1 Money, Banking and Financial Markets

1/33

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

34 Terms

Money

Any generally accepted means of payment

Medium of exchange

What are the functions of money?

Medium of exchange

Unit of account

Unit in which prices are quoted and accounts kept.

Store of value

Token Money

How cost of making $100, is a lot less than its value

IOU Money “I owe you”

Acknowledgement of debt

What is clearing in the banking system

Process of settling transactions between banks within and between countries.

Liquidity

Cheapness, speed and certainty that assets can be converted to cash.

Bank Reserves

Money that bank has available to meet withdrawals by depositors.

Liabilities of Commercial Banks

Sight Deposits

Money that be drawn right away

Time Deposits

Require notice before withdrawal (So pay higher interest)

Liquidity of Time vs Sight deposits

Sight deposits are more liquid than time deposits.

How do banks make profit

By lending and borrowing

Banks 3 Main Assets in their Portfolio of Investments

Low amount of Reserves

Liquid Assets in case in need of immediate cash

Illiquid Assets that earn higher Interest Rates

What is a Financial intermediary

A bank

It specialises in bringing lenders and borrowers together.

Insurance Companies

Pension Fund

Building Societies

Reserve Ratio

Ratio of banks reserves to deposits

Ratio of 10% means 10:90 reserves to deposits

Money Supply

Currency in circulation outside banking system + deposits of commercial banks.

Types of Financial Assets

contract entitling earning to stream of income for a specific period

Commercial Banks Raise money by selling them

e.g. Bonds, Stocks, Treasury Bills

Treasury Bills vs Corporate Bills

Long-term of short term?

Do they pay direct interest?

Types of Bonds

Treasury: GOV

Corporate: From Companies

Short-term e.g. 1 year

Don’t pay direct interest but with a known date of repurchase by the original original borrower at a known price.

Bonds

Way for borrowers to raise money by promising to repay with interest. Investors buy bonds to earn steady income and get their money back at maturity.

Owners are payed a coupon (Fixed Dividend) each year

When it expires (Reaches Maturity), Gov Repurchases it

Bonds vs Bills Liquidity

Bonds are less liquid than bills due to uncertainty of price it can be sold and cash it will generate.

Money Multiplier and what it measures

The Ratio of Broad Money (Liquid and Near Liquid Assets) to the Monetary Base (Currency in circulation +Bank reserves)

Measures how much money supply can increase for each unit of reserves held by banks

M/MB

Broad Money (M)

All Liquid and Near liquid assets in economy

M = Currency in circulation + deposits + savings accounts

Monetary Base (MB)

All Currency in Circulation + Banks reserves

MB = Currency in Circulation + Reserves

What happens to Money Multiplier (M/MB) if there’s a

Disproportionate increase in M

Disproportionate increase in MB

Disproportionate increase in M increases Multiplier

Happens when Banks lend more aggressively, creating new deposits and increasing supply of Money

Disproportionate increase in MB Decreases Multiplier

Happens when banks hold Excess Reserves, instead of lending, or if people prefer to hold cash instead of deposits

What causes a Disproportionate increase in Broad Money (M)

Happens when Banks lend more aggressively, creating new deposits and increasing supply of Money.

What causes a Disproportionate increase in Monetary Base (MB)

Happens when banks hold Excess Reserves, instead of lending, or if people prefer to hold cash instead of deposits.

Factors that affect the Money Multiplier

Reserve Ratio

If there is a greater share of reserves there will be more MB, decreasing Multiplier

Cash holding

If more cash is hold than depositing there will be higher MB, decreasing multiplier

Confidence in the banking system

Means people will deposit more, increasing M which increases the multiplier

Fractional Reserves Banking

How banks only keep of fraction of total deposits as reserves and loan the rest out.

Formula for Money Multiplier

1/Reserve Ratio

e.g. 1/10% = 10

Narrow vs Broad Money

Narrow only includes most liquid assets

Cash + Demand deposits

Broad Includes Liquid and near liquid assets

Cash + Demand deposits + Savings Accounts

Factors that Make Banks Less willing to lend

Economic Downturns

e.g. 2008 crisis

Low interest

Less profitable

High Interest

Less incentives for borrowing as its expensive, reducing demand

Higher risk tos supply loans

Role of Central Banks

Why are they under public control

Set/mange monetary policy in economy

Act as Lender of Last Resort (LOLR)

Provide emergency liquidity to banks during short-term crises.

Because politicians would use them for short-term gains in their best interest

What is monetary policy

Monetary policy is the process by which a central bank manages the money supply and interest rates to achieve specific economic objectives such as controlling inflation and stabilizing currency.

Traditional Means of Monetary Control

Central Banks

Open Market Operations (OMO)

Buying and selling government bonds in the open market

Buying—> Increases Money Supply

Selling—> Decreases Money Supply

Sets Reserve Requirements

High Reserve Ratio —> Less lending and money creation

Low Reserve Ratio —> More lending and money creation

Discount Rate / Bank Rate

Charges Commercial Banks higher or lower rates for borrowing

Higher —> discourages borrowing, tightening money supply

Lower —> encourages borrowing, expanding money supply

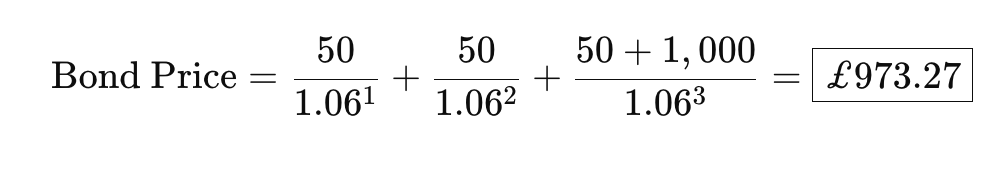

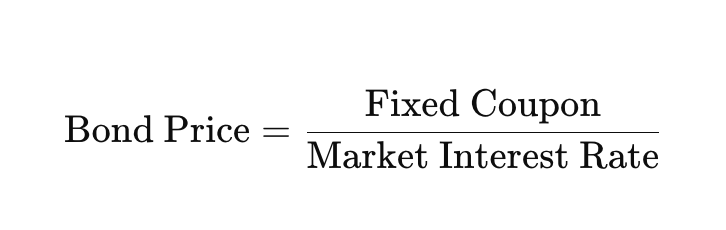

Why are Bond Prices and Interest Rates Inversely Related

Bonds pay a fixed coupon (interest), so if new bonds offer higher rates, old bonds become less attractive unless sold at a lower price.

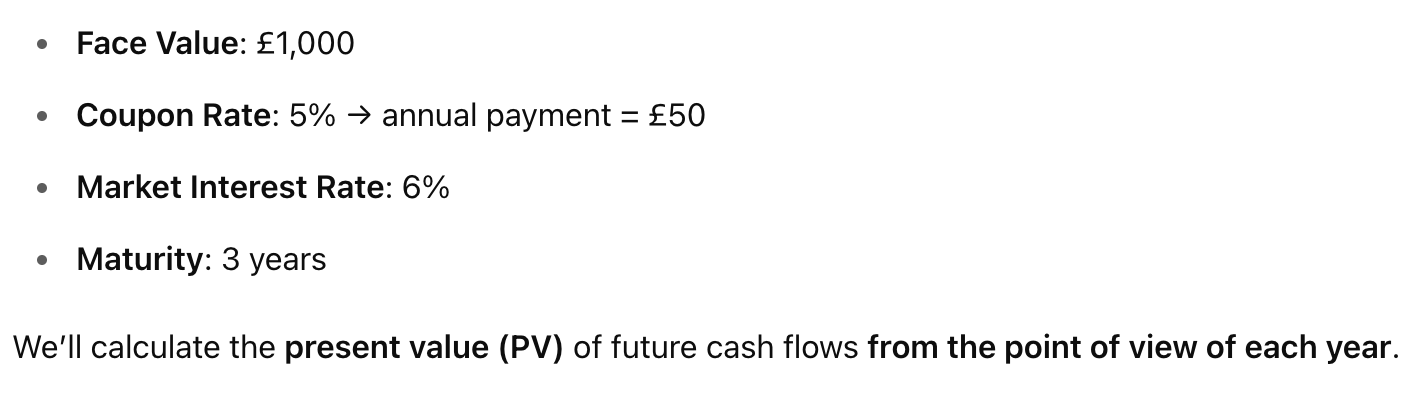

Calculating Bond Price