Chapter 9: Price management and pricing tactics

1/13

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

14 Terms

Price

1) Importance of price

2) Price management

Influencing factors

Price positioning

3) Price setting

4) Alternative methods of pricing

Break-even analysis

5) Pricing existing vs new products

6) Price as a marketing instrument

Immediate sales tactics

Extended sales tactics

Limits on promotional pricing

1) Importance of price

Important in following situations

New product intro: skimming vs penetration

Competitor action / reaction to price change

When the economy “changes”

When prices of substitutes change

With changing government regulations

With technological breakthroughs

2) Price management

Influencing factors on price management

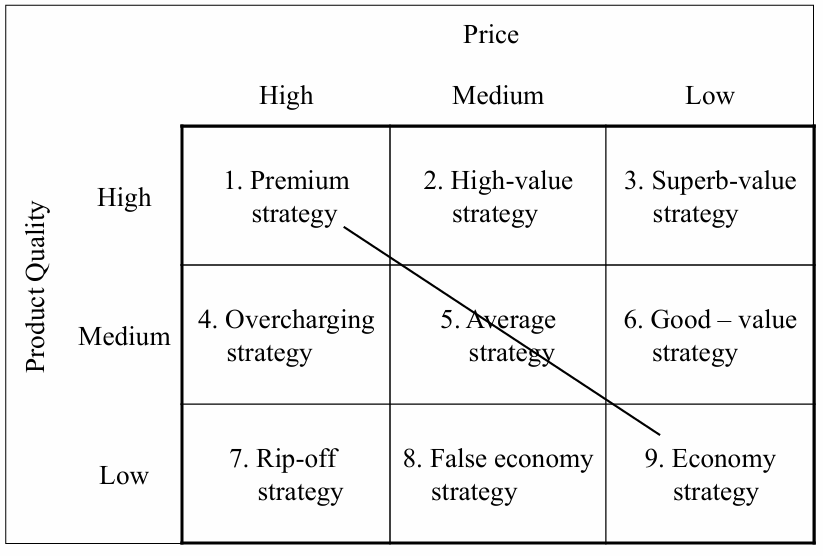

Price vs Quality

3) Price setting

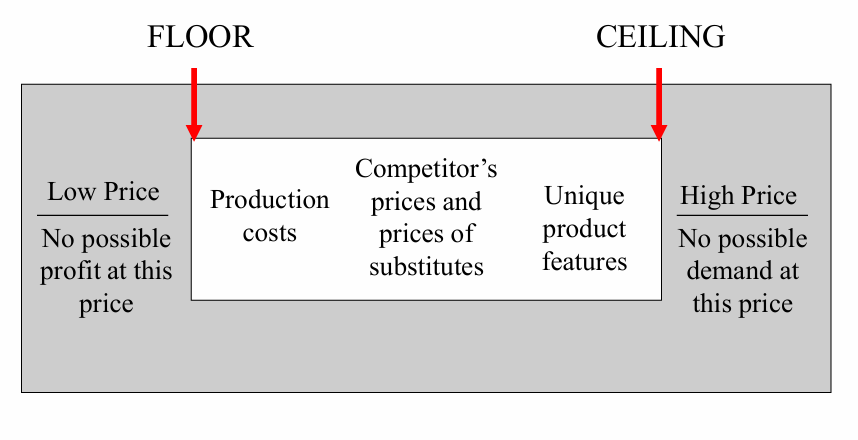

Determining the overall price level

Floor and Ceiling price level

Floor (minimum) | Ceiling (maximum) |

|

|

4) Alternative methods of pricing

Cost-oriented or cost-based pricing

Competition-oriented pricing

market (demand) - oriented pricing

4) Alternative methods of pricing: Cost-oriented or cost-based pricing

Own cost structure as the basis

Knowledge of the cost structure is required

Selling price = Average total cost + Margin

Margin depends on speed of rotation (eg. margin on fast rotating mineral water is usually smaller than the margin on slow rotating exclusive wines)

Break-even analysis

Profit = Total Revenue - Total Costs

Total Revenue (TR) = P x Q

Total Costs (TC) =VC x Q + FC

Profit = P x Q - VC x Q - FC = (P - VC) x Q - FC

Break-even: P and Q where TC = TR

Target rate of return

Financial goal (eg. 20% on investment)

Added to “fixed costs” in break-even analysis

Return on investment

Accounts for “turnover”

Number of times a company uses its investments per year

Payback period

How long it takes before original investment is recovered

Payback period = (break even sales) / (annual demand)

4) Alternative methods of pricing: Competition-oriented pricing

Price of competitor as the basis

Somewhat cheaper or somewhat more expensive ?

Procedures with competing bids (procurements)

Entails risks from neglecting

Own cost structure (underestimating own costs)

Market demand and customer’s ability and willingness to-pay

4) Alternative methods of pricing: Market-oriented pricing

Based on demand elasticity

Market responsiveness to price changes

Generic vs brand demand elasticities

Simulation studies

5) Important considerations when pricing new products

Price positioning strategy

Target market choice

Value to the consumers

Multiple segments, versions, prices

5) Important considerations when pricing new products: Strategic options with pricing

When introducing new products to the markets

Skimming strategy

High prices

Big profit margins

High returns on investment

Rapid payback of investment

Price penetration strategy

Low prices

Rapid market share gain

Stimulate product trial

Strategic options with pricing of existing products

Build: P lower than competition

Hold: maintain P

Harvest: premium P

Reposition: change P

6) Price as Marketing Instrument: Immediate sales tactics

Off-season discounts

Seasonal demand

Offset storage costs

Level out productioon schedule

Quantity discounts

Volume discount

Cash discount

Discount for cash payment

Special sale prices

Discount coupons

6) Price as Marketing Instrument: Extended sales tactics

Trade discounts

List price vs actual price

For performing a specific marketing function

One price vs Variable price

Price flexibility

One price: inflexible, consumers’ trust

Variable prices: flexible, bargaining

Pricing multiple products

Overall goal vs individual goal

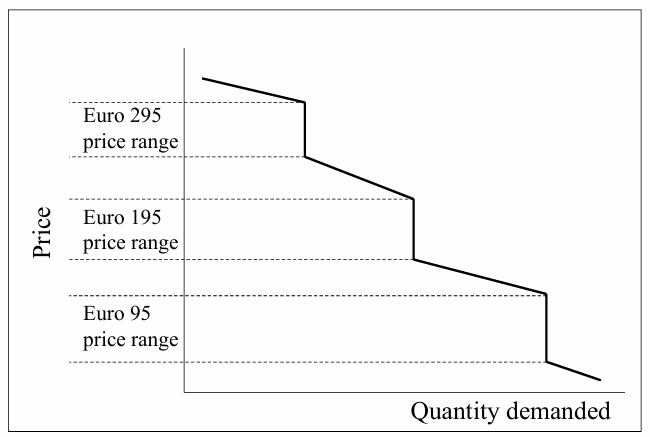

Price lining

Offering a price range: cheap to expensive version

Resale price maintenance

control of the price level at retail level

Suggest or enforce: on-label or on-pack?

Psychological pricing

Odd pricing

Demand curve effect

6) Price as Marketing Instrument: Limits on Promotional pricing

Techniques at retail level

Loss Leader pricing (eg. Lotus (€1,79) → Colruyt (€1,89) vs Carrefour (€1,69) = loss leader pricing)

Pricing below costs

Objective = realise revenues from

sales other products

develop shopping habits

attract new buyers

Bait and Switch (2+5 in AH)

Price special

Quick supply run out

Convince customers to buy more expensive alternative

Forbidden by law

General limitations

No selling at price below costs

Specials should be available to all interested buyers

Rules of thumb for price policy

Put the price up when everyone else does

Not too much at any one time

Not too often

Move something down when you move up

Look after your key accounts

Provide sound and true explanations