Accounting Reports & Analysis - Week 11

1/21

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

22 Terms

Business Sector Decisions

These are all decisions that people have to make when running a business.

But in order to make good decisions, you need good information.

Cash flow management example:

If you want to out and buy a brand new machine tomorrow, do you have the finances for it? Do you actually have cash in the bank right now to go buy that new thing?

If you don't, what decisions do you have to make?

Go to the bank and get a loan, what if something that is crucial to your business pops up and you cannot buy it because you've now utilized all your cash on something else.

Decisions in Action

Dynamic pricing: price changes depending on demand

E.g. Uber

Seasonal prices:

Ice cream

In summer consumers are more willing to pay a premium price for ice cream

These are all decisions made by management

Types of costs: CVP

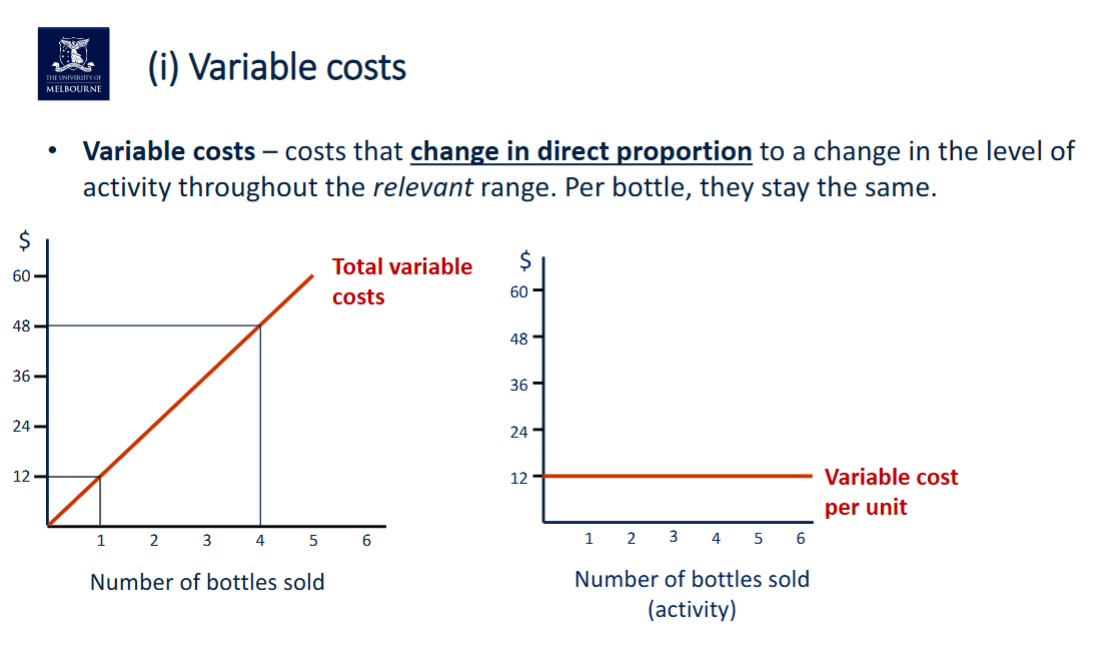

Variable costs: Costs that vary in total based on the number of bottles sold.

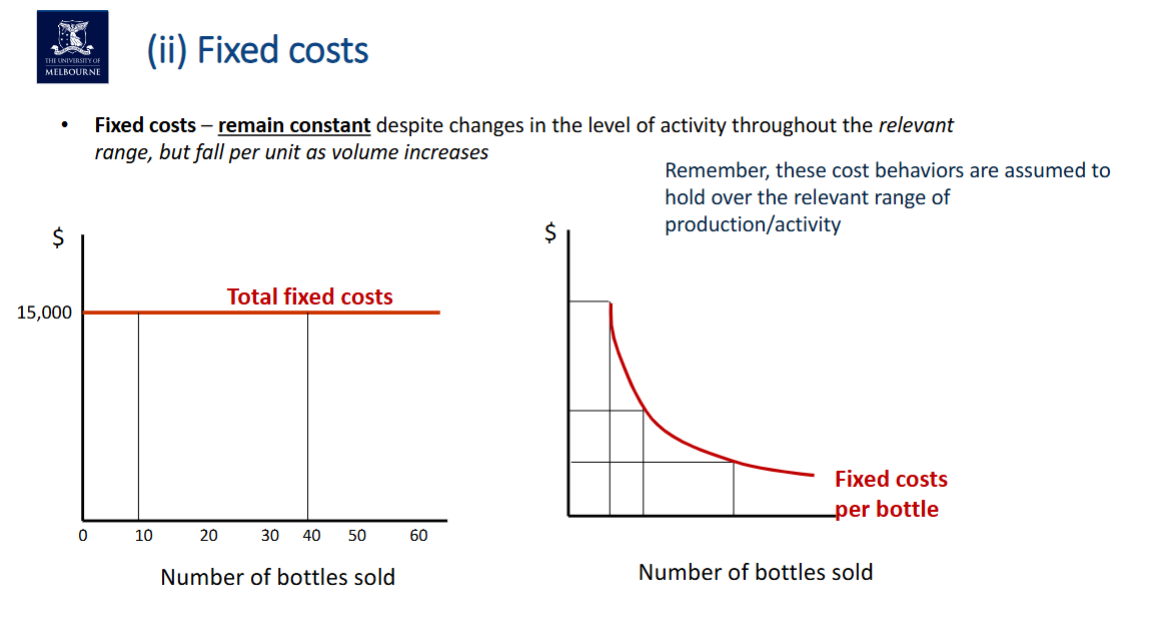

Fixed costs: Costs that DO NOT vary in total vary in direct proportion to a change in the number of bottles sold.

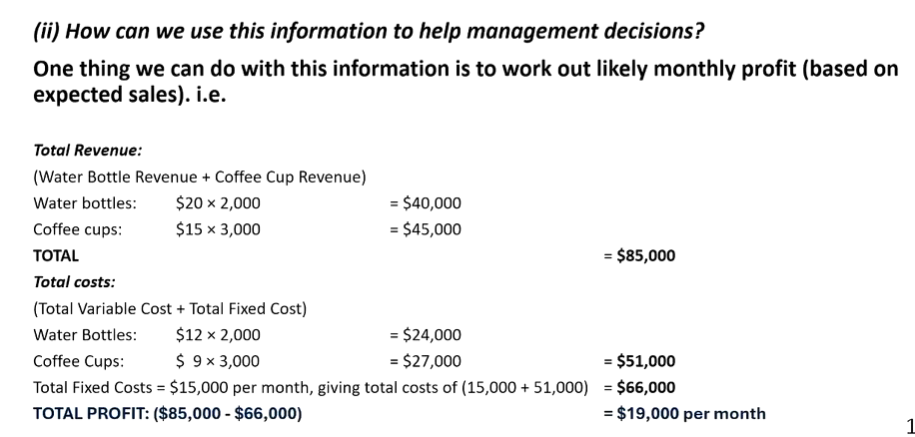

Is $19,000 per month a good profit?

Based on this is appears that the business is profitable for now… but note:

This is based on expected sales volume and prices

Are those expectations reasonable? Will they hold? What about competition?

Will cost behaviours really hold for the relevant range?

What are alternative outcomes for this investment?

What if our assumptions are wrong? How will we know when our assumptions are wrong?

What is the opportunity cost of producing water bottles?

Since all our figures are expectations, is it possible that we will sell 2000 coffee cups per month?

What if we only sell to UniMelb students and in a couple of months every student has their own cup?

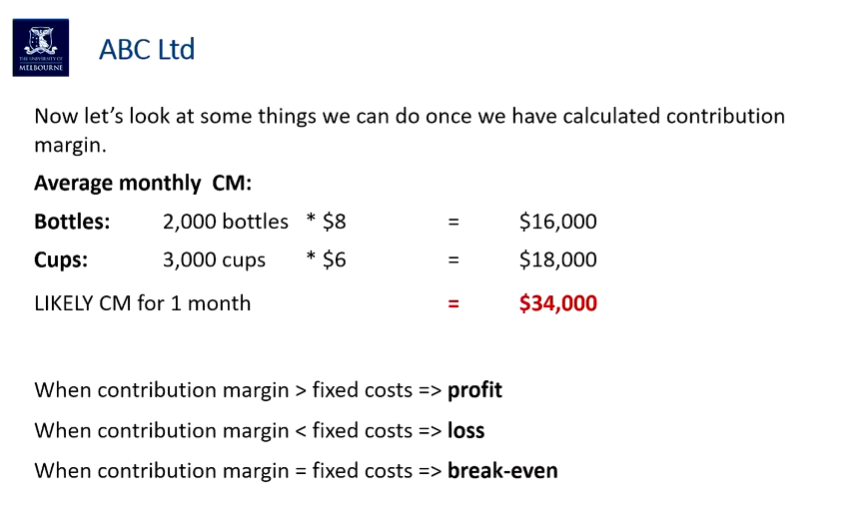

Contribution Margin

Contribution margin: how much revenue do we have after deducting variable costs from sales revenue?

In other words, of the revenue that we've generated, once those necessary costs have been deducted, how much is left for us to pay the fix costs before we generate a profit.

Can be expressed per unit or overall

This can be used in various calculations

A negative contribution margin, means we are losing money every single time we sell a water bottle.

If you're selling a greater variety of products, are you opening up your customer base?

It depends on your constraints

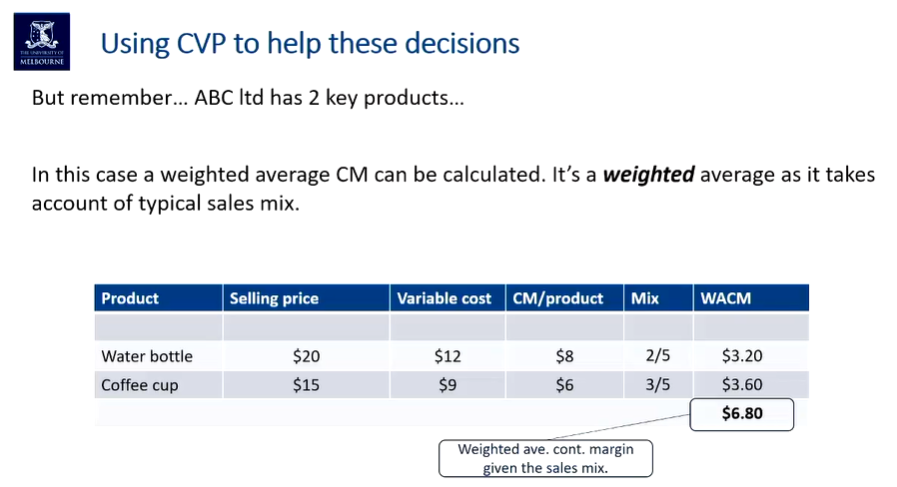

Weighted Average Contribution Margin

Why do we need this weighted average contribution margin?

What is the WACM if we reduce the wattle bottles and coffee cups to introduce new products for new customers to buy? What is going to be that WACM?

What is the WACM for a new product?

Is this going to result in opportunity loss or gain

Break-even point

In order for us to sell our products, we need to spend $34,000 every single month

Break Even Formula

Time Break Even = Annual Fixed Costs / Total monthly CM

Unit Break Even = Annual Fixed Costs / WACM per unit

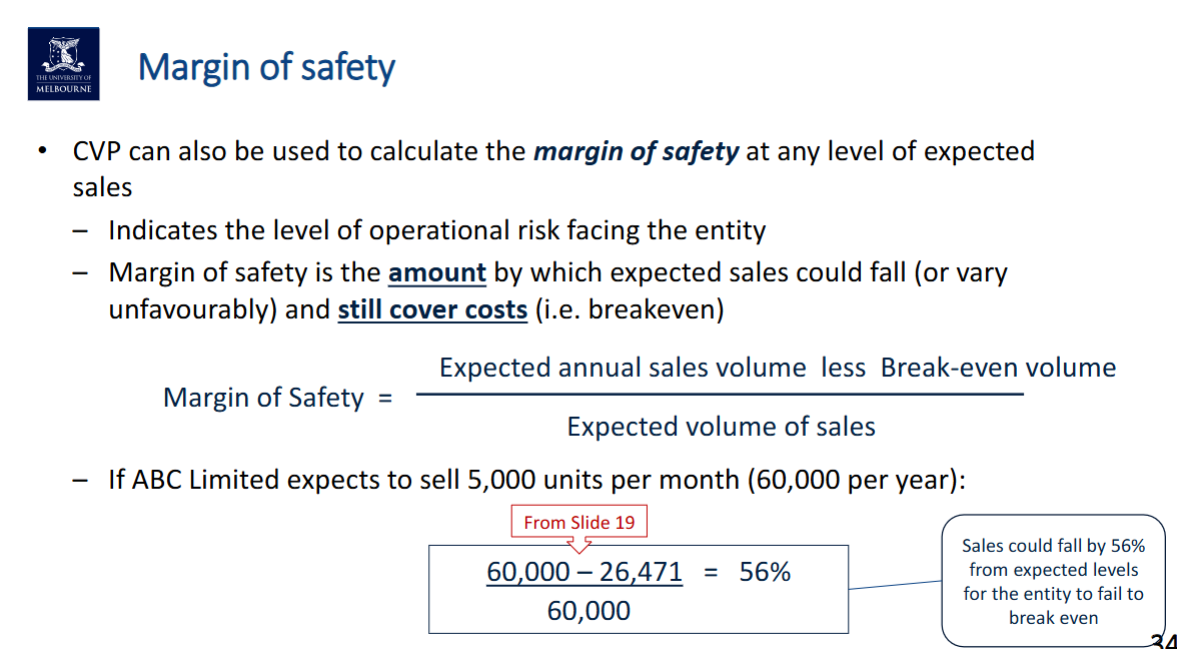

To understand whether the break even is realistic a margin of safety can be calculated.

What break even point means?

At your current selling price and at your current selling volume you will break even in our business after 5.3 months.

After selling 26,471 units, we have broken even.

We need to sell 10.589 bottles and 15,883 cups each month to break even

Desired Profit

Sales volume (units) = (Fixed costs + Desired profit before tax) / WACM margin per unit

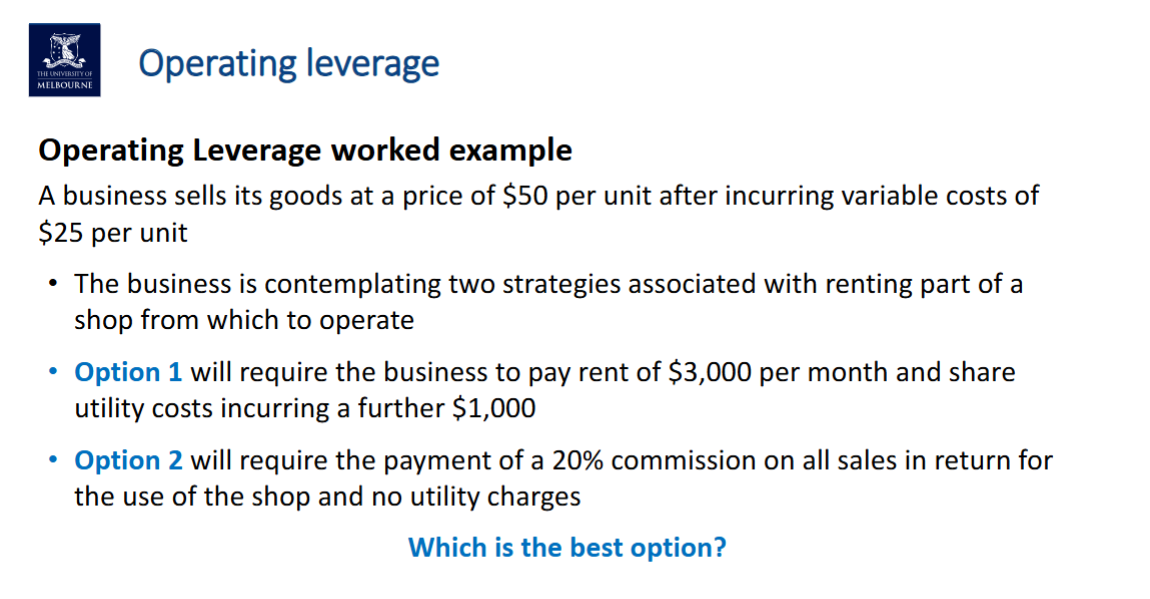

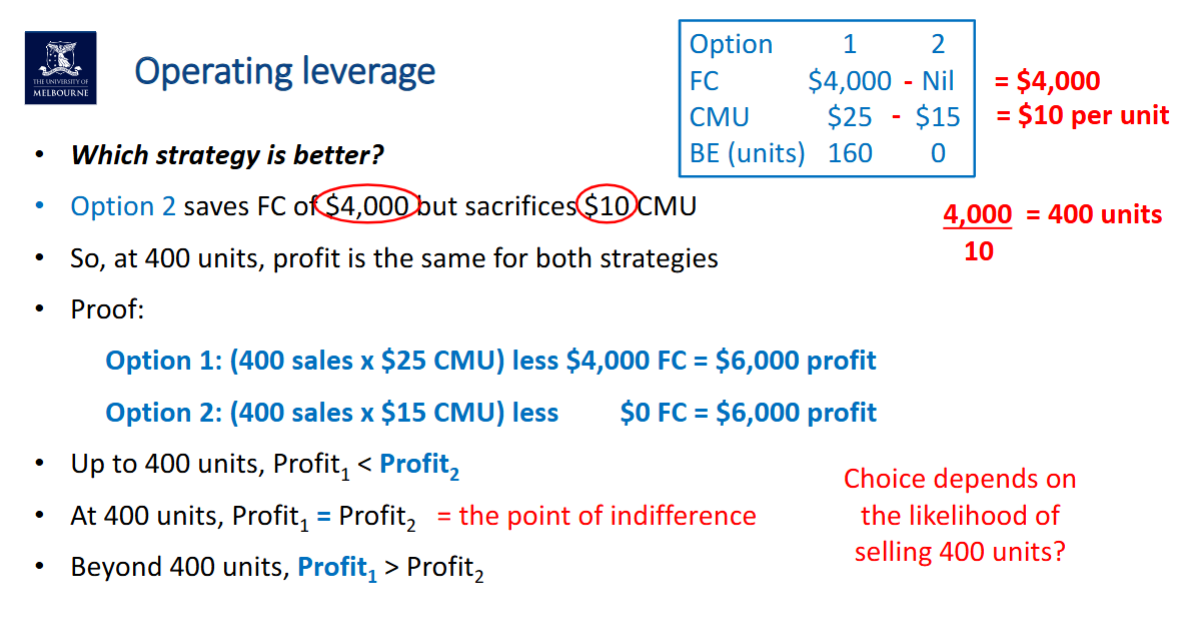

Operating Leverage

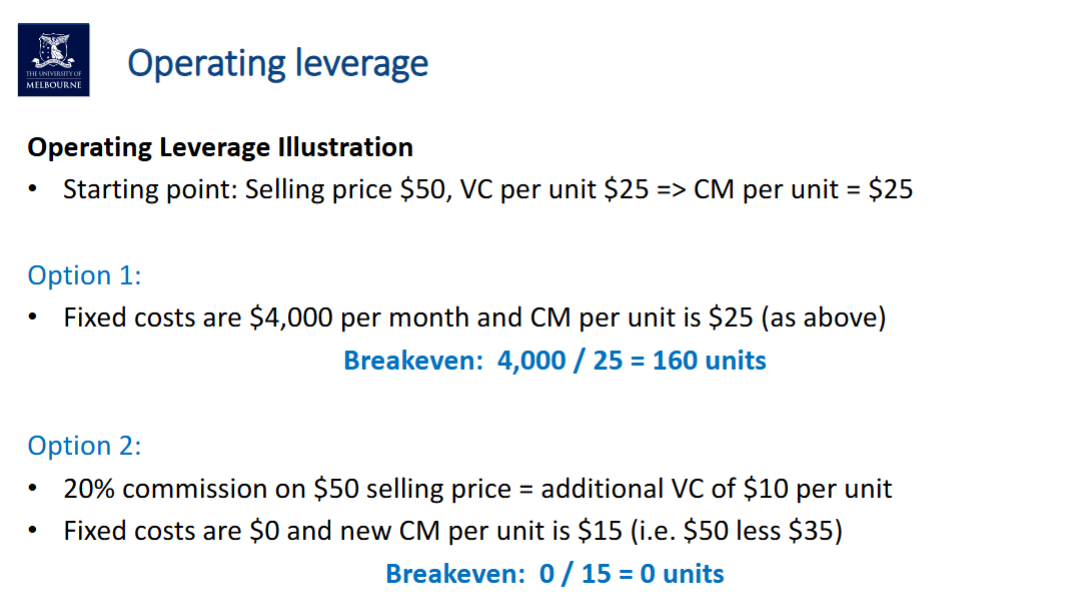

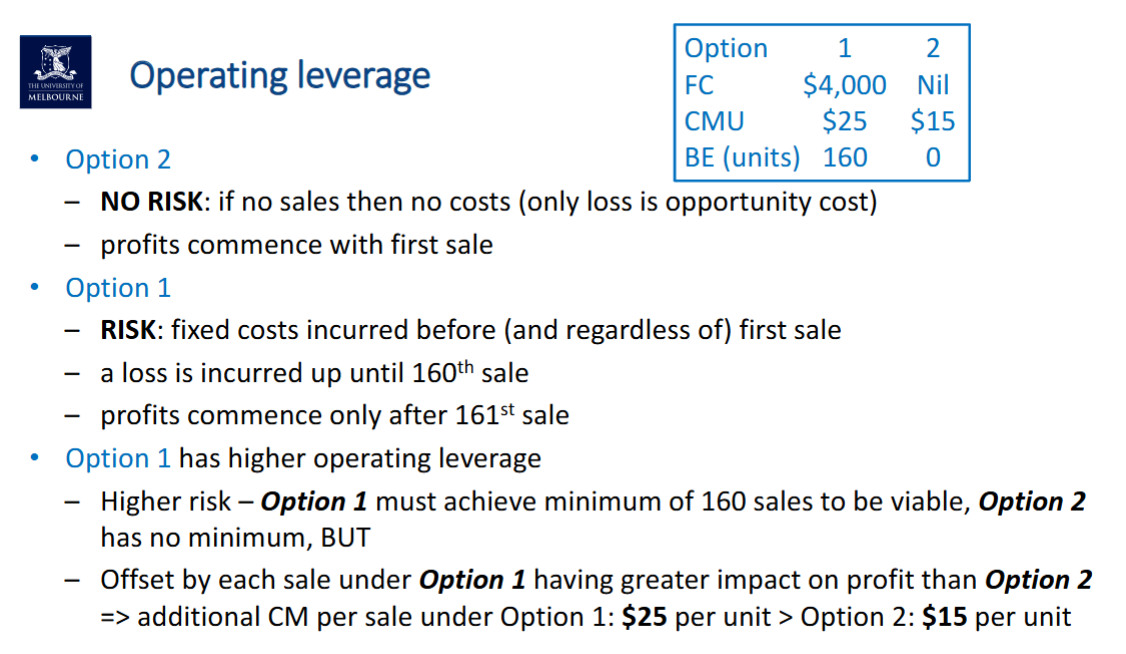

Refers to the relative mix between fixed and variable costs in the entity's cost structure

Entities with higher levels of fixed costs relative to variable costs are said to have higher operating leverage

Higher FC means higher sales are required to break-even

BUT, once break-even is achieved, the impact of additional sales is more significant => leverage (LOWER VC => HIGHER CMU)

The reverse also applies - a decline in sales will have a greater adverse impact

Higher operating leverage => less agility and higher operating risk

Industries with high operating leverage:

Airlines

Hardly any flights during COVID

Lots of fixed costs

Tollways

Entertainment venues

Universities

Extremely high fixed costs

Did not disappear during COVID like staff salaries.

Pivoted to online and fixed costs like tutorial staff were reduced

Outsourcing (make or buy) decisions

Whether to make a product (or service) or outsource to an external party

Compare the cost of outsourcing to the benefit of any cost savings

Special order decisions

Whether to accept a one-off order that differs from normal orders

If idle capacity, then can increase output with no change in fixed costs - generate additional profit

If no idle capacity, then need to consider the opportunity cost of taking the order

CVP assumptions

All costs can be classified as fixed or variable and mixed costs can be separated into their variable and fixed components

Cost and revenue behaviors will hold constant over the period and over the relevant range of activity

All unit selling prices, unit variable costs, fixed costs, and sales mix are as expected and remain constant

Production / purchases during the period = Cost of sales

Variable Costs Appendix

Fixed costs Appendix

Operating Leverage #1

Operating Leverage #2

Operating Leverage #3

Operating Leverage #4

Margin of Safety