ECON 371 All Exams

1/150

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

151 Terms

Key issue with centralized policies

Asymmetric information: the decision makers set regulations that do not take into account all private information held by polluters

Advantage with market-based instruments

The regulator can set an objective and designs how firms are incentivized to meet objectives, but all firms act based on their own private information

Two main market-based instruments

Emissions taxes/subsidies and permit trading

How emissions taxes/subsidies work

Firms respond to a new price for using environmental resources

How permit trading systems work

Firms interact to distribute the costs of causing environmental harm

Tax incidence

The way tax burden is split across consumers and producers

Tax burden

Change in price to producer/consumer times quantity after tax

Statutory incidence

Who ends up actually paying the tax

Progressive tax

Tax rate increases as taxable amount increasses

Regressive tax

Tax rate decreases as taxable about increases

How is tax incidence determined?

Supply and demand elasticities:

- Inelastic demand leads to buyers paying more of the burden

- Inelastic supply leads to sellers paying more of the burden

Pigouvian tax

A tax on a good with an external cost in hopes to remove a distortion caused by the externality while also potentially raising revenue

How Pigouvian taxes should be set

Set equal to the marginal damages at the optional level of production

How do Pigouvian taxes incentivize emission reduction

Profit maximizing firms will try to find a least-cost way of reducing emissions so they don't have to pay the tax. E.g. reduce output, invest in emission reduction, develop cleaner technology

Double dividend hypothesis

We want to reduce taxes on goods (things we want to encourage like employment) and replace the lost revenue with taxes on bads (like pollution)

Advantages with emissions taxes

- Provides strong incentives for innovation

- Taxes ensure that marginal abatement costs are equalized across all sources and the equimarginal principle is satisfied (everyone abates until MAC = tax)

- Cost effective outcomes can be achieved without knowing the individual marginal abatement costs of many sources

Disadvantages of emissions taxes

- Certain emissions like nonpoint source emissions are difficult to measure (and therefore tax)

- Taxes also need enforcement and high enforcement costs lead to higher abatement costs

Second-best taxes

Sometimes it's not possible to directly tax the pollutant you want to control so authorities will tax the 'second-best option' which is something highly connected to the pollutant being emitted (e.g. tax fertilizers to decrease runoff)

How do abatement subsidies work?

Authorities offer a reward for every unit of abatement. This creates an opportunity cost where the polluter forgoes the subsidy if they emit. In the short run subsidies and taxes will have the same effect because polluters will abate to the level where MAC = subsidy rate.

Downside of abatement subsidies

Subsidies increase profits for the firm, making the industry more attractive for new entrants which could increase overall emissions. So it's likely to be less efficient than taxes.

Offset trading

Buyer pays seller to reduce their emissions on their behalf

Emissions rate trading

Buyer pays seller to reduce the rate of emissions so they can have a higher emissions rate

Cap and trade

Regulator sets a cap on emissions, distributes allowances, then allows polluters to trade permits amongst themselves

Compliance offset trading

Firms must meet a requirement but may trade allowances amongst themselves to meet these requirements

Voluntary offset trading

Individuals buy offsets at their own discretion (e.g. you buy an offset for a flight)

What makes an offset 'real'

- permanence

- additional (reduction wouldn't have occurred without the transaction)

- verifiable

- enforceable (can only be counted once)

Steps of implementing cap and trade

- Set the cap

- Allocate or auction allowances

- Firms operate and buy/sell allowances

- Regulator checks that firms have enough allowances to cover emissions at end of period

Ways to allocate allowances

- For free following historical emissions

- For free based on size of sources

- Sold at auction (firms don't like this one)

- Hybrid approach where the initial permits are free but more are auctioned over time

Independence property

The initial allocation doesn't matter for cost effectiveness

Key difference between taxes and permit systems

Taxes are price instruments, permits are quantity instruments

When to use taxes vs permits?

- If MAC are know, either can be used to get equivalent outcomes

- If MAC unknown and MAB is less elastic (steeper) than MAC, permits are better

- If MAC unknown and MAB is more elastic (flatter) than MAC, taxes are better

Social cost of carbon

The net present value of the future damages cause by one more ton of carbon emissions

Prescriptive approach to discounting

- All generations are valued equally

- 0-2% discount rate

- Take action now

Descriptive approach to discounting

- Value future generations using observed investment behaviour

- Use prevailing interest rate (3-5%)

- Gradually ramp up climate policy

Free-ridership and climate change

Fixing climate change is a global public good and the free-rider problem exists just like with any other public good

Free-rider problem

If anyone pays to reduce carbon emissions, everyone benefits whether they paid or not so then people are not incentivized to contribute

How to manage the prisoners dilemma and free-ridership?

Climate agreements

Kyoto Protocol (1997)

The original international agreement to reduce emissions which included most European countries plus US, Canada, and Japan (left out big developing countries like China and India)

Paris Accord (2015)

A follow-up to Kyoto which includes 196 countries that aims to limit global warming below 1.5-2 degrees Celsius

Limitations of Paris Accord

- Countries set, monitor, and report their own contributions

- Commitments are not legally enforceable leaving moral pressure or bilateral sanctions as the main enforcement mechanism

2 fundamental responses to climate change

- Mitigation

- Adaptation

(both are required since we cannot mitigate fast or cheaply enough)

Climate mitigation

Reducing GHG emissions so as to delay or reduce global temperature increases

Climate adaptation

Adjusting in ways that will substantially reduce the negative effects of temperature increases (e.g. installing air conditioning)

Human effect damages

Things like adverse health effects, being unable to use an environmental resource, deterioration of the visual environment, etc.

Nonhuman effect damages

Things like endangering plant and animal species, reducing biodiversity, etc.

Possible marginal damage function shapes

Flat, increasing, decreasing, rise and then fall

Aggregate marginal damages

The vertical summation of many marginal demand functions. One unit of pollution can harm multiple people.

Relationship between marginal damages and marginal abatement benefits

- The first unit of abatement has a benefits equal to the damages of the last level of emissions.

- The shape is mirrored, rising MD = falling MAB

Abatement cost

The cost of reducing the quantity of emissions (e.g. loss of profit, costly technology, recycling costs, etc.)

Aggregate marginal abatement cost

The horizontal summation of multiple MAC curves.

Coase theorem

If transaction costs are negligible, negotiation is free, and property rights are clearly assigned, then private negotiation will lead to an efficient allocation even when there are externalities, regardless of who holds property rights

Insights from Coase theorem

- In some situations, government intervention is not needed and could even be harmful

- Transaction costs of bargaining are often too high for parties to work out the problem on their own

- Governments can effectively intervene by lowering transaction costs

- Initial assignment of property rights are irrelevant to social efficiency if transaction costs are low

Drawbacks of Coase therorem

Most of the time, bargaining is not costless and property rights are not clear. It also doesn't consider things like market power, imperfect information, enforcement costs, people not always maximizing, income/wealth effects.

Performance standards

Takes the form of either ambient or emissions standards

Ambient standards

An ongoing 'never-exceed' level of some pollutant in the ambient environment. E.g. PM2.5 levels in the ambient air must not exceed a certain level.

Emissions standard

A cap on the quantity of emissions output or emissions rate of an activity in a time frame

Pros of performance standards

Gives very direct control to regulators over pollution control

Con of performance standards

Information is often limited about the efficient level of abatement. So it's likely that the standard will be set too high or too low.

Technology standards

Requires the adoption of a specific type of technology by polluters. Focuses on design and not end result.

Pro of technology standards

Usually easier to enforce

Con of technology standards

Disincentivizes innovation into new, more effective types of technologies

Zero-risk approach

Set a standard so high that there's basically zero damages created

Downside to zero-risk approach

Not efficient, and essentially impossible in some scenarios

Uniformity standard

Everyone has to abide by the exact same standard (e.g. same emission level, same abatement amounts, etc.)

Downside to uniformity standard

Different firms will have different MAC and MAB so there will be a deadweight loss if everyone needs to meet the same standard

Upside to uniformity standards

Ease of implementation

Individual standards

Everyone has a different standard to meet, accounting for differences in the costs and benefits of abatement, allocated per the equimarginal principle

Downside of individual standards

High information costs

Environmental economics

The study of how humans use the natural environment and how that use can impact other people. Focuses on the flow of waste products and their impacts.

Positive statement

A statement that describes what something is (fact based)

Normative statement

A statement that describes how things should be (opinionated)

Natural resource economics

Studies the allocation of raw materials as inputs to production

Environmental quality

The quantity of pollutants in the environment

Pollutants

Residuals that are placed in the environment (e.g. emissions/discharges of particles)

Pollution

The result of releasing pollutants (e.g. the smog as a result of the release of particles)

Damages

The negative impacts of environmental pollutants

Source

Where emissions occur

The fundamental balance

In the long run, there will be a balance of inputs and outputs. Raw materials flowing into the system much eventually be discharged. You can only recycle something so many times.

The fundamental balance equation

Raw materials (M) = Residuals discharged by consumers (RDC) + Residuals discharged by producers (RDP)

Residuals discharged equation

Total residuals discharged = all residuals from production (Rp) - residuals recycled by producers (RRP) + quantity of goods consumed (G) - residuals recycled by consumers (RRC)

Conclusions from residuals discharged equation

The only ways to reduce total residuals discharged is by producing fewer goods, producing goods in a way that leads to fewer residuals, or increase recycling.

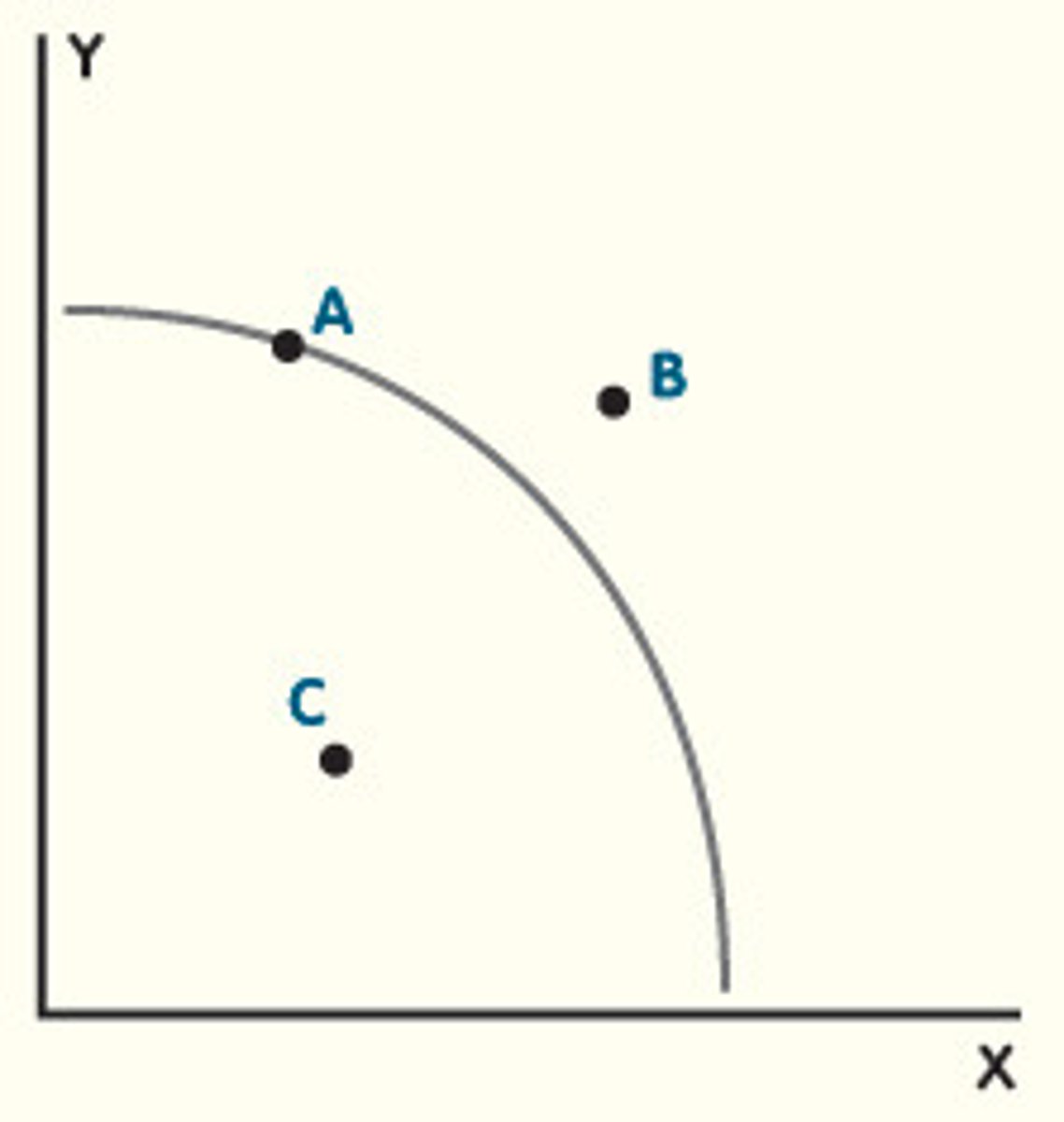

Production possibility curve

A downward sloping curve that demonstrates the negative relationship between environmental quality and number of market goods produced.

Sustainability

The ability to meet the needs of present generations without compromising the ability for future generations to meet their own needs.

Sustainability represented on the PPC

Sustainability would mean finding a point on the PPC today that meets our needs without shifting the PPC of the future inwards.

Cumulative pollutants

Pollutants that build up over time (e.g. plastics do not break down immediately)

Non-cumulative pollutants

Pollutants that stop as soon as the source is shut off (e.g. noise pollution)

Local pollutants

Pollutants with impacts only in small regions

Regional/Global Pollutants

Pollutants with wide reaching effects

Point-source pollutants

Pollution that can be traced by to a distinct single point (e.g. a wastewater treatment facility releasing sewage into a lake)

Nonpoint-source pollutants

Pollution that cannot be traced to a single point (E.g. exhaust emissions from millions of cars contributing to smog)

Continuous emissions

Steady emissions with little fluctuation over time like those from a power plant

How to manage continuous emissions?

Look at ways to reduce the rate of discharge

Episodic emissions

Rare events like oil spills

How to manage episodic emissions?

Work on reducing the probability of a discharge event happening

Prescriptive regulation

a mandate about what can and cannot be done (e.g. tech requirements, max emission quantity)

Market-based regulation

alter market incentives so that they discourage pollution. E.g. taxes, tradable permits, subsidies

Behavioural regulations

Establishing social norms, defaults, and nudging

Why do people pollute?

People aren't inherently bad but do bad things like pollute because there are incentives to do so (e.g. money, risk, power, norms, etc.)

Perverse incentives

Unintended behaviour as a result of an incorrectly designed policy

Private costs

Costs experienced by the party making the decision