Phillips curve

1/18

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No study sessions yet.

19 Terms

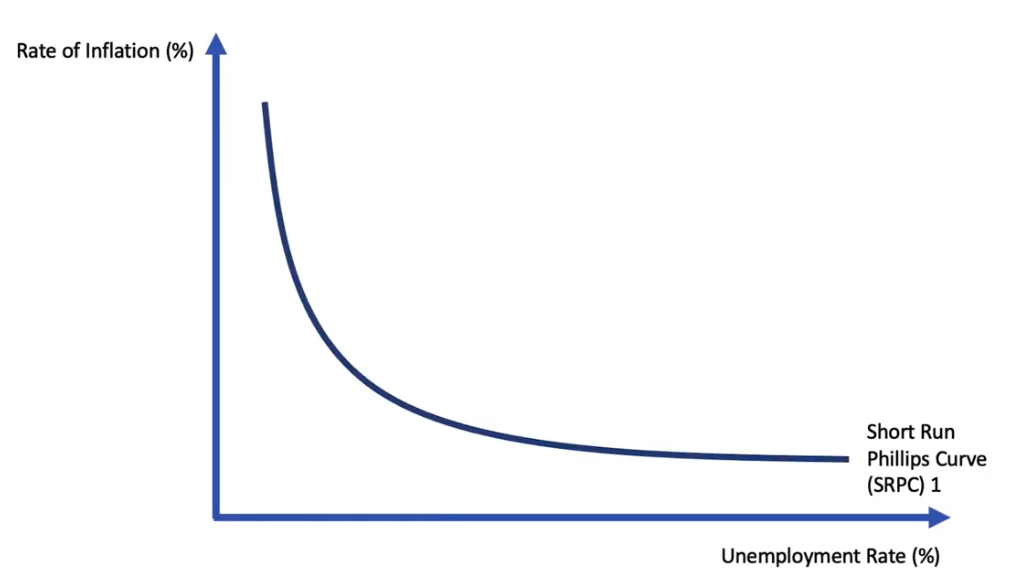

Which two macroeconomic objectives does the Phillips curve show? What does it suggest?

Inflation and unemployment

It suggests there is an inverse relationship/trade-off between improving the two objectives

What is the Phillips curve?

An economic model that shows the possible inverse relationship (non-linear) between the unemployment rate and the rate of inflation

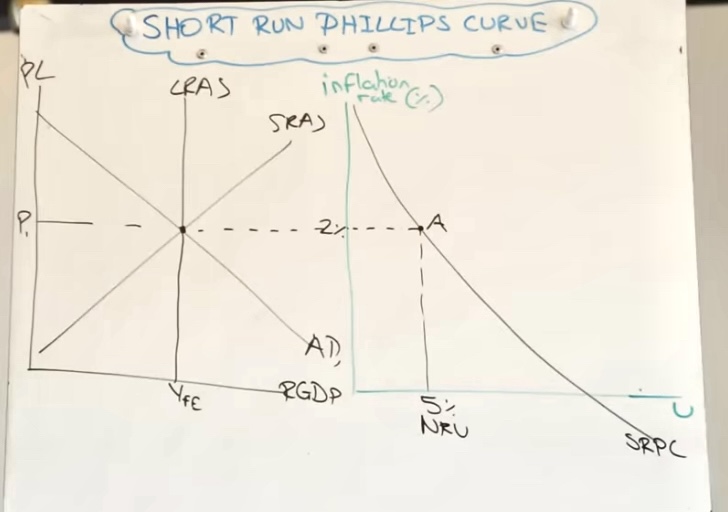

Phillips curve. What are the two variables on the axes?

Y-axis = rate of inflation (%)

X-axis = unemployment rate (%)

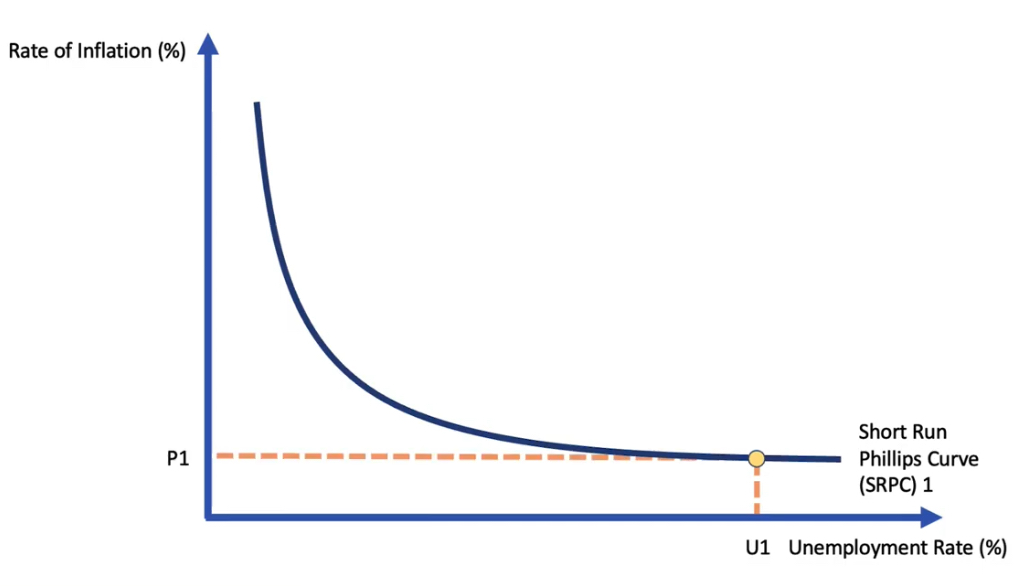

Show a position of high unemployment on the SRPC. What does it mean for an economy?

When unemployment is high (perhaps >10%), inflationary pressures in an economy tend to be weak

With high unemployment, inflationary pressures tend to be weak because: (3)

Negative output gap

High unemployment tilts the balance of wage negotiating power in the labour market towards employers

Real spending power is depressed = reduced consumption = reduced AD

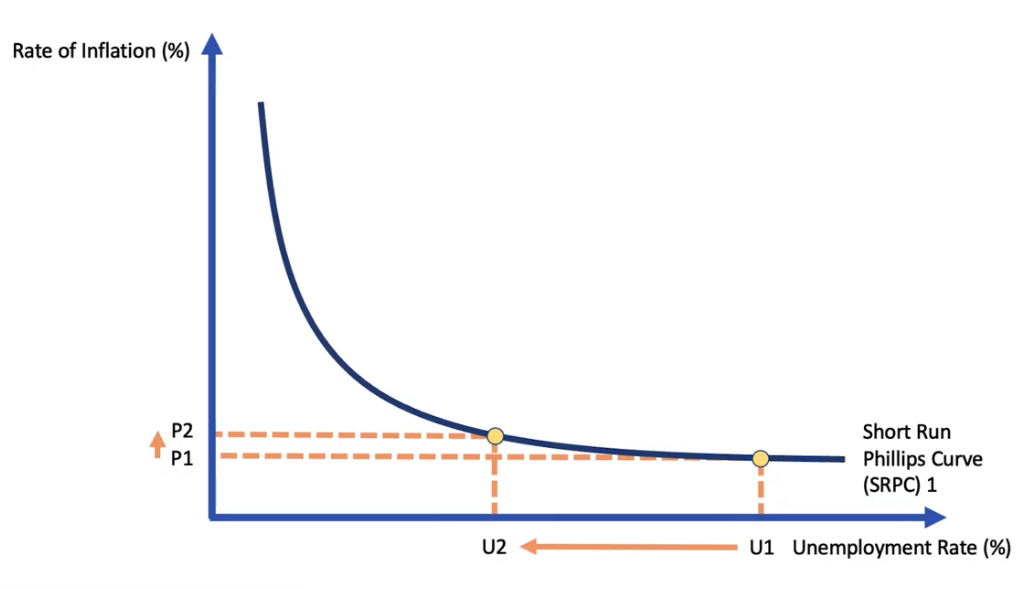

The Phillips curve suggests that high employment causes inflationary pressures. When unemployment starts to fall past U1, why does inflation not rise as much?

A significant fall in unemployment may not cause much of a rise in inflation because spare capacity is being used up (lots of excess labour supply), and rising employment often means an efficient use of factor resources

Once the unemployment rate falls to very low levels (beyond U2), what happens and why?

As unemployment falls further, especially a reduction in cyclical unemployment, then wage pressures and price pressures may start to accelerate.

Because at this stage, the output gap is likely to be positive and factor markets are experiencing shortages

This leads to an increase in wage inflation, which then leads to a faster rise in consumer prices. Hence the inverse relationship.

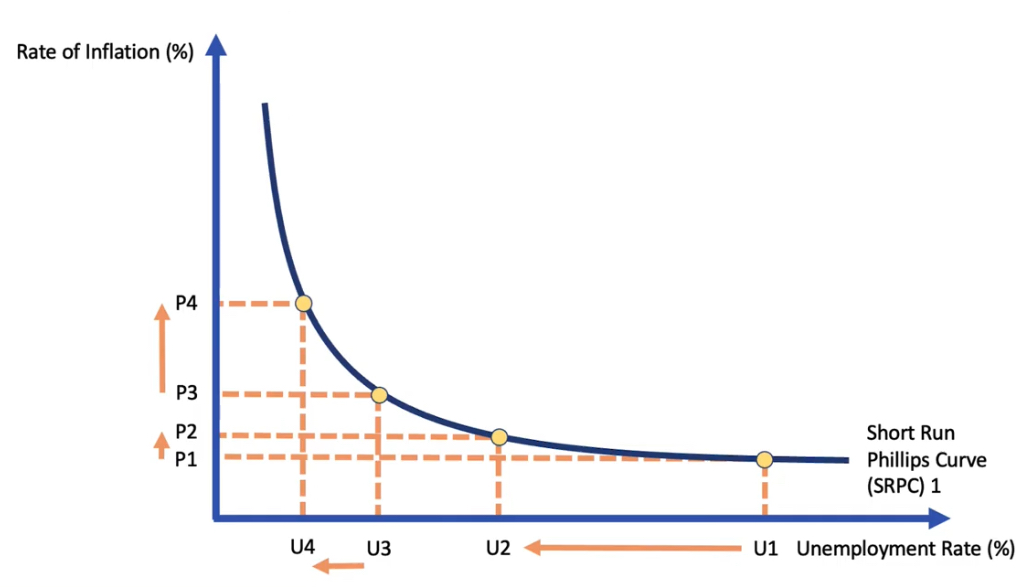

What happens after unemployment falls to very low levels (for example <3%) and causes wage inflation?

The trade-off between jobs and prices has become unfavourable

When inflation is accelerating, the nation’s central bank will tighten monetary policy by raising IRs.

When unemployment is low, there is upward pressure on wages and prices because:

There is a shortage of available labour = excess demand for labour = wages increase = increased consumption = increased AD

Put simply, firms are competing for workers. They therefore have to increase wages to retain, recruit and attain workers = inflation rises

Falling unemployment and strong economic growth can lead to shortages of components and other inputs = cost-push inflation rises

What is cost-push inflation?

Occurs when the cost of production increases, leading to higher prices for goods and services.

COP goes up = companies pass the increased costs onto consumers in the form of higher prices = overall price level increases = inflation.

Businesses respond to rising unit costs by increasing prices to protect their profit margins.

What is the NRU?

Natural rate of unemployment (5%)

This occurs when the economy is at full employment (it doesn’t mean that the economy is at 0 unemployment - there is still some structural, frictional, seasonal unemployment, etc)

The NRU represents the unemployment level when the labour market is in equilibrium

Why did the Phillips curve get challenged?

In the 1970s, the US and other developed countries experienced high inflation and high unemployment at the same time = stagflation occurred.

Economists like Milton Friedman and Edmund Phelps argued that the SRPC was not a reliable guide to economic policy.

Why did some classical economists/monetarists challenge the SRPC?

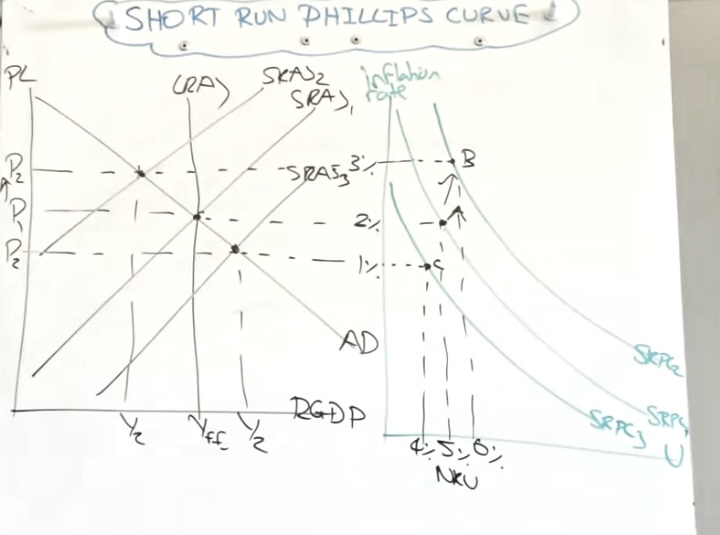

Because it didn’t align with SRAS after supply shocks.

They solved this by showing a movement along SRPC when AD shifted in/out, and showing a shift in/out when SRAS shifted in/out.

What do classical economists/monetarists believe about the long run period for an economy?

In the long run, output will always return to the full employment level

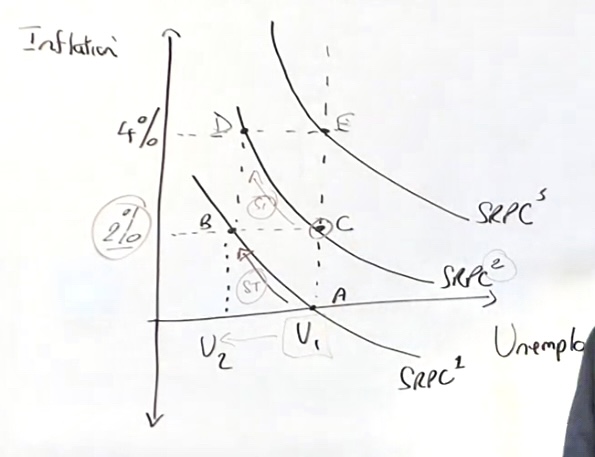

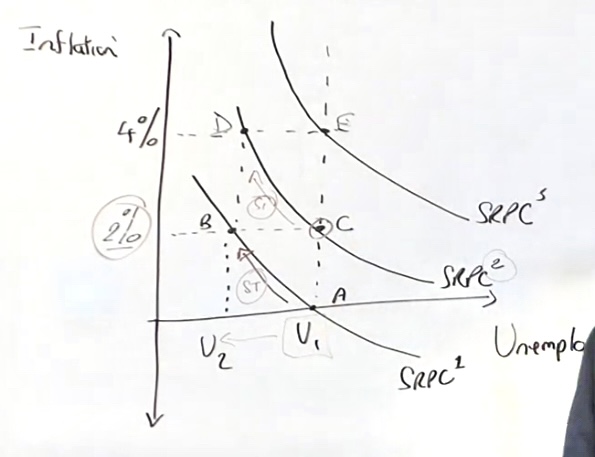

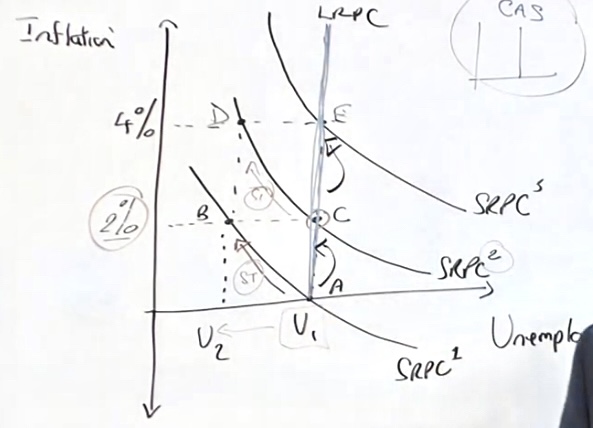

Long run Phillips curve - why does SRPC shift out after unemployment has fallen?

Unemployment falls = wage inflation (A → B = U1 → U2, 0% → 2%)

When workers see inflation occurring, they will demand higher wages in order to restore their purchasing power

Firms’ COP increases, and they realise that they cannot afford to have so many workers, so they make some of them redundant. (B → C = U2 → U1)

Inflation rate stays the same, but unemployment must rise = hence SRPC shifts out

Where is the LRPC?

The process of low unemployment → consequent inflation occurring → workers demanding higher wages may repeat again and again, but the outcome in the long run will be the same = firms will decrease employment back to U1.

You can join the points E, C and A to draw the LRPC.

What does the LRPC tell you?

If a government/monetary authority tries to reduce unemployment beyond the U1 point, the only thing that happens in the long run is that inflation will rise and unemployment will stay the same.

The U1 point is called the NAIRU.

What does NAIRU stand for?

Non-accelerating inflation rate of unemployment

It is equivalent to the NRU = Yfe. Any deviations from this point are only short-term.

What can you use the LRPC for in exams?

To show why inflation targeting is useful (i.e. UK’s MPC target of 2%