Chapter 7 : How the macroeconomy works

1/89

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

90 Terms

What is GDP?

a measure of the output of the economy (national income)

What is national capital stock?

the stock of capital goods, such as buildings or machinery, in the economy that has accumulated over time (part of the stock of national wealth)

What is human capital stock?

the quantity and quality of the work force: the knowledge, skills, competencies and other attributes embodied in individuals or groups of individuals acquired during their life

What is national wealth?

the stock of all goods that exist at a point in time that have value in the economy

What is national income?

the flow of new output produced by the economy in a particular period e.g a year

What is national output?

the same as national income, namely the flow of new output produced by the economy in a particular period e.g a year

What is national product?

another name for national income and national output

What is the difference between national capital stock and national income?

the national capital stock is the stock of capital goods that has accumulated over time in the economy, whilst national income is the flow of new output produced by the stocks off physical and human capital and other factors of production

What will happen to the national capital stock if capital goods aren’t replaced?

national capital stock will reduce which will mean that national output will reduce

National income, national output and national expenditure are…

three different ways of measuring the flow of new output produced in the economy

What does national output measure?

the actual goods and services produced by the economy

What does national income measure?

the incomes received by labour and other factors of production

What does national expenditure measure?

shows the spending of these incomes on the goods and services

How does national income, national output and national expenditure relate?

national income = national output = national expenditure

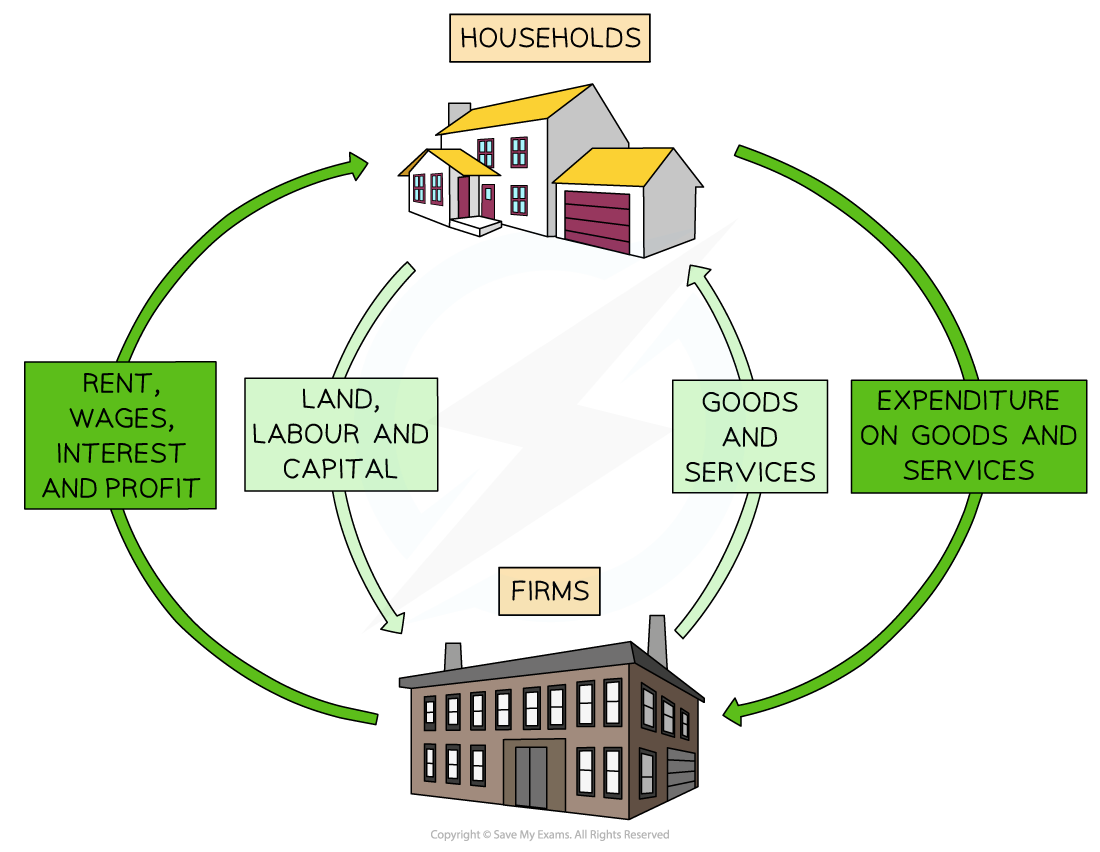

What is the circular flow of income?

fundamental model that illustrates how money moves through an economy between different sectors

What are the key components of the circular flow of income

households, governments, firms and the rest of the world

Illustrate the basic circular flow of income

households

firms

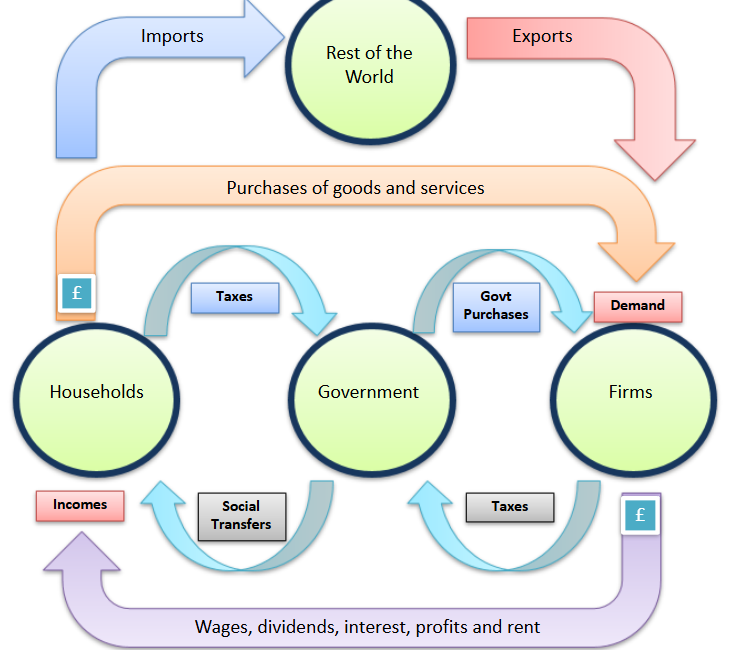

Illustrate the circular flow of income with an external sector

households

firms

government

rest of the world

What is an injection?

spending entering the circular flow of income

What is a withdrawal?

a leakage of spending power out of the circular flow of income

What are the injections?

investment, government spending and exports

What are the withdrawals?

taxes, savings and imports

When is there equilibrium?

when the withdrawals is equal to the injections: X+G+M = S+T+M

What is the other approach that defines the equilibrium of national income?

the level of real output at which aggregate demand equals aggregate supply

What is aggregate demand?

the total planned spending in an economy over a given period of time at a given price level i.e the total demand in an economy

Why is the AD curve downwards sloping?

high prices leads to a fall of value in incomes, so goods and services become less affordable

inflation means an increase in interest rates, saving becomes more attractive and borrowing becomes more expensive

What causes movement across the AD curve?

changes in the price level

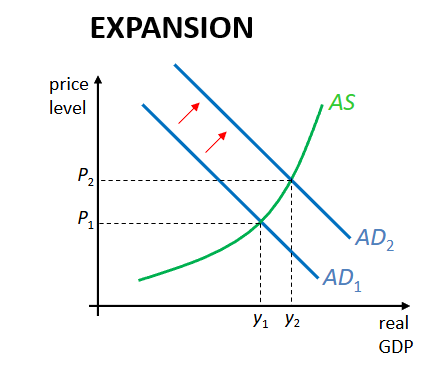

How is a rise in AD shown?

by a shift in the AD curve

What can cause AD to shift to the right?

Consumers and firms have higher confidence levels - invest more to get higher returns

when MPC lower interest rates, it is cheaper to borrow and less incentive to save

lower tax - more disposable income

increase in government spending

deprecation in currency - imports more expensive but exports are cheaper

What happens when AD increases?

the price level and level of national output both increase

What is aggregate supply?

the total quantity of output that all firms in an economy are willing to produce at a given price level

Why is the AS curve upwards sloping?

because at a higher price level, producers are willing to supply more because they can earn more profits.

What causes movement along the AS curve?

only changes in price level (which occur due to changes in AD)

What can cause a shift in the AS curve?

changes in the cost of employment

the costs of other inputs and FOPs

government regulation such as tax

What happens when you are above or bellow price equilibrium?

At a price above equilibrium, there will be excess supply. At a price below equilibrium, there will be excess aggregate demand, in the shortrun

What is an economic shock?

an unexpected event hitting the economy. These can be demand-side (AD) shocks or supply-side (AS) shocks (or both) and unfavourable or favourable e.g war

What are the components of AD?

aggregate demand = consumption +investment +government spending+ (exports-imports)

AD=C+I+G+(X-M)

Define consumption

total planned spending by households on consumer goods and services produced within the economy

How does rate of interest affect saving and consumption?

the rate of interest rewards savers for sacrificing current consumption, and the higher the rate of interest, the greater the reward

How does the level of income affect saving and consumption?

according to Keynes, as income rises, although absolute consumption rises, but relative consumption falls - known as the Keynesian consumption theory

How does the expected level of future income affect saving and consumption?

life-cycle theory of consumption : explains consumption and saving in terms of how people expect their incomes to change over the whole of their life cycles

e.g putting money into a pension

How does wealth affect saving and consumption?

When people feel wealthier, they save less and consume more. In the UK, most of the people’s biggest asset s their house. Rising house prices give people the confidence to spend more and borrow more via mortgages and furniture

How does the state of consumer confidence affect saving and consumption?

when consumer optimism increases, households generally spend more and save less, whereas a fall in optimism has the opposite effect.

Governments try to increase confidence by being optimistic about the future

What is availability of credit?

funds available for households and firms to borrow

What is a credit crunch?

when there is a lack of funds available in the credit market, making it difficult for borrowers to obtain financing, and leads to a rise in the cost of borrowing

How does the availability of credit affect saving and consumption?

if credit is easily and cheaply available, consumption increases as people use credit to add to their current income by borrowing on credit from the bank.

What is distribution of income?

the spread of different incomes among individuals and different income groups in the economy

How does the distribution of income affect saving and consumption?

rich people save a greater proportion of their income than poor people; redistribution of income from rich to poor will therefore increase consumption and reduce saving

How does the expectation of future inflation affect saving and consumption?

on one hand, the expectation of a rise in inflation could cause precautionary saving and reduces consumption.

On the other hand, it might cause consumers to consume more in the short-term, bringing forward purchases

How does unemployment affect saving and consumption?

the higher the rate of unemployment, the lower consumption is likely to be, assuming that welfare benefits provide a lower income than paid employment

How do governments predict future aggregate demand?

recent historic data about people’s saving and spending habits

What is personal savings ratio?

it is used to measure the actual or realised saving on the personal sector as a ratio of total personal sector disposable income

How do you calculate personal savings ratio?

realised (or actual) personal saving / personal disposable income

What is household savings ratio?

it measures households’ realised saving as a ratio of their disposable income

How do you calculate household savings ratio?

realised (or actual) saving / household disposable income

What is the difference between personal savings ratio and household savings ratio?

that the personal sector is more than just households, including unincorporated businesses such as partnerships and charitable organisations such as independent schools

What is investment?

planned demand for capital goods

What are the two parts that makes up a country’s gross investment?

replacement investment - maintains the size of the existing capital stock by replacing worn-out capital

net investment - adds to capital stock, increasing productive potential

What is the difference between saving and investment?

saving is simply income that is not spend on consumption whereas investment is spending by firms on capital goods such as machines and office equipment

What are the two types of investment in physical capital goods?

investment in fixed capital, such as new factories or plant, and social capital such as roads and socially owned hospitals

inventory investment in stocks of raw materials, semi-finished goods and finished goods

What are the factors that firms consider when deciding whether or not to form an investment in fixed capital? (e.g a machine)

the purchase cost (of the new machine)

expected future incomes (due to the new machine)

expected future costs (associated with the new machine e.g maintenance and borrowing costs

the future profit the investment is expected to yield

What are some of the other factors that influence investment decisions (other than rate of interest)?

the relative costs of capital and labour

technological advances

government policies e.g tax and subsidies

What is the accelerator theory of investment?

when the rate of GDP growth is increasing, then firms will be more willing to invest in capital to produce more as they believe aggregate demand will increase in the future

It says that a small change in demand leads to a proportionally much bigger change in investment

What is economic activity?

the production of goods and services AND the employment of labour and other FOPs to do so

What effect does an increase in AD have on real output?

it has an expansionary effect - this will cause a rise in employment as more workers are needed to produce extra good s and services

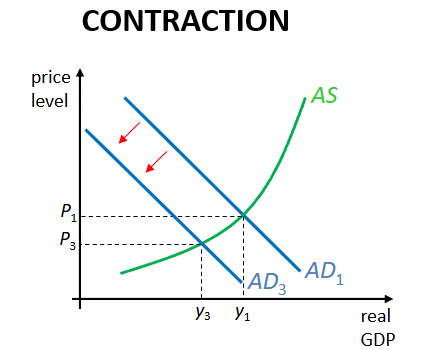

What effect does a decrease in AD have in real output?

it has a contractionary effect - this will cause a fall in employment as workers are no longer needed and made redundant

What is the (national income) multiplier?

the relationship between a change in (the components of) AD and the resulting usually larger change in national income

Give a summary/ example of the multiplier effect?

any increase ins pending by AD going up will create income for someone else which will facilitate spending for someone else, which will then create income for someone else and so on. So AD doesn’t shift to the right due to that initial amount of spending but it keeps moving to the right before settling on that much greater change in national output

What is the multiplier equation?

change in national income / initial change in government spending (usually between 0.5 and 1.5)

What are the fiscal policy multipliers?

government spending multiplier

tax multiplier

investment multiplier

What are the foreign trade multipliers?

export multiplier

import multiplier

What is a negative or backwards multiplier effect?

when a reduction in AD (e.g government reducing spending) leads to a proportionally larger fall in national income

What is the marginal propensity to consume?

the fraction/proportion of an increase in disposable income (income after tax) that people plan to spend on domestically produced (i.e not imported) consumer goods

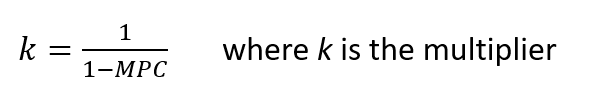

What is the formula for calculating the value of the multiplier?

How does the size of the MPC affect the multiplier?

the smaller the MPC, the smaller the multiplier

Is the size of the multiplier larger in nominal terms or real terms and why?

the size of the multiplier in nominal terms will always be larger than the size of the multiplier in real terms because although national income is rising, so is the price level, making the real-terms spending power of that additional income less (inflation)

What is the difference between real and nominal national income?

real national income measures constant prices (adjusted for inflation - no effect), whereas nominal national income measures current prices (affected by inflation)

How do you calculate the nominal national income?

real national income x average price level

Y=Py

Define short-run aggregate supply (SRAS)

aggregate supply when the level of capital is fixed, though the utilisation of existing factors of production can be altered so as to change the level of real output

What are the assumptions as to why the SRAS curve is upwards sloping?

all firms aim to maximise profits

in the short-run, the cost of producing extra units of output increases as firms produce more output

What does how much price level and real GDP increase depend on?

it depends on the steepness of the SRAS curve at that point - the steeper the curve the more inflationary will be the impact of an increase in AD

Why does the SRAS curve begin to become vertical?

as when all factors are fully employed, it has reached full capacity. If AD were to increase further at this point, the result would be an increase in price level only (inflation) as the economy can’t physically produce more than it is already, so scarcity will push up the prices

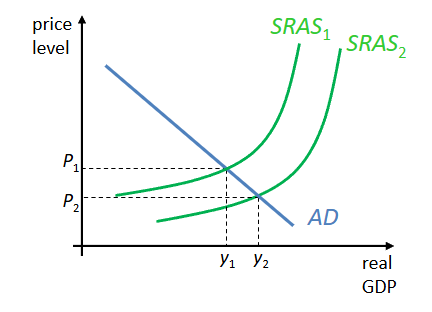

What causes a shift in the SRAS curve?

anything that makes production cheaper/more efficient:

fall in labour costs

fall in raw material costs

fall in taxes (or an increase in subsidies)

increase in labour productivity due to training

increase in productivity due to technological progress

What happens if SRAS shifts to the right (increases) whilst AD remains constant?

this results in lowering the average price level, also known as deflation

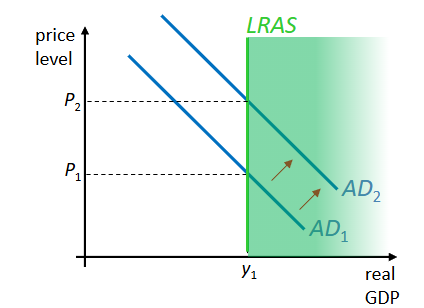

Define long-run aggregate supply (LRAS)

aggregate supply when the economy is producing at its production potential. If more factors of production become available or productivity rises, the LRAS curve shifts to the right

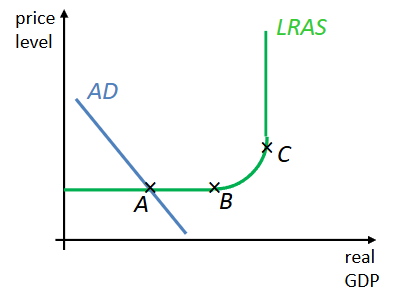

What shape is the LRAS curve and why?

it is vertical as it is the limit beyond which we (currently) can’t increase production

What effect will an increase in aggregate demand have on the LRAS curve?

inflation. An increase in price level, unless the economy can increase the capacity (shifting LRAS to the right)

What is the relationship between a LRAS curve and a PPF curve?

they both show the productive potential of an economy. If LRAS shifts to the right, so does the PPF curve

What are the factors determining LRAS?

all of the following relate to either the quantity or quality of FOPs:

access to natural resources

size and skill-level of workforce

state of technological progress

mobility and productivity of factors of production (particularly labour)

level of entrepreneurship/attitude to risk

attitude to hard work

tax structures and incentives

legal structures that protect copyright (to encourage innovation)

legal structures that enforce contracts

What is an alternative view on the shape of the LRAS curve?

Keynes - he believed that an economy would not automatically tend towards full employment of resources ; instead it could find an equilibrium well below this point unless the government intervened to stimulate demand, growing national output towards full employment

Brings backwards ‘L’ curve. Point A is where the economy has become stuck (recession)