Final week of FAR

1/136

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

137 Terms

Direct method of foreign currency

how much of our currency buys one unit of another

in substance defeances

An in-substance defeasance: puts d securities into an irrevocable trust to cover future principal and interest payments on its long-term debt. However,the liability is not extinguished on the company's books. I

where are intial direct lease costs put

ROU asset

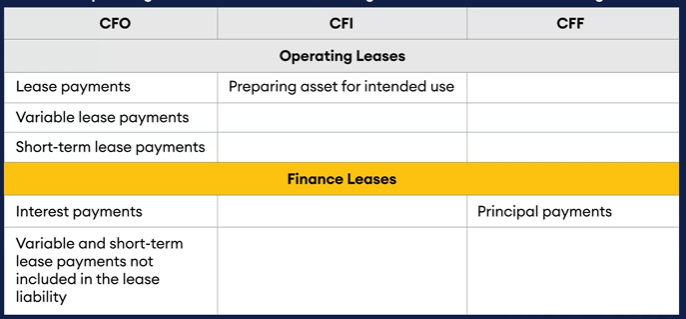

Lease effect on SOCF

How is held for sale PPE accounted for

impaired

recover impairment up to price

can deprecate

Measure at lower of NRV and BV

How are leasehold improvements accounted for

amortize over life

When do you start caplyzing interesr

incurring epxneses

incurring interest

have licenses

however if there are normal delays in getting licenses that is ok

How is interest caplyzed on product vs assets

not capylzed on inventory, is caplysed on assets

PPE Impairment

Recoverability:

undiscounted vs CV

Then impariment loss:

- FV vs CV

how do cummulative PS effect liabilities

They don’t till declared

How do stock dividends and splits effect investors

They are not income

how are services in exchange for stock accounted for

at fv APIC will be the plug

Expense

CS

APIC

Or you could give someone land/property/PPE as a “stock dividend

Recognize a gain on teh differnce between CV and FV

Re

AD

PPE

Gain

Uncertain tax positions

record teh amount that breaks 50% cummualtily

NOL JE and rule

ITE

Valuation account

ussualy not recgonized

intercompany sale of goods

remove revenue adn cogs

reduce inventory

what if we are doign teh equity method and pay more than NBV

allocate to dientifable asset and amortize if avaiable

otherwise it is goodwill

how is a conversion of debt ot equity on teh SOCF

Noncash

what is shown on the consolidated income statment

full parent + sull subsid(unless we dind’t own subsid the full year_

Debt restructuring and beneficial interest preesntation on the SOCF

noncash

transfer of asset in debt restrue treatment

Debtor treatment

- Recgognixe two gains/loss

- Will have a gain on the excess of carrying amount of payable(face amount plus accrued interest) over faor value of assets given up

- Could have a gain or a loss on the difference between the fair value and book value of asset

-

Creditor

- Measured at fair value at the time of restructuring

- If the fair value of teh asset/equity is hard to determine it can be measured at teh fair value of the note

- Any excess of receivable over asset/eqity is a loss

modification of terms on debt restructure

Debtor:

- When the total(undiscounted future cash payments are less than teh carrying amount, the debtor should

- Reduce the carrying amount and recognize a gain

- Now, if the undiscounted future payment exceeds the carrying amount, the debtor should not recognize a gain or adjust the future value

- No interest expense should be recognized after the date of restructure

- Summary: cv - all future payments and principal = gian

- JE:

Note payable old

Interest Payable old

Note payable new at undiscountet FCF

Gain plug

Creditor

- CV receivable - PVFCF(discounted) = impairment

Bad Debt Expense

Allowance for losses

A loan restructured is an impaired loan

use OG preset value facotr but new payments

what is not included in ewuity invesmtment income

PS dividends

what if donors get something in exchange for thier donation

if it is in the normal course expense what you paid for it and credit revnue

other wise dduct it from revenue

spcial hospial rules

pateint service revneu

charipatable care

pruim for capitation

op vs nonop

patient service revenue is accounted for at standard rates less charitable care and deductions

Deductions:

admin dedctions

3rd party agreemtns

policy discounts

credit losses for patiernts not recorded or expected

if it has been assessed and was expected to be collectiable than it is na operating expenses

premuim for capitaion is whre paitnets pay perosically fro services

Other examples of operating revenue:

- Educational program

- Cafeteria revenue

- Parking fees

Nonoperating and toher support gains and losses

- Interest and dividend income

- Gifts and bequests

- Grants

- Income from endowment

- Income from board generated funds

- Donated service

Charity care: services are provided but don’t expect to receive payment

- Management’s policy for this must be discloserd

- Not reconigzed as revenue or receivable

- Deons’t trigger any credit loss expense

Loan with orgination fees

works as a dicount

NP

Cash

Dist

NP

NR

NR

Fee

Cash

Presentation of OCI relssification

reported on teh face with teh effects on net income

presentation of functional vs natrual expenses

functional is on the face

natrual jhust must be somewehre oculd be in the notes on teh face or in a seperate statment

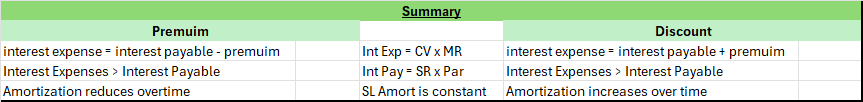

bond chart

Summary | ||||

Premuim | Discount | |||

interest expense = interest payable - premuim | Int Exp = CV x MR | interest expense = interest payable + premuim |

| |

Interest Expenses > Interest Payable | Int Pay = SR x Par | Interest Expenses > Interest Payable |

| |

Amortization reduces overtime |

| SL Amort is constant | Amortization increases over time |

|

when is warranty expense accounted for

when sold

charitable remainder vs benefical interest

charitable remainder

this is where we get an asset with an attached liability

Asset

Liab

Rev

Beneficial interest

we have an interest in assets we don’t control

not financailly related

Beneficial interest

Revenue

S-K

S-T

S-X

S-B

S-K: non financial info

S-T electornc filling infor

S-X itnerm and annual reports

S-B small business

when can you reconize coniditonal promises

when conditions are met

parntesrhip formation wehn they all capital accounts equal

bonus and goodwill

bonus: take the total cpaital and divide by the total partners

goodwill: adjust all accounts to teh largest

unrealized gain or loss JE

what does aggregate mean

unrealized loss

valutoin account

aggreagate does not take into account valuation account

large accelartaetd filer

accelerated filer

other filer

large accelerarated

700mil MV

accelerated filer

700-75mil MV

100mil rev

Other filer

otehr

Discounted NP

Future cash flows

(bank discount)

proceeds

(CV)

interest icnome/expense

TS method for stock options

totoal proceeds/market price

shows us how many we can buy

then take that an see how many new we need otisse

when do we recognize service revenue in NFP

when we enhance an long live asset or;

SOME

Spelized asset

Otherwise need

Measurable easily

how do pension adjusmnets work within pufi

unrelized loss goes to pufi

then it gets amortized out of pufi

what if we issue a stock split after the bs date but before teh issuance date shoudl it be included in EPS - what baout a stock dividend

yes include both in EPS

JE for donated treasury stock

donated TS

APIC

sale

cash

apic

Donated TS

Program vs support expenses

program: directly died to mission

support: fundraising, member ed, maangemnet

how to account for endownments

there are no endowment accounts it is with donor restriction

FS for the following

NFP

Governmental

Fiducary

Properitaty

NFP

SOCF

Statement of activeis

stamtnet of fincnail position

Govenrmental

statemnet of revenes, expenditures, and changes in net postion

BS

Fiducary

statement of net position

statement of changes in net postion

Propertary

statement of net postion

statemetn of revenues, expenses, and changes in net postion

measurement of governmental funds

current fincnail resources and resulting fincail postion

accounting for a notic in will

recongize when teh person deis and you get over legal hurdles

what is teh modified cash basis generally

capalizes adn deprecations ficed assets

accureds taxes

records liab and itnerest expenses

captles investors

reports invesmetns at fv

modifed accural basis - generally

revenue: when avuiable and measuarble

avaiable is within 60 days of BS date

Expenditures are recorded when teh related fund liability is incurred with some expenctions:

- Debt services expenditures are recognized untili either due or paid

- Incurred but unpaid debt service expenditures are not accured

- No BDE

what if we issue new CS after BS date but before issuance

disclose

what if we issue pay off a liab after BS date but before issuance

all we need it intent and reclass as current

how does interest and income tax appear on SOCF

the payable amounts effect operating

the actual cash paid is disclosed

capylyzed inteerest is investing and not included in teh diclosed figure

If my curreny appreciates

I can buy 1 unit of another for less

conribution in kind NFP accounting

this is like free rent or ppe

this is revenue at FMV

unless we don;t know value or use

do we need to diclsoe permadent deferred taxes

no

interest and dividend income on SOCF

operating

interest expense and income taxes on SOCF

in the operating section you will show the icnoem adn itnerest payable

then you will disclose any cash paid

caplyzed itnerst will appear in the investing section and not be shown

partnership formation, goodwill and bonus

if tehy want equal intial balances

Bonus: take the total contributions and divde by the number of partners

goodwill: each partner will have the same intial capital balance as the one that contirbuted the most

how are unrelized losses accounted for

what does the word aggregate mean

recorded in a valuation account

“aggregate” deosn’t include this value of valuation account

conditional promises recogition

never recognize till the condition is met

even if iti bequest

reg s-x

S-t

S-k

S-b

S-X: contents and requirements for interim and annual reports

S-T: governs electronic filings

S-K: governs nonfinancial disclosures on F/S

S-B: disclosures for small businesses

large accelerated filers

vs accellereated filers

vs other filers

large accelerated filers, MV = 700 Mil

10k 60 days

10q 40 dys

accelerated filers: MV= 700-75mil, 100rev

10k 75 days

10q 40 dys

Other: other

10k 90 days

10q 45 dys

how is a note with loan origination fees

Lender:

Note Receivable

Cash

Fee

For the lender interest income is the portion of the proceeds less any fees times the new interest rate

Borrower:

Cash

Dist

NP

interest expense is the new % x the proceeds

Note payable when do you use teh effective interest method

If note noninterset bearing or has an unresonably low interest rate us MR nad effective interest method

PUFI and peniosn

intially an unrelied pension loss is a reduction to AOCI

however overtime this is amortized out of AOCI to the incoem statment

Purchase commitments minimum guarantees

if you get out of a purchase commitment your loss is the total minimum purchase - all years

Deferred charge

LT prepaid expense

if i give a deposit to receive a future discount

How are repairs that benefit future operations accounted for

caplyzed

how are property taxes for the full year accounted for

caplyzed and expensed over time

ROU Asset life

O or W amortize over the assets life

otherwise over the life of the lease

Note: for “W” to be accurate the purchase option must be at a bargain

Costs capitalized into land vs building

before construction = land

once construction begins : i.e excavation its the buildings

valuation of patents

Patents capitalized fees:

purchase price

acquisition

legal fees

however if patent defense fails, write patent off

cash to accural

rental revenue

cash

ending rec - beg rec

beg liab - ending liab

multiyear pledges

if i will not receive a pledge for multiple years it should be recorded at NPV

How do you account for a lapse of a gift certificate

liab

rev

consolidations: provisoinal vs final FV

use final

Amortizing assets assets where NBV < FV in equity

decrease investmetn and invesntmetn income

mulyply by %

What effect do endowments have on the FS

increases net assets with donor restrictions

there is no endowment account

is the aquistion of a new entity a subsequent event

no because the conditions were not present at BS date

however we should disclose it

retirment of TS

CS

APIC-CS

TS

APIC-TS plug

calculating an annuity due when only given ordinary annuities

10 periods of an annuity is the same as 9 period of an ordinary annutiy plus 1

What is one example when you don’t need to do the recoverability test?

When the asset was placed as held for sale.

when are contigent shares recognized in basic eps

So, contingent shares are included in diluted EPS if it is likely (probable) that the contingency will be met, even if the shares have not been issued yet.

how does cummulative ps particapting dividen split up work

the dividend in arrears first go out and then you give dividends to ps

then give dividends to cs based on ps percentage

then split the raminder proprtionally based on par/market value

what if there is no par value

Yes, exactly! When a company issues stock that has no par value, it uses a stated value instead for accounting purposes.

in the par method what do you do if you have a gain on teh intail purchase of the ts

You credit APIC-TS when you reissue treasury stock at a price above its repurchase cost (a "gain" on reissue).

othewise use re

Property dividend

Recorded at the FV and gain/loss is calculated

stock in exchange for a property dividend

valued at the market price of the stock

what does issued stock include

outstanding and treasury

completed contract method

Revenue and gross profit are recognized only when the contract is fully completed.

If the contract is profitable, no profit is recognized during the project; all profit is deferred until completion.

However, if a loss is expected on the contract, the entire loss is recognized immediately in the period it becomes known, even if the contract is not complete

Retrospective vs restatement accounting for changes

Restatement corrects errors

accounting error

ussually adjusts one yea

retrospective: cumulative effect as if it had always been like that

change in accounting principle or entity

ussually adjusts multple years

facotoring with vs without recourse

WITHOUT: this is a true sale, there will be a gain/loss, the factor may hold back a portion as a “retainer” for allowances, returns or discounts

This due from the account needs to be specifically stated

WITH: factor can “resell” any uncollectable receivables back to the seller

2 possible outcomes: selling or borrowing. For it to be selling it must:

uncollectiable AR estimable

transferor surrenders economic benefit

transferor cannot be required to repurchase

Given the following facts, how much is amortized in y2

R&D in y1 = 5,00,000

6/30 The company paid $20,000 in legal and other fees related to the patent registration process.

1/1/y2 the company paid $76,000 in legal fees related to the successful defense of the patent in a patent-infringement lawsuit brought by the company's main competitor. The patent's legal life is 17 years and its estimated economic life is 10 years.

9500

Explain Accretion and depreciation when related to Right of Obligation assets

So when a ARO asset iis put on the boooks it is put on as a prensetn value of an asset and a libaility. THen over time depreication depreicates the asset so it is gone, the accreition increases the asset to teh full amount due at the end

PV and FV factors

Present value factor= (1/((1+r)^n))

Future value facotr= = (1+r)^n

bonds issued with detachable warrants

The bonds were originally issued with detachable warrants. Because the warrants were detachable, they represent a separate security from the bonds, and a value must be attributed to them. So the total issuance price is going to have to be allocated between the bonds and the warrants.

if only teh mv of warrants is given just use that

Book value vs market value method of common stock conversion from bonds

Using the book value method, the common stock is recorded at the carrying amount of the converted bonds, less any conversion expenses. Since there are no conversion expenses in this question, the common stock is recorded at the $1,500,000 carrying amount of the converted bonds.

apic is diff between par value and cv of bond

market value method: pretty much teh same except if the market value of the stock is less than teh cv on the bond a loss is recognized

stock is recorded at market value

leasehold improvemnets

The key point is that leasehold improvements (like the new carpet in the example) are capitalized separately and amortized over the shorter of the lease term or the useful life of the improvement. This amortization is recorded as an expense regardless of the lease classification.

what portion of AFS securities are on the SE

all of it cummulativly from all years

total goodwill generated from an equity method transaction

this is the total ogodwill not my portion