RMIN 4000 (Exam 3)

5.0(1)

5.0(1)

Card Sorting

1/135

Earn XP

Description and Tags

Study Analytics

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

136 Terms

1

New cards

1) Declarations

2) Definition

3) Insuring Agreement

4) Exclusions

5) Conditions

6) Miscellaneous Provisions

2) Definition

3) Insuring Agreement

4) Exclusions

5) Conditions

6) Miscellaneous Provisions

Basic Parts of an Insurance Contract

2

New cards

Declarations

+ Statements that provide information about the particular property or activity to be insured.

+ Declarations Page

- Name and Address of Insurer

- Name and Address of Insured

- Insured Property Location(s)

- Policy Period (Dates)

- Amount(s) of Insurance (Limits)

- Premium

- Deductible (if any)

- Other Relevant Information (Schedule of endorsements et al)

+ Declarations Page

- Name and Address of Insurer

- Name and Address of Insured

- Insured Property Location(s)

- Policy Period (Dates)

- Amount(s) of Insurance (Limits)

- Premium

- Deductible (if any)

- Other Relevant Information (Schedule of endorsements et al)

3

New cards

Definitions

+ Key words or phrases are defined so that coverage under the policy can be determined more easily.

- “We,” “us,” and “our” refer to the insurer.

- “You” and “your” refer to the insured.

- “We,” “us,” and “our” refer to the insurer.

- “You” and “your” refer to the insured.

4

New cards

Insuring Agreement

Summary of the major promises of the insurer (what the policy covers)

5

New cards

Named Perils

Only those perils specifically named in the policy are covered

6

New cards

Open Perils (“All Risk” perils or “Special Coverage”)

All perils are covered except for those that are specifically excluded, provide the most coverage

7

New cards

Exclusions

+ Perils or property that are not covered under the policy.

+ Examples:

- Flood / Earthquake

- War

- Intentional Loss

- Certain types of property

+ Examples:

- Flood / Earthquake

- War

- Intentional Loss

- Certain types of property

8

New cards

+ Certain perils considered uninsurable

- War, wear & tear, inherent vice

+ Presence of extraordinary hazards

- Using personal vehicle as a taxi or for Uber, Lyft

+ Coverage provided by other contracts

- Use of autos is excluded by homeowners policy; coverage available under separate auto policy.

+ Moral hazard

- Addressed by limiting coverage within policy

+ Attitudinal hazard

- Losses due to freezing of pipes are only covered if there was reasonable care to maintain heat in the building.

+ Coverage not needed by typical insureds

- Homeowners policy does not cover aircraft (Coverage available under separate policy)

- War, wear & tear, inherent vice

+ Presence of extraordinary hazards

- Using personal vehicle as a taxi or for Uber, Lyft

+ Coverage provided by other contracts

- Use of autos is excluded by homeowners policy; coverage available under separate auto policy.

+ Moral hazard

- Addressed by limiting coverage within policy

+ Attitudinal hazard

- Losses due to freezing of pipes are only covered if there was reasonable care to maintain heat in the building.

+ Coverage not needed by typical insureds

- Homeowners policy does not cover aircraft (Coverage available under separate policy)

Why Are Exclusions Necessary?

9

New cards

Conditions

+ Provisions in the policy that qualify or place limitations on the insurer’s promise to perform.

+ Examples:

- Prompt notification of loss

- Protect property from further loss

- Valuation/Loss Settlement – “ACV” vs. “RC”

- No concealment or fraud

- Subrogation

+ Examples:

- Prompt notification of loss

- Protect property from further loss

- Valuation/Loss Settlement – “ACV” vs. “RC”

- No concealment or fraud

- Subrogation

10

New cards

Miscellaneous Provisions

+ Notice of Cancellation and Nonrenewal need to be given 30 - 90 days out

+ States have mandatory provisions (added by endorsements)

- Notice of Cancellation

- Notice of Nonrenewal

- Notice of Loss

- Mortgagee Clause

+ States have mandatory provisions (added by endorsements)

- Notice of Cancellation

- Notice of Nonrenewal

- Notice of Loss

- Mortgagee Clause

11

New cards

Named Insured

The person(s) or party named on the Declarations Page of the policy

12

New cards

First Named Insured

Has certain additional rights and responsibilities that do not apply to other Named Insureds

13

New cards

Other Insureds

Persons or parties who are insured under the policy even though they are not specifically named

14

New cards

Additional Insureds

Person or party added to the policy by an endorsement

15

New cards

Endorsements and Riders

+ Provisions that add to, delete from, or modify the original policy terms.

+ Examples:

- Negotiated coverage enhancements

- Specific exclusions

- Statutory provisions to comply with state laws

- (Example: Uninsured Motorists coverage)

+ Examples:

- Negotiated coverage enhancements

- Specific exclusions

- Statutory provisions to comply with state laws

- (Example: Uninsured Motorists coverage)

16

New cards

Deductible

A deductible is a provision by which a specified amount is subtracted from the total loss payment that would otherwise be payable

17

New cards

+ ***Frequency and severity of a loss goes down if they have deductibles

+ Eliminate small claims

- It is expensive (relatively) for an insurance company to adjust small claims.

- May cost more in expenses than the amount of the claim.

+ Reduce premiums

- Pure premium = frequency x severity

- Both frequency and severity are reduced.

+ Reduce moral and morale (attitudinal) hazard

- Dishonest people may not be able to afford deductible.

- People are less careless if they know it will cost them money (skin in the game).

+ Eliminate small claims

- It is expensive (relatively) for an insurance company to adjust small claims.

- May cost more in expenses than the amount of the claim.

+ Reduce premiums

- Pure premium = frequency x severity

- Both frequency and severity are reduced.

+ Reduce moral and morale (attitudinal) hazard

- Dishonest people may not be able to afford deductible.

- People are less careless if they know it will cost them money (skin in the game).

Why Have Deductibles?

18

New cards

Straight Deductible

The amount the insured is responsible for per loss before the insurer pays anything

19

New cards

Insured pays $1,000

Insurer pays $9,000

Insurer pays $9,000

Straight Deductible Examples - $1,000 deductible on Property Policy

Claim #1 – Fire Loss

$10,000 in damages

Insured pays: ?

Insurer pays: ?

Claim #1 – Fire Loss

$10,000 in damages

Insured pays: ?

Insurer pays: ?

20

New cards

Insured pays $900

Insurer pays nothing since the loss is below the deductible

Insurer pays nothing since the loss is below the deductible

Straight Deductible Examples - $1,000 deductible on Property Policy

Claim #2 – Theft of Computer Equipment

$900 covered loss

Insured pays: ?

Insurer pays: ?

Claim #2 – Theft of Computer Equipment

$900 covered loss

Insured pays: ?

Insurer pays: ?

21

New cards

Aggregate Deductible

The amount the insured is responsible for in total (over all losses during the policy period) before the insurer pays anything

22

New cards

Insured pays $600

Insurer pays 0

Insurer pays 0

Aggregate Deductible Example: $1,000 annual aggregate deductible

Doctor appt. #1 on 1/30

Cost $600

Insured pays: ?

Insurer pays: ?

Doctor appt. #1 on 1/30

Cost $600

Insured pays: ?

Insurer pays: ?

23

New cards

Insured pays $400

Insurer pays $500

Insurer pays $500

Aggregate Deductible Example: $1,000 annual aggregate deductible

- Doctor appt. #1 on 1/30

- Insured paid $600, insurer paid 0

Doctor appt. #2 on 10/13

Cost $900

Insured pays: ?

Insurer pays: ?

- Doctor appt. #1 on 1/30

- Insured paid $600, insurer paid 0

Doctor appt. #2 on 10/13

Cost $900

Insured pays: ?

Insurer pays: ?

24

New cards

Elimination (Waiting) Period

- Stated period of time at the beginning of a loss during which no insurance benefits are paid.

- Common in Disability Insurance – typically cannot collect until you’ve been out of work for 30, 60, or 90 days.

- Common in Disability Insurance – typically cannot collect until you’ve been out of work for 30, 60, or 90 days.

25

New cards

***Business Interruption

***________ has an elimination period, can delay start up to 30-60 days out

26

New cards

Coinsurance (in Property Insurance)

+ Encourages the insured to insure the property to a stated percentage of its insurable value.

+ If coinsurance requirement is not met at the time of loss, the insured must share the loss (as a coinsurer)

+ If coinsurance requirement is not met at the time of loss, the insured must share the loss (as a coinsurer)

27

New cards

***Amount of Recovery = (Amount of Insurance Carried / Amount of Insurance Required) x Loss

*** Coinsurance Formula

28

New cards

Insurer Pays: ($300K / $400K ($500K x 80%)) x $200K loss = $150K

Example: Property Coinsurance

- Commercial building with reconstruction/replacement cost of $500,000

- Owner has insured the building for $300,000

Policy includes an 80% ***coinsurance clause

A covered fire causes $200,000 in damages

Insurer pays: ?

- Commercial building with reconstruction/replacement cost of $500,000

- Owner has insured the building for $300,000

Policy includes an 80% ***coinsurance clause

A covered fire causes $200,000 in damages

Insurer pays: ?

29

New cards

Coinsurance (in Health Insurance)

+ Provision that requires the insured to pay a specified percentage of covered medical expenses after the deductible is met.

+ Reduces premiums and prevents overutilization of policy benefits.

+ If you have to pay for a portion of it, are you going to get a medical test you don’t think you need?

+ Reduces premiums and prevents overutilization of policy benefits.

+ If you have to pay for a portion of it, are you going to get a medical test you don’t think you need?

30

New cards

Insured Pays = $1,800 ($1,000 deductible + (20% x $4,000 above deductible)

Insurer Pays = $3,200 (80% x $4,000 above deductible)

Insurer Pays = $3,200 (80% x $4,000 above deductible)

Example: Health Coinsurance

$1,000 deductible

80%/20% coinsurance (insurer pays 80%)

$5,000 cost of a medical procedure

Insurer Pays: ?

Insured Pays: ?

$1,000 deductible

80%/20% coinsurance (insurer pays 80%)

$5,000 cost of a medical procedure

Insurer Pays: ?

Insured Pays: ?

31

New cards

+ Provisions for when multiple insurance policies apply.

+ Prevents the insured from profiting from a loss.

1. Pro Rata Liability

2. Contribution by Equal Shares

+ Prevents the insured from profiting from a loss.

1. Pro Rata Liability

2. Contribution by Equal Shares

“Other-Insurance” Provisions

32

New cards

Pro Rata Liability

Each insurer’s share of a loss is based on the proportion that its insurance bears to the total amount of insurance on the property

33

New cards

Contribution by Equal Shares

Each insurer shares equally in the loss until the share paid by each insurer equals the lowest limit of liability under any policy, or until the full amount of the loss is paid

34

New cards

Company A: $300K/$500K = 60% x $100,000 = $60,000

Company B: $100K/$500K = 20% x $100,000 = $20,000

Company C: $100K/$500K = 20% x $100,000 = $20,000

- Whole $500K loss covered

Company B: $100K/$500K = 20% x $100,000 = $20,000

Company C: $100K/$500K = 20% x $100,000 = $20,000

- Whole $500K loss covered

Example: “Other-Insurance” Pro Rata

+ A building is insured for a total of $500,000.

+ For underwriting reasons, coverage is split between 3 insurers: A ($300,000), B ($100,000) and C ($100,000).

+ How much would each insurer pay for a $100,000 loss?

+ A building is insured for a total of $500,000.

+ For underwriting reasons, coverage is split between 3 insurers: A ($300,000), B ($100,000) and C ($100,000).

+ How much would each insurer pay for a $100,000 loss?

35

New cards

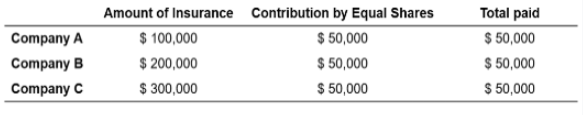

All 3 pay $50,000

Example: “Other-Insurance” Contribution by Equal Shares

3 policies in force, each with different limits

Amount of Loss = $150,000

3 policies in force, each with different limits

Amount of Loss = $150,000

36

New cards

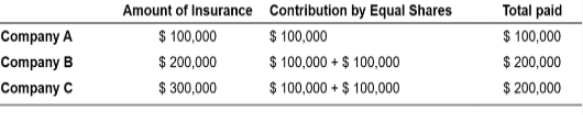

Company A pays $100,000, while Companies B and C pay $200,000 each

Example: “Other-Insurance” Contribution by Equal Shares

3 policies in force, each with different limits

Amount of Loss = $500,000

3 policies in force, each with different limits

Amount of Loss = $500,000

37

New cards

Primary insurer

____________ pays first, and the excess insurer pays only after the policy limits under the primary policy are exhausted

38

New cards

“Umbrella Liability” Insurance

__________ is an example of coverage over primary liability policy limits.

39

New cards

Property Insurance

Cyber used to be covered in ____________

40

New cards

Easier

+ Underwriters can refuse to write policies

+ Brokers cannot refuse to cover clients, it will give them a bad reputation

+ Stress in Underwriting comes from claims settlement

+ Brokers have to deal with stressed out clients

+ Underwriters do not deal with clients nearly as much as brokers

+ Underwriters can refuse to write policies

+ Brokers cannot refuse to cover clients, it will give them a bad reputation

+ Stress in Underwriting comes from claims settlement

+ Brokers have to deal with stressed out clients

+ Underwriters do not deal with clients nearly as much as brokers

Underwriting is generally _____ than being a Broker

41

New cards

young

E&O or Cyber is an extremely _____ field, and most people within the field are young and guessing/figuring out what to do

42

New cards

cost

Cyber is a small portion of the insurance market, but it is growing dramatically in ____

43

New cards

start-up

Cyber practices are easier to _______ in insurance currently, because there is a lot more information that start-ups can learn from the older companies’ mistakes

44

New cards

+ Training

- On the job vs formal training

- Designations

- Differences in forms

- Evolution of coverage

- Technical expertise challenge

+ Day in the Life of a Broker vs Underwriter

- Ability to say no vs challenge of being told no

- Client interaction/education

- Control over the transaction

- Difference in customer

- Different stressors – client vs claims

- Marketing

+ Career Path of Underwriters & Brokers

- Talent gap – Current market conditions

- Lack of significant experience

- Startups

- On the job vs formal training

- Designations

- Differences in forms

- Evolution of coverage

- Technical expertise challenge

+ Day in the Life of a Broker vs Underwriter

- Ability to say no vs challenge of being told no

- Client interaction/education

- Control over the transaction

- Difference in customer

- Different stressors – client vs claims

- Marketing

+ Career Path of Underwriters & Brokers

- Talent gap – Current market conditions

- Lack of significant experience

- Startups

Broker vs Insurance Company Experiences

45

New cards

+ 3rd party

- E&O

- Technology E&O

- Miscellaneous Professional Liability (MPL)

- Media Liability

- Network Security / Privacy

+ 1st party

- Breach Costs

- Regulatory

- PCI DSS

- Business Interruption / System Failure

- Dependent Business Interruption / System Failure

- Digital Asset Restoration / Hardware Replacement

- Cyber Extortion

- E&O

- Technology E&O

- Miscellaneous Professional Liability (MPL)

- Media Liability

- Network Security / Privacy

+ 1st party

- Breach Costs

- Regulatory

- PCI DSS

- Business Interruption / System Failure

- Dependent Business Interruption / System Failure

- Digital Asset Restoration / Hardware Replacement

- Cyber Extortion

Cyber - Coverages

46

New cards

+ Privacy Liability and Operational Risk

+ Industries (Manufacturing, Distribution, Construction vs. Service Providers, Retailer, Hospitality, Financial Institution etc.)

+ Increasing reliance on technology has created an operational risk for almost all industries!

+ Aggregation Concerns

- Dependent Business Interruption

- Infrastructure Exposure

+ Evolution of Controls

- Heightened Awareness From Boards and C-suite Members

+ Ransomware

+ War in Russia & Ukraine

+ Industries (Manufacturing, Distribution, Construction vs. Service Providers, Retailer, Hospitality, Financial Institution etc.)

+ Increasing reliance on technology has created an operational risk for almost all industries!

+ Aggregation Concerns

- Dependent Business Interruption

- Infrastructure Exposure

+ Evolution of Controls

- Heightened Awareness From Boards and C-suite Members

+ Ransomware

+ War in Russia & Ukraine

Cyber - Exposures

47

New cards

+ Ransomware / Business Income Losses

- Ransomware is the catalyst driving the dramatic changes in the cyber insurance market

- Ransomware demands drive decision making during a claim. However, the Business Interruption loss (net income loss and extra expense) are typically magnitudes higher than the actual demand

- Historically benign risks like Manufacturers/Distributors are reevaluating their exposure due to the severity of cyber business interruption losses

- War Exclusion under new scrutiny as a results of the Russia/Ukraine conflict

+ Regulatory Developments

- OFAC SDN list and ransom payment restrictions

- SEC mandating timeline cyber breaches are disclosed

- Cyber Infrastructure and Security Agency (CISA) releases regular updates on ransomware gang activities and Common Vulnerability and Exposures (CVEs)

- Huge Fines and Penalties!

- Ransomware is the catalyst driving the dramatic changes in the cyber insurance market

- Ransomware demands drive decision making during a claim. However, the Business Interruption loss (net income loss and extra expense) are typically magnitudes higher than the actual demand

- Historically benign risks like Manufacturers/Distributors are reevaluating their exposure due to the severity of cyber business interruption losses

- War Exclusion under new scrutiny as a results of the Russia/Ukraine conflict

+ Regulatory Developments

- OFAC SDN list and ransom payment restrictions

- SEC mandating timeline cyber breaches are disclosed

- Cyber Infrastructure and Security Agency (CISA) releases regular updates on ransomware gang activities and Common Vulnerability and Exposures (CVEs)

- Huge Fines and Penalties!

Cyber – Claims Update

48

New cards

+ Increased Primary Pricing (stabilizing Excess Cyber market)

+ Stabilizing Retention / Attachments

+ Increased Excess Limit Deployment / New Carriers Entering the Market (Primary options remain very limited)

+ Evolution of the underwriting process

- More written applications

- Required underwriting calls

- Denial of coverage due to controls

- Follow up questions throughout the renewal process

- Focus on certain controls (MFA, patch management, backups, IAM, detection and response)

+ Quantification of Cyber Exposure

+ Emergence of Startups / Insurance-techs

+ Prediction: 2023 will be the year of War Exclusions and systemic risk restrictions!

+ Stabilizing Retention / Attachments

+ Increased Excess Limit Deployment / New Carriers Entering the Market (Primary options remain very limited)

+ Evolution of the underwriting process

- More written applications

- Required underwriting calls

- Denial of coverage due to controls

- Follow up questions throughout the renewal process

- Focus on certain controls (MFA, patch management, backups, IAM, detection and response)

+ Quantification of Cyber Exposure

+ Emergence of Startups / Insurance-techs

+ Prediction: 2023 will be the year of War Exclusions and systemic risk restrictions!

Cyber – Market Conditions

49

New cards

Premature Death

+ Two Scenarios:

- The death of a family head with outstanding unfulfilled financial obligations

- Death of a person that creates negative business consequences (Example: CEO needs “key person” coverage)

- The death of a family head with outstanding unfulfilled financial obligations

- Death of a person that creates negative business consequences (Example: CEO needs “key person” coverage)

50

New cards

Costs of Premature Death

+ Future earnings are lost forever

+ Additional expenses incurred

- Funeral expenses

- Uninsured medical bills

- Higher childcare costs

- Estate settlement expenses

- Outstanding debts

+ Possible reduction in standard of living for survivors

+ Additional expenses incurred

- Funeral expenses

- Uninsured medical bills

- Higher childcare costs

- Estate settlement expenses

- Outstanding debts

+ Possible reduction in standard of living for survivors

51

New cards

It depends on family size, income levels, existing financial assets, and financial goals

How Much Life Insurance is Needed?

52

New cards

1. Human Life Value Approach

2. Needs Approach

2. Needs Approach

Approaches to Estimate Amount of Life Insurance Needed

53

New cards

Human Life Value Approach

Present value of the family’s share of the deceased breadwinner’s future earnings

1. Estimate the individual’s average annual earnings over his/her productive lifetime.

2. Deduct taxes and self-maintenance costs.

3. Using a discount rate, determine the present value of the family’s share of earnings for the number of years until retirement

1. Estimate the individual’s average annual earnings over his/her productive lifetime.

2. Deduct taxes and self-maintenance costs.

3. Using a discount rate, determine the present value of the family’s share of earnings for the number of years until retirement

54

New cards

Disadvantage of Human Life Value Approach

+ Ignores assets and other sources of income (Social Security, retirement plans).

+ Earnings & expenses assumed to be constant (most people get a raise each year).

+ Based on income rather than need.

+ Effects of inflation on earnings and expenses are ignored

+ Earnings & expenses assumed to be constant (most people get a raise each year).

+ Based on income rather than need.

+ Effects of inflation on earnings and expenses are ignored

55

New cards

Needs Approach

Amount needed depends on the financial needs that must be met if a family head should die

+ Calculation should consider:

- Estate clearing fund (burial, medical bills, debts, attorney’s fees, taxes)

- One- or two-year readjustment period (same income as prior to death)

- Dependency period for children (until youngest is at least 18)

- Income for surviving spouse (if needed)

- Special needs (college education, mortgage, emergencies)

- Retirement needs for surviving spouse

+ Calculation should consider:

- Estate clearing fund (burial, medical bills, debts, attorney’s fees, taxes)

- One- or two-year readjustment period (same income as prior to death)

- Dependency period for children (until youngest is at least 18)

- Income for surviving spouse (if needed)

- Special needs (college education, mortgage, emergencies)

- Retirement needs for surviving spouse

56

New cards

Disadvantages of Needs Approach

+ Difficult to estimate the cost of future needs (what will college cost in 20 years?)

+ Assumptions can be construed in different ways causing a large range of values.

+ Needs may be different (What if the surviving spouse remarries?)

+ Assumptions can be construed in different ways causing a large range of values.

+ Needs may be different (What if the surviving spouse remarries?)

57

New cards

Reasons Why Someone Would Not Purchase (Enough) Life Insurance

+ Belief that life insurance is too expensive to purchase.

+ Difficulty in making the correct decisions about its purchase.

+ Procrastination.

+ They simply don’t understand its importance.

+ Opportunity cost. (What the person gives up by using money to purchase Life insurance.)

+ Difficulty in making the correct decisions about its purchase.

+ Procrastination.

+ They simply don’t understand its importance.

+ Opportunity cost. (What the person gives up by using money to purchase Life insurance.)

58

New cards

1. “Term” Insurance

2. “Whole Life” Insurance

2. “Whole Life” Insurance

Types of Life Insurance

59

New cards

“Term” Insurance

Death benefit only

Temporary protection (Example: 10, 20, 30 years)

Temporary protection (Example: 10, 20, 30 years)

60

New cards

“Term Life” Insurance

+ Term insurance can be provided for 5, 10, 15, 20, 25, or 30 year periods (terms).

+ Premiums paid during the policy term are level (but would increase if the policy was renewed for a new term).

+ Most policies are renewable, meaning the policy can be renewed without evidence of insurability.

+ Most policies are convertible, meaning the term policy can be exchanged for a cash-value policy without evidence of insurability

+ Premiums paid during the policy term are level (but would increase if the policy was renewed for a new term).

+ Most policies are renewable, meaning the policy can be renewed without evidence of insurability.

+ Most policies are convertible, meaning the term policy can be exchanged for a cash-value policy without evidence of insurability

61

New cards

When Is Term Life Insurance Appropriate?

+ ***There is no cash value in the policy

+ The amount of income that can be spent on Life insurance premiums is limited.

+ The need for protection is temporary.

+ The insured wants to guarantee future insurability.

+ The amount of income that can be spent on Life insurance premiums is limited.

+ The need for protection is temporary.

+ The insured wants to guarantee future insurability.

62

New cards

Limitations of Term Insurance

+ Premiums increase with age at an increasing rate and eventually reach prohibitive levels.

+ Inappropriate if you wish to save money for a specific need by accumulating “cash value” via Life insurance

+ Inappropriate if you wish to save money for a specific need by accumulating “cash value” via Life insurance

63

New cards

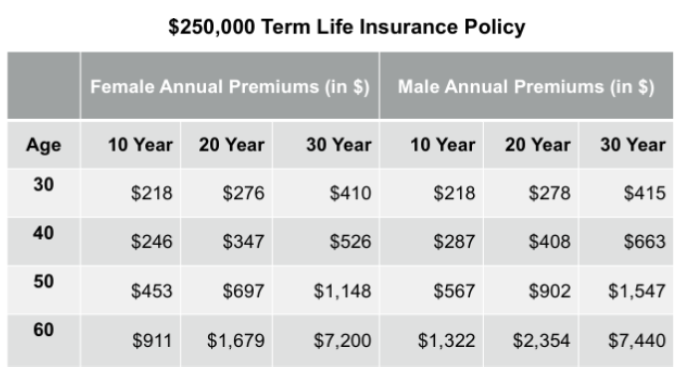

Examples of Term Life Insurance Premiums

Examples of Term Life Insurance Premiums

64

New cards

“Whole Life” Insurance

+ Death benefit plus savings component (cash-value)

+ Policy period is lifetime of insured, doesn’t expire

+ Generic term.

+ A cash-value policy that provides lifetime protection.

+ A stated amount is paid to a designated beneficiary when the insured dies, regardless of when the death occurs.

+ Policy period is lifetime of insured, doesn’t expire

+ Generic term.

+ A cash-value policy that provides lifetime protection.

+ A stated amount is paid to a designated beneficiary when the insured dies, regardless of when the death occurs.

65

New cards

1. Ordinary Life

2. Limited Payment Life

2. Limited Payment Life

Types of Whole Life

66

New cards

Whole Life – Ordinary

+ Level-premium policy that accumulates cash values and provides lifetime protection to age 121.

+ Premiums are payable throughout the lifetime of the insured.

+ The policy accumulates a cash-surrender value, which is the amount paid to a policyholder who surrenders the policy early.

+ The policyholder has the right to borrow the cash value.

+ Premiums are payable throughout the lifetime of the insured.

+ The policy accumulates a cash-surrender value, which is the amount paid to a policyholder who surrenders the policy early.

+ The policyholder has the right to borrow the cash value.

67

New cards

Whole Life – Limited Payment

+ Very similar to Ordinary Life.

+ Insured has lifetime protection, and premiums are level, but they are only paid for a certain period of time.

+ Commonly premiums are paid for 10, 20, or 30 years.

+ Example:

- Buy 20-year limited-payment policy at age 25.

- After 20 years (at age 45), the policy is paid in full.

- No additional premium is required, and the coverage remains in place.

+ Insured has lifetime protection, and premiums are level, but they are only paid for a certain period of time.

+ Commonly premiums are paid for 10, 20, or 30 years.

+ Example:

- Buy 20-year limited-payment policy at age 25.

- After 20 years (at age 45), the policy is paid in full.

- No additional premium is required, and the coverage remains in place.

68

New cards

Advantages: Whole Life

+ Maintain coverage for your entire life (vs. a certain time period with term).

+ Accumulate savings (cash-value)

+ Accumulate savings (cash-value)

69

New cards

Disadvantages: Whole Life

+ Do you really need life insurance when you are 70?

+ Premiums are higher than term insurance.

+ Whole Life is more expensive than Term Life

+ Premiums are higher than term insurance.

+ Whole Life is more expensive than Term Life

70

New cards

1. Variable Life

2. Universal Life

2. Universal Life

Variations of “Whole Life” Insurance

71

New cards

Variable Life Insurance

+ A fixed-premium policy in which the death benefit and cash values vary according to investment experience.

+ Policyholder has input into how cash-value is invested.

+ No minimum guaranteed cash-values

+ Policyholder has input into how cash-value is invested.

+ No minimum guaranteed cash-values

72

New cards

Universal Life Insurance

+ A flexible premium policy that provides lifetime protection.

+ After the first premium, the policyholder decides the amount and frequency of payments.

+ Most policies have a target premium, but the policyholder is not obligated to pay it.

+ Most policies have a no-lapse guarantee if the minimum premium is paid.

+ Cash-value accumulates (accumulation fund) on premiums net of mortality charges and expense charges.

+ Policyholder can borrow the cash-value.

+ After the first premium, the policyholder decides the amount and frequency of payments.

+ Most policies have a target premium, but the policyholder is not obligated to pay it.

+ Most policies have a no-lapse guarantee if the minimum premium is paid.

+ Cash-value accumulates (accumulation fund) on premiums net of mortality charges and expense charges.

+ Policyholder can borrow the cash-value.

73

New cards

Advantages of Universal Life

- Flexibility in payments.

- Cash withdrawals are permitted

- Favorable tax benefits (death benefit is normally tax-free)

- Cash withdrawals are permitted

- Favorable tax benefits (death benefit is normally tax-free)

74

New cards

Disadvantages of Universal Life

- More expensive than “Term” Life insurance.

- Advertised rates of return do not include deductions for expenses.

- Insurers can increase expenses at any time.

- *Policy can lapse because some policyholders do not have a commitment to pay premiums

- Advertised rates of return do not include deductions for expenses.

- Insurers can increase expenses at any time.

- *Policy can lapse because some policyholders do not have a commitment to pay premiums

75

New cards

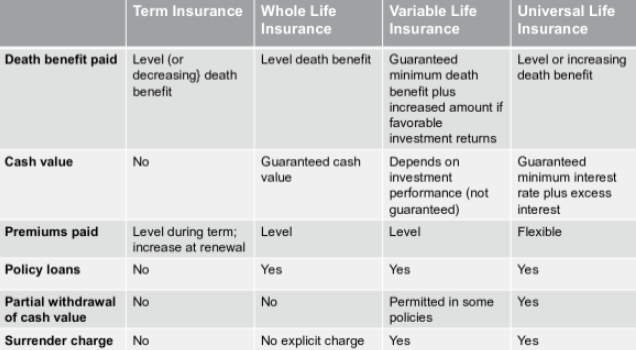

Life Insurance Comparison

Life Insurance Comparison

76

New cards

Group Life Insurance

+ Differs from individual insurance.

+ Coverage of many persons under one contract.

+ Examples:

- Life insurance through an employer.

- Life insurance through a group sponsor

+ Coverage of many persons under one contract.

+ Examples:

- Life insurance through an employer.

- Life insurance through a group sponsor

77

New cards

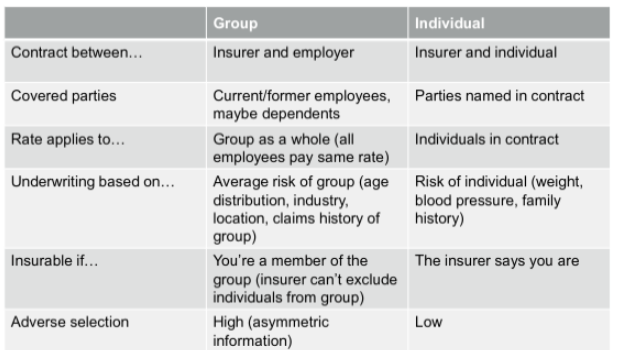

Group vs. Individual Insurance

Group vs. Individual Insurance

78

New cards

Advantages of Group Insurance

1. May be less expensive.

2. Tax benefits to employees (costs are usually pre-tax).

3. Employer may pay all/part of premium.

4. No evidence of insurability; no physical exam.

5. Insurance you would not have otherwise.

2. Tax benefits to employees (costs are usually pre-tax).

3. Employer may pay all/part of premium.

4. No evidence of insurability; no physical exam.

5. Insurance you would not have otherwise.

79

New cards

Disadvantages of Group Insurance

1. Inflexible for individuals.

2. Must be employed or part of group to be covered.

3. Not always available. Employer could discontinue benefit.

4. May not provide sufficient limits

2. Must be employed or part of group to be covered.

3. Not always available. Employer could discontinue benefit.

4. May not provide sufficient limits

80

New cards

Group Life Insurance

+ Differs from individual insurance.

+ Coverage of many persons under one contract.

+ Examples

- Life insurance through an employer.

- Life insurance through a group sponsor

+ Coverage of many persons under one contract.

+ Examples

- Life insurance through an employer.

- Life insurance through a group sponsor

81

New cards

Contestability

ability to cancel a policy

82

New cards

***Incontestable Clause

insurer can not contest the policy after it has been in force for 2 years

83

New cards

Ownership Clause

The policyholder possesses all contractual rights in the policy while the insured is living

84

New cards

Entire Contract Clause

The policy and application constitutes the entire contract

85

New cards

Suicide Clause

If insured commits suicide within 2 years the face amount of the policy is not paid. Premiums refunded

86

New cards

Grace Period

Period to pay overdue premiums

87

New cards

Reinstatement Clause

Terms if policy lapses for non-payment. (Evidence of insurability, et al)

88

New cards

Misstatement of Age or Sex Clause

Payment at death adjusted to amount of coverage premiums paid would have purchased

89

New cards

Beneficiary Designation

+ Primary / Contingent

+ Revocable / Irrevocable

+ Specific person(s) / Class

+ Revocable / Irrevocable

+ Specific person(s) / Class

90

New cards

Change of Plan

Provides policyholders flexibility to change plans

91

New cards

Nonforfeiture Options (Cash Value)

+ Only Whole Life; Applies to Whole Life / Cash Value policies if policies are “surrendered”.

+ Whole Life policies have higher premiums than just life insurance protection.

+ Insurers must pay at least a minimum to policyholders who “surrender” policies.

+ Statutory options:

1. Cash value – Take cash

2. Reduced paid-up insurance – Cash surrender value is used to buy a paid-up policy with a reduced limit.

3. Extended term insurance – Cash surrender value used to buy period of term insurance with the same limit.

+ Whole Life policies have higher premiums than just life insurance protection.

+ Insurers must pay at least a minimum to policyholders who “surrender” policies.

+ Statutory options:

1. Cash value – Take cash

2. Reduced paid-up insurance – Cash surrender value is used to buy a paid-up policy with a reduced limit.

3. Extended term insurance – Cash surrender value used to buy period of term insurance with the same limit.

92

New cards

1. Cash – Recieve Cash payment for policy

+ Cash is generally Tax Free

2. Interest Option – Interest paid to beneficiary periodically

3. Fixed Period Option – Payment over a fixed period of time at guaranteed interest rate.

4. Fixed Amount Option – Scheduled payment of a fixed amount with an agreed interest rate until funds are exhausted.

5. Life Income (Annuity) Option – Guarantees income for life.

- Life Income

- Life Income with Guaranteed Period

- Life Income with Guaranteed Total Amount

- Joint and Survivor Income

+ Cash is generally Tax Free

2. Interest Option – Interest paid to beneficiary periodically

3. Fixed Period Option – Payment over a fixed period of time at guaranteed interest rate.

4. Fixed Amount Option – Scheduled payment of a fixed amount with an agreed interest rate until funds are exhausted.

5. Life Income (Annuity) Option – Guarantees income for life.

- Life Income

- Life Income with Guaranteed Period

- Life Income with Guaranteed Total Amount

- Joint and Survivor Income

Settlement Options on Policy Proceeds

93

New cards

Additional Policy Terms/Benefits

+ Waiver of Premium Provision

+ Term Insurance Rider / Buy Additional Term limits

+ Guaranteed Purchase Option / Insurability + Guaranteed

+ Accident Death & Dismemberment Rider / Higher limits

+ Cost of Living Rider / Increase by CPI

+ Accelerated Death Benefits / Certain illnesses or conditions

+ Viatical Settlement / Sell policy to investors

Stranger Owned Life Policy

+ Term Insurance Rider / Buy Additional Term limits

+ Guaranteed Purchase Option / Insurability + Guaranteed

+ Accident Death & Dismemberment Rider / Higher limits

+ Cost of Living Rider / Increase by CPI

+ Accelerated Death Benefits / Certain illnesses or conditions

+ Viatical Settlement / Sell policy to investors

Stranger Owned Life Policy

94

New cards

1) Narrative Summary with policy features

2) Numeric Summary with current, guaranteed and midpoint APR

3) Annual Report

2) Numeric Summary with current, guaranteed and midpoint APR

3) Annual Report

NAIC – Life Insurance Model Regulation

95

New cards

1) A.M. Best

2) Fitch

3) Moody’s

4) Standard & Poors

2) Fitch

3) Moody’s

4) Standard & Poors

Financial Strength of Insurer - Ratings

96

New cards

Annuities

Periodic payment that continues for a fixed period of time or for the duration of a designated life or lives

97

New cards

Individual Retirement Account (IRA)

+ Allows workers with taxable compensation to make annual contributions to a retirement plan up to certain limits and receive favorable income-tax treatment

+ IRA rules are horribly complex and detailed

+ Contribution and tax-deductible amounts are updated periodically

+ Eligibility Requirements

1) Must have taxable income; you can’t put more into account than you earned

2) Must be under age 72 (SECURE Act increased required minimum distribution age from age 70 ½ )

+ IRA rules are horribly complex and detailed

+ Contribution and tax-deductible amounts are updated periodically

+ Eligibility Requirements

1) Must have taxable income; you can’t put more into account than you earned

2) Must be under age 72 (SECURE Act increased required minimum distribution age from age 70 ½ )

98

New cards

Traditional IRA

+ Annual contributions to a Traditional IRA are income-tax deductible, investment income accumulates tax free, and distributions are taxed upon withdrawal.

+ Deduction for contribution gradually phased out if your income is above a certain amount

+ Deduction for contribution gradually phased out if your income is above a certain amount

99

New cards

Roth IRA

+ Annual contributions to a Roth IRA are not income-tax deductible, investment income accumulates tax free, and qualified distributions are received tax free (if certain requirements are met).

+ 2022 Maximum annual contribution - $6,000

+ 2022 Age 50 and over catch up - $1,000 per year for total of $7,000

+ 2023 Maximum annual contribution - $6,500

+ 2023 Age 50 and over catch up - $1,000 per year for total of $7,500

+ 2022 Maximum annual contribution - $6,000

+ 2022 Age 50 and over catch up - $1,000 per year for total of $7,000

+ 2023 Maximum annual contribution - $6,500

+ 2023 Age 50 and over catch up - $1,000 per year for total of $7,500

100

New cards

401K Plans

- Must have taxable income

- Must be under age 72 (SECURE Act increased required minimum

distribution age to 72 from age 70 ½ )

- Annual contributions to a 401K plan are income-tax deductible, investment income accumulates tax free, and distributions are taxed upon withdrawal.

- Withdraw without penalty at age 59 ½.

- Certain hardship exceptions prior to age 59 ½.

- 2022 Maximum annual contribution - $20,500

- 2022 Over 50 catch up - $6,500 per year for a total of $27,000

- 2023 Maximum annual contribution - $22,500

- 2023 Over 50 catch up - $6,500 per year for a total of $29,000

- Any employer match that you receive does not count toward this limit!!!

- Note key ages

- Must be under age 72 (SECURE Act increased required minimum

distribution age to 72 from age 70 ½ )

- Annual contributions to a 401K plan are income-tax deductible, investment income accumulates tax free, and distributions are taxed upon withdrawal.

- Withdraw without penalty at age 59 ½.

- Certain hardship exceptions prior to age 59 ½.

- 2022 Maximum annual contribution - $20,500

- 2022 Over 50 catch up - $6,500 per year for a total of $27,000

- 2023 Maximum annual contribution - $22,500

- 2023 Over 50 catch up - $6,500 per year for a total of $29,000

- Any employer match that you receive does not count toward this limit!!!

- Note key ages