Finance and Investment Cycle, Completing the Audit, Reports on Audited Financial Statements

1/9

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

10 Terms

Describe the finance and investment cycle, including typical source documents

The finance and investment cycle involves strategic financial planning, raising capital via debt/equity, and investing in diverse assets, characterized by infrequent, high-value transactions. Managed by senior officials, it relies on external parties (e.g., transfer agents) and robust documentation. Typical source documents include:

Planning/Capital: Cash flow forecasts, capital budgets, board approvals

Financing: Board minutes, registration documents, financing contracts, transfer agent/registrar reports, executive signatures, payment notices, bond agreements, ledger entries, trustee confirmations, stock certificate books, shareholder confirmations

Investing: Investment policy approvals, brokerage statements, safe deposit records, legal contracts, vouchers, checks, electronic logs, broker confirmations, securities count records, certificate details

These documents ensure proper authorization, recording, custody, and reconciliation, critical for auditing this complex cycle.

Identify significant accounts and relevant assertions related to the finance and investment cycle.

Investments: Existence/Occurrence, Completeness, Valuation, Presentation and Disclosure—driven by diverse investment types and valuation complexities.

Long-Term Debt: Existence/Occurrence, Completeness, Valuation, Presentation and Disclosure—focused on capturing all obligations and proper terms disclosure.

Capital Stock: Completeness, Presentation and Disclosure—ensuring all equity transactions are recorded and disclosed accurately.

Retained Earnings: Completeness—verifying dividends and adjustments are fully captured.

Discuss the risk of material misstatement in the finance and investment cycle, with a specific focus on improper valuation and disclosure.

The finance and investment cycle is prone to material misstatements due to its infrequent, high-value transactions, which require significant authorization and involve complex valuation and disclosure requirements. The cycle’s reliance on estimates and professional judgment heightens risks, particularly in improper valuation and disclosure.

Identify important internal control activities present in a properly designed system to mitigate the risk of material misstatements for each relevant assertion in the finance and investment cycle.

A properly designed system in the finance and investment cycle includes internal control activities to mitigate misstatement risks:

Authorization: Board approvals for financing and investments ensure valid transactions (Existence, Completeness).

Custody: Secure storage with dual control protects assets (Existence, Valuation).

Record Keeping: Detailed processes by skilled accountants capture and value transactions (Completeness, Valuation, Presentation/Disclosure).

Periodic Reconciliation: External confirmations or counts verify holdings (Existence, Completeness, Valuation).

These controls address relevant assertions—Existence/Occurrence, Completeness, Valuation, and Presentation/Disclosure—for significant accounts (Investments, Long-Term Debt, Capital Stock, Retained Earnings). Due to the cycle’s complexity, auditors emphasize management oversight and substantive testing to complement controls.

Give examples of tests of controls to test the operating effectiveness of internal controls in the finance and investment cycle.

Give examples of substantive procedures in the finance and investment cycle and relate them to assertions about significant account balances at the end of the period.

Identify major activities performed by auditors in completing the substantive procedures following the date of the financial statements.

Beginning of Year January 1, 2023

Interim testing

Tests Of Controls

Substantive Procedures - testing whether or not the financial statements are fair and accurate

Year-End Date December 31, 2023

Completing substantive procedures

Attorney’s Letters

Written representations

Going concern assessment - The probability that the company will continue operating

Adjusting journal entries

Audit documentation review

Subsequent events

Date of the Auditors Report

Subsequently discovered facts

Audit Report Release Date

Subsequently discovered facts

Omitted Audit procedures

Management letter

Communications with those charged with governance

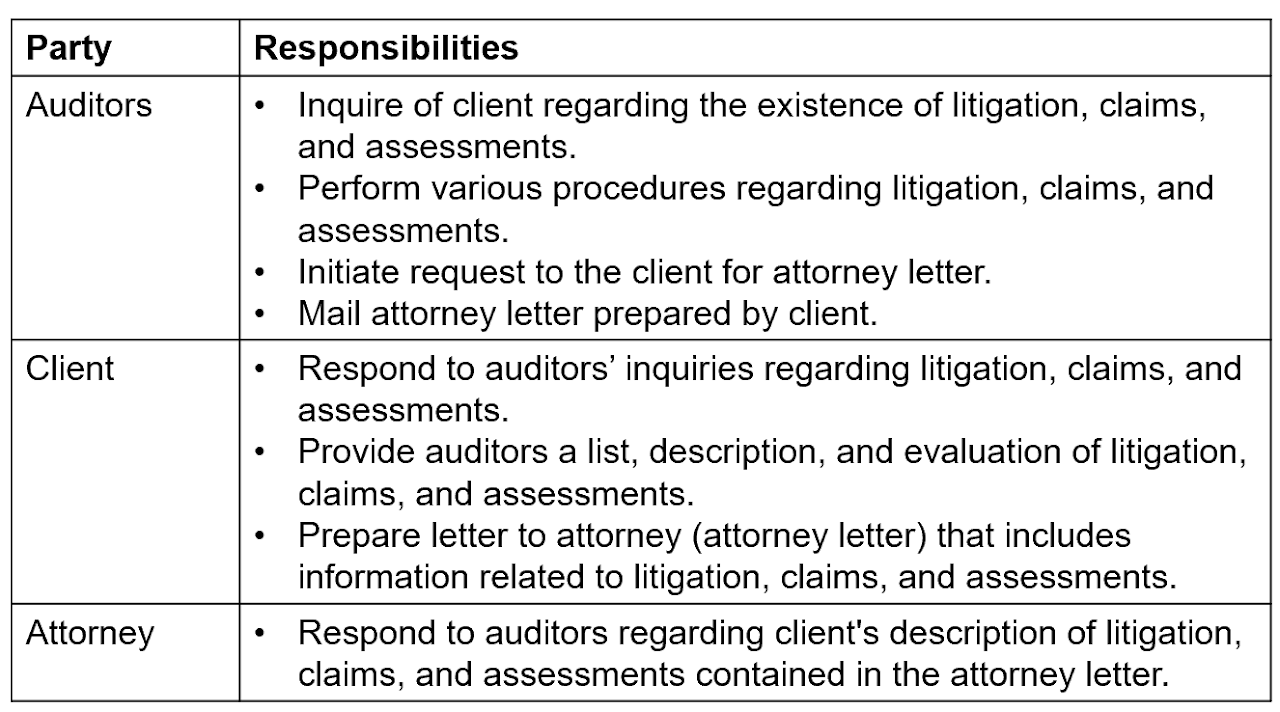

Understand the role of attorney letters in evaluating litigation, claims, and assessments.

Auditors request client to prepare attorney letter

Client responds with a list, description, and evaluation of litigation, claims, and assessments. Then writes attorney letter

Attorney Letter - includes information related to litigation, claims, and assessments (sent from client to auditor, then auditor to attorney)

Attorney responds to auditors regarding the Attorney Letter

Explain why auditors obtain written representations and identify the key components of written representations.

Written representations are provided by management and dated using the audit completion date. They highlight the responsibility of management for the financial statements, and it may establish auditors’ defense if a question related to inquiries comes up later. Can qualify or disclaim an opinion if not provided by the client.

Key Components:

Information related to financial statements:

Management’s responsibility for F/S and internal control over financial reporting.

Appropriate disclosure, presentation, and reasonableness of items.

Statement that uncorrected misstatements are immaterial.

Information provided to auditors by management.

Internal control over financial reporting (for public entities).

Identify the final steps in the completion of an audit.

Auditors consider whether evidence obtained during audit raises questions about ability for the company to be a going concern. If there are concerns, auditors must modify their report and ensure proper use of going concern basis of accounting. Next, auditors accumulate dollar effects of identified misstatements and evaluate materiality.