Alternative Investments

1/77

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

78 Terms

Alternative Investment Features

Compared with Traditional Investments

More specialized knowledge required of investment managers

Relatively low correlations with returns of traditional investments

Less liquidity of assets held

Longer time horizons for investors

Larger size of investment commitments

Unique Features

Investment structures that facilitate direct investment by managers

Information asymmetry between fund managers and investors, which funds typically address by means of incentive-based fee structures

Difficulty in appraising performance, such as more problematic and less available historical returns and volatility data

Private Equity

Private equity invests in non-public companies or public companies taken private.

Main types:

Leveraged Buyouts (LBOs): Use debt to buy mature companies.

Venture Capital (VC): Invests in early-stage, unproven companies.

Private Debt: may make loans directly to companies

Distressed Debt: loans to struggling companies

Real Assets

Real assets are tangible or physical assets used for income and inflation protection.

Types include:

Real Estate (properties, RE-backed debt)

Natural Resources (commodities, farmland, timberland)

Infrastructure (roads, utilities, airports, schools)

Other Assets (art, patents, cryptocurrencies)

Hedge Funds

Hedge funds are investment firms for qualified investors, using flexible strategies.

They may use:

Leverage

Long/short positions

Derivatives

Illiquid assets

Despite the name, they do not always hedge risk.

Fund Investing

Using funds to invest following an agreed-upon strategy

Manager gains

Management Fees

Investment gains

Term Sheet

Describes

Investment Policy

Fee structure (higher than normal)

Requirements for investors to participate

Co-investing

Investor contributes to a pool of investment funds but has right to invest with fund manager

Reduces overall fees (while benefit from manager’s expertise)

Learn/experience to direct investing

For a fund manager, permitting co-investing may increase the availability of investment funds and expand scope/diversification

Direct Investing

Direct investing means an investor purchases assets directly (e.g., companies, real estate) rather than using funds or outside managers.

✅ Advantages:

No fees to outside managers

Greater control over investment decisions

❌ Disadvantages:

Requires more expertise and due diligence

Higher minimum investment amounts

Less diversification

Alternative investment structure

Limited Partnerships

GP

fund manager

makes all investment choices

LP

investors

own partnership share proportional to investment amount

Accredited Investors

LP shares that are only available to those with sufficient wealth to bear significant risk and enough investment sophistication to understand risk

Limited Partnership Agreement

Rules and operational details contained here:

Side Letters: Special terms that apply to one limited partner but not to others

Excusal Right: withhold capital contribution that GP would otherwise require

Most-favored-nation clause: Side letters applied to others should also be applied to them

Master Limited Partnership (MLP)

Can be publicly traded

Most commonly specialize in natural resources or real estate

Committed Capital

Committed capital is the total amount that investors (LPs) agree to invest in a private equity fund.

It is not all invested upfront.

Funds are "drawn down" over time as investment opportunities arise.

The management fee is usually based on committed capital.

Undrawn capital is called dry powder.

Soft/Hard Hurdle Rate

Soft

Performance fees are percentage of total increase in value of each partner’s investment

Hard

Only on gains above the hurdle rate

Catch-up clause

LP

Take off of hurdle rate

GP

If excess, get performance fee of hurdle rate

Residual

Split using performance fee

High-water mark

A high-water mark ensures that performance fees are only charged on new net gains, not on recoveries of prior losses.

Fees are paid only if the fund value exceeds the previous highest net-of-fee value.

Prevents charging investors twice for the same gains.

Each investor may have a different high-water mark if they enter the fund at different times.

Waterfalls

A waterfall defines how profits are split between the GP and LPs.

Deal-by-Deal (American):

GP can take performance fees from each profitable deal, even if other deals lose money.

→ Favors the GP.Whole-of-Fund (European):

LPs must first receive all invested capital + hurdle rate from the entire fund before the GP earns carry.

→ Favors the LPs.

Clawback Provision

A clawback provision allows LPs to recover excess performance fees from the GP if earlier gains (on which carry was paid) are offset by later losses.

Protects LPs in deal-by-deal waterfalls

Ensures GP doesn’t keep carry if the fund underperforms overall

Alternative Investment Additional Risks

Timing of cash flows over an investment's life cycle

Use of leverage by fund managers

Valuation of investments that may or may not have observable market prices

Complexity of fees, taxes, and accounting

Timing of Cash Flow

Capital Commitment Phase: Managers issue capital calls; LPs commit capital gradually.

Returns: Typically negative due to cash outflows without immediate gains.

Capital Deployment Phase: Managers fund and manage investments (e.g., start-ups or turnarounds).

Returns: Often still negative due to risk and development costs.

Capital Distribution Phase: Investments mature and generate income/cash flows.

Returns: Turn positive and typically accelerate as profits are realized.

Multiple of invested capital (money multiple)

Ratio of total capital returned plus the value of any remaining assets

does not consider timing of cash flows

affect annual returns on invested capital significant

Prime brokers

People that arrange margin financing with hedge funds

Leverage Purposes

Purpose: Leverage amplifies returns, especially when exploiting small pricing inefficiencies.

Risks:

Margin calls if equity falls below thresholds → forced sales at a loss.

Fire sale risk: Large liquidations can depress asset prices further.

Borrowing limits: Lenders may restrict further access to capital.

Fair Value Hierarchy

Level 1. The assets trade in active markets and have quoted prices readily available, such as exchange-traded securities.

Level 2. The assets do not have readily available quoted prices, but they can be valued based on directly or indirectly observable inputs, such as many derivatives that can be priced using models.

Level 3. The assets require unobservable inputs to establish a fair value, such as real estate or private equity investments, for which there have been few or no market transactions.

Investor Redemptions

Investors ask managers to redeem their positions

Typically take measures to restrict early redemptions

Lockup period/ Notice period

Lockup Period

Time after initial investment over which limited partners either cannot request redemptions or incur significant fees for redemptions

Notice Period

Amount of time a fund has to fulfill redemption request

Redemption fees/Gate

Redemption fee

Redemption costs

Can counteract transaction costs

Gate

Restricts redemptions for a temp period

Founders class shares

Early investors receive lower fees or better liquidity terms

Either-of-fees

Maximum of management fee or incentive fee (excess return fee)

Vintage year

Compare funds that originated in the same vintage year

Each fund’s structure is unique

Can be in different phase of life cycle

Survivorship/Backfill Bias

Survivorship

Index only includes those who have not failed

Backfill

Managers only select their successful funds for inclusion in index

Portfolio Companies

Companies PE funds invests in

Management Buyouts/Buy-ins

Buyouts

Existing management team participates in purchase

Buy-in

PE replaces portfolio company’s current team

Stages of Venture Capital

Formative Stage: earliest period

Pre-seed (Angel): Idea-stage funding from individuals for planning and market potential.

Seed-stage: Funds for product development, research, and marketing—first VC involvement.

Early-stage: Supports operations before production and sales begin.

Later-stage: For companies with sales—used for growth, expansion, or improvement. Often involves giving up control to VCs.

Mezzanine-stage: Pre-IPO funding to prepare for public offering; typically equity or short-term debt.

Minority Equity Investing

Buy a less than controlling interest in public companies that are looking for capital

Private investment in public equity

Allows publicly traded firm to raise capital more quickly and cost effectively than IPO

Main PE exit strategies

Trade Sale: Sell to a strategic buyer; often at a premium. Faster and cheaper than IPOs, but may face internal resistance and few buyers.

Public Listing:

IPO: Most common, higher valuation, visibility; costly and complex. Best for large, stable, growing firms.

Direct Listing: Lower cost, no capital raised.

SPAC: Flexible, less valuation uncertainty, but dilution and regulatory risks.

Recapitalization: Take on debt to pay dividends; not a full exit but returns capital to investors.

Secondary Sale: Sell to another PE firm or investor group.

Write-off/Liquidation: Recognize loss from failed investments.

Private debt categories

Direct Lending: Senior, secured loans made directly to companies—often with covenants.

Leveraged Loans: Fund's portfolio of loans is itself financed with debt to amplify returns.

Venture Debt: Convertible or warrant-linked loans to VC-backed start-ups; preserves founder ownership.

Mezzanine Debt: Subordinated debt with higher risk and return; may include equity features like warrants.

Distressed Debt: Acquired from troubled firms; investors may engage in restructuring or turnaround strategies.

Most typical in mature companies

Unitranche Debt: Blends senior and subordinated debt into one facility with a blended interest rate.

Vintage year investments

Vintage year: The year a private equity fund makes its first investment.

Importance: Performance is influenced by the economic cycle at that time.

Expansion phase: Favors early-stage investments.

Contraction phase: Favors distressed investments.

Investor strategy: Diversify across vintage years to manage cycle risk.

Private capital ranking (high to low risk)

Private Equity

Mezzanine debt

Unitranche debt

Senior direct lending

Senior real estate debt

Infrastructure debt

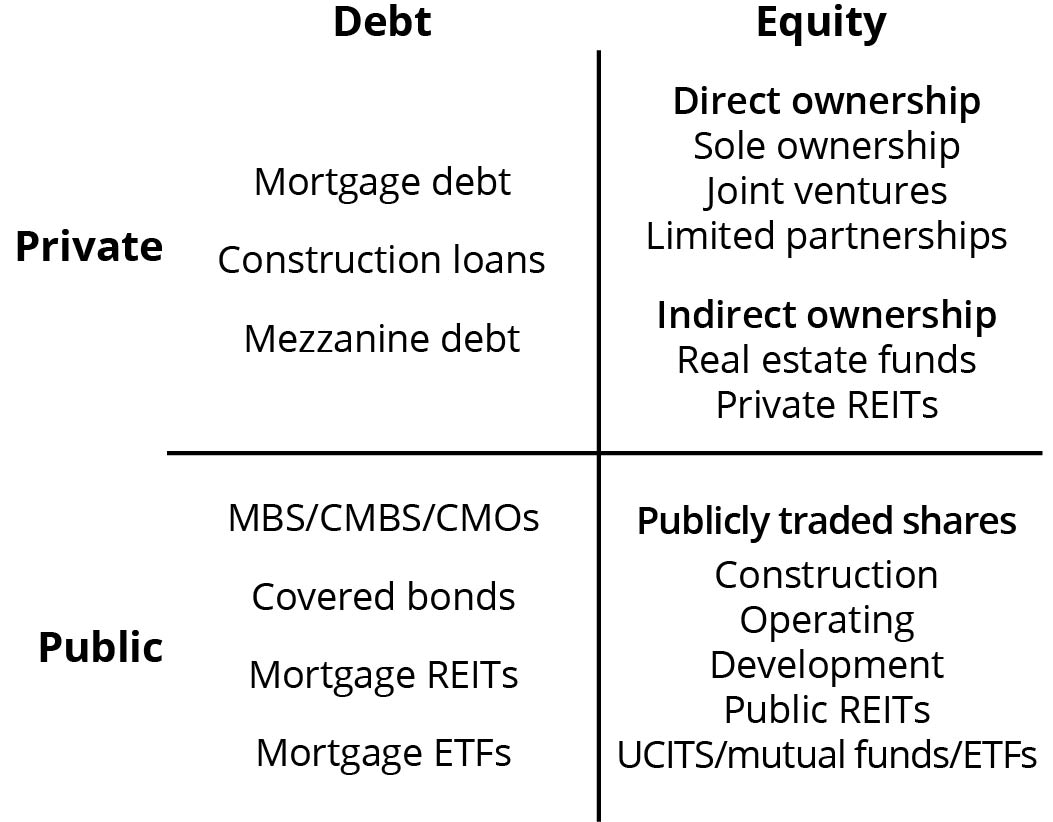

Private/Public RE Investments

Private

Usually direct investments

Can be solely owned or indirect owned through partnerships

GP provides property management services

LP provides investments

Public

REITS

MBS

ETF

Basic Forms of RE Investments

Pros

Control. The owner can decide on what to purchase, how to finance it, what improvements to make, to which segment of tenants to market the property, and when to sell.

Diversification. Real estate returns are less than perfectly correlated with the returns of stocks and bonds. Thus, adding private real estate investment to a portfolio can reduce risk relative to the expected portfolio return.

Tax benefits. Real estate can provide deductions for noncash depreciation (even as properties typically appreciate) as well as interest expense.

Cons

Illiquidity and price opacity

Complexity of managing property

Need for specialized knowledge about current market conditions

High initial investment/capital needed

Concentration risk if a portfolio has one or few properties

Equity/Mortgage REITs

Equity

Invest RE directly or via partnerships

Mortgage

Lend money for RE or invest in MBS/CMBS

REITS investment strategies

First Mortgages or investment grade CMBS

Core real estate strategies, invests in high-quality commercial and residential properties with stable returns

Core-plus real estate strategies, which accept a bit more risk than core strategies by undertaking modest development and redevelopment.

Value-add real estate strategies, which undertake development and redevelopment on a somewhat larger scale than core-plus strategies.

Opportunistic real estate strategies, which pursue large-scale redevelopment and repurposing of assets, invest in distressed properties, or speculate on upturns in real estate markets.

REIT Equity correlation

REITs correlation with equity is higher than that for direct investment

increase during steep market downturns

Infrastructure Investments

Transportation assets

Roads/airports/ports/railways

Utility

Gas/electricity/waste

Information and communication

telecom/cable

Social

prisons/schools/healthcare

Cash flows generated from infrastructure Investments

Availability payments

making infrastructure available

Usage-base payments

highways tolls

Take-or-pay arrangements

require minimum purchase price for an agreed-upon volume

Greenfield investments

Infrastructure to be constructed

build operate transfer BOT

greenfield life cycle

cash outflows during building phase

increase cash inflows when begin operating

transfer of facility to a gov or third party

Brownfield investments

Expand or privatize an existing infrastructure

secondary stage investments

sale leaseback arrangement where asset is purchased from and leased back to government

Infrastructure correlation with equities

Long term contracts and barriers to entry

CF from equity investments in infrastructure are stable

low correlation with public equities

Safer and less affected by economic cycles

Infrastructure investments investors

Longer term investors

Pension

Life insurance

Sovereign wealth funds

Timberland Investment management organizations TIMOs

Investment for those who lack expertise

Commodity major sectors

Metals

Agricultural

Energy

Other ways to invest commodities

Exchange-Traded Products (ETPs): Include ETFs and ETNs; trade like stocks; suitable for investors limited to equity purchases.

ETFs: Can hold commodities or futures; passively track prices or indexes.

ETNs: Unsecured debt notes that track commodity indexes; carry credit risk.

Managed Futures Funds: Actively managed by CTAs; structured as hedge fund-like partnerships (with high minimums and restrictions) or mutual fund-like vehicles (more accessible, liquid).

Separately Managed Accounts (SMAs): Customized for high-net-worth individuals.

Specialized Funds: Can focus on specific sectors (e.g., oil, metals) and use any of the structures above.

Contango/Backwardation

Contango

Futures > spot

decrease return of long only

Backwardation

Futures < spot

increases return of long only

When are commodities prices volatile

Supply is inelastic in short run due to long lead times

Volatile when demand changes significantly over economic cycle

supply shocks like natural disasters

weather

Commodity Risk Return

High Return Potential: Commodities and real assets like timberland/farmland have historically offered higher average returns than global stocks and bonds.

Volatility: Commodities are more volatile than stocks and bonds; timberland/farmland have lower volatility.

Diversification: Low correlation with global equities and bonds provides portfolio diversification benefits.

Inflation Hedge: Commodity prices tend to rise with inflation, offering protection against inflation risk.

Risk Sensitivity: Prices are sensitive to geopolitical events and weather.

Investor Analysis Focus: Includes inventory, supply/demand forecasts, and economic/policy expectations.

Farmland vs Timberland vs Raw land

Farmland

steadiest CF form leasing or selling crops

Timberland

More discretion over timing

Can choose to let timber grows or harvest for sale

Raw Land

no CF

Mutual vs Hedge Funds

Hedge funds lightly regulated

Managers have great freedom in selecting investment strategies

Hedge Fund Strategies

Hedge fund strategies aim to profit from market inefficiencies:

Equity Hedge: Long/short positions in equities.

Fundamental Long/Short: Long undervalued, short overvalued (net long).

Growth: Long high-growth, short low-growth (net long).

Value: Long undervalued, short overvalued (value vs. growth).

Market Neutral: Equal long/short to reduce market exposure.

Short Bias: Predominantly short positions.

Event-Driven: Linked to corporate actions (typically long biased).

Merger Arbitrage: Long target, short acquirer.

Distressed: Long distressed, short overvalued.

Activist: Buy to influence management.

Special Situations: Capital structure changes (e.g., spinoffs).

Relative Value: Exploit price discrepancies.

Convertible Arbitrage: Bonds vs. stock/options.

Fixed Income: ABS/MBS/high yield or across issuers.

Multistrategy: Across assets/markets.

Opportunistic: Macro trends or commodities.

Macro: Positions across asset classes based on global trends.

Managed Futures (CTAs): Trade commodity/financial futures.

Separately managed accounts

Single large investor fund

customized portfolio to meet investor’s objectives

no manger stake - no interest

require more operational oversight

lower negotiated fees offset by disadvantage of receiving allocations of only the fund’s most liquid trades

Master-feeder strcuture

Tax efficient, Economies of scale, allows funding from global investors

bypasses regional regulatory requirements

Hedge Funds structure

GP

fund manager

Private Placement Memorandum: contractual relationships between GP and LPs laid out in documents

Recent push from 2/20 to 1/30

Fund of funds

investment company that invests in hedge funds

gives investors diversification among hedge fund strategies

charge additional layer of fees beyond the fees charged by the individual hedge funds in the portfolio

1/10

Hedge Fund Return sources

Market beta. This is the return attributable to the broad market index. Investors can get this from passive investments in index funds.

Strategy beta. This is the return attributable to specific sectors in which a fund has exposure.

Alpha. This is the additional return that is delivered by the manager through security selection.

Why Hedge fund index overstated

Hedge fund indexes may overstate performance due to:

Voluntary Reporting: Poor performers may not report.

Survivorship Bias: Excludes failed/short-lived funds.

Selection Bias: Inconsistent category assignment.

Backfill Bias: Adds prior strong returns when funds join index.

Including only successful funds’ prior returns inflates historical index performance.

Despite biases, hedge funds offer diversification, with higher equity correlation than fixed income.

Distributed Ledger Technology DLT

Digital asset is secured and validated

Blockchain

Cryptocurrencies have their own blockchains

crypto tokens are built on blockchains that already exist

Distributed Ledger

Database among participants

stored record of all transactions, allows each participant to have an identical copy

Smart Contracts

Computer program self-executes based on predetermined terms and conditions

Automate contingent claims and collateral transfers during default events ie.

Blockchain

Digital ledger that records information sequentially within blocks

linked together and secured using cryptographic techniques

Consensus Protocols

Determine how blocks are chained together

Structured to protect against market manipulation

Proof of work (PoW)

Proof of Stake (PoS)

PoW/PoS

Proof of Work (PoW):

Miners solve cryptographic puzzles using powerful computers.

High energy consumption due to intensive computation.

Security depends on controlling >50% of the network’s computing power.

Rewards go to the first miner to solve the puzzle.

Most widely used in early blockchains (e.g., Bitcoin).

Proof of Stake (PoS):

Validators stake cryptocurrency to earn the right to validate blocks.

Much lower energy use; no complex computations required.

Security relies on economic incentives and majority stake control.

Validators are rewarded based on stake and participation.

Emerging mechanism used by newer blockchains (e.g., Ethereum 2.0).

Permission(less) Networks

Forms of DLT networks

Permissionless

Transactions are visible to all users within the network

Confirmed or denied through consensus mechanisms rather than centralized authority

Permission

May be restricted from some network activities

Permissions can modify level of ledger accessibility

more cost effective due to stronger restrictions

Types of Digital Assets

ryptocurrencies | Tokens |

|---|---|

|

|

Utility/Governance Tokens

Utility Tokens:

Provide access to services within a blockchain network.

Used for payments, transaction fees, or subscriptions.

Do not represent ownership or offer dividends.

Reward users for participating in the network.

Governance Tokens:

Represent voting rights in decentralized protocols.

Allow holders to vote on upgrades, fees, or policies.

Offered mainly on permissionless networks.

Empower users to help shape the network’s future.

Digital Assets v Traditional Assets

Inherent Value:

Digital assets lack cash flows (e.g., interest/dividends) → no fundamental value

Valued based on scarcity and future utility

Transaction Validation:

Traditional assets recorded by central intermediaries

Digital assets recorded on decentralized blockchains

Medium of Exchange:

Traditional assets priced in fiat currencies

Digital assets act as fiat alternatives, but face legal and cost barriers

Regulation:

Traditional markets are well-regulated

Digital assets face unclear, evolving rules and often unregulated exchanges

Indirect Investments in Crypto

Coin Trusts:

Trade over-the-counter like closed-end funds

Hold large crypto positions; no need for wallets or keys

Offer transparency but often charge high fees

Futures Contracts:

Cash-settled contracts to buy/sell crypto at a future date

Traded on exchanges (e.g., CME)

Use leverage; more volatile and less liquid than traditional futures

Exchange-Traded Products (ETPs):

ETFs and similar products that mimic crypto returns

Use spot holdings or derivatives for exposure

Cryptocurrency Stocks:

Companies connected to digital assets (e.g., exchanges, miners, payment firms)

Exposure via business operations or crypto holdings

Hedge Funds:

Use active strategies (e.g., long/short, quant) to invest in crypto

Some also engage in mining to enhance returns