Macro - Ch. 12: Monetary and Fiscal Policy

1/47

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

48 Terms

open market operation

Federal Reserve buys bonds in exchange for money, thus increasing the stock of money; or it sells bonds in exchange for money paid by the purchasers of the bonds, thus reducing the money stock

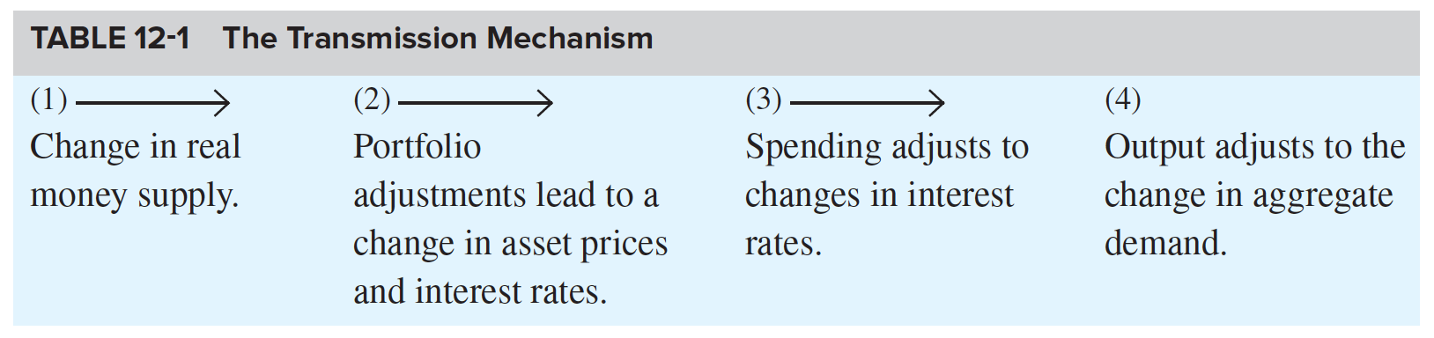

Transmission Mechanism

The process through which changes in monetary policy affect aggregate demand and overall economic activity.

Portfolio Disequilibrium

At the prevailing interest rate and level of income, people are holding more money than they want. Caused by an increase in real balances

Liquidity Trap

A situation in which monetary policy becomes ineffective because the nominal interest rate is near zero, leading to a preference for holding cash over bonds, regardless of the low interest rates.

Classical Case

Vertical LM curve

Quantity Theory of Money

A theory asserting that the general price level is directly proportional to the amount of money in circulation, expressed by the equation MV=PQ, where M is money supply, V is velocity, P is price level, and Q is output. Level of nomical income is determined by this

Zero Lower Bound

refers to a situation where nominal interest rates cannot be lowered below zero, limiting the effectiveness of monetary policy to stimulate the economy.

Deflation

prices are dropping, or equivalently, that the inflation rate is negative

Quantitive Easing

A monetary policy tool used by central banks to stimulate the economy by purchasing government securities or other securities from the market, increasing the money supply and lowering interest rates when the overnight rate is zero.

Basis Point

a unit of measure used in finance to describe the percentage change in interest rates, equal to one-hundredth of a percentage point.

crowding out

the phenomenon where increased government spending (expansionary fiscal policy) leads to reduced private sector investment due to higher interest rates.

Monetary Accomodation

a policy stance by central banks that maintains low interest rates and increases the money supply to support economic growth, often utilized during periods of economic downturn.

Monetizing Budget Deficit

the process by which a government finances its budget deficit by borrowing from the central bank, or printing more money leading to an increase in the money supply.

Investment subsidy

a financial incentive provided by the government to encourage businesses or individuals to invest in specific sectors or projects, aimed at boosting economic activity.

Gov pays part of the cost of each firm’s investment

Investment tex credit

A firm’s tax payments are reduced when it increase its investment spending —> a way to subsidize investments

policy mix

A combination of monetary and fiscal policies implemented to achieve economic stability and growth.

real interest rate

nominal rate of interest minus the rate of inflation

Anticipatory Monetary policy

A strategy used by central banks to preemptively adjust the money supply and interest rates in anticipation of future economic conditions or changes.

IS-LM model show how monetary and fiscal policy work

– Fiscal policy has its initial impact in the goods market

– Monetary policy has its initial impact mainly in the assets markets

Because the goods and assets markets are interconnected

both fiscal and monetary policies have effects on both the level of output and interest rates

Expansionary/contractionary monetary policy moves the

LM curve to the right/left

Expansionary/contractionary fiscal policy moves the

IS curve to the right/left

The Federal Reserve is responsible for monetary policy in the U.S

conducted mainly through open market operations

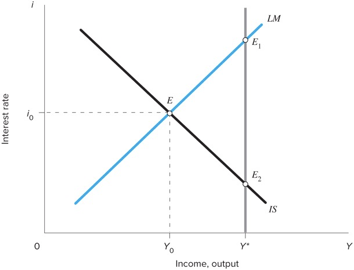

Adjustment to the monetary expansion:

– Increase in money supply

creates excess supply of

money

– Public buys other assets

– Asset prices increase, yields

decrease —> move to point E1

– Decline in interest rate results

in excess demand for goods

– Output expands and move up

LM’ schedule

Two steps in the transmission mechanism (the process by which changes in monetary policy affect AD):

1. An increase in real balances generates a portfolio disequilibrium

2. A change in interest rates affects AD

transmission mechanism steps

Two extreme cases arise when discussing the effects of monetary policy on the economy, 1st is

liquidity trap

implies the LM curve is horizontal changes in the quantity

of money do not shift it

Monetary policy has no impact on either the interest rate or

the level of income monetary policy is powerless

Possibility of a liquidity trap at low interest rates is a notion

that grew out of the theories of English economist John

Maynard Keynes

Two extreme cases arise when discussing the effects of monetary policy on the economy, 2nd is

reluctance of banks to lend

Another situation in which monetary policy is powerless to

alter the economy —> break down in the transmission

mechanism

Despite lower interest rates and increased demand for

investment, banks may be unwilling to make the loans

necessary for the investment purchases

If banks made prior bad loans that are not repaid, may

become reluctant to make more, despite demand —> prefer

instead to lend to the government (safer)

The opposite of the horizontal LM curve (implies that monetary policy cannot affect the level of income) is the

vertical LM curve

Demand for money is unresponsive to the interest rate

Given the equation for the LM curve implies h = 0

The vertical LM curve is called the classical case

When the LM curve is vertical

1. A given change in the quantity of money has a maximal effect on the

level of income

2. Shifts in the IS curve do not affect the level of income

Vertical LM curve implies

the comparative effectiveness of

monetary policy over fiscal policy

“Only money matters” for the determination of output

Requires that the demand for money be irresponsive to i —> important issue in determining the effectiveness of alternative policies

The equation for the IS curve is:

The fiscal policy variables, G and t, are within this definition

– G is a part of A

– t is a part of the multiplier

—> Fiscal policy actions, changes in G and t, affect the IS curve

In the IS curve equation, if G increases…

– At unchanged interest rates, AD increases

– To meet increased demand, output must increase

– At each level of the interest rate, equilibrium income must rise by

Monetary policy operates by

stimulating interest-responsive components of AD

fiscal policy operates through G and t —>

impact depends upon what goods the government buys and what taxes and transfers it changes

The Composition of Output and the Policy Mix

Table 12-2: Policy Effects on Income and Interest Rates | ||

POLICY | EQUILIBRIUM INCOME | EQUILIBRIUM INTEREST RATES |

Monetary expansion | + | − |

Fiscal expansion | + | + |

Policies all increase output, but

impact sectors differently

Choices for reaching full employment from point E:

1. Fiscal policy expansion, moving to point E1, with

higher income and higher interest rates

2. Monetary policy expansion, resulting in full employment with lower interest rates at point E2

3. A mix of fiscal expansion and accommodating monetary policy resulting in an intermediate position

Who should be the primary beneficiary of expansion?

The general public, through increased employment and income opportunities as a result of economic expansion.

open market sale by the Fed

A monetary policy tool where the Federal Reserve sells government securities to reduce the money supply and increase interest rates.

Show the impact of an open market sale on the interest rate and output. Show both the immediate- and the longer-term impacts.

An open market sale by the Fed leads to higher interest rates as the money supply decreases, initially causing a reduction in output. In the longer term, this can stabilize inflation but may slow economic growth.

What is a liquidity trap? If the economy was stuck in one, would you advise the use of monetary or fiscal policy?

A liquidity trap is a situation in which interest rates are low and savings rates are high, rendering monetary policy ineffective. In such cases, fiscal policy may be more effective to stimulate demand and revive economic activity.

What is crowding out, and when would you expect it to occur? In the face of substantial crowding out, which will be more successful—fiscal or monetary policy?

Crowding out occurs when government spending leads to a reduction in private sector spending, often because higher interest rates make borrowing more expensive. It is expected to occur during periods of high public borrowing, and in such cases, monetary policy may be more successful in stimulating the economy than fiscal policy.

What would the LM curve look like in a classical world? If this really were the LM curve that we thought best characterized the economy, would we lean toward the use of fiscal policy or monetary policy?

In a classical world, the LM curve would be vertical, indicating that real output is determined by real factors rather than the money supply. In this scenario, monetary policy would be more effective than fiscal policy, as it can influence interest rates and investment without crowding out private spending.

What happens when the Fed monetizes a budget deficit? Is this something it should always try to do?

When the Fed monetizes a budget deficit, it purchases government securities to finance government spending, effectively increasing the money supply. This action can lead to inflation if done excessively, so it should be approached with caution.

Who should be the primary beneficiary of an expansion through a decline in interest rates and increased investment spending?

The primary beneficiaries of an expansion through a decline in interest rates and increased investment spending are typically businesses and consumers, as they benefit from lower borrowing costs, leading to increased capital investments and consumer spending.

Who should be the primary beneficiary of an expansion through a tax cut and increased personal

consumption?

The primary beneficiaries of an expansion through a tax cut and increased personal consumption are usually households and individuals, as they experience higher disposable income, which can stimulate consumer spending and economic growth.

Who should be the primary beneficiary of an expansion in the form of an increase in the size of the government?

The primary beneficiaries of an expansion in the form of an increase in the size of government are generally the public sector and various social programs, as government spending can lead to improved infrastructure, services, and welfare benefits that support the economy and communities.