PERFORMANCE EVALUATION

1/62

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

63 Terms

It is an internal reporting system that supports decentralization of decision making and generation of information specific to the center

Responsibility Accounting

It is the delegation of authority and responsibility to supervisor or mid-level management

Decentralization

It leaves decision making to few top-level management

Centralization

It breaks out a company’s financial data by company divisions, subsidiaries, or other kinds of business segments.

Segment Reporting

Segment Reporting Formula

Sales | xx |

Variable Manufacturing | (xx) |

Manufacturing CM | xx |

Variable Selling and Admin | (xx) |

Contribution Margin | xx |

Controllable Fixed Cost | (xx) |

Performance Margin | xx |

Direct Fixed Cost | (xx) |

Segment Income | xx |

Allocated Fixed Cost | (xx) |

Net Income | xx |

It is the situation in which people in multiple levels of an organization share the same goal

Goal Congruence and Motivation

It is a situation in which a business is not as successful as it could be because one part or department works only on its own or only for its own success

Sub-optimization

These are costs which may be directly regulated at a given level of managerial authority and time-frame

Controllable Costs

This cost is cannot be altered based on a personal business decision or need.

Non-controllable Cost

These are fixed costs under direct supervision of the segment manager (advertising)

Controllable Fixed Costs

These fixed costs are not controllable but is avoidable if a segment or division is discontinued (supervisor’s salary)

Direct/Traceable Fixed Costs

These are fixed cost necessary to sustain operations of multiple segments. It cannot be directly identified to a specific segment or division (salary of top management)

Common Fixed Cost (Unavoidable fixed, allocated fixed)

It is a performance metric intended to evaluate segment manager’s performance considering all controllable costs including controllable fixed cost

Performance Margin

Responsibility Centers

Cost Center

Profit Center

Investment Center

Revenue Center

Comparison of Responsibility Centers

Factor | Cost | Profit | Revenue | Investment |

Accountability | Cost and Expenses | Revenues; Costs and Expenses | Revenue | Investment; Revenues; Cost and Expenses |

Evaluation | Standard Cost Variance | CM; Segment Income | Revenue Variances | Return on Investment; Residual Income; Economic Value Added |

Example | Production; HR; Repairs and Maintenance department | Marketing department | Each sales division in a department store | Branch; Subsidiary |

This is a test of profitability by comparing a desired minimum required rate of return (ROR)

Return on Investment

Formula for Return on Investment (ROI)

Operating Income ÷ Average Investment or Assets

or

Profit Margin x Asset Turnover

It measures the absolute peso return of an investment over the minimum ROR

Residual Income (RI)

Formula of Residual Income

Operating Income - (minimum ROR x Average Investment or Assets) or

(ROI (%) - Min ROR (%) or Cost of Capital) x Asset Base

ROI VS RI

ROI | RI |

Measures net operating income earned relative to investment in average operating assets | Measures net operating income less the minimum required return on average operating assets |

Approach that results to goal congruence

Residual Income

It measures company’s financial performance based on the residual wealth

Economic Value Added (EVA)

Economic Value Added (EVA) Formula

EBIAT - (WACC x Long-term Sources of Financing) or

NOPAT - [(Total Assets - Current Liabilities) x WACC]

It is the price charged by one segment of an organization for a product or service that it supplies to another segment of an organization.

Transfer Price

Three Primary Approaches of Transfer Pricing

Negotiated Transfer Price

Cost of the Selling Division

External Price of the Buying Division

It is a price agreed for goods or services between the buying and selling division without basing it on market price

Negotiated Transfer Price

It is the price charged for an item on the open market and is often regarded as best approach

Transfers at Market Price

Approach where the selling division records one price whereas the buying division is charged a different price for the same product or service

Dual Transfer Price

It is the acceptable transfer price between the highest transfer price of the buying division and the lowest acceptable transfer price of the selling division

Transfer Price Range

Formula of the Lowest/Minimum Acceptable Transfer Price

Variable Cost + Opportunity Cost if any + Incremental Fixed Cost if any or

Variable Cost + (Total CM of Lost Sales ÷ Total Units Transferred)

It is the highest/maximum transfer price

External Price (MV) or Selling Price of selling division

It consists of an integrated set of performance measures that are derived from and support the company’s strategy throughout the organization

Balanced Scorecard

Four Perspectives of Balanced Scorecard

Financial Perspective

Customer Perspective

Internal Business Process Perspective

Learning and Growth (Infrastructure) Perspective

It establishes the long and short term financial performance objectives expected from the organization’s strategy and simultaneously describes the economic consequences of actions taken in the other three perspectives.

Financial Perspective

Three components of Financial Perspective

Revenue Growth

Price-Recovery

Productivity

It defines the customer and market segments in which the business unit will compete and describes the way the value is created for customers.

Customer Perspective

Five Key Core Objectives of Customer Perspective

Increase market share

Increase customer retention

Increase customer acquisition

Increase customer satisfaction

Increase customer profitability

3 Processes of Value Chain

Innovation Process

Operation Process

Post-sales Service Process

It defines the capabilities that an organization needs to create long-term growth and improvement

Learning and Growth Perspective

Three Major Objectives of Learning and Growth Perspective

Increase employee capabilities

Increase motivation, empowerment, and alignment

Increasing information systems capabilities

It is a diagram that describes how an organization creates value by connecting strategic objectives in explicit cause-and-effect relationships with each other in the financial, customer, internal business process, and learning and growth perspectives,

Strategy Map

It is a measure that expresses the efficient conversion of inputs into outputs

Productivity

Formula of Productivity

Output ÷ Input

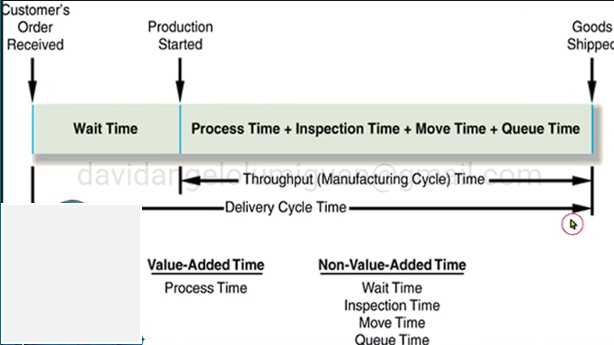

It is the total elapsed time between when an order is placed by a customer and when it is shipped to the customer

Delivery Cycle Time

It is the total elapsed time between when an order is started into production and when it is shipped to the customer

Throughput (Manufacturing Cycle) Time

Formula of Throughput Time

Process Time | xx |

Inspection Time | xx |

Move Time | xx |

Queue Time | xx |

Throughput Time | xx |

Value-Added Time

Process Time

It is the ratio of value-added time (i.e., process time) to total throughput time

Manufacturing Cycle Efficiency (MCE)

Formula of Manufacturing Cycle Efficiency (MCE)

Value-Added Time ÷ Throughput Time = Process Time ÷ Throughput Time

It is the number of units of output that can be produced in a given period of time

Velocity

Delivery Cycle Time Illustration

It quantifies the proportion of time dedicated to activities that directly contribute value to the final product or service activities that customers are willing to pay for

Process/Service Cycle Efficiency

Formula of Process/Service Cycle Efficiency

Value Added Time ÷ Cycle Time

It measures the change in operating income attributable solely to the change in the quantity of output sold

Growth Component

It measures change in output price compared with changes in input prices.

Price-Recovery Component

It measures the amount by which operating income increases by using inputs efficiently to lower costs

Productivity Component

It is the cost incurred in producing the product

Outlay Cost

It is the price representing the cash outflows of the supplying division plus contribution to the supplying division from an outside sale

Outlay Cost + Opportunity Cost

It is the price set by charging for variable costs plus a lump sum or an additional markup, but less that full markup

Variable Cost + Price

Successful implementation of a cost leadership strategy will result in:

Large favorable productivity and growth components

Successful implementation of a product differentiation strategy will result in:

Large favorable price-recovery and growth components

One of the results in using balanced scorecards is a shift from a focus on financial results to a focus on

increasing customer satisfaction

In the balanced scorecard, the financial perspective addresses which of the following questions?

“To succeed financially, how should we appear to our shareholders?”