exam 2 Financing Health Care I: Private Insurance (7/10)

1/26

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

27 Terms

Majority of all healthcare payments come from

individual/employment based private insurance OR government financing

(INSURANCE)

What percent of people have coverage through the government?

a third

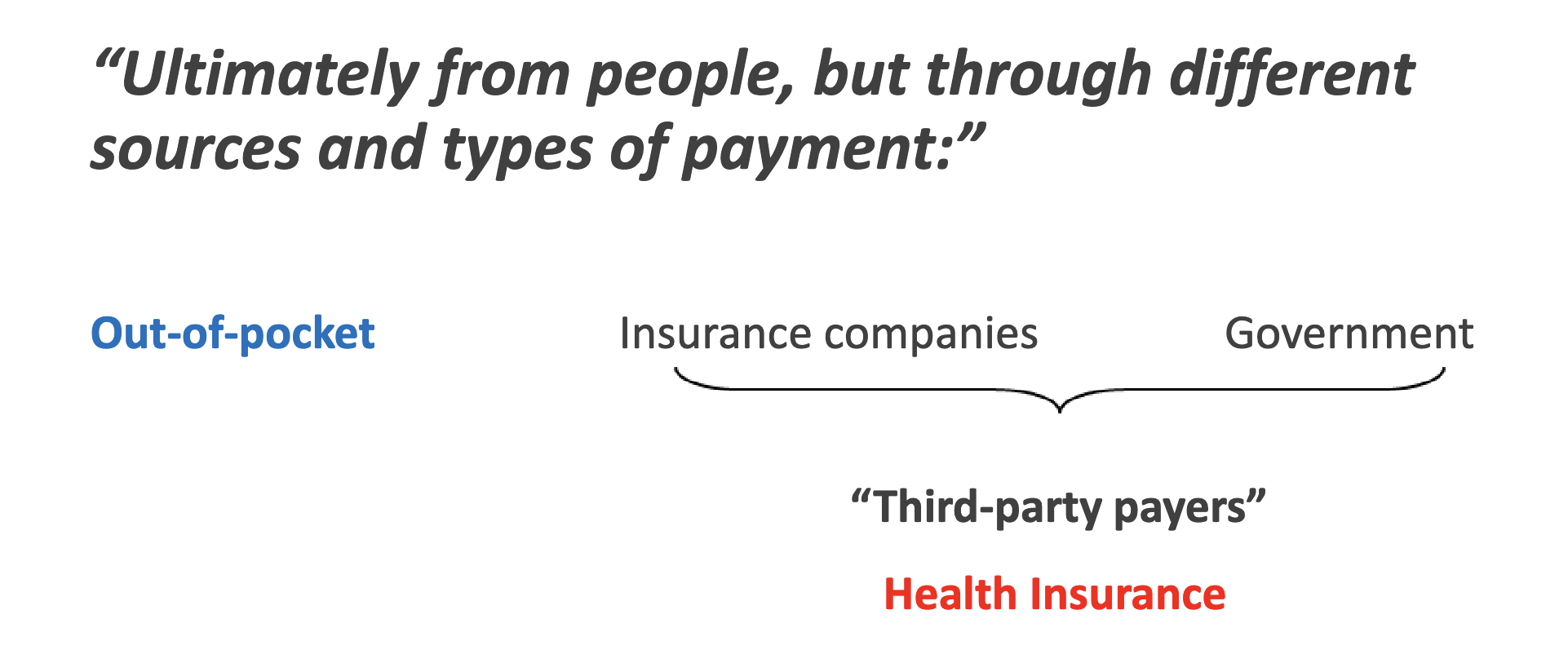

Where does the money for health care come from

Out-of-pocket payment is made directly from — to —.

Out-of-pocket payment is made directly from patient to provider.

Individual private insurance.

A third party, the insurance plan (health plan), is added, dividing payment into a financing component and a payment component. The ACA added an individual coverage mandate for

those not otherwise insured and federal subsidy to help individuals pay the insurance premium.

Employment-based private insurance.

In addition to the direct employer subsidy, indirect government subsidies occur through the tax-free status of employer contributions for health insurance benefits.

Government-financed insurance.

Under the social insurance model (e.g., Medicare Part A), only individuals paying taxes into the public plan are eligible for benefits. In other models (e.g., Medicaid), an individual’s eligibility for benefits may not be directly linked to payment of taxes into the plan. *Some public plans, for example Medicare Advantage, pay a private insurance intermediary that in turn pays providers.

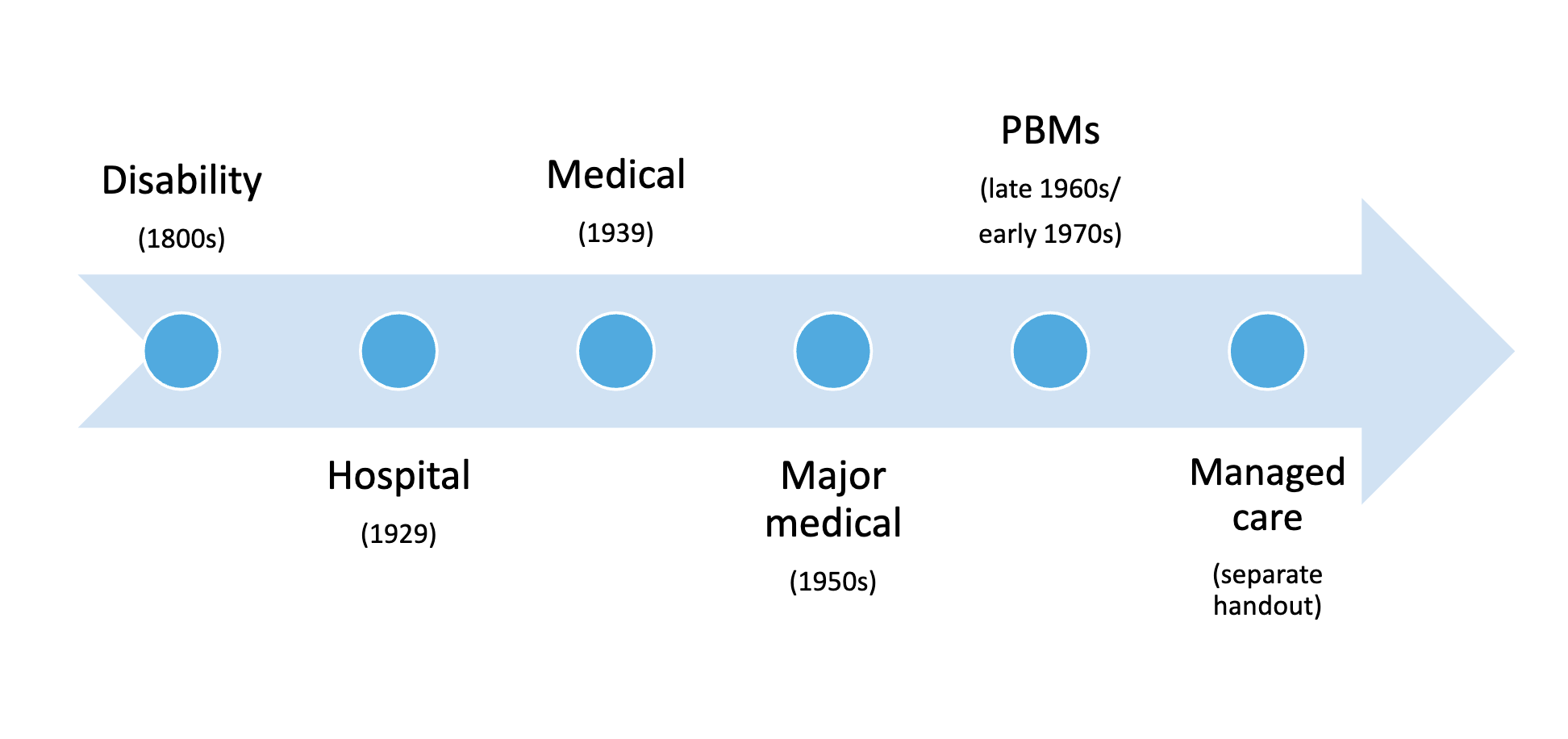

Health insurance evolution

1800s: disability insurance

loss of income resulting from specific illnesses; didnt cover health expenses

Hospital Insurance

a. Baylor Univ. Hospital (1929) –

b. Blue Cross –

Hospital Insurance

a. Baylor Univ. Hospital (1929) – prepaid plan for teachers. Premium paid for those with hospital expenses

b. Blue Cross – started by AHA; free choice of hospital; patient paid bill and was then reimbursed by the plan for 80% of the first 21 days of hospital expenses

Medical Insurance

a. Blue Shield (1939) –

b. Employment-based insurance –

Medical Insurance

a. Blue Shield (1939) – started by a medical group practice; reimbursed patient for a portion of their medical expenses

b. Employment-based insurance – in the 1940s insurance became an important part of labor negotiations Before World War II, 5% of the US population had medical insurance After World War II, 50% of the US population had medical insurance

Major Medical Insurance (1950s) –

Indemnity vs Service Benefit

Major Medical Insurance (1950s) – merger of hospital and medical insurance; designed to help offset expenses incurred because of catastrophic illness or injury

Indemnity (early plans) vs. Service Benefit (most plans today) Terms tend to be used interchangeably...

Prepaid Prescription Drug Programs -

Managed Care -

Prepaid Prescription Drug Programs - In the late 1960s/early 1970s, labor unions started to bargain for more generous outpatient prescription drug coverage, which resulted in the growth of standalone prescription benefit managers (PBMs). Managed Care - most insurance plans today!

Health Insurance Trends

• Private insurance has reinforced patterns of health services rather than address gaps of care

• public sector takes care of gaps

• Early plans did little to curb overutilization and control costs

• controlled by hospitals and physicians to protect providers from financial loss

• Over time, the insurance industry began to restrict reimbursement to providers and control the use of health care services

• Decrease in fee-for-service reimbursement

• Increase in managed care plans brought about

• more cost controls

• emphasis on quality improvement & positive patient outcomes

Private Health Insurance

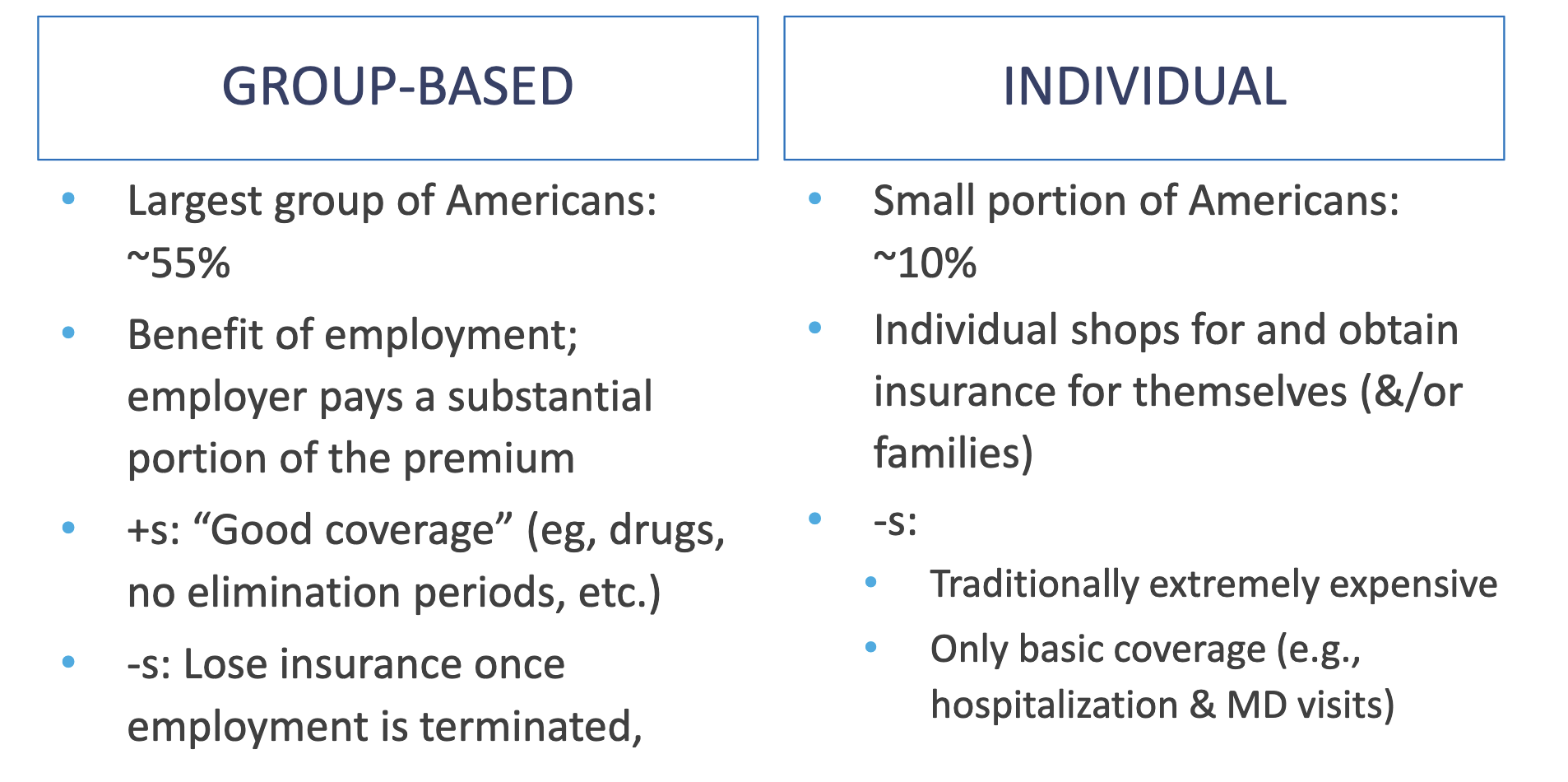

Group-Based vs Individual

Paradoxes of Health Insurance

• Insurance ensures payment, yet restricts reimbursement.

• Insurance creates access, yet restricts utilization. • Providers supply services, yet they can create demand for services.

• Insurance increases access, yet it encourages unnecessary use of services.

• Very “uninsurable” are covered through government, yet “working poor” remain uninsured.

• Individuals with “catastrophic illnesses” have greatest need for insurance, yet they have the most difficulty obtaining it.

Health Insurance Participants

• Patient/Employees -

• Employers (“sponsors”) -

• Health care providers -

Health Insurance Participants

• Patient/Employees - want to be healthy, with convenient access to providers, quality services, and reduced out-of-pocket costs

• Employers (“sponsors”) - want healthy and satisfied employees while maintaining reasonable costs for their employee health coverage

• Health care providers - often view insurance as an intrusion into the patient-provider relationship and an unfair market force that controls their practice and limit their earnings.

Underwriting

process of insuring someone

Actuarial Analysis –

Estimates can be adjusted based on:

- Community rating -

- Experience rating -

Actuarial Analysis – estimating the amount of risk to be assumed by an insurance company: statistical analysis of the population served, it estimates the income (premiums) that must be earned to cover the estimates expenses (aka, cost per member per month)

Estimates can be adjusted based on:

- Community rating - premiums based on known characteristics of some community (e.g., a geographic area)

- Experience rating - premiums based on the plan’s past claims-paying experience; theoretically with an individual, but often with a group (of employees)

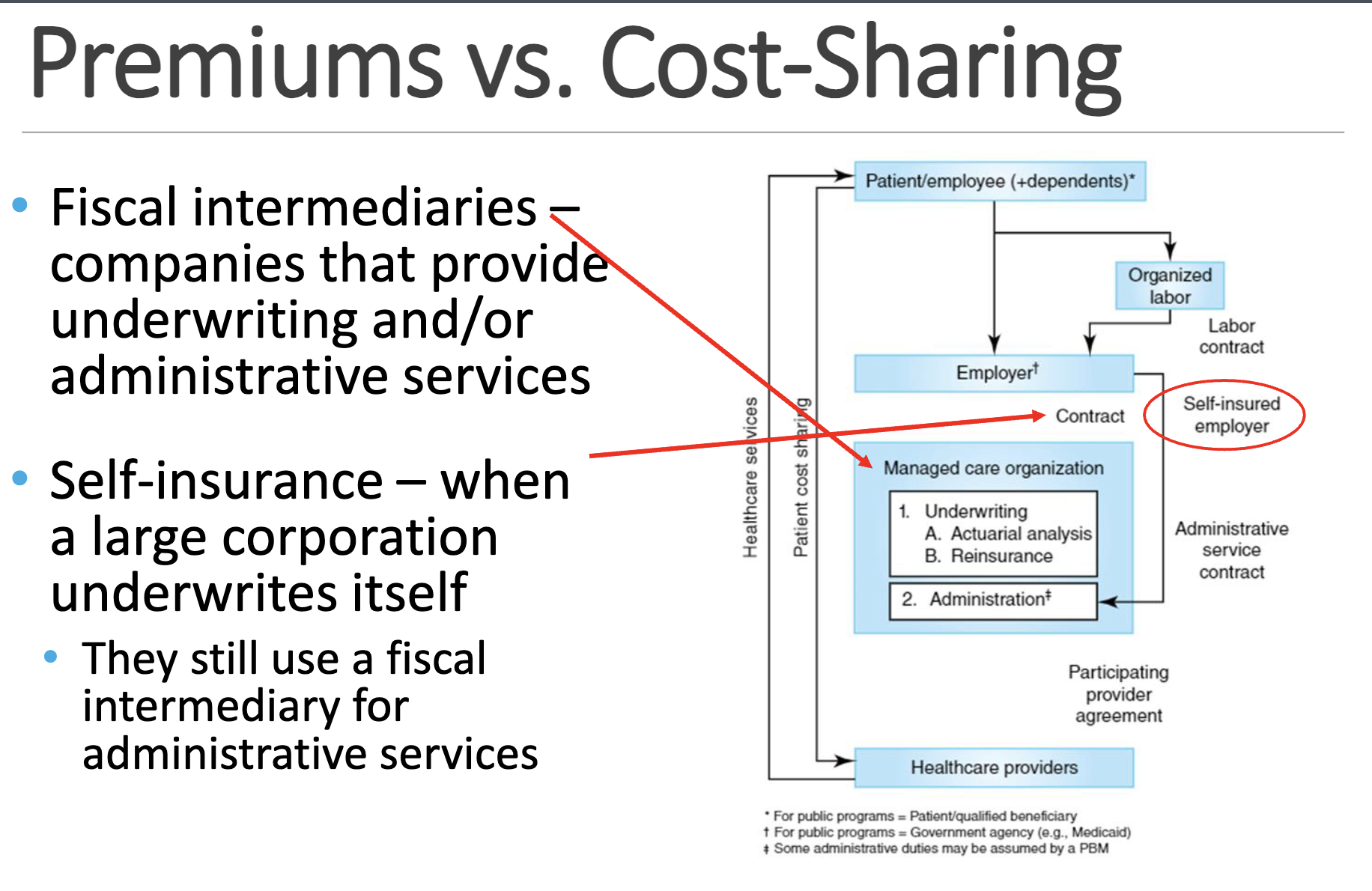

Premium -

Patient Cost-Sharing -

o Deductible -

o Co-insurance -

o Co-payment -

Premium - amount paid to have insurance coverage

Patient Cost-Sharing - dollar amount meant to control utilization of health services by making patients more cost-conscious

o Deductible - specific amount to be spent out of pocket before insurance coverage starts E.g., $1,500/year

o Co-insurance - specific percentage of the cost of service E.g., 20% paid by Medicare patient

o Co-payment - specific amount of money E.g., $10 per prescription

X

X

Principles of Risk Management

Insurance helps manage some types of “unanticipated risks.”

Pure risk vs Speculative risk

Pure risk: loss, no gain

examples: accidents, death, fire, illness

Speculative risk: loss or gain

examples: gambling, pursuing a business venture

Pure risk becomes insurable when the following conditions are met:

Pure risk becomes insurable when the following conditions are met:

✓ The probability of peril occurring in a population can be accurately determined

✓ The peril is an irregular event on an individual basis

✓ The loss must be accidental

✓ The event must result in a substantial loss

✓ The loss must be measurable

✓ The individual must have an insurable interest

Risk Management Problems

Catastrophic hazard -

Adverse selection -

Incentives to create losses -

Supplier-induced demand -

Moral hazard -

Risk Management Problems

Catastrophic hazard - widespread catastrophes (war, acts of God, etc.); typically excluded from coverage

Adverse selection - insurance is purchased because a loss is expected

Incentives to create losses - the level of insurance can result in an actual gain when an insured loss is incurred (e.g., insuring your car for more than it is worth)

Supplier-induced demand - providers can create demand for the same services they supply

Moral hazard - an insured individual’s behavior is different than in an uninsured state (e.g., overutilization when insurance is present)

Strategies for Avoiding Risk Management Problems

Group policies -

Elimination (exclusionary) period -

Coverage limitations -

Coordination of benefits -

Strategies for Avoiding Risk Management Problems

Group policies - less prone to adverse selection, less expensive to sell and administer

Elimination (exclusionary) period - preexisting health problems are not covered by a new health insurance policy until after the policyholder has been covered for a given period of time

Coverage limitations - limits: payments for certain covered expenditures and/or what services are covered

Coordination of benefits - limits total reimbursement of all insurance to the amount of loss; used in cases in which multiple payments could be made for the same care

Pharmacy Benefit Management (PBMs)

Pharmacy benefits are somewhat unique:

• Benefit includes ? and ?

• ? and ? than medical benefits

Pharmacy Benefit Management (PBMs)

Pharmacy benefits are somewhat unique:

• Benefit includes goods and services

• Higher volume and more frequent than medical benefits

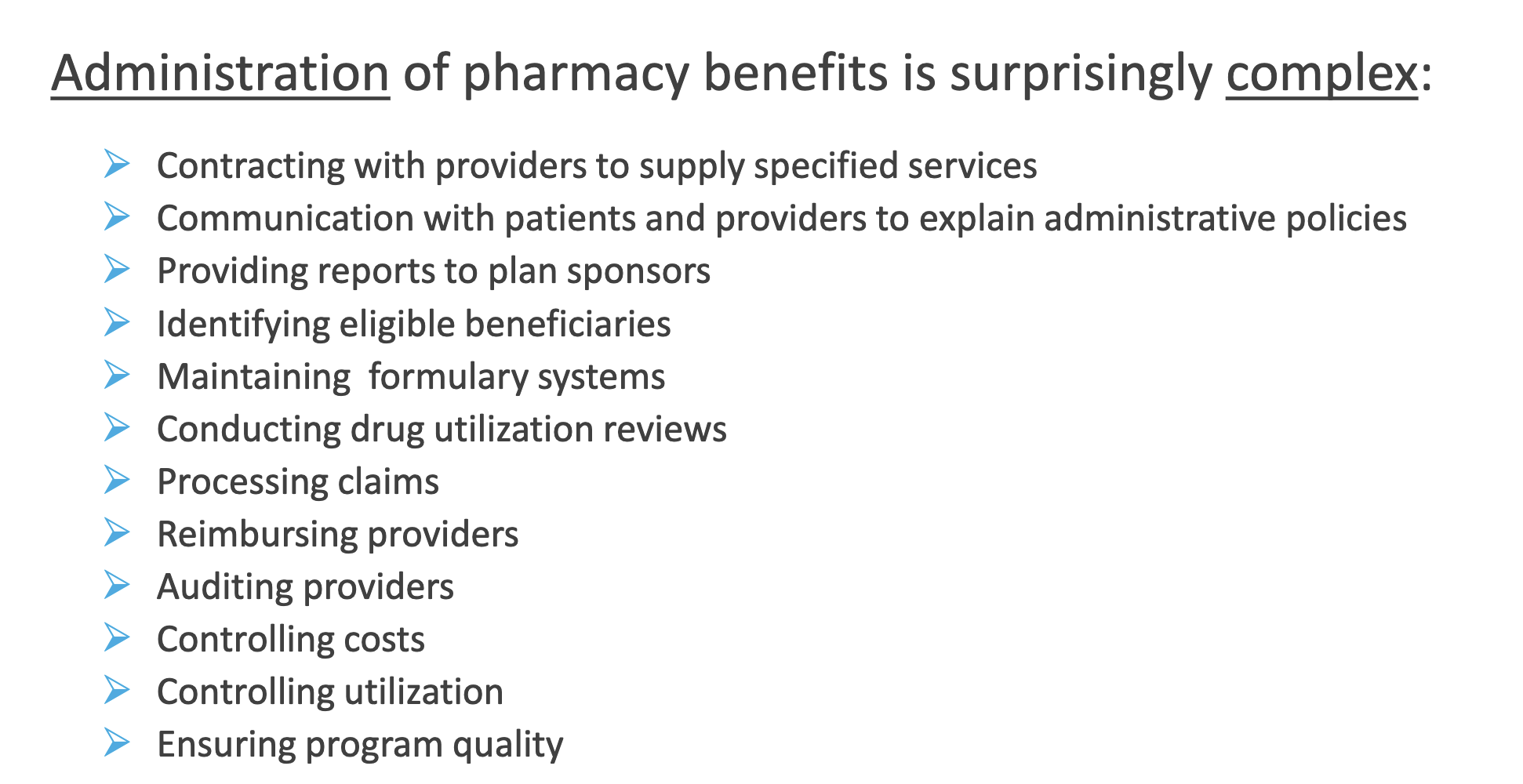

Administration of pharmacy benefits is surprisingly complex: