3.5 Monetary policy (demand management)

1/53

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

54 Terms

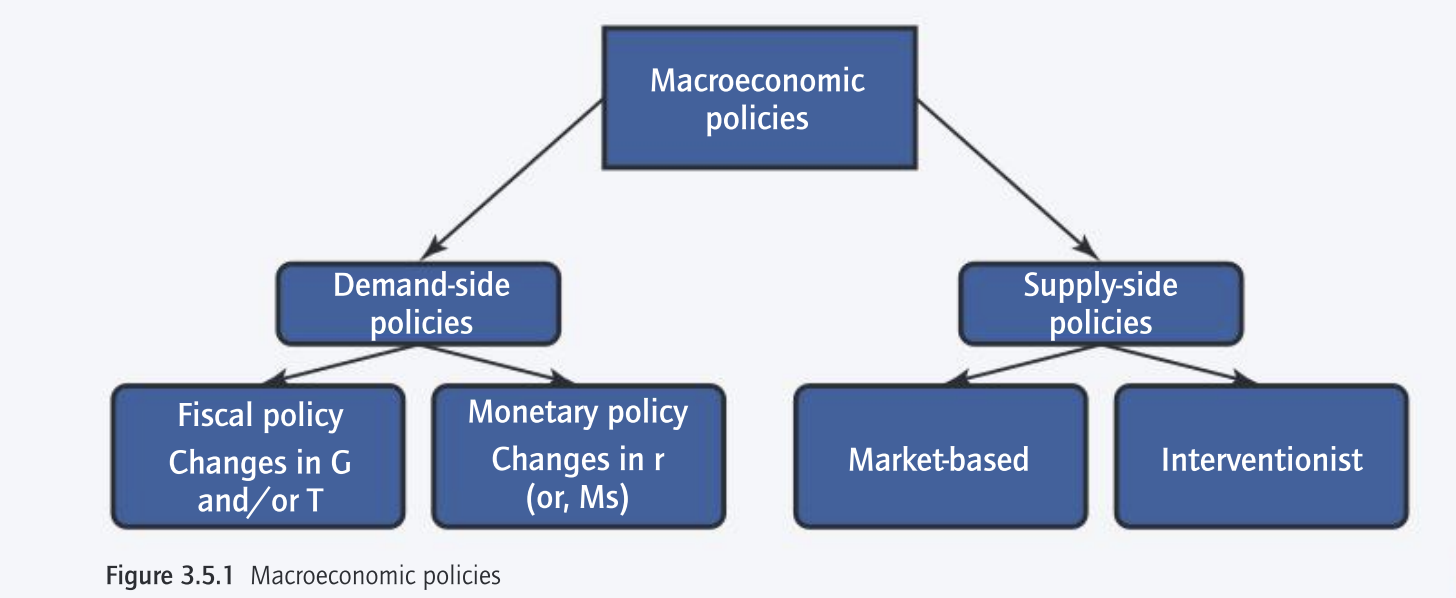

3 types of policies to achieve policy objectives

Monetary

Fiscal

Supply-side

Aim of demand-side policies

To affect AD

Hence stablilize it

Types of demand side policies

Fiscal

Monetary

Functions of money

Medium of exchange / payment

Unit of account (compare value of g/s)

Store of value (purchasing power + wealth over time)

Standard of deferred payment (allows ppl / firms to borrow + lend)

Central bank

Functions of central bank

Issue notes

Issues new government bonds, collects the proceeds, paying back bondholders when bonds mature

Conducts monetary policy

Exchange rate policy → infuences the competitiveness of a country’s exports + the attractiveness of imports.

Regulate how commericial banks operate

Most importantly, the central bank makes sure

that banks, in their quest for prots, do not engage

in excessively risky lending as this could prove

catastrophic for the whole banking system.

• The central bank is what is known as the “lender of last

resort”. Commercial banks must always have enough

cash in their vaults to meet their cash obligations to

depositors. The central bank is always ready to provide

commercial banks with any required cash liquidity in

case of a sudden emergency, to avoid a banking crisis