How markets work 1.2

1/54

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

55 Terms

underlying assumptions of rational economic decision making

consumers aim to maximise utility- utility is the satisfaction gained from consuming a product

Firms aim to profit maximise- to keep shareholders happy

Governments aim to maximise social welfare- governments are voted in by the public and work for the public

Demand

the ability and willingness to buy a particular good at a given price and at a given moment

movements and shifts along the demand curve

change in price or qty of the good

conditions of demand

population- demand would increase

income- if income increases demand increase as they can afford to buy more

related goods- complements or substitutes

advertising

seasons

taste

Diminishing marginal utility

the satisfaction derived from the consumption of an additional unit of good will decrease as more of a good is consumed

demand slopes downwards, if more of a good is consumed, there is less satisfaction derived from the good, consumers are less willing to pay high prices at high quantities since they are gaining less satisfaction

elasticity of demand

An attempt to measure the responsiveness of quantity demanded to changes in price

PED formular

% change in qty demanded/ % change in price

value of unitary

PED=1

a change in price does not affect total revenue

value of relative elastic PED

PED>1

relatively inelastic PED

PED<1

perfectly elastic PED

infinity

A decrease in price leads to an increase in revenue

An increase in price leads to a decrease in revenue

perfectly inelastic PED

0

A decrease in price leads to a decrease in revenue

An increase in price leads to an increase in revenue

Factors affecting PED

substitutes

time - st, lt

necessity

income

addictive

Significance of PED

Determine the effects of the imposition of direct taxes and subsidies

more elastic demand is = the lower the incidence of tax on the consumer

more inelastic demand= tax is passed onto consumer, higher tax revenue to government

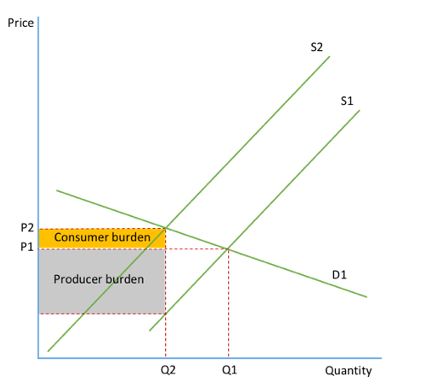

inelastic demand on diagram (subsidy)

elastic demand on diagram (subsidy)

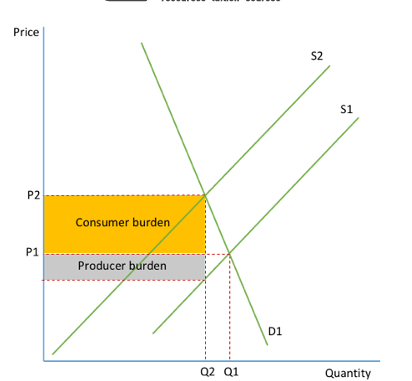

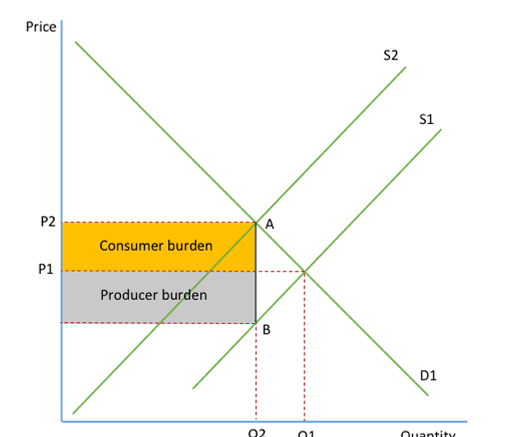

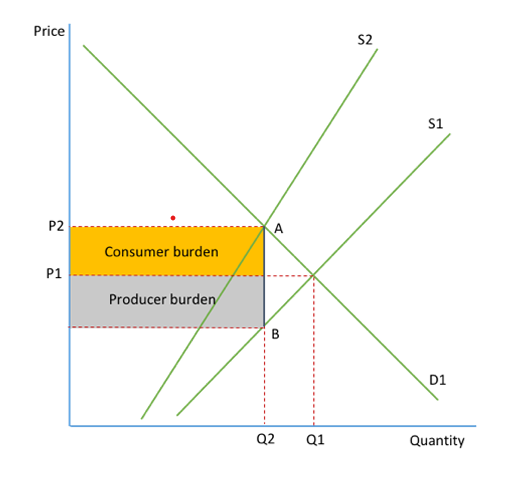

inelastic demand diagram (tax)

Shift from S1 to S2 is a result of the imposition of indirect tax

Income elasticity of demand

the responsiveness of demand to a change in income

YED formular

% change in qty demanded/ % change in income

value of an inferior good

YED<0

a rise in income will lead to a fall in demand for the good

Value of a normal good

YED>0

a ride in income will lead to a rise in demand for good

value of luxury good

YED>1

Significance of YED

Important for businesses to know if their sales will be affected by changes in the income for the population

Impact the of good that a firm produces

Cross elasticity of demand

the responsiveness of demand for one good to a change in price for another

% change in qty demanded of A/ % change in price of B

Substitutes

XED>0

An increase in the price of good B will increase demand for good A

Complementary

XED<0

An increase in the price of good B will decrease demand for good A

Unrelated goods

XED=0

change in the price of good B has no impact on good A

Significance of XED

Firms need to be aware on their competition and how changes by other firms will impact them

Supply

The willingness to provide a good or service at a particular price at a given moment

Movement of supply

caused by a change in the price of a good

Shift in supply

The amount of goods being supplied

Conditions of supply

cost of production

Price of other goods

Weather

Technology

subsidies ad tax

Why is supply upward sloping

If prices are higher, firms will increase production to take advantage of the high profits they can make

Higher prices will encourage new firms to enter

Price elasticity of supply

The responsiveness of supply to a change in price of the good

% change in qty supplied/ % change in price

Factors affecting PES

Time

Stocks

Availability of factors of production

Availability of substitutes

Price determinism

The equilibrium point is the point in which there are no forces bringing about change

supply is equal to demand

Excess demand

if price is set below equilibrium there is excess demand

will lead to a contraction in demand

Excess Supply

If price is set higher than the equilibrium there is excess supply

firms have unsold goods

Price mechanism

Allocates resources

Price is determined by the interactions of demand and supply

Adam smith described the invisible hand

Rationing

the price system is a way of rationing goods because when price increases some people may not be able to afford the product

limiting resources for those who can afford them and value them the most highly

Signalling

Where resources should be used

Price indicates to suppliers and consumers that market conditions have changed so they should change the qty bought and sold

Incentive

Acts as an incentive for people to work hard

more money more goods they can buy

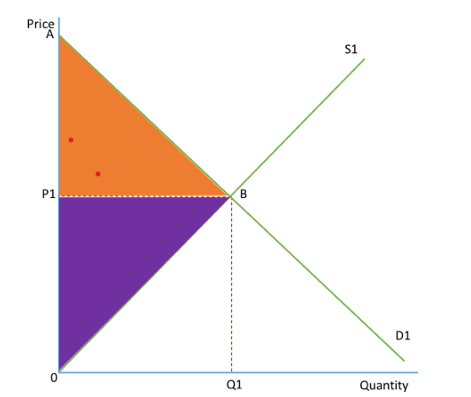

Consumer surplus

the difference between what consumers are willing to pay and what they actually pay

(top part of diagram)

Producer surplus

The difference between the price that the supplier is willing to produce their product at and the price they actually produce at

( bottom part of diagram)

CS and PS diagram

show economic gain from buying and selling of goods

Indirect taxes

tax on expenditure where the person who is ultimately charged the tax is not the person responsible for paying the sum to the government

ad valorem

specific tax

Ad valorem

where the tax payable increases in proportion to the good

VAT

Specific tax

where an amount is added to the price

excise duties

Impacts of tax

increase in the cost of production

consumer sees higher prices and sufferes from a tax burden

producer sees a rise in costs and a fall in output

CB and PB of tax

CB and PB ad valorem

Incidence of tax

the tax burden on the tax payer

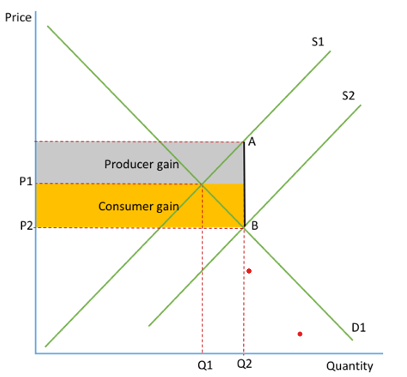

Subsidies

A grant given by the government and is the opposite of a tax

An extra payment to encourage production/ consumption of a good/ service

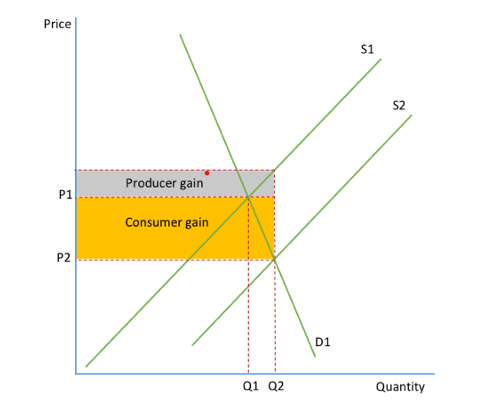

Subsidy on a diagram

increase in supply

producer sees a fall in production costs

rise in output

total shaded area is gov spending

consumer behaviour

aim to maximise utility

companies aim to maximise profit

governments aim to maximise welfare of citizens

influences of other people

influence of habitual behaviour

consumer weakness at computation- consumers arent willing or able to make comaprisons between prices and so they will buy more expensive goods than needed