Working Capital Management

1/52

Earn XP

Description and Tags

Flashcards related to Working Capital Management, Cash Management, Receivable Management, Inventory Management and Short-Term Financing

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

53 Terms

Working Capital Management

The administration and control of current assets and current liabilities with the goal of maximizing the value of the firm with appropriate balance between profitability and risk.

Matching

Matching the maturity of a financing source with an asset’s useful life. Short-term assets are financed with short-term liabilities. Long-term assets are funded by long-term financing sources.

Conservative

Operations are conducted with too much working capital; involves financing almost all asset investments with long-term capital.

Aggressive

Operations are conducted on a minimum amount of working capital; uses short-term liabilities to finance, not only temporary, but also part or all of the permanent current asset requirement.

Cash Management

Maintenance of the appropriate level of cash and investment in marketable securities to meet the firm’s cash requirements and to maximize income on idle funds.

Transaction motive

To facilitate normal transactions of the business.

Precautionary motive

To provide for buffer against contingencies.

Speculative motive

To avail of business and investment opportunities.

Contractual motive

By provisions of a contract (e.g. compensating balance in a bank).

OPTIMAL CASH BALANCE (OCB) formula

√{2 [(𝐴𝑛𝑛𝑢𝑎𝑙 𝐶𝑎𝑠ℎ 𝑅𝑒𝑞𝑢𝑖𝑟𝑒𝑚𝑒𝑛𝑡) x (𝐶𝑜𝑠𝑡 𝑃𝑒𝑟 𝑇𝑟𝑎𝑛𝑠𝑎𝑐𝑡𝑖𝑜𝑛)] / 𝑂𝑝𝑝𝑜𝑟𝑡𝑢𝑛𝑖𝑡𝑦 𝐶𝑜𝑠𝑡 𝑜𝑓 𝐻𝑜𝑙𝑑𝑖𝑛𝑔 𝐶𝑎𝑠ℎ}

Float

The difference between the cash balance per bank and the cash balance per book as of a particular period, primarily due to outstanding checks and other similar reasons.

Positive Float

Bank Balance > Book Balance (Example: Outstanding checks issued by the firm that have not cleared yet.)

Negative Float

Book Balance > Bank Balance (e.g. mail float, processing float, clearing float)

Mail Float

Payments mailed by customers but not yet received by the seller company.

Processing Float

Payments that have been received by the seller but not yet deposited.

Clearing Float

Checks that have been deposited but have not cleared yet.

Accounting Receivable Management

Plans and policies related to sales on account and ensuring the maintenance of receivables at a predetermined level and their collectibility as planned.

Character

Customers’ willingness to pay.

Capacity

Customers’ ability to generate cash flows.

Capital

Customers’ financial sources.

Conditions

Current economic or business conditions.

Collateral

Customers’ assets pledged to secure debt.

Inventory Management

Plans and policies to efficiently and satisfactorily meet production and merchandising requirements and minimize costs relative to inventories.

Economic Order Quantity

The quantity to be ordered, which minimizes the sum of the ordering and carrying costs.

EOQ Formula

√[(2𝑎𝐷) / 𝑘]

where:

a = cost of placing one order (or ordering cost)

D = Annual Demand in Units

k = Annual cost of carrying one unit in inventory for one year

Lead time

Period between the time the order is placed and received.

Normal time usage

Normal lead time x Average usage.

Safety stock

(Maximum lead time – Normal lead time) x Average usage

Reorder point if there is safety stock required

Safety stock + Normal lead time usage or Maximum lead time x Average usage

Cost of giving up cash discount

[CD/(100% - CD)] x 360/N)

where:

CD = cash discount percentage

N = number of days payment can be delayed by giving up the cash discount

Compensating Balance

An arrangement whereby a borrower is required to maintain a certain percentage of amount borrowed as compensating balance in the current account of the borrower.

A basic inventory model exists to assist in two inventory questions

How many units should be ordered?

When should the units be ordered?

Assumptions of the EOQ Model

Demand occurs at a constant rate throughout the year.

Lead time on the receipt of the orders is constant.

The entire quantity ordered is received at one time.

The unit costs of the items ordered are constant; thus, there can be no quantity discounts.

There are no limitations on the size of the inventory

Average inventory formula

EOQ / 2

Reorder point if there is no safety stock required

Normal lead time usage

SHORT-TERM FINANCING

Accounts Payable

Bank Loans

Analysis of credit terms

Taking the cash discount

Giving up cash discount

Cost of giving up cash discount

Taking the cash discount

If cash discount is to be taken, a firm should pay on the last day of the discount period.

Giving up cash discount

If the firm has to give up the cash discount, it should pay on the last day of the credit period

Single-payment notes

If the interest is payable upon maturity, the effective interest rate is equal to the nominal rate.

Discounted Note

The effective interest rate is higher than the nominal rate.

Cost of Bank Loans (Effective Annual Rate) Without Compensating Balance

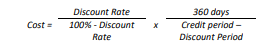

(Discount rate/100% - Discount rate) x (360 days / (Credit period - Discount period))

Cost of Bank Loans (Effective Annual Rate) With Compensating Balance

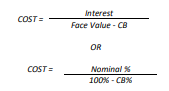

Interest / (Face value - CB) or Nominal % / (100% - CB%)

Working Capital Financing Policies

Matching

Conservative

Aggressive

Reasons for holding cash

Transaction motive

Precautionary motive

Speculative motive

Contractual motive

Total cost of cash balance formula

Holding costs + Transaction costs

Holding Costs = average cash balance* x opportunity cost

Transaction Costs = number of transactions** x cost per transaction

Where:

*Average cash balance = OCB ÷ 2

**Number of transactions per year = annual cash requirement ÷ OCB

Types of Float

Positive float

Negative float

Ways to Accelerate Collection of Receivables

Shorten credit terms.

Offer special discounts to customers who pay their accounts within a specified period.

Speed up the mailing time of payments form customers to the firm.

Minimize float, that is, reduce the time during which payments received by the firm remain uncollected funds

Analyzing Receivables

Ratio of receivables to net credit sales

Receivable turnover

Average collection period

Aging of accounts

Factors considered in making Accounts Receivable Policies

Credit Standard

Credit Terms

Collection Program

Five C’s of Credit

Character

Capacity

Capital

Conditions

Collateral

Credit Terms

This defines the credit period and discount offered for customer’s prompt payment. The following costs associated with the credit terms must be considered: cash discounts, credit analysis and collections costs, bad debt losses and financing costs

Collection Program

Shortening the average collection period may preclude too much investment in receivable (low opportunity costs) and too much loss due to delinquency and defaults. The same could also result to loss of customers if harshly implemented.