ch 7: production, costs and industry structure

1/78

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

79 Terms

monopolistic competition

many firms selling similar, but not identical products

e.g., burger king and mcdonalds

oligopoly

few firms that sell identical or similar products

e.g., coca cola

monopoly

only one firm is selling the product, and this firm faces no competition

ex., de beers (diamond producer), microsoft

stats 2010

US Census bureau counted 5.7 million firms with employees in the US economy

slightly less than half of all the workers in private firms are at the 17,000 large firms, meaning they employ more than 500 workers

another 35% of workers in US economy are at firms with fewer than 100 workers

around 90% of firms have less than 20 employees

profit function

profit= total revenue- total cost

total revenue

income firm generates from selling its products

total cost

what firm pays for producing and selling its products

simplified

total revenue= price * quantity (yield, y)

total cost

what firm pays for producing and selling its products

2 types:

explicit

out of pocket costs, actual payments

implicit

subtle, opportunity cost of using resources that the firm already owns

total revenue

income firm generates from selling its products

explicit costs

out of pocket costs (actual payments)

easily identifiable and can be directly attributed to a specific activity or business fx

e.g., wages

implicit costs

more subtle, still important

represent the opportunity cost of using resources that the firm already owns

e.g, employee training, cost of small business using ground floor of home as a retail store

The $40,000 in rental income an entrepreneur no longer receives after converting the rental space to their new storefront.

Which of the following is an example of an implicit cost?

a. The $40,000 in rental income an entrepreneur no longer receives after converting the rental space to their new storefront.

b.$25 hourly wage paid to a seasonal clerk that a firm employs on a contract basis.

c.$60,000 spent to purchase the lumber needed to create a product.

d. Federal taxes paid by the firm.

accounting profit

a cash concept

total revenue-explicit costs

difference btw dollars brought in and dollars paid out

economic profit

total revenue-total cost

includes both explicit and implicit costs

even though a business pays income taxes based on its accounting profit, this helps to determine if the business is economically successful

the sum of the materials ($100), website charge ($10), and 4% payment processing charge (4%).

Mirtha owns an online jewelry store that specializes in earrings. In March, she sells 50 pairs of earrings priced at $15. The cost of materials to create the 50 pairs of earrings was $100. The website she uses to sell her wares costs her $10 a month, and she is also charged 4% on each sale by the company that processes debit/credit card purchases. Which of the following best represents Mirth’s total cost?

a. The costs of materials minus the costs it takes to run her business through the online store, in this case the $10 website charges and the 4% payment processing charge.

b. The cost of all the materials used to create the earrings, $100.

c. The sum of the materials ($100), website charge ($10), and 4% payment processing charge (4%).

d. The $750 Mirtha earned from earring sales minus the materials ($100), online website charge ($10), and payment processing charge (4%)

fixed inputs K

can’t be increased or decreased in a short period of time

define the firm’s maximum output capacity

variable inputs L

those that can be easily increased or decreased in a short period of time

e.g., ingredients for pizza (can easily add more or less ingredients)

production fx

a mathematical expression explaining the engineering relationship btw inputs and outputs

answers q of how much output can the firm produce given different amounts of inputs

factors of production categories

natural resources (land and raw materials), labor, capital, and entrepreneurship

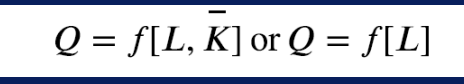

when by definition, capital is fixed in the short run, the fx becomes:

eq indicates that since capital is fixed, the amount of output (e.g., trees cut down per day) depends only on the amount of labor employed (e.g., number of lumberjacks working)

The building where the assembly takes place

Thinking about a company that assembles cars, which of the following would be an example of a fixed input that could not be changed in the short run?

A. The electricity required to support the assembly activity.

B. The robots that help assemble the cars.

C. The employees that work for the company.

D. The building where the assembly takes place

The machines required to produce cars

The input factors of production include Land, Labor, Capital, Technology, and Entrepreneurial ability. Which of the following is an example of Capital?

a. The secret formula used to create a can of Coca Cola.

b. The 200 acres the factory sits on.

c. The total of all the workers employed by the firm.

d. The machines required to produce cars

short run

period of time during which at least some factors of production are fixed

ex., during pizza restaurant lease, the pizza place is operating in the ? run bc it is limited housing the current building- owner can’t choose a larger or smaller building

ex., electric appliances factory need short time to increase their labor, so labor can be considered as a ? run variable (input or cost)

long run

period of time during which all factors are variable

once the lease expires for the pizza restaurant, the shop owner can move to a larger or smaller place

for a company when buying building it will be hard to change the building of the business for the short run, that’s why it will fall under the definition of the long run

marginal product

the additional output that could be gotten from hiring one more worker

the change in total product/change in labor

law of diminishing marginal product: it may be that as we add workers, the marginal product increases at first, but sooner or later additional workers will have decreasing marginal product (eventually there may be no effect or negative effect on output)

law of diminishing marginal product

it may be that as we add workers, the marginal product increases at first, but sooner or later additional workers will have decreasing marginal product (eventually there may be no effect or negative effect on output)

characteristic of production in short run

occurs bc of fixed capital

factor payments

what the firm pays for the use of the factors of production

from firm perspective, these are costs

from owner of each factor’s perspective, these are income

ex.,

labor: wages or salary

capital: interest and dividends

land: mortgage or rent

entrepreneur: profits

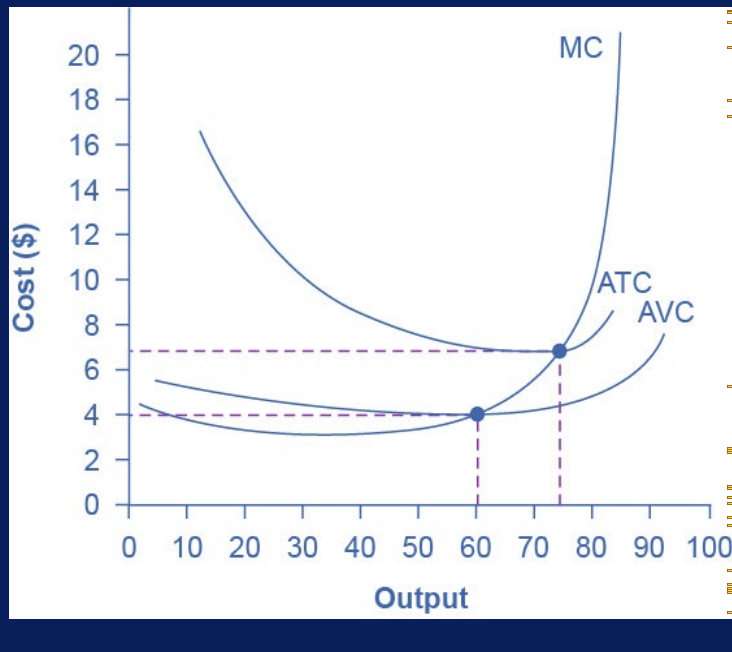

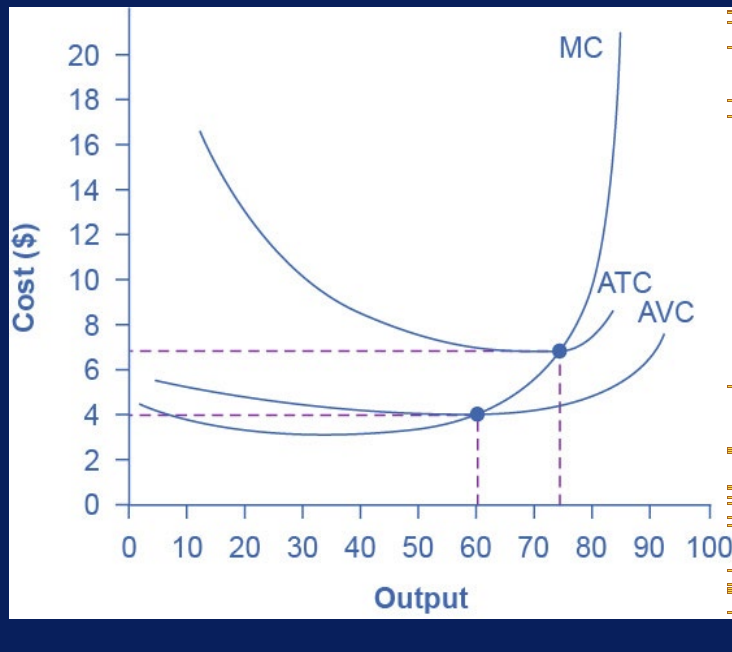

avg costs

total cost/qty of output produced

one way to measure per unit cost

marginal costs

the cost of each (more) individual unit produced

cost of producing one more unit of output

change in total cost/change in qty of output

one way to measure per unit cost

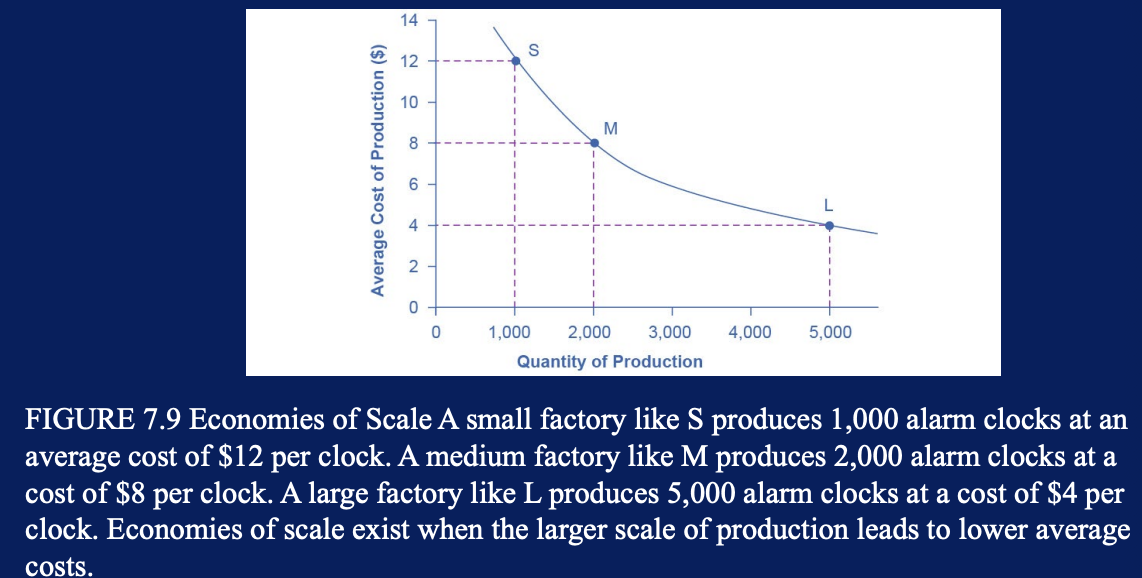

range of economies of scale

the portion of long run avg cost curve that is downward sloping

economies of scale may arise from all but govt economic subsidies protect firms from competition to avoid losses

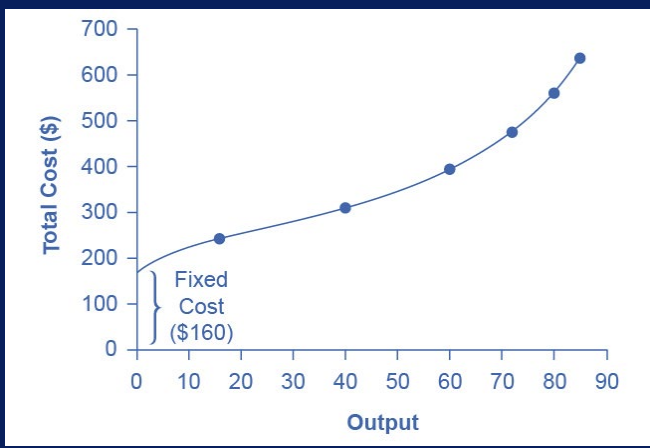

fixed costs

costs of the fixed inputs (e.g., capital)

don’t change in the short run, so they’re expenditures that don’t change regardless of production level

ex., once lease is signed, the rent is the same regardless of how much you produce, at least until expiration date of lease

represented by horizontal line

always show this as the vertical intercept of total cost curve; that is, they are the costs incurred when output is zero so there are no variable costs

e.g., this is the y intercept

variable costs

costs of the variable inputs (e.g., labor)

the only way to increase or decrease output is by increasing or decreasing the variable inputs

therefore, variable costs increase or decrease with output

ex., labor (since producing a greater qty of good or service typically requires more workers or more work hours), raw materials

slope upward

total costs

= fixed costs + variable costs

avg total cost ATC

total cost/total qty of output

U shaped curve

avg variable cost AVC

variable cost/qty of output

at any level of output, ? curve will always lie below the avg total cost curve

typically U shaped

marginal cost

additional cost of producing 1 more unit of output

it’s not the cost per unit of all units produced, but only the next one (or next few)

change in total cost (btw 2 levels of output)/change in qty (output)

generally an upward sloping curve

bc diminishing marginal returns imply that additional units are more costly to produce

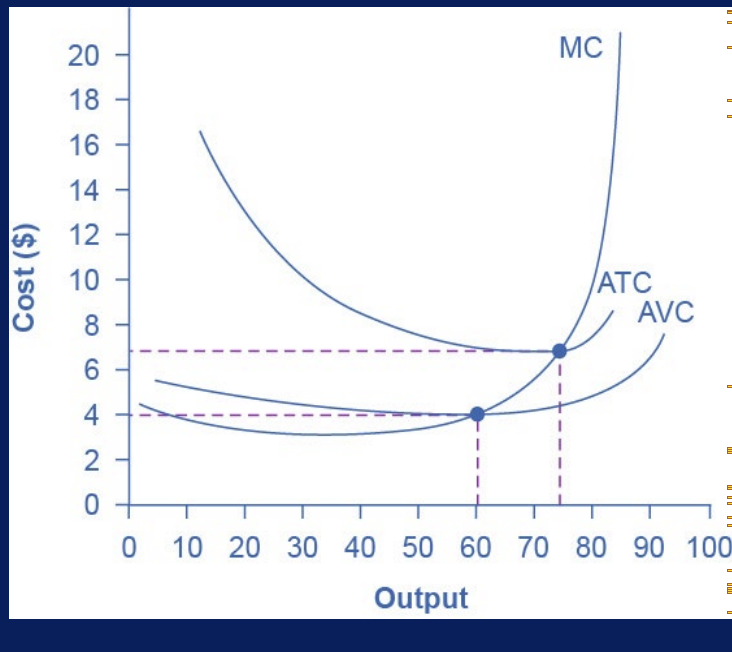

avg profit

(total revenue-total cost)/ qty produced

profit margin for the firm

implies that if market price is above average cost, avg profit (and thus total profit) will be positive

if price is below avg cost, then profits will be negative

long run

period of time when all costs are variable

ex., if you have 1 yr lease on your factor, then the long run is any period longer than a year, since after a year you are no longer bound by the lease

no costs are fixed int he long run

technology

refers to all alternative methods of combining inputs to produce outputs

demand curve

as input becomes more expensive (e.g., labor), firms will attempt to conserve on using that input and will instead shift to other inputs that re relatively less expensive

this pattern helps explain why the ? curve for labor (or any input), slopes down; that is, as labor becomes relatively more expensive, profit-seeking firms will seek to substitute the use of other inputs

diseconomies of scale

the level of output and the scale rises, avg costs rise as well

a firm or factory can grow so large that it becomes very difficult to manage, resulting in unnecessarily high costs as many layers of management try to communicate w the workers and w each other, and as failures to communicate lead to disruptions in the flow of work and materials

not many overly large factories exist in real world, bc with their v high production costs, they are unable to compete for long against plants with lower avg costs of production

aka decreasing returns to scale

can also be present across an entire firm, not just a large factory

occur when company or business grows so large that the costs per unit increase

when economies of scale no longer function for a firm

leviathan effect can hit firms that become too large to rune efficiently, across the entirety of the enterprise

firms that shrink their operations are often responding to finding itself in the ? region, thus moving back to a lower avg cost at a lower output level

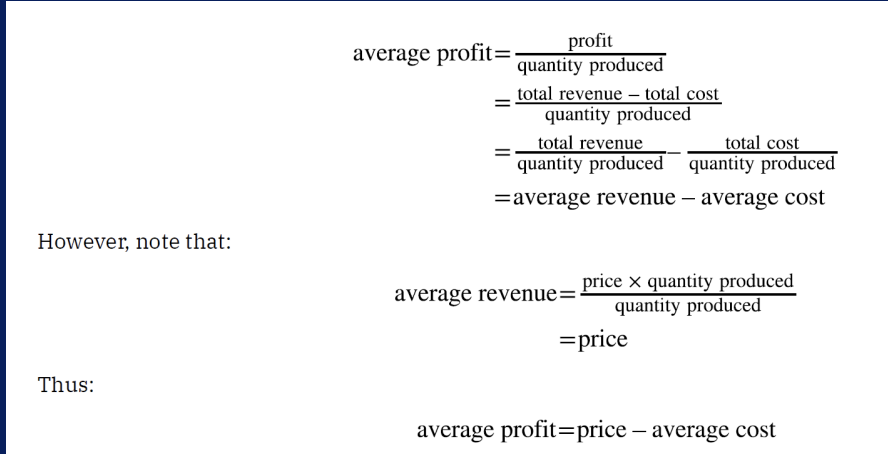

long run avg cost curve LRAC

based on group of short run avg cost SRAC curves, each of which representing 1 specific level of fixed costs

low level of fixed costs at SRAC 1, high level at SRAC5

other SRAC curves not shown lie btw the ones visible

the ? curve shows the lowest cost for producing each qty of output when fixed costs can vary, and so it is formed by the bottom edge of the family of SRAC curves

if firm wished to produce qty Q3, it would choose the fixed costs associated w SRAC3

agglomeration economies

refer to the economies created by concentration of large populations in a large city

fundamental reason for agglomeration economies relates to the idea of economies of scale in a broad sense

cities offer businesses many nearby customers, a large pool of workers and suppliers, access to specialized goods, and attractions that need big crowds to succeed. Cities also provide variety, which appeals to shoppers.

helps explain why every developing economy has an increasing portion of its population living in urban areas

at some point this must turn into diseconomies due to negative factors like traffic congestion (gains from being geographically nearby are counterbalanced by how long it takes to travel)

high densities of ppl, cars, and factories can mean more garbage and air and water pollution. facilities like parks or museum may become overcrowded.

there may be economies of scale for negative activities like crime, bc high densities of ppl and businesses, combined with the greater impersonality of cities, make it easier for illegal activities as well as legal ones

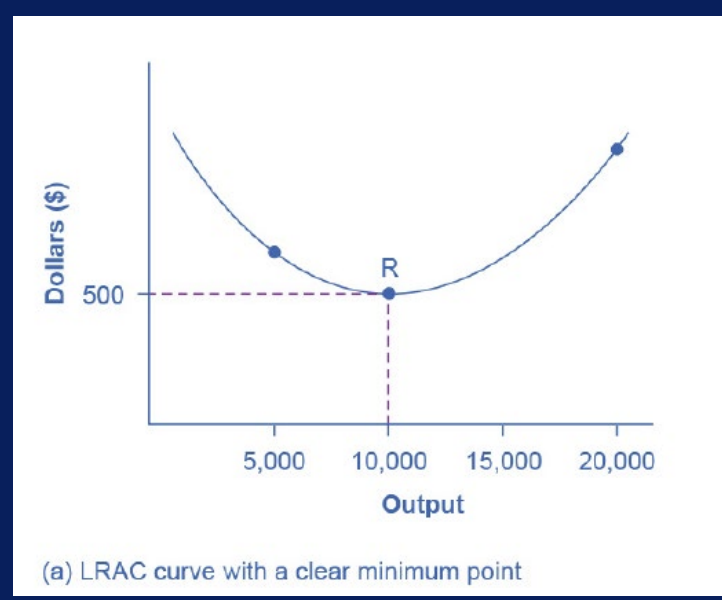

LRAC w clear minimum point

low cost firms will produce at output level R

when LRAC curve has ? , then any firm producing a diff qty will have higher costs

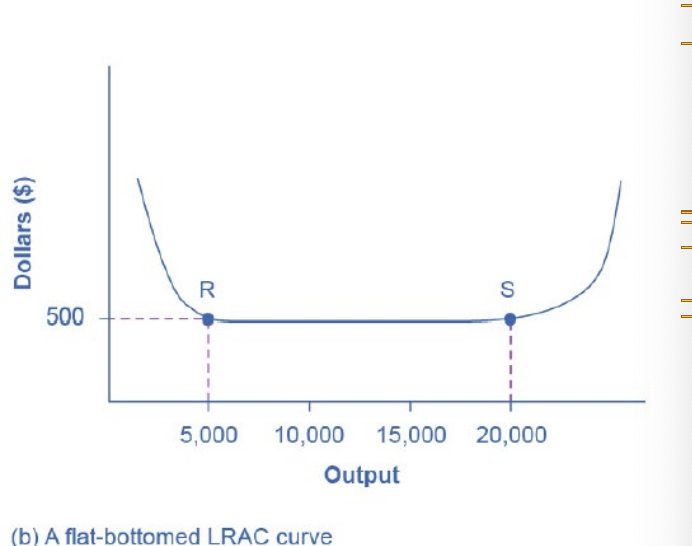

LRAC with flat bottom

Low cost firms will produce btw output levels R and S

firms producing at any qty along this flat bottom can compete

shifting patterns of LRAC

In the 20th century, large-scale production (e.g., assembly lines, department stores) often had cost advantages.

This extended the economies of scale portion of the long-run average cost (LRAC) curve.

However, newer technologies don’t always favor larger firms.

Small-scale electricity generation (e.g., gas turbines under 100 MW) can now be cost-efficient.

Pirelli’s robotic tire plant (1 million tires/year) had lower costs than traditional plants producing 6 million/year.

Ask ChatGPT

economies of scale; a larger factory can produce at a lower average cost than a smaller company.

When __________________ exist, doubling of all inputs will result in more than doubling output, which means __________________________________________.

Option A

low labor inputs; larger scale of production leads to higher costs.

Option B

labor inputs; economies-of-scale curve is U-shaped

Option C

economies of scale; a smaller factory can produce at a lower average cost than a larger company

Option D

economies of scale; a larger factory can produce at a lower average cost than a smaller company.

35%

Approximately what percentage of the US labor force is employed by firms that have fewer than 100 employees?

Option A

45%

Option B

50%

Option C

35%

Option D

63%

Inputs and outputs

A production function is a mathematical expression or equation that explains the engineering relationship between:

Option A

Inputs and outputs

Option B

Capital and labor

Option C

The size of the factory and the rate of production

Option D

New technology and its application

physical space for the gallery

Marcella operates a small, but very successful art gallery. All but one of the following can be classified as a variable cost arising from the physical inputs Marcella requires to operate her business. Which is it?

Option A

physical space for the gallery

Option B

wages paid to three part-time employees

Option C

costs of purchasing art work to sell in the gallery

Option D

accountant's fees for preparing tax returns

The building where the assembly takes place.

We can describe inputs as either fixed or variable. Thinking about a company that assembles cars, which of the following would be an example of a fixed input that could not be changed in the short run?

Option A

The robots that help assemble the cars.

Option B

The electricity required to support the assembly activity.

Option C

The building where the assembly takes place.

Option D

The employees that work for the company.

Q1/ Production Method 1 (50 units of labor, 10 units of capital) should be used since the total cost of $9,000 is significantly lower than the cost using the other methods.

Q2/ Production Method 1 is still the best option if the cost of labor rises to $200/unit, since $14,000 is less than the total cost for the other methods.

A small company that shovels sidewalks and driveways has 100 homes signed up for its services this winter. It can use various combinations of capital and labor: lots of labor with hand shovels, less labor with snow blowers, and still less labor with a pickup truck that has a snowplow on front. To summarize, the method choices are:

Method 1: 50 units of labor, 10 units of capital

Method 2: 20 units of labor, 40 units of capital

Method 3: 10 units of labor, 70 units of capital

Q1/If hiring labor for the winter costs $100/unit and a unit of capital costs $400, what production method should be chosen?

Q2/ What method should be chosen if the cost of labor rises to $200/unit?

total costs

___________ include all spending on labor, machinery, tools, and supplies purchased from other firms.

Option A

Total revenues

Option B

Total costs

Option C

Total profits

Option D

Total profit margins

$2.43

I’MABigCorp. produces and sells kitchen wares. Last year, it produced 7,000 can openers and sold each one for $6. To produce the 7,000 can openers, the company incurred variable costs of $28,000 and a total cost of $45,000. I'MABIGCorp.'s average fixed cost to produce the 7,000 can openers was

Option A

$1.50

Option B

$1.23

Option C

$2.25

Option D

$2.43

The change in total cost divided by the change in output.

Mathematically, marginal cost is expressed as..

Option A

Unit production costs times the change in output

Option B

Unit production costs times the number of workers employed

Option C

The change in total cost divided by the change in output.

Option D

Total cost divided by output.

Interest and dividends.

The factor payment for the use of financial capital (loans and equity investments) is called...

Option A

Profit.

Option B

Interest and dividends.

Option C

Wages.

Option D

Rent.

When the number of bakery staff increases from 2 to 3 bakers, 5 additional loaves are made.

Which of the following best describes marginal product?

Option A

The total number of loaves a bakery can create with 5 workers and a fixed amount of capital

Option B

When the number of bakery staff increases from 2 to 3 bakers, 5 additional loaves are made.

Option C

Leftover output - the loaves a bakery makes but does not sell and that goes unused.

Option D

The loaves made by a bakery using a substandard quality flour that ultimately harms business profits.

avg cost

In order to determine ____________, the firm's total costs must be divided by the quantity of its output.

Option A

average cost

Option B

variable cost

Option C

fixed costs

Option D

diminishing marginal returns

total revenue

Whatever the firm’s quantity of production, _____________ must exceed total costs if it is to earn a profit.

Option A

marginal costs

Option B

total revenue

Option C

average costs

Option D

variable costs

Fixed costs refer to the costs of fixed inputs that do not change regardless of production level. These costs remain constant since they do not change in the short run. Examples of fixed costs include mortgage payments, insurance premiums, and property taxes.

Briefly explain what is meant by the term "fixed costs" and provide three examples.

government economic subsidies protect firms from competition to avoid losses.

Economies of scale may arise from all but one of the following. Which one is it?

Option A

doubling promotional expenses to expand sale more than proportionately

Option B

having a larger retail space can expand sales more than proportionately

Option C

government economic subsidies protect firms from competition to avoid losses.

Option D

spreading the fixed-costs of administration over more customers holds average costs down

Land: mortgage or rent

Labor: wages or salary

Capital: interest and dividends

What are the factor payments for the following:

Land

Labor

and capital?

a monopoly

In economics, a firm that faces no competitors is referred to as _________________.

Option A

an oligopoly

Option B

an oligopolizor

Option C

a perfect competitor

Option D

a monopoly

costs incurred in the act of producing

Which of the following falls outside of the classification of business expenses that fall into the category of fixed costs?

Option A

costs that vary according to specific line of business

Option B

costs incurred in the act of producing

Option C

costs incurred as advertising expenses

Option D

costs that must be made before production starts

divide total costs into two categories: fixed costs that can’t be changed in the short run and variable costs that can be

If a solar panel manufacturer wants to look at its total costs of production in the short run, which of the following would provide a useful starting point?

Option A

divide the total costs of production by the quantity of output

Option B

divide total costs into two categories: fixed costs that can’t be changed in the short run and variable costs that can be

Option C

divide total costs into two categories: variable costs that can't be changed in the short run and fixed costs that can be

Option D

divide the variable costs of production by the quantity of output

The sum of the materials ($100), website charge ($10), and 4% payment processing charge (4%)

Mirtha owns an online jewelry store that specializes in earrings. In March, she sells 50 pairs of earrings priced at $15. The cost of materials to create the 50 pairs of earrings was $100. The website she uses to sell her wares costs her $10 a month, and she is also charged 4% on each sale by the company that processes debit/credit card purchases.

Which of the following best represents Mirth’s total cost?

Option A

The costs of materials minus the costs it takes to run her business through the online store, in this case the $10 website charges and the 4% payment processing charge

Option B

The cost of all the materials used to create the earrings, $100

Option C

The sum of the materials ($100), website charge ($10), and 4% payment processing charge (4%)

Option D

The $750 Mirtha earned from earring sales minus the materials ($100), online website charge ($10), and payment processing charge (4%)

decreasing/diminishing returns to scale

A situation where the level of output, scale and average costs are all rising is called

Option A

decreasing returns to scale

Option B

diminishing returns to scale

Option C

both a and b are correct

Option D

diseconomies of scale

do so regardless of what type of competition exists in a market.

According to the definition of profit, if a profit-maximizing firm will always attempt to produce its desired level of output at the lowest possible cost, then it will

Option A

take a long-run perspective on costs, when such costs cannot be adjusted

Option B

take a short-run perspective on labor costs which cannot be immediately changed.

Option C

breakdown its cost structure according to short-run adjustments.

Option D

do so regardless of what type of competition exists in a market.

20,000 (Economic profit = accounting profit minus implicit cost = $50,000 - $30,000 = $20,000.)

Continuing the firm Exercise the firm’s factory sits on land owned by the firm that could be rented out for $30,000 per year. What was the firm’s economic profit last year?

Option A

30,000

Option B

10,000

Option C

20,000

Option D

50,000

50,000

A firm had sales revenue of $1 million last year. It spent $600,000 on labor, $150,000 on capital and $200,000 on materials. What was the firm’s accounting profit?

Option A

50,000

Option B

35,000

Option C

70,000

Option D

85,000

all factors are variable

The long run is the period of time during which...

Option A

All factors are variable.

Option B

Some outputs are variable.

Option C

All outputs are variable.

Option D

At least some factors of production are fixed.

The $40,000 in rental income an entrepreneur no longer receives after converting the rental space to their new storefront.

Which of the following is an example of an implicit cost?

Option A

$60,000 spent to purchase the lumber needed to create a product.

Option B

The $40,000 in rental income an entrepreneur no longer receives after converting the rental space to their new storefront.

Option C

Federal taxes paid by the firm.

Option D

$25 hourly wage paid to a seasonal clerk that a firm employs on a contract basis.

Economies of scale.

The portion of a long run average cost curve that is downward sloping is called the range of:

Option A

Constant returns to scale.

Option B

Diseconomies of scale.

Option C

Economies of scale.

Option D

Unit returns to scale.

variable costs

If a paper mill shuts down its operations for three months so that it produces nothing, its __________________ will be reduced to zero?

Option A

fixed costs

Option B

opportunity costs

Option C

variable costs

Option D

total cost

variable costs

______________ include all of the costs of production that increase with the quantity produced.

Option A

Variable costs

Option B

Fixed costs

Option C

Average costs

Option D

Average variable costs