Monetary fiscal policy final exam

1/14

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

15 Terms

Draw the diagram of the Federal Reserve System

Federal Reserve Board of Governors

The Federal Open Market Committee (FOMC)

12 Federal Reserve Branch Banks

Commercial Banks : Thrift Insitituions

The Public (Households and Businesses

When was the Second Bank of United States established? Who headed this institution? Explain what led the closure of the Second Bank of the United States? When did the Second Bank of the United States close?

The Second Bank of the United States was established in 1816. It was given a 20-year charter to operate until 1836. Nicholas Biddle was the President of the Second Bank of the United States. Disputes between Biddle and then-President Andrew Jackson led to arguments about the economic power of the Second Bank of the United States and the influence of Biddle. In 1832, an attempt was made to renew the charter of the Second Bank. The renewal was passed in the U.S. Senate but vetoed by President Jackson. An attempt to override President Jackson's veto failed by one vote. The Second Bank's charter expired in 1836 but Biddle continued to operate the bank as a commercial bank. Because of a loss of business within the nation's financial communities, the bank permanently closed in 1841.

List the names of individuals who have served as Chair of the Federal Reserve Board of Governors since the 1950s in the order of their appointment.

William McChesney Martin

Arthur Burns

G. William Miller

Paul Volker

Alan Greenspan

Benjamin Bernanke

Janet Yellen

Jerome Powell

What are the functions of the Federal Reserve System? Briefly explain each function.

1. Issues Currency: Prints cash in the denominations of $1, $2, $5, $10, $20, $50, $100.

2. The Bank of the Banks:

a. Holds reserves of commercial banks; deposits from customers can be held at the Fed.

b. Lender of Last Resort: makes loans to commercial banks when loans through the Federal Funds Market do not materialize.

c. Conducts electronic payments: conducts wire transfers, both domestic and international.

d. Conducts check collection: electronic sorting of all checks written against commercial bank accounts.

3. Fiscal Agent of the Federal Government

4. Regulatory agency: (with other State agencies).

5. Formulates and Implements Monetary Policy

a.Open Market Operations

b. Changing the Discount Rate

c. Changing the Administrative Rates

Explain the strengths and the weaknesses that grew out of the National Banking Act of 1863?

Strengths: The National Banking created "National Banks" which stabilized the printing of a uniform currency throughout the country thus phasing out the practice of state banks printing their own form of the U.S. dollar.

Weakness: The National Banking act did not establish an elastic currency that could expand or contract to meet the needs of the economy during periods of economic growth and periods of economic contraction.

What are the challenges that face the recognition and eventual application of monetary and fiscal policies?

1. Timing in (i) the recognition of unemployment or inflation, (ii) the formulation of the needed policies, and (iii) the lag in effect of the formulated policies.

2. Political factors such as implementing policies that confirm with the political business cycle.

3. Crowding out effect: expansionary policy places downward pressure on interest rates, expansionary fiscal policy places upward pressure on interest rates. Public spending impedes the expansionary potential of private spending.

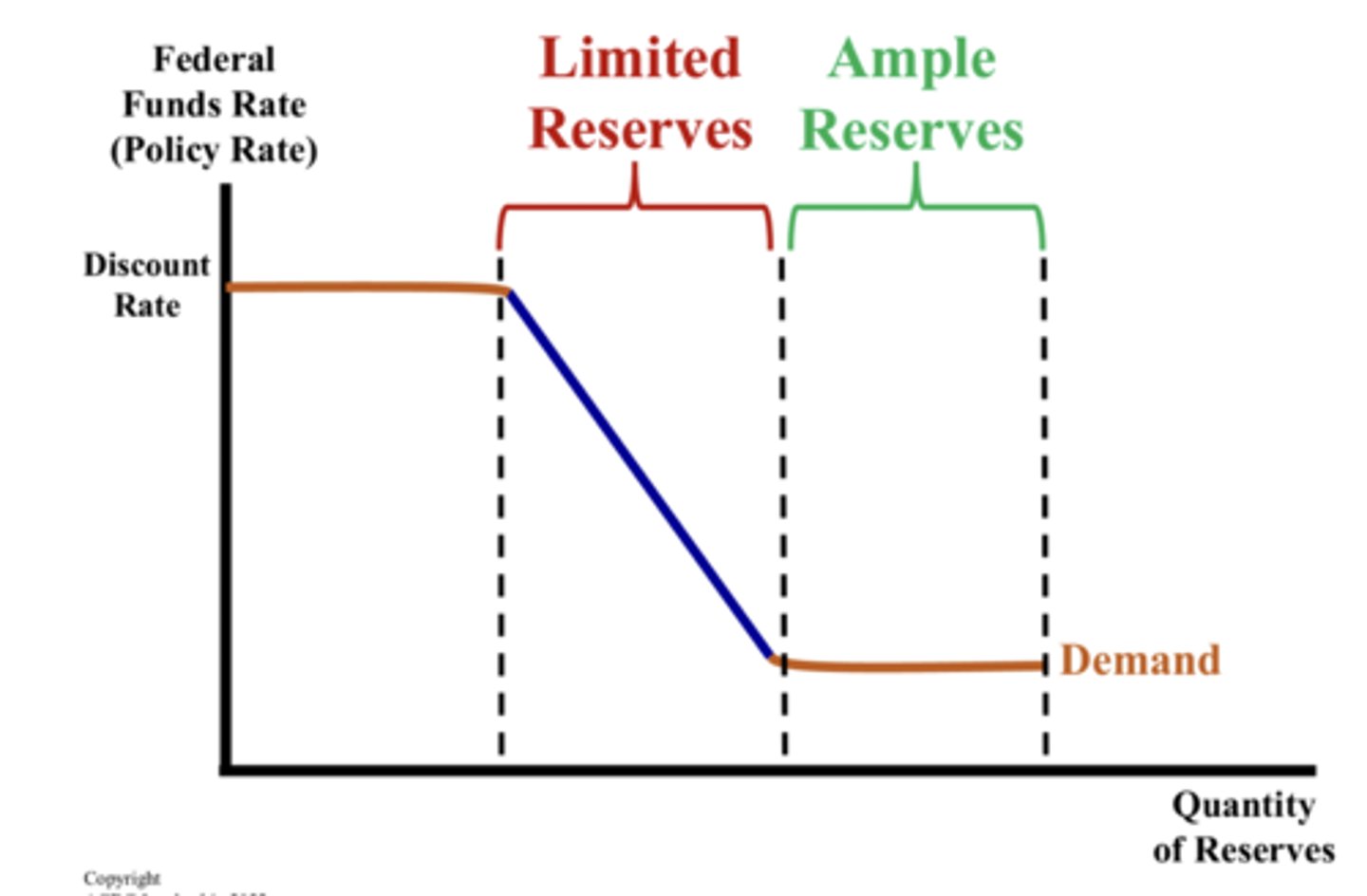

Draw and explain two graphs, one graph illustrating the market for reserves prior to 2020 and another graph illustrating the market for resources after 2020.

The market for reserves after 2020 operates on a ample reserve system, meaning banks have their reserves gaining interest instead of in vaults

Graph the impact on an economy according to the Classical School if the monetary authorities enacted an expansionary monetary policy and the government enacted an expansionary fiscal policy?

Expansionary monetary policy would result in a rightward shift of the Ms curve/line (Ms to Ms'). With the velocity of money (v) assumed constant, the level of nominal income/GDP or PY would increase (PY to P'Y). Since the full employment level of workers (QLFE) has not changed, P would increase (P to P'). This increase in P would lower the real wage (W/P) (from W/P to W/P') temporarily causing an excess demand for labor (QDL > QSL). The labor market would react to this excess demand by bidding up (increasing) the nominal wage (W) so that the real wage returns to the original level (W/P) consistent with the quantity of labor at full employment (QLFE). Hence, expansionary monetary will only have a wage and price inflationary impact on the economy.

Expansionary fiscal policy (increase in G) would increase the demand for loanable funds which would be illustrated by an outward shift in the DLF (or I) curve. This increase in DLF would induce an increase in the real interest rate (from r to r'). This increase in r would cause a decrease in the quantity of investment spending and an increase in the quantity of savings (which is equivalent to a decrease in the quantity of consumption spending). Hence, the expansionary intent of fiscal policy (the budget deficit) would be nullified by the decrease in consumption and investment spending.

What would cause a rise in the full employment level but a fall in the real wage according to the Classical School? What would be the impact on real output? What would be the impact on the nominal wage? Justify your answers with graph(s).

A rise in the full employment level of labor and a fall in the real wage would occur with an increase in the supply of labor. This would be illustrated with a rightward shift of the LS curve. The higher full employment level would result in an increase in real output/GDP on the Aggregate Production function (Yr). However, this increase in Yr would have to result in a fall in the price level P because there is no change in the money supply to force a change on the right-hand side of the equation of exchange. This fall in the price would have to be accompanied by a fall in the nominal wage so that new real wage (w'/p') is lower at the new/higher full employment level of labor.

Given: Autonomous Savings is -$2,000. The percentage of additional income that is saved is 25%. The amount of autonomous business spending is twice the level of autonomous household spending, and the level of autonomous government spending is twice the amount of autonomous business spending. (a) What is the equilibrium level of real income for this economy? If the level of full employment real income is $60,000, (b) if the government runs a lump-sum balanced budget, what are the appropriate values for the correct fiscal policy? Derive your answers for (a) and (b) mathematically.

So is the negative of Autonomous Consumption (household spending). Thus. Co = $2,000

Autonomous business spending is twice the level of autonomous household spending. Thus $2,000 * 2 = $ 4,000 = Io

Autonomous government spending (Go) is twice the level of autonomous business spending. Thus $4,000 * 2 = $8,000 = Go

The MPS = 25%, therefore the MPC = 75%.

The total expenditure function is:

Y = C + I + G

Y = 2,000 + 0.75Y + 4,000 + 8000

(a) The equilibrium level of real income is found by solving for Y

0.25 Y = 14,000

Y = $56,000.

(b) The lump sum balance budget multiplier = 1

The desire level of ∆Y = 60,000 - 56,000 = $4,000

Thus the required amount of Government spending is $4,000, since

∆Y = 4,000 = 1,

∆Go bb ∆Gobb

∆Go or G = $4,000 and

T = $4,000 for a balanced budget G = T

Given the information in the question before and given a proportional tax rate of 50%, what is the (a) simple multiplier, (b) the proportional tax expenditure multiplier, and (c) what is the tax multiplier? Show the formulas for your answers and how each multiplier was computed.

The formula for the proportional tax expenditure multiplier is:

k = 1/(1 - b + bt) = 1/(1 - b(1 - t)) = 1/(1 - .75(1 - .5)) = 1/(1 - .75 (.5)) = 1/(1 - .375 ) = 1/(.625) = 1.61

The formula for the proportional tax multiplier is:

k = -b/(1 - b + bt) = -b/(1 - b(1 - t)) = -.75/(1 - .75(1 - .5)) = -.75/(1 - .75 (.5)) = -.75/(1 - .375 ) = -.75/.625 = -1.21

Derive the IS equation, the LM equation and the equilibrium interest rate and equilibrium income level given the following:

Investment demand is 60 - 200r; transactions demand for money is 0.20Y; Asset demand for money is 80 - 1000r; money supply is $200; marginal propensity to consume is 80%.

IS Curve:

Y=C+I+G

No G so

Y=C+I or Y =140+0.8Y+60-200r

Y=1000-1000r

LM Curve:

M^s=M^d

M^d=0.20Y+80-1000r

M^s=200

200=0.20Y+80-1000r

Y=600+5000r

Equlibrium rate:

1000-1000r=600+5000r

r=6.67%

Equilibrium income:

1000-1000*(6.67)=933.3

If the government runs a budget surplus and the Fed raises the discount rate, illustrate graphically and explain how these two policies affect the interest rate and real income through the IS-LM model

Budget surplus means G

If the government runs a budget surplus and the Fed raises the discount rate, human capital is improved, and labor costs fall. Illustrate and explain how the price level and real income are affected through the AD-AS model

Budget surplus and fed raising the discount rate shifts AD left

Human capital increase and labor costs decrease shifts LRAS and SRAS to the right

AD shifting left lowers price levels and real GDP is indeterminate

Graph and explain how a recessionary gap can be eliminated in the short run through changes in both aggregate demand an aggregate supply but without incurring inflation or deflation

Recessionary gap is when Equilibrium Y < full employment

To eliminate the gap both AD and AS have to shift to the right so that they intersect and the same initial price level.

For AD to shift right expansionary fiscal and monetary policy must take place and for AS to shift right production costs have to decrease or production as a whole must increase.