Topic 3.3 and 5.5 Finance, sources of finance, types of costs, break even

1/33

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

34 Terms

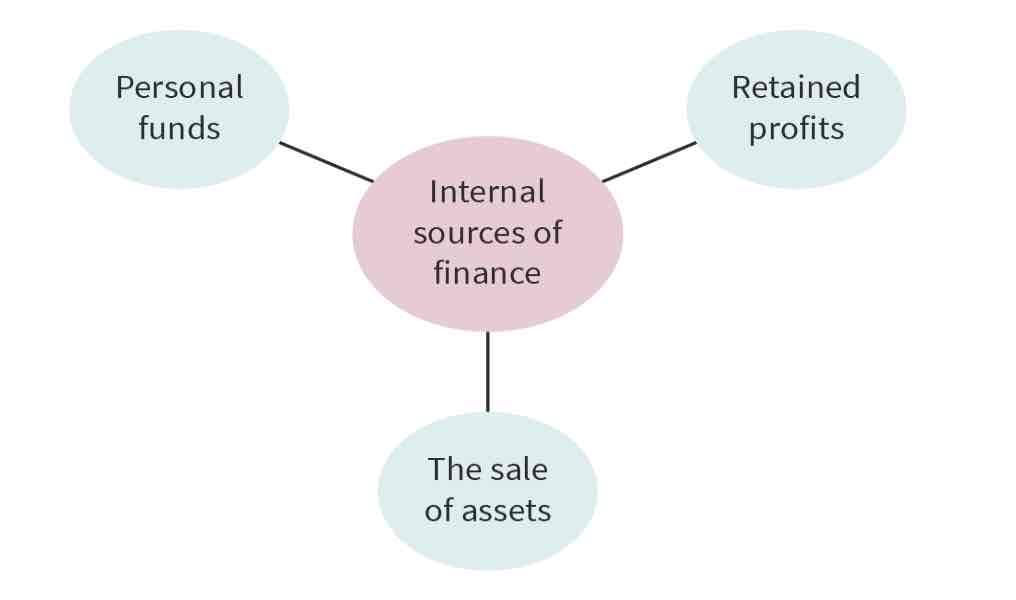

What are internal sources of finance?

Are funds generated within the organization, such as retained profit, personal funds and sale of assets.

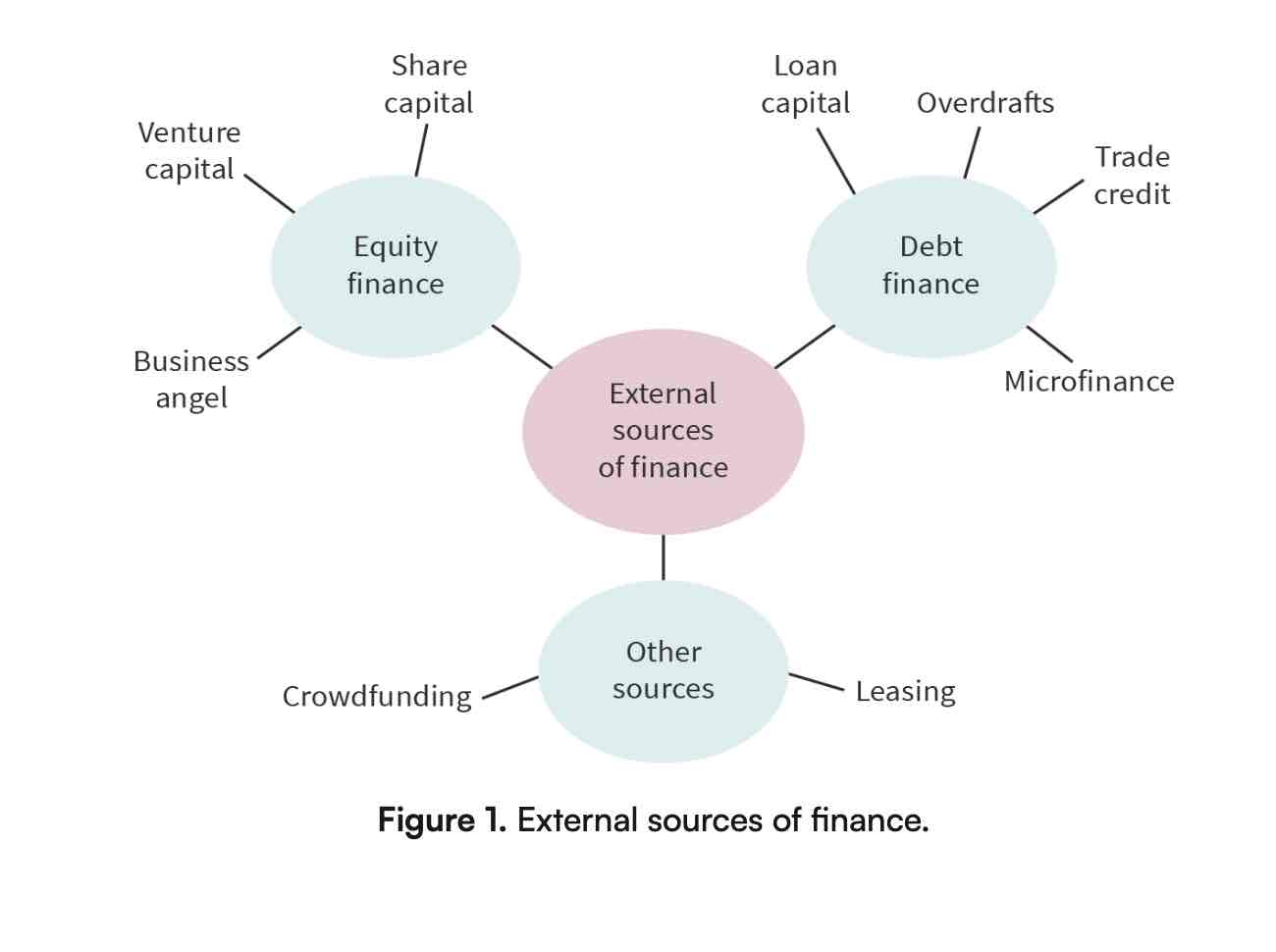

What are external sources of finance?

Are funds raised from outside the organization like loans, equity, leasing, crowdfunding and grants

What is equity financing?

Is the method of raising capital through the sale of shares in the company. Method include: share capital, venture capital, business angel

What is debt financing?

Is a type of external source of finance when a business borrows money that must be repaid over time, usually with interest. Method include: trade credit, overdrafts, loan capital, microfinance

What are retained earnings?

Is an internal source of finance in which the profits of a company is reinvested in the business after paying its dividends

What is crowdfunding?

Is an external source of finance, raising capital through the collective efforts of a large number of individuals, typically via online websites like Kickstarter.

What is venture capital?

Is financing provided to startups and small businesses with perceived long-term growth potential by investment companies. They are different compared to business angels because it is a company and a group of people instead

What is leasing?

External source of finance and a way to obtain financing by renting an asset instead of purchasing it outright, is usually lower price, and does not need to worry about meeting repairing the equipment

What is capital expenditure?

It is the funds used by a company to acquire or upgrade fixed assets such as property, buildings, copyright or equipment. And are considered long term investments

What is revenue expenditure?

It refers to spending on the day-to-day operational costs of running a business, such as rent, utilities, and salaries. And is considered short-term

What is insolvency?

When a business is unable to pay it’s debts

What is a business angel?

An individual who provides financial investment to startups in exchange for ownership equity or convertible debt. It is different to venture capital because they are individuals and use personal money

What is share capital?

The funds generated by a company through the issuance of shares to new investors on the stock market.

What is loan capital?

Refers to the funds that a business borrows from external sources, such as banks or a mortgage, typically in the form of loans that must be repaid over time. Businesses can also provide an asset as collateral in the event that the business does not pay their loan

What are overdrafts?

Are a form of credit that allows a business to withdraw more money from its account than is available, up to a certain limit and must be paid back before spending anymore

What is microfinance?

Is a financial service that provides small loans and financial support to individuals and small businesses lacking access to traditional banking and can include transaction, saving accounts and insurance products. Typically have high interest rates

What is trade credit?

Is a form of short-term financing where a business receives goods or services and agrees to pay for them later. Typically has no interest

Personal Funds/savings

Is an internal source of income that comes directly from the stakeholder’s own money. It will affect their personal finance

Sales of assets

An external source of finance where a business sells their assets(machinery, land, patents, brandnames) to buyers.

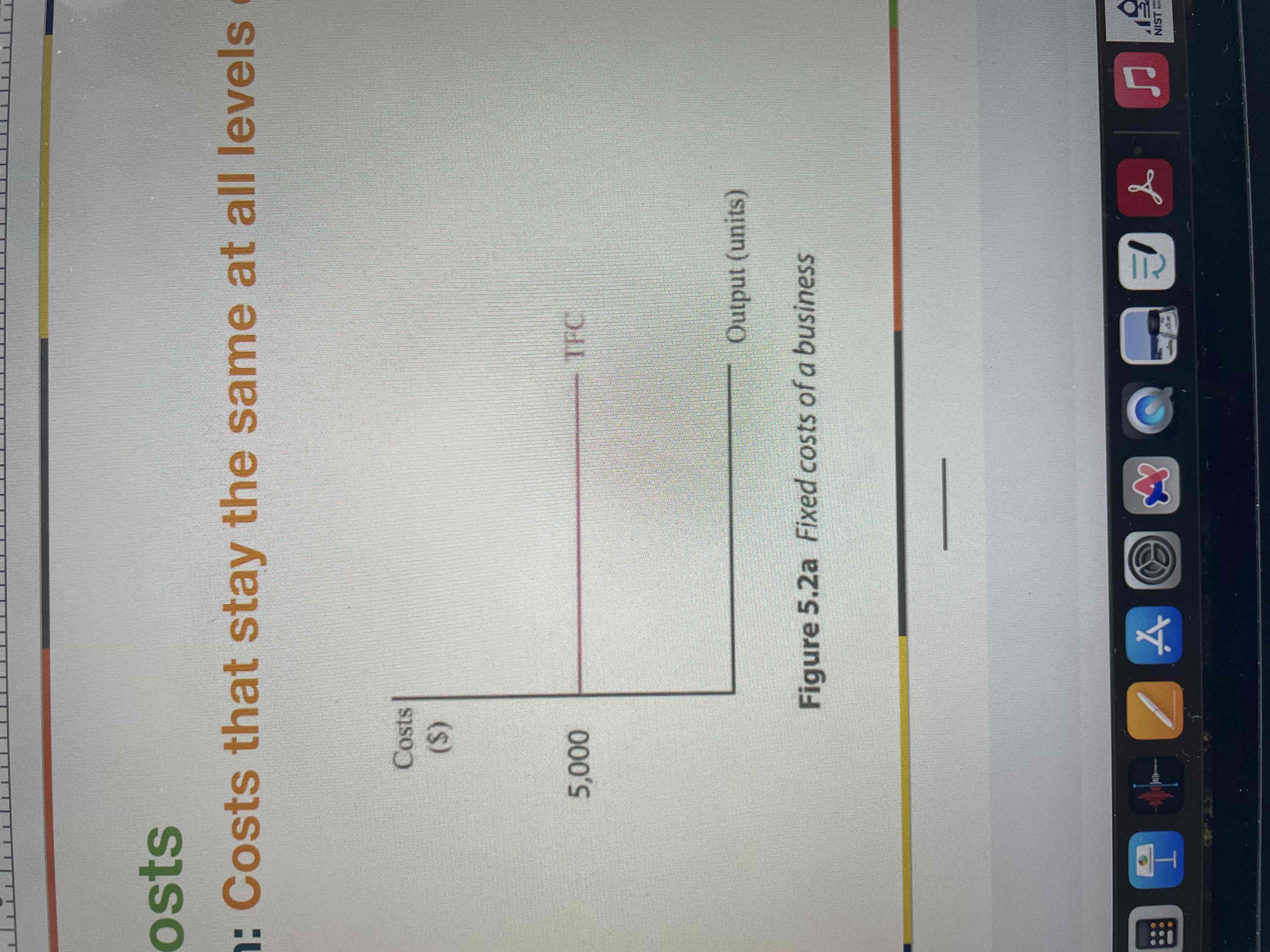

Fixed costs

Costs that stay the same at all levels of output eg:Rent, salaries, accounting fees, insurance premiums

Variable costs

Costs of production that are based on the level of usage/output eg:raw materials, utility, packaging, delivery costs

total costs

Costs consisting of both variable and fixed costs. FC+VC

Semi-variable costs

Costs that are fixed until a level of production is reached where they become variable eg: Labour cost, telephone, Internet, and maintenance

direct costs

Cause identified with a particular and specific product or process from the business eg: raw materials, direct labour, packaging

Indirect cost/overhead

Costs that come from the business as a whole and isn’t a specific product or process eg:rent, insurance, admin salaries

Revenue

Is the income that a business earns from goods and services. Formula:price*quantity of sales

Contribution

Money leftover from selling a product to pay for the variable cost needed to produce it. Formula: selling price-variable cost per unit. It isn’t profit yet

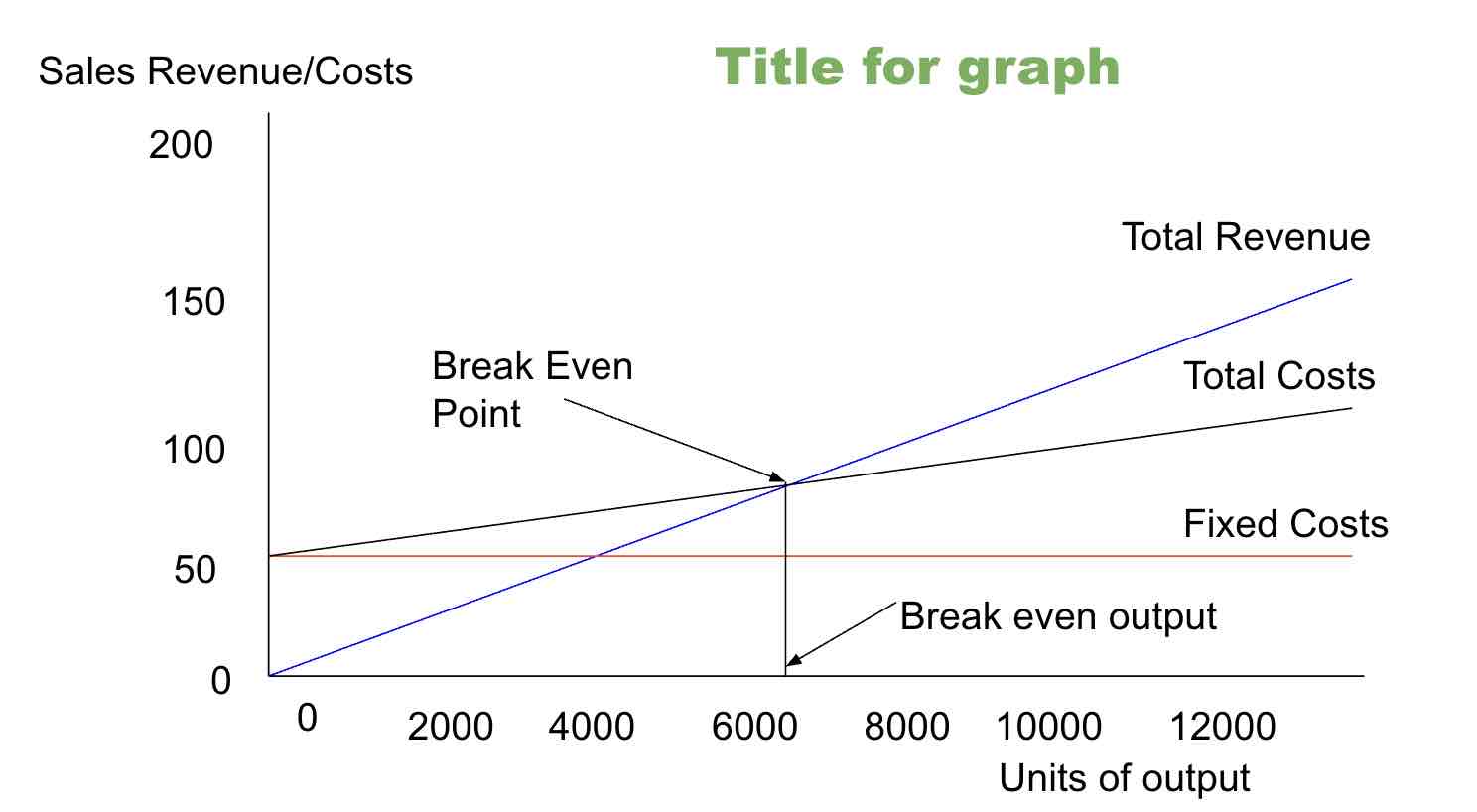

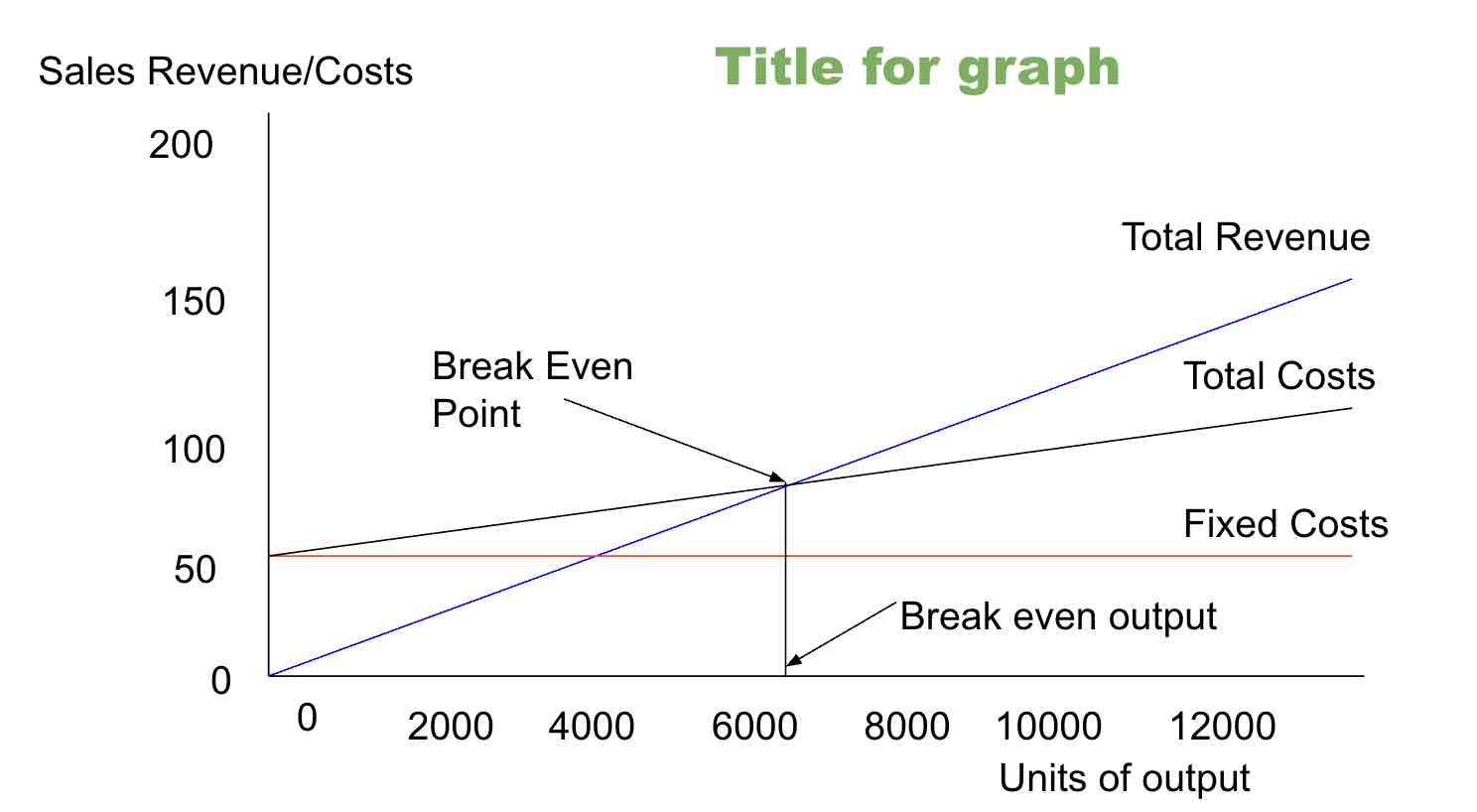

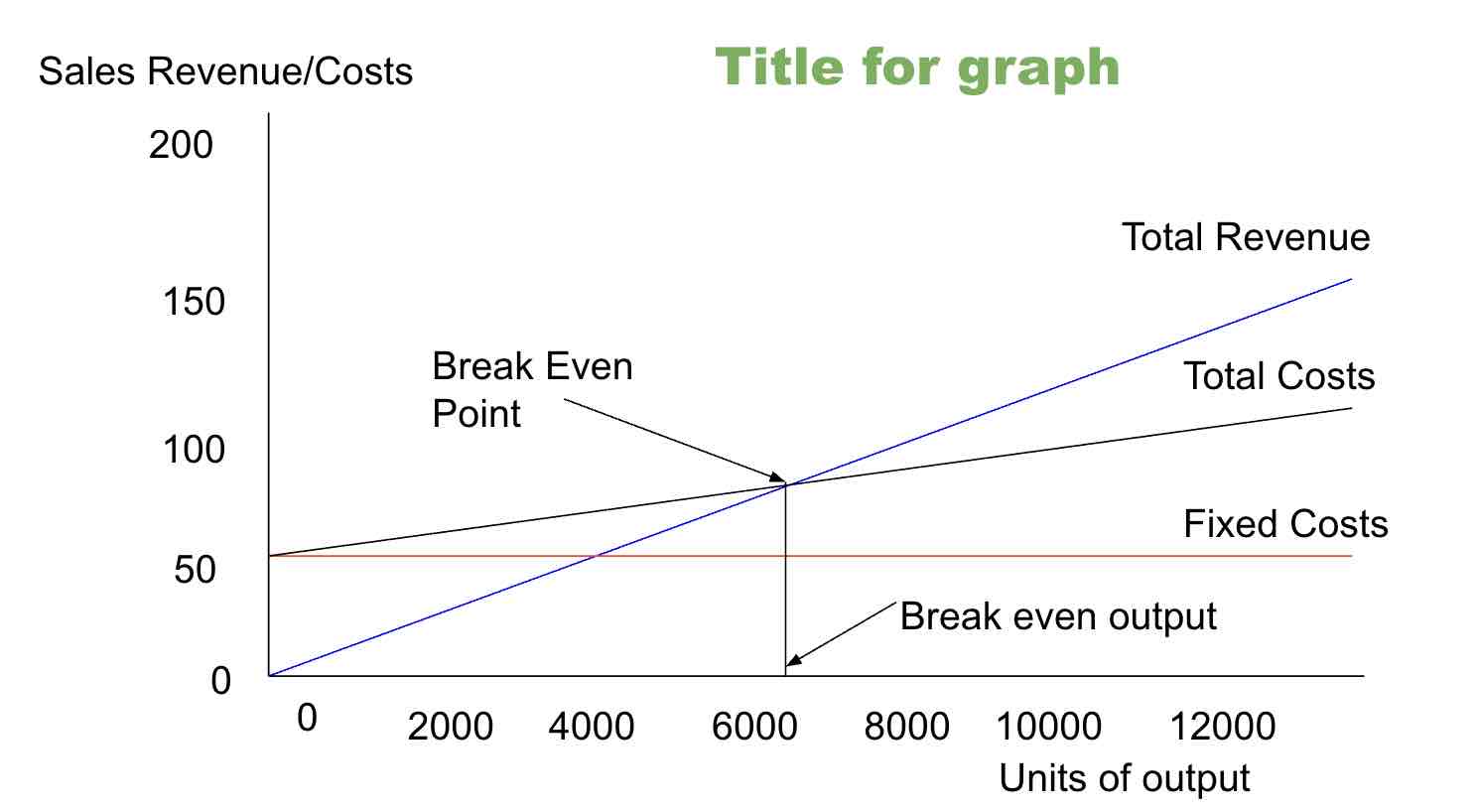

Break even(quantity)

It is the stage where a business neither makes a profit nor incurs a loss, meaning all expenses are equal to the income. Formula: fixed costs/contribution per unit

Break-even point (BEP)

The position where total cost and total revenue lines cross in a graph

Margin of safety

Is the cushion between expected performance and the worst case scenario. Formula:(Current sales-break even point)/ current sales

Pros of break even analysis

Allows a firm to see profits at different levels of production

Help businesses understanding pricing decisions, changes in its profitability resulting from the impact of changes in sales, pricing, fixed costs, and variable costs

Easy to interpret

Can be used to support of raising of finance

Limitations of a break even analysis

Reliance on assumptions, such as fixed cost and selling price remaining the same

Lack of consideration for external factors, such as market changes

Simplicity compared to real world complexities

Expects everything to go perfectly

Target profit

Profit that the business expects to get

Price x Quantity – [Fixed Costs (FC) + Average Variable Cost (AVC) x Quantity])

Absorption costing

Is a managerial accounting method for capturing all costs associated with manufacturing a particular product. Under this method, all manufacturing costs, whether variable or fixed, are allocated to the product.