Economics IB

1/123

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No study sessions yet.

124 Terms

Opportunity Cost

the cost of the next best alternative when a choice is made

Production possibilities curve

a graphical representation of the maximum output possibilities for two goods given a set of inputs

market/free economy

economic decisions made by individuals and businesses

planned economy

gov makes all economic decisions

demand

quantity of a good or service that consumers are willing and able to purchase at a given price

supply

quantity of a good or service that producers are able and willing to produce at a given price over a particular time period

ceteris paribus

assumption that all else is equal

equilibrium

where quantity demanded and quantity supplied is equal

law of diminishing marginal returns

as more resources are allocated to a good’s production in the short run, productivity of additional resources decrease

consumer/producer surplus

benefit that consumers/producers recieve when they pay a price below what they are supposed to pay/price more than they are willing to sell for

elasticity

responsiveness of quantity of produce demanded/supplied when price changes

PED

% change in quantity demanded/% change in price

% change=(new value-old value) / old value

subsidies

amount of money paid by gov to firm per unit of output

direct taxes

tax paid directly by individual or oganiztion (income tax)

indirect taxes

tax imposed on good or service that consumers consume

marginal cost and marginal revenue

Marginal Cost (MC) is the cost of producing one more unit of a good, while Marginal Revenue (MR) is the additional revenue gained from selling one more unit.

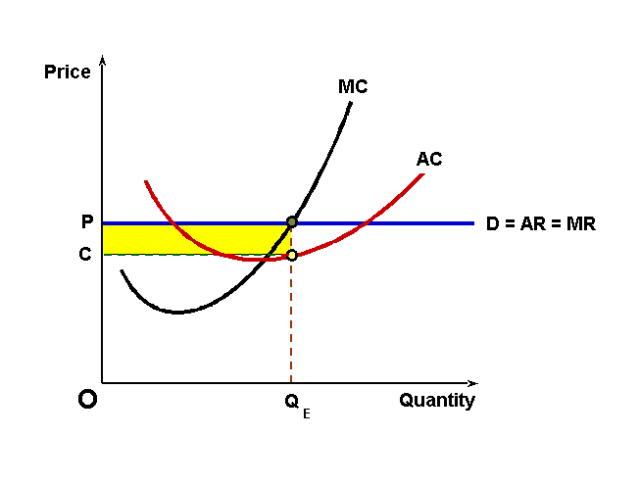

perfect competition

all firms sell identical products

in short run, abnormal profits can be made, long run = normal profit

VIEW note book for diagrams

abnormal profit

total revenue minus explicit and implicit costs

normal profit

total revenue minus explicit cost

Imperfect Competition

different products, short run = abnormal profits, long run = normal profits

look at diagram

Monopoly

single firm being sole supplier

hydro one

oligopolies

market dominated by a few large firms, high barriers to entry

collusion: can collaborate to limit competition

cartels: formal agreement between firms to increase profits

price leaders: dominant firm in the industry

airlines/banks

monopolistic competition

large # of small firms compete against each other (firm choices have little influence)

restaurants

market failure

situation where allocation of goods in a free market is not efficient

common pool resource

resource that benefits a group of people, but benefit is eliminated if each individual pursues their own interest (Forests)

tragedy of the commons

occurs when individuals act in their own self interest without consideration of long term impact of the resource

the free rider problem

occurs when individual’s benefit from resource without paying or contributing to their provision (libraries)

public goods

non excludable: no one can be excluded from using this good

non rivalrous: one person’s use of the good does not reduce it for others

seen as market failure because private market unlikely to provide them

equity

recognizes that each person has different circumstances and allocates the amount each person needs

equality

given same resources

merit/demerit goods

merit: products that creates spiller over benefits

demerit: goods have a harmful effect on society

negative externality of production/consumption

occurs when the production of a good causes negative effects to unrelated third parties (noise/dust pollution)

occurs when consumption of a good causes negative effects to unrelated third parties

DIAGRAM

positive externality of production/consumption

occurs when the production of a good causes positive effects to unrelated third parties (production of honey)

occurs when goods that are consumed benefits third parties (healthcare)

DIAGRAM

Leakages

any use of income that causes money to be taken out of income stream (Taxes + savings + imports)

DIAGRAM

Injections

expenditure that causes money to be put into income expenditure stream (Gov spending + investment spending + exports)

GDP (gross domestic product)

sum of final goods and services produced in a country over a period of time

GNP (gross national product)

GDP + property income from abroad

Economic Growth and economic development

increase in national income during a time period

economic development is concerned with reducing poverty, income, inequality, education

Recession

2 quarters of zero or negative growth

Nominal GDP vs Real GDP

Nominal: GDP at current market price with inflation

Real GDP: GDP with inflation factored out

National Income Measurement

C+I+G+(X-M)

Purchasing power parity (PPP)

calculates relative purchasing power of different currencies

shows the number of units it would take to buy a basket of goods in the US, and the same amount itd take to buy it in the relative country

consumer confidence

measures degree of optimism that consumers feel about the state of the economy

aggregate demand

total demand for all goods/services in an economy at any given average price level

AD = C + I + G + (X-M)

aggregate supply

total amount of goods/services that all industries in the economy produce at every given price level

determinants of investment

interest rates

business confidence

technology

business taxes

LRAS

perfectly elastic at full employment level of output as it represents what the economy could be producing if it wre operating at full capacity

Keynesian AS

phase 1: AS perfectly elastic as producers can raise level of output without higher average costs

phase 2: spare capacity is used up, as producers continue to increase output, resources must be bid on

phase 3: impossible to raise output any further

DIAGRAM

inflationary classical

economy is at a level of output greater than the full employment level of output

upward pressure on wages and input prices because resources are overutilized.

This causes cost-push inflation, shifting SRAS leftward until the economy returns to Yfe but at a higher price level

DIAGRAM

deflationary classical

economy is operating below the full employment level, leading to downward pressure on wages and input prices, which results in decreasing price levels

DIAGRAM

keynesian long run

equilibrium levels may occur at different levels as wages and prices are sticky and aggregate demand determines real output in the long run. This means the economy can settle at underemployment equilibrium without automatic self-correction

increase in real output wont change price level because of spare capacity

DIAGRAM

fiscal policy

set of government’s policies relating to expenditure and taxation rates

aims: stable inflation, low unemployment, long term growth

expansionary fiscal policy

gov spending and decreasing taxes to increase consumption (AD)

trade off between lower unemployment and higher inflation

DIAGRAM

deflationary fiscal policy

gov reduces it’s spending and increases taxes

pros and cons of fiscal policy

can be used to target specific sectors

cons: time lags, political pressure, unsustainable debt

gov debt

amount of all budget deficits over the years

in short term, spending drives economic growth, in long term, debt servicing costs need to be paid back

multiplier effect

MPC = amount respent as people’s income, example, if 40% leaves flow, 0.6 is MPC

mutiplier= 1/(1-mpc)

or

k= 1/(MPS+MPT+MPM)

to save, to tax, to import

monetary policy

set of official policies governing the supply of money and level of interest rates in an economy

often set by central banks

(base rate)

expansionary monetary policy

increases AD by lowering base rate of interest, increases supply of money which increases consumption

same as fiscal policy diagram

pros and cons of monetary policy

strengths: quickly put into place, bank is independent from gov, ability to make small changes

cons: time lags, cannot cut interest rates infinitely, lower consumer/business confidence

credit creation

commercial banks create money (can lend more money than they have as long as they fulfill the reserve requirement

govs controlling money supply

gov can increase or decrease reserve requirement, buying selling bonds in open market

changing minimum lending rate

supply side policy

designed to increase AS in long run by increasing quality and quantity of factors of production

market based supply side

focus on allowing markets to operate freely

- reduction in household income taxes, reduction in union power, reduction of min wage

intervention for supply side policies

investment in human capital, research and development

cons: significant cost

distribution of income and lorenz curve

graphical representation of a country’s income distribution

gini coefficient

A / (A+B)

A= area between line of equality and Lorenz Curve

B= area below Lorenz Curve

Gini Index

A measure of income inequality. It ranges from 0 (perfect equality) to 1 (perfect inequality).

Importance of wealth concentration

has to be incentives that inspire competition, if wealth is concentrated without mobility, no motivation to do so

absolute poverty

measured in terms of basic need for survival (income needed to stay alive)

relative poverty

comparative measure of poverty, said to be poor if they do not reach some specified level of income

multidimensional poverty index

identifies different aspects of poverty and assigning them each a weight

causes of poverty

inequality of opportunity, different levels of resource ownership and human capital, discrimination

consequences of poverty

less economic growth, less social stability, individual and family struggles

proportional vs regressive vs progressive tax

proportional: tax for which the percentage remains constant as income increases

regressive: tax decreases in percentage as income increases (larger burden on lower income families, ex: taxes on goods)

progressive: percentage paid in tax increases as income increases

calculating progressive tax rates

view note book: take income earned in that bracket and multiply by the rate

avg tax rate: amount paid in taxes/ income x 100

pros and cons for progressive tax system

pros: poor are better able to meet basic needs, marginal utility per dollar decreases with each dollar earned

cons: taxing higher income at higher rates creates a disincentive to work

policies that reduce inequality

investment in human capital, health policies, education policies

transfer payments

gov programmes that shift tax revenues and deliver them to individuals without an exchange of goods or services

pensions, unemployment insurance, business subsidies

universal basic income

periodic payment delivered to all citizens of a population

unemployed people

people who are registered as able/available and willing to work at the going wage rate but cannot find work despite active search for work

unemployment rate: # of unemployed/# in labour force

labour force

% of population of working age who are able and willing to work

full employment

level of employment where economy is working at full potential

underemployment

occurs when full time job seeker accepts a part time job

disguised underemployment

exists where part of labour force is left without work or working in a redundant manner where work productivity is essentially zero

examples. workers leave labour force: forced retirement

discouraged workers: stop looking

part time works who want full jobs

structural unemployment

structure of economy changes - less jobs because of fall in demand

demand for workers reduced from DL1 to DL2 maybe causes by new tech, decreased demand

min wage rises, increasing supply of labour but reduction of demand

DIAGRAM

frictional

workers entering work force on day data is collected

seasonal unemployment

cyclical unemployment

widespread, occurs during recession as aggregate demand is too low to achieve full unemployment

inflation

a general sustained increase in average price level of goods and services in an economy over time

deflation

a general sustained decreases in average price level of goods and services over time

disinflation

a decrease in rate of inflation from a higher to a lower level

consumer price index

measures change in income a consumer needs to maintain same standard of living over time

check notebook

demand pull inflation - increase in AD

supply struggles to satisfy demand, which causes demand pull inflation

DIAGRAM

cost push inflation - decrease SRAS

negative supply shock

DIAGRAM

costs of high inflation

economic uncertainty, redistributive effects, less export competitiveness

deflation

sustained decrease in the average price of a nation’s output overtime

deflation - decrease in AD

fall in consumption = negative demand shock, workers are laid off

deflation - increase in SRAS

output increases so cost decreases

costs of deflation

uncertainty, less consumption