Liquidity Ratio

1/6

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

7 Terms

Liquidity Ratios

Financial ratios that measure a company's ability to repay both short- and long term obligations

Current Ratio

Measures a company’s ability to pay short-term obligations & liabilities or those due within one year

FORMULA:

= Current assets / Current liabilities

Example Current Ratio

If a company has the following financial information: - Current Assets = €150000 - Current Liabilities = €100000 Then, the current ratio would be calculated as follows: Current Ratio = Current assets / Current liabilities = 150000 /100000 = 1.5

Current Ratio > 1: company has more current assets than current liabilities, suggesting good short-term financial health.

Current Ratio = 1: current assets equal current liabilities, suggesting that the company can cover its short-term obligations.

Current Ratio < 1: current liabilities exceed current assets, which may raise concerns about the company’s liquidity & ability to meet short-term obligations.

Acid-Test Ratio or Quick Ratio

measures how sufficient a company's short-term assets are to cover its current liabilities. In other words, the acid-test ratio is a measure of how well a company can satisfy its short-term (current) financial obligations.

Compares a company's "quick assets" (current assets convertible in cash - inventories) to its current or immediate liabilities. Not relying on the sale of inventory that could take more time

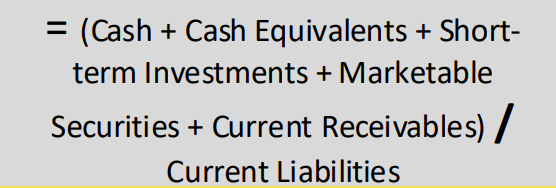

FORMULA:

= (Cash + Cash Equivalents + Shortterm Investments + Marketable Securities + Current Receivables) / Current Liabilities

formula can also be= current assets - inventory / current liabilities

Example Acid-Test Ratio

If a company has current assets of $500000, inventory of $150000, and current liabilities of $300000, the ratio would be:

Acid-Test Ratio = Current Assets − Inventory Current Liabilities = 500000− 150000 300000 = 1.17

Interpretation:

A ratio greater than 1 indicates that the company can meet its short-term obligations without relying on the sale of inventory.

A lower ratio may indicate liquidity issues.

Considerations:

very high ratio may indicate that the company is not effectively using its assets to generate revenue.

The industry standard can vary, so it’s essential to compare with peers.

Cash Ratio

liquidity metric that indicates a company’s capacity to pay off short-term liabilities with its cash and cash equivalents. Most conservative liquidity position.

Compared to other liquidity ratios such as the current ratio, cash ratio is a stricter, more conservative measure because only cash & cash equivalents – a company’s most liquid assets – are used in the calculation.

FORMULA:

= Cash + Cash Equivalents / Current Liabilities

Operating Cash Flow Ratio

Indicates if company's normal operations are sufficient to cover its near-term obligations. Provides vital info on company’s health.

measures a company’s ability to cover its current liabilities w/cash generated from its operating activities

represents a company's ability to pay its debts with its existing cash flows. It is determined by dividing operating cash flow by current liabilities. A ratio greater than 1.0 indicates that a company is in a strong position to pay its debts without incurring additional liabilities.

FORMULA:

= Operating Cash Flow / Current Liabilities