) What information do we need?

B) How do you calculate the annual payment?

C) When we calculate the IPMT, what do we put in the per space?

D) How do we calculate the total payment?

E) How do we calculate the remaining valance after period t payment?

A) The loan amount, annual interest rate and loan period in years.

B) Using the PMT formula

C) We put the period, which in this example is 2.

D) We add the result of the IPMT to the result of the PPMT. This is going to be the same value that we get when we calculate the PMT for the same period.

E) We use the PV formula

=PV(Rate ; Loan period in years - Period t; - annual payment)

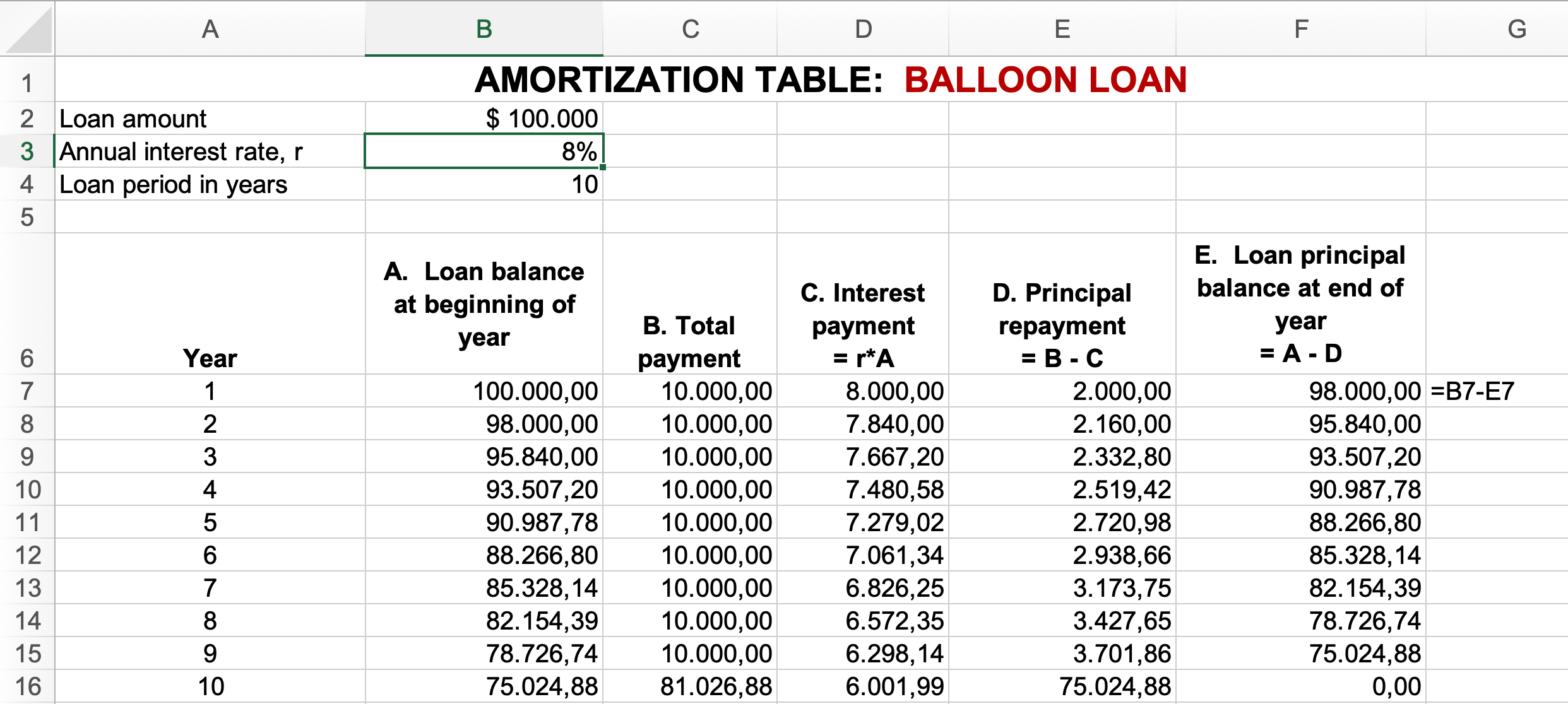

Ballon Loan:

A) What is a ballon loan?

B) What are ballon loans with a negative principal repayment?

A) A balloon loan is a type of loan where the borrower makes regular small payments for a set period. However, at the end of the loan term, there is a final payment, known as the balloon payment, which is significantly larger than the regular payments made throughout the loan term.

This balloon payment covers the remaining balance of the loan. Balloon loans are often used in situations where the borrower expects to have a large sum of money available at the end of the loan term to cover the balloon payment, such as with certain types of investments or business ventures.

B) Balloon loans with negative principal repayments, also known as negative amortization loans, are loans where the borrower's payments are not enough to cover the interest accrued on the loan. As a result, the unpaid interest is added to the loan balance, causing the overall loan balance to increase over time instead of decreasing.

Simply put the payments are too small and the interest keeps pilling up. So the loan balance at the beginning of the year keeps going up.

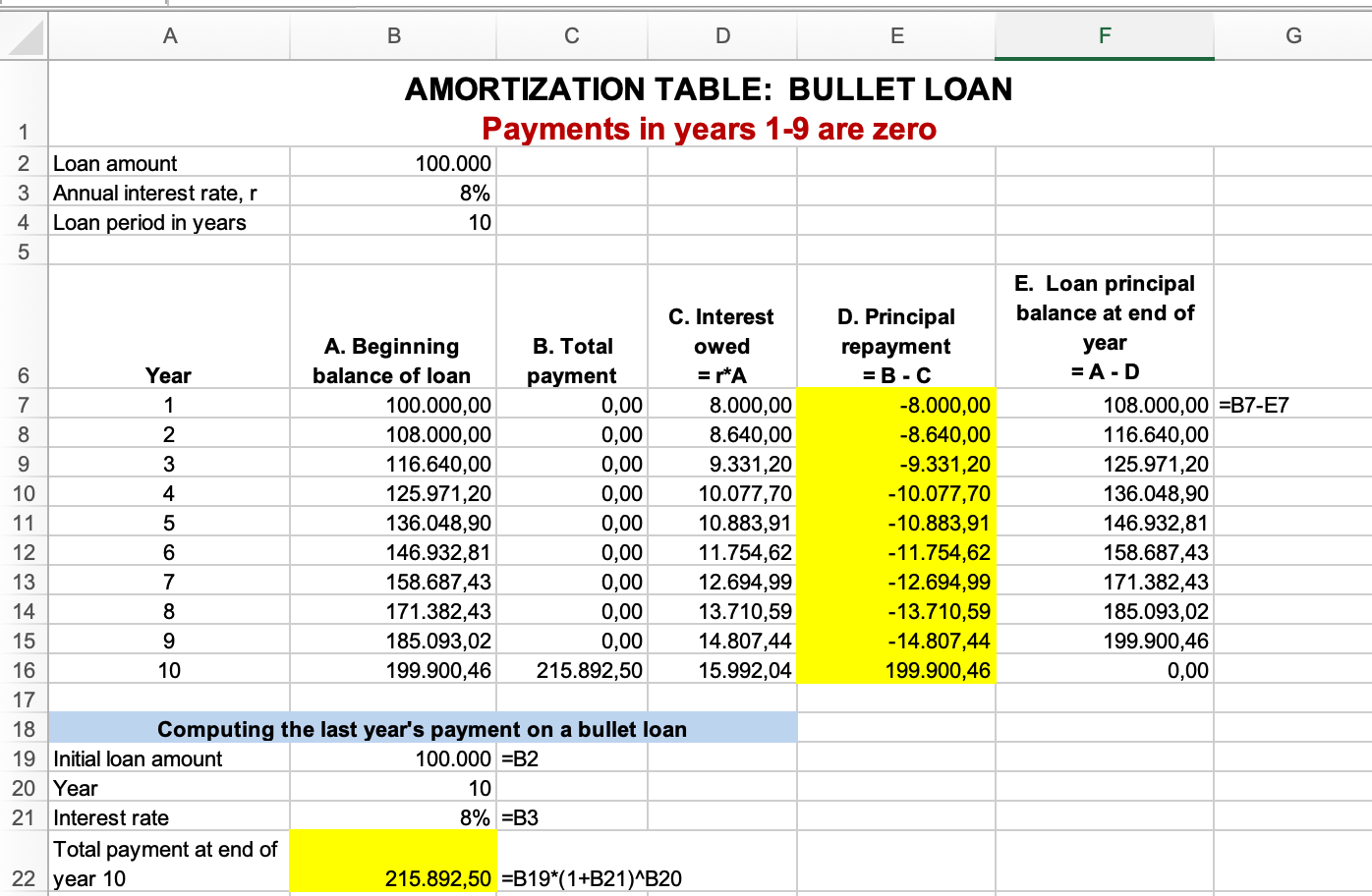

Bullet Loan:

A) How does a bullet loan work?

A) A bullet loan is a type of loan where you don't make any payments until the very end. Instead of paying a little bit every month, you pay off the entire loan amount, plus any interest, in one big payment at the end. This lump sum payment at the end is often referred to as the "bullet payment," which clears the entire debt.